Volume Behind 200 Day Moving Average Line Violation - Friday, October 19, 2018

FleetCor Technologies, Inc (FLT -$2.64 or -1.28% to $204.09) fell further below its 200-day moving average (DMA) line ($209) with today's volume-driven loss. it will be dropped from the Featured Stocks list tonight. A prompt recovery and subsequent rebound above the 50 DMA line ($217) is needed for its outlook to improve. Three out of 4 stocks tend to follow the direction of the broader market (M criteria) which has been repeatedly noted in a "correction".Perched Within Close Striking Distance of New Pivot Point - Thursday, September 20, 2018

FleetCor Technologies, Inc (FLT +$2.25 or +1.02% to $222.18) recently rebounded above its 50-day moving average (DMA) line ($217.81) helping its outlook improve. A new pivot point was cited based on its 7/25/18 high plus 10 cents. Subsequent volume-driven gains above the pivot point may trigger a new (or add-on) technical buy signal. The prior low ($210.64 on 8/03/18) defines important near-term support above its 200 DMA line($202). Fundamentals remain strong.Testing 50-Day Average With Loss on Higher Volume - Friday, August 3, 2018

FleetCor Technologies, Inc (FLT -$5.51 or -2.49% to $216.06) retreated from its 52-week high with today's volume-driven loss testing its 50-day moving average (DMA) line and prior highs in the $212 area defining important near-term support. Recently it reported earnings +29% on +8% sales revenues for the Jun '18 quarter, its 3rd consecutive quarterly comparison above the +25% minimum guideline (C criteria). Annual earnings history (A criteria) has been strong, a good match with the fact-based investment system's guidelines."Breakaway Gap With Heavy Volume - Monday, June 18, 2018

FleetCor Technologies, Inc (FLT+$13.35 or +6.45% to $220.44) was highlighted in yellow with pivot point cited based on its 1/25/18 high plus 10 cents in the earlier mid-day report (read here). It triggered a technical buy signal as it hit new highs with a "breakaway gap" and considerable volume-driven gain clearing previously stubborn resistance in the $212-213 area.Relative Strength Rating Fell While Consolidating Near 50-Day Average - Monday, May 18, 2015

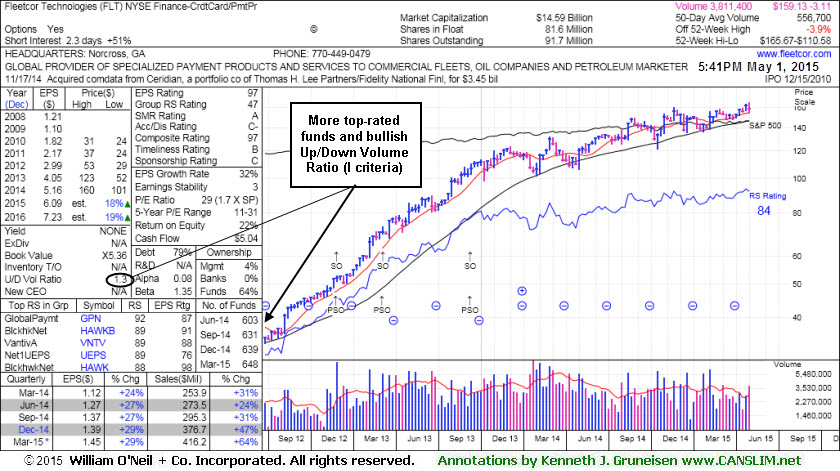

FleetCor Technologies, Inc (FLT +$0.03 or +0.02% to $154.37) is sputtering near its 50-day moving average (DMA) line. Its Relative Strength Rating has slumped to 71, below the 80+ minimum guideline for buy candidates. Technically, it broke out on 4/23/15 with a volume-driven gain for new highs, and healthy stocks rarely fall more than -7% below their pivot point in favorable market environments.

It reported earnings +27%, +27%, +29%,and +29% for the Jun, Sep, Dec 14, and Mar '15 quarterly comparisons versus the year ago periods, respectively. Sales revenues rose +24%, +31%, +47%, and +64% during that span, a very reassuring acceleration in its growth rate. Fundamentals (C and A criteria) remain a good match with the fact-based investment system's guidelines. FLT last appeared in this FSU section on 5/01/15 with annotated graphs under the headline, "Testing Support at 50-Day Moving Average Line". It was highlighted in yellow in the earlier mid-day report (read here)

The company hails from the Finance - Credit Card Payment Processing group which saw big gains in recent weeks from Visa (V) and MasterCard (MA). Impressive strength and leadership from other firms in the same industry group is a reassurance concerning the L criteria. The company completed a Secondary Offering on 9/11/13. Prior Secondary Offerings on 3/14/12, 6/11/12, 11/29/12, and 3/08/13 were previously noted, "Such offerings often are a short-term hindrance to upward price progress yet typically result in broader institutional ownership interest." The number of top-rated funds owning its shares rose from 603 in Jun '14 to 665 in Mar '15, a reassuring sign concerning the I criteria.

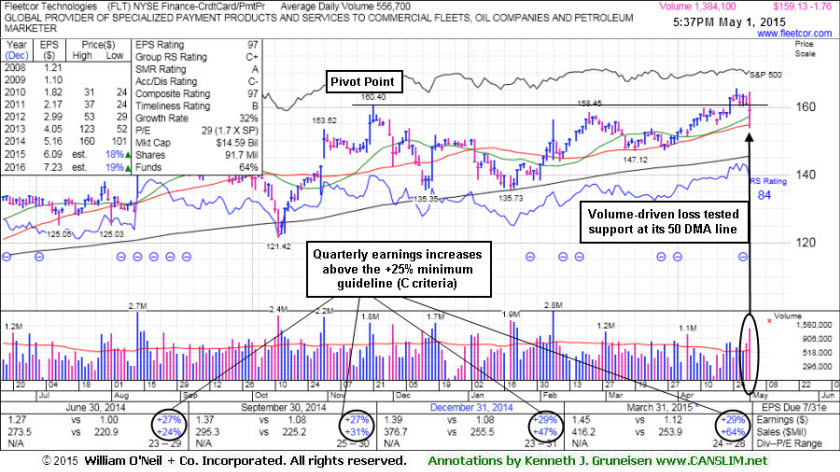

Testing Support at 50-Day Moving Average Line - Friday, May 01, 2015

FleetCor Technologies, Inc (FLT -$1.76 or -1.09% to $159.13) was highlighted in yellow in the earlier mid-day report (read here) while testing support at its 50-day moving average (DMA) line ($154.74) with a volume-driven loss. Technically, it broke out on 4/23/15 with a volume-driven gain for new highs, and healthy stocks rarely fall more than -7% below their pivot point in favorable market environments.

It reported earnings +29% on +64% sales revenues for the Mar '15 quarter. Fundamentals (C and A criteria) remain a good match with the fact-based investment system's guidelines. It found support at its 200 DMA line and made gradual progress since dropped from the Featured Stocks list on 12/16/14. Its Relative Strength rating of 85 remains above the 80+ minimum guideline for buy candidates.

FLT last appeared in this FSU section on 12/08/14 with annotated graphs under the headline, "Testing Support While Encountering Recent Distributional Pressure". The company hails from the Finance - Credit Card Payment Processing group which saw big gains in recent weeks from Visa (V) and MasterCard (MA). Impressive strength and leadership from other firms in the same industry group is a reassurance concerning the L criteria. The company completed a Secondary Offering on 9/11/13. Prior Secondary Offerings on 3/14/12, 6/11/12, 11/29/12, and 3/08/13 were previously noted, "Such offerings often are a short-term hindrance to upward price progress yet typically result in broader institutional ownership interest." The number of top-rated funds owning its shares rose from 603 in Jun '14 to 648 in Mar '15, a reassuring sign concerning the I criteria. Its current Up/Down Volume Ratio of 1.3 is an unbiased indication its shares have been under accumulation over the past 50 days.

