You are not logged in.

This means you

CAN ONLY VIEW reports that were published prior to Monday, April 14, 2025.

You

MUST UPGRADE YOUR MEMBERSHIP if you want to see any current reports.

AFTER MARKET UPDATE - FRIDAY, APRIL 15TH, 2011

Previous After Market Report Next After Market Report >>>

|

|

|

|

DOW |

+56.68 |

12,341.83 |

+0.46% |

|

Volume |

1,046,910,310 |

+13% |

|

Volume |

1,738,414,770 |

+4% |

|

NASDAQ |

+4.43 |

2,764.65 |

+0.16% |

|

Advancers |

2,049 |

66% |

|

Advancers |

1,700 |

63% |

|

S&P 500 |

+5.16 |

1,319.68 |

+0.39% |

|

Decliners |

949 |

30% |

|

Decliners |

900 |

33% |

|

Russell 2000 |

+7.51 |

834.98 |

+0.91% |

|

52 Wk Highs |

108 |

|

|

52 Wk Highs |

84 |

|

|

S&P 600 |

+3.99 |

442.10 |

+0.91% |

|

52 Wk Lows |

14 |

|

|

52 Wk Lows |

33 |

|

|

|

Major Indices Made A Stand at Their 50-Day Averages

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

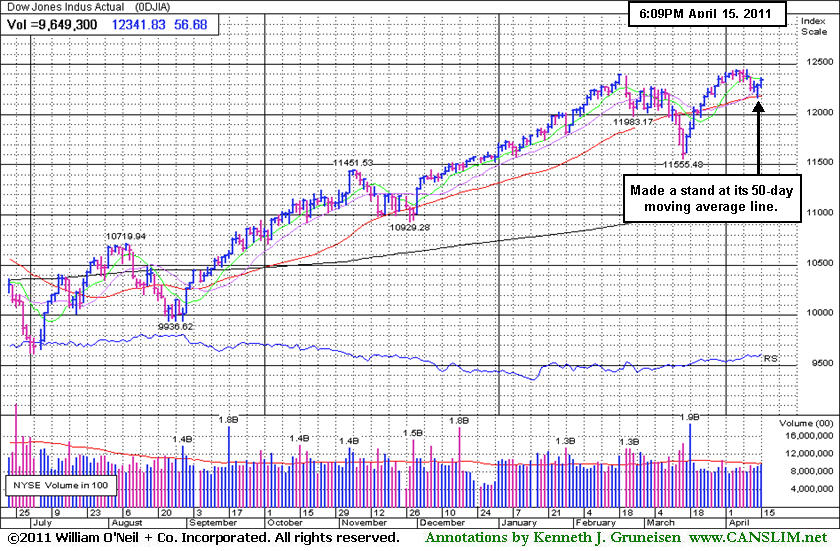

For the week, the Dow Jones Industrial Average lost -0.3%, meanwhile the benchmark S&P 500 Index and the tech-heavy Nasdaq Composite Index were both down -0.6%. Behind Friday's gains for the major averages the volume totals were higher on the NYSE and on the Nasdaq exchange, a sign that institutional investors were accumulating stocks. Advancing issues beat decliners by 2-1 on the NYSE and by 9-5 on the Nasdaq. New 52-week highs solidly outnumbered new 52-week lows on the NYSE, and on the Nasdaq exchange. There were 48 high-ranked companies from the CANSLIM.net Leaders List that made new 52-week highs and appeared on the CANSLIM.net BreakOuts Page, up meaningfully from the total of 28 on the prior session. On the Featured Stocks Page there were gains from 16 of the 21 high-ranked market leaders currently listed.

Positive economic data overcame disappointing earnings. Economic reports signaled manufacturing continues to expand and consumer confidence is improving. March industrial production grew 0.8%, more than expected. The Empire state manufacturing index, a measure of factory activity in the New York state region, increased in April at a faster pace. The University of Michigan’s first reading of consumer sentiment for April also was higher than forecast. On the inflation front, the core consumer price index excluding food and energy rose only 0.1% in March. Analysts had been looking for a gain of 0.2%.

Treasuries advanced and gold hit a new record above $1,480 per ounce. Speculation increased that Europe’s sovereign-debt crisis may worsen.

