You are not logged in.

This means you

CAN ONLY VIEW reports that were published prior to Sunday, April 6, 2025.

You

MUST UPGRADE YOUR MEMBERSHIP if you want to see any current reports.

AFTER MARKET UPDATE - FRIDAY, AUGUST 23RD, 2013

Previous After Market Report Next After Market Report >>>

|

|

|

|

DOW |

+46.77 |

15,010.51 |

+0.31% |

|

Volume |

571,786,020 |

-0% |

|

Volume |

1,460,301,260 |

+64% |

|

NASDAQ |

+18.19 |

3,656.90 |

+0.50% |

|

Advancers |

2,058 |

66% |

|

Advancers |

1,347 |

52% |

|

S&P 500 |

+6.54 |

1,663.50 |

+0.39% |

|

Decliners |

976 |

31% |

|

Decliners |

1,158 |

44% |

|

Russell 2000 |

+2.04 |

1,038.24 |

+0.20% |

|

52 Wk Highs |

67 |

|

|

52 Wk Highs |

92 |

|

|

S&P 600 |

+0.96 |

588.53 |

+0.16% |

|

52 Wk Lows |

35 |

|

|

52 Wk Lows |

17 |

|

|

|

Major Averages Edge Higher Yet Ongoing Correction Continues

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

For the week, the Dow Jones Industrial Average was unchanged, the S&P 500 rose +0.5% and the Nasdaq Composite Index rallied +1.5%. The major averages posted modest gains on Friday. The volume totals were reported mixed, slightly lighter than the prior session totals on the NYSE while heavier on the Nasdaq exchange. Breadth was positive as advancers led decliners by a 2-1 margin on the NYSE while advancers led by a narrower 7-6 margin on the Nasdaq exchange. There were 19 high-ranked companies from the CANSLIM.net Leaders List that made new 52-week highs and appeared on the CANSLIM.net BreakOuts Page, down from a total of 21 stocks on the prior session. The list of stocks hitting new 52-week lows outnumbered new 52-week highs on the NYSE and on the Nasdaq exchange. There were gains for 10 of the 16 high-ranked companies currently included on the Featured Stocks Page. The market (M criteria) clearly signaled that the major averages are in a "correction" based on recent technical damage. Individual holdings should be closely monitored for any worrisome technical sell signals. This is precisely how the fact-based system helps investors avoid serious setbacks and raise cash levels during market downdrafts. Historic studies suggest that no new buying efforts should be made during market corrections.

Stocks managed to end the session higher despite a significantly weaker-than-expected report on July new home sales. The Fed's symposium in Jackson Hole, Wyoming also kept a lid on gains as no new details were given on when the central bank might begin to reduce their stimulus measures.

Most sectors on the S&P ended higher. Material stocks were the top performers as gold and copper prices rose. Shares of Freeport-McMoRan Copper & Gold Inc (FCX +1.4%). Retailers were also active in the session on some mixed earnings. Aeropostale (ARO -20.2%) fell and Foot Lock (FL -3%) following their profit tallies. In other news, Microsoft Corp (MSFT +7.3%) after the company announced CEO Steve Ballmer would be retiring within the next 12 months.

Turning to fixed income markets, Treasuries were higher along the curve. The benchmark 10-year note was up 9/16 of a point to yield 2.82% and the 30-year bond advanced over a full point to yield 3.80%.

Stay familiar with companies listed on the CANSLIM.net Featured Stocks Page - a page showing the most action-worthy candidates' latest notes and links to additional resources including detailed analysis with data-packed graphs which are annotated by a Certified expert. The Premium Member Homepage - includes "dynamic archives" to all prior pay reports published. Watch for an announcement via email concerning the next WEBCAST.

