You are not logged in.

This means you

CAN ONLY VIEW reports that were published prior to Monday, April 14, 2025.

You

MUST UPGRADE YOUR MEMBERSHIP if you want to see any current reports.

AFTER MARKET UPDATE - TUESDAY, MAY 29TH, 2012

Previous After Market Report Next After Market Report >>>

|

|

|

|

DOW |

+125.86 |

12,580.69 |

+1.01% |

|

Volume |

714,340,990 |

+20% |

|

Volume |

1,599,585,570 |

+28% |

|

NASDAQ |

+33.46 |

2,870.99 |

+1.18% |

|

Advancers |

2,421 |

77% |

|

Advancers |

1,753 |

66% |

|

S&P 500 |

+14.60 |

1,332.42 |

+1.11% |

|

Decliners |

635 |

20% |

|

Decliners |

758 |

29% |

|

Russell 2000 |

+10.75 |

777.16 |

+1.40% |

|

52 Wk Highs |

62 |

|

|

52 Wk Highs |

26 |

|

|

S&P 600 |

+5.85 |

436.80 |

+1.36% |

|

52 Wk Lows |

30 |

|

|

52 Wk Lows |

45 |

|

|

|

Major Indices Tallied Gains With Better Volume

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

Tuesday's session brought unanimous gains for the Dow Jones Industrial Average, S&P 500 Index, and the Nasdaq Composite Index, however the gains on "Day 6" were not large enough to qualify as the convincing confirming gains disciplined fact-based investors might consider a proper follow-through day. Volume totals were reported higher on the Nasdaq exchange and on the NYSE versus the prior session's totals as traders returned from the long Memorial Day weekend. Breadth was positive as advancers led decliners by more than 3-1 on the NYSE and by more than 2-1 on the Nasdaq exchange. New 52-week highs outnumbered new 52-week lows on the NYSE, but new lows still easily held the lead on the Nasdaq exchange. There were 25 high-ranked companies from the CANSLIM.net Leaders List that made new 52-week highs and appeared on the CANSLIM.net BreakOuts Page, more than doubling the prior session total of 11 stocks. Investors watching for a follow-through day in the days and weeks ahead should be aware that an expansion in the number of stocks hitting new 52-week highs is an important component to any new confirmed rally. There were gains for 13 of the 20 high-ranked companies currently included on the Featured Stocks Page.

Stocks gained after recent polls showed Greek voters increased support for the parties in favor of austerity measures ahead of the June 17 election. Investors were also encouraged by Europe's central bank saying its primary goal is to keep Greece in the euro. Meanwhile in the U.S., new housing data offset an unexpected decline in consumer confidence. The Case/Shiller report showed home prices fell by the slowest pace in over a year. Consumer confidence fell to 64.9 in May from a revised 68.7 last month.

Material stocks helped lead stocks higher as Peabody Energy (BTU +5.61%) rose after receiving an analyst upgrade. Chesapeake Energy Corp (CHK +3.42%) added more to its recent spurt of gains after activist investor Carl Icahn disclosed a 7.6% stake in the company. Tech was seeing green with Apple Inc (AAPL +1.77%) up on reports of a trial production run of the company's TV sets. Cyclical stocks also led the market higher with Caterpillar Inc (CAT +2.87%) and Alcoa Inc (AA +3.01%) rising. Facebook Inc (FB -9.36%) sat out the rally, extending its loss to over -20% since going public on May 17. Vertex Pharmaceuticals (VRTX -10.87%) tumbled after results of a recent study were revised to show less of a benefit.

European markets rallied into the close. The FTSE finished up +0.7% in London and the DAX rose +1.2% in Germany. The 10-year note closed down 5/32 to yield 1.75%.