Bank of America (BAC -2.36%) reported its first profit in three quarters and news that it settled more claims tied to faulty mortgages, but the bank's Chief Executive Brian Moynihan said a dividend hike might not come until next year. Google Inc (GOOG -8.26%) reported disappointing earnings as expenses rose. Keep in mind that earnings announcements will likely be the catalysts for increased volatility for the next couple of weeks.

Leadership (new highs totals) has expanded reassuringly since this commentary cited the newspaper's reference to the current market environment as an "uptrend under pressure" after Tuesday's damaging losses.

PICTURED: The Dow Jones Industrial Average made a stand at its 50-day moving average (DMA) line. The other major averages also found support near their respective 50 DMA lines in the past week.

|

Kenneth J. Gruneisen started out as a licensed stockbroker in August 1987, a couple of months prior to the historic stock market crash that took the Dow Jones Industrial Average down -22.6% in a single day. He has published daily fact-based fundamental and technical analysis on high-ranked stocks online for two decades. Through FACTBASEDINVESTING.COM, Kenneth provides educational articles, news, market commentary, and other information regarding proven investment systems that work in good times and bad.

Kenneth J. Gruneisen started out as a licensed stockbroker in August 1987, a couple of months prior to the historic stock market crash that took the Dow Jones Industrial Average down -22.6% in a single day. He has published daily fact-based fundamental and technical analysis on high-ranked stocks online for two decades. Through FACTBASEDINVESTING.COM, Kenneth provides educational articles, news, market commentary, and other information regarding proven investment systems that work in good times and bad.

Comments contained in the body of this report are technical opinions only and are not necessarily those of Gruneisen Growth Corp. The material herein has been obtained from sources believed to be reliable and accurate, however, its accuracy and completeness cannot be guaranteed. Our firm, employees, and customers may effect transactions, including transactions contrary to any recommendation herein, or have positions in the securities mentioned herein or options with respect thereto. Any recommendation contained in this report may not be suitable for all investors and it is not to be deemed an offer or solicitation on our part with respect to the purchase or sale of any securities. |

|

|

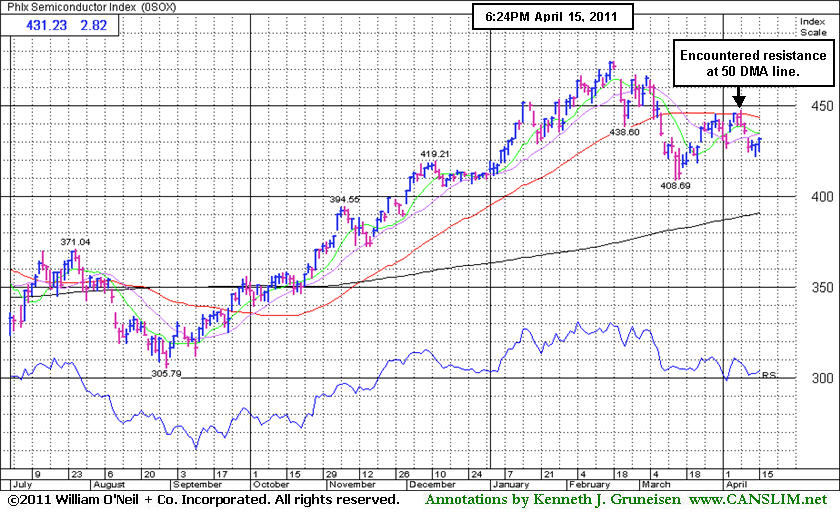

Semiconductor Index Still Sputtering Below 50-Day Average

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

The Bank Index ($BKX -0.16%) ended slightly lower, however gains from the Broker/Dealer Index ($XBD +0.86%) and Retail Index ($RLX +0.26%) had an important positive influence on the major averages on Friday. The Biotechnology Index ($BTK +1.32%) and Semiconductor Index ($SOX +0.66%) also posted helpful gains, but weakness from the Internet Index ($IIX -0.29%) and Networking Index ($NWX -0.17%) created a drag in the tech sector. Modest gains in energy-related shares boosted the Oil Services Index ($OSX +0.32%) and Integrated Oil Index ($XOI +0.51%). Defensive groups were mixed as the Gold & Silver Index ($XAU -0.21%) inched lower, meanwhile the Healthcare Index ($HMO +0.13%) inched higher.

