Consolidation Near Prior Highs While Market Sputters

Wednesday, September 02, 2009 CANSLIM.net

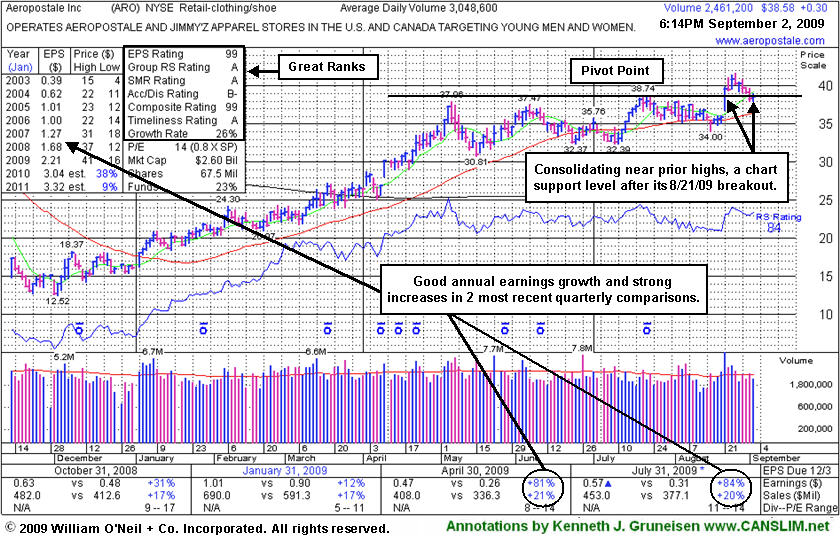

Aeropostale Inc (ARO +$0.30 or +0.78% to $38.58) is a high-ranked leader in the Retail - Clothing/shoe group now consolidating near its pivot point and support at prior highs in the $38 area. It has endured some distributional pressure without closing under its old high close ($38.22 on 7/22/09), but deterioration leading to a close back in its prior base would raise concerns. Keep in mind, 3 out of 4 stocks tend to follow along with the direction of the major averages. Weaker market conditions (the M criteria) have hindered its progress since its gap up gain for a new all-time high on 8/21/09 triggered a technical buy signal as it rose from a flat base pattern with almost 3 times average volume.

ARO was featured in yellow with new pivot point and max buy levels noted in the 8/21/09 Mid-Day BreakOuts Report (read here). It has a great annual earnings history (the A criteria), and the 2 latest quarterly comparisons showed +81% and +84% earnings increases, well above the investment system's +25% guideline. The number of top-rated funds owning an interest in its shares rose from 209 in Dec '08 to 239 in Jun '09, which is good news concerning the I criteria.

Disciplined investors avoid chasing stocks more than 5% above their pivot point, as doing so increases the chances that a normal pullback will prompt them to sell the stock -as investors should always limit losses by selling any stock that falls 7% from their buy price. Healthy stocks in healthy market environments do not typically retreat under their pivot points by very much, so subsequent losses would raise concerns, particularly if volume swells behind and damaging declines.