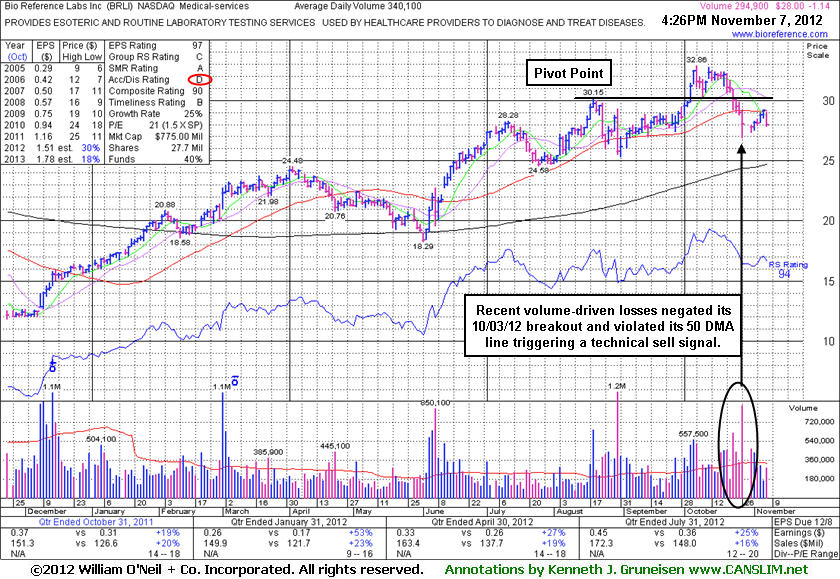

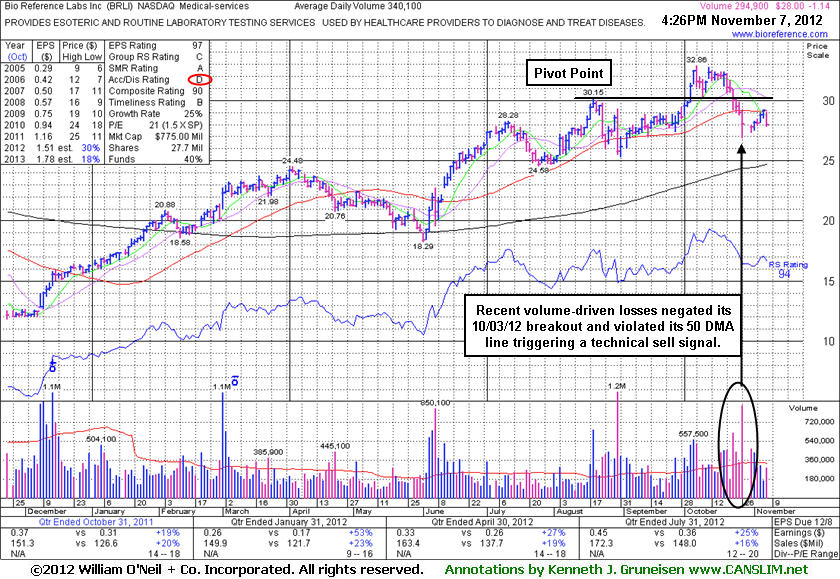

Recent bullish action and strong fundamentals helped it return to the Featured Stocks list, however it will be dropped from that list of noteworthy leaders tonight due to its technical deterioration. The company has maintained a good annual earnings history (A criteria) and quarterly earnings increases were above the +25% minimum guideline (C criteria) in the 3 latest comparisons through Jul '12 while prior comparisons were borderline or below the guideline. BRLI now has 27.7 million shares outstanding (S criteria). The number of top-rated funds owning its shares rose from 214 in Dec '11 to 261 in Sep '12 which is reassuring in regard to the I criteria of the investment system.

Bio-Reference Laboratories, Inc. (BRLI -$0.06 or -0.19% to $31.51) is still trading above its "max buy" level, slightly extended from its prior base. It triggered a technical buy signal as it tallied a considerable volume-driven gain above its pivot point cited in the 10/03/12 mid-day report (read here). An additional volume-driven gain into new high territory on the next session provided another confirmation that it was under institutional accumulation. Prior resistance in the $30 are now defines initial support to watch on pullbacks. Disciplined investors always limit losses if ever any stock falls more than -7% from their purchase price.

