You are not logged in.

This means you

CAN ONLY VIEW reports that were published prior to Monday, April 14, 2025.

You

MUST UPGRADE YOUR MEMBERSHIP if you want to see any current reports.

AFTER MARKET UPDATE - MONDAY, APRIL 29TH, 2013

Previous After Market Report Next After Market Report >>>

|

|

|

|

DOW |

+106.20 |

14,818.75 |

+0.72% |

|

Volume |

598,726,600 |

-12% |

|

Volume |

1,465,238,770 |

-8% |

|

NASDAQ |

+27.76 |

3,307.02 |

+0.85% |

|

Advancers |

2,215 |

71% |

|

Advancers |

1,680 |

65% |

|

S&P 500 |

+11.37 |

1,593.61 |

+0.72% |

|

Decliners |

791 |

25% |

|

Decliners |

789 |

31% |

|

Russell 2000 |

+7.18 |

942.43 |

+0.77% |

|

52 Wk Highs |

255 |

|

|

52 Wk Highs |

154 |

|

|

S&P 600 |

+3.88 |

526.88 |

+0.74% |

|

52 Wk Lows |

10 |

|

|

52 Wk Lows |

16 |

|

|

|

Indices' New Highs Argue That Market Has Returned to Confirmed Uptrend

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

The major averages finished higher on Monday. The volume totals on the exchanges were reported lighter than the prior session totals on the NYSE and on the Nasdaq exchange, indicating lackluster institutional buying demand. Breadth was positive as advancers outnumbered decliners by nearly 3-1 on the NYSE and by more than 2-1 on the Nasdaq exchange. New 52-week highs totals expanded and new highs solidly outnumbered new 52-week lows on both the NYSE and the Nasdaq exchange. There were 60 high-ranked companies from the CANSLIM.net Leaders List making new 52-week highs and appearing on the CANSLIM.net BreakOuts Page, up from the prior session total of 42 stocks. There were gains for 7 of the 11 high-ranked companies currently included on the Featured Stocks Page.

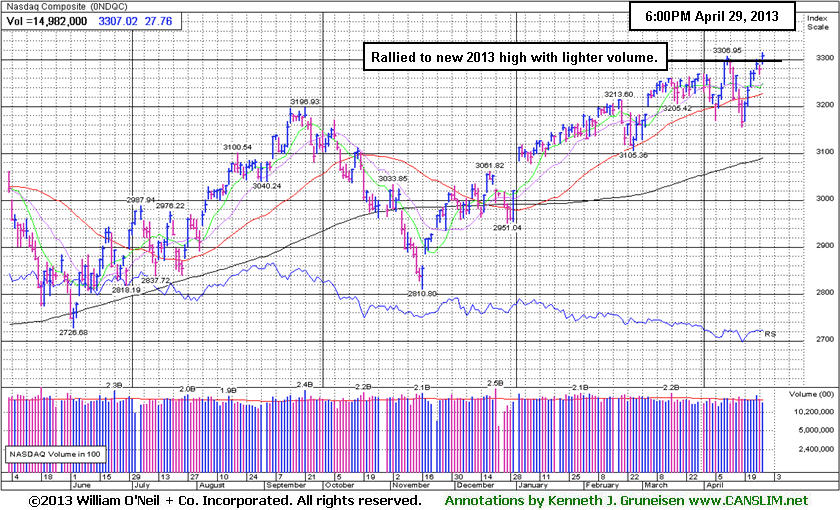

The major averages posted solid gains on Monday. The S&P 500 Index finished at a best-ever close a new record high as it increased 11 points to 1,593. The Nasdaq Composite Index advanced to its highest closing level since November 2000 as it rallied over 27 points to 3,307.

Better-than-expected housing data helped push stocks higher as pending home sales increased +1.5% in March after a downwardly revised -1% loss in February. Other data showed consumer spending and income both rose by +0.2% in March. News that Italy's two-month political deadlock came to a close added to the positive tone after the country formed a coalition government.

Ultimately, all sectors gained ground. Technology was the best performing group as Apple Inc (AAPL +3.10%) rebounded from recent losses and Microsoft Corp (MSFT +2.58%) advanced. Materials and Energy stocks also paced the advance as commodities rallied, which pushed Freeport-McMoRan Copper & Gold Inc (FCX +1.63%) and Chevron Corp (CVX +1.07%) advanced.

