You are not logged in.

This means you

CAN ONLY VIEW reports that were published prior to Tuesday, April 15, 2025.

You

MUST UPGRADE YOUR MEMBERSHIP if you want to see any current reports.

AFTER MARKET UPDATE - THURSDAY, JUNE 24TH, 2010

Previous After Market Report Next After Market Report >>>

|

|

|

|

DOW |

-145.64 |

10,152.80 |

-1.41% |

|

Volume |

1,260,972,400 |

+12% |

|

Volume |

1,974,780,930 |

+8% |

|

NASDAQ |

-36.81 |

2,217.42 |

-1.63% |

|

Advancers |

694 |

22% |

|

Advancers |

647 |

23% |

|

S&P 500 |

-18.35 |

1,073.69 |

-1.68% |

|

Decliners |

2,351 |

75% |

|

Decliners |

2,004 |

73% |

|

Russell 2000 |

-11.08 |

633.17 |

-1.72% |

|

52 Wk Highs |

28 |

|

|

52 Wk Highs |

15 |

|

|

S&P 600 |

-5.51 |

338.33 |

-1.60% |

|

52 Wk Lows |

53 |

|

|

52 Wk Lows |

99 |

|

|

|

Distributional Pressure Sends Stocks Lower Again

Adam Sarhan, Contributing Writer,

The major averages got smacked on Thursday sending the benchmark S&P 500 Index to its longest losing streak in seven weeks, dragged lower by the ailing financial sector and the latest round of tepid economic data. Volume totals were reported higher on the NYSE and the Nasdaq exchange compared to Wednesday's levels which marked the latest distribution day and suggests large institutions are aggressively selling stocks. Decliners trumped advancers by more than 3-to-1 on the NYSE and on the Nasdaq exchange. There were only 2 high-ranked companies from the CANSLIM.net Leaders List that made a new 52-week high and appeared on the CANSLIM.net BreakOuts Page, barely higher than the 1 issue that appeared on the prior session. Leadership has evaporated, and without a healthy crop of leaders hitting new highs it is hard for the major averages to sustain a rally. New 52-week lows outnumbered new 52-week highs on the NYSE and on the Nasdaq exchange.

Before Thursday's opening bell, two separate government reports showed unemployment claims fell from a two-month high while durable-goods orders excluding transportation rose slightly. The Labor Department said weekly jobless claims (i.e. the number of Americans applying for jobless benefits) slid by -19,000 to 457,000 in the week ended June 19. Elsewhere, the Commerce Department said durable goods, goods meant to last at least three years, excluding autos and aircraft, rose in May for the third time since February 2010. However, the overall reading was down -1.1%. The fact that the major averages sold off on the news suggests investors were not pleased with the results.

