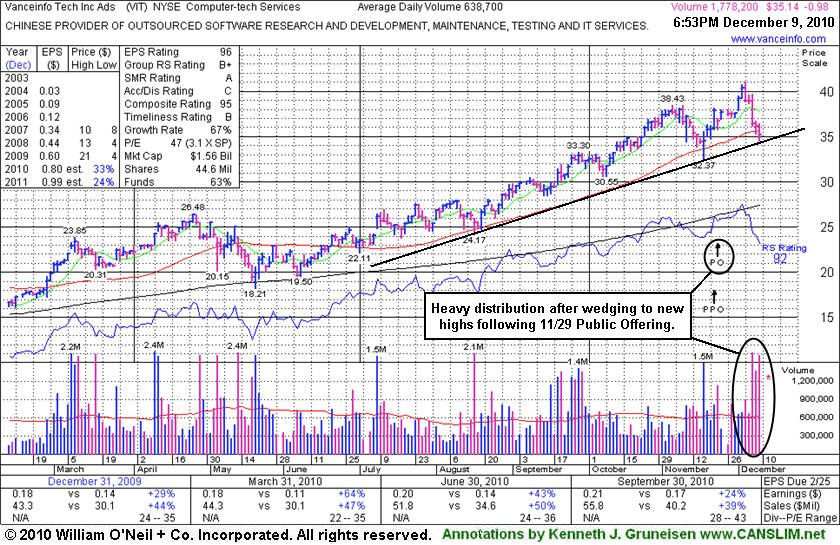

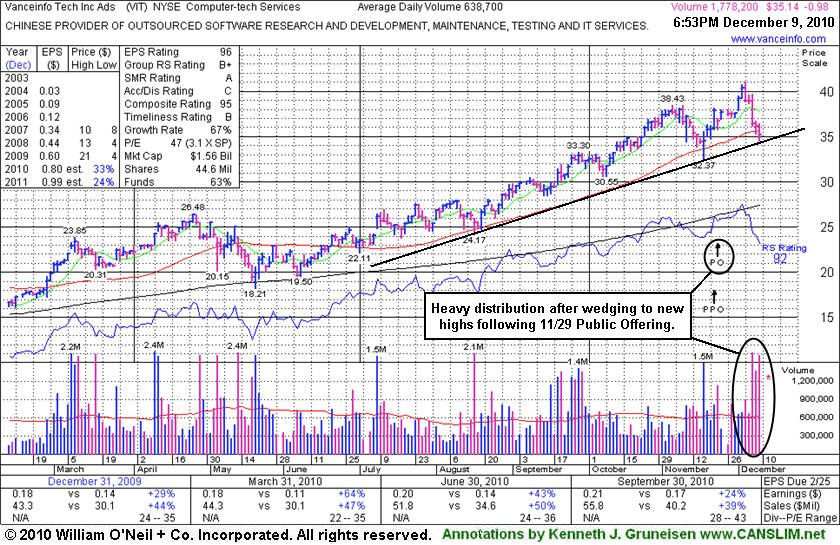

Since its last appearance in this FSU section with an annotated graph on 10/21/10 under the headline "Volume Totals Cooling While Perched At Historic High" it has made a choppy ascent marked by two pullbacks near its 50 DMA line. VIT has traded up as much as +104% from $20.07 when first featured in yellow nearly one year ago in the 12/24/09 mid-day report (read here).

