Recently Sputtering Below 50-Day Moving Average - Wednesday, September 9, 2020

Emergent Biosolutions (EBS -$0.21 or -0.20% to $104.00) violated its prior high $107.16 on 7/20/20) and its 50-day moving average (DMA) line ($109) during a spurt of 12 losses over the span of 14 sessions. A rebound above its 50 DMA line is needed for its outlook to improve. Fundamentals remain strong after it reported Jun '20 quarterly earnings +890% on +62% sales revenue for the Jun '20 quarter versus the year ago period.

The company is in the Medical - Biomed/Biotech industry group group rank fell from 39th to 70th out of the 197 industry groups (L criteria) since last shown in this FSU section on 8/21/20 with an annotated graph under the headline, "High Ranked Biomed Leader is Extended From Prior Base". It currently has a 94 Earnings Per Share Rating, putting it in the top 10% of all publicly traded companies based on its earnings history. It has shown very strong quarterly comparisons versus the year ago periods. Annual earnings history (A criteria) has been strong since a downturn in FY '16.

The company is in the Medical - Biomed/Biotech industry group group rank fell from 39th to 70th out of the 197 industry groups (L criteria) since last shown in this FSU section on 8/21/20 with an annotated graph under the headline, "High Ranked Biomed Leader is Extended From Prior Base". It currently has a 94 Earnings Per Share Rating, putting it in the top 10% of all publicly traded companies based on its earnings history. It has shown very strong quarterly comparisons versus the year ago periods. Annual earnings history (A criteria) has been strong since a downturn in FY '16.

It has a small supply (S criteria) of only 45.5 million shares in the publicly traded float which can contribute to greater price volatility in the event of institutional buying or selling. The number of top-rated funds owning its shares rose from 453 in Sep '19 to 539 in Jun '20, and its current Up/Down Volume Ratio of 0.8 is an unbiased indication its shares have been under distributional pressure over the past 50 days. It has a B Timeliness rating and a B- Accumulation/Distribution rating.

Charts courtesy of www.stockcharts.com

High Ranked Biomed Leader is Extended From Prior Base - Friday, August 21, 2020

Emergent Biosolutions (EBS -$3.08 or -2.35% to $128.04) has seen volume totals cooling while it remains perched near its all-time high, very extended from any sound base. Recent strength came after it reported Jun '20 quarterly earnings +890% on +62% sales revenue for the Jun '20 quarter versus the year ago period. Its 50-day moving average (DMA) line ($99.18) define initial support to watch above prior highs in the $93 area.

EBS showed resilience since last shown in this FSU section on 8/04/20 with an annotated graph under the headline, "Rally Continues Into Record High Territory". It currently has a 94 Earnings Per Share Rating, putting it in the top 10% of all publicly traded companies based on its earnings history. It has shown very strong quarterly comparisons versus the year ago periods. Annual earnings history (A criteria) has been strong since a downturn in FY '16.

It has a small supply (S criteria) of only 45.5 million shares in the publicly traded float which can contribute to greater price volatility in the event of institutional buying or selling. The number of top-rated funds owning its shares rose from 453 in Sep '19 to 547 in Jun '20, and its current Up/Down Volume Ratio of 1.0 is an unbiased indication its shares have been neutral concerning accumulation/distribution over the past 50 days. It has an A Timeliness rating and an B+ Accumulation/Distribution rating. The company is in the Medical - Biomed/Biotech industry group which is a leading group currently ranked 39th out of the 197 industry groups (L criteria).

Charts courtesy of www.stockcharts.com

Rally Continues Into Record High Territory - Tuesday, August 4, 2020

Emergent Biosolutions (EBS +$4.63 or +3.92% to $122.63) hit yet another new all-time high with higher volume behind today's 5th consecutive gain, rallying further above its "max buy" level. Recent strength came after it reported Jun '20 quarterly earnings +890% on +62% sales revenue for the Jun '20 quarter versus the year ago period. Prior highs in the $93 area define initial support above its 50-day moving average (DMA) line ($86.19).

