Slump Below Prior Lows Raises More Serious Concerns - Monday, November 19, 2018

Dominos Pizza Inc (DPZ -$12.55 or -4.74% to $252.07) slumped below its 200-day moving average (DMA) line and below prior lows ($253) today triggering a technical sell signal. It will be dropped from the Featured Stocks list tonight. Recently it met resistance at its 50 DMA line ($273.87), but a rebound above the 50 DMA line is needed for its outlook to improve. Fundamentals remain strong.

The popular pizza firm recently reported earnings +54% on +22% sales revenues for the Sep '18 quarter, continuing its strong earnings track record. That marked its 9th consecutive quarterly comparison above the +25% minimum earnings guideline (C criteria). Annual earnings (A criteria) growth has been good. The company has a new CEO effective 7/02/18. The Retail - Restaurants industry group currently has a Relative Strength rating of 91, and leadership (L criteria) from others in the group is also a reassuring sign.

It was shown in this FSU section on 10/31/18 with an annotated graph under the headline, "Found Support at 200-Day Moving Average Line". DPZ was highlighted in the 2/20/18 mid-day report with pivot point cited based on its 1/25/18 high plus 10 cents (read here). The number of top-rated funds owning its shares rose from 772 in Mar '17 to 978 in Sep '18 a reassuring sign concerning the I criteria. Its current Up/Down Volume Ratio of 0.9 is an unbiased indication its shares have been under accumulation over the past 50 days. It has a small supply of only 41.6 million shares outstanding (S criteria).

Charts used courtesy of www.stockcharts.com

Found Support at 200-Day Moving Average Line - Wednesday, October 31, 2018

Dominos Pizza Inc (DPZ +$2.56 or +0.96% to $268.79) posted a 2nd consecutive gain on near average volume after finding support at its 200-day moving average (DMA) line ($256.04). A subsequent rebound above the 50 DMA line ($281.50) is needed for its outlook to improve. The prior low ($253.63 on 7/31/18) and 200 DMA line define important near-term support to watch.

The popular pizza firm recently it reported earnings +54% on +22% sales revenues for the Sep '18 quarter, continuing its strong earnings track record. That marked its 9th consecutive quarterly comparison above the +25% minimum earnings guideline (C criteria). Annual earnings (A criteria) growth has been good. The company has a new CEO effective 7/02/18.

It was shown in this FSU section on 10/15/18 with an annotated graph under the headline, "Sank Below 50 DMA Line Ahead of Earnings News". DPZ was highlighted in the 2/20/18 mid-day report with pivot point cited based on its 1/25/18 high plus 10 cents (read here). The number of top-rated funds owning its shares rose from 772 in Mar '17 to 978 in Sep '18 a reassuring sign concerning the I criteria. Its current Up/Down Volume Ratio of 0.9 is an unbiased indication its shares have been under accumulation over the past 50 days. It has a small supply of only 41.6 million shares outstanding (S criteria). The Retail - Restaurants industry group currently has a Relative Strength rating of 91, and leadership (L criteria) from others in the group is also a reassuring sign.

Charts used courtesy of www.stockcharts.com

Sank Below 50 DMA Line Ahead of Earnings News - Monday, October 15, 2018

Dominos Pizza Inc (DPZ -$4.40 or -1.59% to $272.94) is due to report earnings news before the open on Tuesday. Volume and volatility often increase near earnings news. It has still been sputtering below its 50-day moving average (DMA) line ($287) after volume-driven losses last week raised greater concerns. The prior low ($253.63 on 7/31/18) and 200 DMA line ($253) and define important near-term support to watch.

The company has a new CEO effective 7/02/18. It was shown in this FSU section on 9/05/18 with an annotated graph under the headline, "Pulling Back After Wedging Gains for Highs Lacked Great Volume". The popular pizza firm reported earnings +39% on +24% sales revenues for the Jun '18 quarter. That marked its 8th consecutive quarterly comparison above the +25% minimum earnings guideline (C criteria). Annual earnings (A criteria) growth has been good.

DPZ was highlighted in the 2/20/18 mid-day report with pivot point cited based on its 1/25/18 high plus 10 cents (read here). The number of top-rated funds owning its shares rose from 772 in Mar '17 to 976 in Jun '18 a reassuring sign concerning the I criteria. Its current Up/Down Volume Ratio of 1.0 is an unbiased indication its shares have been under accumulation over the past 50 days. It has a small supply of only 41.9 million shares outstanding (S criteria). The Retail - Restaurants industry group currently has a Relative Strength rating of 90, and leadership (L criteria) from others in the group is also a reassuring sign.