Charts courtesy www.stockcharts.com

PICTURED: The Semiconductor Index ($SOX +0.66%) recently encountered resistance at its 50-day moving average line. Subsequent gains above that important short-term average would bode well for tech stocks, meanwhile, any slump below its March lows would likely coincide with numerous individual breakdowns within in the tech sector.

| Oil Services |

$OSX |

283.10 |

+0.89 |

+0.32% |

+15.49% |

| Healthcare |

$HMO |

2,172.77 |

+2.84 |

+0.13% |

+28.41% |

| Integrated Oil |

$XOI |

1,340.65 |

+6.83 |

+0.51% |

+10.51% |

| Semiconductor |

$SOX |

431.23 |

+2.82 |

+0.66% |

+4.71% |

| Networking |

$NWX |

327.25 |

-0.56 |

-0.17% |

+16.64% |

| Internet |

$IIX |

317.00 |

-0.92 |

-0.29% |

+3.01% |

| Broker/Dealer |

$XBD |

120.03 |

+1.02 |

+0.86% |

-1.22% |

| Retail |

$RLX |

528.39 |

+1.37 |

+0.26% |

+3.94% |

| Gold & Silver |

$XAU |

218.71 |

-0.47 |

-0.21% |

-3.47% |

| Bank |

$BKX |

51.13 |

-0.08 |

-0.16% |

-2.07% |

| Biotech |

$BTK |

1,427.65 |

+18.56 |

+1.32% |

+10.02% |

|

|

|

|

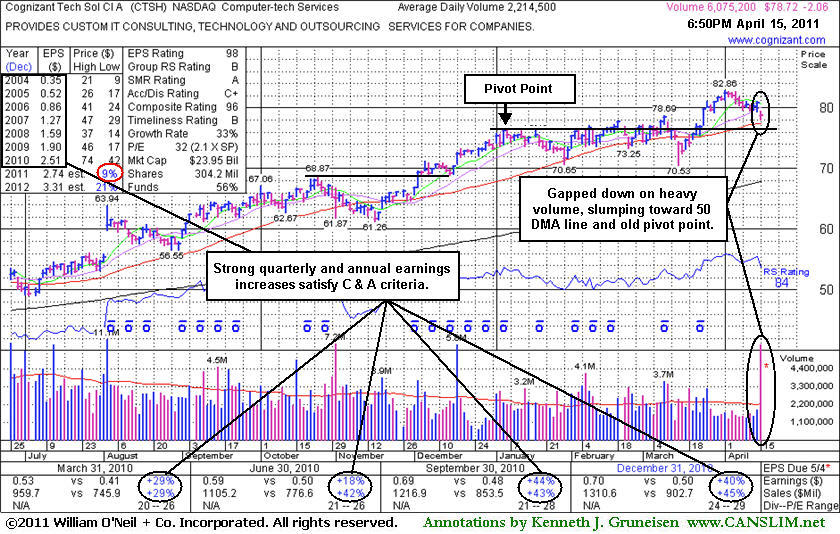

Collateral Damage Hurts IT Firm's Shares

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

Cognizant Technology Solutions Corp. (CTSH -$2.06 or -2.55% to $78.72) suffered collateral damage today. It gapped down for a damaging loss on high volume, testing support at prior highs in the $77-78 area previously noted as chart support to watch above its 50-day moving average (DMA) line. A prominent competitor, India-based Infosys Technologies (INFY -13.42%), sank after giving disappointing guidance, putting pressure on other IT companies' shares.

Since its gain with +40% above average volume on 2/08/11 cleared a short flat base, the high-ranked leader hailing from the strong Computer-tech Services group has given investors mixed signals. It sputtered along above its 50 DMA, then a gap down and shakeout on 3/15/11 below its 50 DMA line briefly undercut its January low, yet it found prompt support and soon repaired that 50 DMA violation. Then it surged to a new all-time high again with heavy volume behind its gains in late March.

Along with the concerns raised by the latest damaging loss, the low Street earnings estimates (see red circle) for FY '11 may be cause for concern. It is already a familiar name to the institutional crowd too. In fact, the number of top-rated funds owning its shares waned from 1,658 in Dec '10 to 1,612 in Mar '11. Additional losses would make it increasingly harder to give it the benefit of the doubt, especially when compared to a fresh new breakout with healthy characteristics.

|

|

|

Color Codes Explained :

Y - Better candidates highlighted by our

staff of experts.

G - Previously featured

in past reports as yellow but may no longer be buyable under the

guidelines.

