You are not logged in.

This means

you CAN ONLY VIEW reports that were published prior to Monday, April 7, 2025.

You

MUST UPGRADE YOUR MEMBERSHIP if you want to see any current reports.

MIDDAY BREAKOUTS REPORT - WEDNESDAY, JANUARY 8TH, 2014 MIDDAY BREAKOUTS REPORT - WEDNESDAY, JANUARY 8TH, 2014

Previous Mid Day Report Next Mid Day Report >>>

|

|

DOW 16452.1 -78.84 (-0.48%) | NASDAQ 4165.35 12.17 (0.29%) | S&P 500 1836.66 -1.22 (-0.07%)

|

Time of Screening :

1/8/2014 12:16:46 PM Report Released :

1/8/2014 1:14:18 PM

Price is:

Above 52W High and Less Than 52W High

but within 10% of the 52 Week High

Volume Is:

At least 85% of 50 Day Average at

the time of the screening.

More details about this report...

At around

mid-way through each trading day we run

a screen against our database of

high-ranked stocks, searching for

possible buy candidates that are trading

at or near their 52-week high on above

average volume. The results of that

screen are split into the two sections

you see below. The first, titled

"TODAY's FEATURED STOCKS" shows stocks

that our experts have recently

identified as among the strongest candidates to

consider. Stocks highlighted in yellow

are the most timely and noteworthy, so

particular attention and prompt action

may be appropriate. The second section,

titled "TODAY's BREAKOUT SCREEN" shows

the remainder of stocks meeting today's

screen parameters. Our experts have

reviewed and included notes on these

stocks as well, but found that they may

not match up as favorably.

|

|

Y - Today's strongest

candidates

highlighted

by our staff

of experts.

|

|

G - Previously featured in

this report as yellow and

now may no longer be buyable

under the guidelines.

|

|

|

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(50 DAV) |

52 Wk Hi

% From Hi |

Date

Featured |

Price

Featured |

Pivot Point |

|

Max Buy |

BITA

- NYSE

Bitauto Hldgs Ltd Ads

|

$33.00

|

+2.59

8.52%

|

$33.48

|

1,949,615

152.04% of 50 DAV

50 DAV is 1,282,300

|

$35.04

-5.82%

|

1/8/2014 |

$33.00

|

PP = $35.14

MB = $36.90 |

Most Recent Note - 1/8/2014 12:24:57 PM

Y - Color code is changed to yellow with new pivot point cited based on its 11/25/13 high plus 10 cents. Subsequent volume-driven gains to new highs may trigger a new technical buy signal. Found support above its 50 DMA line during its consolidation since completing a Public Offering on 12/06/13. Faces little overhead supply to act as resistance A 50 DMA line violation would be a more worrisome technical sell signal.

>>> The latest Featured Stock Update with an annotated graph appeared on 12/11/2013. Click here.

|

|

View all notes |

Alert me of new notes |

Company Profile |

SEC |

News |

Chart | C

A N

S L

I M

|

GNRC

- NYSE

Generac Hldgs Inc

|

$54.99

|

-1.01

-1.80%

|

$55.60

|

721,143

106.54% of 50 DAV

50 DAV is 676,900

|

$57.29

-4.01%

|

11/26/2013 |

$53.02

|

PP = $52.42

MB = $55.04 |

Most Recent Note - 1/8/2014 12:34:25 PM

G - Enduring mild distributional pressure while consolidating -4.0% off its all-time high. Prior highs in the $52 area define initial support to watch on pullbacks.

>>> The latest Featured Stock Update with an annotated graph appeared on 1/2/2014. Click here.

|

|

View all notes |

Alert me of new notes |

Company Profile |

SEC |

News |

Chart | C

A N

S L

I M

|

JAZZ

- NASDAQ

Jazz Pharmaceuticals Plc

|

$138.13

|

+7.71

5.91%

|

$138.92

|

610,862

86.17% of 50 DAV

50 DAV is 708,900

|

$128.49

7.50%

|

9/30/2013 |

$93.20

|

PP = $89.10

MB = $93.56 |

Most Recent Note - 1/8/2014 12:40:50 PM

G - Hitting yet another new 52-week high with today's considerable gain, getting more extended from any sound base. Its 50 DMA line and prior low near $108 define important support to watch on pullbacks.