Charts used courtesy of www.stockcharts.com

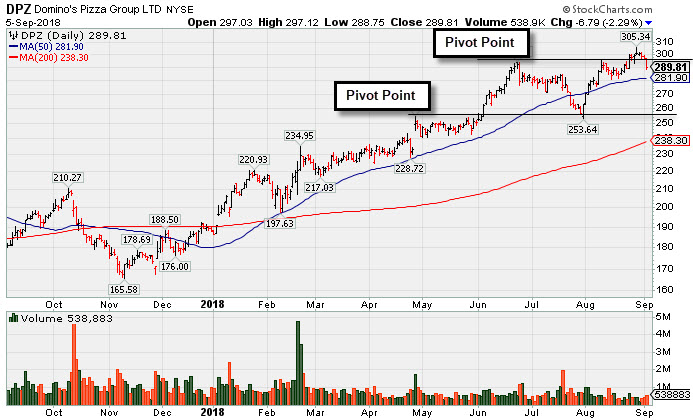

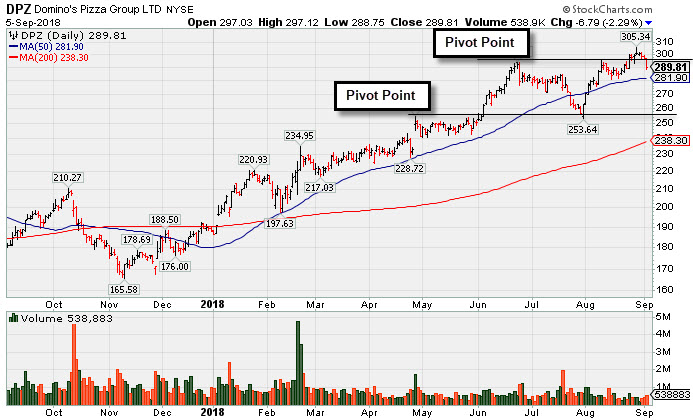

Pulling Back After Wedging Gains for Highs Lacked Great Volume - Wednesday, September 5, 2018

Dominos Pizza Inc (DPZ -$6.79 or -2.29% to $289.81) ended the session -5.1% off its 52-week high. Recent gains into new high territory were noted for lacking volume conviction. Subsequent gains above the pivot point backed by at least +40% above average volume are still needed to clinch a proper new (or add-on) technical buy signal.

The company has a new CEO effective 7/02/18. It was shown in this FSU section on 7/23/18 with an annotated graph under the headline, "Consolidating Near 50-Day Moving Average Line". The popular pizza firm reported earnings +39% on +24% sales revenues for the Jun '18 quarter. That marked its 8th consecutive quarterly comparison above the +25% minimum earnings guideline (C criteria). Annual earnings (A criteria) growth has been good.

DPZ was highlighted in the 2/20/18 mid-day report with pivot point cited based on its 1/25/18 high plus 10 cents (read here). The number of top-rated funds owning its shares rose from 772 in Mar '17 to 907 in Jun '18 a reassuring sign concerning the I criteria. Its current Up/Down Volume Ratio of 1.0 is an unbiased indication its shares have been under accumulation over the past 50 days. It has a small supply of only 41.9 million shares outstanding (S criteria). The Retail - Restaurants industry group currently has a Relative Strength rating of 78, and leadership (L criteria) from others in the group is also a reassuring sign.

Charts used courtesy of www.stockcharts.com

Consolidating Near 50-Day Moving Average Line - Monday, July 23, 2018

Dominos Pizza Inc (DPZ -$5.42 or -1.96% to $271.75) is consolidating near its 50-day moving average (DMA) line ($269.15) which defines near-term support to watch. Subsequent losses leading to a violation would raise concerns and trigger a technical sell signal.

The company has a new CEO effective 7/02/18. Last shown in this FSU section on 6/05/18 with an annotated graph under the headline, "New High With Gain Backed by Above Average Volume", the popular pizza firm reported earnings +39% on +24% sales revenues for the Jun '18 quarter. That marked its 8th consecutive quarterly comparison above the +25% minimum earnings guideline (C criteria). Annual earnings (A criteria) growth has been good.

DPZ was highlighted in the 2/20/18 mid-day report with pivot point cited based on its 1/25/18 high plus 10 cents (read here). The number of top-rated funds owning its shares rose from 772 in Mar '17 to 834 in Jun '18 a reassuring sign concerning the I criteria. Its current Up/Down Volume Ratio of 1.5 is an unbiased indication its shares have been under accumulation over the past 50 days. It has a small supply of only 41.9 million shares outstanding (S criteria). The Retail - Restaurants industry group currently has a Relative Strength rating of 88, and leadership (L criteria) from others in the group is also a reassuring sign.

Charts used courtesy of www.stockcharts.com

New High With Gain Backed by Above Average Volume - Tuesday, June 5, 2018

Dominos Pizza Inc (DPZ +$7.24 or +2.83% to $262.63) hit another new all-time high (N criteria)with today's gain backed by +36% above average volume. A new pivot point was cited based on its 4/26/18 high plus 10 cents after an advanced "3-weeks tight" base. However, gains above a stock's pivot point should have at least +40% above average volume to trigger a proper new (or add-on) technical buy signal. Additional confirming gains with heavier volume would be a reassuring sign of fresh institutional buying demand. Its 50-day moving average (DMA) line ($242.39) and prior highs in the $236 area define important near-term support to watch on pullbacks.

