You are not logged in.

This means you

CAN ONLY VIEW reports that were published prior to Monday, April 14, 2025.

You

MUST UPGRADE YOUR MEMBERSHIP if you want to see any current reports.

AFTER MARKET UPDATE - TUESDAY, JUNE 15TH, 2010

Previous After Market Report Next After Market Report >>>

|

|

|

|

DOW |

+213.88 |

10,404.77 |

+2.10% |

|

Volume |

1,165,245,390 |

+2% |

|

Volume |

2,185,258,340 |

+18% |

|

NASDAQ |

+61.92 |

2,305.88 |

+2.76% |

|

Advancers |

2,626 |

83% |

|

Advancers |

2,162 |

77% |

|

S&P 500 |

+25.60 |

1,115.23 |

+2.35% |

|

Decliners |

458 |

14% |

|

Decliners |

543 |

19% |

|

Russell 2000 |

+16.50 |

668.77 |

+2.53% |

|

52 Wk Highs |

64 |

|

|

52 Wk Highs |

46 |

|

|

S&P 600 |

+8.15 |

356.64 |

+2.34% |

|

52 Wk Lows |

4 |

|

|

52 Wk Lows |

29 |

|

|

|

Follow Through Gains Confirm A New Rally That May Have Legs

Adam Sarhan, Contributing Writer,

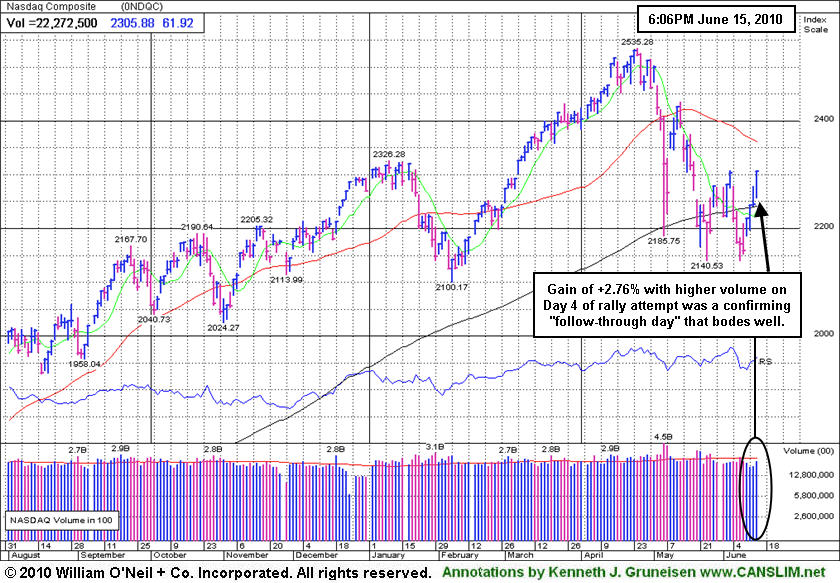

The current rally was confirmed after the tech-heavy Nasdaq Composite and other major averages scored significant gains and produced a follow-through day (FTD) on Tuesday. Volume totals were reported slightly higher on the Nasdaq and on the NYSE. Breadth was very positive as advancers led decliners by almost a 6-to-1 ratio on the NYSE and nearly a 5-to-1 ratio on the Nasdaq exchange. There were 37 high-ranked companies from the CANSLIM.net Leaders List that made a new 52-week high and appeared on the CANSLIM.net BreakOuts Page, higher than the 31 issues that appeared on the prior session. New 52-week highs outnumbered new 52-week lows on the NYSE and on the Nasdaq exchange.

The MSCI World Index advanced for a sixth consecutive day as the greenback continued its 6-day slide after a New York manufacturing report suggested the global economy remains strong. The Federal Reserve Bank of New York’s general economic index, which measures economic activity in the NY area, rose for an 11th consecutive month which helped offset European Debt woes. The weaker dollar helped a slew of dollar denominated assets rally. Elsewhere, oil jumped above $76 a barrel and the euro rose above $1.23.