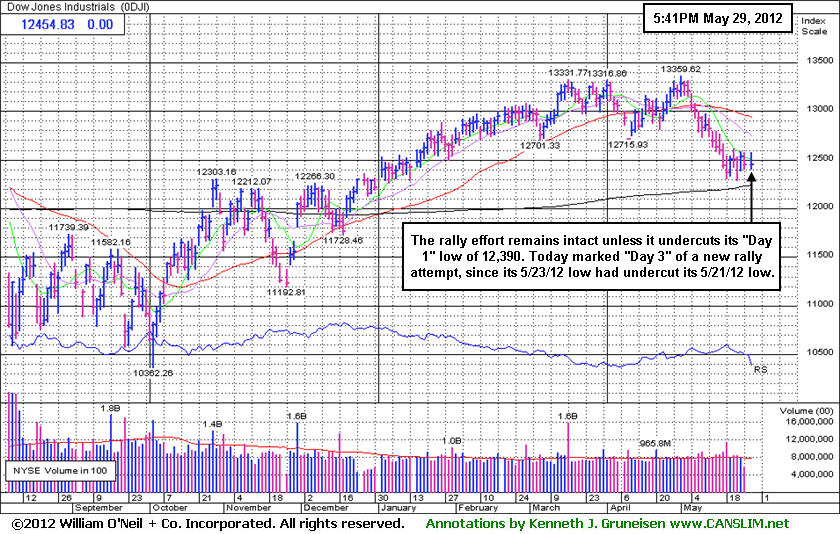

Tuesday marked "Day 6" of a new rally effort that remains intact for the Nasdaq Composite Index provided that its Day 1 low (2,774.76) is not undercut. The S&P 500 Index, the benchmark index, held its ground after dipping at Wednesday's intra-day low to within 1 point of its 5/21/12 low (1,295.73).

Historical studies suggest that the most constructive market rallies produced a solid follow-through day (FTD) between Days 4-7 of a new rally effort. The window is open for a new confirmed rally to present itself, and such technical proof may give fact-based investors the clearance to begin with new buying efforts only in sound candidates. Meanwhile, investors should keep up a watchlist of worthy buy candidates while remaining protective of capital. The major averages (M criteria) are technically still considered to be in a "correction" and stocks remain vulnerable to much greater downside. Ideally, a follow-through day (FTD) between Day 4-7 of additional confirming gains of +1.4% or greater by either the Nasdaq Composite Index or the S&P 500 Index, backed by higher volume, and coupled with an expansion in the number of stocks hitting new highs, would "confirm" a new rally.

PICTURED: The Dow Jones Industrial Average's rally effort remains intact unless it undercuts its "Day 1" low of 12,390. Tuesday marked "Day 3" of the Dow's new rally attempt, since its 5/23/12 low had undercut its 5/21/12 low.

|

Kenneth J. Gruneisen started out as a licensed stockbroker in August 1987, a couple of months prior to the historic stock market crash that took the Dow Jones Industrial Average down -22.6% in a single day. He has published daily fact-based fundamental and technical analysis on high-ranked stocks online for two decades. Through FACTBASEDINVESTING.COM, Kenneth provides educational articles, news, market commentary, and other information regarding proven investment systems that work in good times and bad.

Kenneth J. Gruneisen started out as a licensed stockbroker in August 1987, a couple of months prior to the historic stock market crash that took the Dow Jones Industrial Average down -22.6% in a single day. He has published daily fact-based fundamental and technical analysis on high-ranked stocks online for two decades. Through FACTBASEDINVESTING.COM, Kenneth provides educational articles, news, market commentary, and other information regarding proven investment systems that work in good times and bad.

Comments contained in the body of this report are technical opinions only and are not necessarily those of Gruneisen Growth Corp. The material herein has been obtained from sources believed to be reliable and accurate, however, its accuracy and completeness cannot be guaranteed. Our firm, employees, and customers may effect transactions, including transactions contrary to any recommendation herein, or have positions in the securities mentioned herein or options with respect thereto. Any recommendation contained in this report may not be suitable for all investors and it is not to be deemed an offer or solicitation on our part with respect to the purchase or sale of any securities. |

|

|

Financial, Tech, Energy, and Retail Indexes Posted Gains

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

The Bank Index ($BKX +1.45%) and the Broker/Dealer Index ($XBD +2.08%) tallied gains and had a positive influence on the major averages on Tuesday. The Networking Index ($NWX +2.59%) and Semiconductor Index ($SOX +2.03%) led he tech sector higher, followed by the Internet Index ($IIX +1.17%), but the Biotechnology Index ($BTK -0.48%) lagged. The Retail Index ($RLX +1.04%) also posted a modest gain, and strength in energy-related issues gave the Oil Services Index ($OSX +2.04%) and Integrated Oil Index ($XOI +1.00%) a boost. The Healthcare Index ($HMO +0.57%) edged higher, but the Gold & Silver Index ($XAU -1.37%) lost ground, making it a standout laggard.

