You are not logged in.

This means

you CAN ONLY VIEW reports that were published prior to Wednesday, April 9, 2025.

You

MUST UPGRADE YOUR MEMBERSHIP if you want to see any current reports.

MIDDAY BREAKOUTS REPORT - TUESDAY, MARCH 13TH, 2012 MIDDAY BREAKOUTS REPORT - TUESDAY, MARCH 13TH, 2012

Previous Mid Day Report Next Mid Day Report >>>

|

|

DOW 13061.81 102.1 (0.79%) | NASDAQ 3012.32 28.66 (0.96%) | S&P 500 1382.22 11.13 (0.81%)

|

Time of Screening :

3/13/2012 11:34:54 AM Report Released :

3/13/2012 12:07:40 PM

Price is:

Above 52W High and Less Than 52W High

but within 10% of the 52 Week High

Volume Is:

At least 75% of 50 Day Average at

the time of the screening.

More details about this report...

At around

mid-way through each trading day we run

a screen against our database of

high-ranked stocks, searching for

possible buy candidates that are trading

at or near their 52-week high on above

average volume. The results of that

screen are split into the two sections

you see below. The first, titled

"TODAY's FEATURED STOCKS" shows stocks

that our experts have recently

identified as among the strongest candidates to

consider. Stocks highlighted in yellow

are the most timely and noteworthy, so

particular attention and prompt action

may be appropriate. The second section,

titled "TODAY's BREAKOUT SCREEN" shows

the remainder of stocks meeting today's

screen parameters. Our experts have

reviewed and included notes on these

stocks as well, but found that they may

not match up as favorably.

|

|

Y - Today's strongest

candidates

highlighted

by our staff

of experts.

|

|

G - Previously featured in

this report as yellow and

now may no longer be buyable

under the guidelines.

|

|

|

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(50 DAV) |

52 Wk Hi

% From Hi |

Date

Featured |

Price

Featured |

Pivot Point |

|

Max Buy |

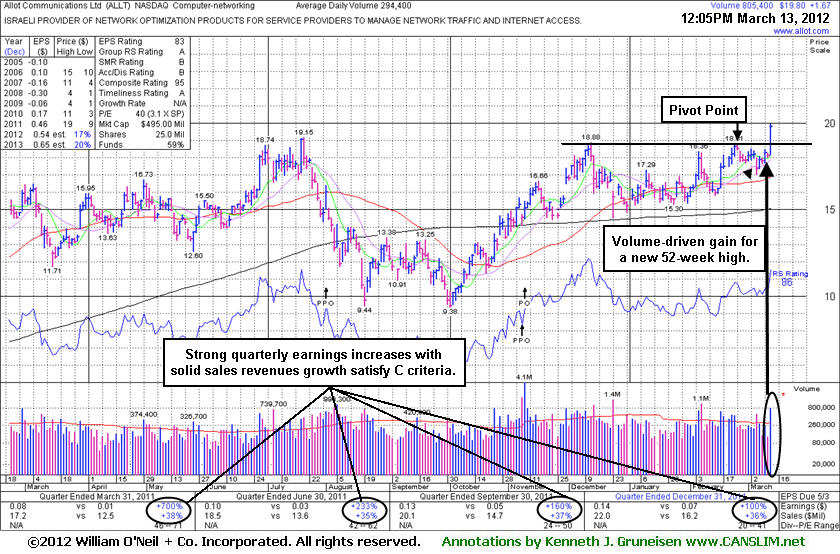

ALLT

- NASDAQ

Allot Communications Ltd

|

$19.72

|

+1.59

8.77%

|

$19.78

|

539,359

183.21% of 50 DAV

50 DAV is 294,400

|

$19.96

-1.20%

|

3/13/2012 |

$19.72

|

PP = $18.91

MB = $19.86 |

Most Recent Note - 3/13/2012 12:15:48 PM

Y - Hitting a new 52-week high today with a volume-driven gain, rising from an orderly 13-week base. Completed a new Public Offering on 11/09/11. It has attracted increasing interest from top-rated funds (I criteria). Quarterly comparisons have shown strong sales revenues and earnings increases satisfying the C criteria. This Israeli Computer - Networking firm showed good annual earnings increases in FY '10 & '11 after losses in prior years. Color code is changed to yellow with pivot point cited based on its 2/23/12 high plus 10 cents. A volume-driven gain and strong close above its pivot point may clinch a technical buy signal, and no overhead supply remains to act as resistance.

