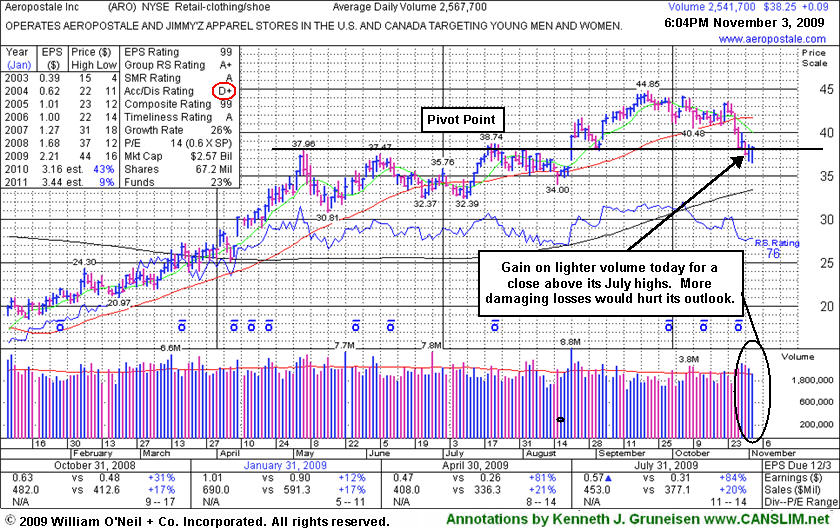

Aeropostale Inc. (ARO +$0.09 or +0.24% to $38.25) posted a small gain today with lighter volume, overcoming a weak start for a second positive reversal in a row. It also closed back above its July 20th high close, which is a somewhat encouraging sign. Last week's serious 50-day moving average (DMA) line violation led to previously noted technical sell signals. It essentially negated its 8/21/09 technical breakout with a close below July's highest close (its highest pre-breakout close), while it is currently trading near its prior highs in the $38 area which have been identified as important support. More damaging losses would hurt its outlook.

This high-ranked leader in the Retail - Clothing/shoe group has encountered some very obvious distributional pressure in recent weeks. Its Accumulation/Distribution rank (see red circle on left) has slumped to a D+ from a B- on October 6th. Its Relative Strength rank also fell to 76 from 84 over that same time frame, indicating its relative under-performance in recent weeks. ARO was featured in yellow with new pivot point and max buy levels noted in the 8/21/09 Mid-Day BreakOuts Report (read here). It has a great annual earnings history (the A criteria), and the 2 latest quarterly comparisons showed +81% and +84% earnings increases, well above the investment system's +25% guideline. The number of top-rated funds owning an interest in its shares rose from 207 in Dec '08 to 237 in Jun '09, which is good news concerning the I criteria.

Aeropostale Inc. (ARO +$1.58 or +3.59% to $44.05) posted a solid gain today with slightly higher volume, which helped it rally up from support at its 50-day moving average (DMA) line. Additional analysis in response to a member inquiry was included in the "Ken's Mailbag" section of the 10/21/09 After-Market Update (read here). Its color code was changed to yellow again, and new pivot point and max buy levels have just been noted. It appears to be building a new flat base while finding support at its 50 DMA line, its short-term average which has been enduring its first test since its latest sound breakout occurred. A more serious 50 DMA line violation could subsequently raise concerns and trigger a technical sell signal, with the next important chart support level being its prior highs in the $38 area.

This high-ranked leader in the Retail - Clothing/shoe group has encountered some very obvious distributional pressure in recent weeks. Its Accumulation/Distribution rank (see red circle on left) has slumped to a D from a B- on October 6th, when it last appeared in this FSU section. Its Relative Strength rank (see the larger red circle on the right) also fell to 72 from 84 over that same time frame, indicating its relative under-performance in recent weeks. ARO was featured in yellow with new pivot point and max buy levels noted in the 8/21/09 Mid-Day BreakOuts Report (read here). It has a great annual earnings history (the A criteria), and the 2 latest quarterly comparisons showed +81% and +84% earnings increases, well above the investment system's +25% guideline. The number of top-rated funds owning an interest in its shares rose from 207 in Dec '08 to 238 in Jun '09, which is good news concerning the I criteria.

