You are not logged in.

This means you

CAN ONLY VIEW reports that were published prior to Wednesday, April 30, 2025.

You

MUST UPGRADE YOUR MEMBERSHIP if you want to see any current reports.

AFTER MARKET UPDATE - FRIDAY, MAY 7TH, 2010

Previous After Market Report Next After Market Report >>>

|

|

|

|

DOW |

-139.89 |

10,380.43 |

-1.33% |

|

Volume |

2,420,069,140 |

-6% |

|

Volume |

4,076,744,260 |

-7% |

|

NASDAQ |

-54.00 |

2,265.64 |

-2.33% |

|

Advancers |

893 |

28% |

|

Advancers |

611 |

22% |

|

S&P 500 |

-17.27 |

1,110.88 |

-1.53% |

|

Decliners |

2,243 |

70% |

|

Decliners |

2,130 |

75% |

|

Russell 2000 |

-19.23 |

653.00 |

-2.86% |

|

52 Wk Highs |

16 |

|

|

52 Wk Highs |

14 |

|

|

S&P 600 |

-10.26 |

350.69 |

-2.84% |

|

52 Wk Lows |

60 |

|

|

52 Wk Lows |

91 |

|

|

|

Stocks Continue Falling After Worrisome Technical Damage

Adam Sarhan, Contributing Writer,

Stock markets around the world plunged this week as concern spread that Greece's debt woes will spread to other countries. Volume totals were reported lower on both the NYSE and on the Nasdaq exchange compared to Thursday's very high levels. Decliners trumped advancers by more than a 2-to-1 ratio on the NYSE, and by more than a 3-to-1 ratio on the Nasdaq exchange. New 52-week lows outnumbered new 52-week highs on the NYSE and on the Nasdaq exchange. For the first time in many months there were 0 high-ranked companies from the CANSLIM.net Leaders List that made a new 52-week high and appeared on the CANSLIM.net BreakOuts Page, lower than the 6 issues that appeared on the prior session. Waning leadership has been evidenced by the recent lack of stocks making new highs as the rally came under pressure.

On Monday, stocks rallied after news spread that the EU and the IMF will bailout Greece. The news sent the EU plunging as fear spread that other EU nations will also need assistance. In the US, billionaire investor, Warren Buffett defended Goldman Sachs Group Inc. (GS +0.47%) at his annual shareholders meeting in Omaha. Last year, Buffett invested $5 billion in the investment bank and said the bank should not be blamed for losses on lousy mortgage bets. The major averages fell into a correction on Tuesday after the NYSE composite sliced below its 50-day moving average (DMA) line and the euro plunged to a fresh 14-month low. On Wednesday, stocks edged lower sending the benchmark S&P 500 and tech-heavy Nasdaq Composite index both below their respective 50 DMA lines on heavy turnover.

On Thursday, the European Central Bank (ECB) held interest rates steady at a record low of 1% as the Greek parliament approved austerity measures demanded by the EU and IMF. Shortly after the Greek parliament approved the measures, around 2:15PM EST, the Dow Jones Industrial Average plunged nearly 1,000 points before rebounding to close down -347 points on the day. The aggressive sell off briefly sent all of the major averages below their respective 200 DMA lines before a late day rebound. That was the Dow's largest single day point decline in history which reiterates the importance of raising capital when the market (M criteria) enters a correction. Even after the rebound from the intra-day lows, the Dow plunged on heavy volume as fear spread that the EU may collapse if other European countries fall behind on their debt payments. The euro tanked to a fresh 14-month low as gold topped $1,200 per ounce which suggests investors are moving away from so-called risky assets and into higher quality names. Stocks were trading all over the place on Friday after the government said US employers added 290,000 jobs last month as the unemployment rate rose to +9.9%.

Taking the appropriate action on a case-by-case basis with your stocks prompts investors to raise cash when any holdings start getting into the trouble zone. A reminder was added to many Featured Stocks' notes this week -Broader market action (M criteria) is normally expected to impact 3 out of 4 stocks. Trade accordingly.