The Nasdaq Composite Index confirmed its latest rally attempt and produced a sound FTD which means the window is now open for disciplined investors to begin carefully buying high-ranked stocks again. Technically, it was encouraging to also see the Dow Jones Industrial Average and the benchmark S&P 500 Index rally for solid gains of more than +2% and close above their respective 200-day moving average (DMA) lines. The volume on the NYSE was reported higher than the prior session, which allowed the Dow and S&P 500 to also score a proper FTD.

The S&P 500 is down -8.6% from its April 26, 2010 high of 1,219 and managed to rise above resistance (200 DMA line) of its latest trading range. Looking forward, the 200 DMA line should now act as support as this market continues advancing, while any reversal would be a worrisome sign. Remember to remain very selective because all of the major averages are still trading below their downward sloping 50 DMA lines. It was somewhat disconcerting to see volume remain light (below average) behind the confirming gains. It is important to note that approximately 75% of FTDs lead to new sustained rallies, while 25% fail. In addition, every major rally in market history has begun with a FTD, but not every FTD leads to a new rally. Trade accordingly.

Are You Ready For This NEW Confirmed Rally?

Inquire Today About Our Professional Money Management Services:

If your portfolio is greater than $100,000 and you would like a free portfolio review, click here to get connected with one of our portfolio managers. ** Serious inquires only, please.

PICTURED: The Nasdaq Composite Index's gain of +2.76% with higher volume on Day 4 of its rally attempt was a confirming "follow-through day" that bodes well.

|

|

|

|

Tech and Commodity-Linked Groups Posted Best Gains

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

The tech sector and commodity-linked groups helped spearhead Tuesday's solid gains for the major averages. The Semiconductor Index ($SOX +5.54%) was a standout gainer, followed by the Networking Index ($NWX +3.45%), Internet Index ($IIX +2.60%), and Biotechnology Index ($BTK +2.24%). Energy-related shares rose and gave the Oil Services Index ($OSX +4.72%) and Integrated Oil Index ($XOI +2.96%) a boost, and the Gold & Silver Index ($XAU +2.49%) rallied.

Financial shares posted smaller gains as the Broker/Dealer Index ($XBD +1.88%) and Bank Index ($BKX +2.72%) helped to underpin the major averages' rally attempt. The Retail Index ($RLX +1.27%) and Healthcare Index ($HMO +1.52%) also posted modest gains on the widely positive session.

Charts courtesy www.stockcharts.com

PICTURED: The Semiconductor Index ($SOX +5.54%) posted a considerable gain that lifted it above its 50-day moving average line.

