You are not logged in.

This means you

CAN ONLY VIEW reports that were published prior to Monday, April 14, 2025.

You

MUST UPGRADE YOUR MEMBERSHIP if you want to see any current reports.

AFTER MARKET UPDATE - FRIDAY, SEPTEMBER 11TH, 2009

Previous After Market Report Next After Market Report >>>

|

|

|

|

DOW |

-22.07 |

9,605.41 |

-0.23% |

|

Volume |

1,293,161,590 |

-13% |

|

Volume |

2,334,258,650 |

-6% |

|

NASDAQ |

-3.12 |

2,080.90 |

-0.15% |

|

Advancers |

1,678 |

54% |

|

Advancers |

1,120 |

40% |

|

S&P 500 |

-1.41 |

1,042.73 |

-0.14% |

|

Decliners |

1,339 |

43% |

|

Decliners |

1,599 |

56% |

|

Russell 2000 |

-1.31 |

593.59 |

-0.22% |

|

52 Wk Highs |

174 |

|

|

52 Wk Highs |

94 |

|

|

S&P 600 |

-0.56 |

311.96 |

-0.18% |

|

52 Wk Lows |

2 |

|

|

52 Wk Lows |

1 |

|

|

|

Stocks Quietly Pause After 5-Days Of Gains

Adam Sarhan, Contributing Writer,

The major averages ended higher this week but they snapped a 5-day winning streak and ended the session slightly lower on Friday. Advancers had a slight lead over decliners on the NYSE, but decliners led advancers by more than a 4-to-3 ratio on the Nasdaq exchange. On Friday, volume totals were lighter than the prior day's sessions, which was a reassuring sign suggesting that institutional investors were not dumping stocks. There were 26 high-ranked companies from the CANSLIM.net Leaders List that made a new 52-week high and appeared on the CANSLIM.net BreakOuts Page, down from the 33 issues that appeared on the prior session. New 52-week highs still outnumbered new 52-week lows on both exchanges while new lows were in the single digits yet again.

The stock market was closed on Monday in observance of Labor Day. On Tuesday, the Nasdaq Composite jumped to a fresh 2009 high close on heavier volume than the prior session. The major headline on Tuesday was that China posted gains considered by certain analysts as a "follow-through day" confirming its latest rally attempt. This may be very important, since China led the world markets higher in early March, many recent leaders are Chinese ADR's, and the immensely populous country continues to be a strong engine for economic growth.

On Wednesday, stocks ended higher, sending the benchmark S&P 500 and Nasdaq Composite to fresh 2009 closing highs. The US dollar continued its week long sell off as investors shy away from the greenback. The US dollar slid to a fresh one-year low against six major currencies including the euro, which sent most dollar denominated assets higher. Remember that there tends to be an inverse relationship between a weak dollar and dollar denominated assets since they become more attractive to foreign investors due to favorable exchange rates. A weaker dollar played a pivotal role in the massive increase in commodity prices several years ago. The Fed released its Beige Book on Wednesday afternoon which showed that showed that 11 out of 12 regional banks reported signs of a stable or improving economy in July and August while retail sales were "flat" and labor markets remained "weak." 5 regions "mentioned signs of improvement," which helped support the notion that the economy is recovering.

After Wednesday's close, President Obama gave a speech on Capital Hill outlining his health care plan. He said his health insurance plan of $900 billion over 10 years will be funded with spending cuts and tax increases. Managed care stocks responded with gains for the near-term, however the uncharacteristically poor performance of the healthcare group during the most recent period of economic uncertainty has been discussed numerous times in this commentary. The HMO group was just featured in the Industry Group Watch section of Wednesday's After Market Update (read here).

On Thursday, stocks edged higher sending the Dow Jones Industrial Average, S&P 500 Index, and the Nasdaq Composite Index to fresh 2009 highs! Treasury Secretary Geithner's testimony before Congress Thursday suggested that policymakers are in a position to evolve their strategy with the goal of repairing and rebuilding the economy's foundation for future growth. He also said that it is unlikely more bank bailout money will be needed, so its contingency provision can be removed from the budget.

