You are not logged in.

This means you

CAN ONLY VIEW reports that were published prior to Monday, April 14, 2025.

You

MUST UPGRADE YOUR MEMBERSHIP if you want to see any current reports.

AFTER MARKET UPDATE - TUESDAY, AUGUST 4TH, 2009

Previous After Market Report Next After Market Report >>>

|

|

|

|

DOW |

+33.63 |

9,320.19 |

+0.36% |

|

Volume |

1,249,225,730 |

+3% |

|

Volume |

2,294,308,480 |

+4% |

|

NASDAQ |

+2.70 |

2,011.31 |

+0.13% |

|

Advancers |

1,853 |

59% |

|

Advancers |

1,535 |

54% |

|

S&P 500 |

+3.02 |

1,005.65 |

+0.30% |

|

Decliners |

1,164 |

37% |

|

Decliners |

1,189 |

42% |

|

Russell 2000 |

+4.96 |

570.74 |

+0.88% |

|

52 Wk Highs |

158 |

|

|

52 Wk Highs |

74 |

|

|

S&P 600 |

+2.29 |

302.80 |

+0.76% |

|

52 Wk Lows |

7 |

|

|

52 Wk Lows |

5 |

|

|

|

Major Averages Overcome Early Pressure to Close With Small Gains

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

The major averages overcame early losses to end with small gains on Tuesday while volume totals on the NYSE and Nasdaq exchange were reported slightly up from the prior session totals. Advancing issues led decliners on the NYSE by about a 3-to-2 ratio, but by a narrower 5-to-4 ratio on the Nasdaq exchange. There were 38 high-ranked companies from the CANSLIM.net Leaders List that made a new 52-week high and appeared on the CANSLIM.net BreakOuts Page, down from the 42 issues that appeared on the prior session. On both exchanges new 52-week highs still significantly outnumbered 52-week lows, and new lows were in the single digits again. The market's more favorable conditions of late (concerning the M criteria) are detailed more extensively in the new August 2009 issue of our monthly newsletter, CANSLIM.net News (read here)..

The session began in negative territory after reports that June personal income fell a larger-than-expected -1.3% and June spending made a generally in-line -0.4% increase. A better-than-expected monthly increase of +3.6% for June pending home sales provided some encouraging news. Late afternoon buying helped stocks make a strong finish.

Caterpillar Inc. (CAT +6.14%) plowed higher, leading the Dow's gainers. General Electric Co. (GE +0.73%) posted a small gain, and investors hardly noticed as the world’s biggest maker of locomotives and medical imaging equipment agreed to pay $50 million to settle U.S. regulatory claims it manipulated earnings to meet analysts’ estimates.

The US dollar traded near the weakest level against the euro this year. A private report report from ADP Employer Services is due at 8:15AM ET which economists expect will show U.S. companies eliminated fewer jobs in July, reaffirming that the end of the recession may be near. Many pundits are calling for a pullback after the market's latest sprint higher. The action in the major averages has been marked by positive breadth which still suggests that buyers remain in control.

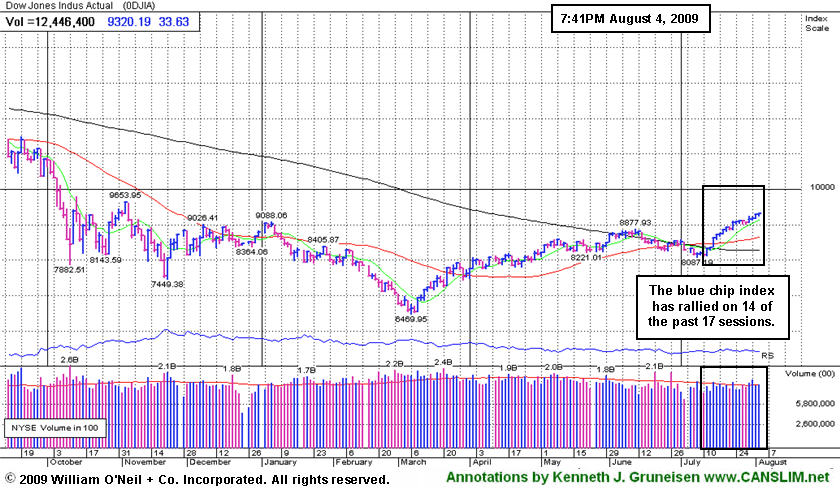

PICTURED: The Dow Jones Industrial Average has rallied on 14 of the past 17 sessions. The recent weeks show virtually no distributional pressure weighing on the market.