Charts courtesy www.stockcharts.com

PICTURED: The Semiconductor Index ($SOX +2.03%) fell as much as -18.3% from its March '12 high while undercutting its 50-day and 200-day moving average (DMA) lines.

| Oil Services |

$OSX |

212.47 |

+4.24 |

+2.04% |

-1.76% |

| Healthcare |

$HMO |

2,338.25 |

+13.17 |

+0.57% |

+2.48% |

| Integrated Oil |

$XOI |

1,130.81 |

+11.22 |

+1.00% |

-8.00% |

| Semiconductor |

$SOX |

379.66 |

+7.55 |

+2.03% |

+4.18% |

| Networking |

$NWX |

211.21 |

+5.32 |

+2.59% |

-1.83% |

| Internet |

$IIX |

300.00 |

+3.48 |

+1.17% |

+6.48% |

| Broker/Dealer |

$XBD |

87.78 |

+1.78 |

+2.08% |

+5.42% |

| Retail |

$RLX |

613.45 |

+6.32 |

+1.04% |

+17.25% |

| Gold & Silver |

$XAU |

155.66 |

-2.17 |

-1.37% |

-13.83% |

| Bank |

$BKX |

44.72 |

+0.64 |

+1.45% |

+13.56% |

| Biotech |

$BTK |

1,460.94 |

-7.03 |

-0.48% |

+33.86% |

|

|

|

|

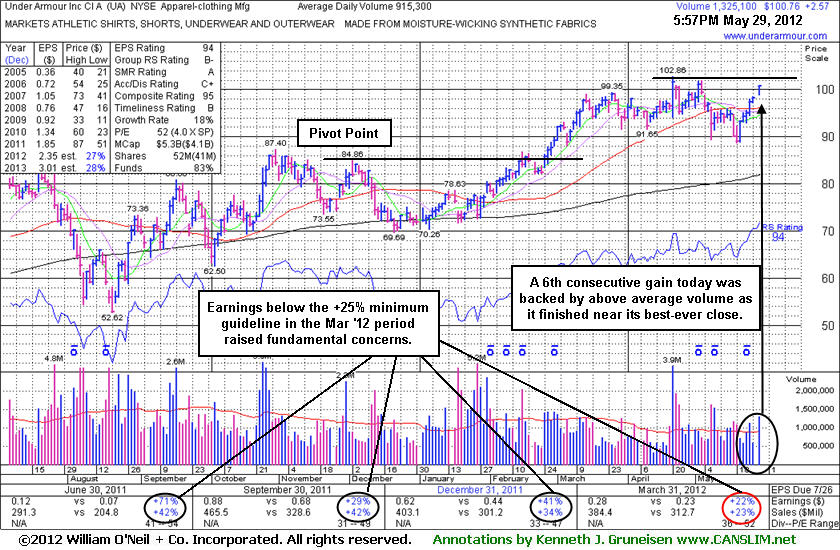

Apparel Firm Raised Fundamental Concerns With Sub Par Quarter

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

Under Armour Inc (UA +$2.57 or +2.62% to $100.76) posted a 6th consecutive gain today, and its gain was backed by above average volume as it finished near its best-ever close. Concerns were recently raised by weaker fundamentals in the Mar '12 period, its first quarterly earnings increase below the +25% minimum guideline in more than 2 years. Otherwise, a new pivot point might be cited based on its recent resilience and while now approaching its 52-week high.

It was last shown in this FSU section on 4/04/12 with an annotated graph under the headline, "Encountering Distributional Pressure While Building New Base". Subsequent volume-driven gains into new high territory would be a very reassuring sign of fresh institutional buying demand that could lead to another meaningful and sustained advance. However, its latest earnings comparison being sub par fundamentally makes it a less ideal candidate for disciplined investors to have on their watchlist, even though it is now perched only -2% off its all-time high. The high-ranked Apparel - Clothing Manufacturing firm has seen the number of top-rated funds owning its shares rise from 379 in Jun '11 to 454 in Mar '12, a reassuring trend concerning the I criteria.

|

|

|

Color Codes Explained :

Y - Better candidates highlighted by our

staff of experts.