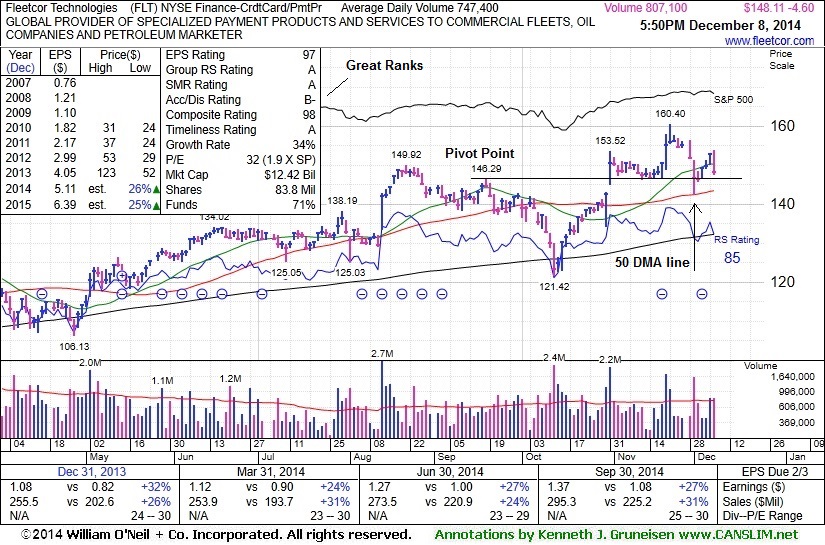

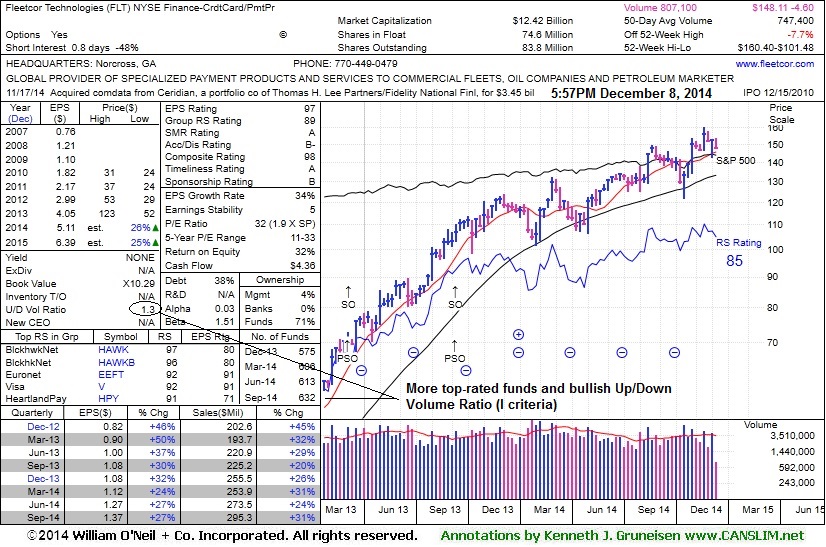

Testing Support While Encountering Recent Distributional Pressure - Monday, December 08, 2014

FleetCor Technologies, Inc's (FLT -$4.60 or -3.01% to $148.11) has been encountering distributional pressure while consolidating above prior highs in the $146-149 area. Big losses recently tested support at its 50-day moving average (DMA) line. More damaging losses may trigger a worrisome technical sell signal.

FLT last appeared in this FSU section on 11/18/14 with annotated graphs under the headline, "Consolidation Continues Above Prior Highs". It was highlighted in yellow in the 10/31/14 mid-day report (read here) and finished strong after blasting above the pivot point cited based on its 9/18/14 high in a "double bottom" base.

It reported earnings +27% on +31% sales revenues for the Sep '14 quarter, continuing its strong earnings history with results above the +25% minimum guideline (C criteria). Its Relative Strength rating of 85 remains above the 80+ minimum guideline for buy candidates.

The company hails from the Finance - Credit Card Payment Processing group which saw big gains in recent weeks from Visa (V) and MasterCard (MA). Impressive strength and leadership from other firms in the same industry group is a reassurance concerning the L criteria. The company completed a Secondary Offering on 9/11/13. Prior Secondary Offerings on 3/14/12, 6/11/12, 11/29/12, and 3/08/13 were previously noted, "Such offerings often are a short-term hindrance to upward price progress yet typically result in broader institutional ownership interest." The number of top-rated funds owning its shares rose from 193 in Mar '12 to 632 in Sep '14, a reassuring sign concerning the I criteria. Its current Up/Down Volume Ratio of 1.3 is an unbiased indication its shares have been under accumulation over the past 50 days.

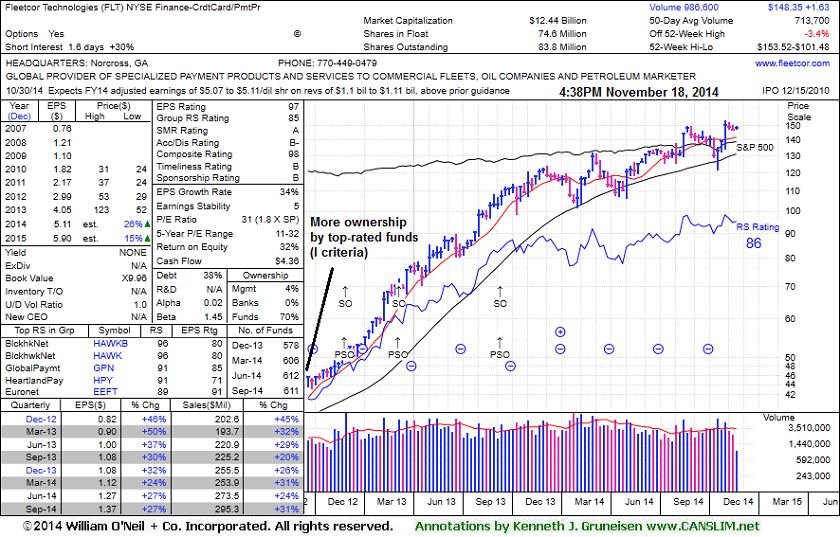

Consolidation Continues Above Prior Highs - Tuesday, November 18, 2014

FleetCor Technologies, Inc's (FLT +$0.56 or +0.38% to $148.31) is still consolidating with volume totals cooling after highlighted in yellow in the 10/31/14 mid-day report (read here) clinching a convincing technical buy signal. Prior highs acted as support during its recent consolidation and it remains trading above its pivot point and below its "max buy" level. FLT last appeared in this FSU section on 10/31/14 with annotated graphs under the headline, "Strong Finish Following Gap Up After Earnings News". It finished strong after highlighted in yellow with new pivot point cited based on its 9/18/14 high in a "double bottom" base (read here).

It reported earnings +27% on +31% sales revenues for the Sep '14 quarter, continuing its strong earnings history with results above the +25% minimum guideline (C criteria). Its Relative Strength rating of 86 remains above the 80+ minimum guideline for buy candidates.

The company hails from the Finance - Credit Card Payment Processing group which saw big gains in recent weeks from Visa (V) and MasterCard (MA). Impressive strength and leadership from other firms in the same industry group is a reassurance concerning the L criteria. The company completed a Secondary Offering on 9/11/13. Prior Secondary Offerings on 3/14/12, 6/11/12, 11/29/12, and 3/08/13 were previously noted, "Such offerings often are a short-term hindrance to upward price progress yet typically result in broader institutional ownership interest." The number of top-rated funds owning its shares rose from 193 in Mar '12 to 611 in Sep '14, a reassuring sign concerning the I criteria.

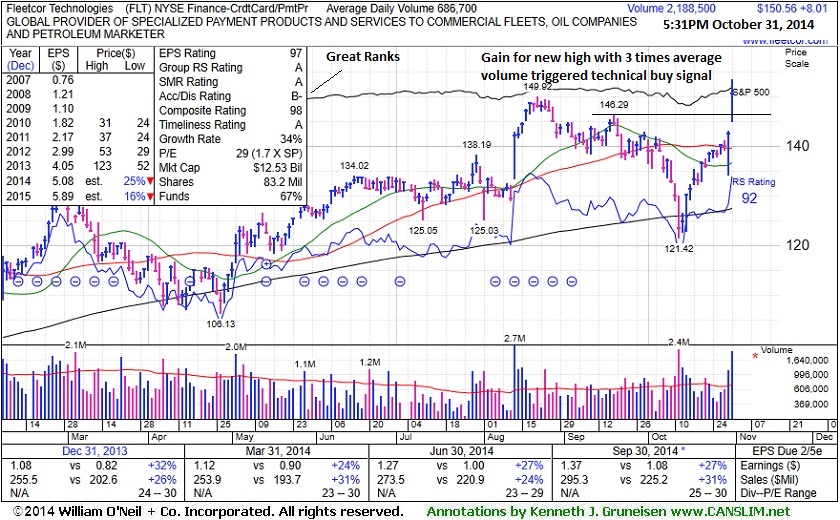

Strong Finish Following Gap Up After Earnings News - Friday, October 31, 2014

FleetCor Technologies, Inc's (FLT +$8.01 or +5.62% to $150.56) finished strong after highlighted in yellow with new pivot point cited based on its 9/18/14 high in a "double bottom" base (read here). It gapped up hitting a new 52-week high and clinched a convincing technical buy signal. It reported earnings +27% on +31% sales revenues for the Sep '14 quarter, continuing its strong earnings history with results above the +25% minimum guideline (C criteria).

FLT last appeared in this FSU section on 3/24/14 with annotated graphs under the headline, "Negated Recent Breakout and Testing Support at 50-Day Average", as its slump below its old high close ($122.70 on 12/02/13) raised concerns as it completely negated the prior breakout. Its Relative Strength rating has improved to 92, above the 80+ minimum guideline for buy candidates.