|

Kenneth J. Gruneisen started out as a licensed stockbroker in August 1987, a couple of months prior to the historic stock market crash that took the Dow Jones Industrial Average down -22.6% in a single day. He has published daily fact-based fundamental and technical analysis on high-ranked stocks online for two decades. Through FACTBASEDINVESTING.COM, Kenneth provides educational articles, news, market commentary, and other information regarding proven investment systems that work in good times and bad.

Kenneth J. Gruneisen started out as a licensed stockbroker in August 1987, a couple of months prior to the historic stock market crash that took the Dow Jones Industrial Average down -22.6% in a single day. He has published daily fact-based fundamental and technical analysis on high-ranked stocks online for two decades. Through FACTBASEDINVESTING.COM, Kenneth provides educational articles, news, market commentary, and other information regarding proven investment systems that work in good times and bad.

Comments contained in the body of this report are technical opinions only and are not necessarily those of Gruneisen Growth Corp. The material herein has been obtained from sources believed to be reliable and accurate, however, its accuracy and completeness cannot be guaranteed. Our firm, employees, and customers may effect transactions, including transactions contrary to any recommendation herein, or have positions in the securities mentioned herein or options with respect thereto. Any recommendation contained in this report may not be suitable for all investors and it is not to be deemed an offer or solicitation on our part with respect to the purchase or sale of any securities. |

|

|

Mixed Group Action Limits Major Averages' Headway

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

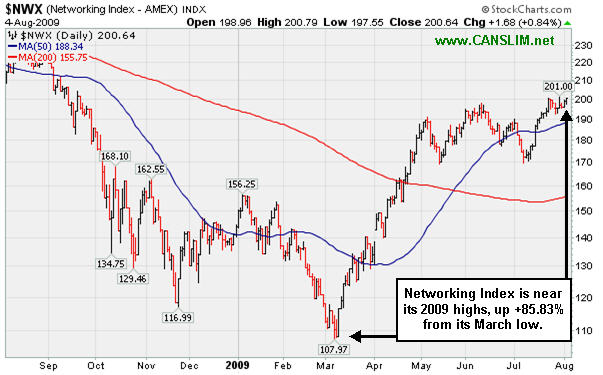

Group action was mixed on Tuesday, with modest losses for the Retail Index ($RLX -0.86%), Healthcare Index ($HMO -0.49%), and energy-related Oil Services ($OSX -1.65%) and Integrated Oil ($XOI -0.28%) indexes. Meanwhile, standout gainer were the Bank Index ($BKX +2.65%) and Biotechnology Index ($BTK +2.29%), followed by the Networking Index ($NWX +0.84%). There was little change for the other regularly followed indices in this Industry Group Watch section, with a tiny loss for the Internet Index ($IIX -0.09%) and minimal gains for the Broker/Dealer Index ($XBD +0.05%), Semiconductor Index ($SOX +0.07%), and Gold & Silver Index ($XAU +0.13%).

Charts courtesy www.stockcharts.com

PICTURED: The Networking Index ($NWX +0.84%) is near its 2009 highs, up +85.83% from its March low.