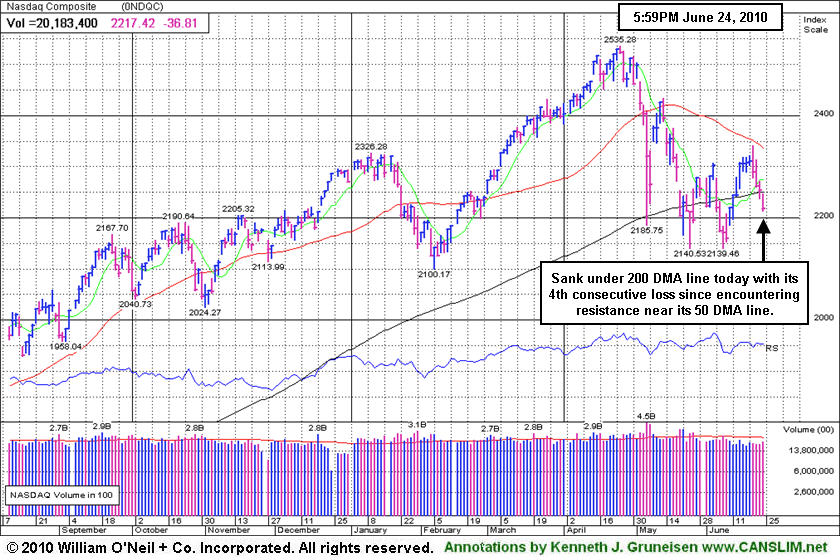

Technically, the fact that both the Dow Jones Industrial Average and the S&P 500 Index continue falling after closing below their respective 200-day moving average (DMA) lines earlier this week suggests the market may retest its recent lows. Looking forward, the 50 DMA line may act as stubborn resistance and this month's lows should act as support. Since the June 15, 2010 follow-through day (FTD), this column has steadily noted the importance of remaining very selective and disciplined because all of the major averages are still trading below their downward sloping 50-day moving average (DMA) lines. This week's sell-off simply confirms that view. Trade accordingly.

Are You Ready For A Change?

Inquire Today About Professional Money Management Services:

If your portfolio is greater than $100,000 and you need assistance, click here to get connected with portfolio managers using the fact-based investment system CANSLIM.net is built upon. ** Serious inquires only, please.

PICTURED: The Nasdaq Composite Index sank under its 200 DMA line with its 4th consecutive loss since encountering resistance near its 50 DMA line.

|

|

|

|

Widespread Losses Push Retail, Financial, Tech Groups Lower

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

Losses in the Retail Index ($RLX -2.73%) and the sinking financial group pulled the Bank Index ($BKX -2.23%) and Broker/Dealer Index ($XBD -1.57%) down, hurting the market's rally. Tech-related groups ended unanimously lower as the Semiconductor Index ($SOX -2.94%), Networking Index ($NWX -2.35%), Internet Index ($IIX -2.06%), and Biotechnology Index ($BTK -1.19%) fell. Weakness in energy-related shares weighed on the Oil Services Index ($OSX -2.49%) and Integrated Oil Index ($XOI -2.27%). Meanwhile, the Healthcare Index ($HMO -1.01%) and Gold & Silver Index ($XAU -0.85%) sank, giving "safe haven" investors no reward.

Charts courtesy www.stockcharts.com

PICTURED: The Bank Index ($BKX -2.23%) closed below its 200 DMA line after its 4th consecutive loss.

| Oil Services |

$OSX |

170.08 |

-4.34 |

-2.49% |

-12.74% |

| Healthcare |

$HMO |

1,496.29 |

-15.20 |

-1.01% |

+1.59% |

| Integrated Oil |

$XOI |

925.04 |

-21.52 |

-2.27% |

-13.40% |

| Semiconductor |

$SOX |

352.22 |

-10.66 |

-2.94% |

-2.14% |

| Networking |

$NWX |

227.35 |

-5.47 |

-2.35% |

-1.60% |

| Internet |

$IIX |

233.51 |

-4.91 |

-2.06% |

-0.15% |

| Broker/Dealer |

$XBD |

102.43 |

-1.63 |

-1.57% |

-10.97% |

| Retail |

$RLX |

405.38 |

-11.36 |

-2.73% |

-1.40% |

| Gold & Silver |

$XAU |

178.67 |

-1.54 |

-0.85% |

+6.19% |

| Bank |

$BKX |

47.80 |

-1.09 |

-2.23% |

+11.92% |

| Biotech |

$BTK |

1,060.08 |

-12.77 |

-1.19% |

+12.52% |

|

|

|

|

Distribution Followed By Half-Hearted Gains

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

Summer Infant Inc (SUMR +$0.12 or +1.76% or $6.93) has seen its Accumulation/Distribution rank fall, from a B- when it was first featured in the 5/04/10 mid-day report, to a worst possible E rating today. Since negating its breakout, volume behind the latest gains has been light. Gains above its 50-day moving average (DMA) line and above recent chart highs near $7.40 would be an encouraging technical improvement. Meanwhile, recent chart lows in the $6.25 area define the next important support level to watch.

