You are not logged in.

This means you

CAN ONLY VIEW reports that were published prior to Monday, April 14, 2025.

You

MUST UPGRADE YOUR MEMBERSHIP if you want to see any current reports.

AFTER MARKET UPDATE - MONDAY, MARCH 18TH, 2013

Previous After Market Report Next After Market Report >>>

|

|

|

|

DOW |

-62.05 |

14,452.06 |

-0.43% |

|

Volume |

676,207,050 |

-63% |

|

Volume |

1,482,727,510 |

-30% |

|

NASDAQ |

-11.48 |

3,237.59 |

-0.35% |

|

Advancers |

1,170 |

37% |

|

Advancers |

865 |

34% |

|

S&P 500 |

-8.60 |

1,552.10 |

-0.55% |

|

Decliners |

1,868 |

59% |

|

Decliners |

1,617 |

63% |

|

Russell 2000 |

-5.28 |

947.20 |

-0.55% |

|

52 Wk Highs |

166 |

|

|

52 Wk Highs |

105 |

|

|

S&P 600 |

-3.15 |

528.58 |

-0.59% |

|

52 Wk Lows |

19 |

|

|

52 Wk Lows |

15 |

|

|

|

Breadth Negative as Indices Fall on Lighter Volume

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

The equity markets ended Monday's session lower, albeit off their worst levels. The session had much lower volume totals reported versus the prior session totals on the NYSE and on the Nasdaq exchange, as Friday's totals were inflated by options expirations. Breadth was negative as decliners led advancers by a 3-2 margin on the NYSE and by nearly a 2-1 ratio on the Nasdaq exchange. The total number of stocks hitting new 52-week highs contracted but still easily outnumbered new 52-week lows on the NYSE and on the Nasdaq exchange. There were 45 high-ranked companies from the CANSLIM.net Leaders List making new 52-week highs and appearing on the CANSLIM.net BreakOuts Page, down from the prior session's total of 89 stocks. There were gains for 5 of the 16 high-ranked companies currently included on the Featured Stocks Page

Stocks were lower from the opening bell as investors digested discouraging news out of Europe. In an unexpected move, European finance ministers, the IMF and the Cypriot government placed a tax on Cypriot bank deposits, in return for bailout funding. The unprecedented move heightened concerns throughout the European Union that seizing deposits could potentially be part of future bailouts.

On our shores, housing data was disappointing. The NAHB housing market index unexpectedly fell for the third straight month in March to a five month low of 44. Nine of the 10 sectors on the S&P ended lower, led by declines in financials. Shares of Citigroup Inc (C -2.16%), JP Morgan Chase & Co (JPM -1.02%), and The Goldman Sachs Group Inc (GS -1.87%) fell. Material stocks also retreated after copper prices touched a four-month low which pushed Cliffs Natural Resources (CLF -1.45) shares lower. Gains in telecommunications helped limit losses as Verizon Communications Inc (VZ +1.52%) posted a gain. Hewlett-Packard Co (HPQ +2.93%) rose following an analyst's upgrade.

Turning to fixed income markets, Treasuries ended higher along the curve. The benchmark 10-year note was up 5/16 of a point to yield 1.96% and the 30-year bond gained 17/32 to yield 3.19%.

New buying efforts are justified under the fact-based system since a follow-through day on 3/05/13 shifted the market's (M criteria) direction to a confirmed rally again after a brief correction. Any sustainable rally requires a healthy crop of companies hitting new 52-week highs, so it is always essential to see meaningful leadership (stocks hitting new 52-week highs).

Watch for an announcement via email concerning the next WEBCAST. The webcast will also be available via an updated link highlighted at the top of the Premium Member Homepage.