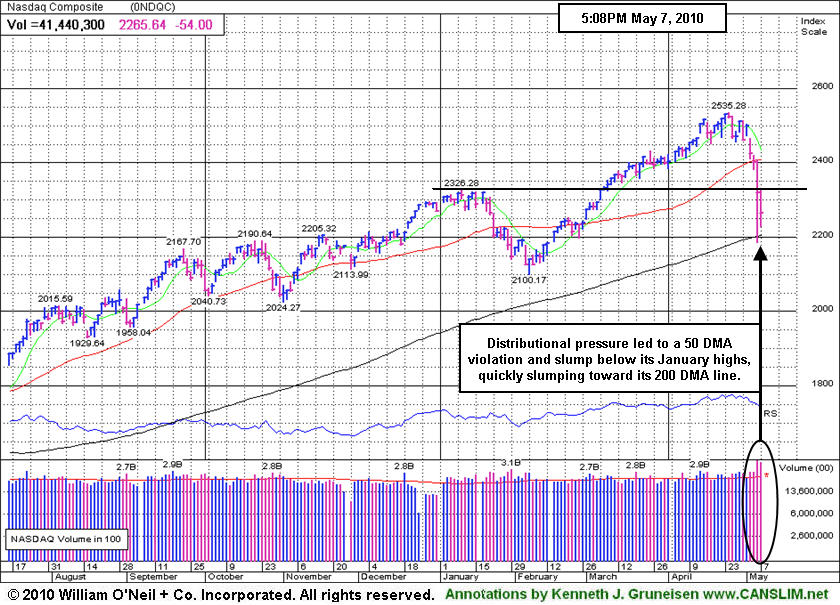

PICTURED: The Nasdaq Composite Index came under heavy distributional pressure leading to a 50 DMA violation and slump below its January highs, quickly slumping toward its 200 DMA line.

|

|

|

|

Widespread Weakness Weighs On All Groups

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

Defensive groups were included among widespread losses on Friday as the Healthcare Index ($HMO -3.06%), Oil Services Index ($OSX -3.63%), Integrated Oil Index ($XOI -1.65%), and Gold & Silver Index ($XAU -1.55%) fell. The tech sector was weak as the Biotechnology Index ($BTK -3.05%), Internet Index ($IIX -2.97%), Networking Index ($NWX -2.66%), and Semiconductor Index ($SOX -1.64%) ended unanimously lower. The influential Retail Index ($RLX -1.72%) and financial groups also were on the decline as the Broker/Dealer Index ($XBD -1.62%) and Bank Index ($BKX -1.52%) rounded out a clearly negative session and dismal week of trading.

Charts courtesy www.stockcharts.com

PICTURED: The Bank Index ($BKX -1.52%) violated its 50-day moving average (DMA) line with losses this week.

