Volume-Driven Gain Challenging High - Wednesday, September 15, 2021

Copart Inc (CPRT +$3.97 or +2.75% to $148.56) finished strong after highlighted in yellow in the earlier mid-day report with pivot point cited based on its 8/04/21 high plus 10 cents. It is rebounding near its 52-week high. Subsequent gains above the pivot point backed by at least +40% above average volume may trigger a technical buy signal. It found support near its 50-day moving average (DMA) line ($143) during consolidations in recent months.

It has a 97 Earnings Per Share Rating. Earnings rose +51% on +42% sales revenues for the Jul '21 quarter versus the year ago period, its 3rd consecutive quarterly comparison above the +25% minimum guideline. Sequential comparisons show impressive acceleration in its sales revenues growth rate.

CPRT rallied as much as +31.9% after 9/05/19 when it was first highlighted in yellow with pivot point cited based on its 7/26/19 high plus 10 cents (read here). It was last shown in this FSU session on 2/18/20 with an annotated graph under the headline, "Perched at Record High With Earnings News Due". It showed resilience and strength since 2/25/20 when it was dropped from the Featured Stocks list.

The number of top-rated funds owning its shares rose from 1,120 in Sep '18 to 1,738 in Jun '21, a reassuring sign concerning the I criteria. It has a Timeliness Rating of A and Sponsorship Rating of B. Its current Up/Down Volume Ratio of 1.3 is an unbiased indication its shares have been under accumulation over the past 50 days.

Charts courtesy of www.stockcharts.com

Perched at Record High With Earnings News Due - Tuesday, February 18, 2020

Copart Inc (CPRT -$0.83 or -0.80% to $102.42) reversed into the red today after touching a new all-time high. It has been stubbornly holding its ground, extended from any sound base. Its 50-day moving average (DMA) line ($95.71) defines near-term support above prior highs in the $91-92 area. Keep in mind that it is due to report earnings news after the close on Wednesday, February 19, 2020. Volume and volatility often increase near earnings news.

Bullish action came after it reported earnings +38% on +20% sales revenues for the Oct '19 quarter, continuing its strong earnings track record. The past 3 quarterly earnings increases were above the +25% minimum guideline (C criteria) and its sales revenues growth rate has accelerated. Annual earnings (A criteria) history has been strong and steady since a downturn in FY '13.

CPRT has rallied as much as +31.9% since 9/05/19 when it was first highlighted in yellow with pivot point cited based on its 7/26/19 high plus 10 cents (read here). It was last shown in this FSU session on 1/28/20 with an annotated graph under the headline, "New High With Yet Another Gain Backed by Light Volume".

The number of top-rated funds owning its shares rose from 1,120 in Sep '18 to 1,525 in Dec '19, a reassuring sign concerning the I criteria. It has a Timeliness Rating of B and Sponsorship Rating of B. Its current Up/Down Volume Ratio of 1.8 is an unbiased indication its shares have been under accumulation over the past 50 days.

Charts courtesy of www.stockcharts.com

New High With Yet Another Gain Backed by Light Volume - Tuesday, January 28, 2020

Copart Inc (CPRT +$1.21 or +1.22% to $100.71) is perched at its all-time high after another gain backed by light volume, extended from any sound base. Its color code was changed to green after recent gains above its "max buy" level were marked by below average volume. Its 50-day moving average (DMA) line ($91.64) defines near-term support coinciding with prior highs in the $91-92 area.

Fundamentals remain strong. Bullish action came after it reported earnings +38% on +20% sales revenues for the Oct '19 quarter, continuing its strong earnings track record. The past 3 quarterly earnings increases were above the +25% minimum guideline (C criteria) and its sales revenues growth rate has accelerated. Annual earnings (A criteria) history has been strong and steady since a downturn in FY '13.

CPRT has rallied +27.9% since 9/05/19 when it was first highlighted in yellow with pivot point cited based on its 7/26/19 high plus 10 cents (read here). It was last shown in this FSU session on 1/07/20 with an annotated graph under the headline, "Perched at All-Time HIgh Following Recent Volume-Driven Gain".

The number of top-rated funds owning its shares rose from 1,120 in Sep '18 to 1,480 in Dec '19, a reassuring sign concerning the I criteria. It has a Timeliness Rating of A and Sponsorship Rating of B. Its current Up/Down Volume Ratio of 2.3 is an unbiased indication its shares have been under accumulation over the past 50 days.

Charts courtesy of www.stockcharts.com

Perched at All-Time HIgh Following Recent Volume-Driven Gain - Tuesday, January 7, 2020

Copart Inc (CPRT -$0.12 or -0.13% to $93.37) is quietly perched near its all-time high. Its gain on 1/02/20 was backed by +45% above average volume as it rose above the new pivot point cited based on its 11/25/19 high plus 10 cents triggering a proper new (or add-on) technical buy signal. Its 50-day moving average (DMA) line ($87.51) defines near-term support.

