You are not logged in.

This means you

CAN ONLY VIEW reports that were published prior to Tuesday, April 15, 2025.

You

MUST UPGRADE YOUR MEMBERSHIP if you want to see any current reports.

AFTER MARKET UPDATE - MONDAY, JULY 19TH, 2010

Previous After Market Report Next After Market Report >>>

|

|

|

|

DOW |

+56.53 |

10,154.43 |

+0.56% |

|

Volume |

955,512,670 |

-36% |

|

Volume |

1,687,779,600 |

-21% |

|

NASDAQ |

+19.18 |

2,198.23 |

+0.88% |

|

Advancers |

1,963 |

63% |

|

Advancers |

1,552 |

56% |

|

S&P 500 |

+6.37 |

1,071.25 |

+0.60% |

|

Decliners |

1,041 |

33% |

|

Decliners |

1,083 |

39% |

|

Russell 2000 |

+2.69 |

613.08 |

+0.44% |

|

52 Wk Highs |

95 |

|

|

52 Wk Highs |

11 |

|

|

S&P 600 |

+1.79 |

330.85 |

+0.54% |

|

52 Wk Lows |

43 |

|

|

52 Wk Lows |

79 |

|

|

|

Major Indices Rise With Lighter Volume Behind Gains

Adam Sarhan, Contributing Writer,

The major averages ended higher on Monday after getting smacked on Friday. As expected, volume was reported lower than Friday's session on both exchanges due to options expirations. There were only 7 high-ranked companies from the CANSLIM.net Leaders List that made a new 52-week high and appeared on the CANSLIM.net BreakOuts Page, up from 4 issues that appeared on the prior session. Advancers led decliners by almost a 2-to-1 ratio on the NYSE and by a 3-to-2 ratio on the Nasdaq exchange. New 52-week highs solidly outnumbered new 52-week lows on the NYSE but trailed on the Nasdaq exchange. For the rally to have ongoing success it will be critical for a healthy crop of leaders to continue showing up hitting new 52-week highs.

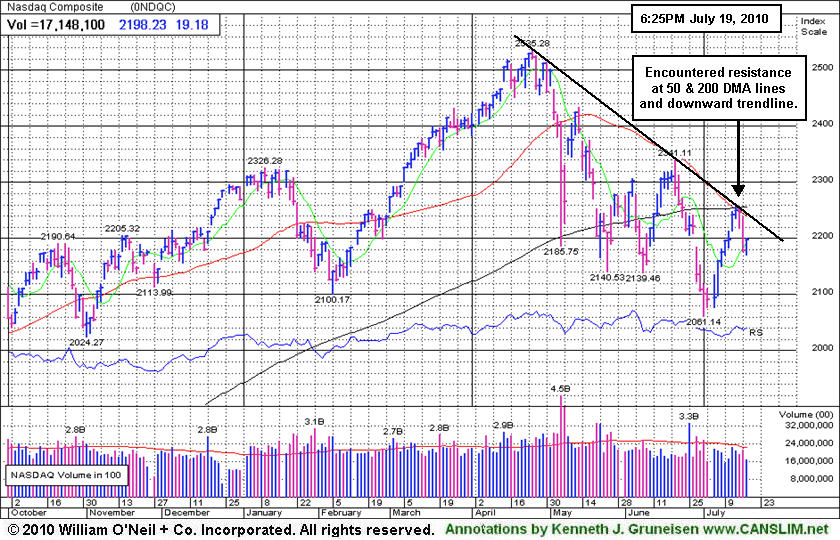

The National Association of Home Builders/Wells Fargo confidence index slid to 14 in July which is the the lowest reading since April 2009 and down from last month's reading of 16. Any reading below 50 means that respondents consider the current environment as poor. Later this week housing starts and existing home sales are slated to be released which will give the latest read on the ailing housing market. The major averages continue to face stubborn resistance near last week's highs and their respective multi month downward trendline and moving averages. Over the next few weeks, it will be very interesting to see how companies fared last quarter and, equally important, to see how the market reacts to the numbers. Analysts believe that Q2 earnings for S&P 500 companies rose +34%.

Looking forward, the window remains open for disciplined investors to carefully buy high-ranked stocks. Since the current rally began on July 1, the major averages have rallied on suspiciously light volume for the most part. It is ideal to see volume expand as the major averages break above resistance and see a new batch of high-ranked leaders trigger fresh technical buy signals. These latest improvements are helping to confirm this nascent rally and provide a reassurance that odds are more favorable for successful investing using the fact-based system.

