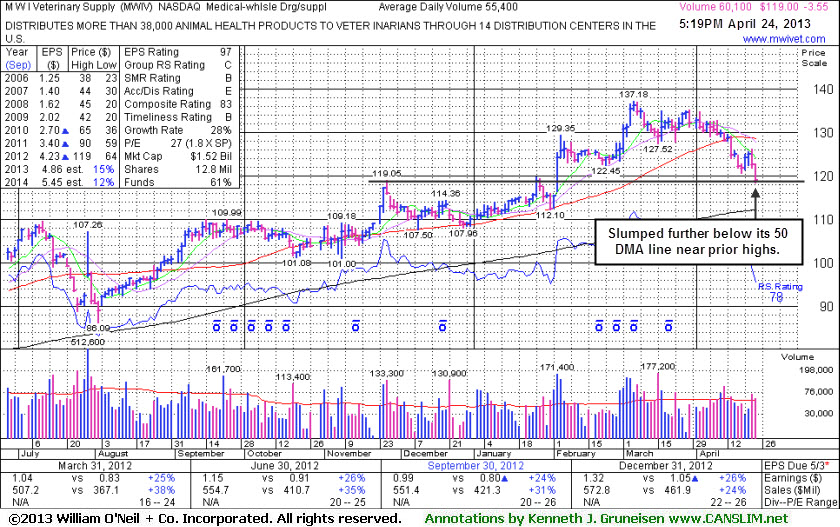

Prior Highs Define Support After Slumping Under 50-Day Average - Wednesday, April 24, 2013

M W I Veterinary Supply (MWIV -$3.55 or -2.90% to $119.00) is trading near its November highs which define an important support level after slumping further below its 50-day moving average (DMA) line. Its Relative Strength rating has slumped to 78, below the 80+ minimum guideline for buy candidates. Its last appearance in this FSU section with an annotated graph was on 4/04/13 under the headline, "Consolidating Above 50-Day Moving Average and Above Pivot Point". Its 50-day moving average (DMA) line violation on 4/15/13 raised concerns and triggered a technical sell signal. Disciplined investors limit losses by always selling if ever any stock fall more than -7% from their purchase price.The high-ranked Medical - Wholesale Drug/Supplies firm reported earnings +26% on +24% sales revenues for the quarter ended December 31, 2012 versus the year ago period, continuing its trend of recent quarterly earnings increases near the +25% minimum guideline (C criteria). Decelerating sales revenues increases in sequential quarterly comparisons through Dec '12 is a slight cause for concern while waiting and watching for the next quarterly report for the period ended March 31, 2013 versus the year ago period. Revenues rose by +38%, +35%, +31% and +24% in the Mar, Jun, Sep, and Dec '12 quarterly comparisons, respectively, versus the year ago periods. It is preferred when stocks show acceleration, rather than deceleration in their growth rates.

Its solid annual earnings history satisfies the A criteria. Its small supply (S criteria) of only 12.8 million shares outstanding could contribute to greater volatility in the event of institutional buying or selling. The number of top-rated funds owning its shares rose from 266 in Mar '12 to 301 in Mar '13, a very reassuring sign of interest coming from the institutional (I criteria) crowd.

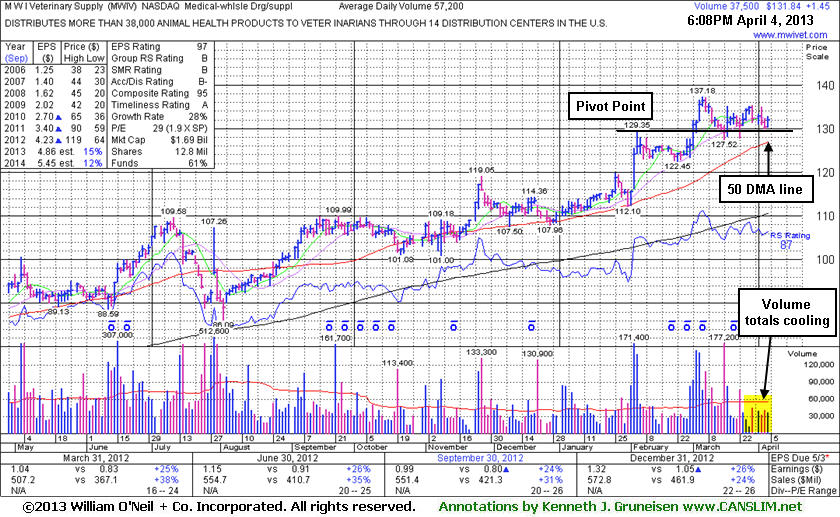

Consolidating Above 50-Day Moving Average and Above Pivot Point - Thursday, April 04, 2013