| Oil Services |

$OSX |

187.77 |

-7.07 |

-3.63% |

-3.67% |

| Healthcare |

$HMO |

1,416.94 |

-44.67 |

-3.06% |

-3.80% |

| Integrated Oil |

$XOI |

1,001.22 |

-16.82 |

-1.65% |

-6.27% |

| Semiconductor |

$SOX |

346.75 |

-5.79 |

-1.64% |

-3.66% |

| Networking |

$NWX |

242.36 |

-6.63 |

-2.66% |

+4.89% |

| Internet |

$IIX |

233.06 |

-7.12 |

-2.97% |

-0.34% |

| Broker/Dealer |

$XBD |

111.25 |

-1.83 |

-1.62% |

-3.30% |

| Retail |

$RLX |

443.29 |

-7.77 |

-1.72% |

+7.82% |

| Gold & Silver |

$XAU |

171.88 |

-2.71 |

-1.55% |

+2.16% |

| Bank |

$BKX |

51.70 |

-0.80 |

-1.52% |

+21.05% |

| Biotech |

$BTK |

1,047.37 |

-32.96 |

-3.05% |

+11.17% |

|

|

|

|

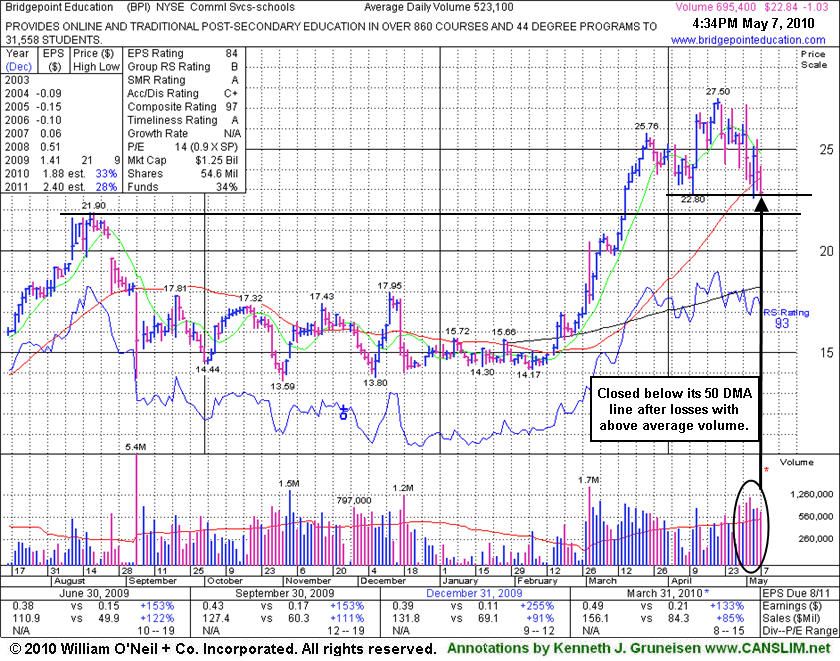

Leadership In Group Waning Under Threat Of Regulatory Changes

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

Bridgepoint Education (BPI -$1.03 or -4.32% to $22.84) suffered another loss today with above average volume and closed below its 50-day moving average (DMA) line. Leadership in the Commercial Services - Schools group has waned as many for-profit schools have encountered distributional pressure in the wake of recently proposed regulatory changes. Broader market action (M criteria) is normally expected to impact 3 out of 4 stocks, and widespread losses effectively ended the latest rally. BPI was featured in yellow in the 4/13/10 mid-day report (read here) as rose from a cup-with-high-handle hit a new 52 week high after a brief consolidation above its old chart high ($21.90). It has an impressive history of very strong annual and quarterly increases in sales revenues and earnings above the +25% guideline which is good concerning the C & A criteria.

A prompt sign of support near its 50 DMA line would be encouraging, while any further deterioration leading to a slump below its August 2009 highs would raise more serious concerns.

|

|

|

Color Codes Explained :

Y - Better candidates highlighted by our

staff of experts.

G - Previously featured

in past reports as yellow but may no longer be buyable under the

guidelines.

***Last / Change / Volume data in this table is the closing quote data***

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

BIDU

-

NASDAQ

Baidu Inc Ads

INTERNET - Internet Information Providers

|

$639.49

|

-28.53

-4.27% |

$670.95

|

1,704,627

111.97% of 50 DAV

50 DAV is 1,522,400

|

$718.00

-10.93%

|

1/13/2010

|

$431.25

|

PP = $426.75

|

|

MB = $448.09

|

Most Recent Note - 5/7/2010 3:36:52 PM

Most Recent Note - 5/7/2010 3:36:52 PM

G - Damage is mounting today as it falls toward its 50 DMA line with a 4th consecutive loss, breaking a streak of 13 consecutive weekly gains.

>>> The latest Featured Stock Update with an annotated graph appeared on 4/20/2010. Click here. >>> The latest Featured Stock Update with an annotated graph appeared on 4/20/2010. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile

|

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

BPI

-

NYSE

Bridgepoint Education

DIVERSIFIED SERVICES - Education and; Training Services

|

$22.84

|

-1.03

-4.32% |

$24.14

|

704,568

137.96% of 50 DAV

50 DAV is 510,700

|

$27.50

-16.95%

|

4/13/2010

|

$25.59

|

PP = $25.76

|

|

MB = $27.05

|

Most Recent Note - 5/7/2010 4:01:50 PM

Most Recent Note - 5/7/2010 4:01:50 PM

G - Loss today with above average volume, closing below its 50 DMA line, raising concerns. The Commercial Services - Schools firm was featured in yellow in the 4/13/10 mid-day report (read here) as rose from a cup-with-high-handle.

>>> The latest Featured Stock Update with an annotated graph appeared on 5/7/2010. Click here. >>> The latest Featured Stock Update with an annotated graph appeared on 5/7/2010. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile

|

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

BRLI

-

NASDAQ

Bio Reference Labs Inc

HEALTH SERVICES - Medical Laboratories and Researc

|

$20.79

|

-1.37

-6.18% |

$22.11

|

335,205

179.25% of 50 DAV

50 DAV is 187,000

|

$24.67

-15.74%

|

2/12/2010

|

$39.02

|

PP = $20.49

|

|

MB = $21.51

|

Most Recent Note - 5/7/2010 3:31:51 PM

Most Recent Note - 5/7/2010 3:31:51 PM

G - Damaging loss today on higher volume, sinking further below its 50 DMA line. Wild action on 5/06/10 intra-day undercut its 200 DMA line and revisited its November 2009 lows, yet it rebounded to close near its 50 DMA line and in the upper part of its range. Broader market action (M criteria) is normally expected to impact 3 out of 4 stocks, and widespread losses effectively ended the latest rally.