| Oil Services |

$OSX |

179.69 |

+8.10 |

+4.72% |

-7.81% |

| Healthcare |

$HMO |

1,532.73 |

+23.01 |

+1.52% |

+4.06% |

| Integrated Oil |

$XOI |

968.47 |

+27.87 |

+2.96% |

-9.34% |

| Semiconductor |

$SOX |

371.47 |

+19.50 |

+5.54% |

+3.21% |

| Networking |

$NWX |

239.88 |

+8.00 |

+3.45% |

+3.82% |

| Internet |

$IIX |

243.94 |

+6.18 |

+2.60% |

+4.31% |

| Broker/Dealer |

$XBD |

107.43 |

+1.98 |

+1.88% |

-6.62% |

| Retail |

$RLX |

441.69 |

+5.53 |

+1.27% |

+7.44% |

| Gold & Silver |

$XAU |

176.95 |

+4.30 |

+2.49% |

+5.17% |

| Bank |

$BKX |

49.87 |

+1.32 |

+2.72% |

+16.76% |

| Biotech |

$BTK |

1,094.78 |

+24.03 |

+2.24% |

+16.20% |

|

|

|

|

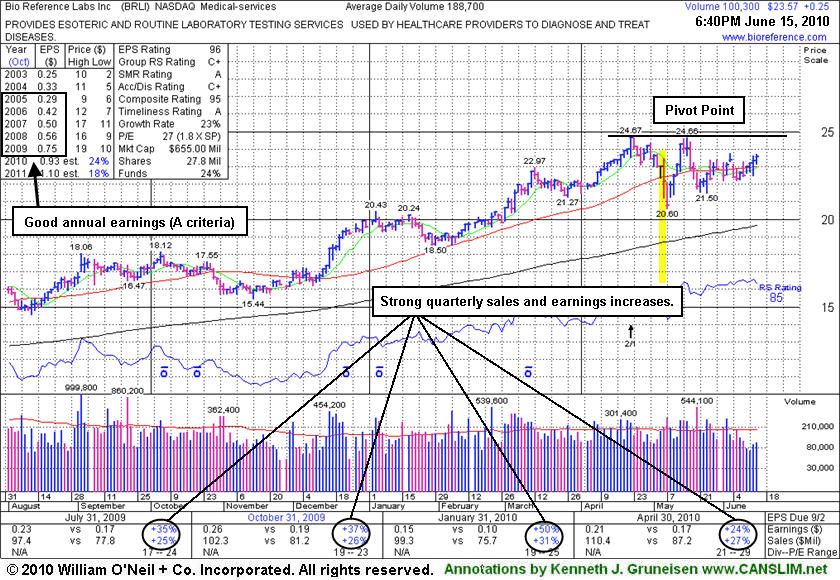

Consolidation Could Eventually Lead To New Breakout

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

Bio-Reference Laboratories, Inc. (BRLI +$0.25 or +1.07% to $23.57) today marked its 4th consecutive gain on light volume, consolidating above its 50-day moving average (DMA) line. It has been basing for about 8 weeks since a 2:1 stock split effective on 4/22/10. A new pivot point based on its all-time high plus ten cents is being noted. Subsequent gains above that level with at least +50% above average volume could trigger a new technical buy signal.

BRLI gapped up on 5/10/10 and promptly rallied back above its 3/26/10 low. It was noted that during the wild 5/06/10 trading session it reportedly traded down considerably intra-day, undercutting its 200 DMA line and revisiting its November 2009 lows, yet it rebounded to close near its 50 DMA line and in the upper part of its range. In the May 11, 2010 FSU section under the headline "50-Day Moving Average Violation Triggered Recent Sell Signal" we observed - "Apparently some low trades must have been taken off the tape, as the chart now reads differently for that date. More time is needed to see if a proper new base may form, and to also see if the major averages (M criteria) will confirm their new rally attempt with a powerful follow-through-day." Soon afterward, one of our valued members wrote in, and the ongoing exchange since has been summarized in the "Ken's Mailbag" section tonight. While we continue to do our utmost in fact-based reporting, the fact that other charting services continue reporting the questioned data differently should not be overlooked. Still, the following links to charts on Nasdaq.com and Stockcharts.com and BigCharts.com each show lows on May 6th far below $16.00 which is NOT SHOWN on the graph below.

Earnings growth and sales revenues growth has accelerated, with increases better than the +25% minimum guideline in recent quarters. Fundamentals are favorable with respect to the C and A criteria of the investment system. Since splitting its shares 2:1 on 4/22/10 BRLI now has 27.7 million shares outstanding (S criteria). The number of top-rated funds owning its shares rose from 77 in Mar '09 to 87 in Mar '10 which is somewhat reassuring in regard to the I criteria of the investment system.

|

|

|

Color Codes Explained :

Y - Better candidates highlighted by our

staff of experts.

G - Previously featured

in past reports as yellow but may no longer be buyable under the

guidelines.

***Last / Change / Volume data in this table is the closing quote data***

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

APEI

-

NASDAQ

American Public Educ Inc

DIVERSIFIED SERVICES - Education and Training Services

|

$46.28

|

-0.34

-0.73% |

$46.46

|

253,563

160.38% of 50 DAV

50 DAV is 158,100

|

$48.26

-4.10%

|

6/7/2010

|

$46.60

|

PP = $46.29

|

|

MB = $48.60

|

Most Recent Note - 6/15/2010 4:40:42 PM

Most Recent Note - 6/15/2010 4:40:42 PM

Y - Gapped down and slumped near its 50 DMA line today, yet it proved resilient and rebounded to close near the session high. Its 6/07/10 gain and close above its pivot point with above average volume triggered a technical buy signal.