It has maintained a good annual earnings history (A criteria) and quarterly earnings increases were above the +25% minimum guideline (C criteria) in the 3 latest comparisons through Jul '12 while prior comparisons were borderline or below the guideline. BRLI now has 27.7 million shares outstanding (S criteria). The number of top-rated funds owning its shares rose from 214 in Dec '11 to 246 in Sep '12 which is reassuring in regard to the I criteria of the investment system. Its current Up/Down Volume Ratio of 1.6 also is an unbiased indication that its shares have been under accumulation over the past 50 days.

Its last appearance in this FSU section was on 6/15/10 under the headline, "Consolidation Could Eventually Lead To New Breakout", however it was subsequently dropped the Featured Stocks list and it later went through a deep correction before rebounding. Recent bullish action and strong fundamentals helped it return to the Featured Stocks list.

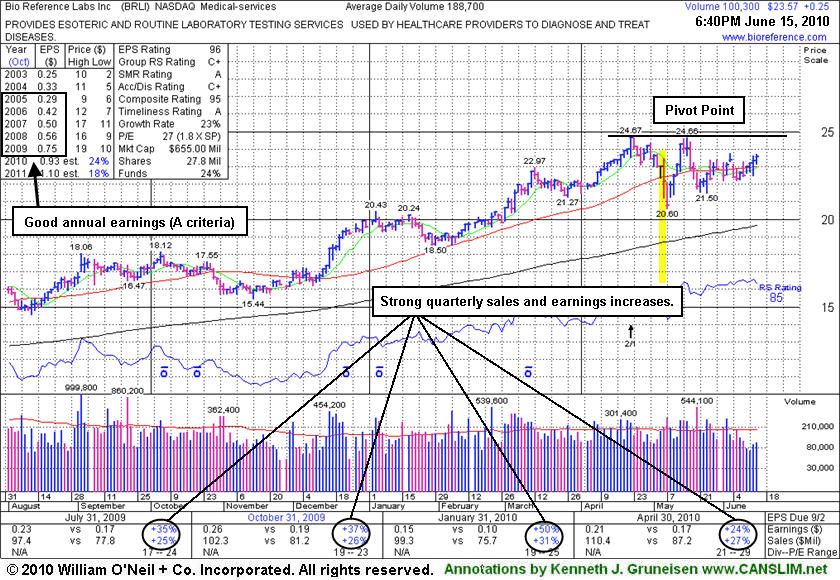

Bio-Reference Laboratories, Inc. (BRLI +$0.25 or +1.07% to $23.57) today marked its 4th consecutive gain on light volume, consolidating above its 50-day moving average (DMA) line. It has been basing for about 8 weeks since a 2:1 stock split effective on 4/22/10. A new pivot point based on its all-time high plus ten cents is being noted. Subsequent gains above that level with at least +50% above average volume could trigger a new technical buy signal.

BRLI gapped up on 5/10/10 and promptly rallied back above its 3/26/10 low. It was noted that during the wild 5/06/10 trading session it reportedly traded down considerably intra-day, undercutting its 200 DMA line and revisiting its November 2009 lows, yet it rebounded to close near its 50 DMA line and in the upper part of its range. In the May 11, 2010 FSU section under the headline "50-Day Moving Average Violation Triggered Recent Sell Signal" we observed - "Apparently some low trades must have been taken off the tape, as the chart now reads differently for that date. More time is needed to see if a proper new base may form, and to also see if the major averages (M criteria) will confirm their new rally attempt with a powerful follow-through-day." Soon afterward, one of our valued members wrote in, and the ongoing exchange since has been summarized in the "Ken's Mailbag" section tonight. While we continue to do our utmost in fact-based reporting, the fact that other charting services continue reporting the questioned data differently should not be overlooked. Still, the following links to charts on Nasdaq.com and Stockcharts.com and BigCharts.com each show lows on May 6th far below $16.00 which is NOT SHOWN on the graph below.

Earnings growth and sales revenues growth has accelerated, with increases better than the +25% minimum guideline in recent quarters. Fundamentals are favorable with respect to the C and A criteria of the investment system. Since splitting its shares 2:1 on 4/22/10 BRLI now has 27.7 million shares outstanding (S criteria). The number of top-rated funds owning its shares rose from 77 in Mar '09 to 87 in Mar '10 which is somewhat reassuring in regard to the I criteria of the investment system.