PICTURED: The Nasdaq Composite Index recently encountered resistance at its 50-day and 200-day moving average lines and downward trendline.

|

|

|

|

Semiconductor Index Led Tech Sector Gains

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

The tech-heavy Nasdaq Composite Index outpaced its peers as strength in the tech sector was led by the Semiconductor Index ($SOX +2.51%), meanwhile the Internet Index ($IIX +1.12%), Networking Index ($NWX +0.77%), and Biotechnology Index ($BTK +0.47%) posted unanimous gains. The Retail Index ($RLX +0.42%) and Broker/Dealer Index ($XBD +0.78%) were also among the positive influences while the Bank Index ($BKX -0.04%) finished virtually unchanged. The Integrated Oil Index ($XOI -0.27%) edged lower while the Oil Services Index ($OSX +1.55%) and Healthcare Index ($HMO +0.90%) were also on the rise. Meanwhile, the Gold & Silver Index ($XAU -1.28%) was one of the day's laggard groups.

Charts courtesy www.stockcharts.com

PICTURED: The Semiconductor Index ($SOX +2.51%) posted a solid gain that ended a 3 session losing streak and helped it rally above its 50-day moving average (DMA) line.

| Oil Services |

$OSX |

175.68 |

+2.68 |

+1.55% |

-9.87% |

| Healthcare |

$HMO |

1,434.83 |

+12.85 |

+0.90% |

-2.59% |

| Integrated Oil |

$XOI |

942.82 |

-2.55 |

-0.27% |

-11.74% |

| Semiconductor |

$SOX |

357.94 |

+8.78 |

+2.51% |

-0.55% |

| Networking |

$NWX |

239.39 |

+1.83 |

+0.77% |

+3.61% |

| Internet |

$IIX |

237.55 |

+2.64 |

+1.12% |

+1.58% |

| Broker/Dealer |

$XBD |

102.40 |

+0.80 |

+0.78% |

-11.00% |

| Retail |

$RLX |

392.22 |

+1.64 |

+0.42% |

-4.60% |

| Gold & Silver |

$XAU |

165.25 |

-2.14 |

-1.28% |

-1.78% |

| Bank |

$BKX |

47.04 |

-0.02 |

-0.04% |

+10.14% |

| Biotech |

$BTK |

1,020.44 |

+4.80 |

+0.47% |

+8.31% |

|

|

|

|

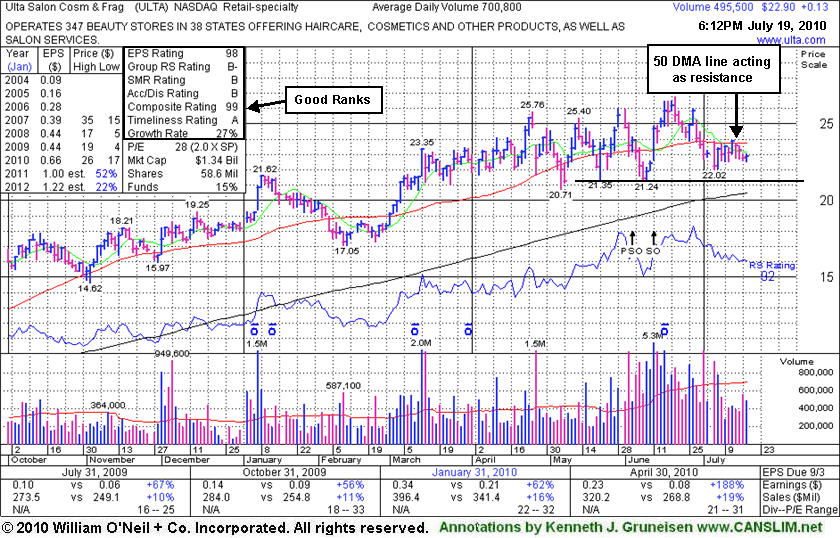

50 DMA Line Recently Acted As Resistance

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

Ulta Salon Cosmetics & Fragrance, Inc. (ULTA +$0.13 or +0.57% to $22.90) held its ground today after 3 consecutive losses on light volume. Its 50-day moving average (DMA) line has acted as resistance after recent distributional pressure sent it below that important short-term average. While it has been consolidating since a negative reversal from an all-time high on 6/21/10, its May - June chart lows in the $21 area define the next support level just above its 200 DMA line.

On 6/11/10 it completed a Secondary Offering which we previously noted may hinder upward price progress for the near-term. For now it remains an ideal candidate for investors' watch lists, awaiting a rebound above its 50 DMA line and confirming gains for a new high close with heavy volume for a fresh technical buy signal.

This high-ranked leader in the Retail - Misc group which has shown accelerating sales revenues increases with strong quarterly earnings increases above the +25% guideline in the 4 latest comparisons (satisfies the C criteria). The number of top-rated funds with an ownership interest has grown from 49 funds in March '09 to 81 funds as of Jun '10 which is an encouraging sign of increasing institutional interest (the I criteria). Management's 36% ownership stake (after the latest offering) still keeps the company's directors very motivated to look after and build shareholder value.

|

|

|

Color Codes Explained :

Y - Better candidates highlighted by our

staff of experts.

