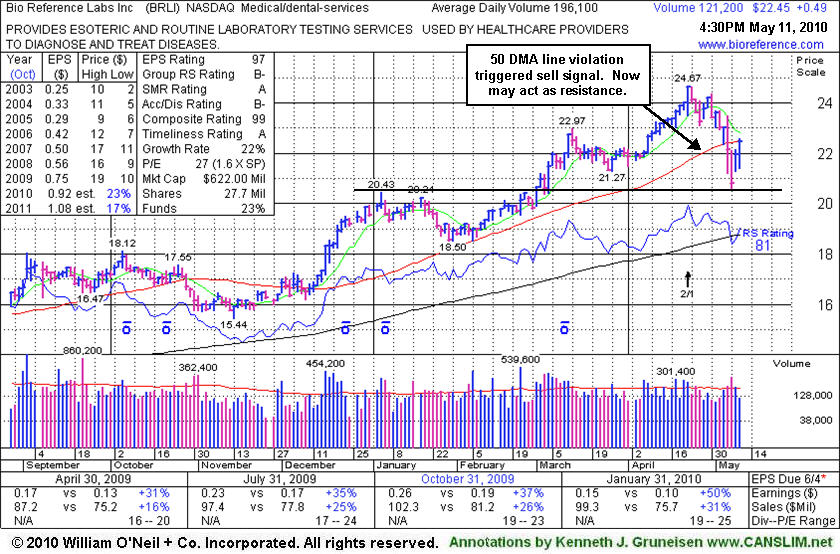

50-Day Moving Average Violation Triggered Recent Sell Signal

Tuesday, May 11, 2010 CANSLIM.net

Bio-Reference Laboratories, Inc. (BRLI +$0.49 to $22.45) remains below its 50 DMA line which may now act as resistance. It gapped up on 5/10/10 and promptly rallied back above its 3/26/10 low. It was noted that during the wild 5/06/10 trading session it reportedly traded down considerably intra-day, undercutting its 200 DMA line and revisiting its November 2009 lows, yet it rebounded to close near its 50 DMA line and in the upper part of its range. Apparently some low trades must have been taken off the tape, as the chart now reads differently for that date. More time is needed to see if a proper new base may form, and to also see if the major averages (M criteria) will confirm their new rally attempt with a powerful follow-through-day.

A gain on 3/04/10 with 2 times average volume lifted it solidly above its previously cited pivot point, confirming a technical buy signal. Now that old resistance level it cleared is a key chart support level. Its weekly chart is marked by many up weeks with above average volume and few down weeks on volume - very bullish characteristics. Earnings growth and sales revenues growth has accelerated, with increases better than the +25% minimum guideline in recent quarters. Fundamentals are favorable with respect to the C and A criteria of the investment system. Since splitting its shares 2:1 on 4/22/10 BRLI now has 27.7 million shares outstanding (S criteria). The number of top-rated funds owning its shares rose from 77 in Mar '09 to 86 in Mar '10 which is somewhat reassuring in regard to the I criteria of the investment system.