M W I Veterinary Supply (MWIV +$1.45 or +1.11% to $131.84) is still consolidating above its pivot point with volume totals cooling in recent weeks. The light volume totals are viewed as a reassuring indication that few investors are headed for the exit while it is perched near its 52-week high. Its 50-day moving average (DMA) line defines near-term support where any subsequent violation would raise concerns and trigger a technical sell signal. Disciplined investors limit losses by always selling if ever any stock fall more than -7% from their purchase price. MWIV marked its 52-week high on its last appearance in this FSU section with an annotated graph on 3/06/13 under the headline, "Getting Extended From "3-Weeks Tight" Base With Streak of Volume-Driven Gains". It had cleared the pivot point based on its 2/05/13 high plus 10 cents with a spurt of volume-driven gains. The price recently hitting new highs satisfied the N criteria.The high-ranked Medical - Wholesale Drug/Supplies firm reported earnings +26% on +24% sales revenues for the quarter ended December 31, 2012 versus the year ago period, continuing its trend of recent quarterly earnings increases near the +25% minimum guideline (C criteria). Decelerating sales revenues increases in sequential quarterly comparisons through Dec '12 is a slight cause for concern while waiting and watching for the next quarterly report for the period ended March 31, 2013 versus the year ago period. Revenues rose by +38%, +35%, +31% and +24% in the Mar, Jun, Sep, and Dec '12 quarterly comparisons, respectively, versus the year ago periods. It is preferred when stocks show acceleration, rather than deceleration in their growth rates.

Its solid annual earnings history satisfies the A criteria. Its small supply (S criteria) of only 12.8 million shares outstanding could contribute to greater volatility in the event of institutional buying or selling. The number of top-rated funds owning its shares rose from 266 in Mar '12 to 301 in Mar '13, a very reassuring sign of interest coming from the institutional (I criteria) crowd.

Getting Extended From "3-Weeks Tight" Base With Streak of Volume-Driven Gains - Wednesday, March 06, 2013

Often, when a leading stock is breaking out of a solid base it is highlighted in CANSLIM.net's Mid-Day Breakouts Report. The most relevant factors are noted in the report which alerts prudent CANSLIM oriented investors. After doing any necessary backup research, the investor is prepared to act. Disciplined investors know to buy as near as possible to the pivot point and avoid chasing stocks after they have rallied more than +5% above their pivot point. It is crucial to always limit losses whenever any stock heads the wrong direction, and disciplined investors sell if a struggling stock ever falls more than -7% from their purchase price.

M W I Veterinary Supply (MWIV +$0.86 or +0.64% to $136.29) was highlighted in yellow with pivot point based on its 2/05/13 high plus 10 cents in the 3/04/13 mid-day report (read here) and it touched another new 52-week high today while adding to its spurt of volume-driven gains. Gains in the major averages and strong leadership on 3/05/13 helped the market (M criteria) to produce a new confirmed rally with a follow-through day following a brief correction (noted in prior Market Commentaries). Last week it cleared an advanced "3-weeks tight" base pattern formed since it technically broke out of a sound base on 2/04/13. Its color code was changed to green after rallying above the "max buy" level.

The high-ranked Medical - Wholesale Drug/Supplies firm reported earnings +26% on +24% sales revenues for the quarter ended December 31, 2012 versus the year ago period, continuing its trend of recent quarterly earnings increases near the +25% minimum guideline (C criteria). MWIV has shown resilience in recent months after rebounding impressively from its lows since dropped from the Featured Stocks list on 8/05/11. Its last appearance in this FSU section with an annotated graph was back on 6/30/11 under the headline, "50-Day Moving Average Still Acting as Resistance". The price recently hitting new highs, solidly satisfies the N criteria.

Its solid annual earnings history satisfies the A criteria. Its small supply (S criteria) of only 12.8 million shares outstanding could contribute to greater volatility in the event of institutional buying or selling. The number of top-rated funds owning its shares rose from 266 in Mar '12 to 294 in Dec '12, a reassuring sign of support from the institutional (I criteria) crowd.