There are no Featured Stock Updates™ available for this stock at this time. You may request one by clicking the Request a New Note link below

|

|

View all notes |

Alert me of new notes |

Company Profile |

SEC |

News |

Chart | C

A N

S L

I M

|

GNC

- NYSE

G N C Holdings Inc

|

$33.84

|

+2.60

8.32%

|

$34.71

|

2,594,893

257.12% of 50 DAV

50 DAV is 1,009,200

|

$34.71

-2.51%

|

1/19/2012 |

$28.99

|

PP = $29.60

MB = $31.08 |

Most Recent Note - 3/13/2012 11:55:00 AM

G - Gapped up today after raising guidance based on stronger same store sales than previously expected. Hit a new all-time high following a brief consolidation above prior highs in the $29.50 area and its 50 DMA line defining near-term support to watch.

>>> The latest Featured Stock Update with an annotated graph appeared on 3/5/2012. Click here.

|

|

View all notes |

Alert me of new notes |

Company Profile |

SEC |

News |

Chart | C

A N

S L

I M

|

|

|

Symbol - Exchange - Industry Group

Company Name |

Last |

Chg |

Day

High |

52 WK Hi |

% From Hi |

Volume

% DAV |

DAV |

CECE

- NASDAQ - Pollution Control

Ceco Environmental

|

$8.41 |

-0.17

-1.98%

|

$8.60

|

$8.60

|

-2.21% |

31,243

122.52%

|

25,500

|

Most Recent Note for CECE - 3/13/2012 11:45:33 AM

Pulling back slightly today after tallying another big volume-driven gain on the prior session. The 3/09/12 mid-day report noted - "Gapped up and hit a new 52-week high today with a considerable volume-driven gain. Recent quarterly comparisons showed greatly improved earnings but the lack of sales revenues growth and erratic annual earnings (A criteria) history are fundamental flaws. Low-priced stocks are discouraged from consideration under the fact-based system unless all key criteria are solidly satisfied."

|

|

View all notes |

Alert me of new notes |

Company Profile |

SEC |

News |

Chart | C

A N

S L

I M

|

CHSP

- NYSE - Finance-Property REIT

Chesapeake Lodging Tr

|

$17.65 |

-0.06

-0.34%

|

$17.94

|

$18.18

|

-2.92% |

124,900

86.92%

|

143,700

|

Most Recent Note for CHSP - 3/13/2012 11:46:53 AM

Holding its ground after enduring distributional pressure while the 3/06/12 mid-day report noted - "Limited history is a concern although recent quarterly comparisons have shown strong sales revenues and earnings increases versus the year ago periods. This REIT has rebounded near its prior highs in the $19-20 area after a deep slump well below its 200 DMA line."

|

|

View all notes |

Alert me of new notes |

Company Profile |

SEC |

News |

Chart | C

A N

S L

I M

|

CKEC

- NASDAQ - MEDIA - Movie Production, Theaters

Carmike Cinemas Inc

|

$11.08 |

+1.98

21.76%

|

$11.82

|

$11.82

|

-6.26% |

329,837

772.45%

|

42,700

|

Most Recent Note for CKEC - 3/13/2012 11:49:58 AM

Considerable gap up gain today after providing encouraging guidance. Held its ground following a previously noted 3/07/12 gap up gain with heavy volume for a new 52-week high after an analyst upgrade. Prior mid-day reports noted - "Fundamentals still are not a match with the investment system's guidelines. It survived but failed to impress since noted in the 10/14/09 mid-day report - 'Poor annual earnings history.'"