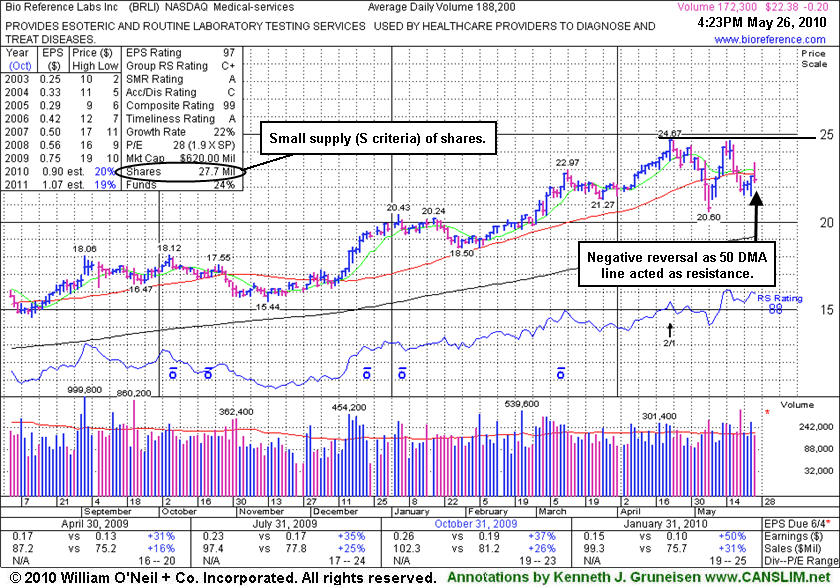

Bio-Reference Laboratories, Inc. (BRLI -$0.28 or -1.24% to $22.30) reversed its early gains today as its 50-day moving average (DMA) line acted as resistance. For its outlook to improve it would need to repair the violation of its short-term average line and work up through a bit of resistance due to overhead supply. Meanwhile it is now -9.6% off its 52-week high.

BRLI gapped up on 5/10/10 and promptly rallied back above its 3/26/10 low. It was noted that during the wild 5/06/10 trading session it reportedly traded down considerably intra-day, undercutting its 200 DMA line and revisiting its November 2009 lows, yet it rebounded to close near its 50 DMA line and in the upper part of its range. In the May 11, 2010 FSU section under the headline "50-Day Moving Average Violation Triggered Recent Sell Signal" we observed - "Apparently some low trades must have been taken off the tape, as the chart now reads differently for that date. More time is needed to see if a proper new base may form, and to also see if the major averages (M criteria) will confirm their new rally attempt with a powerful follow-through-day." Soon afterward, one of our valued members wrote in, and the ongoing exchange since has been summarized in the "Ken's Mailbag" section tonight. While we continue to do our utmost in fact-based reporting, the fact that other charting services continue reporting the questioned data differently should not be overlooked. The following links to charts on Nasdaq.com and Stockcharts.com and BigCharts.com each show lows on May 6th far below that which is shown on the graph below.

A gain on 3/04/10 with 2 times average volume lifted it solidly above its previously cited pivot point, confirming a technical buy signal. Now that old resistance level it cleared is a key chart support level. Its weekly chart is marked by many up weeks with above average volume and few down weeks on volume - very bullish characteristics. Earnings growth and sales revenues growth has accelerated, with increases better than the +25% minimum guideline in recent quarters. Fundamentals are favorable with respect to the C and A criteria of the investment system. Since splitting its shares 2:1 on 4/22/10 BRLI now has 27.7 million shares outstanding (S criteria). The number of top-rated funds owning its shares rose from 77 in Mar '09 to 87 in Mar '10 which is somewhat reassuring in regard to the I criteria of the investment system.