Recent quarterly comparisons show sales revenues growth accelerating and big earnings increases (triple digit percentages), plus it has a good annual earnings (A criteria) history. Low-priced stocks are supposed to be avoided under the fact-based system because they are typically riskier candidates, however, when all key criteria are satisfied and market conditions are bullish buying efforts may be justified. Broader market action (M criteria) is normally expected to impact 3 out of 4 stocks, and since 6/15/2010 (read here) when the new rally produced a follow-through day, distributional has begun weighing on the market again.

|

|

|

Color Codes Explained :

Y - Better candidates highlighted by our

staff of experts.

G - Previously featured

in past reports as yellow but may no longer be buyable under the

guidelines.

***Last / Change / Volume data in this table is the closing quote data***

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

AAPL

-

NASDAQ

Apple Inc

COMPUTER HARDWARE - Personal Computers

|

$269.00

|

-1.97

-0.73% |

$273.20

|

25,501,995

91.52% of 50 DAV

50 DAV is 27,864,000

|

$279.01

-3.59%

|

6/17/2010

|

$270.95

|

PP = $272.56

|

|

MB = $286.19

|

Most Recent Note - 6/24/2010 4:54:01 PM

Most Recent Note - 6/24/2010 4:54:01 PM

Y - Hovering near its all-time high since featured in the 6/17/10 mid-day report (read here) with a new pivot point cited based upon its all-time high plus ten cents while "working on the right side of a choppy 9-week consolidation marked by heavy distribution."

>>> The latest Featured Stock Update with an annotated graph appeared on 6/17/2010. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

APEI

-

NASDAQ

American Public Educ Inc

DIVERSIFIED SERVICES - Education and Training Services

|

$45.57

|

+0.18

0.40% |

$46.21

|

116,816

67.06% of 50 DAV

50 DAV is 174,200

|

$48.95

-6.91%

|

6/7/2010

|

$46.60

|

PP = $46.29

|

|

MB = $48.60

|

Most Recent Note - 6/24/2010 4:56:11 PM

Most Recent Note - 6/24/2010 4:56:11 PM

Y - Holding its ground above its 50 DMA line today. Slumped below its pivot point after gains to new highs on better volume.

>>> The latest Featured Stock Update with an annotated graph appeared on 6/14/2010. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

BIDU

-

NASDAQ

Baidu Inc Ads

INTERNET - Internet Information Providers

|

$73.80

|

-2.39

-3.14% |

$75.91

|

10,588,055

69.21% of 50 DAV

50 DAV is 15,298,500

|

$82.29

-10.32%

|

1/13/2010

|

$43.13

|

PP = $42.68

|

|

MB = $44.81

|

Most Recent Note - 6/24/2010 5:03:07 PM

Most Recent Note - 6/24/2010 5:03:07 PM

G - Consolidating -10% below its 52-week high while building a sloppy late-stage base.

>>> The latest Featured Stock Update with an annotated graph appeared on 6/21/2010. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

BRLI

-

NASDAQ

Bio Reference Labs Inc

HEALTH SERVICES - Medical Laboratories and Researc

|

$23.00

|

-0.01

-0.04% |

$23.26

|

231,677

123.17% of 50 DAV

50 DAV is 188,100

|

$24.67

-6.78%

|

6/15/2010

|

$23.57

|

PP = $24.77

|

|

MB = $26.01

|

Most Recent Note - 6/23/2010 12:20:20 PM

Y - Consolidating in a tight range for the past 4 weeks near its 50 DMA line, still perched within close striking distance (-7%) of its all-time high.

>>> The latest Featured Stock Update with an annotated graph appeared on 6/15/2010. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

CISG

-

NASDAQ

Cninsure Inc Ads

INSURANCE - Insurance Brokers

|

$27.47

|

-0.10

-0.36% |

$27.81

|

332,580

106.87% of 50 DAV

50 DAV is 311,200

|

$28.62

-4.02%

|

6/16/2010

|

$27.20

|

PP = $27.75

|

|

MB = $29.14

|

Most Recent Note - 6/24/2010 5:05:26 PM

Most Recent Note - 6/24/2010 5:05:26 PM

Y - Hovering in a tight trading range near its pivot point since featured in the 6/16/10 mid-day report (read here).