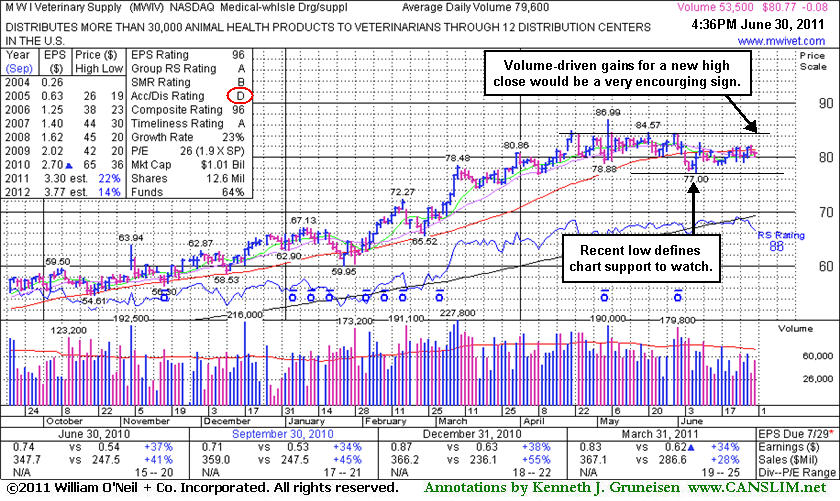

50-Day Moving Average Still Acting as Resistance - Thursday, June 30, 2011

M W I Veterinary Supply (MWIV -$0.34 or -0.42% to $80.51) may be forming a new base, however gains in recent weeks have lacked volume conviction. Its Accumulation/Distribution Rating (see red circle) of D remains a cause for concern. After its last appearance in this FSU section with an annotated graph on 6/09/11 under the headline, "Quiet Gains Following Technically Damaging Distribution", its 50-day moving average (DMA) line has been acting as a stubborn resistance level.

Sales revenues acceleration (bigger percentage increases sequentially, +34%, +41%, +45% and +55% in the Mar, Jun, Sep, and Dec '10 quarterly comparisons versus the year earlier) was noted as a very reassuring sign. For the latest period ended March 31, 2011 its +28% sales revenues increase was still was very strong, but it broke the sequential streak of bigger sales increases. Acceleration suggests increasing demand for the company's products, which, along with the price recently hitting new highs, solidly satisfied the N criteria.

Its solid quarterly and annual earnings history satisfies the C and A criteria. Its small supply (S criteria) of only 12.6 million shares outstanding could contribute to greater volatility in the event of institutional buying or selling. The number of top-rated funds owning its shares rose from 255 in Mar '10 to 280 in Mar '11, a reassuring sign of support from the institutional (I criteria) crowd. Since it was first featured in yellow at $52.05 on 7/29/10 it traded as much as +67.1% higher in about 9 months. It has the look of a sound new base forming, and although a new pivot point is not being cited, subsequent volume-driven gains for a new high close (above the $84.30 close from 5/31/11) would be considered a very encouraging sign. Disciplined investors would watch for a sound base to be noted and wait for market conditions (the M criteria) to signal that odds are more favorable. Keep in mind that during market corrections, the M criteria argues against new buying efforts, since 3 out of 4 stocks typically go in the same direction of the broader market.

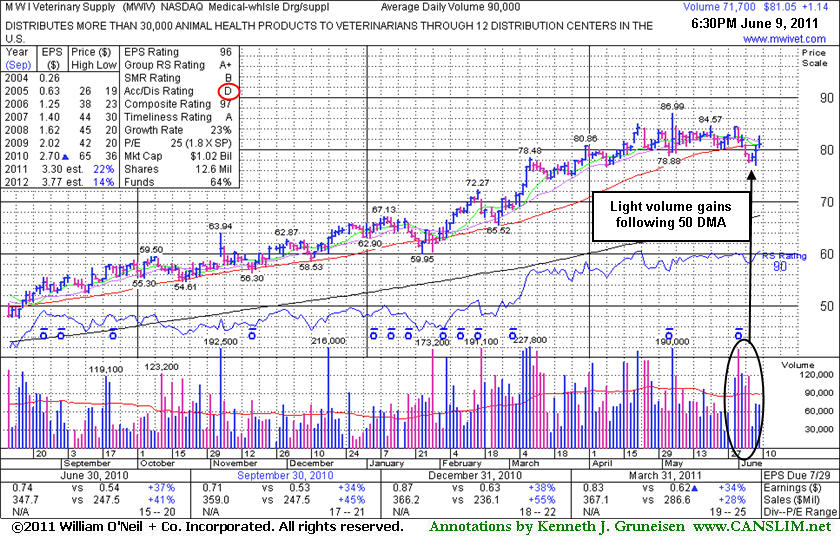

Quiet Gains Following Technically Damaging Distribution - Thursday, June 09, 2011