>>> The latest Featured Stock Update with an annotated graph appeared on 12/10/2013. Click here.

|

|

View all notes |

Alert me of new notes |

Company Profile |

SEC |

News |

Chart | C

A N

S L

I M

|

MRLN

- NASDAQ

Marlin Business Services

|

$27.97

|

+1.15

4.29%

|

$28.11

|

34,209

121.74% of 50 DAV

50 DAV is 28,100

|

$28.64

-2.34%

|

12/19/2013 |

$26.69

|

PP = $28.74

MB = $30.18 |

Most Recent Note - 1/8/2014 12:46:50 PM

Y - Posting a 5th consecutive gain today and perched within close striking distance of its 52-week high with little resistance remaining due to overhead supply. Subsequent volume-driven gains above the pivot point are needed to trigger a proper new technical buy signal. Its Relative Strength (RS) Rating at 76 remains below the 80+ minimum guideline for buy candidates.

>>> The latest Featured Stock Update with an annotated graph appeared on 12/19/2013. Click here.

|

|

View all notes |

Alert me of new notes |

Company Profile |

SEC |

News |

Chart | C

A N

S L

I M

|

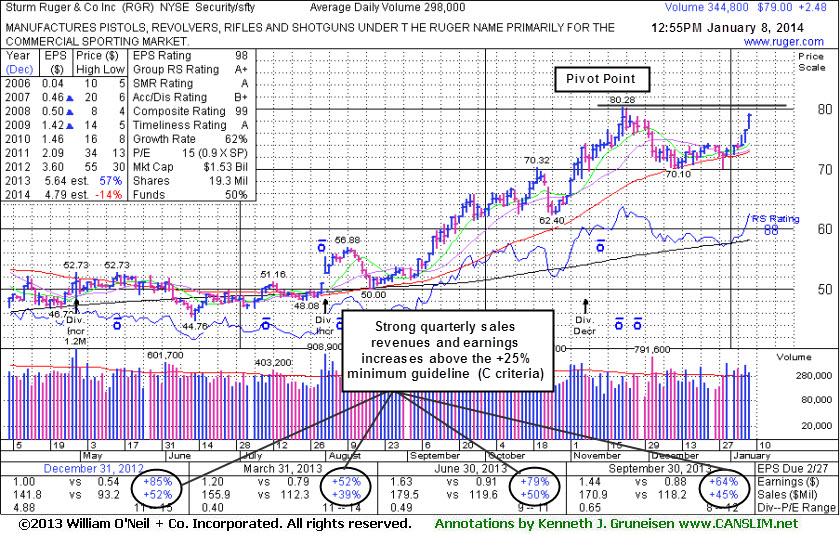

RGR

- NYSE

Sturm Ruger & Co Inc

|

$78.87

|

+2.35

3.07%

|

$79.27

|

298,096

100.03% of 50 DAV

50 DAV is 298,000

|

$80.28

-1.76%

|

1/8/2014 |

$78.87

|

PP = $80.38

MB = $84.40 |

Most Recent Note - 1/8/2014 1:04:39 PM

Y - Color code is changed to yellow with new pivot point cited based on its 11/21/13 high plus 10 cents. Subsequent volume-driven gains for new highs may trigger a new technical buy signal. Fundamentals remain strong with respect to the C and A criteria. Recent lows in the $70 area and its 50 DMA line define important near-term support. Perched -1.7% off its 52-week high and on the right side of an 8-week cup shaped base. Showed resilience since dropped from the Featured Stocks list on 12/18/12 as firearms-makers endured heavy selling following tragedies.

>>> The latest Featured Stock Update with an annotated graph appeared on 12/14/2012. Click here.

|

|

View all notes |

Alert me of new notes |

Company Profile |

SEC |

News |

Chart | C

A N

S L

I M

|

SSNC

- NASDAQ

S S & C Technologies

|

$46.28

|

+0.39

0.85%

|

$46.60

|

277,347

93.10% of 50 DAV

50 DAV is 297,900

|

$45.55

1.60%

|

10/22/2013 |

$39.17

|

PP = $40.04

MB = $42.04 |

Most Recent Note - 1/8/2014 1:05:43 PM

G - Adding to its recent spurt of gains and hitting a new 52-week high today, getting more extended from any sound base. Found recent support near its 50 DMA line.