>>> The latest Featured Stock Update with an annotated graph appeared on 6/14/2010. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

BIDU

-

NASDAQ

Baidu Inc Ads

INTERNET - Internet Information Providers

|

$75.37

|

+2.44

3.35% |

$75.40

|

8,250,711

54.40% of 50 DAV

50 DAV is 15,167,900

|

$82.29

-8.41%

|

1/13/2010

|

$43.13

|

PP = $42.68

|

|

MB = $44.81

|

Most Recent Note - 6/15/2010 4:43:32 PM

Most Recent Note - 6/15/2010 4:43:32 PM

G - Quietly wedging up from support at its 50 DMA line, consolidating within -10% of its 52-week high. A worrisome negative reversal from its all-time high on 5/13/10 followed a 10:1 stock split.

>>> The latest Featured Stock Update with an annotated graph appeared on 6/1/2010. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

BRLI

-

NASDAQ

Bio Reference Labs Inc

HEALTH SERVICES - Medical Laboratories and Researc

|

$23.57

|

+0.25

1.07% |

$23.70

|

104,548

55.35% of 50 DAV

50 DAV is 188,900

|

$24.67

-4.47%

|

2/12/2010

|

$39.02

|

PP = $20.49

|

|

MB = $21.51

|

Most Recent Note - 6/15/2010 4:46:41 PM

Most Recent Note - 6/15/2010 4:46:41 PM

G - Today marked its 4th consecutive gain on light volume, consolidating above its 50 DMA line. Basing for about 8 weeks since a 2:1 stock split effective on 4/22/10.

>>> The latest Featured Stock Update with an annotated graph appeared on 5/26/2010. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

CRM

-

NYSE

Salesforce.Com Inc

INTERNET - Internet Software and Services

|

$95.01

|

+1.51

1.61% |

$95.62

|

3,272,038

130.07% of 50 DAV

50 DAV is 2,515,600

|

$96.87

-1.92%

|

6/2/2010

|

$88.44

|

PP = $89.60

|

|

MB = $94.08

|

Most Recent Note - 6/15/2010 4:48:10 PM

Most Recent Note - 6/15/2010 4:48:10 PM

G - It is slightly extended from its latest base. Prior highs in the $89 area are an important support level to watch above its 50 DMA line.

>>> The latest Featured Stock Update with an annotated graph appeared on 6/2/2010. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

DECK

-

NASDAQ

Deckers Outdoor Corp

CONSUMER NON-DURABLES - Textile - Apparel Footwear

|

$164.02

|

+3.44

2.14% |

$164.61

|

658,033

131.74% of 50 DAV

50 DAV is 499,500

|

$160.00

2.51%

|

6/11/2010

|

$157.34

|

PP = $158.57

|

|

MB = $166.50

|

Most Recent Note - 6/15/2010 4:52:29 PM

Most Recent Note - 6/15/2010 4:52:29 PM

Y - Hit another new 52-week high today with its 4th consecutive gain backed by above average volume.

>>> The latest Featured Stock Update with an annotated graph appeared on 6/11/2010. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

MELI

-

NASDAQ

Mercadolibre Inc

INTERNET - Internet Software and; Services

|

$60.23

|

+2.39

4.13% |

$60.97

|

1,124,461

154.44% of 50 DAV

50 DAV is 728,100

|

$58.81

2.41%

|

5/13/2010

|

$54.21

|

PP = $55.85

|

|

MB = $58.64

|

Most Recent Note - 6/15/2010 4:57:44 PM

Most Recent Note - 6/15/2010 4:57:44 PM

G - Hit another new 52-week high today with its 6th consecutive gain, getting extended and rising further above its "max buy" level. Prior chart highs in the $55 area may now act as an initial support level on pullbacks.