M W I Veterinary Supply (MWIV +$1.14 or +1.43% to $81.05) has posted 3 consecutive gains with below average volume and rallied to a close near its 50-day moving average (DMA) line. It recently suffered 3 losses in the span of 4 sessions with above average volume, violating its 50 DMA line and recent chart lows triggering technical sell signals. After its last appearance in this FSU section with an annotated graph on 5/05/11 under the headline, "Spike to New High on Latest Strong Earnings Release", it stalled and volume totals cooled for a few weeks while it consolidated in an orderly fashion above its 50 DMA line. Disciplined investors would watch for a new base to form and wait for market conditions to signal that odds are more favorable. Sales revenues acceleration (bigger percentage increases sequentially, +34%, +41%, +45% and +55% in the Mar, Jun, Sep, and Dec '10 quarterly comparisons versus the year earlier) was noted as a very reassuring sign. For the latest period ended March 31, 2011 its +28% sales revenues increase was still was very strong, but it broke the sequential streak of bigger sales increases. The acceleration suggests increasing demand for the company's products, which, along with the price recently hitting new highs, solidly satisfied the N criteria.Its solid quarterly and annual earnings history satisfies the C and A criteria. Its small supply (S criteria) of only 12.5 million shares outstanding could contribute to greater volatility in the event of institutional buying or selling. The number of top-rated funds owning its shares rose from 255 in Mar '10 to 280 in Mar '11, a reassuring sign of support from the institutional (I criteria) crowd. Since it was first featured in yellow at $52.05 on 7/29/10 it traded as much as +67.1% higher in about 9 months. It has the look of a sound new base forming, and although a new pivot point is not being cited, subsequent volume-driven gains for a new high close (above the $84.30 close from 5/31/11) would be considered a bullish sign. Keep in mind that during market corrections, the M criteria argues against new buying efforts, since 3 out of 4 stocks typically go in the same direction of the broader market.

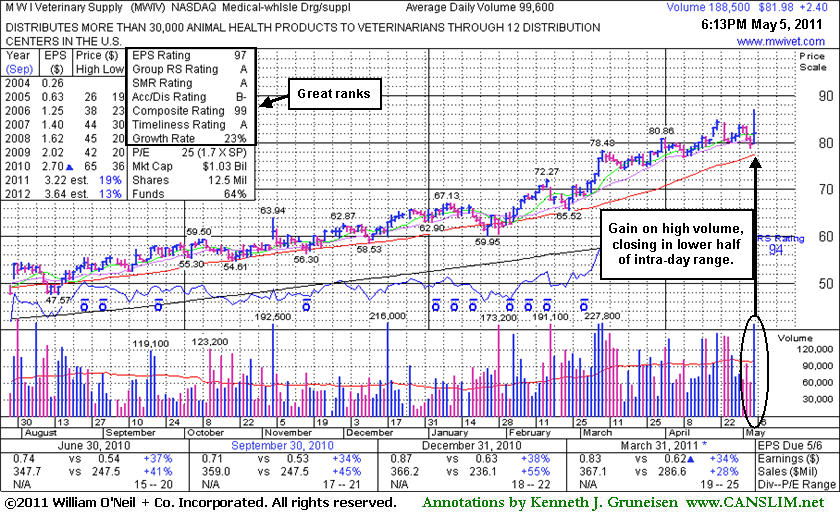

Spike to New High on Latest Strong Earnings Release - Thursday, May 05, 2011

M W I Veterinary Supply (MWIV +$2.40 or +3.02% to $81.98) posted a gain today with high volume, but closed in the lower half of its intra-day range after spiking to a new all-time high. It reported earnings +34% on +28% sales revenues for the quarter ended March 31st versus the year ago period. It has been noted as extended from any sound base pattern. Its 50-day moving average (DMA) line defines important support to watch on pullbacks.Since its last appearance in this FSU section with an annotated graph on 4/08/11 under the headline, "Strength Continues But No Sound Base Has Formed", it made progress into new high territory, but also endured distributional pressure. It has been a long time since a sound base was formed. Disciplined investors would watch for a new base to form and wait for market conditions to signal that odds are more favorable. Sales revenues acceleration (bigger percentage increases sequentially, +34%, +41%, +45% and +55% in the Mar, Jun, Sep, and Dec '10 quarterly comparisons versus the year earlier) was noted as a very reassuring sign. The +28% sales increase in the latest period (Mar '11) still was very strong, but it broke the sequential streak of bigger sales increases. The acceleration suggests increasing demand for the company's products, which, along with the price hitting new highs, solidly satisfies the N criteria.