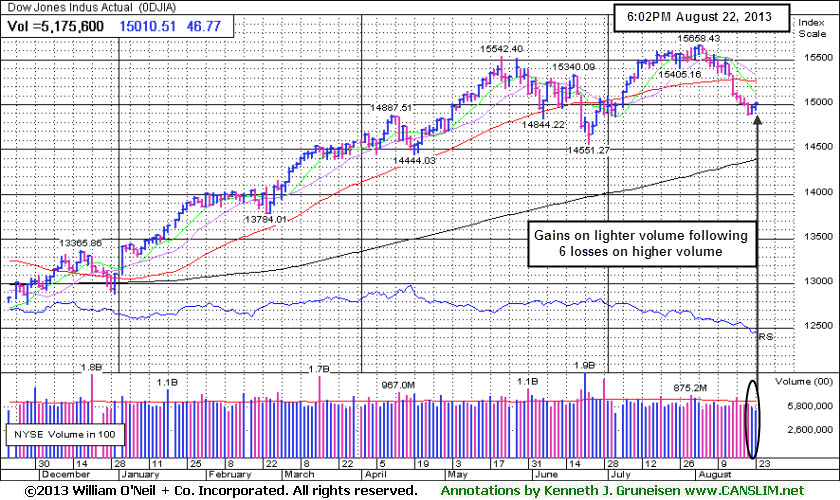

PICTURED: The Dow Jones Industrial Average has tallied gains with lighter volume following 6 losses on higher volume during which it slumped below its 50-day moving average (DMA) line.

|

Kenneth J. Gruneisen started out as a licensed stockbroker in August 1987, a couple of months prior to the historic stock market crash that took the Dow Jones Industrial Average down -22.6% in a single day. He has published daily fact-based fundamental and technical analysis on high-ranked stocks online for two decades. Through FACTBASEDINVESTING.COM, Kenneth provides educational articles, news, market commentary, and other information regarding proven investment systems that work in good times and bad.

Kenneth J. Gruneisen started out as a licensed stockbroker in August 1987, a couple of months prior to the historic stock market crash that took the Dow Jones Industrial Average down -22.6% in a single day. He has published daily fact-based fundamental and technical analysis on high-ranked stocks online for two decades. Through FACTBASEDINVESTING.COM, Kenneth provides educational articles, news, market commentary, and other information regarding proven investment systems that work in good times and bad.

Comments contained in the body of this report are technical opinions only and are not necessarily those of Gruneisen Growth Corp. The material herein has been obtained from sources believed to be reliable and accurate, however, its accuracy and completeness cannot be guaranteed. Our firm, employees, and customers may effect transactions, including transactions contrary to any recommendation herein, or have positions in the securities mentioned herein or options with respect thereto. Any recommendation contained in this report may not be suitable for all investors and it is not to be deemed an offer or solicitation on our part with respect to the purchase or sale of any securities. |

|

|

Defensive, Retail, and Energy-Related Shares Rose

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

The Gold & Silver Index ($XAU +2.76%) was among the best gainers on Friday. The Retail Index ($RLX +0.80%) underpinned the major averages' gains. Meanwhile, financial shares were mixed and little changed as the Bank Index ($BKX -0.18%) edged lower while the Broker/Dealer Index ($XBD +0.39%). Energy-related shares had a positive bias as the Oil Services Index ($OSX +0.68%) and the Integrated Oil Index ($XOI +1.15%) rose. The Networking Index ($NWX +0.11%) and the Internet Index ($IIX +0.25%) eked out small gains while the Semiconductor Index ($SOX -0.00%) finished flat. Medical-related shares were mixed as the Healthcare Index ($HMO +0.66%) rose and the Biotechnology Index ($BTK -0.75%) fell.

Charts courtesy www.stockcharts.com

PICTURED: The Semiconductor Index ($SOX -0.00%) is trading below is 50-day moving average (DMA) line, above its June lows.