G - Previously featured

in past reports as yellow but may no longer be buyable under the

guidelines.

***Last / Change / Volume data in this table is the closing quote data***

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

ACN

-

NYSE

Accenture Plc

DIVERSIFIED SERVICES - Business/Management Services

|

$58.41

|

+0.97

1.69% |

$58.76

|

4,218,216

112.19% of 50 DAV

50 DAV is 3,760,000

|

$65.89

-11.35%

|

3/23/2012

|

$64.13

|

PP = $63.76

|

|

MB = $66.95

|

Most Recent Note - 5/29/2012 4:00:32 PM

Most Recent Note - 5/29/2012 4:00:32 PM

G - Consolidating just above support at its longer-term 200 DMA line. Triggered technical sell signals with its recent losses undercutting prior highs in the $62-63 area and violating its 50 DMA line.

>>> The latest Featured Stock Update with an annotated graph appeared on 5/22/2012. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

ALXN

-

NASDAQ

Alexion Pharmaceuticals

DRUGS - Drug Manufacturers - Other

|

$92.07

|

-0.35

-0.38% |

$92.98

|

2,642,383

137.15% of 50 DAV

50 DAV is 1,926,700

|

$95.01

-3.09%

|

5/1/2012

|

$91.73

|

PP = $95.11

|

|

MB = $99.87

|

Most Recent Note - 5/29/2012 4:31:49 PM

Most Recent Note - 5/29/2012 4:31:49 PM

Y - Completed a new Public Offering on 5/25/12 and it is consolidating above its 50 DMA line. Volume-driven gains to new highs may trigger a technical buy signal. Faces little resistance in the $94-95 area.

>>> The latest Featured Stock Update with an annotated graph appeared on 4/16/2012. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

ARBA

-

NASDAQ

Accenture Plc

INTERNET - Internet Software and Services

|

$44.98

|

-0.24

-0.53% |

$45.15

|

5,535,738

147.23% of 50 DAV

50 DAV is 3,760,000

|

$45.48

-1.10%

|

4/27/2012

|

$38.53

|

PP = $37.24

|

|

MB = $39.10

|

Most Recent Note - 5/29/2012 4:33:06 PM

Most Recent Note - 5/29/2012 4:33:06 PM

G - Still holding its ground since tallying a considerable gain on 5/22/12 with heavy volume on news it will be bought by SAP in a $4.3 billion deal. The stock quickly got extended from its prior base after a quiet consolidation above chart support at its 50 DMA line and prior highs.

>>> The latest Featured Stock Update with an annotated graph appeared on 4/30/2012. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

CERN

-

NASDAQ

Cerner Corp

COMPUTER SOFTWARE and SERVICES - Healthcare Information Service

|

$79.68

|

+0.67

0.85% |

$81.14

|

969,851

80.96% of 50 DAV

50 DAV is 1,198,000

|

$84.10

-5.26%

|

4/27/2012

|

$77.23

|

PP = $78.63

|

|

MB = $82.56

|

Most Recent Note - 5/29/2012 4:35:13 PM

Most Recent Note - 5/29/2012 4:35:13 PM

Y - Found prompt support near its 50 DMA line after a prior loss negated its recent technical breakout. Volume totals have been cooling while hovering within close striking distance of its 52-week high.

>>> The latest Featured Stock Update with an annotated graph appeared on 5/1/2012. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

CMCSA

-

NASDAQ

Comcast Corp Cl A

MEDIA - CATV Systems

|

$29.22

|

+0.37

1.28% |

$29.28

|

9,905,581

78.06% of 50 DAV

50 DAV is 12,690,400

|

$30.88

-5.36%

|

5/2/2012

|

$30.04

|

PP = $30.51

|

|

MB = $32.04

|

Most Recent Note - 5/29/2012 4:38:39 PM

Most Recent Note - 5/29/2012 4:38:39 PM

G - Gains have lacked volume conviction since slumping under its 50 DMA line and undercutting the prior low ($28.54 on 4/10/12). A rebound above its short-term average would help its technical stance and near-term outlook improve.