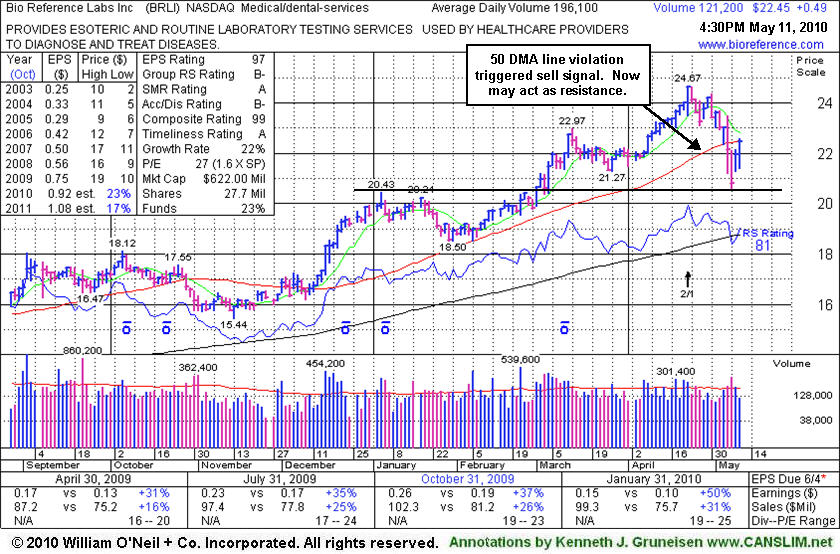

Bio-Reference Laboratories, Inc. (BRLI +$0.49 to $22.45) remains below its 50 DMA line which may now act as resistance. It gapped up on 5/10/10 and promptly rallied back above its 3/26/10 low. It was noted that during the wild 5/06/10 trading session it reportedly traded down considerably intra-day, undercutting its 200 DMA line and revisiting its November 2009 lows, yet it rebounded to close near its 50 DMA line and in the upper part of its range. Apparently some low trades must have been taken off the tape, as the chart now reads differently for that date. More time is needed to see if a proper new base may form, and to also see if the major averages (M criteria) will confirm their new rally attempt with a powerful follow-through-day.

A gain on 3/04/10 with 2 times average volume lifted it solidly above its previously cited pivot point, confirming a technical buy signal. Now that old resistance level it cleared is a key chart support level. Its weekly chart is marked by many up weeks with above average volume and few down weeks on volume - very bullish characteristics. Earnings growth and sales revenues growth has accelerated, with increases better than the +25% minimum guideline in recent quarters. Fundamentals are favorable with respect to the C and A criteria of the investment system. Since splitting its shares 2:1 on 4/22/10 BRLI now has 27.7 million shares outstanding (S criteria). The number of top-rated funds owning its shares rose from 77 in Mar '09 to 86 in Mar '10 which is somewhat reassuring in regard to the I criteria of the investment system.

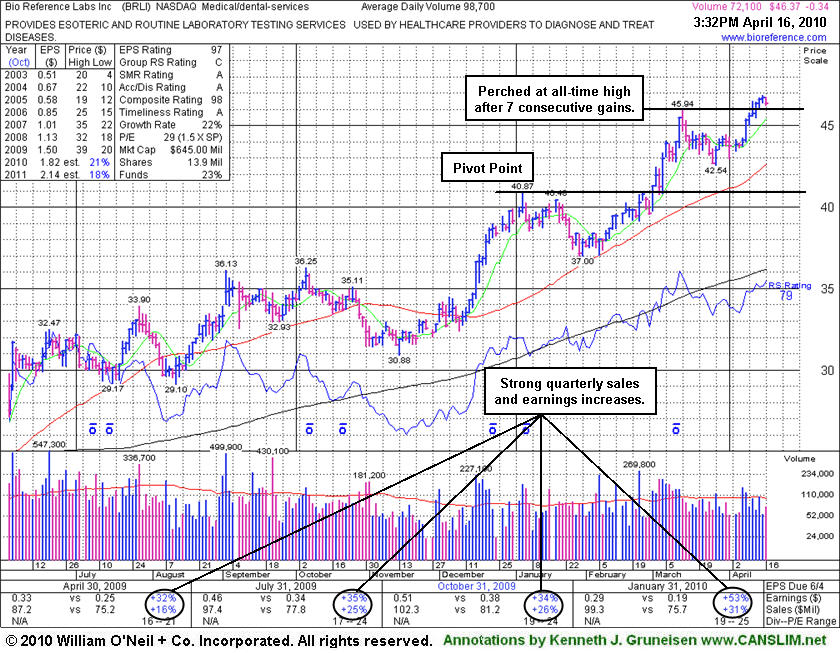

Bio-Reference Laboratories, Inc. (BRLI +$0.05 to $46.76) finished with a small gain and it has posted 8 consecutive gains. Its current Up/Down Volume Ratio of 2.0 is an unbiased indication its shares have been under accumulation recently. However, its latest consolidation for 4 weeks well above its 50-day moving average (DMA) line was considered too short to be a 5-week flat base, and volume behind its latest gains for new highs was not heavy. Its recent chart low ($42.54 on 3/26/10) is an initial support level to watch, and it now coincides with its short-term average.

