Needs Rebound Above 50-Day Average for Outlook to Improve - Wednesday, May 8, 2019

S S & C Technologies Holdings, Inc (SSNC -$0.02 or -0.03% to $58.90) still needs a rebound above its 50-day moving average (DMA) line ($63.12) for its outlook to improve. It halted its slide after a damaging gap down violated its 50 DMA line triggering a technical sell signal noted on 5/01/19.Charts courtesy of www.stockcharts.com

Hovering Near High With Volume Totals Cooling in Recent Weeks - Wednesday, March 27, 2019

S S & C Technologies Holdings, Inc (SSNC -0.89 or -1.43% to $61.53) has been hovering near its all-time high with volume totals cooling in recent weeks. It found prompt support and ended near the session high after a deep shakeout on 3/08/19.Charts courtesy of www.stockcharts.com

Volume-Driven Gain for New High Close - Tuesday, February 19, 2019

S S & C Technologies Holdings, Inc (SSNC +$0.60 or +1.00% to $60.46) posted a 7th consecutive gain and managed a new high close with today's gain backed by +41% above average volume. It was highlighted in yellow with pivot point cited based on its 8/03/19 high plus 10 cents in the 2/15/19 mid-day report (read here). No resistance remains due to overhead supply. Subsequent volume-driven gains above the pivot point may be a more convincing new technical buy signal.It has earned high ranks due to its strong earnings history. The past 3 quarterly comparisons through Dec '18 showed earnings increases above the +25% minimum guideline (C criteria) for buy candidates. Its annual earnings (A criteria) history has also been very strong. The Computer Software - Financial industry group currently has an A- Rating, and leadership among other individual issues in the group is a reassuring sign.

Charts courtesy of www.stockcharts.com

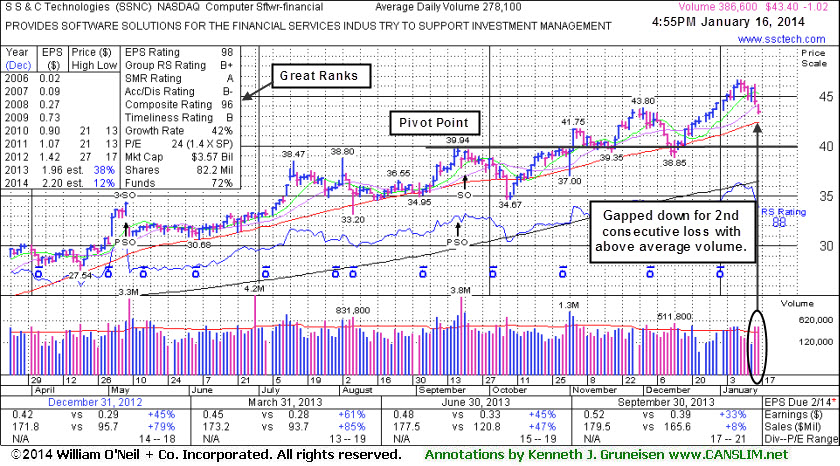

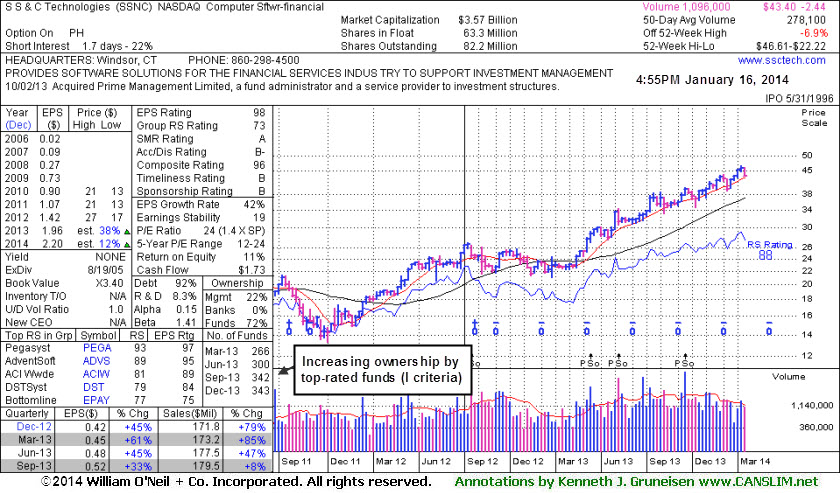

Enduring Distributional Pressure While Retreating Near Prior Highs - Thursday, January 16, 2014