On Friday, there was a moment of silence to remember the victims of 9/11. The market closed lower as leading stocks paused to consolidate their recent move. Gold stocks also emerged as a strong area of leadership after a recent pause to consolidate their run. In our view, the major averages are very strong, as every correction over the past six months has been mild (no more than a few percentage points) and the bulls remain in control. It is very important to remain selective and stand ready to buy when you see the right stock trigger a fresh breakout, not make excuses. Making excuses is easy, but being disciplined (buying/selling "right") is not always easy for investors. However, no one said it is easy to be disciplined and successful in the market. PICTURED: The S&P 500 Index hit a new 2009 high and closed above near term resistance this week.

|

|

|

|

Influential Retail and Financial Groups Hit 2009 Highs And Paused

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

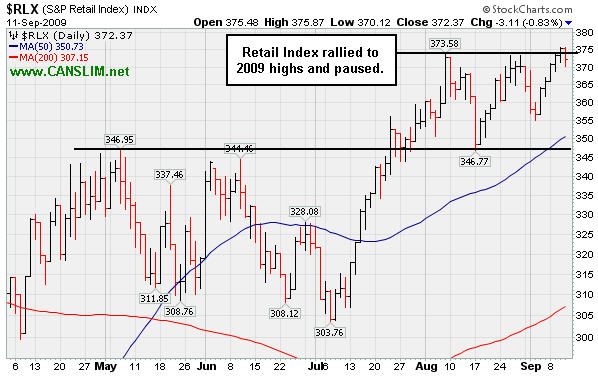

Losses for the Retail Index ($RLX -0.83%) and the financial group including the Bank Index ($BKX -1.15%) and Broker/Dealer Index ($XBD -1.02%) contributed to the slightly negative bias for the major averages on Friday. We take a closer look at two of those influential indexes below. The Semiconductor Index ($SOX -1.41%) and Biotechnology Index ($BTK -0.78%) also ended with losses while the Internet Index ($IIX -0.04%) held its ground and the Networking Index ($NWX +0.70%) slid. Defensive areas posted gains as the Gold & Silver Index ($XAU +1.20%), Healthcare Index ($HMO +0.60%), and Oil Services Index ($OSX +0.82%) rose, yet the Integrated Oil Index ($XOI -0.30%) ended slightly lower.

Charts courtesy www.stockcharts.com

PICTURED: The Retail Index ($RLX -0.83%) rallied to a new 2009 high this week and paused.

Charts courtesy www.stockcharts.com

PICTURED: The Broker/Dealer Index ($XBD -1.02%) rallied to a new 2009 high this week and paused.