| Oil Services |

$OSX |

261.52 |

+1.76 |

+0.68% |

+18.79% |

| Healthcare |

$HMO |

3,402.17 |

+22.44 |

+0.66% |

+35.32% |

| Integrated Oil |

$XOI |

1,371.67 |

+15.61 |

+1.15% |

+10.46% |

| Semiconductor |

$SOX |

463.82 |

-0.01 |

-0.00% |

+20.77% |

| Networking |

$NWX |

286.66 |

+0.32 |

+0.11% |

+26.53% |

| Internet |

$IIX |

401.85 |

+1.00 |

+0.25% |

+22.89% |

| Broker/Dealer |

$XBD |

134.64 |

+0.52 |

+0.39% |

+42.73% |

| Retail |

$RLX |

822.43 |

+1.41 |

+1.70% |

+25.72% |

| Gold & Silver |

$XAU |

111.39 |

+2.99 |

+2.76% |

-32.74% |

| Bank |

$BKX |

64.91 |

-0.12 |

-0.18% |

+26.58% |

| Biotech |

$BTK |

2,075.17 |

-15.75 |

-0.75% |

+34.14% |

|

|

|

|

Stalled Following Gap Up Gain To New High

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

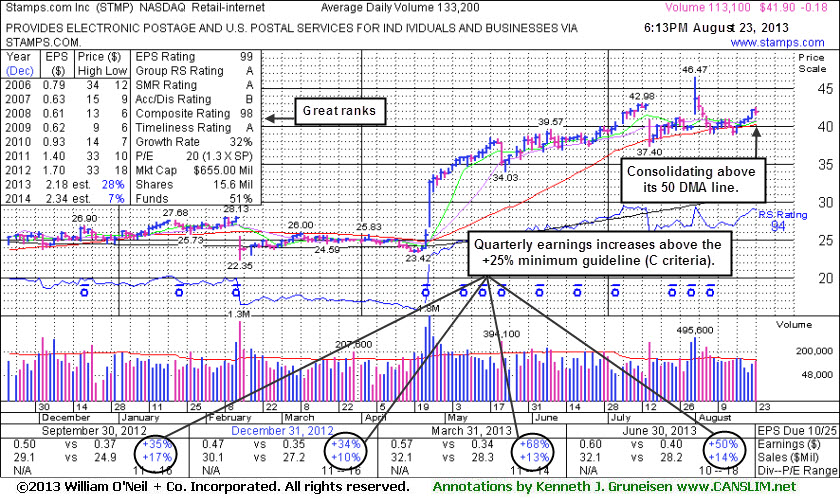

Stamps.Com Inc (STMP -$0.18 or +0.18% to $41.90) has recently been consolidating above its 50-day moving average (DMA) line. It was last shown in this FSU section with an annotated graph on 7/31/13 under the headline, "Following Test of Support Secondary Buy Point Exists". It stalled following a considerable volume-driven gap up gain on 8/01/13. Keep in mind that the broader market direction (M criteria) weighs heavily into the mix as historic studies showed that 3 out of 4 stocks typically move in the same direction of the major averages. For as long as the current market correction continues, odds are not favorable for most stocks making meaningful headway.

Pay close attention to stocks that hold up well during corrections and watch for those that are the first ones breaking into new high ground upon any new confirmed rally. Meanwhile, if holding onto current gains, investors should stand ready to reduce exposure before too much damage starts to mount. Disciplined investors always limit losses by selling any stock that falls more than -7% from their purchase price, but sometimes weak technical action may hint that it is a smart time to sell even before losses reach that important maximum loss threshold.

After clearing multi-year resistance in the $33 area it subsequently made steady progress. STMP had not formed a sound new base, however it was highlighted in yellow in the 7/31/13 mid-day report (read here) as it was noted - "A valid secondary buy point exists following its successful test of support up to +5% above its prior high. Reported earnings +68% on +13% sales revenues for the quarter ended March 31, 2013 versus the year ago period, marking a 3rd consecutive quarter above the +25% minimum guideline (C criteria). Due to report earnings after the close, and volume and volatility often increase near earnings news. "

After the close it reported earnings +50% on +14% sales for the quarter ended June 30, 2013 versus the year ago period, continuing its strong earnings track record. It has earned an Earnings Per Share Rating of 99, putting it in the top 1% of all publicly traded stocks based on its earnings history over the past 5 years. The Retail - Internet firm has other strong leaders in the group confirming the L criteria, as the group has an A Group Relative Strength Rating. Its annual earnings (A criteria) history has shown strong and steady increases since FY '09 following a couple of flat years. The number of top-rated funds owning its shares rose from 194 in Dec '12 to 204 in Jun '13, a reassuring sign concerning the I criteria. Its small supply of only 15.6 million shares outstanding (S criteria) can contribute to greater price volatility in the event of institutional buying or selling.

|

|

|

Color Codes Explained :

Y - Better candidates highlighted by our

staff of experts.

G - Previously featured

in past reports as yellow but may no longer be buyable under the

guidelines.