Its solid quarterly and annual earnings history satisfies the C and A criteria. Its small supply (S criteria) of only 12.5 million shares outstanding could contribute to greater volatility in the event of institutional buying or selling. The number of top-rated funds owning its shares rose from 255 in Mar '10 to 272 in Mar '11, a reassuring sign of support from the institutional (I criteria) crowd. From $52.05 when first featured in yellow on 7/29/10 it has now traded +67.1% higher. Patient investors may watch for it to eventually form a sound new base or look to accumulate shares at a secondary buy point when and if such circumstances should be noted.

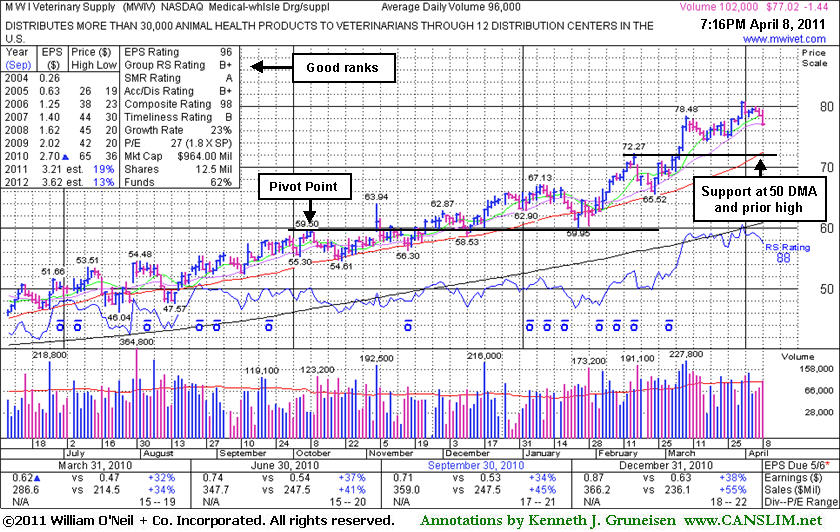

Strength Continues But No Sound Base Has Formed - Friday, April 08, 2011

M W I Veterinary Supply (MWIV -$1.44 or -1.84% to $77.02) pulled back today for a 3rd consecutive loss. Its 50-day moving average (DMA) line defines important support to watch. It has not formed any sound new base patterns this year and been repeatedly noted - "Extended from any sound base pattern." Since its last appearance in this FSU section with an annotated graph on 3/08/11 under the headline "Surge To New Highs Has Leader Extended From Sound Base " it stubbornly held its ground well above its 50 DMA line and rose to new all-time highs. As previously noted, sales revenues acceleration (bigger percentage increases sequentially, +34%, +41%, +45% and +55% in the Mar, Jun, Sep, and Dec '10 quarterly comparisons versus the year earlier) is a very reassuring sign. The acceleration suggests increasing demand for the company's products, which, along with the price hitting new highs, solidly satisfies the N criteria.

Its solid quarterly and annual earnings history satisfies the C and A criteria. Its small supply (S criteria) of only 12.5 million shares outstanding could contribute to greater volatility in the event of institutional buying or selling. The number of top-rated funds owning its shares rose from 255 in Mar '10 to 270 in Dec '10, a reassuring sign of support from the institutional (I criteria) crowd. From $52.05 when first featured in yellow on 7/29/10 it has now traded +55.4% higher. Patient investors may watch for it to eventually form a sound new base or look to accumulate shares at a secondary buy point when and if such circumstances should be noted.