EBS showed resilience since last shown in this FSU section on 7/09/20 with an annotated graph under the headline, "Impressive Rebound to Hit a New High". It currently has a 94 Earnings Per Share Rating, putting it in the top 10% of all publicly traded companies based on its earnings history. It reported Mar '20 earnings of 1 cent per share versus a 10 cents per share loss for the year ago period with +1% better sales revenues. Earnings rose +101% on +33% sales revenues for the Dec '19 quarter, and earnings rose +120% on +80% sales revenues in the Sep '19 quarter, very strong quarterly comparisons versus the year ago periods. Annual earnings history (A criteria) has been strong since a downturn in FY '16.

It has a small supply (S criteria) of only 45.5 million shares in the publicly traded float which can contribute to greater price volatility in the event of institutional buying or selling. The number of top-rated funds owning its shares rose from 453 in Sep '19 to 536 in Jun '20, and its current Up/Down Volume Ratio of 1.0 is an unbiased indication its shares have been neutral concerning accumulation/distribution over the past 50 days. It has an A Timeliness rating and an A- Accumulation/Distribution rating. The company is in the Medical - Biomed/Biotech industry group which is a leading group currently ranked 35th out of the 197 industry groups (L criteria).

Charts courtesy of www.stockcharts.com

Impressive Rebound to Hit a New High - Thursday, July 9, 2020

Emergent Biosolutions (EBS +$0.07 or +0.07% to $94.48) hit a new all-time high with today's 7th consecutive gain. Its color code was changed to yellow with a new pivot point cited based on its 6/01/20 high plus 10 cents. Recent gains above the 50-day moving average (DMA) line ($79.89) helped its outlook improve. No resistance remains due to overhead supply. Fundamentals remain strong.

EBS showed resilience since last shown in this FSU section on 6/16/20 with an annotated graph under the headline, "Still Below 50-Day Moving Average Following Damaging Gap Down". It currently has a 91 Earnings Per Share Rating, putting it in the top 10% of all publicly traded companies based on its earnings history. It reported Mar '20 earnings of 1 cent per share versus a 10 cents per share loss for the year ago period with +1% better sales revenues. Earnings rose +101% on +33% sales revenues for the Dec '19 quarter, and earnings rose +120% on +80% sales revenues in the Sep '19 quarter, very strong quarterly comparisons versus the year ago periods. Annual earnings history (A criteria) has been strong since a downturn in FY '16.

It has a small supply (S criteria) of only 45.1 million shares in the publicly traded float which can contribute to greater price volatility in the event of institutional buying or selling. The number of top-rated funds owning its shares rose from 453 in Sep '19 to 522 in Jun '20, and its current Up/Down Volume Ratio of 1.5 is an unbiased indication its shares have been under accumulation over the past 50 days. It has an A Timeliness rating and an A- Accumulation/Distribution rating. The company is in the Medical - Biomed/Biotech industry group which is a leading group currently ranked 14th out of the 197 industry groups (L criteria).