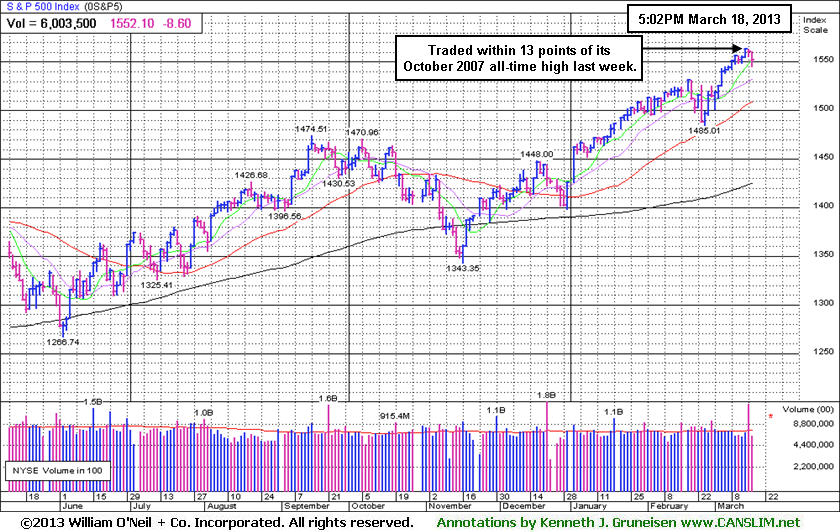

PICTURED: The S&P 500 Index traded within 13 points of its October 2007 all-time high last week.

|

Kenneth J. Gruneisen started out as a licensed stockbroker in August 1987, a couple of months prior to the historic stock market crash that took the Dow Jones Industrial Average down -22.6% in a single day. He has published daily fact-based fundamental and technical analysis on high-ranked stocks online for two decades. Through FACTBASEDINVESTING.COM, Kenneth provides educational articles, news, market commentary, and other information regarding proven investment systems that work in good times and bad.

Kenneth J. Gruneisen started out as a licensed stockbroker in August 1987, a couple of months prior to the historic stock market crash that took the Dow Jones Industrial Average down -22.6% in a single day. He has published daily fact-based fundamental and technical analysis on high-ranked stocks online for two decades. Through FACTBASEDINVESTING.COM, Kenneth provides educational articles, news, market commentary, and other information regarding proven investment systems that work in good times and bad.

Comments contained in the body of this report are technical opinions only and are not necessarily those of Gruneisen Growth Corp. The material herein has been obtained from sources believed to be reliable and accurate, however, its accuracy and completeness cannot be guaranteed. Our firm, employees, and customers may effect transactions, including transactions contrary to any recommendation herein, or have positions in the securities mentioned herein or options with respect thereto. Any recommendation contained in this report may not be suitable for all investors and it is not to be deemed an offer or solicitation on our part with respect to the purchase or sale of any securities. |

|

|

Financial, Tech, and Energy-Related Shares Led Decliners

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

Weakness in financial shares weighed on the market as the Broker/Dealer Index ($XBD -1.05%) and Bank Index ($BKX -0.94%) pulled back. The tech sector also faced pressure as the Semiconductor Index ($SOX -1.33%), Networking Index ($NWX -0.96%), Biotechnology Index ($BTK -0.73%), and Internet Index ($IIX -0.53%) ended unanimously lower. Energy-related shares retreated as the Oil Services Index ($OSX -2.38%) outpaced the Integrated Oil Index ($XOI -0.51%) to the downside. The Retail Index ($RLX -0.36%) and Healthcare Index ($HMO -0.19%) also edged lower while the Gold & Silver Index ($XAU +0.23%) posted a small gain.

Charts courtesy www.stockcharts.com

PICTURED: The Internet Index ($IIX -0.53%) is testing an upward trendline connecting its November-February lows defining near-term support above its 50-day moving average (DMA) line.