***Last / Change / Volume data in this table is the closing quote data***

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

BITA

-

NYSE

Bitauto Hldgs Ltd Ads

INTERNET - Internet Information Providers

|

$14.93

|

-0.17

-1.13% |

$15.50

|

322,524

162.32% of 50 DAV

50 DAV is 198,700

|

$18.10

-17.51%

|

8/7/2013

|

$12.01

|

PP = $13.30

|

|

MB = $13.97

|

Most Recent Note - 8/22/2013 5:48:25 PM

G - Tallied 3 gains with above average volume in the span of 4 sessions since finding prompt support near prior highs. Consolidating well above its 50 DMA line. Disciplined investors always limit losses if any stock falls more than -7-8% from their purchase price.

>>> The latest Featured Stock Update with an annotated graph appeared on 8/7/2013. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

CELG

-

NASDAQ

Celgene Corp

DRUGS - Drug Manufacturers - Major

|

$138.27

|

+0.36

0.26% |

$139.39

|

1,685,329

65.85% of 50 DAV

50 DAV is 2,559,400

|

$149.92

-7.77%

|

7/11/2013

|

$133.25

|

PP = $131.92

|

|

MB = $138.52

|

Most Recent Note - 8/21/2013 9:42:54 PM

Y - Consolidating above prior highs in the $131 area coinciding with its 50 DMA line, defining important chart support. See the latest FSU analysis for more details and a new annotated graph.

>>> The latest Featured Stock Update with an annotated graph appeared on 8/21/2013. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

FLT

-

NYSE

Fleetcor Technologies

DIVERSIFIED SERVICES - Business/Management Services

|

$102.82

|

-0.30

-0.29% |

$104.35

|

725,093

108.63% of 50 DAV

50 DAV is 667,500

|

$104.80

-1.89%

|

8/19/2013

|

$99.01

|

PP = $100.97

|

|

MB = $106.02

|

Most Recent Note - 8/22/2013 5:50:19 PM

Y- Rallied with above average volume today, rising from an advanced "3-weeks tight" base, albeit a riskier "late stage" base. It cleared the new pivot point with +56% above average volume. Keep in mind the M criteria argues against new buying efforts until a new confirmed rally.

>>> The latest Featured Stock Update with an annotated graph appeared on 8/12/2013. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

GNRC

-

NYSE

Generac Hldgs Inc

CONSUMER DURABLES - Electronic Equipment

|

$42.22

|

-0.08

-0.19% |

$42.35

|

542,536

50.77% of 50 DAV

50 DAV is 1,068,700

|

$44.30

-4.70%

|

7/30/2013

|

$42.60

|

PP = $42.10

|

|

MB = $44.21

|

Most Recent Note - 8/22/2013 5:46:33 PM

Y - Holding its ground stubbornly after it recently rallied from an advanced "3-weeks tight" base and priced a Secondary Offering. Disciplined investors always limit losses by selling if any stock falls more than -7% from its purchase price. See the latest FSU analysis for more details and a new annotated graph.

>>> The latest Featured Stock Update with an annotated graph appeared on 8/22/2013. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

KORS

-

NYSE

Michael Kors Hldgs Ltd

RETAIL - Apparel Stores

|

$72.57

|

+0.38

0.53% |

$72.82

|

2,271,980

64.43% of 50 DAV

50 DAV is 3,526,200

|

$72.98

-0.56%

|

8/6/2013

|

$69.66

|

PP = $66.28

|

|

MB = $69.59

|

Most Recent Note - 8/23/2013 6:50:01 PM

Most Recent Note - 8/23/2013 6:50:01 PM

G - Finished at a new high close today with a 4th consecutive gain on below average volume. Prior highs in the $66 area define initial support to watch on pullbacks.

>>> The latest Featured Stock Update with an annotated graph appeared on 8/6/2013. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

LOPE

-

NASDAQ

Grand Canyon Education

DIVERSIFIED SERVICES - Education and; Training Services

|

$34.08

|

+0.42

1.25% |

$34.18

|

243,915

54.69% of 50 DAV

50 DAV is 446,000

|

$37.17

-8.31%

|

6/19/2013

|

$31.47

|

PP = $34.17

|

|

MB = $35.88

|

Most Recent Note - 8/21/2013 9:47:50 PM

G - Color code is changed to green as it has slumped below its 50 DMA line. Recently reported earnings +15% on +19% sales for the Jun '13 quarter, below the +25% minimum earnings guideline (C criteria), raising fundamental concerns.