Fundamentals remain strong. Bullish action came after it reported earnings +38% on +20% sales revenues for the Oct '19 quarter, continuing its strong earnings track record. The past 3 quarterly earnings increases were above the +25% minimum guideline (C criteria) and its sales revenues growth rate has accelerated. Annual earnings (A criteria) history has been strong and steady since a downturn in FY '13.

CPRT was last shown in this FSU session on 12/12/19 with an annotated graph under the headline, "Extended From Prior Base and Hovering Near Record High". A volume-driven gain above the pivot point on 9/05/19 clinched a technical buy signal when CPRT was highlighted in yellow with pivot point cited based on its 7/26/19 high plus 10 cents (read here).

The number of top-rated funds owning its shares rose from 1,120 in Sep '18 to 1,452 in Sep '19, a reassuring sign concerning the I criteria. It has a Timeliness Rating of A and Sponsorship Rating of B. Its current Up/Down Volume Ratio of 1.8 is an unbiased indication its shares have been under accumulation over the past 50 days.

Extended From Prior Base and Hovering Near Record High - Thursday, December 12, 2019

Copart Inc (CPRT +$0.19 or +0.22% to $88.48) is consolidating after getting extended from any sound base. The 50-day moving average (DMA) line ($84.47) defines near-term support above the prior low ($80.71 on 11/06/19).

Fundamentals remain strong. Bullish action came after it reported earnings +38% on +20% sales revenues for the Oct '19 quarter, continuing its strong earnings track record. The past 3 quarterly earnings increases were above the +25% minimum guideline (C criteria) and its sales revenues growth rate has accelerated. Annual earnings (A criteria) history has been strong and steady since a downturn in FY '13.

CPRT was last shown in this FSU session on 11/21/19 with an annotated graph under the headline, "Gapped Up Following Another Strong Earnings Report". A volume-driven gain above the pivot point on 9/05/19 clinched a technical buy signal when CPRT was highlighted in yellow with pivot point cited based on its 7/26/19 high plus 10 cents (read here).

The number of top-rated funds owning its shares rose from 1,120 in Sep '18 to 1,378 in Sep '19, a reassuring sign concerning the I criteria. It has a Timeliness Rating of A and Sponsorship Rating of B. Its current Up/Down Volume Ratio of 1.6 is an unbiased indication its shares have been under accumulation over the past 50 days.

Gapped Up Following Another Strong Earnings Report - Thursday, November 21, 2019

Copart Inc (CPRT +$2.93 or +3.45% to $87.85) gapped up today hitting a new all-time high. It is extended from any sound base. The 50-day moving average (DMA) line ($82.41) defines near-term support above the prior low ($80.71 on 11/06/19).

Bullish action came after it reported earnings +38% on +20% sales revenues for the Oct '19 quarter, continuing its strong earnings track record. The past 3 quarterly earnings increases were above the +25% minimum guideline (C criteria) and its sales revenues growth rate has accelerated. Annual earnings (A criteria) history has been strong and steady since a downturn in FY '13.

CPRT was last shown in this FSU session on 11/06/19 with an annotated graph under the headline, "Testing Support at 50-Day Moving Average". A volume-driven gain above the pivot point on 9/05/19 clinched a technical buy signal when CPRT was highlighted in yellow with pivot point cited based on its 7/26/19 high plus 10 cents (read here).

The number of top-rated funds owning its shares rose from 1,120 in Sep '18 to 1,353 in Sep '19, a reassuring sign concerning the I criteria. It has a Timeliness Rating of A and Sponsorship Rating of B.

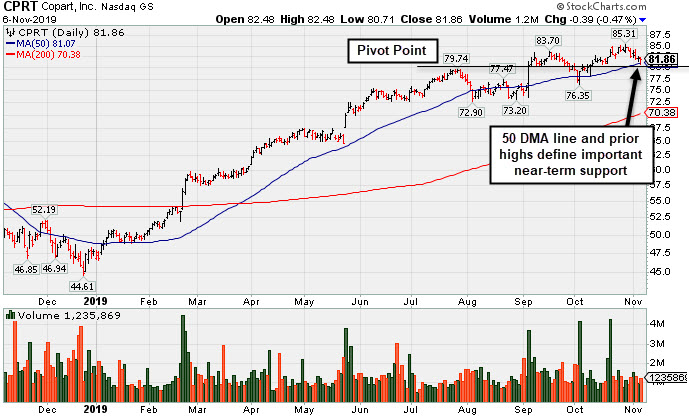

Testing Support at 50-Day Moving Average - Wednesday, November 6, 2019

Copart Inc (CPRT $81.86 -$0.39 -0.47%) is consolidating near its 50-day moving average (DMA) line ($81.07) which defines near-term support and its color code was changed to yellow while sputtering below its "max buy" level again.

CPRT wedged to new all-time highs with gains lacking great volume conviction after last shown in this FSU session on 10/22/19 with an annotated graph under the headline, "Reversed Into Red Today After Hitting New All-Time High". A volume-driven gain above the pivot point on 9/05/19 clinched a technical buy signal when CPRT was highlighted in yellow with pivot point cited based on its 7/26/19 high plus 10 cents (read here).

