You are not logged in.

This means you

CAN ONLY VIEW reports that were published prior to Thursday, March 20, 2025.

You

MUST UPGRADE YOUR MEMBERSHIP if you want to see any current reports.

AFTER MARKET UPDATE - THURSDAY, FEBRUARY 12TH, 2015

Previous After Market Report Next After Market Report >>>

|

|

|

|

DOW |

+110.24 |

17,972.38 |

+0.62% |

|

Volume |

786,698,630 |

+7% |

|

Volume |

1,913,671,900 |

+16% |

|

NASDAQ |

+56.43 |

4,857.61 |

+1.18% |

|

Advancers |

2,422 |

76% |

|

Advancers |

2,129 |

70% |

|

S&P 500 |

+19.95 |

2,088.48 |

+0.96% |

|

Decliners |

680 |

21% |

|

Decliners |

821 |

27% |

|

Russell 2000 |

+14.70 |

1,216.25 |

+1.22% |

|

52 Wk Highs |

182 |

|

|

52 Wk Highs |

130 |

|

|

S&P 600 |

+8.98 |

701.95 |

+1.30% |

|

52 Wk Lows |

10 |

|

|

52 Wk Lows |

24 |

|

|

|

Breadth Was Positive and Leadership Expanded as Major Averages Rallied

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

Stocks finished higher on Thursday. The Dow advanced 110 points to 17,972. The S&P 500 climbed 19 points to 2,088. The NASDAQ reached a 14+ year high as it gained 56 points to 4,857. Volume totals were reported higher than the prior session total on the NYSE and on the Nasdaq exchange, a sign of hearty buying demand coming from institutional investors. Breadth was positive as advancers led decliners by almost a 4-1 margin on the NYSE and nearly a 3-1 margin on the Nasdaq exchange. Leadership expanded as there were 90 high-ranked companies from the CANSLIM.net Leaders List that made new 52-week highs and appeared on the CANSLIM.net BreakOuts Page, up considerably from the prior session total of 55 stocks. New 52-week highs easily outnumbered new 52-week lows on the NYSE and on the Nasdaq exchange. There were gains for 11 of the 13 high-ranked companies currently on the Featured Stocks Page.

Concerning the M criteria, additional gains for the major averages have followed last Monday's "positive reversal", avoiding more worrisome technical damage that could have signaled the beginning of a serious market "correction". Keep in mind that new buying efforts should only be made in stocks meeting all of the fundamental and technical guidelines the fact-based investment system.

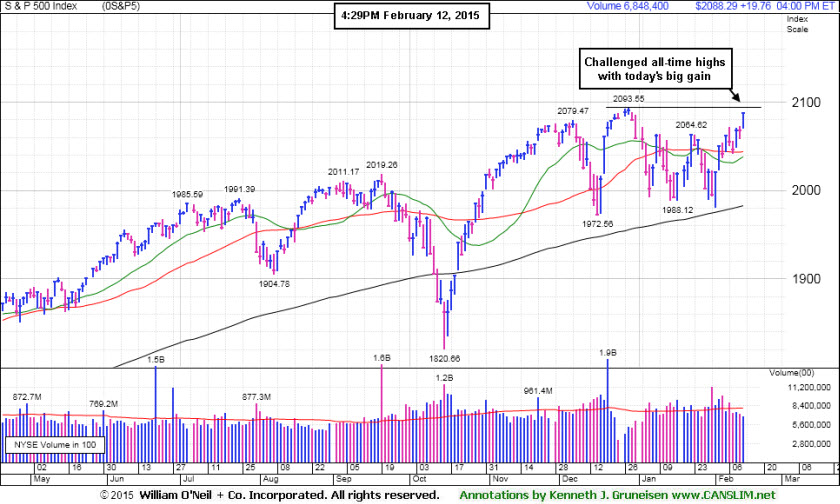

PICTURED: The S&P 500 Index rallied for a big gain challenging its all-time highs.

The major averages pushed higher as investors cheered corporate earnings and easing of geopolitical tensions. At the close, eight of the 10 S&P 500 sectors were in positive territory.