| Oil Services |

$OSX |

175.38 |

-2.95 |

-1.65% |

+44.48% |

| Healthcare |

$HMO |

1,170.89 |

-5.77 |

-0.49% |

+21.94% |

| Integrated Oil |

$XOI |

977.94 |

-2.72 |

-0.28% |

-0.18% |

| Semiconductor |

$SOX |

307.22 |

+0.20 |

+0.07% |

+44.80% |

| Networking |

$NWX |

200.64 |

+1.68 |

+0.84% |

+39.44% |

| Internet |

$IIX |

203.83 |

-0.18 |

-0.09% |

+52.37% |

| Broker/Dealer |

$XBD |

110.13 |

+0.06 |

+0.05% |

+42.16% |

| Retail |

$RLX |

357.09 |

-3.11 |

-0.86% |

+27.87% |

| Gold & Silver |

$XAU |

153.71 |

+0.20 |

+0.13% |

+24.11% |

| Bank |

$BKX |

42.60 |

+1.10 |

+2.65% |

-3.88% |

| Biotech |

$BTK |

897.56 |

+20.06 |

+2.29% |

+38.69% |

|

|

|

|

Violation Of 50-Day Moving Average Raises Concerns

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

HMS Holdings Corp (HMSY -$0.97 or -2.49% to $38.00) suffered another loss today with above average volume, closing back under its 50-day moving average (DMA) line, raising more concerns. Its 7/31/09 gap down and 50 DMA violation following its latest quarterly financial report which showed sales and earnings increases near the investment system's minimum guidelines, decelerating sequentially. This high-ranked Commercial Services - Healthcare firm's prior highs in the $38 area are an important support level. Deterioration into its prior base, or a violation of its 50 DMA line, would raise more serious concerns and trigger additional technical sell signals. It has shown healthy action since a gap up gain on 6/16/09 with heavy volume triggered a technical buy signal. The heavy volume and gap up provided a nice reassurance of institutional (the I criteria) buying demand.

A downturn in 2006 earnings is a fundamental flaw in HMS Holdings Corp's annual earnings history that raises some concerns with respect to the A criteria of the investment system. Investors' odds are usually better with a company that has a steady 3-5 year earnings growth history. That shortcoming could give investors one extra reason to be very careful about limiting losses.

|

|

|

Color Codes Explained :

Y - Better candidates highlighted by our

staff of experts.

G - Previously featured

in past reports as yellow but may no longer be buyable under the

guidelines.

***Last / Change / Volume quote data in this table corresponds with the timestamp on the note***

Symbol/Exchange

Company Name

Industry Group |

Last |

Chg. |

Vol

% DAV |

Date Featured |

Price Featured |

Latest Pivot Point

Featured |

Status |

| Latest Max Buy Price |

ASIA

-

|

$19.91

|

+0.56

|

665,059

N/A

|

8/2/2009

(Date

Featured) |

$19.27

(Price

Featured) |

PP = $22.19 |

Y |

| MB = $23.30 |

Most Recent Note - 8/4/2009 6:16:01 PM

Y - Edging higher on average volume since its its 7/30/09 gap up gain on heavy volume. It was just featured in the August, 2009 CANSLIM.net News available here

There are no Featured Stock Updates™ available for this stock at this time. You may request one by clicking here

|

|

C

A

S

I |

News |

Chart |

SEC

View all notes Alert

me of new notes

Company

Profile

|

CPLA

- NASDAQ

Capella Education Co

DIVERSIFIED SERVICES - Education and Training Services

|

$64.72

|

-0.28

|

127,939

N/A

|

7/9/2009

(Date

Featured) |

$59.69

(Price

Featured) |

PP = $62.06 |

Y |

| MB = $65.16 |

Most Recent Note - 8/4/2009 6:18:11 PM

Y - Quietly perched near its 52-week high. On 7/28/09 it reported solid results for the quarter ended June 30, 2009, with a +21% increase in sales revenues (accelerating) and +51% earnings per share, and it technically gapped up and traded more than the +50% above average volume guideline as it rose above its pivot point. Featured in yellow in the 7/09/09 Mid-Day BreakOuts Report (read here). The group has shown some leadership, yet currently has a D- and 10 for Relative Strength Rating/Ranks. CPLA is a high-ranked leader in the Commercial Services-Schools Group. Its small supply of only 13.9 million shares in the float could contribute to greater price volatility in the event of institutional accumulation or distribution. The number of top-rated funds owning an interest rose from 91 in Sept '08, to 135 as of March '09, which is reassuring with respect to the I criteria. It has a very good earnings history that satisfies the C & A criteria, while recent quarters showed steady sales revenues increases in the +17-18% range.