***Last / Change / Volume data in this table is the closing quote data***

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

AIXG

-

NASDAQ

Aixtron Se

ELECTRONICS - Semiconductor Equipment andamp; Mate

|

$41.39

|

-0.17

-0.41% |

$41.55

|

191,121

76.88% of 50 DAV

50 DAV is 248,600

|

$44.96

-7.94%

|

4/5/2011

|

$44.14

|

PP = $44.64

|

|

MB = $46.87

|

Most Recent Note - 4/14/2011 12:11:42 PM

G - Gapped down today violating its 50 DMA line, raising concerns. Color code is changed to green based on weak action, meanwhile the next support level to watch is prior lows in the $38 area. Only a prompt rebound above its short-term average would help its outlook. As previously noted - "Disciplined investors watch for proof of institutional buying demand and avoid the urge to get in 'early'".

>>> The latest Featured Stock Update with an annotated graph appeared on 4/5/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

BIDU

-

NASDAQ

Baidu Inc Ads

INTERNET - Internet Information Providers

|

$146.81

|

-0.20

-0.14% |

$147.30

|

5,677,537

82.65% of 50 DAV

50 DAV is 6,869,400

|

$148.92

-1.42%

|

3/17/2011

|

$121.97

|

PP = $131.73

|

|

MB = $138.32

|

Most Recent Note - 4/14/2011 12:19:43 PM

G - Holding its ground today after a gain yesterday with above average volume for a best-ever close. It is extended from its latest base, and the prior high near $131 defines initial chart support to watch above its 50 DMA line.

>>> The latest Featured Stock Update with an annotated graph appeared on 4/7/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

CMG

-

NYSE

Chipotle Mexican Grill

LEISURE - Restaurants

|

$285.13

|

+2.22

0.78% |

$285.45

|

910,773

80.50% of 50 DAV

50 DAV is 1,131,400

|

$285.97

-0.29%

|

4/1/2011

|

$274.00

|

PP = $275.10

|

|

MB = $288.86

|

Most Recent Note - 4/15/2011 4:07:45 PM

Most Recent Note - 4/15/2011 4:07:45 PM

Y - Today's 4th consecutive small gain with below average volume helped it wedge higher for a new all-time high close. The investment system requires a gain above a stock's pivot point with volume +40-50% above average, or preferably much heavier, to trigger a proper technical buy signal. Its 50 DMA line ($258.98 now) defines important chart support to watch.

>>> The latest Featured Stock Update with an annotated graph appeared on 4/13/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

CTCT

-

NASDAQ

Constant Contact Inc

MEDIA - Advertising Services

|

$33.00

|

-1.29

-3.76% |

$33.29

|

2,216,068

522.66% of 50 DAV

50 DAV is 424,000

|

$36.33

-9.17%

|

3/22/2011

|

$33.59

|

PP = $32.49

|

|

MB = $34.11

|

Most Recent Note - 4/15/2011 12:49:32 PM

Most Recent Note - 4/15/2011 12:49:32 PM

G - After an analyst downgrade it gapped down today for a considerable loss on heavy volume, violating prior highs in the $32 area and slicing below its 50 DMA line. It found prompt support and has rebounded above the old highs and its 50 DMA line, now -3.7% and at the session high after trading -13.9% earlier. Due to report earnings after the close on Thursday, April 28th.

>>> The latest Featured Stock Update with an annotated graph appeared on 3/22/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

CTSH

-

NASDAQ

Cognizant Tech Sol Cl A

COMPUTER SOFTWARE and SERVICES - Business Software and Services

|

$78.72

|

-2.06

-2.55% |

$79.51

|

6,104,362

275.65% of 50 DAV

50 DAV is 2,214,500

|

$82.86

-5.00%

|

2/7/2011

|

$75.09

|

PP = $76.46

|

|

MB = $80.28

|

Most Recent Note - 4/15/2011 7:27:44 PM

Most Recent Note - 4/15/2011 7:27:44 PM

G - Gapped down today for a damaging loss on high volume, testing support at prior highs in the $77-78 area previously noted as chart support to watch above its 50 DMA line. See the latest FSU analysis for more details and a new annotated graph.