First-quarter earnings continued after the closing bell with notable profit tallies out from Express Scripts Holding Co (ESRX +0.92%), The Hartford Financial Services Group Inc (HIG +0.33%) , Newmont Mining Corp (NEM +1.49%) and Masco Corp (MAS -0.97%).

In fixed-income, Treasuries gave up earlier gains and finished slightly lower. The 10-year note was down 1/32 to yield 1.67% and the 30-year bond lost 11/32 to yield 2.88%.

The market (M criteria) is considered to be back in a "confirmed uptrend" because of the new closing highs from both the Nasdaq Composite and the S&P 500 Index on Monday. Although none of the major averages produced a solid follow-through-day within the most favorable period between Days 4-7 of the new rally attempt, the new highs from the indices argue sufficiently that the prior uptrend has resumed. Another encouraging characteristic of the current market is the latest expansion in leadership (stocks hitting new 52-week highs).

Watch for an announcement via email concerning the next WEBCAST. The webcast will also be available via an updated link highlighted at the top of the Premium Member Homepage.

PICTURED: The Nasdaq Composite Index rallied with lighter volume conviction as it hit a new 2013 high. It promptly repaired the recent violation of its 50-day moving average (DMA) line.

|

Kenneth J. Gruneisen started out as a licensed stockbroker in August 1987, a couple of months prior to the historic stock market crash that took the Dow Jones Industrial Average down -22.6% in a single day. He has published daily fact-based fundamental and technical analysis on high-ranked stocks online for two decades. Through FACTBASEDINVESTING.COM, Kenneth provides educational articles, news, market commentary, and other information regarding proven investment systems that work in good times and bad.

Kenneth J. Gruneisen started out as a licensed stockbroker in August 1987, a couple of months prior to the historic stock market crash that took the Dow Jones Industrial Average down -22.6% in a single day. He has published daily fact-based fundamental and technical analysis on high-ranked stocks online for two decades. Through FACTBASEDINVESTING.COM, Kenneth provides educational articles, news, market commentary, and other information regarding proven investment systems that work in good times and bad.

Comments contained in the body of this report are technical opinions only and are not necessarily those of Gruneisen Growth Corp. The material herein has been obtained from sources believed to be reliable and accurate, however, its accuracy and completeness cannot be guaranteed. Our firm, employees, and customers may effect transactions, including transactions contrary to any recommendation herein, or have positions in the securities mentioned herein or options with respect thereto. Any recommendation contained in this report may not be suitable for all investors and it is not to be deemed an offer or solicitation on our part with respect to the purchase or sale of any securities. |

|

|

Financial, Tech, and Commodity-Linked Groups Led Gainers

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

The Retail Index ($RLX -0.06%) ended flat and the Healthcare Index ($HMO +0.12%) inched higher. Financial shares were a positive influence on the major averages as the Broker/Dealer Index ($XBD +0.79%) outpaced the Bank Index ($BKX +0.35%). The Semiconductor Index ($SOX +1.27%) led the tech sector higher while the Internet Index ($IIX +0.62%) and the Biotechnology Index ($BTK +0.73%) posted smaller gains and the Networking Index ($NWX +0.16%) edged higher. Commodity-linked groups also had a positive bias as the Gold & Silver Index ($XAU +1.48%) rallied and the Oil Services Index ($OSX +0.97%) and Integrated Oil Index ($XOI +1.26%) posted gains.

Charts courtesy www.stockcharts.com

PICTURED: The Networking Index ($NWX +0.16%) is consolidating above its 200-day moving average (DMA) line.