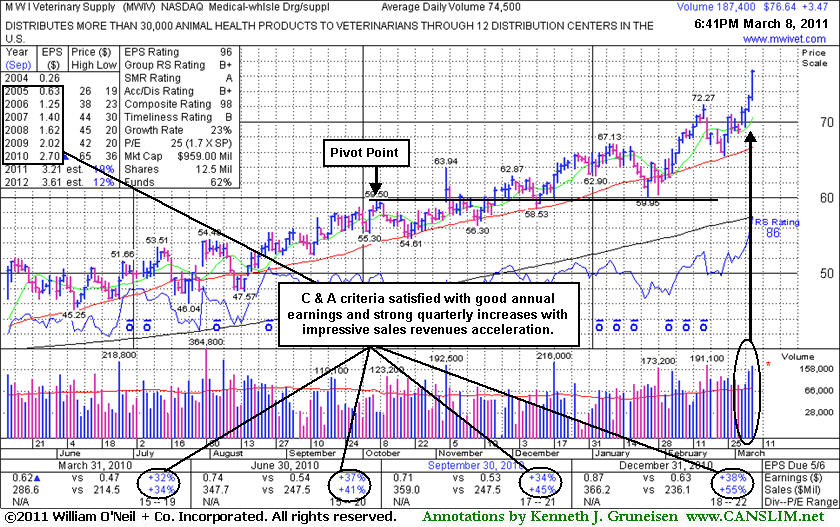

Surge To New Highs Has Leader Extended From Sound Base - Tuesday, March 08, 2011

M W I Veterinary Supply (MWIV +$3.48 or +4.76% to $76.65) was up again today with above above average volume for another new all-time high. It found support near prior highs and its 50-day moving average (DMA) line recently but did not build a sound new base pattern. It could go on to produce more climactic gains, but disciplined investors avoid chasing extended stocks. Following its last appearance in this FSU section on 2/02/11 with detailed analysis and an annotated graph included under the headline, "Earnings News Due While Consolidating Near Support", it reported strong earnings news. As previously noted, sales revenues acceleration (bigger percentage increases sequentially, +34%, +41%, +45% and +55% in the Mar, Jun, Sep, and Dec '10 quarterly comparisons versus the year earlier) is a very reassuring sign. The acceleration suggests increasing demand for the company's products, which, along with the price hitting new highs, solidly satisfies the N criteria.

Its solid quarterly and annual earnings history satisfies the C and A criteria. Its small supply (S criteria) of only 12.5 million shares outstanding could contribute to greater volatility in the event of institutional buying or selling. The number of top-rated funds owning its shares rose from 255 in Mar '10 to 270 in Dec '10, a reassuring sign of support from the institutional (I criteria) crowd. From $52.05 when first featured in yellow on 7/29/10 it has now traded +47% higher. Patient investors may watch for it to eventually form a sound new base or look to accumulate shares at a secondary buy point when and if such circumstances should be noted.

Earnings News Due While Consolidating Near Support - Wednesday, February 02, 2011

M W I Veterinary Supply (MWIV -$1.11 or -1.74% to $62.65) is consolidating near its 50-day moving average (DMA) line, showing resilience after recently enduring distributional pressure. It is scheduled to report earnings results prior to the open on Thursday (tomorrow). Volume and volatility often increase near earnings news. It has not formed a sound new base, yet it is perched just -6.7% off its high. More damaging losses for a new low close or violation of its recent chart low ($59.95 on 1/25/11) could raise greater concerns and trigger a more worrisome technical sell signal. Its small supply (S criteria) of only 12.5 million shares outstanding could contribute to greater volatility in the event of institutional buying or selling.

MWIV's last appearance in this FSU section was on 12/21/10 with detailed analysis and an annotated graph included under the headline, "New High Close After Recent Confirming Gains", shortly after a confirming gain on 12/17/10 with 3 times average volume for a new high close. Concerns were then noted due to rather tame Street estimates for its FY '11 and FY '12 earnings and signs of waning leadership in the Medical - Wholesale Drugs/Supplies group. Following that reassuring sign of solid support from the institutional (I criteria) crowd it only went on to trade up to a new all-time high of $67.13 before beginning its latest consolidation. In fact, from $52.05 when first featured in yellow on 7/29/10 it only traded as much as +29% higher, not especially strong in the context of other great winners in the past 6 months.

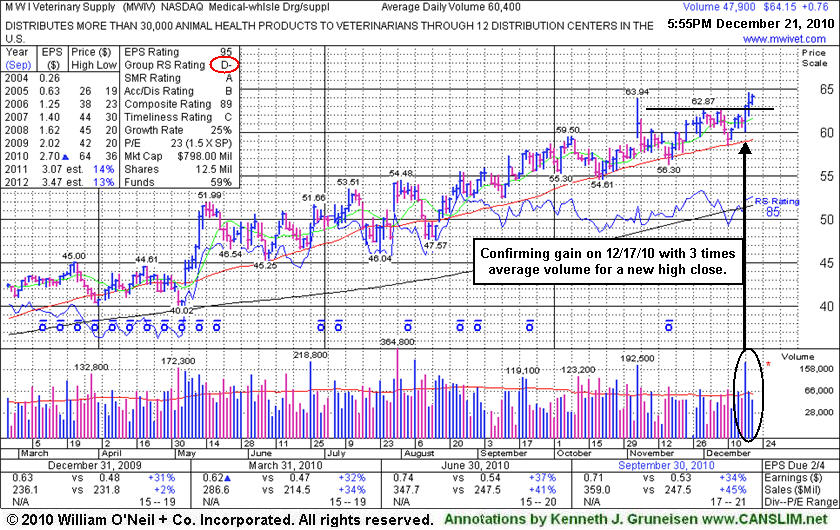

New High Close After Recent Confirming Gains - Tuesday, December 21, 2010

M W I Veterinary Supply (MWIV +$0.76 or +1.20% to $64.15) has rallied further on lighter volume after a confirming gain on 12/17/10 with 3 times average volume for a new high close. The gain reconfirmed bullish action it showed in recent weeks after it found support above its 50-day moving average (DMA) line, a reassuring sign of solid support from the institutional (I criteria) crowd. It may deserve the benefit of the doubt in a bullish market environment (M criteria), but disciplined investors might be on the lookout for candidates that more solidly satisfy all key criteria.