>>> The latest Featured Stock Update with an annotated graph appeared on 4/15/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

DECK

-

NASDAQ

Deckers Outdoor Corp

CONSUMER NON-DURABLES - Textile - Apparel Footwear

|

$94.27

|

+2.54

2.76% |

$95.49

|

1,784,897

131.54% of 50 DAV

50 DAV is 1,356,900

|

$94.70

-0.45%

|

2/3/2011

|

$79.61

|

PP = $82.67

|

|

MB = $86.80

|

Most Recent Note - 4/15/2011 12:53:02 PM

Most Recent Note - 4/15/2011 12:53:02 PM

G - Rallying for a new all-time high today after rising from the shorter than minimum length "cup-with-handle" type consolidation previously noted. It is clear of resistance due to overhead supply. Its 50 DMA line defines initial chart support to watch.

>>> The latest Featured Stock Update with an annotated graph appeared on 4/6/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

EZPW

-

NASDAQ

Ezcorp Inc Cl A

SPECIALTY RETAIL - Specialty Retail, Other

|

$28.91

|

+0.44

1.55% |

$29.00

|

243,865

70.85% of 50 DAV

50 DAV is 344,200

|

$33.08

-12.61%

|

2/18/2011

|

$27.94

|

PP = $30.04

|

|

MB = $31.54

|

Most Recent Note - 4/13/2011 4:28:32 PM

G - Down again today with higher volume, slumping further below its 50 DMA line. Damaging losses triggered technical sell signals while it slumped below its prior high closes in the $29-30 area previously noted as important support to watch.

>>> The latest Featured Stock Update with an annotated graph appeared on 4/11/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

FOSL

-

NASDAQ

Fossil Inc

CONSUMER DURABLES - Recreational Goods, Other

|

$94.48

|

+0.85

0.90% |

$94.53

|

548,230

54.80% of 50 DAV

50 DAV is 1,000,500

|

$95.39

-0.95%

|

2/1/2011

|

$73.30

|

PP = $74.44

|

|

MB = $78.16

|

Most Recent Note - 4/13/2011 4:55:47 PM

G - Gain with average volume today for a best-ever close. It has rallied more than +108% higher in 8 months since first featured in yellow in the 8/10/10 mid-day report (read here). It could produce more climactic gains, but recently it has been noted - "Extended from any sound base. Prior highs in the $83-85 area define chart support to watch above its 50 DMA line."

>>> The latest Featured Stock Update with an annotated graph appeared on 3/30/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

HMSY

-

NASDAQ

H M S Holdings Corp

COMPUTER SOFTWARE and SERVICES - Healthcare Information Service

|

$82.08

|

+0.63

0.77% |

$82.22

|

94,148

58.81% of 50 DAV

50 DAV is 160,100

|

$84.82

-3.23%

|

11/19/2010

|

$61.89

|

PP = $63.01

|

|

MB = $66.16

|

Most Recent Note - 4/14/2011 5:16:42 PM

G - Perched -4.0% below its all-time high with volume totals cooling in recent weeks. It is extended from any sound base pattern. Its 50 DMA line ($77.12 now) defines support to watch on pullbacks.

>>> The latest Featured Stock Update with an annotated graph appeared on 3/25/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

HS

-

NYSE

Healthspring Inc

HEALTH SERVICES - Health Care Plans

|

$38.54

|

+0.63

1.66% |

$38.77

|

643,552

74.00% of 50 DAV

50 DAV is 869,700

|

$40.78

-5.49%

|

3/22/2011

|

$38.29

|

PP = $38.85

|

|

MB = $40.79

|

Most Recent Note - 4/14/2011 5:20:46 PM

Y - It managed a positive reversal today for a gain on higher volume after a small gap down. Its pullback below its pivot point technically negated its 4/01/11 breakout. Its nearby 50 DMA line ($36.49 now) defines important support above recent lows in the $35.50 area.

>>> The latest Featured Stock Update with an annotated graph appeared on 3/23/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

INFA

-

NASDAQ

Informatica Corp

COMPUTER SOFTWARE and SERVICES - Business Software and Services

|

$53.09

|

+0.02

0.04% |

$53.36

|

833,253

98.31% of 50 DAV

50 DAV is 847,600

|

$53.95

-1.59%

|

3/24/2011

|

$50.04

|

PP = $49.86

|

|

MB = $52.35

|

Most Recent Note - 4/13/2011 5:08:37 PM

G - Considerable gain today with more than 2 times average volume for a new high. Color code is changed to green after rallying beyond its max buy level. Prior highs in the $49 area define support to watch coinciding with its 50 DMA line. Subsequent violations would raise concerns and may trigger technical sell signals.