| Oil Services |

$OSX |

247.59 |

+2.37 |

+0.97% |

+12.46% |

| Healthcare |

$HMO |

2,932.49 |

+3.56 |

+0.12% |

+16.64% |

| Integrated Oil |

$XOI |

1,360.26 |

+16.88 |

+1.26% |

+9.54% |

| Semiconductor |

$SOX |

440.80 |

+5.51 |

+1.27% |

+14.77% |

| Networking |

$NWX |

220.73 |

+0.36 |

+0.16% |

-2.57% |

| Internet |

$IIX |

360.95 |

+2.21 |

+0.62% |

+10.38% |

| Broker/Dealer |

$XBD |

112.07 |

+0.88 |

+0.79% |

+18.81% |

| Retail |

$RLX |

745.06 |

-0.45 |

-0.06% |

+14.09% |

| Gold & Silver |

$XAU |

107.88 |

+1.57 |

+1.48% |

-34.86% |

| Bank |

$BKX |

56.78 |

+0.20 |

+0.35% |

+10.73% |

| Biotech |

$BTK |

1,931.67 |

+14.06 |

+0.73% |

+24.86% |

|

|

|

|

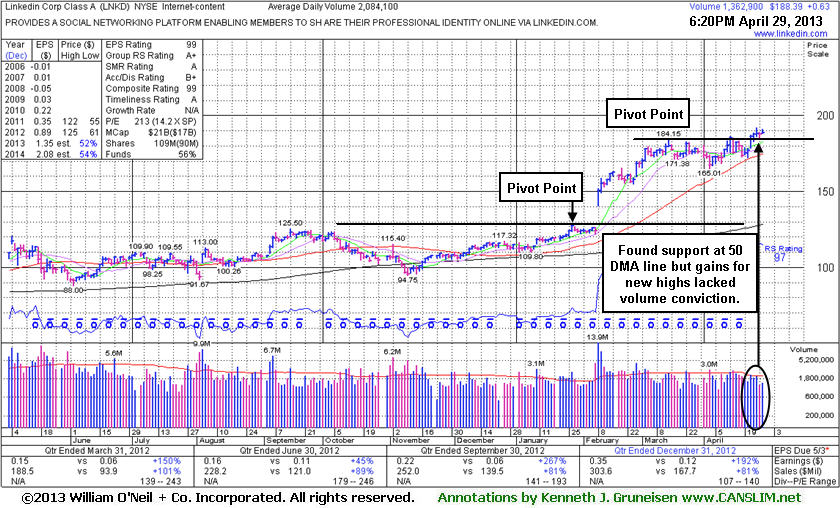

Found Support At 50 Day Average But Gains for New 52-Week Highs Lacked Volume

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

Linkedin Corp (LNKD +$0.63 or +0.34% to $188.39) rallied with near average volume recently for new 52-week highs. Gains above the pivot point backed by a minimum of +40% above average volume are needed to trigger a proper new (or add-on) technical buy signal. Its 50-day moving average (DMA) line and recent low define important near-term chart support to watch. Its last appearance in this FSU section was on 4/05/13 with an annotated graph under the headline, "Extended From Prior Base 8-Weeks After Breakaway Gap".

Investors should be especially watchful for any subsequent sell signals, especially with consideration that the broader market direction (M criteria) is always likely to impact 3 out of 4 stocks. The company's fundamentals (C and A criteria) remain strong. The high-ranked leader from the Internet - Content group's Return On Equity of 13% is still below the 17% guideline, which is a minor concern. Ownership by top-rated funds has been on the rise, increasing from 601 in Jun '12 to 845 in Mar '13, a very reassuring sign concerning the I criteria. Its current Up/Down Volume Ratio of 1.2 is an unbiased indication that its shares have been under accumulation over the past 50 days.

|

|

|

Color Codes Explained :

Y - Better candidates highlighted by our

staff of experts.

G - Previously featured

in past reports as yellow but may no longer be buyable under the

guidelines.

***Last / Change / Volume data in this table is the closing quote data***

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

CELG

-

NASDAQ

Celgene Corp

DRUGS - Drug Manufacturers - Major

|

$118.47

|

-1.87

-1.55% |

$120.92

|

3,521,737

108.75% of 50 DAV

50 DAV is 3,238,400

|

$128.52

-7.82%

|

3/27/2013

|

$113.24

|

PP = $115.54

|

|

MB = $121.32

|

Most Recent Note - 4/25/2013 11:54:30 AM

G - Holding its ground today after encountering distributional pressure and gapping down on the prior session, retreating with above average volume from its high. It is extended from any sound base. Its 50 DMA line ($111.84 now) defines important near-term support to watch.

>>> The latest Featured Stock Update with an annotated graph appeared on 4/19/2013. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

CMCSA

-

NASDAQ

Comcast Corp Cl A

MEDIA - CATV Systems

|

$41.49

|

+0.12

0.29% |

$41.69

|

8,376,944

62.84% of 50 DAV

50 DAV is 13,330,900

|

$42.61

-2.63%

|

12/3/2012

|

$37.08

|

PP = $38.06

|

|

MB = $39.96

|

Most Recent Note - 4/26/2013 4:28:11 PM

G - Rebounded above its 50 DMA line with higher volume behind its gain, helping its technical stance improve. Fundamental concerns were repeatedly noted after sub par earnings results for the Dec '12 quarter.