>>> The latest Featured Stock Update with an annotated graph appeared on 12/16/2013. Click here.

|

|

View all notes |

Alert me of new notes |

Company Profile |

SEC |

News |

Chart | C

A N

S L

I M

|

VRX

- NYSE

Valeant Pharmaceuticals

|

$128.31

|

+2.96

2.36%

|

$135.73

|

1,950,829

168.74% of 50 DAV

50 DAV is 1,156,100

|

$125.95

1.87%

|

9/11/2013 |

$100.26

|

PP = $105.50

MB = $110.78 |

Most Recent Note - 1/8/2014 1:13:39 PM

G - Reversed much of its early gain today after gapping up for a 2nd consecutive session hitting new 52-week highs. Considerable volume-driven gains came after the company provided encouraging guidance. Its 50 DMA line and prior lows ($105.17) define near term support to watch.

>>> The latest Featured Stock Update with an annotated graph appeared on 12/18/2013. Click here.

|

|

View all notes |

Alert me of new notes |

Company Profile |

SEC |

News |

Chart | C

A N

S L

I M

|

|

|

Symbol - Exchange - Industry Group

Company Name |

Last |

Chg |

Day

High |

52 WK Hi |

% From Hi |

Volume

% DAV |

DAV |

AMBA

- NASDAQ - ELECTRONICS - Semiconductor - Specialized

Ambarella Inc

|

$32.02 |

-3.60

-10.10%

|

$34.85

|

$35.02

|

-8.58% |

2,864,830

260.13%

|

1,101,300

|

Most Recent Note for AMBA - 1/8/2014 12:18:42 PM

Retreating abruptly from a new 52-week high hit on the prior session following an analyst downgrade. Prior mid-day reports repeatedly cautioned - "Reported earnings +23% on +29% sales revenues for the Oct '13 quarter, a 2nd consecutive quarter below the +25% minimum earnings guideline (C criteria). Found support at its 200 DMA line during its consolidation after violating prior lows near $15.50 when dropped from the Featured Stocks list on 8/21/13."

|

|

View all notes |

Alert me of new notes |

Company Profile |

SEC |

News |

Chart | C

A N

S L

I M

|

ATRO

- NASDAQ - CONSUMER NON-DURABLES - Packaging & Containers

Astronics Corp Cl A

|

$56.40 |

+3.21

6.03%

|

$56.61

|

$54.30

|

3.87% |

168,944

199.46%

|

84,700

|

Most Recent Note for ATRO - 1/8/2014 12:20:09 PM

Hitting yet another new 52 week high with today's 4th consecutive gain on ever-increasing volume after finding support at its 50 DMA line. No resistance remains due to overhead supply. Reported earnings +44% on +30% sales revenues for the quarter ended Sep 30, 2013. Prior mid-day reports cautioned members - "Prior quarterly comparisons have not shown strong and steady +25% earnings increases. Its annual earnings (A criteria) history has been up and down."

|

|

View all notes |

Alert me of new notes |

Company Profile |

SEC |

News |

Chart | C

A N

S L

I M

|

BR

- NYSE - Financial Svcs-Specialty

Broadridge Finl Sltns

|

$38.91 |

-0.33

-0.84%

|

$39.28

|

$40.36

|

-3.59% |

910,232

115.70%

|

786,700

|

Most Recent Note for BR - 1/8/2014 12:25:57 PM

Consolidating above its 50 DMA line and only -4.3% off its 52-week high. Prior mid-day reports cautioned members - "Quarterly and annual earnings increases and underlying sales revenues are not a match with the fact-based investment system (C and A criteria)."

|

|

View all notes |

Alert me of new notes |

Company Profile |

SEC |

News |

Chart | C

A N

S L

I M

|

ESYS

- NASDAQ - Elec-Contract Mfg

Elecsys Corp

|

$13.83 |

+0.53

3.98%

|

$14.14

|

$14.86

|

-6.93% |

37,377

98.62%

|

37,900

|

Most Recent Note for ESYS - 1/8/2014 12:28:47 PM

Trading within close striking distance of its 52-week high today after stubbornly holding its ground well above prior highs in recent weeks while consolidating. Reported earnings +55% on +19% sales revenues for the Oct '13 quarter, but fundamental concerns remain. Prior mid-day reports cautioned members - "Recent quarterly comparisons through Jul '13 showed greatly improved earnings results and improved sales revenues growth. Quarterly revenues totals in the $6-8 million range are rather minuscule, and its annual earnings (A criteria) history has not been strong and steady. Low-priced stocks are discouraged from consideration unless all key criteria are solidly satisfied. Recently enduring distributional pressure after getting extended from any sound base."

