Distributional Action While Consolidating Above 50-Day Average

Tuesday, November 02, 2010 CANSLIM.net

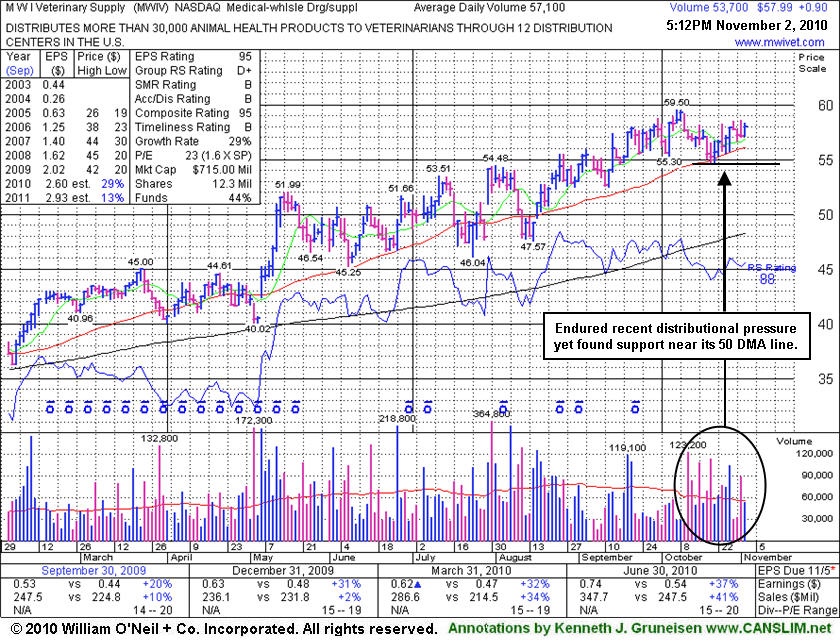

M W I Veterinary Supply (MWIV +$0.90 or +1.58% to $57.99) has been consolidating near its 52-week high, and it recently has found support near its 50-day moving average (DMA) line. Any subsequent violation of that classic chart support level or breach of recent lows near $54.60 would raise greater concerns and could trigger technical sell signals. The company is due to announce earnings results for the latest quarter ended September 30, 2010 on Thursday, November 4, 2010. Volume and volatility often increase near earnings news, so investors should remain alert and be disciplined. It has a good annual earnings (A criteria) history, and the latest quarter ended June 30, 2010 showed more impressive sales and earnings acceleration after prior earnings comparisons showed improvement above the guidelines of the fact-based investment system. Its small supply (S criteria) of only 12.3 million shares outstanding could contribute to greater volatility in the event of institutional buying or selling.

It was last shown in this FSU section on 9/07/10 under the headline "Volume Totals Cooling While Perched Near Highs" and it subsequently found support above its 50-day moving average (DMA) line and then rallied on to new highs. The annotated chart shows numerous sessions with losses in recent weeks that have been marked by above average volume. While it has avoided any technical breakdown, the recent action is recognized as a sign of distributional pressure that raises some concerns. Continued healthy trading above its 50 DMA line would be a reassuring sign of solid support from the institutional (I criteria) crowd, while any damaging violation would raise concerns and suggest that a longer and deeper consolidation is likely.