>>> The latest Featured Stock Update with an annotated graph appeared on 5/7/2012. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

COO

-

NYSE

Cooper Companies Inc

HEALTH SERVICES - Medical Instruments and Supplies

|

$85.72

|

+0.19

0.22% |

$86.26

|

420,465

102.28% of 50 DAV

50 DAV is 411,100

|

$89.31

-4.02%

|

3/9/2012

|

$83.05

|

PP = $81.02

|

|

MB = $85.07

|

Most Recent Note - 5/29/2012 4:39:31 PM

Most Recent Note - 5/29/2012 4:39:31 PM

G - Still consolidating above prior highs in the $83-84 area and above its 50 DMA line, important near-term support. A subsequent violation may trigger a worrisome sell signal.

>>> The latest Featured Stock Update with an annotated graph appeared on 5/18/2012. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

DG

-

NYSE

Dollar General Corp

RETAIL - Discount, Variety Stores

|

$48.06

|

+0.48

1.01% |

$48.28

|

2,433,537

89.82% of 50 DAV

50 DAV is 2,709,300

|

$48.76

-1.44%

|

5/7/2012

|

$48.51

|

PP = $47.69

|

|

MB = $50.07

|

Most Recent Note - 5/29/2012 4:42:18 PM

Most Recent Note - 5/29/2012 4:42:18 PM

Y - Rebounded further above its 50 DMA line today and finished near its best-ever close. Its color code is changed to yellow based on recent resilience.

>>> The latest Featured Stock Update with an annotated graph appeared on 5/9/2012. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

EXPE

-

NASDAQ

Expedia Inc

INTERNET - Internet Information Providers

|

$45.30

|

+0.41

0.91% |

$45.78

|

2,274,559

50.36% of 50 DAV

50 DAV is 4,516,400

|

$46.07

-1.67%

|

4/27/2012

|

$41.80

|

PP = $35.57

|

|

MB = $37.35

|

Most Recent Note - 5/29/2012 4:46:07 PM

Most Recent Note - 5/29/2012 4:46:07 PM

G - Held its ground near its 52-week high today. As previously noted, heavy volume behind a considerable gain on 5/23/12 technically helped it break out from an advanced "3-weeks tight" base with no resistance remaining due to overhead supply, however no new pivot point was cited. Until the market confirms a new rally with a solid follow through day from at least one of the major averages (M criteria) the fact-based investment system argues against new buying efforts in any stocks.

>>> The latest Featured Stock Update with an annotated graph appeared on 5/3/2012. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

GNC

-

NYSE

G N C Holdings Inc

RETAIL - Drug Stores

|

$39.54

|

-0.01

-0.03% |

$40.00

|

1,140,933

59.94% of 50 DAV

50 DAV is 1,903,400

|

$41.95

-5.74%

|

1/19/2012

|

$28.99

|

PP = $29.60

|

|

MB = $31.08

|

Most Recent Note - 5/29/2012 4:47:20 PM

Most Recent Note - 5/29/2012 4:47:20 PM

G - Hovering within close striking distance of its 52-week high today. Found support near prior highs and its 50 DMA line while recently consolidating. Reported earnings +82% on +23% sales revenues for the quarter ended March 31, 2012 versus the year ago period.

>>> The latest Featured Stock Update with an annotated graph appeared on 4/26/2012. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

MG

-

NYSE

Mistras Group Inc

DIVERSIFIED SERVICES - Bulding and Faci;ity Management Services

|

$22.99

|

+0.00

0.00% |

$23.43

|

81,297

84.60% of 50 DAV

50 DAV is 96,100

|

$26.24

-12.39%

|

3/22/2012

|

$24.96

|

PP = $26.34

|

|

MB = $27.66

|

Most Recent Note - 5/29/2012 4:48:35 PM

Most Recent Note - 5/29/2012 4:48:35 PM

G - Suffered another loss today with lighter volume. Recently slumping toward prior lows and its 200 DMA line defining important near-term support in the $22.50 area.