It found support at its 200 DMA line during its consolidation since last noted in the 8/25/14 mid-day report - "It did not form a sound base and made a choppy ascent since dropped from the Featured Stocks list on 4/07/14. Patient investors may watch for a new base to possibly form.

The company hails from the Finance - Credit Card Payment Processing group which saw big gains this week from Visa (V) and MasterCard (MA). and the impressive strength and leadership from other firms in the same industry group is a reassurance concerning the L criteria. The company completed a Secondary Offering on 9/11/13. Prior Secondary Offerings on 3/14/12, 6/11/12, 11/29/12, and 3/08/13 were previously noted, "Such offerings often are a short-term hindrance to upward price progress yet typically result in broader institutional ownership interest." The number of top-rated funds owning its shares rose from 193 in Mar '12 to 612 in Sep '14, a reassuring sign concerning the I criteria.

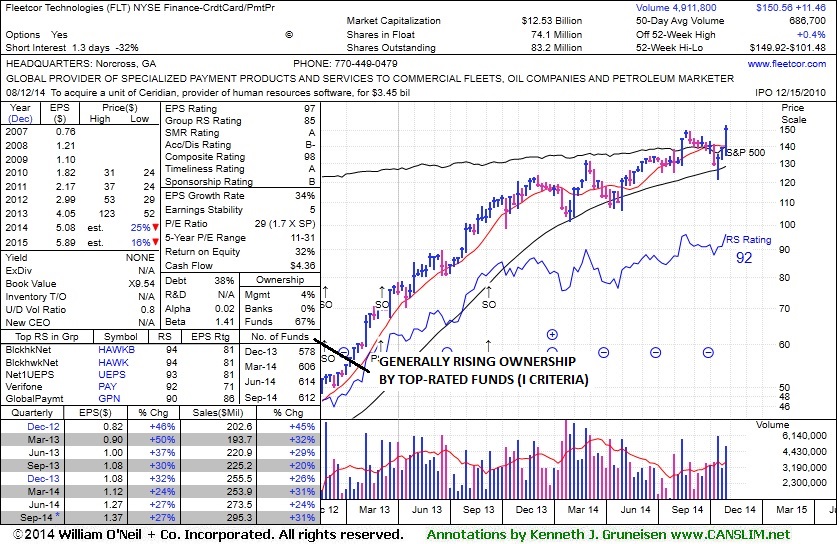

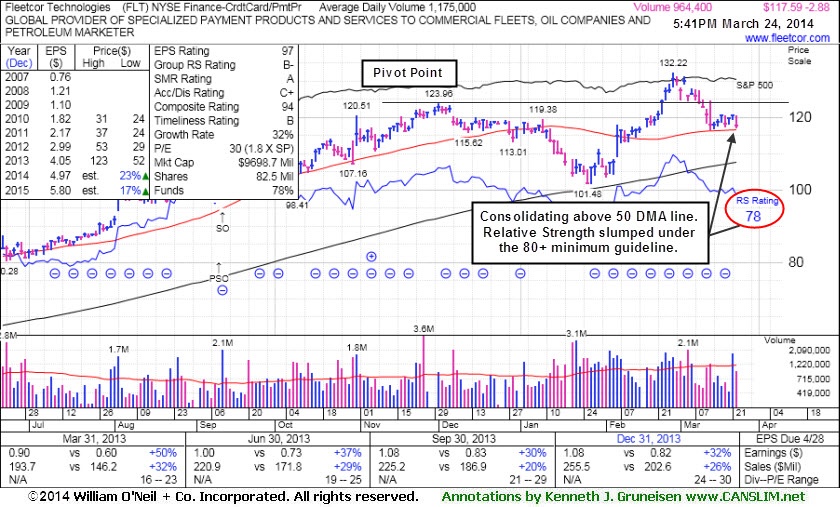

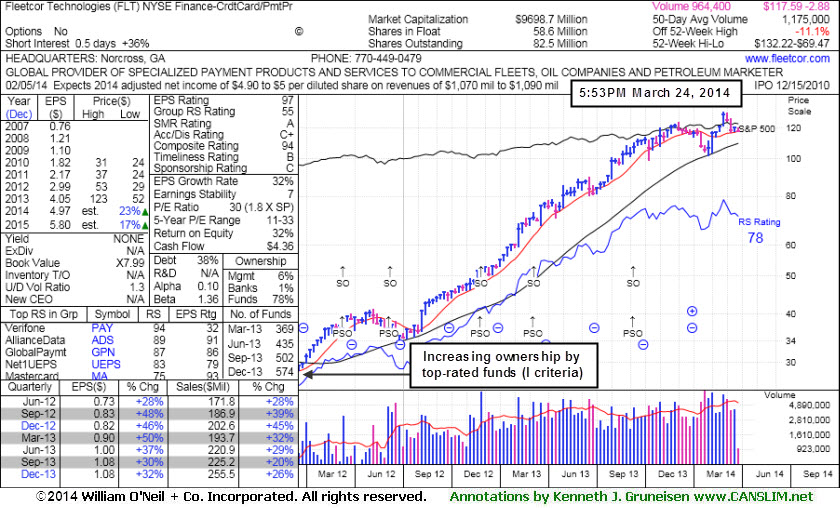

Negated Recent Breakout and Testing Support at 50-Day Average - Monday, March 24, 2014

FleetCor Technologies, Inc's (FLT -$2.88 or -2.39% to $117.59) recent slump below its old high close ($122.70 on 12/02/13) raised concerns as it completely negated the prior breakout. Still it is consolidating above its 50-day moving average (DMA) line, an encouraging sign of institutional support, but its Relative Strength rating has slumped to 78, below the 80+ minimum guideline for buy candidates. Fundamentals remain strong with earnings +32% on +26% sales revenues for the Dec '13 quarter continuing its strong earnings history satisfying the C criteria.FLT last appeared in this FSU section on 3/05/14 with annotated graphs under the headline, "Consolidating Following Recent Breakout to New High Territory". It made limited headway after highlighted in yellow with a pivot point cited based on its 12/02/13 high plus 10 cents in the 3/05/14 mid-day report (read here). Members were previously cautioned - "Odds are most favorable for investors who buy while a stock is rising, rather than buying stocks on pullbacks. Disciplined investors limit losses by selling any stock that falls more than -7% from their purchase price."

The company hails from the Finance - Credit Card Payment Processing group which currently has a mediocre 55 Group Relative Strength Rating, however, impressive strength and leadership from a couple of other firms in the same industry group is considered a sufficient reassurance concerning the L criteria. The company completed a Secondary Offering on 9/11/13. Prior Secondary Offerings on 3/14/12, 6/11/12, 11/29/12, and 3/08/13 were previously noted, "Such offerings often are a short-term hindrance to upward price progress yet typically result in broader institutional ownership interest." The number of top-rated funds owning its shares rose from 193 in Mar '12 to 574 in Dec '13, a reassuring sign concerning the I criteria.

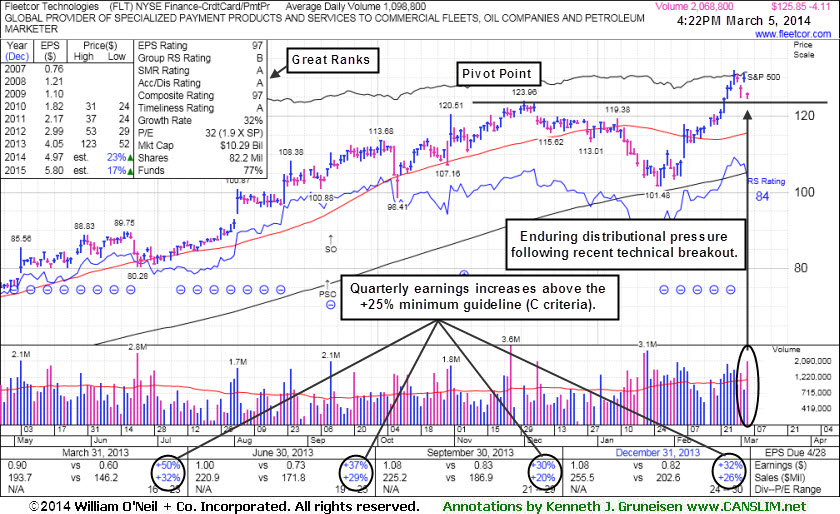

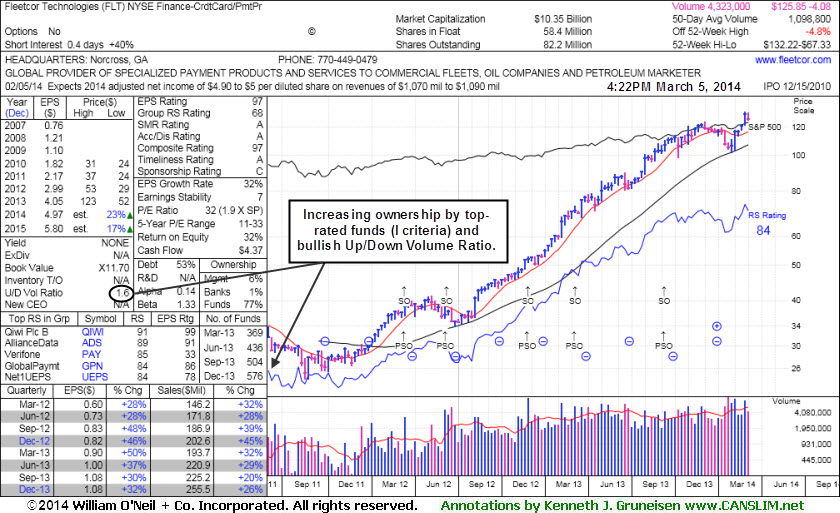

Consolidating Following Recent Breakout to New High Territory - Wednesday, March 05, 2014