S S & C Technologies Holdings, Inc (SSNC -$1.02 or -2.30% to $43.40) pulled back for the 2nd day in a row with above average volume and finished near the session low, enduring distributional pressure. It is extended from any sound base. During its last consolidation it found support near its 50-day moving average (DMA) line. It rebounded and wedged to new high territory with gains lacking great volume conviction since last shown in this FSU section on 12/16/13 with annotated graphs under the headline, "Found Prompt Support After Damaging Losses Raised Concerns". Members were alerted then - "Technically, the prompt rebound above that short-term average helped its outlook improve. Damaging losses had recently raised concerns by undercutting the 50 DMA line and prior lows. Subsequent losses undercutting the latest low ($38.85 on 12/13/13) would raise greater concerns and trigger more worrisome sell signals."The number of top-rated funds owning its shares rose from 260 in Dec' 12 to 343 in Dec '13, a reassuring sign concerning the I criteria of the fact-based investment system. The high-ranked Computer Software - Financial firm completed previously noted Secondary Offerings on 5/09/13, 3/14/13, and on 7/19/12. Such offerings can be a short-term hindrance, however new institutional owners are often attracted when a company has the help of underwriters in placing shares during offerings.

It has earned high ranks due to its strong earnings history. The past 6 quarterly comparisons through Sep '13 showed earnings increases above the +25% minimum guideline (C criteria) for buy candidates. Its annual earnings (A criteria) history has also been very strong. The Computer Software - Financial industry group currently has a B+ Rating, and leadership among other individual issues in the group is a reassuring sign concerning the L criteria.