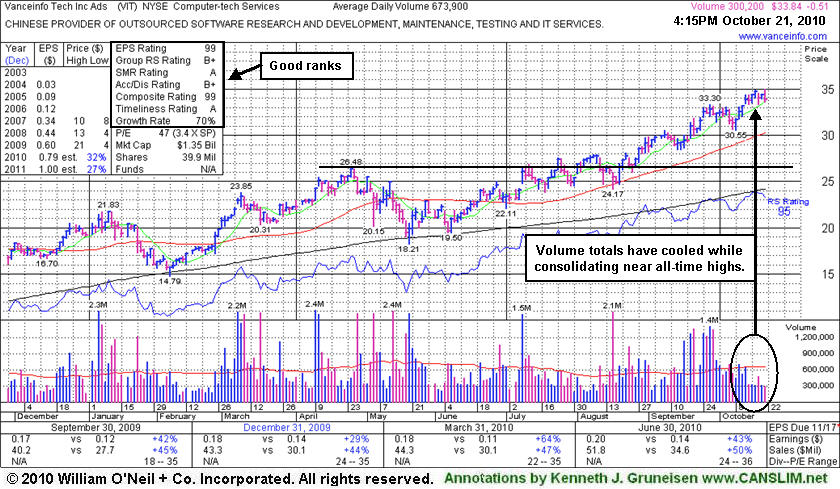

Vanceinfo Tech Inc Ads (VIT -$0.51 or -1.48% to $33.84) quietly touched a new high today then reversed into the red. Volume totals have cooled while recently consolidating near all-time highs, which suggests that few investors are anxious to head for the exits. It has not formed a recent sound base pattern, but patient investors may watch for it to eventually offer an ideal add-on buy point. Meanwhile, its 50-day moving average (DMA) line and recent lows near $26.50 define important chart support to watch.

No resistance remains due to overhead supply, making it easy for it to continue rallying. This China-based Computer - Tech Services firm is an ideal candidate for investors' watchlists, while disciplined investors will wait until a new base forms. The market scored a solid follow-through day (FTD) with big gains for the major averages satisfying the M criteria immediately following its last appearance in this FSU section on 8/31/10 under the headline "Tech Services Firm Rising With Above Average Volume".

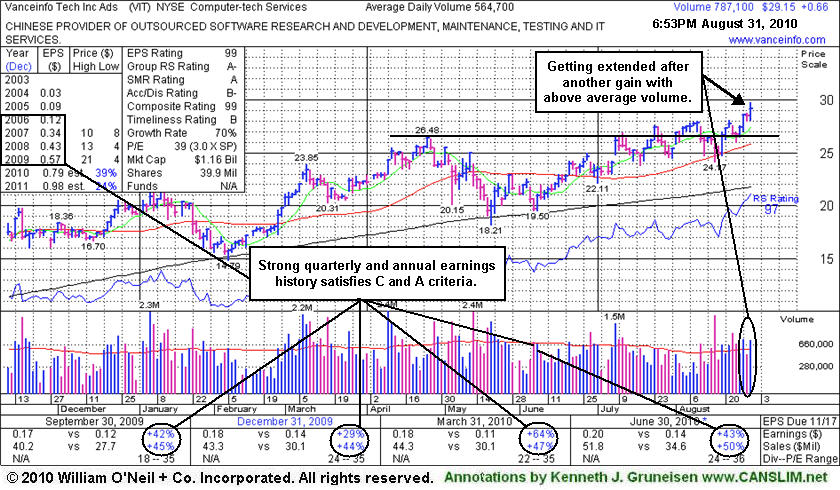

Vanceinfo Tech Inc Ads (VIT +$0.66 or +2.32% to $29.15) hit another new all-time high today with another gain backed by above average volume. Its color code was changed to green after a solid gain on 8/27/10 with +50% above average volume helped it rally to a new all-time high and close above its "max buy" level. No resistance remains due to overhead supply.

Its last appearance in this FSU section was on 7/26/10 under the headline "Prior Session's Light Volume Breakout Promptly Negated." This China-based Computer - Tech Services firm found impressive support near its 50-day moving average (DMA) line since then. Disciplined investors might watch for a secondary buy point after the market is back in confirmed rally. A proper follow-through day is still needed from at least one of the major averages to satisfy the M criteria before investors engage in new buying efforts under the fact-based system's guidelines.

Considerable gains above a prior chart high with heavy volume are a very important part of a solid technical buy signal under the fact-based investment system's guidelines. Keep in mind that if a stock is going to rally substantially, its price/volume chart usually will show a powerful move into new high territory, clearing old resistance levels with great conviction that clearly suggests it is under heavy accumulation from the institutional crowd.