FleetCor Technologies, Inc. (FLT -$4.11% or -3.16% to $125.85) fell today on higher volume indicative of distributional pressure. Prior highs in the $123 area define initial support to watch. It was highlighted in yellow while pivot point cited is based on its 12/02/13 high plus 10 cents in the earlier mid-day report (read here). It is consolidating above prior highs following a recent spurt of volume-driven gains for new 52-week highs. Technically, it broke out last week with volume-driven gains. Odds are most favorable for investors who buy while a stock is rising, rather than buying stocks on pullbacks. Disciplined investors limit losses by selling any stock that falls more than -7% from their purchase price.

FLT last appeared in this FSU section on 12/17/13 with annotated daily and weekly graphs under the headline, "Enduring Distributional Pressure While Extended From Sound Base". After dropped from the Featured Stocks list on 1/15/14 it slumped near its 200-day moving average (DMA) line. Volume-driven gains helped it rebound above its 50-day moving average (DMA) line and since then it made gradual progress. Fundamentals remain strong with earnings +32% on +26% sales revenues for the Dec '13 continuing its strong earnings history satisfying the C criteria.

The company completed a Secondary Offering on 9/11/13. Prior Secondary Offerings on 3/14/12, 6/11/12, 11/29/12, and 3/08/13 were previously noted, "Such offerings often are a short-term hindrance to upward price progress yet typically result in broader institutional ownership interest."

The number of top-rated funds owning its shares rose from 193 in Mar '12 to 576 in Dec '13, a reassuring sign concerning the I criteria. The company hails from the Finance - Credit Card Payment Processing group which currently has a 68 Group Relative Strength Rating. Impressive strength and leadership from a couple of other firms in the same industry group is also considered a reassurance concerning the L criteria.

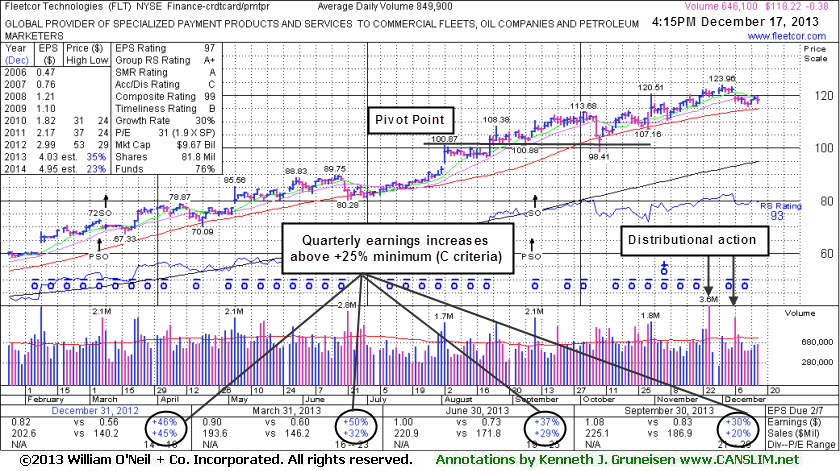

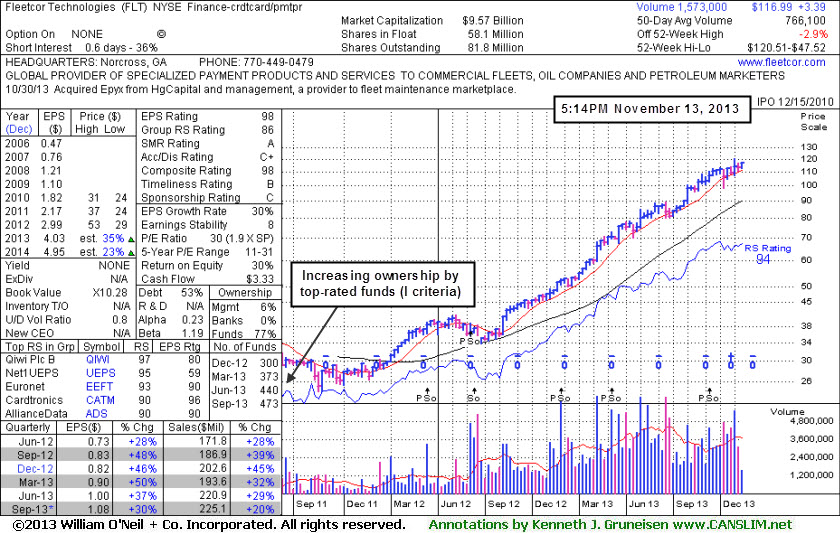

Enduring Distributional Pressure While Extended From Sound Base - Tuesday, December 17, 2013

FleetCor Technologies, Inc. (FLT -$0.31% or -0.26% to $118.29) has been slumping toward its 50-day moving average (DMA) line ($114.85 now) since gapping down on 12/06/13 while retreating from all-time highs. A subsequent violation of that important near-term support level may trigger a technical sell signal. It has not formed any sound base pattern, and the annotated daily graph below highlights recent signs of distributional pressure. It has traded up as much as +74.25% since first featured in yellow at $71.14 in the mid-day report on 3/21/13 (read here). Disciplined investors avoid chasing stocks extended more than +5% above their pivot point or prior highs and always limit losses by selling any stock that falls more than -7% from their purchase price.Last appearing in this FSU section on 11/13/13 with annotated daily and weekly graphs under the headline, "Perched Near All-Time High Tallying Quiet Gains", it was shown inching higher with light volume for a best-ever close. It is currently perched only -4.7% off its all-time high and no resistance remains due to overhead supply. The 9/06/13 summary, under the headline, "Holding Ground Following Latest Volume Driven Gains", showed a weekly graph where it recently rose with volume-driven gains from an advanced "3-weeks tight" base noted as a riskier "late stage" base.

It reported earnings +30% on +20% sales revenues for the Sep '13 quarter, marking its 7th consecutive quarterly comparison with earnings above the +25% guideline (C criteria). The company completed yet another Secondary Offering on 9/11/13. On 3/14/12, 6/11/12, 11/29/12, and 3/08/13 it priced Secondary Offerings and it was previously noted, "Such offerings often are a short-term hindrance to upward price progress yet typically result in broader institutional ownership interest."

The number of top-rated funds owning its shares rose from 193 in Mar '12 to 498 in Sep '13, a reassuring sign concerning the I criteria. The company hails from the Finance - Credit Card Payment Processing group which improved to a 94 Group Relative Strength Rating from a 55 rating when shown in the FSU section on 7/18/13. Impressive strength and leadership from a couple of other firms in the same industry group is also considered a reassurance concerning the L criteria.