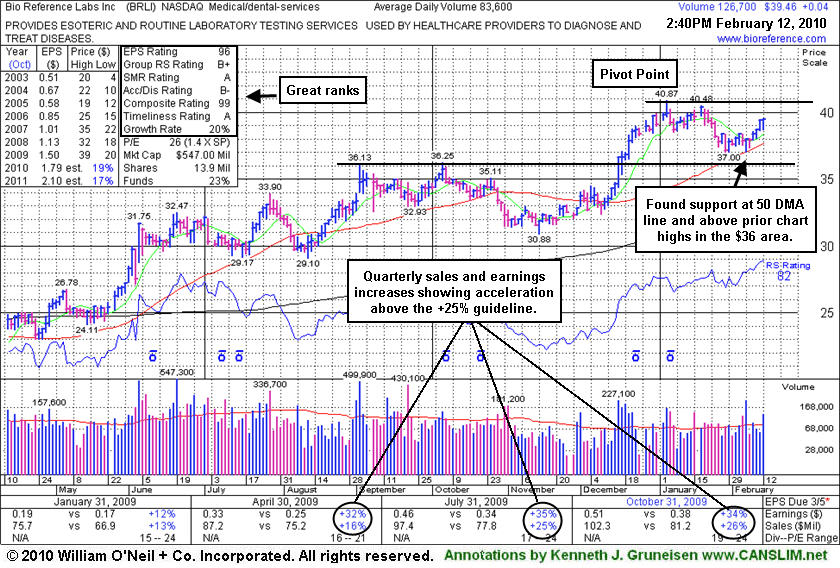

A gain on 3/04/10 with 2 times average volume lifted it solidly above its previously cited pivot point, confirming a technical buy signal. Its weekly chart is marked by many up weeks with above average volume and few down weeks on volume - very bullish characteristics. No resistance remains due to overhead supply now, which could allow for a significant sprint higher. Earnings growth and sales revenues growth has accelerated, with increases better than the +25% minimum guideline in recent quarters. Fundamentals are favorable with respect to the C and A criteria of the investment system. BRLI has only 13.9 million shares outstanding (S criteria) and has average daily volume under 100,000 shares, which could contribute to greater price volatility in the event of more decisive institutional buying or selling. The number of top-rated funds owning its shares rose from 77 in Mar '09 to 84 in Mar '10 which is somewhat reassuring in regard to the I criteria of the investment system.

Bio-Reference Laboratories, Inc. (BRLI +$0.52 or +1.19% to $44.37) has been consolidating very near its 52-week high since its negative reversal on 3/12/10. This high-ranked Medical-Dental - Services firm is slightly extended from its prior base, and prior chart highs and its 50-day moving average (DMA) line now coincide in the $40 area defining important support to watch. Any subsequent deterioration below those levels would raise concerns and trigger technical sell signals.

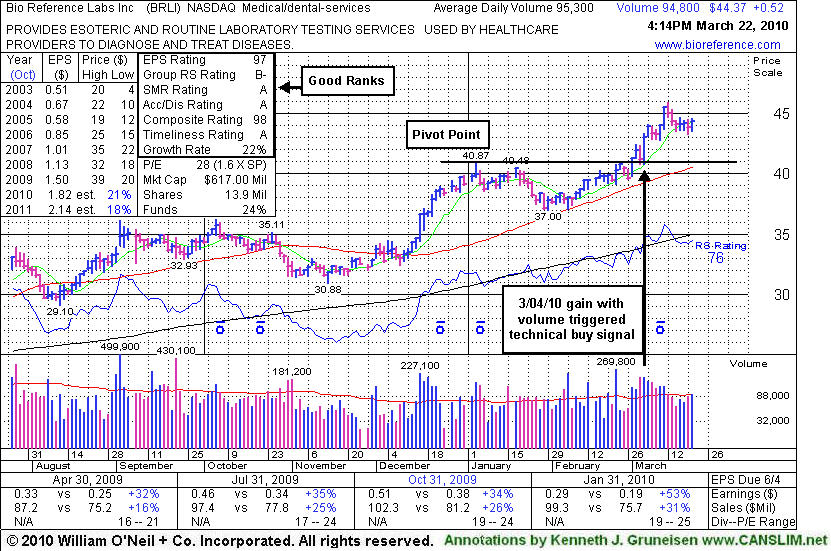

A gain on 3/04/10 with 2 times average volume lifted it solidly above its pivot point, confirming a technical buy signal. Its weekly chart is marked by many up weeks with above average volume and few down weeks on volume - very bullish characteristics. No resistance remains due to overhead supply now, which could allow for a significant sprint higher. Earnings growth and sales revenues growth has accelerated, with increases better than the +25% minimum guideline in recent quarters. Fundamentals are favorable with respect to the C and A criteria of the investment system. BRLI has only 13.9 million shares outstanding (S criteria) and has average daily volume under 100,000 shares, which could contribute to greater price volatility in the event of more decisive institutional buying or selling. The number of top-rated funds owning its shares rose from 77 in Mar '09 to 87 in Dec '09 which is somewhat reassuring in regard to the I criteria of the investment system.

