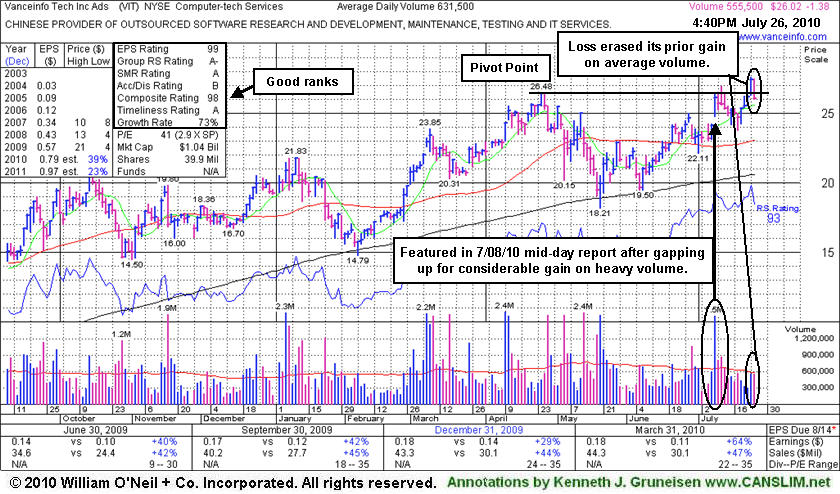

Prior Session's Light Volume Breakout Promptly Negated

Monday, July 26, 2010 CANSLIM.net

Considerable gains above a prior chart high with heavy volume are a very important part of a solid technical buy signal under the fact-based investment system's guidelines. Keep in mind that if a stock is going to rally substantially, its price/volume chart usually will show a powerful move into new high territory, clearing old resistance levels with great conviction that clearly suggests it is under heavy accumulation from the institutional crowd.

Vanceinfo Tech Inc Ads (VIT -$1.26 or -4.60% to $26.14) suffered a large loss today. That loss erased all of the prior session's gain for a new 52-week high with volume near average, not sufficient (+50% above average volume or greater is required) to trigger a proper technical buy signal. In fact, VIT did not yet trigger a technical buy signal with respect to the pivot point cited when it made its last appearance in this FSU section on 7/08/10 under the headline "Gap Up Gain Worth Noting As Sign Of Accumulation". When it met the 7/08/10 mid-day report screen parameters and was highlighted in yellow (read here) we observed that it also drew some headlines in the newspaper. Our analysis stated - "Some may consider it a 'cup-with-handle' or a 'double bottom' pattern with a sightly lower pivot point, however the new pivot point now being cited is based upon its 4/26/10 all-time high (which it matched earlier today to the penny) plus ten cents. A powerful breakout to a new high would be a very reassuring technical buy signal, meanwhile one may consider it a high-ranked leader that is currently challenging a previous resistance level where heavy distributional pressure was encountered not long ago. Volume should be +50% above average or greater with a gain above its pivot point to confirm any technical buy signal."

This China-based Computer - Tech Services firm found impressive support near its 200 DMA line in May-June. Since then its weekly chart remains marked by several big down weeks with above average volume and not a single up week marked by substantially above average volume since April. Based on weak action it was dropped from the Featured Stocks list on 5/19/10.