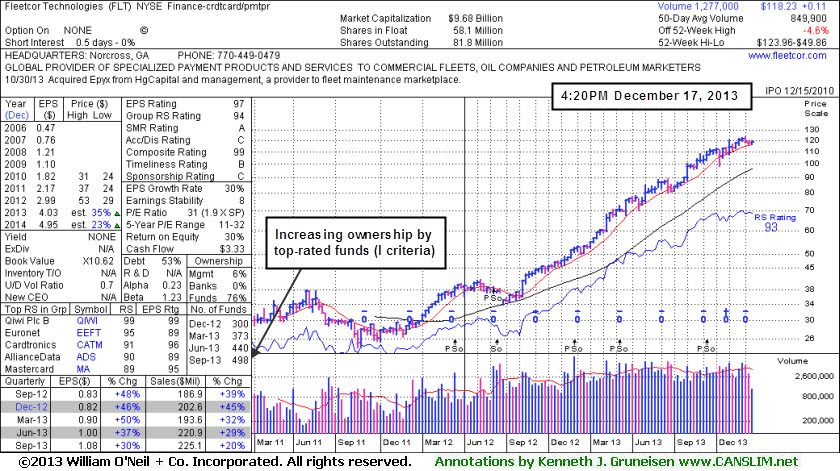

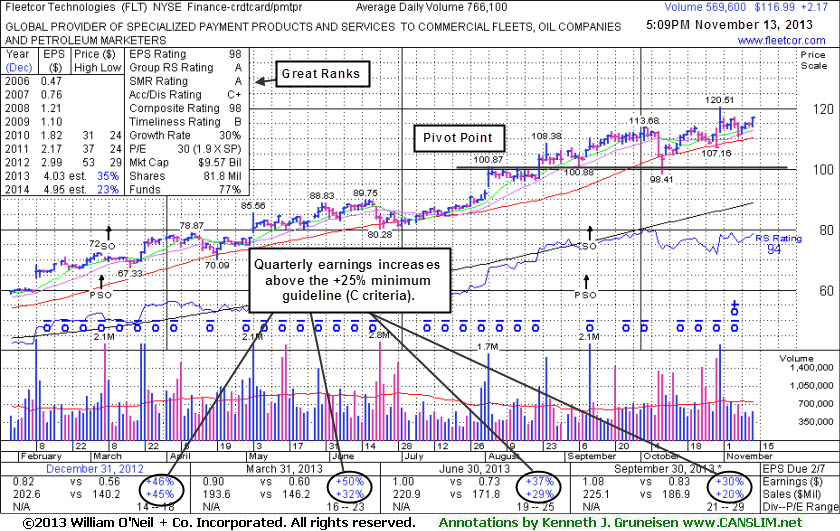

Perched Near All-Time High Tallying Quiet Gains - Wednesday, November 13, 2013

FleetCor Technologies, Inc. (FLT +$2.17% or +1.89% to $116.99) inched higher with light volume for a best-ever close. It endured distributional pressure in recent weeks and did not form a sound base. Its 50-day moving average (DMA) line defines near-term support to watch on pullbacks. It was last shown in this FSU section on 10/07/13 with an annotated daily graph under the headline, "Extended After 13 Weekly Gains in Span of 14 Weeks".

It is perched only -2.9% off its all-time high and no resistance remains due to overhead supply. The 9/06/13 summary, under the headline, "Holding Ground Following Latest Volume Driven Gains", showed a weekly graph where it recently rose with volume-driven gains from an advanced "3-weeks tight" base noted as a riskier "late stage" base. It had enjoyed a considerable rally even before the three latest Pivot Points (PP) were discussed on the ongoing coverage published while FLT has traded up as much as +69.39% since first featured in yellow at $71.14 in the mid-day report on 3/21/13 (read here). Disciplined investors avoid chasing stocks extended more than +5% above their pivot point or prior highs and always limit losses by selling any stock that falls more than -7% from their purchase price.

It reported earnings +30% on +20% sales revenues for the Sep '13 quarter, marking its 7th consecutive quarterly comparison with earnings above the +25% guideline (C criteria). The company completed yet another Secondary Offering on 9/11/13. On 3/14/12, 6/11/12, 11/29/12, and 3/08/13 it priced Secondary Offerings and it was previously noted, "Such offerings often are a short-term hindrance to upward price progress yet typically result in broader institutional ownership interest."

The number of top-rated funds owning its shares rose from 193 in Mar '12 to 473 in Sep '13, a reassuring sign concerning the I criteria. The company hails from the Finance - Credit Card Payment Processing group which improved to a 86 Group Relative Strength Rating from a 55 rating when shown in the FSU section on 7/18/13. Impressive strength and leadership from a couple of other firms in the same industry group is also considered a reassurance concerning the L criteria.

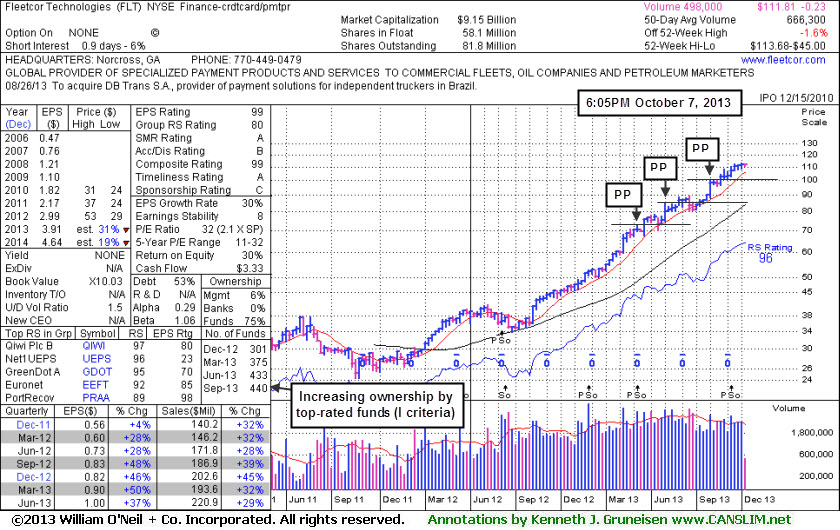

Extended After 13 Weekly Gains in Span of 14 Weeks - Monday, October 07, 2013

FleetCor Technologies, Inc. (FLT -$0.23 or -0.21% to $111.81) is hovering only -1.6% off its all-time high after wedging higher since completing yet another Secondary Offering on 9/11/13. No resistance remains due to overhead supply. It has tallied 13 weekly gains in the past 14 weeks. Its 50-day moving average (DMA) line (now $103.57) defines important near term support to watch on pullbacks. It was last shown in this FSU section on 9/06/13 with an annotated daily graph under the headline, "Holding Ground Following Latest Volume Driven Gains". Its weekly graph below shows where it recently rose with volume-driven gains from an advanced "3-weeks tight" base noted as a riskier "late stage" base. It had enjoyed a considerable rally even before the three latest Pivot Points (PP) were discussed on the ongoing coverage published while FLT has traded up as much as +59.8% since first featured in yellow in the mid-day report on 3/21/13 (read here). Disciplined investors avoid chasing stocks extended more than +5% above their pivot point or prior highs and always limit losses by selling any stock that falls more than -7% from their purchase price.It reported earnings +37% on +29% sales for the Jun '13 quarter, marking its 6th consecutive quarterly comparison with earnings above the +25% guideline (C criteria). The company completed a Secondary Offering on 3/08/13 after a streak of volume-driven gains into new high territory. On 3/14/12, 6/11/12, and 11/29/12 it priced Secondary Offerings and it was previously noted, "Such offerings often are a short-term hindrance to upward price progress yet typically result in broader institutional ownership interest."

The number of top-rated funds owning its shares rose from 193 in Mar '12 to 440 in Jun '13, a reassuring sign concerning the I criteria. The company hails from the Finance - Credit Card Payment Processing group which improved to a 80 Group Relative Strength Rating from a 55 rating when shown in the FSU section on 7/18/13. Impressive strength and leadership from a couple of other firms in the same industry group is also considered a reassurance concerning the L criteria.

Holding Ground Following Latest Volume Driven Gains - Friday, September 06, 2013

FleetCor Technologies, Inc. (FLT -$0.68 or -0.65% to $103.33) is consolidating above prior highs with light volume totals. It is perched at all-time highs. No resistance remains due to overhead supply. It recently rose with volume-driven gains from an advanced "3-weeks tight" base, albeit a riskier "late stage" base. Keep in mind the M criteria argues against new buying efforts until a new confirmed rally. It was last shown in this FSU section on 8/12/13 with an annotated graph under the headline, "Holding Ground Following Volume-Driven Gains From Late-Stage Base".Disciplined investors avoid chasing stocks extended more than +5% above their pivot point or prior highs and always limit losses by selling any stock that falls more than -7% from their purchase price. Volume totals have been cooling after spiking higher with gains backed by above average volume.

It reported earnings +37% on +29% sales for the Jun '13 quarter, marking its 6th consecutive quarterly comparison with earnings above the +25% guideline (C criteria). The company completed another Secondary Offering on 3/08/13 after a streak of volume-driven gains into new high territory. On 3/14/12, 6/11/12, and 11/29/12 it priced Secondary Offerings and it was previously noted, "Such offerings often are a short-term hindrance to upward price progress yet typically result in broader institutional ownership interest."

The number of top-rated funds owning its shares rose from 193 in Mar '12 to 427 in Jun '13, a reassuring sign concerning the I criteria. The company hails from the Finance - Credit Card Payment Processing group which improved to a 79 Group Relative Strength Rating from a 55 rating when shown in the FSU section on 7/18/13. Impressive strength and leadership from a couple of other firms in the same industry group is also considered a reassurance concerning the L criteria.