G - Previously featured

in past reports as yellow but may no longer be buyable under the

guidelines.

***Last / Change / Volume data in this table is the closing quote data***

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

AAPL

-

NASDAQ

Apple Inc

COMPUTER HARDWARE - Personal Computers

|

$245.58

|

-4.32

-1.73% |

$249.88

|

36,558,614

124.03% of 50 DAV

50 DAV is 29,475,700

|

$279.01

-11.98%

|

6/17/2010

|

$270.95

|

PP = $272.56

|

|

MB = $286.19

|

Most Recent Note - 7/19/2010 5:21:00 PM

Most Recent Note - 7/19/2010 5:21:00 PM

G - Today marked its 3rd loss with above average volume in a span of 5 sessions since slumping under its 50 DMA line again. It closed in the upper half of its intra-day range after trading below the $242-243 area defining important chart support.

>>> The latest Featured Stock Update with an annotated graph appeared on 7/12/2010. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

ABV

-

NYSE

Comp De Bebidas Adr

FOOD and BEVERAGE - Beverages - Brewers

|

$106.78

|

+0.22

0.21% |

$107.37

|

588,414

78.05% of 50 DAV

50 DAV is 753,900

|

$109.33

-2.33%

|

6/29/2010

|

$104.74

|

PP = $109.33

|

|

MB = $114.80

|

Most Recent Note - 7/16/2010 12:41:35 PM

Y - This Brazil-based beverage firm is quietly perched within close striking distance of its 52-week high. It found support near its 50 DMA line recently and has not yet traded above its pivot point since featured in the 6/29/10 mid-day report (read here).

>>> The latest Featured Stock Update with an annotated graph appeared on 6/29/2010. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

BIDU

-

NASDAQ

Baidu Inc Ads

INTERNET - Internet Information Providers

|

$72.90

|

-0.63

-0.86% |

$73.39

|

15,393,704

107.67% of 50 DAV

50 DAV is 14,297,700

|

$82.29

-11.41%

|

7/14/2010

|

$75.03

|

PP = $78.59

|

|

MB = $82.52

|

Most Recent Note - 7/19/2010 5:26:58 PM

Most Recent Note - 7/19/2010 5:26:58 PM

Y - Gapped down today and then rallied to close above its 50 DMA line near the session high. Disciplined investors avoid the temptation to get in "early" and watch for a proper technical buy signal. Color code was changed to yellow with new pivot point cited based on 6/21/10 high after a proper double-bottom pattern of sufficient length.

>>> The latest Featured Stock Update with an annotated graph appeared on 7/14/2010. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

CRM

-

NYSE

Salesforce.Com Inc

INTERNET - Internet Software and Services

|

$92.63

|

+0.58

0.63% |

$93.55

|

1,999,313

67.61% of 50 DAV

50 DAV is 2,957,000

|

$97.94

-5.42%

|

6/2/2010

|

$88.44

|

PP = $89.60

|

|

MB = $94.08

|

Most Recent Note - 7/19/2010 5:31:22 PM

Most Recent Note - 7/19/2010 5:31:22 PM

G - Holding its ground and working on building a new base with volume totals cooling in recent weeks.

>>> The latest Featured Stock Update with an annotated graph appeared on 7/15/2010. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

FFIV

-

NASDAQ

F 5 Networks Inc

INTERNET - Internet Software and Services

|

$76.25

|

-0.12

-0.16% |

$77.01

|

1,825,300

108.01% of 50 DAV

50 DAV is 1,690,000

|

$79.21

-3.74%

|

6/16/2010

|

$74.50

|

PP = $74.10

|

|

MB = $77.81

|

Most Recent Note - 7/19/2010 5:32:28 PM

Most Recent Note - 7/19/2010 5:32:28 PM

Y - Consolidating below its "max buy" level now, its color code was changed to yellow. Prior highs in the $74-77 area may now serve as chart support levels above its 50 DMA line.

>>> The latest Featured Stock Update with an annotated graph appeared on 7/7/2010. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

MELI

-

NASDAQ

Mercadolibre Inc

INTERNET - Internet Software and; Services

|

$59.90

|

+1.80

3.10% |

$60.02

|

843,328

87.10% of 50 DAV

50 DAV is 968,200

|

$62.46

-4.10%

|

5/13/2010

|

$54.21

|

PP = $55.85

|

|

MB = $58.64

|

Most Recent Note - 7/19/2010 5:34:36 PM

Most Recent Note - 7/19/2010 5:34:36 PM

G - Gain today with lighter volume followed a considerable 7/16/10 loss with above average volume. Recently it was noted as it wedged to new 52-week high territory with quiet volume behind its gains.