|

|

View all notes |

Alert me of new notes |

Company Profile |

SEC |

News |

Chart | C

A N

S L

I M

|

CMT

- AMEX - CONSUMER NON-DURABLES - Rubber & Plastics

Core Mlding Technologies

|

$9.89 |

+0.07

0.69%

|

$10.04

|

$10.04

|

-1.51% |

35,697

127.95%

|

27,900

|

Most Recent Note for CMT - 3/13/2012 11:52:34 AM

Touching a new 52-week high today following a gap up and solid volume-driven gain on the prior session. Found support above its 50 & 200 DMA lines recently after encountering distributional pressure when challenging previously stubborn resistance in the high $9 area with a spurt of volume-driven gains. Prior mid-day reports noted - "Recent quarters show sales revenues and earnings improving but its annual earnings (A criteria) history is not a good match with the fact-based investment system."

|

|

View all notes |

Alert me of new notes |

Company Profile |

SEC |

News |

Chart | C

A N

S L

I M

|

CYAN

- NASDAQ - CHEMICALS - Specialty Chemicals

Cyanotech Corp

|

$11.62 |

+0.48

4.27%

|

$11.84

|

$11.84

|

-1.89% |

169,461

231.19%

|

73,300

|

Most Recent Note for CYAN - 3/13/2012 11:53:29 AM

Hitting yet another new 52-week high while adding to its streak of volume-driven gains today. Held its ground following a considerable gap up and volume-driven gain on 2/09/12 after reporting strong sales and earnings increases for the latest (Dec '11) quarter. Low-priced stocks are discouraged from consideration under the fact-based system unless all key criteria are solidly satisfied. It went through a deep consolidation below its 50 DMA line from the prior high since noted in the 12/22/11 mid-day report - "The 3 latest quarterly comparisons through September '11 showed strong sales revenues and earnings increases versus the year ago periods, however its annual earnings (A criteria) history has not been strong and steady."

|

|

View all notes |

Alert me of new notes |

Company Profile |

SEC |

News |

Chart | C

A N

S L

I M

|

INVN

- NYSE - ELECTRONICS - Scientific & Technical Instrum

Invensense Inc

|

$20.41 |

+1.29

6.75%

|

$20.84

|

$20.84

|

-2.06% |

2,245,972

182.48%

|

1,230,800

|

Most Recent Note for INVN - 3/13/2012 11:57:56 AM

Rallied up from support at its 50 DMA line last week, and hit a new high today while posting its 5th consecutive volume-driven gain. It hails from the Electronics - Semiconductor Manufacturing group which has recently shown better leadership (L criteria). The brief recent consolidation is not recognized as a sound base pattern. Prior mid-day reports noted - "Its 11/16/11 IPO was priced at $8 per share, and the firm's limited history is a concern. "

|

|

View all notes |

Alert me of new notes |

Company Profile |

SEC |

News |

Chart | C

A N

S L

I M

|

INWK

- NASDAQ - DIVERSIFIED SERVICES - Business/Management Services

Innerworkings Inc

|

$11.68 |

+0.08

0.69%

|

$11.74

|

$12.24

|

-4.58% |

260,869

120.83%

|

215,900

|

Most Recent Note for INWK - 3/13/2012 11:59:23 AM

Hovering within close striking distance of its 52-week high today. Held its ground while enduring distributional pressure in recent weeks while prior mid-day reports noted - "Recent quarterly comparisons show strong sales revenues and earnings increases but its annual earnings (A criteria) history has been up and down and below the fact-based investment system's guidelines. The Commercial Services - Document Management firm is from a low-ranked group on the 197 Industry Groups list, whereas the strongest leaders typically are found in the top quartile of groups."