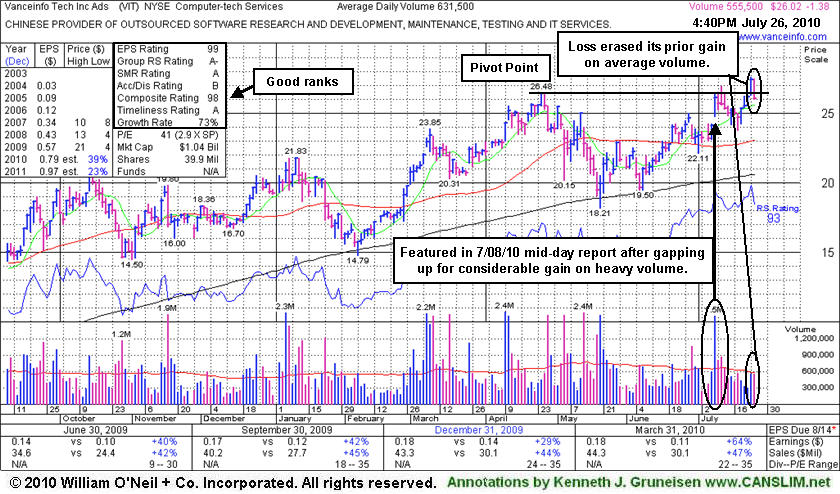

Vanceinfo Tech Inc Ads (VIT -$1.26 or -4.60% to $26.14) suffered a large loss today. That loss erased all of the prior session's gain for a new 52-week high with volume near average, not sufficient (+50% above average volume or greater is required) to trigger a proper technical buy signal. In fact, VIT did not yet trigger a technical buy signal with respect to the pivot point cited when it made its last appearance in this FSU section on 7/08/10 under the headline "Gap Up Gain Worth Noting As Sign Of Accumulation". When it met the 7/08/10 mid-day report screen parameters and was highlighted in yellow (read here) we observed that it also drew some headlines in the newspaper. Our analysis stated - "Some may consider it a 'cup-with-handle' or a 'double bottom' pattern with a sightly lower pivot point, however the new pivot point now being cited is based upon its 4/26/10 all-time high (which it matched earlier today to the penny) plus ten cents. A powerful breakout to a new high would be a very reassuring technical buy signal, meanwhile one may consider it a high-ranked leader that is currently challenging a previous resistance level where heavy distributional pressure was encountered not long ago. Volume should be +50% above average or greater with a gain above its pivot point to confirm any technical buy signal."

This China-based Computer - Tech Services firm found impressive support near its 200 DMA line in May-June. Since then its weekly chart remains marked by several big down weeks with above average volume and not a single up week marked by substantially above average volume since April. Based on weak action it was dropped from the Featured Stocks list on 5/19/10.

Considerable price gaps with heavy volume are often reliable indications of institutional activity. The I criteria is a very important part of the fact-based investment system, and gaps can be very crucial indicators. Keep in mind that if a stock is going to rally substantially it will often be showing multiple signs in its price/volume chart that it is under accumulation from the institutional crowd. That is why a big gap up gain on heavy volume is worth noting.

Vanceinfo Tech Inc Ads (VIT +$2.04 or +8.47% to $26.12) gapped up today and briefly matched its all-time high, and its color code was changed to yellow while it was noted when meeting the mid-day report screen parameters (read here). It also drew some headlines and mention in the newspaper. Some may consider it a "cup-with-handle" or a "double bottom" pattern with a sightly lower pivot point, however the new pivot point now being cited is based upon its 4/26/10 all-time high (which it matched earlier today to the penny) plus ten cents. A powerful breakout to a new high would be a very reassuring technical buy signal, meanwhile one may consider it a high-ranked leader that is currently challenging a previous resistance level where heavy distributional pressure was encountered not long ago. Volume should be +50% above average or greater with a gain above its pivot point to confirm any technical buy signal.

This China-based Computer - Tech Services firm found impressive support near its 200 DMA line and it has rebounded toward its prior highs with gains in recent weeks that lacked great volume conviction. Another concern is that its weekly chart is marked by several down weeks with above average volume, but not a single up week marked by above average volume since April. Based on weak action it was dropped from the Featured Stocks list on 5/19/10.