>>> The latest Featured Stock Update with an annotated graph appeared on 6/18/2010. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

CRM

-

NYSE

Salesforce.Com Inc

INTERNET - Internet Software and Services

|

$91.04

|

-1.90

-2.04% |

$93.64

|

2,870,033

106.00% of 50 DAV

50 DAV is 2,707,500

|

$97.94

-7.05%

|

6/2/2010

|

$88.44

|

PP = $89.60

|

|

MB = $94.08

|

Most Recent Note - 6/24/2010 5:06:35 PM

Most Recent Note - 6/24/2010 5:06:35 PM

G - Consolidating above its old pivot point. Prior highs in the $89 area are an important support level to watch above its 50 DMA line.

>>> The latest Featured Stock Update with an annotated graph appeared on 6/22/2010. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

DECK

-

NASDAQ

Deckers Outdoor Corp

CONSUMER NON-DURABLES - Textile - Apparel Footwear

|

$153.18

|

-4.58

-2.90% |

$156.73

|

302,285

57.50% of 50 DAV

50 DAV is 525,700

|

$168.52

-9.10%

|

6/11/2010

|

$157.34

|

PP = $158.57

|

|

MB = $166.50

|

Most Recent Note - 6/24/2010 5:10:24 PM

Most Recent Note - 6/24/2010 5:10:24 PM

Y - Gapped down today for a loss on light volume, sinking further below its pivot point near prior chart highs that may now serve as initial support.

>>> The latest Featured Stock Update with an annotated graph appeared on 6/11/2010. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

FFIV

-

NASDAQ

F 5 Networks Inc

INTERNET - Internet Software and Services

|

$71.98

|

-2.38

-3.20% |

$74.09

|

1,479,720

87.49% of 50 DAV

50 DAV is 1,691,300

|

$77.10

-6.64%

|

6/16/2010

|

$74.50

|

PP = $74.10

|

|

MB = $77.81

|

Most Recent Note - 6/24/2010 5:11:38 PM

Most Recent Note - 6/24/2010 5:11:38 PM

Y - Gapped down today for a loss on below average volume. Gain on 6/16/10 with +55% above average volume helped it trigger a technical buy signal with its breakout from a flat base of about 5-weeks.

>>> The latest Featured Stock Update with an annotated graph appeared on 6/16/2010. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

MELI

-

NASDAQ

Mercadolibre Inc

INTERNET - Internet Software and; Services

|

$56.85

|

-0.74

-1.28% |

$57.60

|

798,568

102.74% of 50 DAV

50 DAV is 777,300

|

$62.14

-8.51%

|

5/13/2010

|

$54.21

|

PP = $55.85

|

|

MB = $58.64

|

Most Recent Note - 6/24/2010 5:14:31 PM

Most Recent Note - 6/24/2010 5:14:31 PM

G - Consolidating above prior chart highs in the $55 area that define support.

>>> The latest Featured Stock Update with an annotated graph appeared on 6/10/2010. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

NEM

-

NYSE

Newmont Mining Corp

METALS and MINING - Gold

|

$58.95

|

-0.13

-0.22% |

$60.20

|

9,650,024

103.42% of 50 DAV

50 DAV is 9,331,300

|

$61.78

-4.58%

|

6/22/2010

|

$59.60

|

PP = $59.67

|

|

MB = $62.65

|

Most Recent Note - 6/24/2010 5:17:36 PM

Most Recent Note - 6/24/2010 5:17:36 PM

Y - Perched near all-time highs with no overhead supply to act as resistance. It was featured in a 6/22/10 Stock Bulletin with annotated graph (read here).