Last shown in this FSU section on 4/23/18 with an annotated graph under the headline, "Earnings News Due From Pizza Firm", the popular pizza firm reported earnings +59% on +26% sales revenues for the Mar '18 quarter. That marked its 7th consecutive quarterly comparison above the +25% minimum earnings guideline (C criteria). Annual earnings (A criteria) growth has been good.

DPZ was highlighted in the 2/20/18 mid-day report with pivot point cited based on its 1/25/18 high plus 10 cents (read here). The number of top-rated funds owning its shares rose from 772 in Mar '17 to 820 in Mar '18 a reassuring sign concerning the I criteria. Its current Up/Down Volume Ratio of 1.2 is an unbiased indication its shares have been under accumulation over the past 50 days. It has a small supply of only 42.3 million shares outstanding (S criteria). The Retail - Restaurants industry group currently has a Relative Strength rating of 72, and leadership (L criteria) from others in the group is also a reassuring sign.

Charts used courtesy of www.stockcharts.com

Earnings News Due From Pizza Firm - Monday, April 23, 2018

Dominos Pizza Inc (DPZ +$0.55 or +0.23% to $239.48) recently wedged above its "max buy" level with gains lacking great volume conviction. Its 50-day moving average (DMA) line ($226.11) and recent lows define near-term support to watch. The popular pizza firm's volume totals have been cooling while inching into new all-time high (N criteria) territory. Keep in mind that it is due to report earnings for the Mar '18 quarter on Thursday, April 26. Volume and volatility often increase near earnings news.

DPZ was highlighted in the 2/20/18 mid-day report with pivot point cited based on its 1/25/18 high plus 10 cents (read here). Recently it reported Dec '17 earnings +31% on +9% sales revenues. That marked its 6th consecutive quarterly comparison above the +25% minimum earnings guideline (C criteria). Annual earnings (A criteria) growth has been good.

The number of top-rated funds owning its shares rose from 772 in Mar '17 to 806 in Mar '18 a reassuring sign concerning the I criteria. Its current Up/Down Volume Ratio of 1.6 is an unbiased indication its shares have been under accumulation over the past 50 days. It has a small supply of only 43.0 million shares outstanding (S criteria). The Retail - Restaurants industry group currently has a Relative Strength rating of 86, and leadership (L criteria) from others in the group is also a reassuring sign.

Charts used courtesy of www.stockcharts.com

Popular Pizza Firm Perched Near All Time High - Wednesday, March 21, 2018

Dominos Pizza Inc (DPZ -$3.33 or -1.44 to $228.26) volume totals have been cooling while hovering near its high. It hit new all-time highs with volume-driven gains that clinched a proper technical buy signal. It stalled soon after highlighted in the 2/20/18 mid-day report with pivot point cited based on its 1/25/18 high plus 10 cents (read here).

Recently it reported Dec '17 earnings +31% on +9% sales revenues. That marked its 6th consecutive quarterly comparison above the +25% minimum earnings guideline (C criteria). Annual earnings (A criteria) growth has been good.

The number of top-rated funds owning its shares rose from 772 in Mar '17 to 808 in Dec '17 a reassuring sign concerning the I criteria. Its current Up/Down Volume Ratio of 1.8 is an unbiased indication its shares have been under accumulation over the past 50 days. It has a small supply of only 43.0 million shares outstanding (S criteria).

Charts used courtesy of www.stockcharts.com

Popular Pizza Firm Met Resistance Near Prior High - Tuesday, February 20, 2018

Dominos Pizza Inc (DPZ +$0.75 or +0.34% to $221.49) was highlighted in yellow with pivot point cited based on its 1/25/18 high plus 10 cents in the earlier mid-day report (read here). It hit a new all-time high with today's 4th consecutive gain, however it encountered some resistance and distributional pressure as it finished the session just below the pivot point cited. Subsequent confirming volume-driven gains and a close above the pivot point may help clinch a proper technical buy signal.

Recently it reported Dec '17 earnings +31% on +9% sales revenues. That marked its 6th consecutive quarterly comparison above the +25% minimum earnings guideline (C criteria). Annual earnings (A criteria) growth has been good.

The number of top-rated funds owning its shares rose from 772 in Mar '17 to 801 in Dec '17 a reassuring sign concerning the I criteria. Its current Up/Down Volume Ratio of 1.6 is an unbiased indication its shares have been under accumulation over the past 50 days. It has a small supply of only 43.7 million shares outstanding (S criteria).

Charts used courtesy of www.stockcharts.com