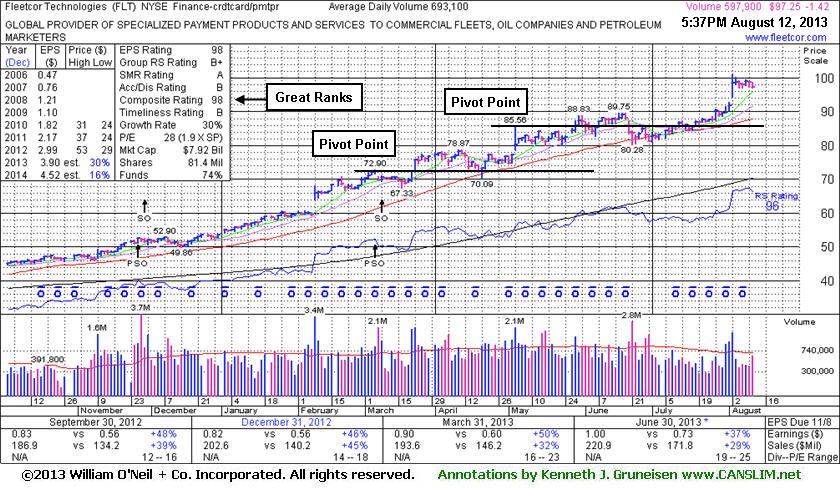

Holding Ground Following Volume-Driven Gains From Late-Stage Base - Monday, August 12, 2013

FleetCor Technologies, Inc. (FLT -$1.42 or -1.44% to $97.25) is holding its ground stubbornly, extended from any sound base and perched at all-time highs. No resistance remains due to overhead supply. Disciplined investors avoid chasing stocks extended more than +5% above their pivot point or prior highs and always limit losses by selling any stock that falls more than -7% from their purchase price. Volume totals have been cooling after spiking higher with gains backed by above average volume. Arguably, the latest breakout cleared a riskier "late-stage" base pattern, however the stock had not made meaningful progress above its latest pivot point cited based on its 5/03/13 high and there were many weeks to accumulate shares. No new pivot point was cited since last shown in this FSU section on 7/18/13 with an annotated graph under the headline, "Volume Totals Cooling During Consolidation", while it found support near its 50-day moving average (DMA) line.

It reported earnings +37% on +29% sales for the Jun '13 quarter, marking its 6th consecutive quarterly comparison with earnings above the +25% guideline (C criteria). The company completed another Secondary Offering on 3/08/13 after a streak of volume-driven gains into new high territory. On 3/14/12, 6/11/12, and 11/29/12 it priced Secondary Offerings and it was previously noted, "Such offerings often are a short-term hindrance to upward price progress yet typically result in broader institutional ownership interest."

The number of top-rated funds owning its shares rose from 193 in Mar '12 to 420 in Jun '13, a reassuring sign concerning the I criteria. The company hails from the Finance - Credit Card Payment Processing group which improved to a 76 Group Relative Strength Rating from a 55 rating when last shown in the FSU section on 7/18/13. Impressive strength and leadership from a couple of other firms in the same industry group is also considered a reassurance concerning the L criteria.

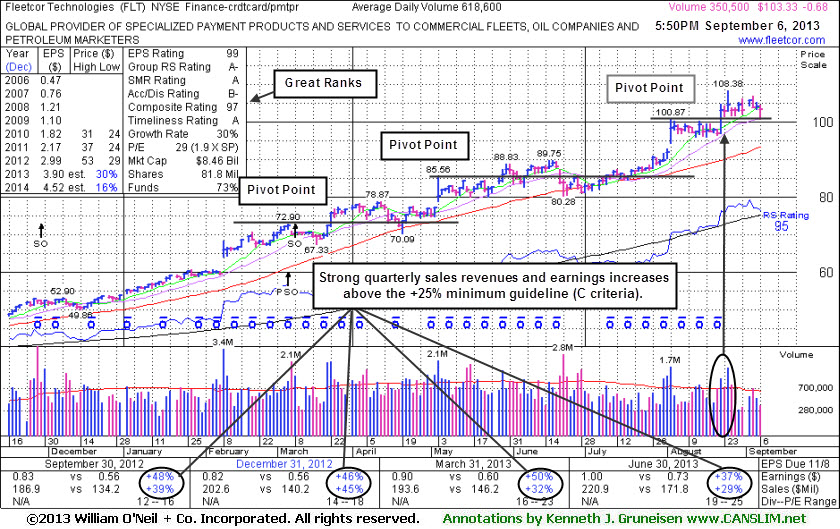

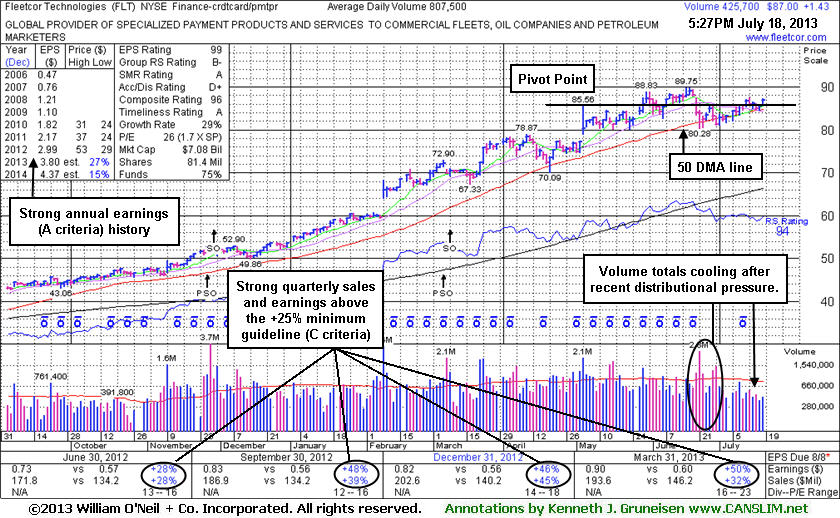

Volume Totals Cooling During Consolidation - Thursday, July 18, 2013

FleetCor Technologies, Inc. (FLT +$1.43 or +1.67% to $87.00) recently found support near its 50-day moving average (DMA) line while enduring distributional pressure. The prior low ($80.28 on 6/21/13) defines the next important near-term support below its short-term average where damaging violations would raise concerns and trigger technical sell signals. It was last shown in the FSU section on 6/28/13 with an annotated graph under the headline, "Distributional Action Leads to Slump Below 50-Day Average". Subsequent gains halted its slide but lacked great volume conviction while it made a stand at the 50 DMA line. Disciplined investors always limit losses by selling any stock that falls more than -7% from their purchase price.It reported earnings +50% on +32% sales for the Mar '13 quarter, marking its 5th consecutive quarterly comparison with earnings above the +25% guideline (C criteria). Little resistance remains due to overhead supply. The company completed another Secondary Offering on 3/08/13 after a streak of volume-driven gains into new high territory. On 3/14/12, 6/11/12, and 11/29/12 it priced Secondary Offerings and it was previously noted, "Such offerings often are a short-term hindrance to upward price progress yet typically result in broader institutional ownership interest."

The number of top-rated funds owning its shares rose from 193 in Mar '12 to 391 in Jun '13, a reassuring sign concerning the I criteria. The company hails from the Finance - Credit Card Payment Processing group which currently has a mediocre 55 Group Relative Strength Rating, however impressive strength and leadership from a couple of other firms in the same industry group is considered sufficient reassurance concerning the L criteria.

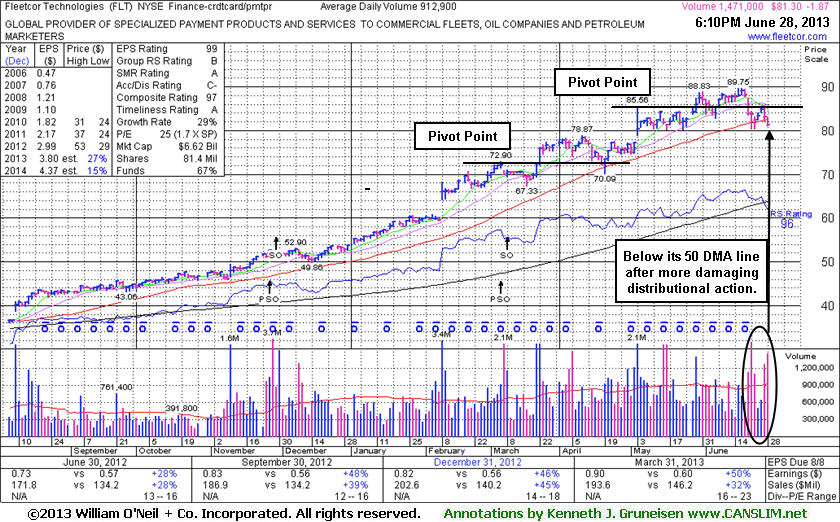

Distributional Action Leads to Slump Below 50-Day Average - Friday, June 28, 2013

FleetCor Technologies, Inc. (FLT -$1.87 or -2.25% to $81.30) endured distributional pressure and ended the week below its 50-day moving (DMA) line, raising concerns. The recent low ($80.28 on 6/21/13) defines important near-term chart support where a subsequent violation may trigger a more worrisome technical sell signal. It was last shown in this FSU section on 6/18/13 with an annotated graph under the headline, "Wedging Higher on Track for 9th Weekly Gain". Very soon thereafter volume-driven losses negated its prior breakout from a late-stage base. Disciplined investors always limit losses by selling any stock that falls more than -7% from their purchase price.It reported earnings +50% on +32% sales for the Mar '13 quarter, marking its 5th consecutive quarterly comparison with earnings above the +25% guideline (C criteria). The company completed another Secondary Offering on 3/08/13 after a streak of volume-driven gains into new high territory. On 3/14/12, 6/11/12, and 11/29/12 it priced Secondary Offerings and it was previously noted, "Such offerings often are a short-term hindrance to upward price progress yet typically result in broader institutional ownership interest."