>>> The latest Featured Stock Update with an annotated graph appeared on 4/16/2010. Click here. >>> The latest Featured Stock Update with an annotated graph appeared on 4/16/2010. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile

|

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

CISG

-

NASDAQ

Cninsure Inc Ads

INSURANCE - Insurance Brokers

|

$23.95

|

-2.78

-10.40% |

$27.00

|

601,429

229.12% of 50 DAV

50 DAV is 262,500

|

$28.62

-16.32%

|

3/3/2010

|

$24.38

|

PP = $23.10

|

|

MB = $24.26

|

Most Recent Note - 5/7/2010 2:01:16 PM

Most Recent Note - 5/7/2010 2:01:16 PM

G - Considerable loss today on higher volume, violating its 50 DMA line and recent chart lows, triggering technical sell signals. Its color code is changed to green based on the damaging loss.

>>> The latest Featured Stock Update with an annotated graph appeared on 4/19/2010. Click here. >>> The latest Featured Stock Update with an annotated graph appeared on 4/19/2010. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile

|

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

CRM

-

NYSE

Salesforce.Com Inc

INTERNET - Internet Software and Services

|

$77.52

|

-3.38

-4.18% |

$81.39

|

3,471,327

203.43% of 50 DAV

50 DAV is 1,706,400

|

$89.50

-13.39%

|

3/5/2010

|

$72.28

|

PP = $75.53

|

|

MB = $79.31

|

Most Recent Note - 5/7/2010 4:04:48 PM

Most Recent Note - 5/7/2010 4:04:48 PM

G - Down today for a 4th consecutive loss, closing below its 50 DMA line and raising concerns. Broader market action (M criteria) is normally expected to impact 3 out of 4 stocks, and widespread losses effectively ended the latest rally.

>>> The latest Featured Stock Update with an annotated graph appeared on 4/21/2010. Click here. >>> The latest Featured Stock Update with an annotated graph appeared on 4/21/2010. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile

|

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

EZPW

-

NASDAQ

Ezcorp Inc Cl A

SPECIALTY RETAIL - Specialty Retail, Other

|

$18.30

|

-0.67

-3.53% |

$18.77

|

1,391,932

247.63% of 50 DAV

50 DAV is 562,100

|

$23.75

-22.95%

|

4/14/2010

|

$21.80

|

PP = $22.29

|

|

MB = $23.40

|

Most Recent Note - 5/7/2010 2:11:56 PM

Most Recent Note - 5/7/2010 2:11:56 PM

G - Down today for a 4th consecutive losing session, sinking toward its 200 DMA line. Based on damaging action it will be dropped from the Featured Stocks list tonight. Considerable weakness intra-day on 5/06/10 led to trading under its 200 DMA line near its $10.00 July 2009 low, yet it rebounded to close with a very small. Broader market action (M criteria) is normally expected to impact 3 out of 4 stocks, and widespread losses effectively ended the latest rally.

>>> The latest Featured Stock Update with an annotated graph appeared on 4/27/2010. Click here. >>> The latest Featured Stock Update with an annotated graph appeared on 4/27/2010. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile

|

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

ISRG

-

NASDAQ

Intuitive Surgical Inc

HEALTH SERVICES - Medical Appliances and Equipment

|

$324.32

|

-12.97

-3.85% |

$337.99

|

1,286,854

220.92% of 50 DAV

50 DAV is 582,500

|

$393.92

-17.67%

|

4/13/2010

|

$363.46

|

PP = $367.10

|

|

MB = $385.46

|

Most Recent Note - 5/7/2010 4:11:32 PM

Most Recent Note - 5/7/2010 4:11:32 PM

G - Considerable loss on higher volume today led to more technical damage for the week after its gap down on 5/05/10 violated its 50 DMA line. Based on weak action it will be dropped from the Featured Stocks list tonight.