>>> The latest Featured Stock Update with an annotated graph appeared on 7/20/2009. click here.

|

|

C

A

S

I |

News |

Chart |

SEC

View all notes Alert

me of new notes

Company

Profile

|

GMCR

- NASDAQ

Green Mtn Coffee Roastrs

FOOD & BEVERAGE - Processed & Packaged Goods

|

$66.76

|

-0.71

|

922,543

N/A

|

7/17/2009

(Date

Featured) |

$60.15

(Price

Featured) |

PP = $63.79 |

G |

| MB = $66.98 |

Most Recent Note - 8/4/2009 6:23:06 PM

G - Quietly held its ground today after its 8/03/09 gap down today after reporting plans for an offering of 4 million shares underwritten by BofA Merrill Lynch. Prior highs in the $62-63 area are initial chart support to watch above its 50 DMA line. Do not be confused by the 3:2 stock split effective 6/09/09. GMCR traded up more than +168% since appearing with an annotated graph under the headline "It May Soon Be Time To Go Green" when featured in the January 2009 CANSLIM.net News (read here).

>>> The latest Featured Stock Update with an annotated graph appeared on 7/30/2009. click here.

|

|

C

A

S

I |

News |

Chart |

SEC

View all notes Alert

me of new notes

Company

Profile

|

HMSY

- NASDAQ

H M S Holdings Corp

COMPUTER SOFTWARE & SERVICES - Healthcare Information Service

|

$38.00

|

-0.97

|

693,046

N/A

|

2/20/2009

(Date

Featured) |

$34.08

(Price

Featured) |

PP = $38.38 |

G |

| MB = $40.30 |

Most Recent Note - 8/4/2009 6:25:24 PM

G - Loss today with above average volume, closing back under its 50 DMA line, raising more concerns. Its 7/31/09 gap down and 50 DMA violation following its latest quarterly financial report. This high-ranked Commercial Services - Healthcare firm's prior highs in the $38 area are an important support level. A gap up gain on 6/16/09 with heavy volume triggered a technical buy signal.

>>> The latest Featured Stock Update with an annotated graph appeared on 8/4/2009. click here.

|

|

C

A

S

I |

News |

Chart |

SEC

View all notes Alert

me of new notes

Company

Profile

|

NTES

- NASDAQ

Netease Inc Adr

INTERNET - Internet Information Providers

|

$45.28

|

-0.62

|

1,233,410

N/A

|

7/17/2009

(Date

Featured) |

$39.29

(Price

Featured) |

PP = $38.74 |

G |

| MB = $40.68 |

Most Recent Note - 8/4/2009 6:29:49 PM

G - Small loss today on light volume after 5 consecutive gains. Well above prior chart highs in the $38 area, an important support level to watch. A recent series of 10 consecutive gains was capped off with a considerable gain on 7/22/09 with very heavy volume that lifted it well above its max buy level. It got extended from its latest base. On 7/17/09 it broke out from a 5-week flat base with +44% above average volume behind its gain. First featured at $26.75 in the 3/31/09 CANSLIM.net Mid-Day Breakouts Report (read here). This high-ranked Chinese Internet - Content firm was also summarized in greater detail including an annotated graph in the April 2009 issue of CANSLIM.net News (read here).

>>> The latest Featured Stock Update with an annotated graph appeared on 7/23/2009. click here.

|

|

C

A

S

I |

News |

Chart |

SEC

View all notes Alert

me of new notes

Company

Profile

|

NVEC

- NASDAQ

N V E Corp

ELECTRONICS - Semiconductor - Specialized

|

$56.25

|

+0.80

|

88,278

N/A

|

3/13/2009

(Date

Featured) |

$33.85

(Price

Featured) |

PP = $49.60 |

G |

| MB = $52.08 |

Most Recent Note - 8/4/2009 6:31:04 PM

G -Consolidating in a tight range since its 7/23/09 breakout. Patience may allow for shares to be accumulated on pullbacks, and prior highs are now an important support level. Featured in the 7/23/09 Mid-Day BreakOuts Report (read here) after it gapped up for a considerable gain on heavy volume following news of stronger sales revenues (+41%) and solid earnings increases for the quarter ended June 30, 2009. The technical action was described as a "breakaway gap" from a valid ascending base. Quarterly sales revenues in the 6 million dollar range are still rather minuscule, leaving concerns.