|

|

View all notes |

Alert me of new notes |

Company Profile |

SEC |

News |

Chart | C

A N

S L

I M

|

FONR

- NASDAQ - HEALTH SERVICES - Medical Appliances & Equipment

Fonar Corp

|

$26.00 |

-0.32

-1.22%

|

$26.40

|

$24.09

|

7.93% |

323,543

94.74%

|

341,500

|

Most Recent Note for FONR - 1/8/2014 12:30:01 PM

Perched at its 52-week high today following 2 considerable volume-driven gains. Found support above its 50 DMA line during its deep consolidation since noted in the 11/25/13 mid-day report with caution - "Reported strong sales revenues and earnings increases in the Jun and Sep '13 quarters, but its prior quarterly and annual earnings (C and A criteria) history is not a good match with the fact-based investment system's guidelines."

|

|

View all notes |

Alert me of new notes |

Company Profile |

SEC |

News |

Chart | C

A N

S L

I M

|

FUL

- NYSE - CHEMICALS - Specialty Chemicals

Fuller H B Co

|

$51.72 |

+0.30

0.57%

|

$51.90

|

$52.70

|

-1.87% |

221,082

104.14%

|

212,300

|

Most Recent Note for FUL - 1/8/2014 12:30:54 PM

Making its 5th consecutive mid-day report appearance while hovering at its 52-week high after finding recent support near its 50 DMA line. Prior reports repeatedly cautioned members - "Quarterly earnings comparisons through Aug '13 versus year ago periods were not strong and steady above the +25% minimum guideline (C criteria). Its annual earnings (A criteria) history has steadily improved since a downturn in FY '08."

|

|

View all notes |

Alert me of new notes |

Company Profile |

SEC |

News |

Chart | C

A N

S L

I M

|

GIII

- NASDAQ - CONSUMER NON-DURABLES - Textile - Apparel Footwear

G Iii Apparel Group Inc

|

$69.22 |

-0.30

-0.43%

|

$73.12

|

$74.88

|

-7.56% |

204,899

85.02%

|

241,000

|

Most Recent Note for GIII - 1/8/2014 12:32:16 PM

Perched -7.4% off its 52-week high today. Prior mid-day reports repeatedly cautioned members - " Found support at its 50 DMA line while making gradual progress. Reported earnings +19% on +23% sales revenues for the Oct '13 quarter and fundamental concerns remain. Earnings history has been erratic and below guidelines of the fact-based investment system."

|

|

View all notes |

Alert me of new notes |

Company Profile |

SEC |

News |

Chart | C

A N

S L

I M

|

GPN

- NYSE - DIVERSIFIED SERVICES - Business/Management Services

Global Payments Inc

|

$64.47 |

-0.43

-0.65%

|

$64.94

|

$67.22

|

-4.10% |

602,478

92.50%

|

651,300

|

Most Recent Note for GPN - 1/8/2014 12:36:51 PM

Sales revenues and earnings increases in recent quarterly comparisons through Aug '13 have been below the +25% minimum guideline (C criteria). It has a steady annual earnings history (A criteria).

|

|

View all notes |

Alert me of new notes |

Company Profile |

SEC |

News |

Chart | C

A N

S L

I M

|

HF

- NYSE - REAL ESTATE - Property Management/Developmen

H F F Inc Cl A

|

$28.48 |

+1.47

5.44%

|

$29.19

|

$27.30

|

4.32% |

275,047

208.05%

|

132,200

|

Most Recent Note for HF - 1/8/2014 12:38:10 PM

Today's 4th consecutive gain on ever-increasing volume has it hitting new 52-week and all-time highs. Reported earnings +30% on +30% sales revenues for the Sep '13 quarter but fundamental concerns remain. Held its ground near its 50 DMA line during its consolidation since noted in the 10/01/13 mid-day report with caution - "Fundamentally below guidelines of the fact-based investment system, its quarterly earnings comparisons through Jun '13 have not satisfied the +25% minimum earnings guideline (C criteria). Its annual earnings (A criteria) history has improved since a drastic downturn and losses in FY '09, not strong and steady."