Bullish action came after it reported earnings +43% on +21% sales revenues for the Jul '19 quarter. Three of the past 4 quarterly earnings increases were above the +25% minimum guideline (C criteria) and its sales revenues growth rate has accelerated. Annual earnings (A criteria) history has been strong and steady since a downturn in FY '13.

The number of top-rated funds owning its shares rose from 1,120 in Sep '18 to 1,339 in Sep '19, a reassuring sign concerning the I criteria. It has a Timeliness Rating of A and Sponsorship Rating of B.

Reversed Into Red Today After Hitting New All-Time High - Tuesday, October 22, 2019

Copart Inc (CPRT -$0.49 or -0.59% to $83.13) pulled back below its "max buy" level and its color code was changed to yellow. Its 50-day moving average (DMA) line ($79.31) defines near-term support above the prior low ($76.35 on 10/03/19).

A volume-driven gain above the pivot point on 9/05/19 clinched a technical buy signal when CPRT was highlighted in yellow with pivot point cited based on its 7/26/19 high plus 10 cents (read here). It was last shown in this FSU session on 10/04/19 with an annotated graph under the headline, "Found Prompt Support Near 50-Day Moving Average".

Bullish action came after it reported earnings +43% on +21% sales revenues for the Jul '19 quarter. Three of the past 4 quarterly earnings increases were above the +25% minimum guideline (C criteria) and its sales revenues growth rate has accelerated. Annual earnings (A criteria) history has been strong and steady since a downturn in FY '13.

The number of top-rated funds owning its shares rose from 1,120 in Sep '18 to 1,327 in Sep '19, a reassuring sign concerning the I criteria. It has a Timeliness Rating of A and Sponsorship Rating of B.

Found Prompt Support Near 50-Day Moving Average - Friday, October 4, 2019

Copart Inc (CPRT +$0.77 or +0.97% to $79.99) found prompt support after a brief slump below its prior high ($79.74 on 7/26/19) and below its 50-day moving average (DMA) line ($78.06). The prompt rebound helped its outlook improve.

A volume-driven gain above the pivot point on 9/05/19 clinched a technical buy signal when CPRT was highlighted in yellow with pivot point cited based on its 7/26/19 high plus 10 cents (read here). It was last shown in this FSU session on 9/19/19 with an annotated graph under the headline, "Hovering Near All-Time High Following Recent Breakout".

Bullish action came after it reported earnings +43% on +21% sales revenues for the Jul '19 quarter. Three of the past 4 quarterly earnings increases were above the +25% minimum guideline (C criteria) and its sales revenues growth rate has accelerated. Annual earnings (A criteria) history has been strong and steady since a downturn in FY '13.

The number of top-rated funds owning its shares rose from 1,120 in Sep '18 to 1,190 in Jun '19, a reassuring sign concerning the I criteria. It has a Timeliness Rating of B and Sponsorship Rating of B.

Hovering Near All-Time High Following Recent Breakout - Thursday, September 19, 2019

Copart Inc (CPRT -$0.34 or -0.41% to $82.23) is below its "max buy" level yet perched very near its all-time high. It held its ground stubbornly after the big volume-driven gain above the pivot point on 9/05/19 clinched a technical buy signal.

CPRT was highlighted in yellow with pivot point cited based on its 7/26/19 high plus 10 cents in the 9/05/19 mid-day report (read here). That evening it was shown in this FSU session with an annotated graph under the headline, "Heavy Volume Behind Breakout Gain After Earnings Report".

Bullish action came after it reported earnings +43% on +21% sales revenues for the Jul '19 quarter. Three of the past 4 quarterly earnings increases were above the +25% minimum guideline (C criteria) and its sales revenues growth rate has accelerated. Annual earnings (A criteria) history has been strong and steady since a downturn in FY '13.

The number of top-rated funds owning its shares rose from 1,120 in Sep '18 to 1,275 in Jun '19, a reassuring sign concerning the I criteria. It has a Timeliness Rating of A and Sponsorship Rating of B.

Heavy Volume Behind Breakout Gain After Earnings Report - Thursday, September 5, 2019

Copart Inc (CPRT +$4.95 or +6.54% to $80.61) finished strong after highlighted in yellow with pivot point cited based on its 7/26/19 high plus 10 cents in the earlier mid-day report (read here). It hit a new all-time high with today's big volume-driven gain, rallying from below its 50-day moving average (DMA) line. The gain and strong close above the pivot point backed by +217% above average volume clinched a technical buy signal.

Bullish action came after it reported earnings +43% on +21% sales revenues for the Jul '19 quarter. Three of the past 4 quarterly earnings increases were above the +25% minimum guideline (C criteria) and its sales revenues growth rate has accelerated. Annual earnings (A criteria) history has been strong and steady since a downturn in FY '13.

The number of top-rated funds owning its shares rose from 1,120 in Sep '18 to 1,269 in Jun '19, a reassuring sign concerning the I criteria. It has a Timeliness Rating of B and Sponsorship Rating of B.