| Oil Services |

$OSX |

185.47 |

+1.50 |

+0.82% |

+52.79% |

| Healthcare |

$HMO |

1,282.31 |

+7.61 |

+0.60% |

+33.55% |

| Integrated Oil |

$XOI |

1,020.83 |

-3.04 |

-0.30% |

+4.20% |

| Semiconductor |

$SOX |

321.24 |

-4.58 |

-1.41% |

+51.41% |

| Networking |

$NWX |

228.95 |

+1.60 |

+0.70% |

+59.11% |

| Internet |

$IIX |

212.20 |

-0.09 |

-0.04% |

+58.63% |

| Broker/Dealer |

$XBD |

114.65 |

-1.18 |

-1.02% |

+47.99% |

| Retail |

$RLX |

372.38 |

-3.10 |

-0.83% |

+33.35% |

| Gold & Silver |

$XAU |

169.08 |

+2.01 |

+1.20% |

+36.52% |

| Bank |

$BKX |

45.42 |

-0.53 |

-1.15% |

+2.48% |

| Biotech |

$BTK |

927.85 |

-7.31 |

-0.78% |

+43.37% |

|

|

|

|

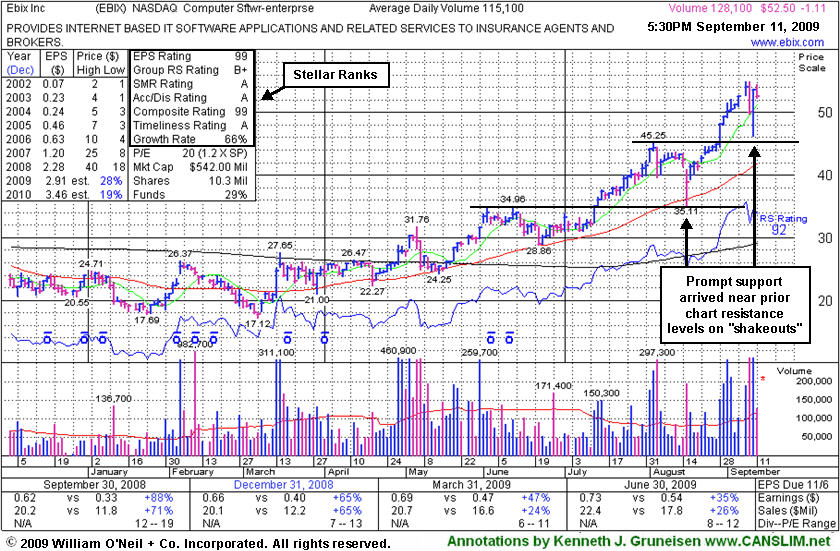

Whipsaw Pullbacks Found Prompt Support Near Prior Resistance

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

Ebix Inc (EBIX -$1.11 or -2.11% to $52.50) has held its ground reasonably well after another wild whipsaw-like shakeout briefly tested support, like its shakeout in mid-August that nearly tested prior chart highs. On the prior 2 sessions it dove as low as $46.25, briefly trading under its $47.62 "max buy" level, and it positively reversed for a big gain on 4 times average volume. Now it is too extended from an ideal buy point within the investment system guidelines. Sales and earnings increases in quarterly comparisons have been strong, but they have shown steady sequential deceleration which is of some concern. EBIX has a small supply of only 6.62 million shares in the float, which has been previously noted as a reason one might expect great volatility.

Volatility like we have recently seen serves as a reminder for investors to always make disciplined buys and sells! Now EBIX rallied as much as +19.76% since featured in yellow in the 8/28/09 CANSLIM.net Mid-Day BreakOuts Report (read here) as it was reaching a new all-time high. A technical buy signal was triggered with a considerable gain backed by volume +81.94% above average as it cleared a cup-with-high-handle pattern after "3-weeks tight". It formed the big cup-with-high-handle shaped pattern (finding great support at its 50 DMA line) since weak action prompted it to be dropped from the Featured Stocks list on 10/07/08.

EBIX traded up more than +59% after it was first featured in the March 2008 CANSLIM.net News (read here). At that time its 50-day average daily volume was only 4,900 shares, whereas today its average volume is at 115,000 shares. Today there are 6.62 million shares (the S criteria) in the public float, so its share price still could be very volatile in the event of heavy institutional buying or selling. The number of top-rated funds owning an interest in its shares rose from 31 in Dec '08 to 55 in Jun '09, which is a good sign concerning the I criteria of the investment system. Do not be confused by the 3:1 split that took effect on 10/09/08. It has rebounded impressively and cleared its August '08 highs in the $40 area recently, after steadily climbing from this year's lows in the $17 range.

|

|

|

Color Codes Explained :

Y - Better candidates highlighted by our

staff of experts.

G - Previously featured

in past reports as yellow but may no longer be buyable under the

guidelines.