|

|

View all notes |

Alert me of new notes |

Company Profile |

SEC |

News |

Chart | C

A N

S L

I M

|

PATK

- NASDAQ - Bldg-Mobile/Mfg & RV

Patrick Industries Inc

|

$9.62 |

+1.18

13.92%

|

$9.63

|

$9.63

|

-0.16% |

51,665

104.80%

|

49,300

|

Most Recent Note for PATK - 3/13/2012 12:00:39 PM

Spiking to another new 52-week high today while adding to a spurt of volume-driven gains. The 3/12/12 mid-day report noted - "Technically it is extended from prior chart highs, too far from any sound base. Fundamentally it is not a match with the fact-based investment system's guidelines. Low-priced stocks are discouraged from consideration as buy candidates unless all key criteria are solidly satisfied."

|

|

View all notes |

Alert me of new notes |

Company Profile |

SEC |

News |

Chart | C

A N

S L

I M

|

REX

- NYSE - Energy-Alternative/Other

Rex American Resources

|

$33.29 |

+0.69

2.11%

|

$33.95

|

$33.95

|

-1.95% |

83,667

178.78%

|

46,800

|

Most Recent Note for REX - 3/13/2012 12:03:28 PM

Hitting another new 52-week high today with a 6th consecutive volume-driven gain. It is very extended from any sound base pattern. Earnings increases were impressive in the Jul and Oct '11 and Jan '12 quarterly comparisons versus the year ago period. Prior mid-day reports noted - "Quarterly and annual earnings history (C & A criteria) has not been a match with the fact-based investment system's guidelines."

|

|

View all notes |

Alert me of new notes |

Company Profile |

SEC |

News |

Chart | C

A N

S L

I M

|

SLXP

- NASDAQ - DRUGS - Drug Related Products

Salix Pharmaceuticals

|

$48.70 |

-0.05

-0.10%

|

$49.34

|

$50.76

|

-4.06% |

1,021,551

155.44%

|

657,200

|

Most Recent Note for SLXP - 3/13/2012 12:04:51 PM

Hovering near its 52-week high since last noted in the 2/28/12 mid-day report - "Quarterly comparisons through Dec '11 showed strong sales revenues and earnings increases satisfying the C criteria, however its prior earnings history has been erratic and is not a match with the fact-based investment system's guidelines."

|

|

View all notes |

Alert me of new notes |

Company Profile |

SEC |

News |

Chart | C

A N

S L

I M

|

TFM

- NASDAQ - RETAIL - Grocery Stores

The Fresh Market Inc

|

$48.36 |

+1.12

2.37%

|

$49.18

|

$49.18

|

-1.67% |

420,477

174.76%

|

240,600

|

Most Recent Note for TFM - 3/13/2012 12:06:18 PM

Small gap up gain with above average volume today for yet another new all-time high. The 3/07/12 mid-day report noted - "Quarterly and annual earnings increases (C & A criteria) are not a match with the fact-based system's guidelines. It is consolidating in an orderly base above its 50 DMA line and perched within close striking distance of its 52-week and multi-year highs."

|

|

View all notes |

Alert me of new notes |

Company Profile |

SEC |

News |

Chart | C

A N

S L

I M

|

|

|

|

THESE ARE NOT BUY RECOMMENDATIONS!

Comments contained in the body of this report are technical

opinions only. The material herein has been obtained

from sources believed to be reliable and accurate, however,

its accuracy and completeness cannot be guaranteed.

We are not an investment advisor, hence it does

not endorse or recommend any securities or other investments.

Any recommendation contained in this report may not

be suitable for all investors and it is not to be deemed

an offer or solicitation on our part with respect to

the purchase or sale of any securities. All trademarks,

service marks and trade names appearing in this report

are the property of their respective owners, and are

likewise used for identification purposes only.

This report is a service available

only to active Paid Premium Members.

You may opt-out of receiving report notifications

at any time. Questions or comments may be submitted

by writing to FactBasedInvesting.com c/o Premium

Member Services 665 S.E. 10 Street, Suite 201

Deerfield Beach, FL 33441-5634 or by calling 954-785-1121.

We appreciate any feedback

members may wish to send via the inquiry form

here.

|

|

|