>>> The latest Featured Stock Update with an annotated graph appeared on 3/28/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

LULU

-

NASDAQ

Lululemon Athletica

MANUFACTURING - Textile Manufacturing

|

$93.28

|

+1.26

1.36% |

$93.94

|

1,501,176

64.78% of 50 DAV

50 DAV is 2,317,500

|

$94.98

-1.79%

|

3/28/2011

|

$68.11

|

PP = $85.38

|

|

MB = $89.65

|

Most Recent Note - 4/13/2011 5:10:36 PM

G - Up today on light volume for its second-best close ever. Prior highs in the $85 area define initial chart support to watch.

>>> The latest Featured Stock Update with an annotated graph appeared on 3/31/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

MG

-

NYSE

Mistras Group Inc

DIVERSIFIED SERVICES - Bulding and Faci;ity Management Services

|

$17.88

|

+0.14

0.79% |

$17.90

|

188,200

152.76% of 50 DAV

50 DAV is 123,200

|

$18.22

-1.87%

|

3/15/2011

|

$15.48

|

PP = $15.90

|

|

MB = $16.70

|

Most Recent Note - 4/15/2011 1:05:51 PM

Most Recent Note - 4/15/2011 1:05:51 PM

G - Holding its ground today following a considerable gap up gain on 4/14/11 for a new all-time high. It is extended from any sound base pattern, meanwhile its 50 DMA line and prior highs define important support to watch. Recently reported earnings +200% on +23% sales revenues for the quarter ended February 28, 2011 versus the year-ago period.

>>> The latest Featured Stock Update with an annotated graph appeared on 4/12/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

MWIV

-

NASDAQ

M W I Veterinary Supply

HEALTH SERVICES - Medical Instruments and; Supplies

|

$81.03

|

+1.12

1.40% |

$81.63

|

141,556

148.38% of 50 DAV

50 DAV is 95,400

|

$80.86

0.21%

|

11/4/2010

|

$61.79

|

PP = $59.60

|

|

MB = $62.58

|

Most Recent Note - 4/15/2011 4:09:52 PM

Most Recent Note - 4/15/2011 4:09:52 PM

G - Up today with above average volume for another new all-time high. Its 50 DMA line defines important support to watch. It has been repeatedly noted - "Extended from any sound base pattern."

>>> The latest Featured Stock Update with an annotated graph appeared on 4/8/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

OPEN

-

NASDAQ

Opentable Inc

INTERNET - Internet Software and Services

|

$105.00

|

+0.26

0.25% |

$106.31

|

1,076,822

82.85% of 50 DAV

50 DAV is 1,299,700

|

$112.78

-6.90%

|

3/17/2011

|

$90.71

|

PP = $96.07

|

|

MB = $100.87

|

Most Recent Note - 4/14/2011 1:30:16 PM

G - Small gap down today. Repeatedly noted - "Extended from its latest base. Prior highs near $96 and its 50 DMA line define support to watch on pullbacks.

>>> The latest Featured Stock Update with an annotated graph appeared on 3/24/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

PAY

-

NYSE

Verifone Systems Inc

COMPUTER HARDWARE - Transaction Automation Systems

|

$53.77

|

-0.23

-0.43% |

$54.72

|

2,726,770

118.07% of 50 DAV

50 DAV is 2,309,400

|

$58.88

-8.68%

|

1/27/2011

|

$41.77

|

PP = $44.97

|

|

MB = $47.22

|

Most Recent Note - 4/15/2011 1:09:07 PM

Most Recent Note - 4/15/2011 1:09:07 PM

G - A positive reversal on 4/12/11 was a reassuring sign of support, but it is extended from any sound base pattern while consolidating well above its 50 DMA line ($50.11 now). That short-term average defines important chart support to watch.

>>> The latest Featured Stock Update with an annotated graph appeared on 4/4/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

PCLN

-

NASDAQ

Priceline.Com Inc

INTERNET - Internet Software and Services

|

$520.07

|

+7.42

1.45% |

$520.34

|

933,145

77.82% of 50 DAV

50 DAV is 1,199,100

|

$522.00

-0.37%

|

1/3/2011

|

$399.55

|

PP = $428.20

|

|

MB = $449.61

|

Most Recent Note - 4/14/2011 3:43:37 PM

G - It recently stalled after wedging to new 52-week highs without great volume conviction. It as been repeatedly noted - "Extended from any sound base pattern. Its 50 DMA line has defined support throughout its advance."