>>> The latest Featured Stock Update with an annotated graph appeared on 4/2/2012. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

NTES

-

NASDAQ

Netease Inc Adr

INTERNET - Internet Information Providers

|

$60.69

|

+3.43

5.99% |

$60.94

|

863,659

117.27% of 50 DAV

50 DAV is 736,500

|

$63.07

-3.77%

|

3/19/2012

|

$56.18

|

PP = $55.10

|

|

MB = $57.86

|

Most Recent Note - 5/29/2012 4:49:45 PM

Most Recent Note - 5/29/2012 4:49:45 PM

G - Rebounded back above its 50 DMA line and finished at a new high close with above average volume behind its solid gain today. Recent lows near the $55 area define important chart support to watch where a violation may trigger a worrisome technical sell signal.

>>> The latest Featured Stock Update with an annotated graph appeared on 5/24/2012. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

SWI

-

NYSE

Solarwinds Inc

COMPUTER SOFTWARE and SERVICES - Application Software

|

$48.12

|

+0.44

0.92% |

$48.64

|

892,594

78.61% of 50 DAV

50 DAV is 1,135,500

|

$48.42

-0.62%

|

4/26/2012

|

$45.15

|

PP = $42.32

|

|

MB = $44.44

|

Most Recent Note - 5/29/2012 4:50:35 PM

Most Recent Note - 5/29/2012 4:50:35 PM

G - Inched higher with light volume for another new all-time high today. It did not form a sound new base of sufficient length.

>>> The latest Featured Stock Update with an annotated graph appeared on 5/21/2012. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

SXCI

-

NASDAQ

S X C Health Solutions

COMPUTER SOFTWARE and SERVICES - Healthcare Information Service

|

$91.34

|

+0.00

0.00% |

$93.00

|

583,302

52.56% of 50 DAV

50 DAV is 1,109,700

|

$100.50

-9.11%

|

2/23/2012

|

$68.24

|

PP = $66.05

|

|

MB = $69.35

|

Most Recent Note - 5/29/2012 4:52:00 PM

Most Recent Note - 5/29/2012 4:52:00 PM

G - Volume totals have been cooling while still holding its ground in a tight range. Completed a new Public Offering on 5/10/12. Consolidating in a tight range since it posted huge volume-driven gains on 4/18 and 4/19 while rallying on M&A news.

>>> The latest Featured Stock Update with an annotated graph appeared on 5/17/2012. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

TDG

-

NYSE

Transdigm Group Inc

AEROSPACE/DEFENSE - Aerospace/Defense Products and; Services

|

$126.34

|

+2.11

1.70% |

$126.34

|

731,236

151.55% of 50 DAV

50 DAV is 482,500

|

$132.69

-4.79%

|

2/29/2012

|

$120.10

|

PP = $118.93

|

|

MB = $124.88

|

Most Recent Note - 5/29/2012 4:53:09 PM

Most Recent Note - 5/29/2012 4:53:09 PM

G - Gain today was backed by above average volume. Recently found prompt support at its 50 DMA line and near prior highs.

>>> The latest Featured Stock Update with an annotated graph appeared on 5/23/2012. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

TNGO

-

NASDAQ

Tangoe Inc

COMPUTER SOFTWARE and SERVICES - Technical and System Software

|

$20.64

|

-0.19

-0.91% |

$21.28

|

479,228

72.84% of 50 DAV

50 DAV is 657,900

|

$23.05

-10.46%

|

3/27/2012

|

$19.35

|

PP = $20.00

|

|

MB = $21.00

|

Most Recent Note - 5/29/2012 4:53:55 PM

Most Recent Note - 5/29/2012 4:53:55 PM

G - Volume totals have been drying up while consolidating above prior highs in the $20 area and above important support at its 50 DMA line. It has consolidated below its "max buy" level, however investors' odds are more favorable when buying on strength rather than on pullbacks.

>>> The latest Featured Stock Update with an annotated graph appeared on 5/25/2012. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

TSCO

-

NASDAQ

Tractor Supply Co

SPECIALTY RETAIL - Specialty Retail, Other

|

$92.47

|

-7.15

-7.18% |

$98.89

|

4,500,303

492.97% of 50 DAV

50 DAV is 912,900

|

$101.20

-8.63%

|

5/1/2012

|

$98.38

|

PP = $101.30

|

|

MB = $106.37

|

Most Recent Note - 5/29/2012 4:55:20 PM

Most Recent Note - 5/29/2012 4:55:20 PM

G - Violated its 50 DMA line today, triggering a technical sell signal with a damaging loss with more than 4 times average volume. It did not trigger a new (or add-on) technical buy signal in recent weeks.