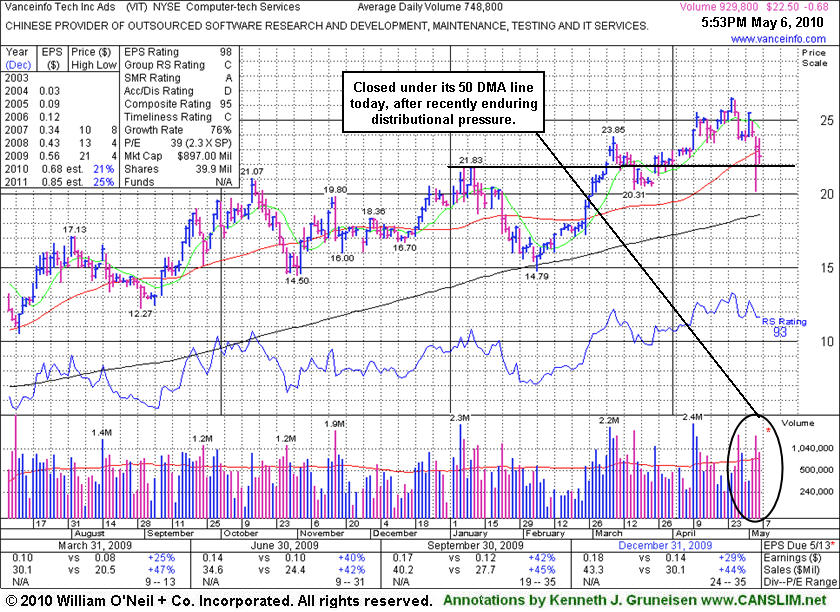

Vanceinfo Tech Inc Ads (VIT -$0.69 or -2.98% to $22.49) was down today and closed below its 50-day moving average (DMA) line. Its color code was changed to green based on recent distributional action. It was color coded yellow on 4/09/10 with new pivot point and "max buy" levels noted in the mid-day report (read here). However, deterioration and closes this week below prior high closes has completely negated the latest breakout. Broader market action (M criteria) is normally expected to impact 3 out of 4 stocks, and widespread losses effectively ended the latest rally.

Its small supply of only 11.6 million shares (the S criteria) in the publicly traded float could be a factor leading to greater volatility, especially in the event of mutual funds accumulating or distributing (selling) shares. This heightens the need for caution when buying and the discipline to limit losses, as always, if any stock ever falls more than -7% from your buy price.

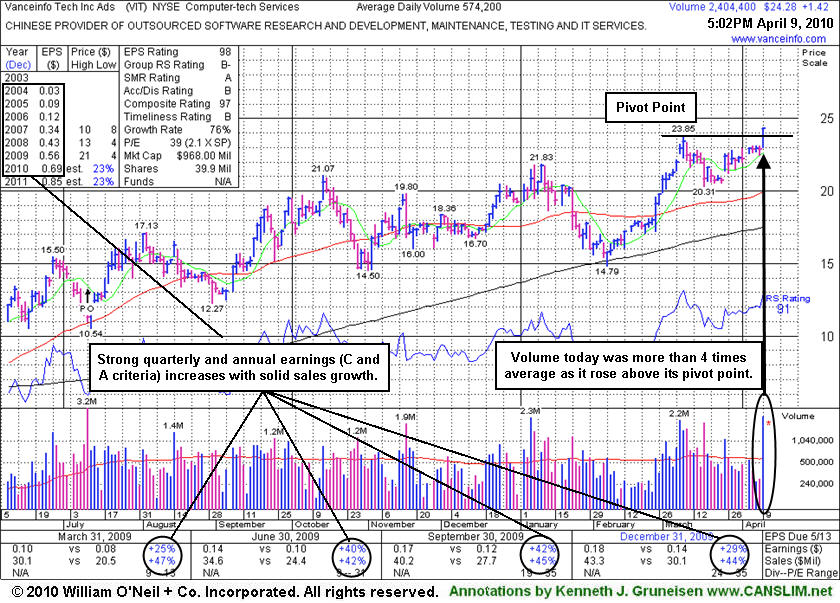

Vanceinfo Tech Inc Ads (VIT +$1.42 or +6.21% to $24.28) blasted to a new 52-week high today and triggered a technical buy signal as a solid gain with heavy volume more than 4 times average helped it trade above its pivot point after a 5-week consolidation. It was color coded yellow with new pivot point and "max buy" levels noted in today's mid-day report (read here). It recently found support after undercutting prior chart highs in the $21 area. Recent lows and its 50-day moving average (DMA) line define an important support level to watch on pullbacks. Data now provided by the service used by our experts shows +25% quarterly earnings increases in the 5 most current comparisons while sales revenues increases have been very strong and steady (above +40%).