| Oil Services |

$OSX |

243.73 |

-5.93 |

-2.38% |

+10.71% |

| Healthcare |

$HMO |

2,784.00 |

-5.39 |

-0.19% |

+10.73% |

| Integrated Oil |

$XOI |

1,353.95 |

-6.96 |

-0.51% |

+9.03% |

| Semiconductor |

$SOX |

428.39 |

-5.79 |

-1.33% |

+11.54% |

| Networking |

$NWX |

239.29 |

-2.33 |

-0.96% |

+5.62% |

| Internet |

$IIX |

362.82 |

-1.93 |

-0.53% |

+10.95% |

| Broker/Dealer |

$XBD |

109.84 |

-1.16 |

-1.05% |

+16.44% |

| Retail |

$RLX |

717.28 |

-2.60 |

-0.36% |

+9.83% |

| Gold & Silver |

$XAU |

134.77 |

+0.31 |

+0.23% |

-18.62% |

| Bank |

$BKX |

56.98 |

-0.54 |

-0.94% |

+11.12% |

| Biotech |

$BTK |

1,785.09 |

-13.04 |

-0.73% |

+15.39% |

|

|

|

|

Holding Ground in Tight Range Following Technical Breakout

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

Cardinal Financial Corp (CFNL -$0.02 or -0.11% to $17.77) has been holding its ground stubbornly in a tight range perched near its 52-week high since volume-driven gains recently cleared a "double bottom" base and triggered a technical buy signal. It is slightly extended from its prior base. Prior highs in the high $16 area define initial support to watch on pullbacks. It was last shown in this FSU section on 2/21/13 with an annotated graph under the headline, "Violation of 50-Day Moving Average on Light Volume", as it violated its 50-day moving average (DMA) line and finished the session at its low with a loss on below average volume. The deterioration raised concerns and triggered technical sell signal as it was then noted - "Only a prompt rebound above its 50 DMA line would help its outlook improve. It has been trading in a tight range in recent weeks without making meaningful progress above its latest pivot point. Meanwhile, more damaging losses leading to a slump below the recent low ($15.74 on 1/18/13) would raise more serious concerns and trigger an additional technical sell signal. Disciplined investors always limit losses if any stock ever falls more than -7% from their purchase price."

It stayed above the prior low noted and soon repaired its 50 DMA violation. Its rally on 3/07/13 was backed by volume +169% above average as it rose above the new pivot point cited based upon its 2/15/13 high, clearing a "double bottom" base and triggering a proper technical buy signal under the fact-based system. The high-ranked leader hailing from the Banks - Southeast industry group reported earnings +54% on +28% sales revenues for the quarter ended December 31, 2012 versus the year ago period, continuing its track record of strong quarterly earnings comparisons underpinned by encouraging sales revenues increases. It has earned the highest possible 99 Earnings Per Share (EPS) rank, and its high ranks and long term earnings history help it match favorably with the C and A criteria. The number of top-rated funds owning its shares rose from 172 in Sep '11 to 209 in Dec '12, a reassuring trend concerning the I criteria. Its small supply (S criteria) of only 29.3 millions shares outstanding is a favorable characteristic, yet it can contribute to greater price volatility in the event of institutional accumulation or distributional pressure.

|

|

|

Color Codes Explained :

Y - Better candidates highlighted by our

staff of experts.

G - Previously featured

in past reports as yellow but may no longer be buyable under the

guidelines.

***Last / Change / Volume data in this table is the closing quote data***

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

CELG

-

NASDAQ

Celgene Corp

DRUGS - Drug Manufacturers - Major

|

$111.90

|

-0.50

-0.44% |

$113.49

|

3,226,933

80.70% of 50 DAV

50 DAV is 3,998,800

|

$115.44

-3.07%

|

12/11/2012

|

$82.24

|

PP = $81.34

|

|

MB = $85.41

|

Most Recent Note - 3/12/2013 1:09:23 PM

G - Wedging further into new all-time high territory with today's 6th consecutive gain, getting very extended from any sound base. Its 50 DMA line defines important support to watch.

>>> The latest Featured Stock Update with an annotated graph appeared on 2/28/2013. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

CFNL

-

NASDAQ

Cardinal Financial Corp

BANKING - Regional - Southeast Banks

|

$17.77

|

-0.02

-0.11% |

$17.79

|

247,463

114.41% of 50 DAV

50 DAV is 216,300

|

$18.19

-2.31%

|

3/7/2013

|

$17.27

|

PP = $16.77

|

|

MB = $17.61

|

Most Recent Note - 3/15/2013 5:05:49 PM

G - Color code is changed to green while holding its ground stubbornly. Perched near its 52-week high since volume-driven gains last week cleared a "double bottom" base and triggered a technical buy signal. Prior highs in the high $16 area define initial support to watch on pullbacks.