>>> The latest Featured Stock Update with an annotated graph appeared on 4/16/2013. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

EMN

-

NYSE

Eastman Chemical Co

CHEMICALS - Chemicals - Major Diversified

|

$68.27

|

-0.70

-1.01% |

$68.51

|

2,264,851

134.25% of 50 DAV

50 DAV is 1,687,000

|

$75.18

-9.19%

|

4/26/2013

|

$69.57

|

PP = $73.83

|

|

MB = $77.52

|

Most Recent Note - 4/26/2013 5:35:58 PM

Y - Finished below its 50 DMA line today after highlighted in yellow with pivot point cited based on its 3/20/13 high mid-point in an 11-week "double bottom" base pattern. Subsequent volume-driven gains above the pivot point are needed to trigger a proper technical buy signal before disciplined investors may consider taking action. Little resistance from overhead supply remains to hinder its progress. Reported earnings +33% on +27% sales revenues for the Mar '13 quarter, marking its 3rd consecutive quarter above the +25% minimum earnings guideline (C criteria). Annual earnings (A criteria) have been improving since a downturn in FY '09. See the latest FSU analysis for more details and a new annotated graph.

>>> The latest Featured Stock Update with an annotated graph appeared on 4/26/2013. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

EQM

-

NYSE

E Q T Midstream Partners

ENERGY - Oil and Gas Pipelines

|

$43.95

|

+0.81

1.88% |

$44.12

|

54,475

76.73% of 50 DAV

50 DAV is 71,000

|

$43.71

0.55%

|

4/25/2013

|

$40.16

|

PP = $40.84

|

|

MB = $42.88

|

Most Recent Note - 4/26/2013 4:34:14 PM

G - Color code is changed to green after rallying beyond its "max buy" level, getting extended from the prior base. See the latest FSU analysis for more details and a new annotated graph.

>>> The latest Featured Stock Update with an annotated graph appeared on 4/25/2013. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

FLT

-

NYSE

Fleetcor Technologies

DIVERSIFIED SERVICES - Business/Management Services

|

$75.44

|

-0.04

-0.05% |

$76.08

|

883,458

111.63% of 50 DAV

50 DAV is 791,400

|

$78.87

-4.35%

|

3/21/2013

|

$71.14

|

PP = $73.00

|

|

MB = $76.65

|

Most Recent Note - 4/25/2013 6:04:39 PM

Y - Perched within close striking distance of its 52-week high, Made a stand near its 50 DMA line recently with a "positive reversal" on 4/19/13. More damaging losses below the 50 DMA line or recent low ($70.09) would raise more serious concerns and trigger a worrisome technical sell signal.

>>> The latest Featured Stock Update with an annotated graph appeared on 4/15/2013. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

LNKD

-

NYSE

Linkedin Corp Class A

INTERNET - Internet Information Providers

|

$188.39

|

+0.63

0.34% |

$190.79

|

1,366,087

65.55% of 50 DAV

50 DAV is 2,084,100

|

$191.78

-1.77%

|

4/12/2013

|

$182.69

|

PP = $184.25

|

|

MB = $193.46

|

Most Recent Note - 4/29/2013 6:44:56 PM

Most Recent Note - 4/29/2013 6:44:56 PM

Y - Recent gains for new 52-week highs lacked the necessary volume conviction to trigger a proper new (or add-on) technical buy signal. Its 50 DMA line and recent low define important near-term chart support to watch. See the latest FSU analysis for more details and a new annotated graph.

>>> The latest Featured Stock Update with an annotated graph appeared on 4/29/2013. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

MRLN

-

NASDAQ

Marlin Business Services

DIVERSIFIED SERVICES - Rental and Leasing Services

|

$23.52

|

+0.39

1.69% |

$23.53

|

5,139

19.47% of 50 DAV

50 DAV is 26,400

|

$24.93

-5.66%

|

3/15/2013

|

$22.29

|

PP = $23.18

|

|

MB = $24.34

|

Most Recent Note - 4/26/2013 2:41:58 PM

Y - Pulling back on lighter volume today after wedging higher with without great volume conviction behind recent gains. Action has not been indicative of fresh institutional buying demand, yet no resistance remains due to overhead supply.