>>> The latest Featured Stock Update with an annotated graph appeared on 5/3/2010. Click here. >>> The latest Featured Stock Update with an annotated graph appeared on 5/3/2010. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile

|

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

LL

-

NYSE

Lumber Liquidators Hldgs

RETAIL - Home Improvement Stores

|

$28.02

|

-0.07

-0.25% |

$28.92

|

343,799

84.31% of 50 DAV

50 DAV is 407,800

|

$33.41

-16.13%

|

4/22/2010

|

$29.87

|

PP = $29.03

|

|

MB = $30.48

|

Most Recent Note - 5/7/2010 4:13:50 PM

Most Recent Note - 5/7/2010 4:13:50 PM

G - Slumping near its 50 DMA line today with a 4th consecutive loss. It closed the week under its December 2009 highs, negating its latest breakout with a loss on above average volume. First featured in yellow at $29.87 in the 4/22/10 the mid-day report (read here).

>>> The latest Featured Stock Update with an annotated graph appeared on 4/26/2010. Click here. >>> The latest Featured Stock Update with an annotated graph appeared on 4/26/2010. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile

|

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

LOPE

-

NASDAQ

Grand Canyon Education

DIVERSIFIED SERVICES - Education and; Training Services

|

$24.42

|

-0.48

-1.93% |

$25.21

|

260,807

70.89% of 50 DAV

50 DAV is 367,900

|

$28.46

-14.20%

|

4/13/2010

|

$27.71

|

PP = $27.33

|

|

MB = $28.70

|

Most Recent Note - 5/7/2010 4:15:53 PM

Most Recent Note - 5/7/2010 4:15:53 PM

G - Closed below its 50 DMA line today with its 11th loss in 13 sessions. Many for-profit schools have encountered distributional pressure in the wake of recently proposed regulatory changes.

>>> The latest Featured Stock Update with an annotated graph appeared on 4/14/2010. Click here. >>> The latest Featured Stock Update with an annotated graph appeared on 4/14/2010. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile

|

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

PCLN

-

NASDAQ

Priceline.Com Inc

INTERNET - Internet Software and Services

|

$225.39

|

-7.71

-3.31% |

$236.55

|

1,731,657

178.82% of 50 DAV

50 DAV is 968,400

|

$273.93

-17.72%

|

2/18/2010

|

$232.69

|

PP = $231.59

|

|

MB = $243.17

|

Most Recent Note - 5/7/2010 4:20:02 PM

Most Recent Note - 5/7/2010 4:20:02 PM

G - Another damaging loss today on above average volume, closing near its session low and below its December '09 highs. Based on weak action it will be dropped from the Featured Stocks list tonight. Broader market action (M criteria) is normally expected to impact 3 out of 4 stocks, and widespread losses effectively ended the latest rally.

>>> The latest Featured Stock Update with an annotated graph appeared on 4/28/2010. Click here. >>> The latest Featured Stock Update with an annotated graph appeared on 4/28/2010. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile

|

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

ROVI

-

NASDAQ

Rovi Corp

COMPUTER SOFTWARE andamp; SERVICES - Security Software andamp; Services

|

$35.10

|

-0.45

-1.27% |

$36.50

|

3,800,476

303.21% of 50 DAV

50 DAV is 1,253,400

|

$40.06

-12.38%

|

4/20/2010

|

$37.62

|

PP = $38.60

|

|

MB = $40.53

|

Most Recent Note - 5/7/2010 4:23:10 PM

Most Recent Note - 5/7/2010 4:23:10 PM

G - Small loss today with heavy volume after reporting its latest strong earnings news. Concerns were raised this week as it violated its 50 DMA line. Deterioration under its October 2009 high would raise more serious concerns.

>>> The latest Featured Stock Update with an annotated graph appeared on 5/5/2010. Click here. >>> The latest Featured Stock Update with an annotated graph appeared on 5/5/2010. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile

|

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

SIRO

-

NASDAQ

Sirona Dental Systems

HEALTH SERVICES - Medical Instruments andamp; Supplies

|

$37.17

|

-1.12

-2.93% |

$38.85

|

1,008,114

177.77% of 50 DAV

50 DAV is 567,100

|

$43.45

-14.45%

|

2/16/2010

|

$36.43

|

PP = $36.15

|

|

MB = $37.96

|

Most Recent Note - 5/7/2010 4:24:40 PM

Most Recent Note - 5/7/2010 4:24:40 PM

G - Loss today with above average volume, closing the week below its 50 DMA line. On 5/05/10 it endured heavy distributional pressure after reporting +231% earnings on +15% sales revenues for the quarter ended March 31, 2010 versus the year ago period.