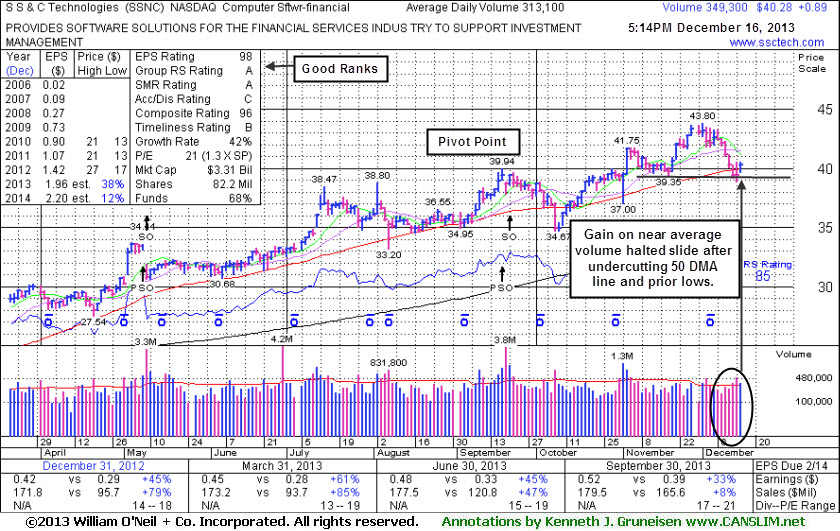

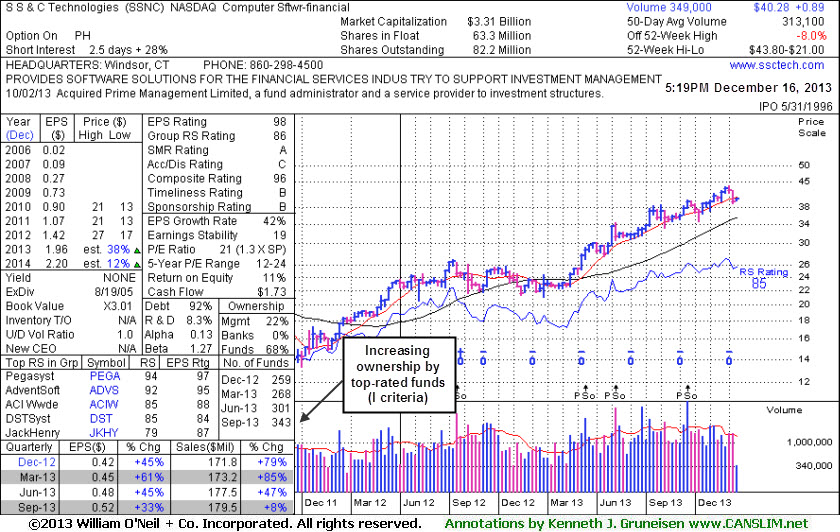

Found Prompt Support After Damaging Losses Raised Concerns - Monday, December 16, 2013

S S & C Technologies Holdings, Inc (SSNC +$0.89 or +2.26% to $40.28) posted a gain today with near average volume and managed to finish the session above its 50-day moving average (DMA) line. Technically, the prompt rebound above that short-term average helped its outlook improve. Damaging losses had recently raised concerns by undercutting the 50 DMA line and prior lows. Subsequent losses undercutting the latest low ($38.85 on 12/13/13) would raise greater concerns and trigger more worrisome sell signals.

SSNC was last shown in this FSU section on 11/12/13 with annotated graphs under the headline, "Volume Totals Cooling Following Recent Volume-Driven Breakout". It had rallied for a new 52-week high with 2 times average volume on 11/04/13 while rising above the pivot point triggering a new (or add-on) technical buy signal.

The number of top-rated funds owning its shares rose from 260 in Dec' 12 to 343 in Sep '13, a reassuring sign concerning the I criteria of the fact-based investment system. The high-ranked Computer Software - Financial firm completed previously noted Secondary Offerings on 5/09/13, 3/14/13, and on 7/19/12. Such offerings can be a short-term hindrance, however new institutional owners are often attracted when a company has the help of underwriters in placing shares during offerings.

It has earned high ranks due to its strong earnings history. The past 6 quarterly comparisons through Sep '13 showed earnings increases above the +25% minimum guideline (C criteria) for buy candidates. Its annual earnings (A criteria) history has also been very strong. The Computer Software - Financial industry group currently has an A Rating, and leadership among other individual issues in the group is a reassuring sign concerning the L criteria.

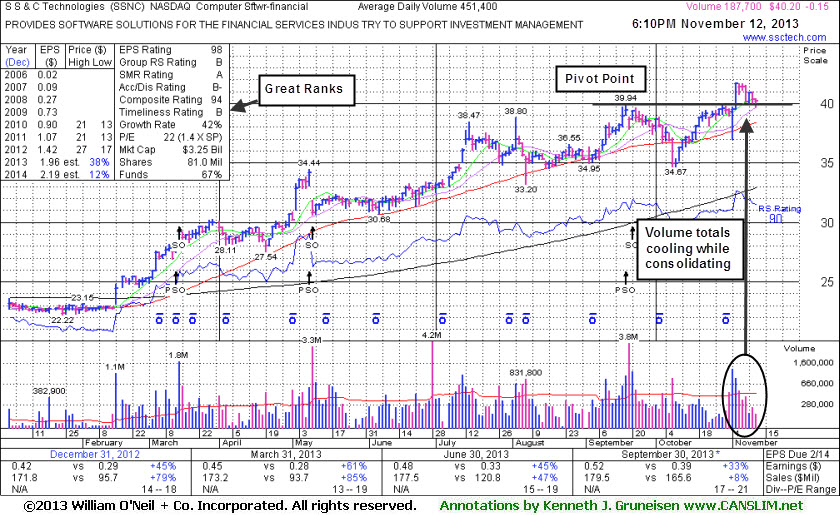

Volume Totals Cooling Following Recent Volume-Driven Breakout - Tuesday, November 12, 2013