Cisco ( CSCO +9.39%) rallied and TripAdvisor (TRIP +22.49%) soared after both blew past quarterly earnings estimates. However, disappointing quarterly results and lowered guidance weighed on Tesla (TSLA -4.61%) and Kellog (K -4.52%).

Internationally, traders were speculating that Greek and German officials came closer to striking an accord, while Ukraine and Russia agreed to a cease-fire beginning Sunday.

On the economic front, retail sales fell -0.8%, twice the estimated drop, and jobless claims last week increased 25,000 to 304,000 versus expectations for an 11,000 increase.

Treasuries snapped a five-day losing streak, as the government auctioned off $16 billion in 30-year bonds. The benchmark 10-year note climbed 8/32 to yield 1.99%.

Commodities finished mixed. WTI crude climbed +4.8% to $51.20/barrel but natural gas lost -2.9% to $2.72MMBtu after the DoE reported inventories.

The Featured Stocks Page shows recent notes and Headline Links directing members to detailed analysis with data-packed graphs annotated by a Certified expert. See the Premium Member Homepage for archives to all prior pay reports published.

|

Kenneth J. Gruneisen started out as a licensed stockbroker in August 1987, a couple of months prior to the historic stock market crash that took the Dow Jones Industrial Average down -22.6% in a single day. He has published daily fact-based fundamental and technical analysis on high-ranked stocks online for two decades. Through FACTBASEDINVESTING.COM, Kenneth provides educational articles, news, market commentary, and other information regarding proven investment systems that work in good times and bad.

Kenneth J. Gruneisen started out as a licensed stockbroker in August 1987, a couple of months prior to the historic stock market crash that took the Dow Jones Industrial Average down -22.6% in a single day. He has published daily fact-based fundamental and technical analysis on high-ranked stocks online for two decades. Through FACTBASEDINVESTING.COM, Kenneth provides educational articles, news, market commentary, and other information regarding proven investment systems that work in good times and bad.

Comments contained in the body of this report are technical opinions only and are not necessarily those of Gruneisen Growth Corp. The material herein has been obtained from sources believed to be reliable and accurate, however, its accuracy and completeness cannot be guaranteed. Our firm, employees, and customers may effect transactions, including transactions contrary to any recommendation herein, or have positions in the securities mentioned herein or options with respect thereto. Any recommendation contained in this report may not be suitable for all investors and it is not to be deemed an offer or solicitation on our part with respect to the purchase or sale of any securities. |

|

|

Financial, Retail, Tech and Commodity-Linked Groups Rose

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

The Retail Index ($RLX +1.17%), Bank Index ($BKX +1.98%), and Broker/Dealer Index ($XBD +1.39%) posted unanimous gains and helped the major averages extend their rally on Thursday. The tech sector saw unanimous gains from the Networking Index ($NWX +1.97%), Biotechnology Index ($BTK +1.36%), and the Semiconductor Index ($SOX +1.59%). The Gold & Silver Index ($XAU +1.47%) and Integrated Oil Index ($XOI +1.71%) also posted solid gains while the Oil Services Index ($OSX -0.12%) ended the session slightly lower.

Charts courtesy www.stockcharts.com

PICTURED: The Biotechnology Index ($BTK +1.36%) found support at its 50-day moving average (DMA) line during its ascent.