The number of top-rated funds owning its shares rose from 193 in Mar '12 to 365 in Mar '13, a reassuring sign concerning the I criteria. Its current Up/Down Volume Ratio of 1.2 is still hinting that its shares have been under accumulation over the past 50 days. The company hails from the Finance - Credit Card Payment Processing group which currently has a mediocre 61 Group Relative Strength Rating, however impressive strength and leadership from a couple of other firms in the same industry group is considered sufficient reassurance concerning the L criteria.

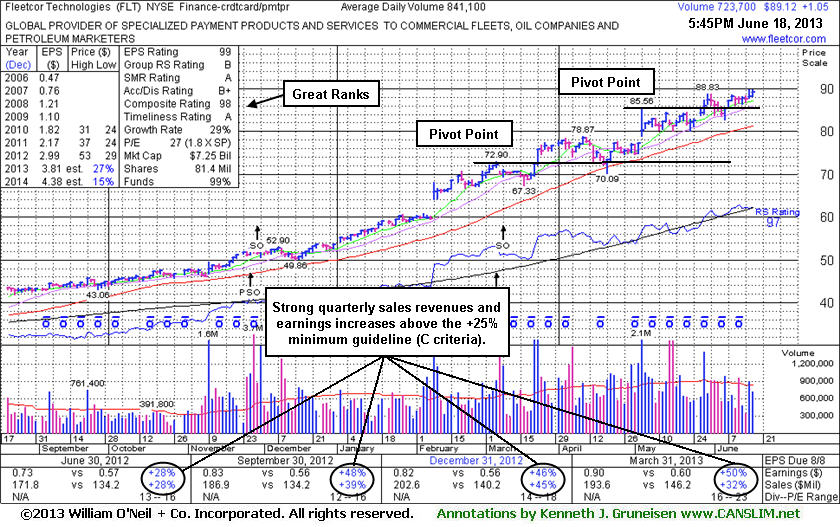

Wedging Higher on Track for 9th Weekly Gain - Tuesday, June 18, 2013

FleetCor Technologies, Inc. (FLT +$1.05 or +1.19% to $89.12) has been wedging to new all-time highs without especially strong volume behind its latest gains. FLT currently has a 9-week winning streak going and it was last shown in this FSU section on 5/31/13 with an annotated graph under the headline, "Institutional Accumulation Lifted This Leader", after noted in the mid-day report on 5/29/13 with a new pivot point cited based on its 5/03/13 high, and it rose from an advanced "3-weeks tight" base with a gain on the session backed by +56% above average volume. It may go on to produce more climactic gains, however this was a riskier "late-stage" base. Its 50-day moving average (DMA) line defines support where a violation would raise concerns and trigger a technical sell signal.It reported earnings +50% on +32% sales for the Mar '13 quarter, marking its 5th consecutive quarterly comparison with earnings above the +25% guideline (C criteria). The company completed another Secondary Offering on 3/08/13 after a streak of volume-driven gains into new high territory. On 3/14/12, 6/11/12, and 11/29/12 it priced Secondary Offerings and it was previously noted, "Such offerings often are a short-term hindrance to upward price progress yet typically result in broader institutional ownership interest."

The number of top-rated funds owning its shares rose from 193 in Mar '12 to 365 in Mar '13, a reassuring sign concerning the I criteria. Its current Up/Down Volume Ratio of 1.5 is also an unbiased indication that its shares have been under accumulation over the past 50 days. The company hails from the Finance - Credit Card Payment Processing group which currently has a mediocre 65 Group Relative Strength Rating, however impressive strength and leadership from a couple of other firms in the same industry group is considered sufficient reassurance concerning the L criteria.

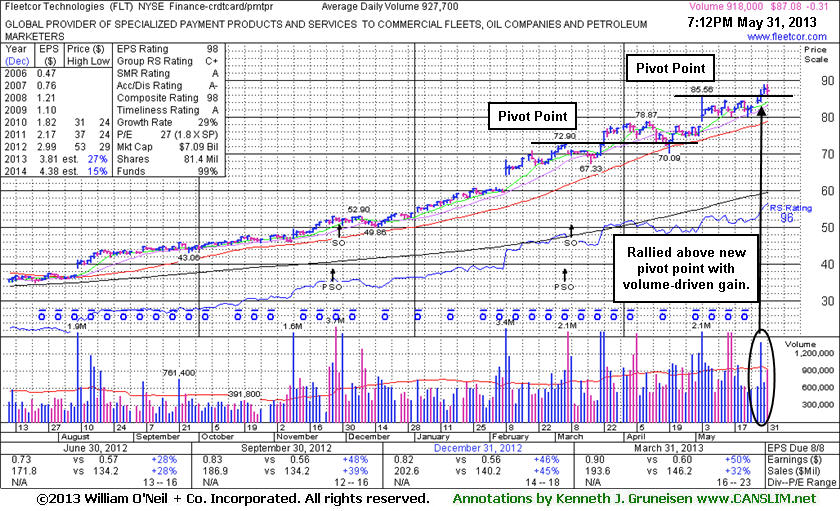

Institutional Accumulation Lifted This Leader - Friday, May 31, 2013

FleetCor Technologies, Inc. (FLT -$0.31 or -0.35% to $87.08) was noted in the mid-day report on 5/29/13 with a new pivot point cited based on its 5/03/13 high, and it rose from an advanced "3-weeks tight" base with a gain on the session backed by +56% above average volume. It may go on to produce more climactic gains, however this was a riskier "late-stage" base. Its 50-day moving average (DMA) line defines support where a violation would raise concerns and trigger a technical sell signal.

FLT currently has a 6-week winning streak going, and it was last shown in this FSU section on 5/08/13 with an annotated graph under the headline, "5th Consecutive Gain And Best Ever Finish". It reported earnings +50% on +32% sales for the Mar '13 quarter, marking its 5th consecutive quarterly comparison with earnings above the +25% guideline (C criteria).

The company completed another Secondary Offering on 3/08/13 after a streak of volume-driven gains into new high territory. On 3/14/12, 6/11/12, and 11/29/12 it priced Secondary Offerings and it was previously noted, "Such offerings often are a short-term hindrance to upward price progress yet typically result in broader institutional ownership interest."The number of top-rated funds owning its shares rose from 193 in Mar '12 to 360 in Mar '13, a reassuring sign concerning the I criteria. Its current Up/Down Volume Ratio of 1.7 is also an unbiased indication that its shares have been under accumulation over the past 50 days. The company hails from the Finance - Credit Card Payment Processing group which currently has a mediocre 52 Group Relative Strength Rating, however impressive strength and leadership from a couple of other firms in the same industry group is considered sufficient reassurance concerning the L criteria.