S S & C Technologies Holdings, Inc (SSNC -$0.15 or -0.37% to $40.20) has seen its volume totals cooling while consolidating since it rallied for a new 52-week high with 2 times average volume on 11/04/13 while rising above the pivot point triggering a new (or add-on) technical buy signal. It was last shown in this FSU section on 10/04/13 with an annotated graph under the headline, "Finding Support Near 50-Day Average After Secondary Offering". Disciplined investors always limit losses if ever any stock falls more than -7% from their purchase price. Any stock which is sold can always be bought back again if strength returns, while limiting losses is critical to investors' success.The number of top-rated funds owning its shares rose from 260 in Dec' 12 to 331 in Sep '13, a reassuring sign concerning the I criteria of the fact-based investment system. The high-ranked Computer Software - Financial firm completed previously noted Secondary Offerings on 5/09/13, 3/14/13, and on 7/19/12. Such offerings can be a short-term hindrance, however new institutional owners are often attracted when a company has the help of underwriters in placing shares during offerings.

It has earned high ranks due to its strong earnings history. The past 6 quarterly comparisons through Sep '13 showed earnings increases above the +25% minimum guideline (C criteria) for buy candidates. Its annual earnings (A criteria) history has also been very strong. The Computer Software - Financial industry group currently has a B Rating, and leadership among other individual issues in the group is a reassuring sign concerning the L criteria.