Charts courtesy of www.stockcharts.com

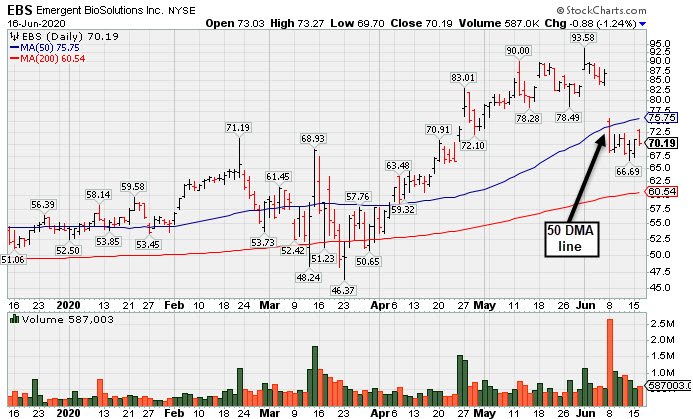

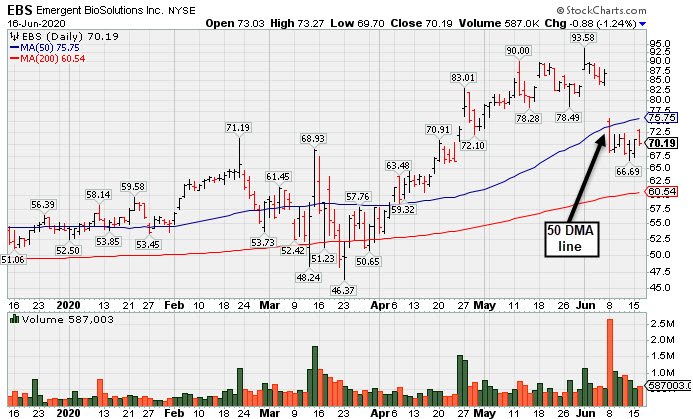

Still Below 50-Day Moving Average Following Damaging Gap Down - Tuesday, June 16, 2020

Emergent Biosolutions (EBS -$0.88 or -1.24% to $70.19) has continued to sputter after a damaging gap down and volume-driven loss on 6/08/20 triggered a worrisome technical sell signal. Subsequent gains and a convincing rebound above the 50-day moving average DMA line ($75.75) are still needed to help its outlook improve.

Fundamentals remain strong. EBS was last shown in this FSU section on 5/26/20 with an annotated graph under the headline, "Volume Light Behind Recent Pullback From All-Time High". It currently has a 91 Earnings Per Share Rating, putting it in the top 10% of all publicly traded companies based on its earnings history. It reported Mar '20 earnings of 1 cent per share versus a 10 cents per share loss for the year ago period with +1% better sales revenues. Earnings rose +101% on +33% sales revenues for the Dec '19 quarter, and earnings rose +120% on +80% sales revenues in the Sep '19 quarter, very strong quarterly comparisons versus the year ago periods. Annual earnings history (A criteria) has been strong since a downturn in FY '16.

It has a small supply (S criteria) of only 45.1 million shares in the publicly traded float which can contribute to greater price volatility in the event of institutional buying or selling. The number of top-rated funds owning its shares rose from 453 in Sep '19 to 467 in Mar '20, and its current Up/Down Volume Ratio of 1.4 is an unbiased indication its shares have been under accumulation over the past 50 days. It has an A Timeliness rating and an B- Accumulation/Distribution rating. The company is in the Medical - Biomed/Biotech industry group which is a leading group currently ranked 7th out of the 197 industry groups (L criteria).

Charts courtesy of www.stockcharts.com

Volume Light Behind Recent Pullback From All-Time High - Tuesday, May 26, 2020

Emergent Biosolutions (EBS -$0.58 or -0.69% to $84.01) has been pulling back from its all-time high with recent losses backed by below average volume. It is extended from the previously noted base. Prior highs in the $71-73 area define initial support to watch on pullbacks. Fundamentals remain strong.

EBS finished strong after highlighted in yellow with pivot point cited based on its December 2018 high in the 4/24/20 mid-day report (read here). It gapped up hitting a new 52-week high and touched a new all-time high (N criteria). Subsequent gains and strong close above the pivot point backed by more than +40% above average volume clinched a convincing technical buy signal (see the annotated graph below).

EBS was last shown in this FSU section on 5/08/20 with an annotated graph under the headline, "Light Volume Gain for New High Close Caps 7th Straight Weekly Gain". It currently has a 90 Earnings Per Share Rating, putting it in the top 10% of all publicly traded companies based on its earnings history. It it reported Mar '20 earnings of 1 cent per share versus a 10 cents per share loss for the year ago period with +1% better sales revenues. Earnings rose +101% on +33% sales revenues for the Dec '19 quarter, and earnings rose +120% on +80% sales revenues in the Sep '19 quarter, very strong quarterly comparisons versus the year ago periods. Annual earnings history (A criteria) has been strong since a downturn in FY '16.

It has a small supply (S criteria) of only 44.9 million shares in the publicly traded float which can contribute to greater price volatility in the event of institutional buying or selling. The number of top-rated funds owning its shares rose from 453 in Sep '19 to 463 in Mar '20, and its current Up/Down Volume Ratio of 1.4 is an unbiased indication its shares have been under accumulation over the past 50 days. It has an A Timeliness rating and an A- Accumulation/Distribution rating. The company is in the Medical - Biomed/Biotech industry group which is a leading group currently ranked 5th out of the 197 industry groups (L criteria).