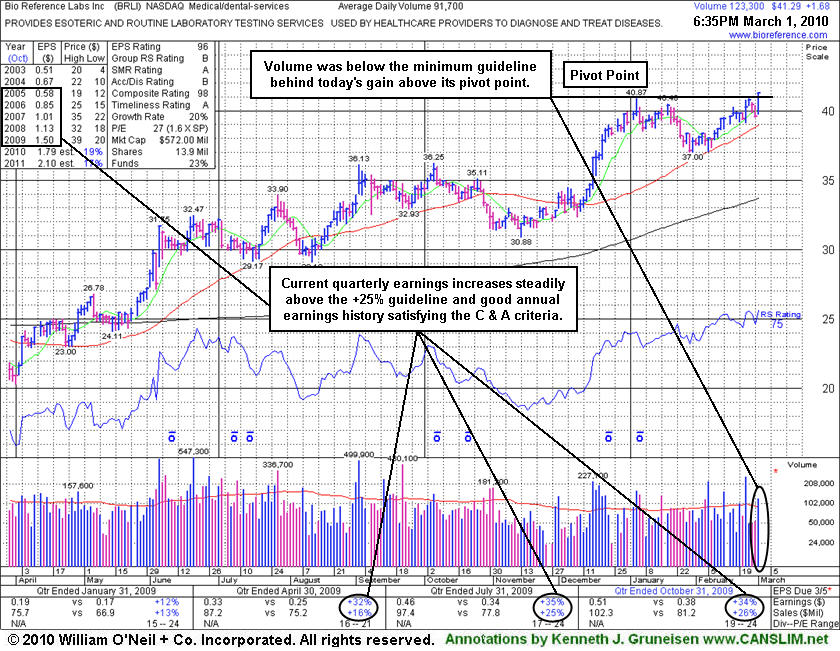

Bio-Reference Laboratories, Inc. (BRLI +$1.62 or +4.09% to $41.23) posted a gain above its pivot point today with +38% above average volume, below the +50% above average volume guideline that defines the minimum volume threshold for a proper technical buy signal! Rising from its recent consolidation for 8-weeks above support at its 50 DMA line, its Up/Down Volume Ratio of 2.3 is an unbiased bullish indicator. This high-ranked Medical-Dental - Services firm was featured on 2/12/10 in yellow in the mid-day report and held its ground since an annotated graph showed it setting up under the headline "High-Ranked Medical Firm Basing Above 50-Day Average Line" in the Featured Stock Update section later that same evening.

No resistance remains due to overhead supply now, which could allow for a significant sprint higher. Earnings growth and sales revenues growth has accelerated, with increases better than the +25% minimum guideline in recent quarters. Fundamentals are favorable with respect to the C and A criteria. The high-ranked Medical/Dental Services firm has only 13.9 million shares outstanding (S criteria) and has average daily volume under 100,000 shares, which could contribute to greater price volatility in the event of more decisive institutional buying or selling. The number of top-rated funds owning its shares rose from 77 in Mar '09 to 88 in Dec '09 which is somewhat reassuring in regard to the I criteria of the investment system. Subsequent gains above its pivot point with at least +50% above average volume could trigger a more compelling technical buy signal, however, the M criteria also remains an overriding concern until a follow-through-day occurs from at least one of the major averages.

Bio-Reference Laboratories, Inc. (BRLI +$0.01 or +0.03% to $39.43) is perched less than -4% from its 52-week high, consolidating for at least 5-weeks above support at its 50-day moving average (DMA) line. It was featured in yellow in today's mid-day report (read here). Very little resistance remains due to overhead supply. Earnings growth and sales revenues growth has accelerated, with increases better than the +25% minimum guideline in recent quarters. Fundamentals are favorable with respect to the C and A criteria. The high-ranked Medical/Dental Services firm has only 13.9 million shares outstanding (S criteria) and has average daily volume under 100,000 shares, which could contribute to greater price volatility in the event of more decisive institutional buying or selling. The number of top-rated funds owning its shares rose from 77 in Mar '09 to 87 in Dec '09 which is somewhat reassuring in regard to the I criteria of the investment system. Gains above its pivot point with at least +50% above average volume could trigger a technical buy signal, however, the M criteria is an overriding concern until a follow-through-day occurs.