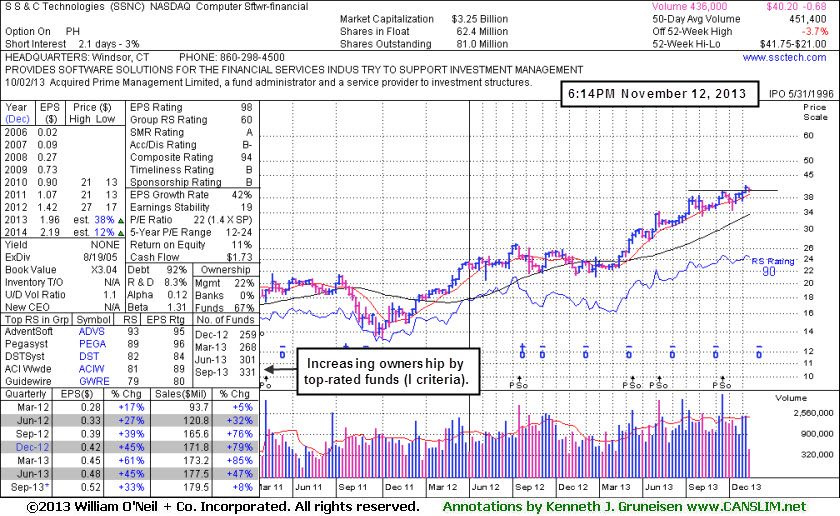

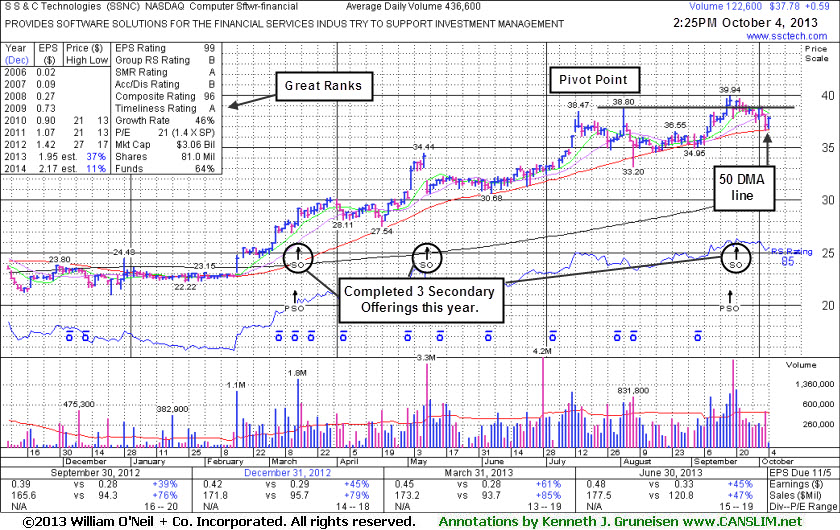

Finding Support Near 50-Day Average After Secondary Offering - Friday, October 04, 2013

S S & C Technologies Holdings, Inc (SSNC) is consolidating near its 50-day moving average (DMA) line which acted as support throughout its advance. After recently clearing the pivot point cited based on its 8/02/13 high plus 10 cents it abruptly retreated on news of the latest Secondary Offering. It was last shown in this FSU section on 9/05/13 with an annotated graph under the headline, "New Base Formed While Finding Support at 50-Day Moving Average".Disciplined investors always limit losses if ever any stock falls more than -7% from their purchase price. Any stock which is sold can always be bought back again if strength returns, while limiting losses is critical to investors' success.

The high-ranked Computer Software - Financial firm completed previously noted Secondary Offerings on 5/09/13, 3/14/13, and on 7/19/12. Such offerings can be a short-term hinderance, however new institutional owners are often attracted when a company has the help of underwriters in placing shares during offerings. The number of top-rated funds owning its shares rose from 260 in Dec' 12 to 305 in Jun '13, a reassuring sign concerning the I criteria of the fact-based investment system.

It has earned high ranks due to its strong earnings history. The past 5 quarterly comparisons through Jun '13 showed earnings increases above the +25% minimum guideline (C criteria) for buy candidates. Its annual earnings (A criteria) history has also been very strong. The Computer Software - Financial industry group currently has a B Rating, and leadership among other individual issues in the group is a reassuring sign concerning the L criteria.

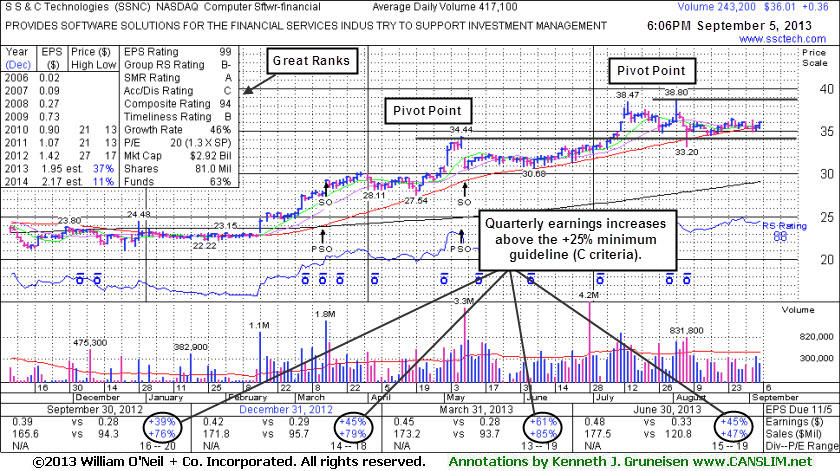

New Base Formed While Finding Support at 50-Day Moving Average - Thursday, September 05, 2013

S S & C Technologies Holdings, Inc (SSNC +$0.36 or +1.01% to $36.01) is still quietly consolidating above its 50-day moving average (DMA) line and prior highs in the $34 area defining important support with volume totals cooling. A new pivot point has been cited based on its 8/02/13 high plus 10 cents. Subsequent volume-driven gains may trigger a new technical buy signal.