| Oil Services |

$OSX |

198.72 |

-0.24 |

-0.12% |

-5.76% |

| Integrated Oil |

$XOI |

1,388.51 |

+23.31 |

+1.71% |

+3.00% |

| Semiconductor |

$SOX |

700.19 |

+10.94 |

+1.59% |

+1.94% |

| Networking |

$NWX |

362.79 |

+7.02 |

+1.97% |

+1.35% |

| Broker/Dealer |

$XBD |

182.18 |

+2.49 |

+1.39% |

-1.33% |

| Retail |

$RLX |

1,093.19 |

+12.62 |

+1.17% |

+5.85% |

| Gold & Silver |

$XAU |

76.48 |

+1.11 |

+1.47% |

+11.20% |

| Bank |

$BKX |

72.49 |

+1.41 |

+1.98% |

-2.38% |

| Biotech |

$BTK |

3,679.14 |

+49.42 |

+1.36% |

+6.98% |

|

|

|

|

Extended From Prior Highs and Previously Noted Base

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

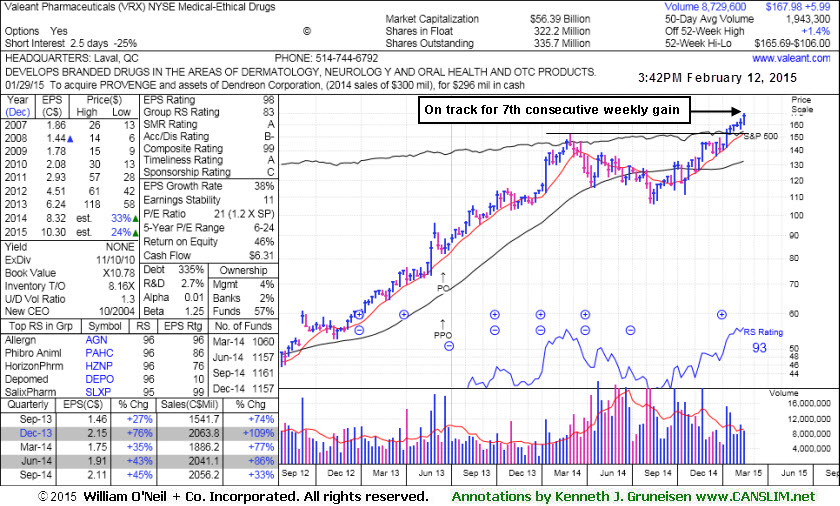

Valeant Pharmaceuticals International, Inc. (VRX +$3.16% or +1.92% to $167.50) hit a new all-time high with above average volume behind today's 3rd consecutive gain. It is extended from any sound base. It faces no resistance due to overhead supply, however disciplined investors avoid chasing extended stocks more than +5% above prior highs. Prior highs and its 50-day moving average (DMA) line define important near-term support to watch on pullbacks.

VRX was last shown in this FSU section on 1/23/15 with annotated daily and weekly graphs under the headline, "Perched at All-Time High Following 3 Quiet Gains". It was highlighted in yellow in the 1/06/15 mid-day report (read here) with an annotated weekly graph showing a new pivot point cited based on the 12/22/14 high while building a cup-with-handle base. Subsequent gains above the pivot point on 1/08/15 were backed by +71% above average volume triggering a new technical buy signal.

VRX is due to report earnings for the Dec '14 quarter on February 24th. It reported better than expected Sep '14 quarterly results with earnings +45% on +33 sales revenues, above the +25% minimum guideline (C criteria). A downturn in FY '07 and '08 earnings (A criteria) has been followed by a strong earnings rebound in recent years. Its current Up/Down Volume Ratio of 1.3 is an unbiased indication its shares have been under accumulation over the past 50 days. The number of top-rated funds owning its shares rose from 1,056 in Mar '14 to 1,157 in Dec '14, a reassuring trend concerning the I criteria. The high-ranked Medical - Ethical Drugs firm completed Public Offering on 6/18/13. The upshot of Public Offerings is that when completed the end result is typically an increase in the total number of institutional owners.

|

|

|

Color Codes Explained :

Y - Better candidates highlighted by our

staff of experts.

G - Previously featured

in past reports as yellow but may no longer be buyable under the

guidelines.

***Last / Change / Volume data in this table is the closing quote data***

|

|

|

THESE ARE NOT BUY RECOMMENDATIONS!

Comments contained in the body of this report are technical

opinions only. The material herein has been obtained

from sources believed to be reliable and accurate, however,

its accuracy and completeness cannot be guaranteed.

This site is not an investment advisor, hence it does

not endorse or recommend any securities or other investments.

Any recommendation contained in this report may not

be suitable for all investors and it is not to be deemed

an offer or solicitation on our part with respect to

the purchase or sale of any securities. All trademarks,

service marks and trade names appearing in this report

are the property of their respective owners, and are

likewise used for identification purposes only.

This report is a service available

only to active Paid Premium Members.

You may opt-out of receiving report notifications

at any time. Questions or comments may be submitted

by writing to Premium Membership Services 665 S.E. 10 Street, Suite 201 Deerfield Beach, FL 33441-5634 or by calling 1-800-965-8307

or 954-785-1121.

|

|

|