>>> The latest Featured Stock Update with an annotated graph appeared on 4/17/2012. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

UA

-

NYSE

Under Armour Inc Cl A

CONSUMER NON-DURABLES - Textile - Apparel Clothing

|

$100.76

|

+2.57

2.62% |

$100.90

|

1,329,924

145.30% of 50 DAV

50 DAV is 915,300

|

$102.86

-2.04%

|

2/15/2012

|

$85.77

|

PP = $84.86

|

|

MB = $89.10

|

Most Recent Note - 5/29/2012 4:56:55 PM

Most Recent Note - 5/29/2012 4:56:55 PM

G - Today's 6th consecutive gain was backed by above average volume as it finished near its best-ever close. Concerns were recently raised by weaker fundamentals, its first quarterly earnings increase below the +25% minimum guideline in more than 2 years.

>>> The latest Featured Stock Update with an annotated graph appeared on 5/29/2012. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

V

-

NYSE

Visa Inc Cl A

DIVERSIFIED SERVICES - Business/Management Services

|

$120.28

|

+0.91

0.76% |

$120.95

|

4,501,482

124.85% of 50 DAV

50 DAV is 3,605,500

|

$125.35

-4.04%

|

3/12/2012

|

$116.53

|

PP = $119.46

|

|

MB = $125.43

|

Most Recent Note - 5/29/2012 4:58:15 PM

Most Recent Note - 5/29/2012 4:58:15 PM

G - Up today with slightly above average volume, rebounding back above its 50 DMA line which helped its outlook improve.

>>> The latest Featured Stock Update with an annotated graph appeared on 5/16/2012. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

VSI

-

NYSE

Vitamin Shoppe Inc

SPECIALTY RETAIL - Specialty Retail, Other

|

$50.64

|

+0.24

0.48% |

$50.93

|

273,086

57.82% of 50 DAV

50 DAV is 472,300

|

$55.29

-8.41%

|

4/25/2012

|

$47.77

|

PP = $48.46

|

|

MB = $50.88

|

Most Recent Note - 5/29/2012 4:59:08 PM

Most Recent Note - 5/29/2012 4:59:08 PM

G - Recent gains have been backed by lighter than average volume as it found some support near its old highs and halted a streak of 5 consecutive losses since a negative reversal at its 52-week high.

>>> The latest Featured Stock Update with an annotated graph appeared on 4/25/2012. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

WFM

-

NASDAQ

Whole Foods Market Inc

RETAIL - Grocery Stores

|

$89.35

|

+2.08

2.38% |

$89.37

|

1,708,999

104.67% of 50 DAV

50 DAV is 1,632,700

|

$91.50

-2.35%

|

5/3/2012

|

$90.28

|

PP = $86.45

|

|

MB = $90.77

|

Most Recent Note - 5/29/2012 5:00:16 PM

Most Recent Note - 5/29/2012 5:00:16 PM

G - Up today with average volume. Found prompt support last week as it rebounded above its 50 DMA line following a streak of 5 consecutive losses which completely negated the latest breakout. It stalled following its considerable "breakaway gap" on 5/03/12.

>>> The latest Featured Stock Update with an annotated graph appeared on 5/11/2012. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

|

|

|

THESE ARE NOT BUY RECOMMENDATIONS!

Comments contained in the body of this report are technical

opinions only. The material herein has been obtained

from sources believed to be reliable and accurate, however,

its accuracy and completeness cannot be guaranteed.

This site is not an investment advisor, hence it does

not endorse or recommend any securities or other investments.

Any recommendation contained in this report may not

be suitable for all investors and it is not to be deemed

an offer or solicitation on our part with respect to

the purchase or sale of any securities. All trademarks,

service marks and trade names appearing in this report

are the property of their respective owners, and are

likewise used for identification purposes only.

This report is a service available

only to active Paid Premium Members.

You may opt-out of receiving report notifications

at any time. Questions or comments may be submitted

by writing to Premium Membership Services 665 S.E. 10 Street, Suite 201 Deerfield Beach, FL 33441-5634 or by calling 1-800-965-8307

or 954-785-1121.

|

|

|