It was last shown in the FSU section on 8/09/13 with an annotated graph under the headline, "Finding Support Above Prior Highs and 50-Day Moving Average Line", as it rebounded and found prompt support after undercutting its 50-day moving average (DMA) and prior highs in the $34 area. Disciplined investors always limit losses if ever any stock falls more than -7% from their purchase price. Any stock which is sold can always be bought back again if strength returns, while limiting losses is critical to investors' success.

Its small supply of only 62.4 million shares in the publicly traded float can contribute to greater price volatility in the event of institutional buying or selling pressure. SSNC completed another Secondary Offering on 5/09/13, while it was previously noted in the 5/20/13 mid-day report - "The high-ranked Computer Software - Financial firm completed previously noted Secondary Offerings on 3/14/13 and on 7/19/12." New institutional owners are often attracted when a company has the help of underwriters in placing shares during offerings.

It has earned high ranks due to its strong earnings history. The past 5 quarterly comparisons through Jun '13 showed earnings increases above the +25% minimum guideline (C criteria) for buy candidates. Its annual earnings (A criteria) history has also been very strong. The number of top-rated funds owning its shares rose from 260 in Dec' 12 to 302 in Jun '13, a reassuring sign concerning the I criteria of the fact-based investment system. The Computer Software - Financial industry group currently has a B- Rating, and leadership among other individual issues in the group is a reassuring sign concerning the L criteria.

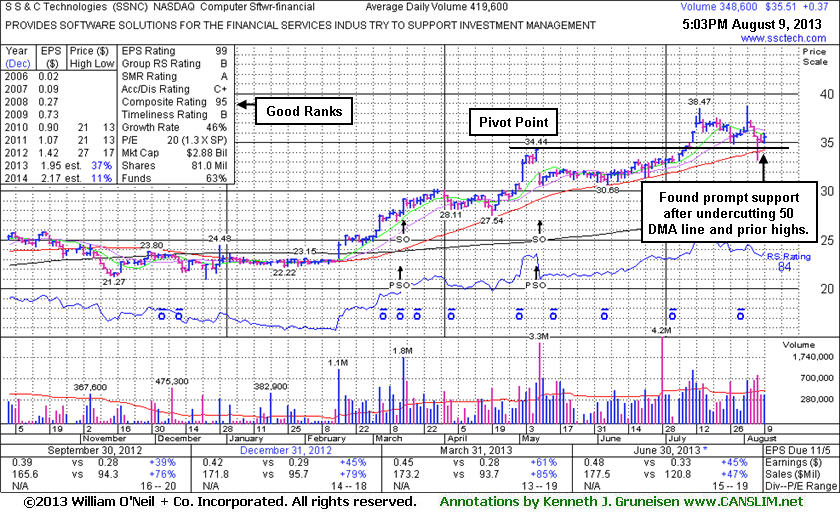

Finding Support Above Prior Highs and 50-Day Moving Average Line - Friday, August 09, 2013

S S & C Technologies Holdings, Inc (SSNC +$0.37 or +1.05% to $35.51) rebounded and found prompt support this week after undercutting its 50-day moving average (DMA) and prior highs in the $34 area. It followed losses on higher volume with a small gain lacking great volume conviction. Disciplined investors always limit losses if ever any stock falls more than -7% from their purchase price. It was last shown in the FSU section on 7/12/13 with an annotated graph under the headline, "Extended From Prior Base Following Gap Up Gains". The stock convincingly cleared the pivot point based on its 5/08/13 high plus 10 cents which was cited in the 7/11/13 mid-day report (read here), triggering a technical buy signal while rising from an orderly base pattern formed above its 50-day moving average (DMA) line. The breakout gain was backed by +124% above average volume, well above the +40% above average volume threshold which is the bare minimum volume needed to trigger a proper technical buy signal.Its small supply of only 62.4 million shares in the publicly traded float can contribute to greater price volatility in the event of institutional buying or selling pressure. SSNC completed another Secondary Offering on 5/09/13, while it was previously noted in the 5/20/13 mid-day report - "The high-ranked Computer Software - Financial firm completed previously noted Secondary Offerings on 3/14/13 and on 7/19/12." New institutional owners are often attracted when a company has the help of underwriters in placing shares during offerings.