>>> The latest Featured Stock Update with an annotated graph appeared on 8/3/2009. click here.

|

|

C

A

S

I |

News |

Chart |

SEC

View all notes Alert

me of new notes

Company

Profile

|

PEGA

- NASDAQ

Pegasystems Inc

COMPUTER SOFTWARE & SERVICES - Business Software & Services

|

$29.29

|

+0.14

|

429,695

N/A

|

7/29/2009

(Date

Featured) |

$27.53

(Price

Featured) |

PP = $27.49 |

G |

| MB = $28.86 |

Most Recent Note - 8/4/2009 6:41:53 PM

G - Posted another gain today with above average volume, then reported strong Q2 earnings after the close with raised guidance. Featured in in the 7/29/09 mid-day report (read here) during the course of its considerable gain on heavy volume 3 times its average for a new 52-week high. There were no news headlines to be found as this software firm triggered a technical buy signal by breaking out from a third stage, 8-week "double bottom" type base. The previously noted downturn in annual earnings (the A criteria) from 2003 to 2006 has been followed by a solid turn around and big earnings increases in '07 and '08, and Street expectations for '09 are calling for well above +25% growth.

>>> The latest Featured Stock Update with an annotated graph appeared on 7/29/2009. click here.

|

|

C

A

S

I |

News |

Chart |

SEC

View all notes Alert

me of new notes

Company

Profile

|

TNDM

- NASDAQ

Tandem Diabetes Care Inc

TELECOMMUNICATIONS - Wireless Communications

|

$32.91

|

-0.33

|

734,277

N/A

|

3/2/2009

(Date

Featured) |

$18.89

(Price

Featured) |

PP = $32.67 |

Y |

| MB = $34.30 |

Most Recent Note - 8/4/2009 6:43:49 PM

Y - Held its ground today after a gap up on 8/03/09 for a considerable gain on above average volume and a new all-time high. It is due to report earnings before Thursday's opening bell. A recent newspaper article suggested its June 29th high ($31.49) was "an adequate buy point." It rallied above that prior peak from a 5-week flat base. More significantly, it has also cleared its resistance level at its June 2nd high of $32.57. Color code is changed to yellow with new pivot point cited based upon its 52-week high plus ten cents. Subsequent deterioration below its 50 DMA average and recent lows would raise concerns and trigger sell signals. It traded up as much as +82.95% since first featured at $18.89 in the 3/02/09 Mid-Day BreakOuts Report (read here).

>>> The latest Featured Stock Update with an annotated graph appeared on 7/21/2009. click here.

|

|

C

A

S

I |

News |

Chart |

SEC

View all notes Alert

me of new notes

Company

Profile

|

UTA

-

|

$16.83

|

+1.98

|

909,908

N/A

|

7/28/2009

(Date

Featured) |

$12.87

(Price

Featured) |

PP = $12.70 |

G |

| MB = $13.34 |

Most Recent Note - 8/4/2009 6:47:18 PM

G - Hit another new 52-week high today with a 4th consecutive gain with above average volume, getting very extended above its "max buy" level. Prior chart highs in the $12 area are now an important support level to watch on pullbacks. Strong action prompted it to be featured in yellow with pivot point and max buy levels noted in the 7/28/09 mid-day breakouts report (read here), with additional analysis included in the after market update (read here). This Chinese provider of airline tickets and travel related services gapped up on 7/28/09, rising from a choppy 6-week base with a considerable gain on very heavy volume.

>>> The latest Featured Stock Update with an annotated graph appeared on 7/28/2009. click here.

|

|

C

A

S

I |

News |

Chart |

SEC

View all notes Alert

me of new notes

Company

Profile

|

|

|

|

THESE ARE NOT BUY RECOMMENDATIONS!

Comments contained in the body of this report are technical

opinions only. The material herein has been obtained

from sources believed to be reliable and accurate, however,

its accuracy and completeness cannot be guaranteed.

This site is not an investment advisor, hence it does

not endorse or recommend any securities or other investments.

Any recommendation contained in this report may not

be suitable for all investors and it is not to be deemed

an offer or solicitation on our part with respect to

the purchase or sale of any securities. All trademarks,

service marks and trade names appearing in this report

are the property of their respective owners, and are

likewise used for identification purposes only.

This report is a service available

only to active Paid Premium Members.

You may opt-out of receiving report notifications

at any time. Questions or comments may be submitted

by writing to Premium Membership Services 665 S.E. 10 Street, Suite 201 Deerfield Beach, FL 33441-5634 or by calling 1-800-965-8307

or 954-785-1121.

|

|

|