VIT rebounded impressively since it was dropped from the Featured Stocks list on 2/02/10. The 1/22/10 violation of its 50-day moving average (DMA) line had triggered a technical sell signal. It continued to struggle until finding support at its 200 DMA line. Its eventual rebound back above its 50 DMA was proof of institutional (I criteria) support and buying demand, especially as it went on rallying to overcome all resistance due to overhead supply. When the high-ranked Computer - Tech Services firm was featured in yellow in the 12/24/09 mid-day report (read here) it had come a long way in the past year, yet it had built a sufficient length base following its steep ascent from its March low ($4.31). Its small supply of only 11.6 million shares (the S criteria) in the publicly traded float could be a factor leading to greater volatility, especially in the event of mutual funds accumulating or distributing (selling) shares. This heightens the need for caution when buying and the discipline to limit losses, as always, if any stock ever falls more than -7% from your buy price.

Vanceinfo Tech Inc Ads (VIT +$1.15 or +5.58% to $21.76) posted a considerable gain today and closed near the session high with +36% above average volume as it rallied above its pivot point. On 1/06/10 it posted a solid gain with 4 times average volume for a new high close as it hit a new all-time high, but it pulled back on that session and closed under its pivot point. It traded higher on the next session, then negatively reversed and closed with a loss. That recent action was noted as a sign of distributional pressure as it tried to rally from a choppy 11-week base, however today's gain offered some additional proof of institutional (I criteria) buying demand driving the stock to new highs (the N criteria). Its current Up/Down Volume Ratio of 1.4 is an unbiased indication that the overall technical price/volume action of late has been bullish, and no overhead supply exists to act as resistance.

The high-ranked Computer - Tech Services firm was featured in yellow in the 12/24/09 mid-day report (read here) while approaching all-time highs. It had come a long way this year, yet it built a sufficient length base following its steep ascent from its March low ($4.31). Fundamentally, its earnings and sales revenues increases have been above or at the +25% minimum guideline. Its small supply of only 11.4 million shares (the S criteria) in the publicly traded float could be a factor leading to greater volatility, especially in the event of mutual funds accumulating or distributing (selling) shares. This heightens the need for caution when buying and the discipline to limit losses, as always, if any stock ever falls more than -7% from your buy price.

Vanceinfo Tech Inc Ads (VIT +$0.30 or +% to $19.94) posted a 5th consecutive gain on ever-increasing volume, and no overhead supply exists to act as resistance. It was featured in yellow in today's mid-day report (read here) while approaching all-time highs on the right side of a choppy 10-week base. The stock has cleared its November high, but it technically did not yet rise above the pivot point cited to trigger a new buy signal. It has come a long way this year, yet it has built a sufficient length base following its steep ascent from its March low ($4.31).

A stock that rises from $20 to $30 must first clear $21, $22, and $23. Disciplined investors would watch for a proper technical buy signal and resist the urge to get in "early" without seeing fresh proof of heavy institutional (I criteria) buying demand driving the stock to new highs (the N criteria). An additional public offering of shares on 7/10/09 coincided with a successful earlier test of 50 DMA support.

Fundamentally, this high-ranked Computer - Tech Services firm's earnings and sales revenues increases have been above or at the +25% minimum guideline. Its small supply of only 11.4 million shares (the S criteria) in the publicly traded float could be a factor leading to greater volatility, especially in the event of mutual funds accumulating or distributing (selling) shares. This heightens the need for caution when buying and the discipline to limit losses, as always, if any stock ever falls more than -7% from your buy price.