>>> The latest Featured Stock Update with an annotated graph appeared on 3/21/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

RAX

-

NYSE

Rackspace Hosting Inc

INTERNET - Internet Software and; Services

|

$43.00

|

+1.40

3.37% |

$43.11

|

1,507,901

87.19% of 50 DAV

50 DAV is 1,729,400

|

$44.19

-2.69%

|

3/16/2011

|

$36.28

|

PP = $40.72

|

|

MB = $42.76

|

Most Recent Note - 4/15/2011 4:00:47 PM

Most Recent Note - 4/15/2011 4:00:47 PM

G - Volume totals have been below average in the past week while consolidating above prior highs near $40 defining important chart support to watch above its 50 DMA line. The investment system permits investors to accumulate shares on light volume pullbacks, but research has proven that odds are best for a successful trade when buying is done as a stock is moving up in price rather than pulling back.

>>> The latest Featured Stock Update with an annotated graph appeared on 3/16/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

TIBX

-

NASDAQ

Tibco Software Inc

COMPUTER SOFTWARE and SERVICES - Business Software and Services

|

$29.52

|

+0.43

1.48% |

$29.54

|

2,727,022

115.29% of 50 DAV

50 DAV is 2,365,300

|

$29.85

-1.11%

|

3/18/2011

|

$23.88

|

PP = $26.04

|

|

MB = $27.34

|

Most Recent Note - 4/14/2011 6:42:08 PM

G - Finished near the session high for a best-ever close today, getting more extended from a sound base after a spurt of volume-driven gains. Support is defined by prior highs in the $25-26 area and its 50 DMA line. See the latest FSU analysis for more details and a new annotated graph.

>>> The latest Featured Stock Update with an annotated graph appeared on 4/14/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

UA

-

NYSE

Under Armour Inc Cl A

CONSUMER NON-DURABLES - Textile - Apparel Clothing

|

$73.87

|

+0.46

0.63% |

$74.40

|

421,464

53.63% of 50 DAV

50 DAV is 785,900

|

$76.85

-3.88%

|

3/31/2011

|

$68.04

|

PP = $70.79

|

|

MB = $74.33

|

Most Recent Note - 4/14/2011 5:12:10 PM

G - Small loss today with lighter than average volume, consolidating below its "max buy" level. The investment system permits investors to accumulate shares on light volume pullbacks, but research has proven that odds are best for a successful trade when buying is done as a stock is moving up in price rather than pulling back No overhead supply remaining to act as resistance. Following its 4/01/11 technical breakout, its prior highs in the $70 area define support to watch.

>>> The latest Featured Stock Update with an annotated graph appeared on 4/1/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

ULTA

-

NASDAQ

Ulta Salon Cosm & Frag

SPECIALTY RETAIL - Specialty Retail, Other

|

$50.07

|

+0.48

0.97% |

$50.43

|

551,024

87.95% of 50 DAV

50 DAV is 626,500

|

$51.82

-3.38%

|

1/6/2011

|

$36.12

|

PP = $37.34

|

|

MB = $39.21

|

Most Recent Note - 4/14/2011 5:14:32 PM

G - Quietly consolidating just -4.3% off its all-time high today. It is extended from any sound base. Prior highs and its 50 DMA line define chart support to watch near the $44 level on pullbacks.

>>> The latest Featured Stock Update with an annotated graph appeared on 3/29/2011. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

|

|

|

THESE ARE NOT BUY RECOMMENDATIONS!

Comments contained in the body of this report are technical

opinions only. The material herein has been obtained

from sources believed to be reliable and accurate, however,

its accuracy and completeness cannot be guaranteed.

This site is not an investment advisor, hence it does

not endorse or recommend any securities or other investments.

Any recommendation contained in this report may not

be suitable for all investors and it is not to be deemed

an offer or solicitation on our part with respect to

the purchase or sale of any securities. All trademarks,

service marks and trade names appearing in this report

are the property of their respective owners, and are

likewise used for identification purposes only.

This report is a service available

only to active Paid Premium Members.

You may opt-out of receiving report notifications

at any time. Questions or comments may be submitted

by writing to Premium Membership Services 665 S.E. 10 Street, Suite 201 Deerfield Beach, FL 33441-5634 or by calling 1-800-965-8307

or 954-785-1121.

|

|

|