>>> The latest Featured Stock Update with an annotated graph appeared on 8/14/2013. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

PCLN

-

NASDAQ

Priceline.Com Inc

INTERNET - Internet Software and Services

|

$954.23

|

+2.08

0.22% |

$956.87

|

380,468

53.58% of 50 DAV

50 DAV is 710,100

|

$994.98

-4.10%

|

7/8/2013

|

$878.28

|

PP = $847.43

|

|

MB = $889.80

|

Most Recent Note - 8/23/2013 6:51:58 PM

Most Recent Note - 8/23/2013 6:51:58 PM

G - Posted a 3rd consecutive gain on light volume, consolidating above prior highs, extended from any sound base. Reported earnings +24% on +27% sales revenues for the Jun '13 quarter, just under the +25% minimum earnings guideline (C criteria).

>>> The latest Featured Stock Update with an annotated graph appeared on 8/19/2013. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

PRAA

-

NASDAQ

Portfolio Recovery Assoc

DIVERSIFIED SERVICES - Business/Management Services

|

$55.45

|

+0.73

1.33% |

$55.50

|

230,351

44.10% of 50 DAV

50 DAV is 522,300

|

$57.57

-3.68%

|

7/31/2013

|

$51.43

|

PP = $54.72

|

|

MB = $57.46

|

Most Recent Note - 8/21/2013 9:53:49 PM

Y - Holding its ground near prior highs with volume totals cooling in recent weeks. Any slump below its old high close ($53.86 on 6/17/13) would raise greater concerns as it would completely negate the recent technical breakout.

>>> The latest Featured Stock Update with an annotated graph appeared on 8/2/2013. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

PRLB

-

NYSE

Proto Labs Inc

MANUFACTURING - Small Tools and Accessories

|

$71.11

|

+0.27

0.38% |

$71.35

|

193,887

38.95% of 50 DAV

50 DAV is 497,800

|

$72.08

-1.35%

|

7/29/2013

|

$64.86

|

PP = $67.50

|

|

MB = $70.88

|

Most Recent Note - 8/19/2013 12:09:12 PM

Y - Recently consolidating above its 50 DMA line with volume totals cooling in recent weeks. That important short-term average and prior lows define important support to watch. Disciplined investors always limit losses if any stock falls more than -7% from their purchase price.

>>> The latest Featured Stock Update with an annotated graph appeared on 8/5/2013. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

QCOR

-

NASDAQ

Questcor Pharmaceuticals

DRUGS - Biotechnology

|

$71.84

|

+3.41

4.98% |

$72.43

|

1,902,392

105.38% of 50 DAV

50 DAV is 1,805,300

|

$70.55

1.83%

|

7/31/2013

|

$66.46

|

PP = $59.01

|

|

MB = $61.96

|

Most Recent Note - 8/21/2013 9:11:57 PM

G - Gapped up today for a solid gain, bucking a mostly negative market. It is extended beyond its "max buy" level, consolidating in a tight trading range for the past 3 weeks.

>>> The latest Featured Stock Update with an annotated graph appeared on 8/1/2013. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

SFUN

-

NYSE

Soufun Hldgs Ltd Ads A

INTERNET - Internet Information Providers

|

$38.19

|

-1.52

-3.83% |

$39.80

|

797,167

159.91% of 50 DAV

50 DAV is 498,500

|

$42.15

-9.40%

|

7/16/2013

|

$29.54

|

PP = $27.90

|

|

MB = $29.30

|

Most Recent Note - 8/23/2013 12:36:54 PM

Most Recent Note - 8/23/2013 12:36:54 PM

G - Pulling back from its 52-week high after getting very extended from its latest base. Prior reports cautioned - "Disciplined investors avoid chasing stocks too extended from sound bases."