>>> The latest Featured Stock Update with an annotated graph appeared on 3/18/2013. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

CMCSA

-

NASDAQ

Comcast Corp Cl A

MEDIA - CATV Systems

|

$40.37

|

-0.34

-0.84% |

$40.50

|

13,026,840

94.99% of 50 DAV

50 DAV is 13,714,400

|

$42.00

-3.88%

|

12/3/2012

|

$37.08

|

PP = $38.06

|

|

MB = $39.96

|

Most Recent Note - 3/15/2013 11:48:12 AM

G - Still consolidating above support at its 50 DMA line and perched very near its 52-week high. Fundamental concerns remain since it reported earnings +11% on +6% sales revenues for the Dec '12 quarter, below the +25% minimum earnings guideline (C criteria).

>>> The latest Featured Stock Update with an annotated graph appeared on 2/19/2013. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

CVLT

-

NASDAQ

Commvault Systems Inc

COMPUTER SOFTWARE and SERVICES - Business Software and Services

|

$82.45

|

-1.31

-1.56% |

$85.00

|

606,644

78.74% of 50 DAV

50 DAV is 770,400

|

$86.89

-5.11%

|

3/14/2013

|

$84.71

|

PP = $79.63

|

|

MB = $83.61

|

Most Recent Note - 3/14/2013 6:09:38 PM

Y - Finished the session with a solid gain backed by 4.5 times average volume while clearing the pivot point cited based on its 2/01/13 high plus 10 cents and hitting new 52-week highs. Found support at its 50 DMA line during its orderly consolidation. See the latest FSU analysis for more details and a new annotated graph.

>>> The latest Featured Stock Update with an annotated graph appeared on 3/14/2013. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

EVER

-

NYSE

Everbank Financial Corp

BANKING

|

$15.09

|

-0.40

-2.58% |

$15.32

|

930,513

108.53% of 50 DAV

50 DAV is 857,400

|

$17.29

-12.72%

|

3/4/2013

|

$15.38

|

PP = $15.83

|

|

MB = $16.62

|

Most Recent Note - 3/18/2013 3:29:36 PM

Most Recent Note - 3/18/2013 3:29:36 PM

G - Small gap down today trading near its 50 DMA line and its color code is changed to green. Damaging losses last week violated prior highs in the $16 area noted as initial chart support to watch, raising concerns and completely negating its prior technical breakout.

>>> The latest Featured Stock Update with an annotated graph appeared on 3/4/2013. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

JAZZ

-

NASDAQ

Jazz Pharmaceuticals Plc

DRUGS - Biotechnology

|

$58.75

|

-0.50

-0.84% |

$59.59

|

511,474

96.60% of 50 DAV

50 DAV is 529,500

|

$60.79

-3.36%

|

3/5/2013

|

$59.10

|

PP = $60.10

|

|

MB = $63.11

|

Most Recent Note - 3/18/2013 5:52:46 PM

Most Recent Note - 3/18/2013 5:52:46 PM

Y - Still holding its ground perched near its 52-week high since completing a Secondary Offering on 3/05/13. Disciplined investors may watch for a volume-driven gain above the pivot point to trigger a technical buy signal before new buying efforts may be justified under the fact-based investment system.

>>> The latest Featured Stock Update with an annotated graph appeared on 3/7/2013. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

KORS

-

NYSE

Michael Kors Hldgs Ltd

RETAIL - Apparel Stores

|

$58.10

|

+0.72

1.25% |

$58.58

|

5,250,854

87.88% of 50 DAV

50 DAV is 5,975,100

|

$65.10

-10.75%

|

1/23/2013

|

$54.98

|

PP = $58.72

|

|

MB = $61.66

|

Most Recent Note - 3/13/2013 7:52:22 PM

Y - Color code is changed to yellow after rebounding above its 50 DMA line with today's volume-driven gain, improving its technical stance. Completed another Secondary Offering 2/20/13 while perched near its all-time high.