Aeropostale Inc. (ARO +$1.58 or +3.59% to $44.05) posted a light volume gain and equaled the second highest close ever for this high-ranked leader in the Retail - Clothing/shoe group. It has recently been consolidating above support at its 50-day moving average (DMA) line, with the next support to watch at prior highs in the $38 area. It has not encountered any very heavy distributional action since it rallied above its 2008 highs, however it also hasn't posted and gains backed by heavy volume since early-September. It is extended from a sound base and not buyable under the investment system guidelines now. Disciplined investors avoid chasing stocks more than 5% above their pivot point, as doing so increases the chances that a normal pullback will prompt them to sell the stock -as investors should always limit losses by selling any stock that falls 7% from their buy price.

ARO has advanced slowly, steadily, and quietly since it was featured in yellow with new pivot point and max buy levels noted in the 8/21/09 Mid-Day BreakOuts Report (read here). It has a great annual earnings history (the A criteria), and the 2 latest quarterly comparisons showed +81% and +84% earnings increases, well above the investment system's +25% guideline. The number of top-rated funds owning an interest in its shares rose from 209 in Dec '08 to 241 in Jun '09, which is good news concerning the I criteria.

Aeropostale Inc (ARO +$0.13 or +0.30% to $44.05) inched to a new all-time high close today with light volume behind its 5th consecutive up session. Its weekly graph below illustrates its streak of 5 consecutive weekly gains on ever-decreasing volume. It has not encountered any distributional action since it rallied above its 2008 highs, however it is extended from a sound base and not buyable under the investment system guidelines now. Support to watch is at prior highs in the $38 area. Disciplined investors avoid chasing stocks more than 5% above their pivot point, as doing so increases the chances that a normal pullback will prompt them to sell the stock -as investors should always limit losses by selling any stock that falls 7% from their buy price.

This a high-ranked leader in the Retail - Clothing/shoe group has advanced slowly, steadily, and quietly since it was featured in yellow with new pivot point and max buy levels noted in the 8/21/09 Mid-Day BreakOuts Report (read here). It has a great annual earnings history (the A criteria), and the 2 latest quarterly comparisons showed +81% and +84% earnings increases, well above the investment system's +25% guideline. The number of top-rated funds owning an interest in its shares rose from 209 in Dec '08 to 243 in Jun '09, which is good news concerning the I criteria. An annotated daily graph was included on 9/02/09 with its last appearance in this FSU section under the headline "Consolidation Near Prior Highs While Market Sputters. It found great support and continued higher as the market improved.

Aeropostale Inc (ARO +$0.30 or +0.78% to $38.58) is a high-ranked leader in the Retail - Clothing/shoe group now consolidating near its pivot point and support at prior highs in the $38 area. It has endured some distributional pressure without closing under its old high close ($38.22 on 7/22/09), but deterioration leading to a close back in its prior base would raise concerns. Keep in mind, 3 out of 4 stocks tend to follow along with the direction of the major averages. Weaker market conditions (the M criteria) have hindered its progress since its gap up gain for a new all-time high on 8/21/09 triggered a technical buy signal as it rose from a flat base pattern with almost 3 times average volume.

ARO was featured in yellow with new pivot point and max buy levels noted in the 8/21/09 Mid-Day BreakOuts Report (read here). It has a great annual earnings history (the A criteria), and the 2 latest quarterly comparisons showed +81% and +84% earnings increases, well above the investment system's +25% guideline. The number of top-rated funds owning an interest in its shares rose from 209 in Dec '08 to 239 in Jun '09, which is good news concerning the I criteria.

Disciplined investors avoid chasing stocks more than 5% above their pivot point, as doing so increases the chances that a normal pullback will prompt them to sell the stock -as investors should always limit losses by selling any stock that falls 7% from their buy price. Healthy stocks in healthy market environments do not typically retreat under their pivot points by very much, so subsequent losses would raise concerns, particularly if volume swells behind and damaging declines.

Aeropostale Inc (ARO +$3.67 or +9.28% to $39.55) is a high-ranked leader in the Retail - Clothing/shoe group that gapped up and hit a new all-time high today, rising from a flat base pattern triggering a technical buy signal. It was featured in yellow with new pivot point and max buy levels noted in the 8/21/09 Mid-Day BreakOuts Report (read here). It has a great annual earnings history (the A criteria), and the 2 latest quarterly comparisons showed +81% and +84% earnings increases, well above the investment system's +25% guideline. The number of top-rated funds owning an interest in its shares rose from 209 in Dec '08 to 232 in Jun '09, which is good news concerning the I criteria.

Disciplined investors avoid chasing stocks more than 5% above their pivot point, as doing so increases the chances that a normal pullback will prompt them to sell the stock -as investors should always limit losses by selling any stock that falls 7% from their buy price.