>>> The latest Featured Stock Update with an annotated graph appeared on 8/8/2013. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

SSNC

-

NASDAQ

S S & C Technologies

COMPUTER SOFTWARE and SERVICES - Application Software

|

$35.67

|

-0.17

-0.47% |

$36.14

|

333,091

79.42% of 50 DAV

50 DAV is 419,400

|

$38.80

-8.07%

|

7/11/2013

|

$35.80

|

PP = $34.54

|

|

MB = $36.27

|

Most Recent Note - 8/23/2013 6:53:34 PM

Most Recent Note - 8/23/2013 6:53:34 PM

Y - Recently consolidating above its 50 DMA line and prior highs in the $34 area defining important support. Disciplined investors always limit losses if ever any stock falls more than -7% from their purchase price.

>>> The latest Featured Stock Update with an annotated graph appeared on 8/9/2013. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

SSYS

-

NASDAQ

Stratasys Ltd

COMPUTER HARDWARE - Computer Peripherals

|

$105.82

|

+0.04

0.04% |

$107.00

|

394,141

47.84% of 50 DAV

50 DAV is 823,900

|

$107.13

-1.22%

|

7/8/2013

|

$91.44

|

PP = $95.00

|

|

MB = $99.75

|

Most Recent Note - 8/19/2013 12:02:45 PM

G - Considerable gain today for a new 52-week high, rallying above its "max buy" level again, and its color code is changed to green

>>> The latest Featured Stock Update with an annotated graph appeared on 8/16/2013. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

STMP

-

NASDAQ

Stamps.Com Inc

INTERNET - Internet Software and Services

|

$41.90

|

-0.18

-0.43% |

$42.48

|

113,152

85.33% of 50 DAV

50 DAV is 132,600

|

$46.47

-9.83%

|

7/31/2013

|

$40.00

|

PP = $42.98

|

|

MB = $45.13

|

Most Recent Note - 8/23/2013 6:44:17 PM

Most Recent Note - 8/23/2013 6:44:17 PM

Y - Recently found support at its 50 DMA line. See the latest FSU analysis for more details and a new annotated graph.

>>> The latest Featured Stock Update with an annotated graph appeared on 8/23/2013. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

VRX

-

NYSE

Valeant Pharmaceuticals

DRUGS - Drug Manufacturers - Other

|

$99.52

|

+0.22

0.22% |

$100.13

|

1,323,261

82.31% of 50 DAV

50 DAV is 1,607,600

|

$105.40

-5.58%

|

4/30/2013

|

$60.24

|

PP = $76.66

|

|

MB = $80.49

|

Most Recent Note - 8/23/2013 6:48:24 PM

Most Recent Note - 8/23/2013 6:48:24 PM

G- Holding its ground -5.6% off its 52-week high. Reported earnings +33% on +34% sales revenues for the Jun '13 quarter, above the +25% minimum earnings guideline (C criteria).

>>> The latest Featured Stock Update with an annotated graph appeared on 8/15/2013. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

YNDX

-

NASDAQ

Yandex N V Class A

INTERNET - Internet Information Providers

|

$33.44

|

+0.14

0.42% |

$33.62

|

823,802

33.13% of 50 DAV

50 DAV is 2,486,900

|

$34.79

-3.88%

|

7/10/2013

|

$29.29

|

PP = $29.59

|

|

MB = $31.07

|

Most Recent Note - 8/19/2013 12:15:13 PM

G - Retreating from its 52-week high hit last week. Its 50 DMA line coincides with prior highs in the $29 area defining important near-term support to watch.

>>> The latest Featured Stock Update with an annotated graph appeared on 8/20/2013. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

|

|

|

THESE ARE NOT BUY RECOMMENDATIONS!

Comments contained in the body of this report are technical

opinions only. The material herein has been obtained

from sources believed to be reliable and accurate, however,

its accuracy and completeness cannot be guaranteed.

This site is not an investment advisor, hence it does

not endorse or recommend any securities or other investments.

Any recommendation contained in this report may not

be suitable for all investors and it is not to be deemed

an offer or solicitation on our part with respect to

the purchase or sale of any securities. All trademarks,

service marks and trade names appearing in this report

are the property of their respective owners, and are

likewise used for identification purposes only.

This report is a service available

only to active Paid Premium Members.

You may opt-out of receiving report notifications

at any time. Questions or comments may be submitted

by writing to Premium Membership Services 665 S.E. 10 Street, Suite 201 Deerfield Beach, FL 33441-5634 or by calling 1-800-965-8307

or 954-785-1121.

|

|

|