>>> The latest Featured Stock Update with an annotated graph appeared on 6/10/2010. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

ROVI

-

NASDAQ

Rovi Corp

COMPUTER SOFTWARE andamp; SERVICES - Security Software andamp; Services

|

$38.50

|

+1.29

3.47% |

$38.60

|

616,987

46.40% of 50 DAV

50 DAV is 1,329,600

|

$40.06

-3.89%

|

6/3/2010

|

$38.70

|

PP = $40.16

|

|

MB = $42.17

|

Most Recent Note - 6/15/2010 4:59:04 PM

Most Recent Note - 6/15/2010 4:59:04 PM

G - Consolidating back above its 50 DMA line with a light volume gain today. Recently found support near prior lows in the $35 area, and stayed above its October 2009 chart high.

>>> The latest Featured Stock Update with an annotated graph appeared on 6/9/2010. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

SUMR

-

NASDAQ

Summer Infant Inc

CONSUMER NON-DURABLES - Personal Products

|

$6.82

|

+0.01

0.15% |

$6.82

|

49,547

63.04% of 50 DAV

50 DAV is 78,600

|

$8.42

-19.00%

|

5/4/2010

|

$6.85

|

PP = $7.09

|

|

MB = $7.44

|

Most Recent Note - 6/15/2010 5:02:40 PM

Most Recent Note - 6/15/2010 5:02:40 PM

G - Quietly holding its ground with a 3rd consecutive gain today on light volume. Recent chart lows in the $6.25 area are important support to watch now, while a subsequent rally back above its 50 DMA would help its outlook.

>>> The latest Featured Stock Update with an annotated graph appeared on 6/8/2010. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

THOR

-

NASDAQ

Thoratec Corp

HEALTH SERVICES - Medical Instruments and Supplies

|

$44.79

|

+0.75

1.70% |

$44.93

|

732,476

80.09% of 50 DAV

50 DAV is 914,600

|

$46.50

-3.68%

|

6/3/2010

|

$44.38

|

PP = $45.35

|

|

MB = $47.62

|

Most Recent Note - 6/15/2010 5:03:43 PM

Most Recent Note - 6/15/2010 5:03:43 PM

Y - Gain today on light volume, finishing -3.7% off its 52 week high. Virtually no resistance remains due to overhead supply.

>>> The latest Featured Stock Update with an annotated graph appeared on 6/3/2010. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

ULTA

-

NASDAQ

Ulta Salon Cosm & Frag

SPECIALTY RETAIL - Specialty Retail, Other

|

$25.12

|

+0.59

2.41% |

$25.37

|

889,210

160.45% of 50 DAV

50 DAV is 554,200

|

$26.00

-3.38%

|

5/28/2010

|

$25.58

|

PP = $25.86

|

|

MB = $27.15

|

Most Recent Note - 6/15/2010 12:31:52 PM

Most Recent Note - 6/15/2010 12:31:52 PM

Y - Hovering within close striking distance of its 52-week high today. Recently completed a Secondary Offering which may hinder upward price progress for the near-term.

>>> The latest Featured Stock Update with an annotated graph appeared on 6/7/2010. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

|

|

|

THESE ARE NOT BUY RECOMMENDATIONS!

Comments contained in the body of this report are technical

opinions only. The material herein has been obtained

from sources believed to be reliable and accurate, however,

its accuracy and completeness cannot be guaranteed.

This site is not an investment advisor, hence it does

not endorse or recommend any securities or other investments.

Any recommendation contained in this report may not

be suitable for all investors and it is not to be deemed

an offer or solicitation on our part with respect to

the purchase or sale of any securities. All trademarks,

service marks and trade names appearing in this report

are the property of their respective owners, and are

likewise used for identification purposes only.

This report is a service available

only to active Paid Premium Members.

You may opt-out of receiving report notifications

at any time. Questions or comments may be submitted

by writing to Premium Membership Services 665 S.E. 10 Street, Suite 201 Deerfield Beach, FL 33441-5634 or by calling 1-800-965-8307

or 954-785-1121.

|

|

|