>>> The latest Featured Stock Update with an annotated graph appeared on 3/8/2013. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

LNKD

-

NYSE

Linkedin Corp Class A

INTERNET - Internet Information Providers

|

$174.28

|

-3.22

-1.81% |

$175.17

|

2,091,480

85.73% of 50 DAV

50 DAV is 2,439,500

|

$184.15

-5.36%

|

2/8/2013

|

$147.04

|

PP = $127.55

|

|

MB = $133.93

|

Most Recent Note - 3/14/2013 12:37:16 PM

G - Hit yet another new high with today's gain. Repeatedly noted - "Very extended from its prior base, but having rallied more than +20% in the first 2-3 weeks after its breakout, the investment system rules suggest holding such winners for a minimum of 8 weeks. See the latest FSU analysis for more details and a new annotated graph."

>>> The latest Featured Stock Update with an annotated graph appeared on 3/11/2013. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

LOPE

-

NASDAQ

Grand Canyon Education

DIVERSIFIED SERVICES - Education and; Training Services

|

$23.80

|

-0.23

-0.96% |

$24.04

|

247,988

53.06% of 50 DAV

50 DAV is 467,400

|

$27.18

-12.44%

|

2/20/2013

|

$26.44

|

PP = $25.10

|

|

MB = $26.36

|

Most Recent Note - 3/13/2013 7:49:45 PM

G - Consolidating near its 50 DMA line with volume totals cooling in recent weeks after it quickly negated the prior technical breakout. It has not formed a sound new base. See the latest FSU analysis for more details and a new annotated graph.

>>> The latest Featured Stock Update with an annotated graph appeared on 3/13/2013. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

MIDD

-

NASDAQ

Middleby Corp

MANUFACTURING - Diversified Machinery

|

$148.81

|

-1.18

-0.79% |

$149.99

|

88,427

95.91% of 50 DAV

50 DAV is 92,200

|

$154.74

-3.83%

|

10/8/2012

|

$118.46

|

PP = $122.67

|

|

MB = $128.80

|

Most Recent Note - 3/12/2013 1:52:24 PM

G - Still hovering near all-time highs today with volume totals cooling. Fundamental concerns were recently noted. Its 50 DMA line defines important near-term chart support.

>>> The latest Featured Stock Update with an annotated graph appeared on 2/25/2013. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

MRLN

-

NASDAQ

Marlin Business Services

DIVERSIFIED SERVICES - Rental and Leasing Services

|

$20.97

|

+0.01

0.05% |

$21.10

|

11,574

50.32% of 50 DAV

50 DAV is 23,000

|

$23.08

-9.14%

|

3/15/2013

|

$22.29

|

PP = $23.18

|

|

MB = $24.34

|

Most Recent Note - 3/18/2013 5:51:50 PM

Most Recent Note - 3/18/2013 5:51:50 PM

Y - Held its ground today following Friday's "negative reversal" and worrisome loss on above average volume. It was highlighted in yellow with pivot point cited based on its 9/21/12 high plus 10 cents in the 3/15/13 mid-day report (read here) and noted - "Disciplined investors may watch for subsequent volume-driven gains above the pivot point to trigger a technical buy signal before action may be justified under the fact-based investment system. Found support near its 200 DMA line in recent months and now rallying within close striking distance of its 52-week high. Recent quarterly comparisons through Dec '12 show strong earnings increases satisfying the C criteria. Annual earnings (A criteria) growth has improved following the downturn in FY '08 and '09." See the latest FSU analysis for more details and a new annotated graph.

>>> The latest Featured Stock Update with an annotated graph appeared on 3/15/2013. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

MWIV

-

NASDAQ

M W I Veterinary Supply

HEALTH SERVICES - Medical Instruments and; Supplies

|

$131.31

|

+2.07

1.60% |

$135.14

|

83,823

144.52% of 50 DAV

50 DAV is 58,000

|

$137.18

-4.28%

|

3/4/2013

|

$130.90

|

PP = $129.45

|

|

MB = $135.92

|

Most Recent Note - 3/18/2013 3:26:52 PM

Most Recent Note - 3/18/2013 3:26:52 PM

Y - Tallying a gain today after dipping below its pivot point late last week. Disciplined investors limit loses by selling if ever any stock fall more than -7% from their purchase price.

