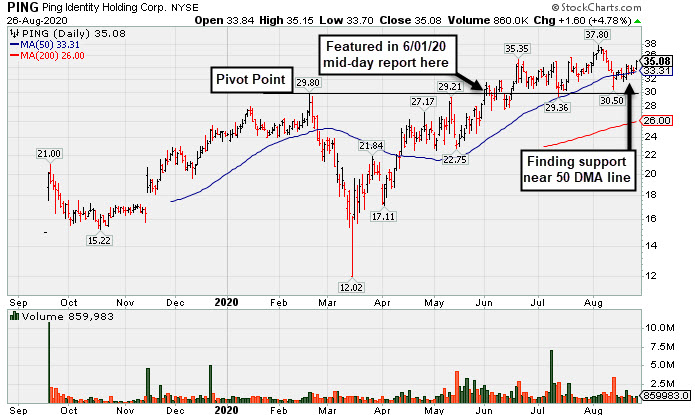

Found Support Near 50 DMA Line But Latest Earnings Were Sub Par - Wednesday, August 26, 2020

Ping Identity Hldg Corp (PING +$1.60 or +4.78% to $35.08) rebound further above its 50-day moving average (DMA) line ($33.31) with today's gain backed by higher (but still below average) volume. Its prompt repair of the recent 50 DMA line breach helped its technical stance improve. However, it recently reported Jun '20 quarterly earnings -27% on -6% sales revenues versus the year ago period, below the +25% minimum earnings guideline, raising fundamental concerns. The next important near-term support below the 50 DMA line is the prior highs in the $29 area. It completed Secondary Offerings on 7/09/20 and 5/15/20.

PING was last shown in this FSU section on 8/10/20 with an annotated graph under the headline, "Perched Near High With Earnings News Due Wednesday Evening". It was highlighted in yellow with new pivot point cited based on its 2/20/20 high plus 10 cents in the 6/01/20 mid-day report (read here). The gain above the pivot point on 6/18/20 was backed by +127% above average volume triggering a technical buy signal as it hit a new 52-week high (N criteria).

Its $15 IPO was completed on 9/19/19. The number of top-rated funds owning its shares rose from 83 in Sep '19 to 192 in Jun '20, a reassuring sign concerning the I criteria. Its current Up/Down Volume Ratio of 1.5 is an unbiased indication its shares have been under accumulation over the past 50 days.

Limited earnings history was previously noted as a concern. The Computer Software-Security firm had reported strong earnings results well above the +25% minimum guideline (C criteria) in the 4 latest quarterly comparisons through Mar '20 versus the year ago periods. Leadership in the Computer Software - Security industry group (L criteria) is a reassuring sign. The group is currently ranked 36th of the 197 industry groups.

Perched Near High With Earnings News Due Wednesday Evening - Monday, August 10, 2020

Ping Identity Hldg Corp (PING -$0.75 or -2.06% to $35.60) pulled back from its all-time high with today's 2nd consecutive loss. Its 50-day moving average (DMA) line ($32.46) defines important near-term support above its prior highs in the $29 area. It has not formed a sound base of sufficient length. Keep in mind it is due to report Jun '20 quarterly results after the close on Wednesday, 8/12/20. Volume and volatility often increase near earnings news.

PING was last shown in this FSU section on 7/16/20 with an annotated graph under the headline, "Consolidating Above 50-Day Moving Average Following Secondary". It completed Secondary Offerings on 7/09/20 and 5/15/20. It was highlighted in yellow with new pivot point cited based on its 2/20/20 high plus 10 cents in the 6/01/20 mid-day report (read here). The gain above the pivot point on 6/18/20 was backed by +127% above average volume triggering a technical buy signal as it hit a new 52-week high (N criteria).

Its $15 IPO was completed on 9/19/19. The number of top-rated funds owning its shares rose from 83 in Sep '19 to 192 in Jun '20, a reassuring sign concerning the I criteria. Its current Up/Down Volume Ratio of 1.5 is an unbiased indication its shares have been under accumulation over the past 50 days.

The Computer Software-Security firm has reported strong earnings results well above the +25% minimum guideline (C criteria) in the 4 latest quarterly comparisons through Mar '20 versus the year ago periods. Limited earnings history is a concern, however, leadership in the Computer Software - Security industry group (L criteria) is a reassuring sign. The groups is currently ranked 25th of the 197 industry groups.