>>> The latest Featured Stock Update with an annotated graph appeared on 4/9/2013. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

MWIV

-

NASDAQ

M W I Veterinary Supply

HEALTH SERVICES - Medical Instruments and; Supplies

|

$118.78

|

+1.95

1.67% |

$119.74

|

46,842

83.80% of 50 DAV

50 DAV is 55,900

|

$137.18

-13.41%

|

3/4/2013

|

$130.90

|

PP = $129.45

|

|

MB = $135.92

|

Most Recent Note - 4/24/2013 5:40:57 PM

G - Slumped near November highs defining near-term support while slumping further below its 50 DMA line. See the latest FSU analysis for more details and a new annotated graph.

>>> The latest Featured Stock Update with an annotated graph appeared on 4/24/2013. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

N

-

NYSE

Netsuite Inc

DIVERSIFIED SERVICES - Business/Management Services

|

$88.70

|

+2.95

3.44% |

$89.19

|

572,892

153.02% of 50 DAV

50 DAV is 374,400

|

$86.64

2.38%

|

12/12/2012

|

$64.75

|

PP = $67.12

|

|

MB = $70.48

|

Most Recent Note - 4/29/2013 12:22:08 PM

Most Recent Note - 4/29/2013 12:22:08 PM

G - Reported earnings -33% on +32% sales revenues for the Mar '13 quarter, marking a 2nd consecutive quarterly comparison with earnings below the +25% minimum guideline (C criteria). Despite fundamental concerns raised it is rallying for another new all-time high with today's 5th consecutive gain. Its 50 DMA line defines important near-term support to watch.

>>> The latest Featured Stock Update with an annotated graph appeared on 4/22/2013. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

RRTS

-

NYSE

Roadrunner Trans Systems

TRANSPORTATION - Air Delivery and Freight Service

|

$22.66

|

-0.11

-0.48% |

$22.87

|

88,889

50.76% of 50 DAV

50 DAV is 175,100

|

$23.88

-5.11%

|

4/3/2013

|

$22.77

|

PP = $23.75

|

|

MB = $24.94

|

Most Recent Note - 4/23/2013 8:58:25 PM

G - Still sputtering below its 50 DMA line after failing to trigger a new buy signal since featured on 4/03/13. A rebound above that important short-term average would help its outlook improve. See the latest FSU analysis for more details and a new annotated graph.

>>> The latest Featured Stock Update with an annotated graph appeared on 4/23/2013. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

VRX

-

NYSE

Valeant Pharmaceuticals

DRUGS - Drug Manufacturers - Other

|

$75.94

|

+2.78

3.80% |

$76.57

|

3,607,445

262.02% of 50 DAV

50 DAV is 1,376,800

|

$76.56

-0.81%

|

12/20/2012

|

$60.24

|

PP = $61.21

|

|

MB = $64.27

|

Most Recent Note - 4/29/2013 12:42:36 PM

Most Recent Note - 4/29/2013 12:42:36 PM

G - Gapped up today. It has formed a short square box base and the color code is changed to green with new pivot point cited based on its 4/02/13 high plus 10 cents. A volume-driven gain above its pivot point may trigger a new (or add-on) technical buy signal. Its 50 DMA line defines near-term support above recent the recent low ($69.87 on 4/04/13) where violations may trigger technical sell signals.

>>> The latest Featured Stock Update with an annotated graph appeared on 4/8/2013. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

|

|

|

THESE ARE NOT BUY RECOMMENDATIONS!

Comments contained in the body of this report are technical

opinions only. The material herein has been obtained

from sources believed to be reliable and accurate, however,

its accuracy and completeness cannot be guaranteed.

This site is not an investment advisor, hence it does

not endorse or recommend any securities or other investments.

Any recommendation contained in this report may not

be suitable for all investors and it is not to be deemed

an offer or solicitation on our part with respect to

the purchase or sale of any securities. All trademarks,

service marks and trade names appearing in this report

are the property of their respective owners, and are

likewise used for identification purposes only.

This report is a service available

only to active Paid Premium Members.

You may opt-out of receiving report notifications

at any time. Questions or comments may be submitted

by writing to Premium Membership Services 665 S.E. 10 Street, Suite 201 Deerfield Beach, FL 33441-5634 or by calling 1-800-965-8307

or 954-785-1121.

|

|

|