***Last / Change / Volume quote data in this table corresponds with the timestamp on the note***

Symbol/Exchange

Company Name

Industry Group |

Last |

Chg. |

Vol

% DAV |

Date Featured |

Price Featured |

Latest Pivot Point

Featured |

Status |

| Latest Max Buy Price |

ARO

- NYSE

Aeropostale Inc

RETAIL - Apparel Stores

|

$42.06

|

-0.19

|

2,570,330

86% DAV

2,972,200

|

8/21/2009

(Date

Featured) |

$39.21

(Price

Featured) |

PP = $38.84 |

G |

| MB = $40.78 |

Most Recent Note - 9/11/2009 5:48:01 PM

G - This high-ranked leader in the Retail - Clothing/shoe group has held its ground near all-time highs for the past week. It found support at prior highs in the $38 area on a healthy pullback after first triggering a technical buy signal when featured in yellow in the 8/21/09 Mid-Day BreakOuts Report (read here).

>>> The latest Featured Stock Update with an annotated graph appeared on 9/2/2009. click here.

|

|

C

A

S

I |

News |

Chart |

SEC

View all notes Alert

me of new notes

Company

Profile

|

ARST

-

|

$22.20

|

-0.50

|

531,525

73% DAV

732,200

|

9/1/2009

(Date

Featured) |

$19.91

(Price

Featured) |

PP = $20.90 |

G |

| MB = $21.95 |

Most Recent Note - 9/11/2009 5:48:41 PM

G - Hovering at all-time highs, stubbornly holding its gains, with volume drying up since its considerable gain on 9/04/09 with nearly 3 times average volume triggered a technical buy signal. Featured in yellow in the 9/01/09 Mid-Day BreakOuts Report with an annotated daily graph (read here) and it was also featured with more detailed analysis in the September 2009 CANSLIM.net News with an annotated weekly graph (read here).

>>> The latest Featured Stock Update with an annotated graph appeared on 9/4/2009. click here.

|

|

C

A

S

I |

News |

Chart |

SEC

View all notes Alert

me of new notes

Company

Profile

|

BIDU

- NASDAQ

Baidu Inc Ads

INTERNET - Internet Information Providers

|

$369.95

|

-2.50

|

1,673,263

95% DAV

1,768,400

|

9/8/2009

(Date

Featured) |

$351.80

(Price

Featured) |

PP = $368.59 |

Y |

| MB = $387.02 |

Most Recent Note - 9/11/2009 5:49:40 PM

Y - Finished in the red with a small loss on lighter volume after earlier gains today. Volume has been below the minimum guidline as it extended its winning streak to 6 days, edging above its pivot point on the right side of its 6-week flat base. However, proper technical buy signals require at least +50% above average volume, preferably more. BIDU was featured again in yellow in the 9/08/09 Mid-Day BreakOuts Report (read here). This high-ranked leader has a solid quarterly and annual earnings history, but a clear sequential deceleration in its increases is a concern. Based on weak technical action it was dropped from the Featured Stocks list on 1/11/08, when it was trading at $329, and it has rebounded very impressively from its January 2009 lows near $100.

>>> The latest Featured Stock Update with an annotated graph appeared on 9/8/2009. click here.

|

|

C

A

S

I |

News |

Chart |

SEC

View all notes Alert

me of new notes

Company

Profile

|

CPLA

- NASDAQ

Capella Education Co

DIVERSIFIED SERVICES - Education and Training Services

|

$62.19

|

-1.25

|

127,508

72% DAV

176,000

|

7/9/2009

(Date

Featured) |

$59.69

(Price

Featured) |

PP = $62.06 |

G |

| MB = $65.16 |

Most Recent Note - 9/11/2009 5:56:44 PM

G - Loss on light volume today led to a close just under its 50 DMA line near prior chart highs. Color code is changed to green based on that deterioration below its short-term average, its general lack of progress, and its waning Relative Strength rank which has slumped to 56, under the 80+ guideline. Group strength has also been thin. Meanwhile, it is still trading in a tight range on light volume for the past 6 weeks near its pivot point, within close striking range less than -6% from its 52-week high. Its small supply of only 13.9 million shares in the float could contribute to greater price volatility in the event of institutional accumulation or distribution. The number of top-rated funds owning an interest rose from 91 in Sept '08, to 138 as of June '09, which is reassuring with respect to the I criteria. It has a very good earnings history that satisfies the C & A criteria.