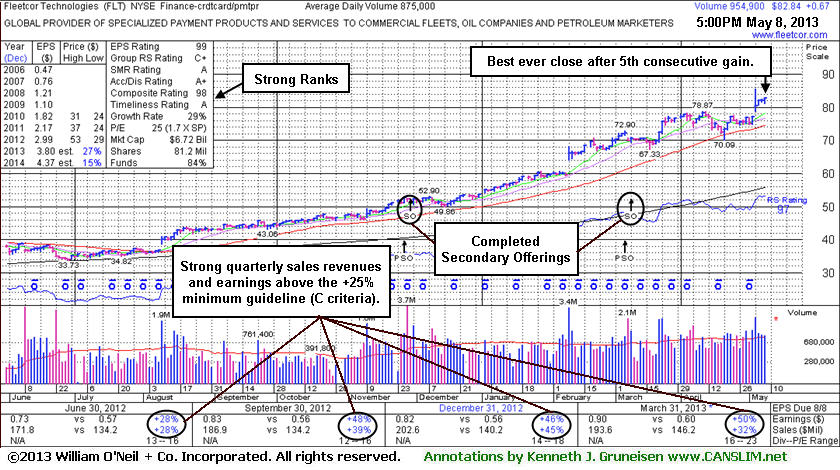

5th Consecutive Gain And Best Ever Finish - Wednesday, May 08, 2013

FleetCor Technologies, Inc. (FLT +$0.67 or +0.82% to $82.84) finished at its best-ever close after a 5th consecutive gain, getting more extended from any sound base pattern. It reported earnings +50% on +32% sales for the Mar '13 quarter, marking its 5th consecutive quarterly comparison with earnings above the +25% guideline (C criteria). Its 50-day moving average (DMA) line acted as support after last shown in this FSU section on 4/15/13 with an annotated graph under the headline, "Distributional Action Followed Latest Breakout After Little Progress". Any subsequent violations of the 50 DMA line or recent low ($70.09) would raise serious concerns and trigger worrisome technical sell signals.The company completed another Secondary Offering on 3/08/13 after a streak of volume-driven gains into new high territory. On 3/14/12, 6/11/12, and 11/29/12 it priced Secondary Offerings and it was previously noted, "Such offerings often are a short-term hindrance to upward price progress yet typically result in broader institutional ownership interest."

The number of top-rated funds owning its shares rose from 193 in Mar '12 to 340 in Mar '13, a reassuring sign concerning the I criteria. Its current Up/Down Volume Ratio of 1.7 is also an unbiased indication that its shares have been under accumulation over the past 50 days. The company hails from the Finance - Credit Card Payment Processing group which currently has a mediocre 48 Group Relative Strength Rating, however impressive strength and leadership from a couple of other firms in the same industry group is considered sufficient reassurance concerning the L criteria.

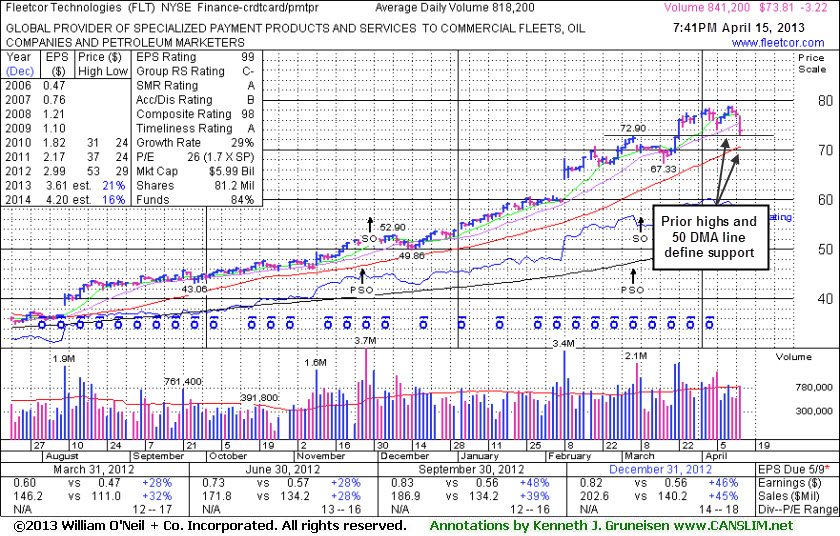

Distributional Action Followed Latest Breakout After Little Progress - Monday, April 15, 2013

FleetCor Technologies, Inc. (FLT -$3.22 or -4.18% to $73.81) is consolidating above prior highs in the $72 area defining near-term support to watch above its 50-day moving average (DMA) line. It was last shown in this FSU section on 3/21/13 with an annotated graph under the headline, "Rallied Near Pivot Point of Advanced '3-Weeks Tight' Base ". Volume driven gains above the pivot point triggered a technical buy signal, but it made limited price progress before encountering distributional pressure. Losses on higher volume than the prior session are defined as "distribution" days. Disciplined investors always limit losses by selling if any stock falls more than -7% from their purchase price.

The company completed another Secondary Offering on 3/08/13 after a streak of volume-driven gains into new high territory. It reported earnings +46% on +45% sales for the Dec '12 quarter, marking its 4th consecutive quarterly comparison with earnings above the +25% guideline (C criteria). On 3/14/12, 6/11/12, and 11/29/12 it priced Secondary Offerings and it was previously noted, "Such offerings often are a short-term hindrance to upward price progress yet typically result in broader institutional ownership interest."

The number of top-rated funds owning its shares rose from 193 in Mar '12 to 316 in Mar '13, a reassuring sign concerning the I criteria. Its current Up/Down Volume Ratio of 1.9 is also an unbiased indication that its shares have been under accumulation over the past 50 days. The company hails from the Finance - Credit Card Payment Processing group which currently has a below average 31 Group Relative Strength Rating, however impressive strength and leadership from a couple of other firms in the same industry group is considered sufficient reassurance concerning the L criteria.

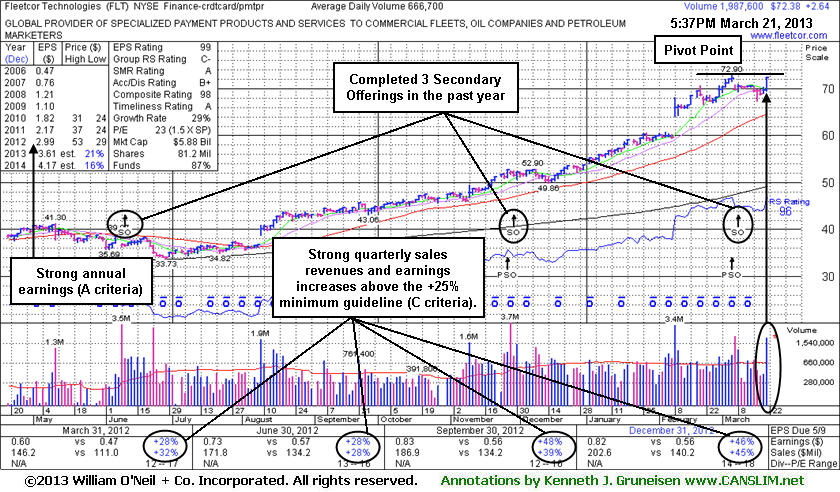

Rallied Near Pivot Point of Advanced "3-Weeks Tight" Base - Thursday, March 21, 2013

Often, when a leading stock is setting up to breakout of a solid base it is highlighted in CANSLIM.net's Mid-Day Breakouts Report. The most relevant factors are noted in the report which alerts prudent CANSLIM oriented investors to place the issue in their watch list. After doing any necessary backup research, the investor is prepared to act after the stock triggers a technical buy signal (breaks above its pivot point on more than +50% average turnover) but before it gets too extended from a sound base. In the event the stock fails to trigger a technical buy signal and its price declines then it will simply be removed from the watch list. Disciplined investors know to buy as near as possible to the pivot point and avoid chasing stocks after they have rallied more than +5% above their pivot point. It is crucial to always limit losses whenever any stock heads the wrong direction, and disciplined investors sell if a struggling stock ever falls more than -7% from their purchase price.

FleetCor Technologies, Inc. (FLT +$2.64 or +3.79% to $72.38) finished near the session high with a solid gain on 3 times average volume after highlighted in yellow with pivot point cited based on its 3/06/13 high plus 10 cents in the earlier mid-day report (click here). A volume driven gain above the pivot point may trigger a new technical buy signal. It recently held its ground and formed an advanced "3-weeks tight" base marked by 3 weekly closes in a very tight range. It rallied near its 52-week high with today's solid gain, coming close but not clearing the pivot point. The high-rank Completed another Secondary Offering on 3/08/13 after a streak of volume-driven gains into new high territory. Reported earnings +46% on +45% sales for the Dec '12 quarter, marking its 4th consecutive quarterly comparison with earnings above the +25% guideline (C criteria). On 3/14/12, 6/11/12, and 11/29/12 it priced Secondary Offerings and it was previously noted, "Such offerings often are a short-term hindrance to upward price progress yet typically result in broader institutional ownership interest."

The number of top-rated funds owning its shares rose from 193 in Mar '12 to 301 in Dec '12, a reassuring sign concerning the I criteria. Its current Up/Down Volume Ratio of 2.0 is also an unbiased indication that its shares have been under accumulation over the past 50 days. The company hails from the Finance - Credit Card Payment Processing group which currently has a below average 33 Group Relative Strength Rating, however impressive strength and leadership from a couple of other firms in the same industry group is considered sufficient reassurance concerning the L criteria.

This advanced base may be considered a "late-stage" and somewhat riskier than bases of greater duration. Careful investors may use a tactic called "pyramiding" to allow the ongoing market action to help dictate their weighting in the stock if subsequent volume-driven gains lift it above the pivot point cited. Disciplined investors avoid chasing a stock more than +5% above the pivot point and always limit losses by selling if any stock falls more than -7% from their purchase price.