Consolidating Above 50-Day Moving Average Following Secondary - Thursday, July 16, 2020

Ping Identity Hldg Corp (PING -$1.08 or -3.43% to $30.39) abruptly retreated from its all-time high with a big loss on 7/13/20 backed by above average volume. The company priced another Secondary Offering on 7/09/20 after an earlier Secondary Offering on 5/15/20. It has not formed a sound base of sufficient length. Prior highs in the $29 area define initial support to watch above its 50-day moving average (DMA) line ($29.49).

PING was highlighted in yellow with new pivot point cited based on its 2/20/20 high plus 10 cents in the 6/01/20 mid-day report (read here). The gain above the pivot point on 6/18/20 was backed by +127% above average volume triggering a technical buy signal as it hit a new 52-week high (N criteria). It was last shown in this FSU section on 6/22/20 with an annotated graph under the headline, "Gain for Recent New High Backed by +71% Above Average Volume".

Its $15 IPO was completed on 9/19/19. The number of top-rated funds owning its shares rose from 83 in Sep '19 to 181 in Jun '20, a reassuring sign concerning the I criteria. Its current Up/Down Volume Ratio of 1.4 is an unbiased indication its shares have been under accumulation over the past 50 days.

The Computer Software-Security firm is due to report Jun '20 quarterly results on 7/28/20. It has reported strong earnings results well above the +25% minimum guideline (C criteria) in the 4 latest quarterly comparisons through Mar '20 versus the year ago periods. Limited earnings history is a concern, however, leadership in the Computer Software - Security industry group (L criteria) is a reassuring sign. The groups is currently ranked 20th of the 197 industry groups.

Gain for Recent New High Backed by +71% Above Average Volume - Monday, June 22, 2020

Ping Identity Hldg Corp (PING +$1.89 or +5.89% to $33.99) rebounded for its second best ever close with lighter volume behind a big gain today following a "negative reversal" after hitting a new all-time high on the prior session. The big gain on 6/18/20 with +71% above average volume triggered a technical buy signal. Prior highs in the $29 area define initial support to watch on pullbacks.

PING was highlighted in yellow with new pivot point cited based on its 2/20/20 high plus 10 cents in the 6/01/20 mid-day report (read here). The gain above the pivot point was backed by +127% above average volume triggering a technical buy signal as it hit a new 52-week high (N criteria). It was shown in this FSU section that evening with an annotated graph under the headline, "Strong Gain for New High Backed by 127% Above Average Volume".

Its $15 IPO was completed on 9/19/19 and after a choppy ascent it completed a Secondary Offering on 5/15/20. The number of top-rated funds owning its shares rose from 83 in Sep '19 to156 in Mar '20, a reassuring sign concerning the I criteria. Its current Up/Down Volume Ratio of 1.4 is an unbiased indication its shares have been under accumulation over the past 50 days.

The Computer Software-Security firm reported strong earnings results well above the +25% minimum guideline (C criteria) in the 4 latest quarterly comparisons through Mar '20 versus the year ago periods. Limited earnings history is a concern, however, leadership in the Computer Software - Security industry group (L criteria) is a reassuring sign. The groups is currently ranked 12th of the 197 industry groups.

Strong Gain for New High Backed by 127% Above Average Volume - Monday, June 1, 2020

Ping Identity Hldg Corp (PING +$2.19 or +7.74% to $30.50) finished strong after highlighted in yellow with new pivot point cited based on its 2/20/20 high plus 10 cents in the earlier mid-day report (read here). The gain above the pivot point was backed by +127% above average volume triggering a technical buy signal as it hit a new 52-week high (N criteria).

Its $15 IPO was completed on 9/19/19 and after a choppy ascent it completed a Secondary Offering on 5/15/20. The number of top-rated funds owning its shares rose from 83 in Sep '19 to157 in Mar '20, a reassuring sign concerning the I criteria. Its current Up/Down Volume Ratio of 1.4 is an unbiased indication its shares have been under accumulation over the past 50 days.

The Computer Sftwr-Security firm reported strong earnings results well above the +25% minimum guideline (C criteria) in the 4 latest quarterly comparisons through Mar '20 versus the year ago periods. Limited earnings history is a concern, however, leadership in the Computer Software - Security industry group (L criteria) is a reassuring sign. Completed its $15 IPO on 9/19/19.