Volume totals had been drying up since hitting its all-time high on 11/04/10 which was a "breakaway gap" shortly after its last appearance in this FSU section on 11/02/10 with detailed analysis and an annotated graph under the headline "Distributional Action While Consolidating Above 50 Day Average". It has a good annual earnings (A criteria) history, and the latest quarter ended September 30, 2010 showed more impressive sales revenues acceleration as it reported +34% earnings on +45% sales revenues versus the year ago period. Its small supply (S criteria) of only 12.5 million shares outstanding could contribute to greater volatility in the event of institutional buying or selling.

Some may consider the recent 6-week consolidation as a new base, and might suggest that volume-driven gains above its prior highs could be considered a new (or add-on) technical buy signal yet again. We chose not to identify a new pivot point because MWIV has struggled to make meaningful progress in recent weeks after its earlier breakout was identified. Its Relative Strength line (the jagged blue line) did not recently lead the way by surging to new high territory first, while seeing the RS line rise to new highs first is considered a more favorable characteristic among big market winners. Additional concerns remain due to rather tame Street estimates for its FY '11 and FY '12 earnings. Also,its Group RS Rating has also slumped to a D- and this shows that leadership in the Medical - Wholesale Drugs/Supplies group has not been improving.

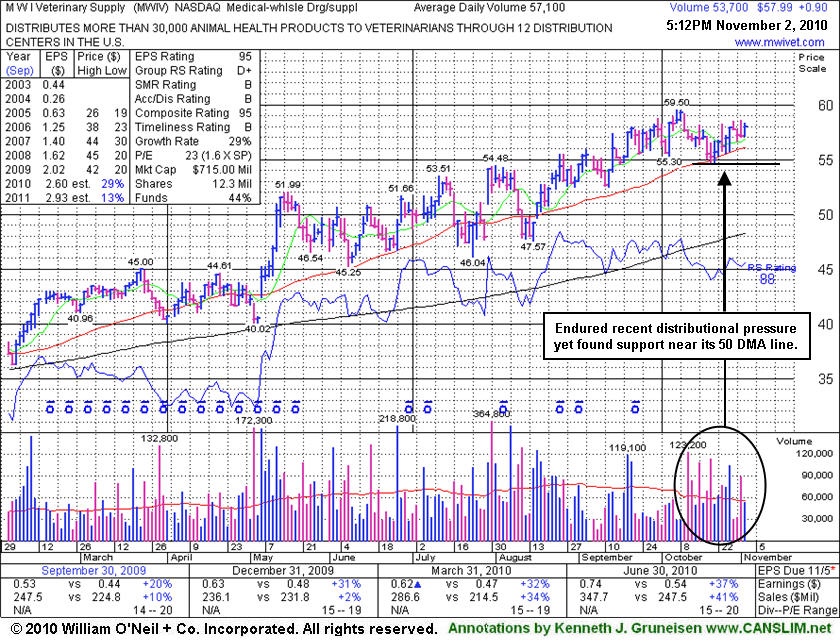

Distributional Action While Consolidating Above 50-Day Average - Tuesday, November 02, 2010

M W I Veterinary Supply (MWIV +$0.90 or +1.58% to $57.99) has been consolidating near its 52-week high, and it recently has found support near its 50-day moving average (DMA) line. Any subsequent violation of that classic chart support level or breach of recent lows near $54.60 would raise greater concerns and could trigger technical sell signals. The company is due to announce earnings results for the latest quarter ended September 30, 2010 on Thursday, November 4, 2010. Volume and volatility often increase near earnings news, so investors should remain alert and be disciplined. It has a good annual earnings (A criteria) history, and the latest quarter ended June 30, 2010 showed more impressive sales and earnings acceleration after prior earnings comparisons showed improvement above the guidelines of the fact-based investment system. Its small supply (S criteria) of only 12.3 million shares outstanding could contribute to greater volatility in the event of institutional buying or selling.