|

|

View all notes |

Alert me of new notes |

Company Profile |

SEC |

News |

Chart | C

A N

S L

I M

|

HTHT

- NASDAQ - LEISURE - Lodging

China Lodging Group Ads

|

$30.39 |

+1.18

4.04%

|

$31.21

|

$32.29

|

-5.88% |

375,580

134.66%

|

278,900

|

Most Recent Note for HTHT - 1/8/2014 12:39:59 PM

Prior mid-day reports repeatedly cautioned - "Reported earnings +30% on +32% sales revenues for the Sep '13 quarter, but fundamental concerns remain. Hovering near its 52-week and all-time highs following volume-driven gains after an orderly consolidation above its 50 DMA line. No resistance remains due to overhead supply. Reported strong sales and earnings increases in the Jun '13 quarter, and earnings in Mar '13 versus a year-ago loss, however prior quarterly and annual earnings (C and A criteria) history included a downward turn in FY '11, making it not a good match with the fact-based investment system's guidelines."

|

|

View all notes |

Alert me of new notes |

Company Profile |

SEC |

News |

Chart | C

A N

S L

I M

|

LOPE

- NASDAQ - DIVERSIFIED SERVICES - Education &; Training Services

Grand Canyon Education

|

$46.56 |

+1.18

2.60%

|

$46.91

|

$50.48

|

-7.76% |

355,847

90.48%

|

393,300

|

Most Recent Note for LOPE - 1/8/2014 12:43:03 PM

Rebounding above its 50 DMA line with today's 4th consecutive gain. Recent lows near $42 define the next important near-term support. Based on weak action and previously noted fundamental concerns it was dropped from the Featured Stocks list on 12/10/13.

|

|

View all notes |

Alert me of new notes |

Company Profile |

SEC |

News |

Chart | C

A N

S L

I M

|

MCK

- NYSE - WHOLESALE - Drugs Wholesale

Mckesson Corp

|

$173.05 |

+11.22

6.93%

|

$173.05

|

$166.57

|

3.89% |

2,843,008

187.76%

|

1,514,200

|

Most Recent Note for MCK - 1/8/2014 12:44:41 PM

Gapped up today hitting new 52-week highs. Held its ground at its 50 DMA line after last noted in the 12/10/13 mid-day report with caution - "It has a steady annual earnings (A criteria) history, however quarterly earnings increases have not been strong and steady and sales revenues increases have been sub par."

|

|

View all notes |

Alert me of new notes |

Company Profile |

SEC |

News |

Chart | C

A N

S L

I M

|

PACR

- NASDAQ - TRANSPORTATION - Air Delivery & Freight Service

Pacer International Inc

|

$9.00 |

+0.06

0.67%

|

$9.09

|

$9.23

|

-2.49% |

493,069

120.76%

|

408,300

|

Most Recent Note for PACR - 1/8/2014 12:50:32 PM

Gapped up on 1/06/14 news XPO Logistics (XPO), a transportation services specialist, will acquire Pacer International for $335 million, a deal that would make it the third largest intermodal services providers in North America.. Perched within close striking distance of its 52-week high after finding support near its 50 DMA line recently. Fundamental concerns remain. Prior mid-day reports cautioned members - "Sales and earnings history below guidelines. Low-priced stocks are discouraged from consideration unless all key criteria are solidly satisfied."

|

|

View all notes |

Alert me of new notes |

Company Profile |

SEC |

News |

Chart | C

A N

S L

I M

|

QIHU

- NYSE - INTERNET - Internet Service Providers

Qihoo 360 Technology Ads

|

$87.08 |

+5.68

6.98%

|

$87.99

|

$96.74

|

-9.99% |

6,161,078

241.01%

|

2,556,400

|

Most Recent Note for QIHU - 1/8/2014 12:54:19 PM

Gapped up today rising above its 50 DMA line which recently acted as resistance. Last noted with caution in the 9/19/13 mid-day report. Fundamental concerns remain after its +135% earnings increase on +124% sales revenues for the Sep '13 quarter, its 2nd quarterly comparison with earnings above the +25% minimum earnings guideline (C criteria).