>>> The latest Featured Stock Update with an annotated graph appeared on 9/3/2009. click here.

|

|

C

A

S

I |

News |

Chart |

SEC

View all notes Alert

me of new notes

Company

Profile

|

CRM

- NYSE

Salesforce.com Inc

INTERNET - Internet Software & Services

|

$57.92

|

+1.50

|

3,323,693

171% DAV

1,945,600

|

8/16/2009

(Date

Featured) |

$47.12

(Price

Featured) |

PP = $45.59 |

G |

| MB = $47.87 |

Most Recent Note - 9/11/2009 5:58:50 PM

G - Posted a 7th consecutive gain, rising today with higher than average volume. Hit new 2009 highs, rising from a "3-weeks tight" type pattern following its "breakaway gap" on 8/21/09 with more than 5 times average volume. Prior highs near $55 are a support level to watch, while it is now extended from a sound base. Detailed analysis and an annotated graph were included when recently featured in the 8/16/09 Stock Bulletin (read here).

>>> The latest Featured Stock Update with an annotated graph appeared on 8/31/2009. click here.

|

|

C

A

S

I |

News |

Chart |

SEC

View all notes Alert

me of new notes

Company

Profile

|

EBIX

- NASDAQ

Ebix Inc

COMPUTER SOFTWARE & SERVICES - Business Software & Services

|

$52.50

|

-1.11

|

128,075

120% DAV

106,600

|

8/28/2009

(Date

Featured) |

$45.86

(Price

Featured) |

PP = $45.35 |

G |

| MB = $47.62 |

Most Recent Note - 9/11/2009 5:59:36 PM

G - Held its ground fairly well after another whipsaw-like shakeout briefly tested support, which it also did in mid-August. On the prior 2 sessions it dove as low as $46.25, briefly trading under its $47.62 "max buy" level, and it positively reversed for a big gain on 4 times average volume. Now it is too extended from an ideal buy point within the investment system guidelines. Its small supply of only 6.62 million shares in the float has been previously noted as a reason one might expect great volatility. Such volatility is a reminder to always make disciplined buys and sells! EBIX rallied as much as +19.76% since featured in yellow in the 8/28/09 Mid-Day BreakOuts Report (read here).

>>> The latest Featured Stock Update with an annotated graph appeared on 9/11/2009. click here.

|

|

C

A

S

I |

News |

Chart |

SEC

View all notes Alert

me of new notes

Company

Profile

|

GMCR

- NASDAQ

Green Mtn Coffee Roastrs

FOOD & BEVERAGE - Processed & Packaged Goods

|

$62.46

|

+2.84

|

1,429,973

96% DAV

1,495,100

|

7/17/2009

(Date

Featured) |

$60.15

(Price

Featured) |

PP = $63.79 |

G |

| MB = $66.98 |

Most Recent Note - 9/11/2009 6:01:22 PM

G - Considerable gain today on average volume helped it rally just above its 50 DMA line, helping its technical outlook. As previously noted, "a violation of its prior chart low ($54.32 on 8/18/09) would complete a bearish 'head-and-shoulders' pattern and may trigger more worrisome technical sell signals." GMCR traded up more than +168% since appearing with an annotated graph under the headline "It May Soon Be Time To Go Green" when featured in the January 2009 CANSLIM.net News (read here).