It was last shown in this FSU section on 9/07/10 under the headline "Volume Totals Cooling While Perched Near Highs" and it subsequently found support above its 50-day moving average (DMA) line and then rallied on to new highs. The annotated chart shows numerous sessions with losses in recent weeks that have been marked by above average volume. While it has avoided any technical breakdown, the recent action is recognized as a sign of distributional pressure that raises some concerns. Continued healthy trading above its 50 DMA line would be a reassuring sign of solid support from the institutional (I criteria) crowd, while any damaging violation would raise concerns and suggest that a longer and deeper consolidation is likely.

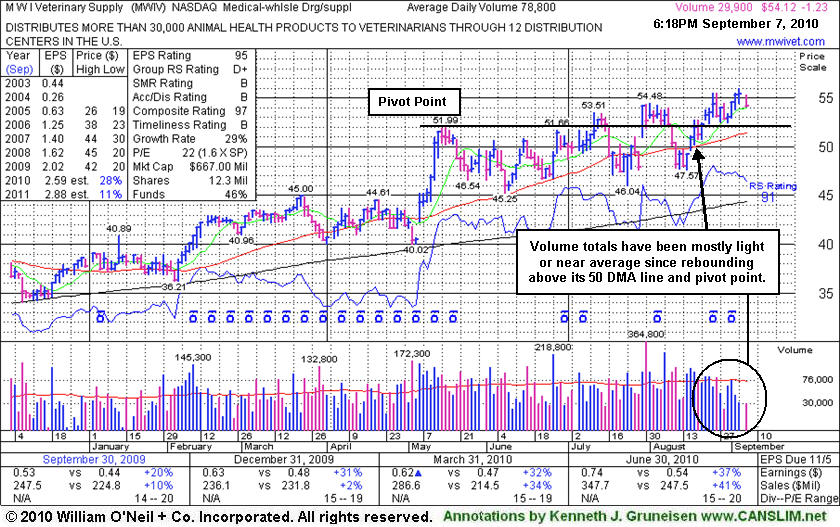

Volume Totals Cooling While Perched Near Highs - Tuesday, September 07, 2010

M W I Veterinary Supply (MWIV -$1.23 or -2.22% to $54.12) suffered a small loss on light volume today, quietly consolidating under its "max buy" level. Its color code was changed to yellow. No overhead supply remains to act as resistance. Recent lows in the $46 area define an important chart support level. It was last shown in this FSU section on 7/30/10 under the headline "Recent Breakout Encountering Some Distributional Pressure" when negatively reversing for a loss on heavy volume, encountering distributional pressure. It subsequently negated its breakout and slumped below its 50-day moving average (DMA) line before rebounding to new highs. However, since repairing its 50 DMA violation its gains have lacked great volume conviction. Normally gains backed by at least +50% above average volume are considered to be indicative of serious buying demand from the institutional (I criteria) crowd that is more likely to fuel a sustained advance into new high ground.

It was featured in the 7/29/10 mid-day report (read here). Its weekly chart still has bullish characteristics and little signs of distribution throughout the past year. It has a good annual earnings (A criteria) history, and the latest quarter ended June 30, 2010 showed more impressive sales and earnings acceleration after prior earnings comparisons showed improvement above the guidelines of the fact-based investment system. Its small supply (S criteria) of only 12.3 million shares outstanding could contribute to greater volatility in the event of institutional buying or selling. An earlier breakout attempt in July failed after its gains above its May highs lacked great volume conviction. Although it briefly slumped under its 50-day moving average line, it again found impressive support above prior chart lows in the $45-46 area.

Recent Breakout Encountering Some Distributional Pressure - Friday, July 30, 2010

M W I Veterinary Supply (MWIV -$1.47 or -2.72% to $52.66) gapped down today then rebounded and touched new high territory. However, it ultimately finished the session near its pivot point with a loss on heavy volume, encountering distributional pressure. It was featured in the 7/29/10 mid-day report (read here). No overhead supply remains to act as resistance after hitting a new 52-week high with its strong close above the pivot point cited (based on its 5/17/10 high plus ten cents) backed by +72% above average volume triggering a buy signal. Its weekly chart has bullish characteristics and little signs of distribution throughout the past year. It has a good annual earnings (A criteria) history, and the latest quarter ended June 30, 2010 showed more impressive sales and earnings acceleration after prior earnings comparisons showed improvement above the guidelines of the fact-based investment system. Its small supply (S criteria) of only 12.3 million shares outstanding could contribute to greater volatility in the event of institutional buying or selling. An earlier breakout attempt in July failed after its gains above its May highs lacked great volume conviction. Although it briefly slumped under its 50-day moving average line, it found impressive support near prior chart lows in the $45-46 area.