|

|

View all notes |

Alert me of new notes |

Company Profile |

SEC |

News |

Chart | C

A N

S L

I M

|

STZ

- NYSE - FOOD & BEVERAGE - Beverages - Wineries & Distill

Constellation Brands A

|

$75.60 |

+5.67

8.11%

|

$78.40

|

$71.62

|

5.56% |

4,279,555

355.06%

|

1,205,300

|

Most Recent Note for STZ - 1/8/2014 1:08:50 PM

Breakaway gap today for a new 52-week high after stubbornly holding its ground above its 50 DMA line while recently consolidating. Reported earnings +75% on +88% sales revenues for the Nov '13 quarter, its 2nd consecutive quarter above the +25% minimum earnings guideline (C criteria). Fundamental concerns remain as prior quarterly earnings (C criteria) history is not a match with the fact-based investment system's guidelines.

|

|

View all notes |

Alert me of new notes |

Company Profile |

SEC |

News |

Chart | C

A N

S L

I M

|

TARO

- NYSE - DRUGS - Drug Manufacturers - Other

Taro Pharmaceutical Inds

|

$108.59 |

+4.28

4.10%

|

$108.75

|

$104.33

|

4.08% |

75,567

343.49%

|

22,000

|

Most Recent Note for TARO - 1/8/2014 1:10:12 PM

Hitting new 52-week highs with today's 4th consecutive volume-driven gain. Prior mid-day reports repeatedly cautioned members - . Reported earnings +47% on +28% sales revenues for the Sep '13 quarter, but fundamental concerns remain. Reported earnings -6% on -4% sales revenues for the Jun '13 quarter, below the +25% minimum guideline (C criteria). The Israel-based Medical - Generic Drugs firm faced no resistance due to overhead supply when noted in prior mid-day reports with caution. The number of top-rated funds owning its shares from 2 in Mar '12 to 23 as of Jun '13, a reassuring sign concerning the I criteria."

|

|

View all notes |

Alert me of new notes |

Company Profile |

SEC |

News |

Chart | C

A N

S L

I M

|

TYL

- NYSE - COMPUTER SOFTWARE & SERVICES - Information Technology Service

Tyler Technologies Inc

|

$101.48 |

-0.91

-0.89%

|

$103.07

|

$105.74

|

-4.03% |

132,716

88.54%

|

149,900

|

Most Recent Note for TYL - 1/8/2014 1:11:49 PM

Consolidating -5.4% off its 52-week high and trading near its 50 DMA line defining important near-term support. Reported earnings +5% on +14% sales revenues for the Sep '13 quarter, well below the +25% minimum earnings guideline (C criteria). Prior earnings growth has not been strong and steady. Last noted in the 11/12/13 mid-day report with caution - "It survived but failed to impress, and fundamentals today are below guidelines. The Computer-Tech Services firm was dropped from the Featured Stocks list on 9/24/08 due to technical weakness."

|

|

View all notes |

Alert me of new notes |

Company Profile |

SEC |

News |

Chart | C

A N

S L

I M

|

|

|

|

THESE ARE NOT BUY RECOMMENDATIONS!

Comments contained in the body of this report are technical

opinions only. The material herein has been obtained

from sources believed to be reliable and accurate, however,

its accuracy and completeness cannot be guaranteed.

We are not an investment advisor, hence it does

not endorse or recommend any securities or other investments.

Any recommendation contained in this report may not

be suitable for all investors and it is not to be deemed

an offer or solicitation on our part with respect to

the purchase or sale of any securities. All trademarks,

service marks and trade names appearing in this report

are the property of their respective owners, and are

likewise used for identification purposes only.

This report is a service available

only to active Paid Premium Members.

You may opt-out of receiving report notifications

at any time. Questions or comments may be submitted

by writing to FactBasedInvesting.com c/o Premium

Member Services 665 S.E. 10 Street, Suite 201

Deerfield Beach, FL 33441-5634 or by calling 954-785-1121.

We appreciate any feedback

members may wish to send via the inquiry form

here.

|

|

|