>>> The latest Featured Stock Update with an annotated graph appeared on 9/10/2009. click here.

|

|

C

A

S

I |

News |

Chart |

SEC

View all notes Alert

me of new notes

Company

Profile

|

NTES

- NASDAQ

Netease Inc Adr

INTERNET - Internet Information Providers

|

$43.46

|

-0.97

|

1,159,643

54% DAV

2,138,700

|

7/17/2009

(Date

Featured) |

$39.29

(Price

Featured) |

PP = $38.74 |

G |

| MB = $40.68 |

Most Recent Note - 9/11/2009 6:03:27 PM

G - Wedging upward toward its 52-week highs while consolidating with light volume for the past 4 weeks above support at its 50 DMA line and above prior chart highs in the $38 area. Deterioration below those levels would raise more serious concerns and triggger additional sell signals.

>>> The latest Featured Stock Update with an annotated graph appeared on 8/27/2009. click here.

|

|

C

A

S

I |

News |

Chart |

SEC

View all notes Alert

me of new notes

Company

Profile

|

NVEC

- NASDAQ

N V E Corp

ELECTRONICS - Semiconductor - Specialized

|

$61.04

|

-0.74

|

99,983

120% DAV

83,100

|

8/26/2009

(Date

Featured) |

$55.32

(Price

Featured) |

PP = $57.60 |

G |

| MB = $60.48 |

Most Recent Note - 9/11/2009 6:04:55 PM

G - Negatively reversed today after initially rising to a new 52-week high. A considerable gain on 9/10/09 with more that 2 times average volume for this high-ranked leader from the Electronics industry group helped it quickly rise beyond its "max buy" level, and its color code was changed to green. The breakout above its latest pivot point triggered a convincing new technical buy signal. Keep in mind its small supply (the S criteria) of shares outstanding which can contribute to greater than usual volatility. Be mindful of its still rather minuscule sales revenues. These concerns heighten the need for great discipline in trading (buying AND selling).

>>> The latest Featured Stock Update with an annotated graph appeared on 9/1/2009. click here.

|

|

C

A

S

I |

News |

Chart |

SEC

View all notes Alert

me of new notes

Company

Profile

|

PEGA

- NASDAQ

Pegasystems Inc

COMPUTER SOFTWARE & SERVICES - Business Software & Services

|

$30.95

|

-0.10

|

167,123

45% DAV

368,700

|

9/9/2009

(Date

Featured) |

$31.14

(Price

Featured) |

PP = $33.35 |

Y |

| MB = $35.02 |

Most Recent Note - 9/11/2009 6:07:30 PM

Y - Volume has been drying up since late August while this high-ranked Computer Software - Financial firm has been consolidating. Recent analysis suggested that it may be forming an "ascending base" pattern, and its color code was changed to yellow with new pivot point and max buy levels noted. The previously cited upward trendline connecting its July-August lows may be considered an initial technical support level above its 50 DMA line and prior chart highs. Disciplined investors will watch for a proper new technical buy signal before making initial buys or add-on buys after this 4th stage base.

>>> The latest Featured Stock Update with an annotated graph appeared on 9/9/2009. click here.

|

|

C

A

S

I |

News |

Chart |

SEC

View all notes Alert

me of new notes

Company

Profile

|

|

|

|

THESE ARE NOT BUY RECOMMENDATIONS!

Comments contained in the body of this report are technical

opinions only. The material herein has been obtained

from sources believed to be reliable and accurate, however,

its accuracy and completeness cannot be guaranteed.

This site is not an investment advisor, hence it does

not endorse or recommend any securities or other investments.

Any recommendation contained in this report may not

be suitable for all investors and it is not to be deemed

an offer or solicitation on our part with respect to

the purchase or sale of any securities. All trademarks,

service marks and trade names appearing in this report

are the property of their respective owners, and are

likewise used for identification purposes only.

This report is a service available

only to active Paid Premium Members.

You may opt-out of receiving report notifications

at any time. Questions or comments may be submitted

by writing to Premium Membership Services 665 S.E. 10 Street, Suite 201 Deerfield Beach, FL 33441-5634 or by calling 1-800-965-8307

or 954-785-1121.

|

|

|