>>> The latest Featured Stock Update with an annotated graph appeared on 3/6/2013. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

N

-

NYSE

Netsuite Inc

DIVERSIFIED SERVICES - Business/Management Services

|

$75.81

|

-1.26

-1.63% |

$76.92

|

306,855

87.42% of 50 DAV

50 DAV is 351,000

|

$77.60

-2.31%

|

12/12/2012

|

$64.75

|

PP = $67.12

|

|

MB = $70.48

|

Most Recent Note - 3/15/2013 5:08:15 PM

G - Rose with above average volume today for another new 52-week and all-time high. Its 50 DMA line acted as support during the recent consolidation.

>>> The latest Featured Stock Update with an annotated graph appeared on 3/1/2013. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

NSR

-

NYSE

Neustar Inc

TELECOMMUNICATIONS - Diversified Communication Serv

|

$45.00

|

-0.09

-0.20% |

$45.37

|

309,006

70.12% of 50 DAV

50 DAV is 440,700

|

$47.24

-4.74%

|

3/8/2013

|

$44.99

|

PP = $47.34

|

|

MB = $49.71

|

Most Recent Note - 3/15/2013 3:52:25 PM

Y - Erased the prior session's gain today, retreating near its 50 DMA line. Volume-driven gains above the pivot point may trigger a new (or add-on) technical buy signal. The 2/21/13 low ($42.40) defines important near-term support where any subsequent deterioration would raise greater concerns and trigger a worrisome technical sell signal.

>>> The latest Featured Stock Update with an annotated graph appeared on 2/27/2013. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

SLCA

-

NYSE

U S Silica Holdings Inc

CHEMICALS - Specialty Chemicals

|

$22.76

|

+1.06

4.88% |

$23.25

|

4,628,485

560.69% of 50 DAV

50 DAV is 825,500

|

$28.50

-20.14%

|

2/26/2013

|

$22.23

|

PP = $21.50

|

|

MB = $22.58

|

Most Recent Note - 3/18/2013 3:25:01 PM

Most Recent Note - 3/18/2013 3:25:01 PM

G - Tallying a volume-driven gain today. Halted its slide following a gap down on 3/14/13 after pricing a Secondary Offering while retreating on heavy volume after a spurt of volume-driven gains into new 52-week high territory. Previously noted - "Very extended from its prior base, but having rallied more than +20% in the first 2-3 weeks after its breakout, the investment system rules suggest holding such winners for a minimum of 8 weeks."

>>> The latest Featured Stock Update with an annotated graph appeared on 2/26/2013. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

VRX

-

NYSE

Valeant Pharmaceuticals

DRUGS - Drug Manufacturers - Other

|

$70.54

|

+0.68

0.97% |

$70.74

|

1,113,798

87.68% of 50 DAV

50 DAV is 1,270,300

|

$71.49

-1.33%

|

12/20/2012

|

$60.24

|

PP = $61.21

|

|

MB = $64.27

|

Most Recent Note - 3/12/2013 2:00:03 PM

Y - Wedged higher with recent gains lacking great volume conviction, and holding its ground stubbornly. A valid secondary buy point exists following the successful test of support at its 10-week moving average up to as high as +5% above the recent high ($67.98 plus 5% or $71.38). Color code was changed to yellow however no new pivot point was cited since a new base was not formed. The 50 DMA line and recent low ($64.05 on 2/21/13) define important support areas to watch.

>>> The latest Featured Stock Update with an annotated graph appeared on 3/12/2013. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

|

|

|

THESE ARE NOT BUY RECOMMENDATIONS!

Comments contained in the body of this report are technical

opinions only. The material herein has been obtained

from sources believed to be reliable and accurate, however,

its accuracy and completeness cannot be guaranteed.

This site is not an investment advisor, hence it does

not endorse or recommend any securities or other investments.

Any recommendation contained in this report may not

be suitable for all investors and it is not to be deemed

an offer or solicitation on our part with respect to

the purchase or sale of any securities. All trademarks,

service marks and trade names appearing in this report

are the property of their respective owners, and are

likewise used for identification purposes only.

This report is a service available

only to active Paid Premium Members.

You may opt-out of receiving report notifications

at any time. Questions or comments may be submitted

by writing to Premium Membership Services 665 S.E. 10 Street, Suite 201 Deerfield Beach, FL 33441-5634 or by calling 1-800-965-8307

or 954-785-1121.

|

|

|