>>> The latest Featured Stock Update with an annotated graph appeared on 4/22/2010. Click here. >>> The latest Featured Stock Update with an annotated graph appeared on 4/22/2010. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile

|

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

SUMR

-

NASDAQ

Summer Infant Inc

CONSUMER NON-DURABLES - Personal Products

|

$6.58

|

+0.06

0.84% |

$6.80

|

22,934

49.11% of 50 DAV

50 DAV is 46,700

|

$7.24

-9.19%

|

5/4/2010

|

$6.85

|

PP = $7.09

|

|

MB = $7.44

|

Most Recent Note - 5/7/2010 4:25:59 PM

Most Recent Note - 5/7/2010 4:25:59 PM

Y - Consolidating near its 50 DMA line with volume totals cooling since featured in the 5/04/10 mid-day report (read here) - "Inching into new high ground this week on the right side of a 7-week flat base above its 50 DMA line and well above prior chart highs in the $5 area. Color code is yellow with pivot point noted based upon its 3/15/10 high plus ten cents. Quarterly earnings (C criteria) in the 2 latest quarterly comparisons showed great increases while sales revenues growth accelerated to +27% in the period ended Mach 31, 2010. It has a good annual earnings (A criteria) history, and a small supply (S criteria) of only 11.0 million shares in the public float. Technically, a gain and strong close above its pivot point with heavy volume would trigger a buy signal."

>>> The latest Featured Stock Update with an annotated graph appeared on 5/4/2010. Click here. >>> The latest Featured Stock Update with an annotated graph appeared on 5/4/2010. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile

|

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

ULTA

-

NASDAQ

Ulta Salon Cosm & Frag

SPECIALTY RETAIL - Specialty Retail, Other

|

$21.24

|

-0.75

-3.41% |

$22.47

|

285,258

66.87% of 50 DAV

50 DAV is 426,600

|

$25.76

-17.55%

|

3/12/2010

|

$22.81

|

PP = $21.72

|

|

MB = $22.81

|

Most Recent Note - 5/7/2010 4:29:20 PM

Most Recent Note - 5/7/2010 4:29:20 PM

G - Today was its 4th consecutive loss, slumping further below its 50 DMA line and closing below its January low, raising greater concerns. Only a prompt rebound above its short-term average would help its outlook.

>>> The latest Featured Stock Update with an annotated graph appeared on 4/30/2010. Click here. >>> The latest Featured Stock Update with an annotated graph appeared on 4/30/2010. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile

|

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

VIT

-

NYSE

Vanceinfo Tech Inc Ads

COMPUTER SOFTWARE and SERVICES - Business Software and Services

|

$22.78

|

+0.29

1.29% |

$23.10

|

935,065

124.88% of 50 DAV

50 DAV is 748,800

|

$26.48

-13.97%

|

4/9/2010

|

$23.79

|

PP = $23.95

|

|

MB = $25.15

|

Most Recent Note - 5/7/2010 4:30:29 PM

Most Recent Note - 5/7/2010 4:30:29 PM

G - Gain today helped it make a stand near its 50 DMA line. Color code was changed to green based on recent distributional action. Broader market action (M criteria) is normally expected to impact 3 out of 4 stocks, and widespread losses effectively ended the latest rally.

>>> The latest Featured Stock Update with an annotated graph appeared on 5/6/2010. Click here. >>> The latest Featured Stock Update with an annotated graph appeared on 5/6/2010. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile

|

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

|

|

|

THESE ARE NOT BUY RECOMMENDATIONS!

Comments contained in the body of this report are technical

opinions only. The material herein has been obtained

from sources believed to be reliable and accurate, however,

its accuracy and completeness cannot be guaranteed.

This site is not an investment advisor, hence it does

not endorse or recommend any securities or other investments.

Any recommendation contained in this report may not

be suitable for all investors and it is not to be deemed

an offer or solicitation on our part with respect to

the purchase or sale of any securities. All trademarks,

service marks and trade names appearing in this report

are the property of their respective owners, and are

likewise used for identification purposes only.

This report is a service available

only to active Paid Premium Members.

You may opt-out of receiving report notifications

at any time. Questions or comments may be submitted

by writing to Premium Membership Services 665 S.E. 10 Street, Suite 201 Deerfield Beach, FL 33441-5634 or by calling 1-800-965-8307

or 954-785-1121.

|

|

|