>>> The latest Featured Stock Update with an annotated graph appeared on 6/22/2010. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

ROVI

-

NASDAQ

Rovi Corp

COMPUTER SOFTWARE andamp; SERVICES - Security Software andamp; Services

|

$37.20

|

+0.21

0.57% |

$37.43

|

822,453

61.07% of 50 DAV

50 DAV is 1,346,800

|

$40.06

-7.14%

|

6/3/2010

|

$38.70

|

PP = $40.16

|

|

MB = $42.17

|

Most Recent Note - 6/24/2010 5:20:41 PM

Most Recent Note - 6/24/2010 5:20:41 PM

G - Quietly consolidating near its 50 DMA line. Recently found support near prior lows in the $35 area, and stayed above its October 2009 chart high.

>>> The latest Featured Stock Update with an annotated graph appeared on 6/9/2010. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

SUMR

-

NASDAQ

Summer Infant Inc

CONSUMER NON-DURABLES - Personal Products

|

$6.93

|

+0.12

1.76% |

$7.07

|

47,822

58.89% of 50 DAV

50 DAV is 81,200

|

$8.42

-17.70%

|

5/4/2010

|

$6.85

|

PP = $7.09

|

|

MB = $7.44

|

Most Recent Note - 6/24/2010 5:32:25 PM

Most Recent Note - 6/24/2010 5:32:25 PM

G - Since negating its breakout volume behind gains has been light. Gains above its 50 DMA line and above recent chart highs near $7.40 would be an encouraging technical improvement while recent chart lows in the $6.25 area define important support to watch.

>>> The latest Featured Stock Update with an annotated graph appeared on 6/8/2010. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

THOR

-

NASDAQ

Thoratec Corp

HEALTH SERVICES - Medical Instruments and Supplies

|

$43.66

|

-0.68

-1.53% |

$44.29

|

843,934

85.10% of 50 DAV

50 DAV is 991,700

|

$47.93

-8.91%

|

6/3/2010

|

$44.38

|

PP = $45.35

|

|

MB = $47.62

|

Most Recent Note - 6/24/2010 5:35:19 PM

Most Recent Note - 6/24/2010 5:35:19 PM

Y- Loss today on below average volume, but its deeper slump below its pivot point raises concerns.

>>> The latest Featured Stock Update with an annotated graph appeared on 6/23/2010. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

ULTA

-

NASDAQ

Ulta Salon Cosm & Frag

SPECIALTY RETAIL - Specialty Retail, Other

|

$24.42

|

-0.55

-2.18% |

$24.81

|

564,573

90.20% of 50 DAV

50 DAV is 625,900

|

$26.75

-8.71%

|

5/28/2010

|

$25.58

|

PP = $25.86

|

|

MB = $27.15

|

Most Recent Note - 6/24/2010 5:39:37 PM

Most Recent Note - 6/24/2010 5:39:37 PM

Y - Pulled back for a 4th consecutive loss today after a negative reversal from an all-time high on 6/21/10. On 6/11/10 it completed a Secondary Offering which may hinder upward price progress for the near-term.

>>> The latest Featured Stock Update with an annotated graph appeared on 6/7/2010. Click here.

View all notes |

Alert me of new notes |

CANSLIM.net Company Profile |

SEC |

Zacks Reports |

StockTalk |

News |

Chart |

Request a new note

C

A N

S L

I M

|

|

|

|

THESE ARE NOT BUY RECOMMENDATIONS!

Comments contained in the body of this report are technical

opinions only. The material herein has been obtained

from sources believed to be reliable and accurate, however,

its accuracy and completeness cannot be guaranteed.

This site is not an investment advisor, hence it does

not endorse or recommend any securities or other investments.

Any recommendation contained in this report may not

be suitable for all investors and it is not to be deemed

an offer or solicitation on our part with respect to

the purchase or sale of any securities. All trademarks,

service marks and trade names appearing in this report

are the property of their respective owners, and are

likewise used for identification purposes only.

This report is a service available

only to active Paid Premium Members.

You may opt-out of receiving report notifications

at any time. Questions or comments may be submitted

by writing to Premium Membership Services 665 S.E. 10 Street, Suite 201 Deerfield Beach, FL 33441-5634 or by calling 1-800-965-8307

or 954-785-1121.

|

|

|