>>> The latest Featured Stock Update with an annotated graph appeared on 6/30/2010. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

NEM

-

NYSE

Newmont Mining Corp

METALS and MINING - Gold

|

$58.02

|

-0.88

-1.49% |

$58.60

|

10,850,514

109.07% of 50 DAV

50 DAV is 9,948,500

|

$63.38

-8.46%

|

6/22/2010

|

$59.60

|

PP = $59.67

|

|

MB = $62.65

|

Most Recent Note - 7/19/2010 5:38:07 PM

Most Recent Note - 7/19/2010 5:38:07 PM

G - Color code is changed to green based on distributional action and technical weakness. It rebounded today from session lows below its 50 DMA and prior chart highs that define support to watch.

>>> The latest Featured Stock Update with an annotated graph appeared on 7/9/2010. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

ROVI

-

NASDAQ

Rovi Corp

COMPUTER SOFTWARE andamp; SERVICES - Security Software andamp; Services

|

$42.35

|

+0.33

0.79% |

$42.72

|

600,241

41.49% of 50 DAV

50 DAV is 1,446,600

|

$43.67

-3.02%

|

6/3/2010

|

$38.70

|

PP = $40.16

|

|

MB = $42.17

|

Most Recent Note - 7/19/2010 5:40:40 PM

Most Recent Note - 7/19/2010 5:40:40 PM

Y - Holding its ground stubbornly, it closed the session -3% off its 52-week high. Support is defined by prior resistance in the $40 area above its 50 DMA line.

>>> The latest Featured Stock Update with an annotated graph appeared on 6/28/2010. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

THOR

-

NASDAQ

Thoratec Corp

HEALTH SERVICES - Medical Instruments and Supplies

|

$42.78

|

-0.25

-0.58% |

$43.15

|

297,510

29.54% of 50 DAV

50 DAV is 1,007,300

|

$47.93

-10.74%

|

6/3/2010

|

$44.38

|

PP = $45.35

|

|

MB = $47.62

|

Most Recent Note - 7/19/2010 5:43:46 PM

Most Recent Note - 7/19/2010 5:43:46 PM

G - Color code is changed to green today as a loss on light volume followed the 50 DMA line violation noted on 7/16/10. Recent low ($41.27 on 7/01/10) defines the next important chart support level.

>>> The latest Featured Stock Update with an annotated graph appeared on 7/16/2010. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

ULTA

-

NASDAQ

Ulta Salon Cosm & Frag

SPECIALTY RETAIL - Specialty Retail, Other

|

$22.90

|

+0.13

0.57% |

$23.00

|

495,557

70.71% of 50 DAV

50 DAV is 700,800

|

$26.75

-14.39%

|

5/28/2010

|

$25.58

|

PP = $25.86

|

|

MB = $27.15

|

Most Recent Note - 7/19/2010 6:08:27 PM

Most Recent Note - 7/19/2010 6:08:27 PM

G - Held its ground today after 3 consecutive losses on light volume. Its 50 DMA line has acted as resistance recently. Its May - June chart lows in the $21 area define the next support level just above its 200 DMA line.

>>> The latest Featured Stock Update with an annotated graph appeared on 7/19/2010. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

VIT

-

NYSE

Vanceinfo Tech Inc Ads

COMPUTER SOFTWARE and SERVICES - Business Software and Services

|

$24.72

|

-0.28

-1.12% |

$25.00

|

583,810

90.14% of 50 DAV

50 DAV is 647,700

|

$26.90

-8.10%

|

7/8/2010

|

$25.20

|

PP = $26.58

|

|

MB = $27.91

|

Most Recent Note - 7/16/2010 4:05:56 PM

Y - Held its ground today after a positive reversal on the prior session. It has formed a handle on the right side of its 11-week cup shaped pattern now. It did not trigger a buy signal with respect to the pivot point cited after gapping up on 7/08/10, when it briefly matched its all-time high and appeared in the mid-day report (read here).

>>> The latest Featured Stock Update with an annotated graph appeared on 7/8/2010. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

|

|

|

THESE ARE NOT BUY RECOMMENDATIONS!

Comments contained in the body of this report are technical

opinions only. The material herein has been obtained

from sources believed to be reliable and accurate, however,

its accuracy and completeness cannot be guaranteed.

This site is not an investment advisor, hence it does

not endorse or recommend any securities or other investments.

Any recommendation contained in this report may not

be suitable for all investors and it is not to be deemed

an offer or solicitation on our part with respect to

the purchase or sale of any securities. All trademarks,

service marks and trade names appearing in this report

are the property of their respective owners, and are

likewise used for identification purposes only.

This report is a service available

only to active Paid Premium Members.

You may opt-out of receiving report notifications

at any time. Questions or comments may be submitted

by writing to Premium Membership Services 665 S.E. 10 Street, Suite 201 Deerfield Beach, FL 33441-5634 or by calling 1-800-965-8307

or 954-785-1121.

|

|

|