Charts courtesy of www.stockcharts.com

Light Volume Gain for New High Close Caps 7th Straight Weekly Gain - Friday, May 8, 2020

Emergent Biosolutions (EBS +$1.48 or +1.87% to $80.73) posted a gain today with light volume for a best-ever close. Recently it reported Mar '20 earnings of 1 cent per share versus a 10 cents per share loss for the year ago period with +1% better sales revenues. Prior highs in the $71-73 area define initial support to watch on pullbacks.

EBS finished strong after highlighted in yellow with pivot point cited based on its December 2018 high in the 4/24/20 mid-day report (read here). It gapped up hitting a new 52-week high and touched a new all-time high (N criteria). Subsequent gains and strong close above the pivot point backed by more than +40% above average volume clinched a convincing technical buy signal (see the annotated graph below).

EBS was last shown in this FSU section on 4/24/20 with an annotated graph under the headline, "Volume-Driven Gain for Vaccine Maker With Great Earnings History". It currently has a 90 Earnings Per Share Rating, putting it in the top 10% of all publicly traded companies based on its earnings history. It reported earnings +101% on +33% sales revenues for the Dec '19 quarter, and earnings +120% on +80% sales revenues in the Sep '19 quarter, very strong quarterly comparisons versus the year ago periods. Annual earnings history (A criteria) has been strong since a downturn in FY '16.

It has a small supply (S criteria) of only 44.9 million shares in the publicly traded float which can contribute to greater price volatility in the event of institutional buying or selling. The number of top-rated funds owning its shares rose from 453 in Sep '19 to 464 in Mar '20, and its current Up/Down Volume Ratio of 1.4 is an unbiased indication its shares have been under accumulation over the past 50 days. It has an A Timeliness rating and an A- Accumulation/Distribution rating. The company is in the Medical - Biomed/Biotech industry group which is a leading group currently ranked 6th out of the 197 industry groups (L criteria).

Charts courtesy of www.stockcharts.com

Volume-Driven Gain for Vaccine Maker With Great Earnings History - Friday, April 24, 2020

Emergent Biosolutions (EBS +$6.73 or +10.11% to $73.30) finished strong after highlighted in yellow with pivot point cited based on its December 2018 high in the earlier mid-day report (read here). It gapped up hitting a new 52-week high and touched a new all-time high today (N criteria). Subsequent gains and strong close above the pivot point backed by at least +40% above average volume may help to clinch a convincing technical buy signal.

It currently has a 90 Earnings Per Share Rating, putting it in the top 10% of all publicly traded companies based on its earnings history. Keep in mind it is due to report Mar '20 earnings news on 4/30/20. Volume and volatility often increase near earnings news. It reported earnings +101% on +33% sales revenues for the Dec '19 quarter, its 2nd strong quarterly comparison versus the year ago period. Annual earnings history (A criteria) has been strong since a downturn in FY '16.

It currently has a 90 Earnings Per Share Rating, putting it in the top 10% of all publicly traded companies based on its earnings history. Keep in mind it is due to report Mar '20 earnings news on 4/30/20. Volume and volatility often increase near earnings news. It reported earnings +101% on +33% sales revenues for the Dec '19 quarter, its 2nd strong quarterly comparison versus the year ago period. Annual earnings history (A criteria) has been strong since a downturn in FY '16.

It has a small supply (S criteria) of only 44.9 million shares in the publicly traded float which can contribute to greater price volatility in the event of institutional buying or selling. The number of top-rated funds owning its shares fell from 461 in Dec '19 to 449 in Mar '20, however its current Up/Down Volume Ratio of 1.3 is an unbiased indication its shares have been under accumulation over the past 50 days. It has an A Timeliness rating and a B+ Accumulation/Distribution rating. The company is in the Medical - Biomed/Biotech industry group which is a leading group currently ranked 5th out of the 197 industry groups (L criteria).

Charts courtesy of www.stockcharts.com