It has earned high ranks due to its strong earnings history. The past 5 quarterly comparisons through Jun '13 showed earnings increases above the +25% minimum guideline (C criteria) for buy candidates. Its annual earnings (A criteria) history has also been very strong. The number of top-rated funds owning its shares rose from 260 in Dec' 12 to 299 in Jun '13, a reassuring sign concerning the I criteria of the fact-based investment system. The Computer Software - Financial industry group currently has a B Rating, and leadership among other individual issues in the group is a reassuring sign concerning the L criteria.

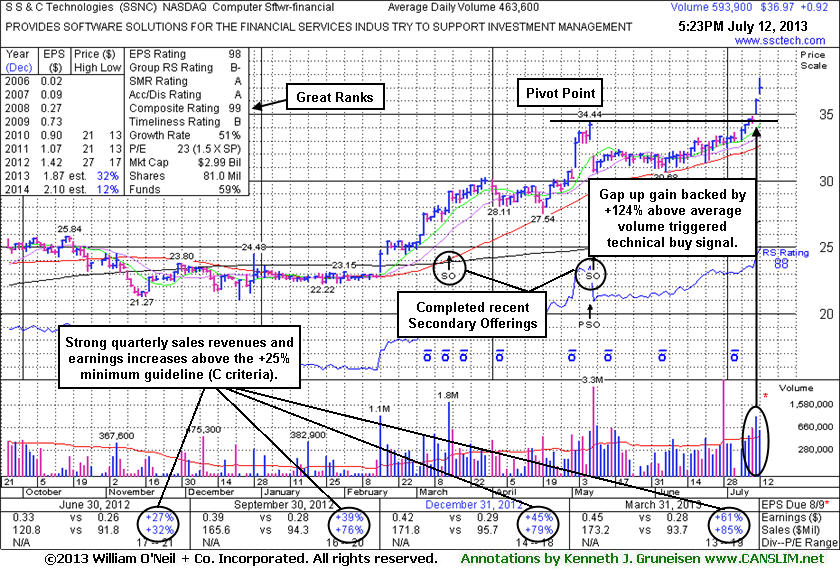

Extended From Prior Base Following Gap Up Gains - Friday, July 12, 2013

S S & C Technologies Holdings, Inc (SSNC +$0.92 or +2.55% to $36.97) gapped up again, rallying further above its "max buy" level today with lighter but still above average volume. Its color code was changed to green while getting extended from its prior base. Disciplined investors avoid chansing stock extended more than +5% above their prior highs. The stock convincingly cleared the pivot point based on its 5/08/13 high plus 10 cents which was cited in the 7/11/13 mid-day report (read here), triggering a technical buy signal while rising from an orderly base pattern formed above its 50-day moving average (DMA) line. The breakout gain was backed by +124% above average volume, well above the +40% above average volume threshold which is the bare minimum volume needed to trigger a proper technical buy signal.

SSNC completed another Secondary Offering on 5/09/13, while it was previously noted in the 5/20/13 mid-day report - "The high-ranked Computer Software - Financial firm completed previously noted Secondary Offerings on 3/14/13 and on 7/19/12." New institutional owners are often attracted when a company has the help of underwriters in placing shares during offerings.

It has earned high ranks due to its strong earnings history. The past 4 quarterly comparisons through Mar '13 showed earnings increases above the +25% minimum guideline (C criteria) for buy candidates. Its annual earnings (A criteria) history has also been very strong. The number of top-rated funds owning its shares rose from 260 in Dec' 12 to 287 in Jun '13, a reassuring sign concerning the I criteria of the fact-based investment system. Its small supply of only 39.1 million shares in the publicly traded float can contribute to greater price volatility in the event of institutional buying or selling pressure. The Computer Software - Financial industry group currently has a B- Rating, and leadership among other individual issues in the group is a reassuring sign concerning the L criteria.