You are not logged in.

This means you

CAN ONLY VIEW reports that were published prior to Sunday, February 16, 2025.

You

MUST UPGRADE YOUR MEMBERSHIP if you want to see any current reports.

AFTER MARKET UPDATE - WEDNESDAY, FEBRUARY 6TH, 2019

Previous After Market Report Next After Market Report >>>

|

|

|

|

DOW |

-21.22 |

25,390.30 |

-0.08% |

|

Volume |

794,729,930 |

-6% |

|

Volume |

2,160,103,160 |

-4% |

|

NASDAQ |

-26.80 |

7,375.28 |

-0.36% |

|

Advancers |

1,184 |

40% |

|

Advancers |

1,445 |

48% |

|

S&P 500 |

-6.09 |

2,731.61 |

-0.22% |

|

Decliners |

1,774 |

60% |

|

Decliners |

1,578 |

52% |

|

Russell 2000 |

-2.20 |

1,518.02 |

-0.15% |

|

52 Wk Highs |

61 |

|

|

52 Wk Highs |

51 |

|

|

S&P 600 |

-1.57 |

944.32 |

-0.17% |

|

52 Wk Lows |

9 |

|

|

52 Wk Lows |

19 |

|

|

|

Leadership Waned and Major Indices Ended Lower

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

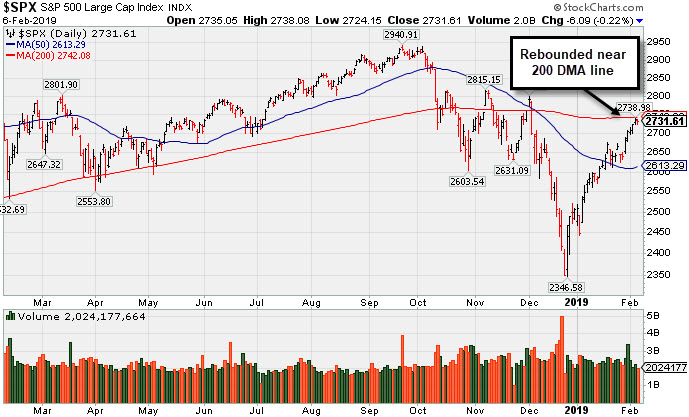

Stocks finished lower Wednesday. The Dow fell 21 points to 25,390 while the S&P 500 slipped 6 points to 2,731. The Nasdaq Composite was off 26 points to 7,375. The volume totals were lighter than the prior session on both the NYSE and the Nasdaq exchange. Breadth was negative as decliners led advancers by a 3-2 margin on the NYSE and by an 8-7 margin on the Nasdaq exchange. There were 26 high-ranked companies from the Leaders List that made a new 52-week high and were listed on the BreakOuts Page, versus the total of 36 on the prior session. New 52-week highs totals expanded and solidly outnumbered new 52-week lows on the NYSE and on the Nasdaq exchange. The major indices are in a confirmed uptrend after recently noted improvements helped to signal a change in market direction (M criteria) back to a bullish stance. The Featured Stocks Page provides the most timely analysis on high-ranked leaders. Charts used courtesy of www.stockcharts.com

PICTURED: The S&P 500 Index has rebounded to its 200-day moving average (DMA) line.

The major averages snapped a multi-day winning streak as potential political and trade headwinds offset generally positive corporate updates. In geopolitics, Treasury Secretary Steve Mnuchin confirmed trade talks will take place next week between U.S. and Chinese leaders and he remains optimistic the two sides can secure a new agreement. On the data front, an update on the housing market revealed mortgage applications fell 2.5% in the most recent week even as mortgage rates continue to fall. A separate update showed the U.S. trade deficit narrowed to $49.3 billion in November.

Eight of 11 S&P 500 sectors finished in negative territory with the Communications Services sector the loss leader. Shares of Electronic Arts (EA -13.31%) and Take-Two Interactive (TTWO -13.76%) fell after both video-game developers fell short of analyst earnings estimates. Semi-conductors offered a bright spot today as Microchip (MCHP +7.29%) rose after management stated it feels the sector downtrend “is nearing its end”. Elsewhere, General Motors (GM +1.58%) rose after the carmaker topped earnings projections.

Treasuries were stronger as the yield on the 10-year note fell one basis point to 2.69%. In commodities, WTI crude added 0.6% to $53.96/barrel. COMEX gold fell 0.4% to $1309.50/ounce. |

Kenneth J. Gruneisen started out as a licensed stockbroker in August 1987, a couple of months prior to the historic stock market crash that took the Dow Jones Industrial Average down -22.6% in a single day. He has published daily fact-based fundamental and technical analysis on high-ranked stocks online for two decades. Through FACTBASEDINVESTING.COM, Kenneth provides educational articles, news, market commentary, and other information regarding proven investment systems that work in good times and bad.

Kenneth J. Gruneisen started out as a licensed stockbroker in August 1987, a couple of months prior to the historic stock market crash that took the Dow Jones Industrial Average down -22.6% in a single day. He has published daily fact-based fundamental and technical analysis on high-ranked stocks online for two decades. Through FACTBASEDINVESTING.COM, Kenneth provides educational articles, news, market commentary, and other information regarding proven investment systems that work in good times and bad.

Comments contained in the body of this report are technical opinions only and are not necessarily those of Gruneisen Growth Corp. The material herein has been obtained from sources believed to be reliable and accurate, however, its accuracy and completeness cannot be guaranteed. Our firm, employees, and customers may effect transactions, including transactions contrary to any recommendation herein, or have positions in the securities mentioned herein or options with respect thereto. Any recommendation contained in this report may not be suitable for all investors and it is not to be deemed an offer or solicitation on our part with respect to the purchase or sale of any securities. |

|

|

Semiconductor Index Rallied; Commodity-Linked Groups Fell

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

The Retail Index ($RLX -0.80%) created a drag on the major indices as it outpaced the Broker/Dealer Index ($XBD -0.23%) and the Bank Index ($BKX -0.09%) to the downside. The tech sector was led higher by the Semiconductor Index ($SOX +2.59%) as the Networking Index ($NWX +0.18%) eked out a tiny gain but the Biotech Index ($BTK -0.41%) ended slightly lower. The Gold & Silver Index ($XAU -1.25%) fell and outpaced the Integrated Oil Index ($XOI -0.89%) and Oil Services Index ($OSX -0.12%) to the downside.

Charts courtesy of www.stockcharts.com

PICTURED: The Broker/Dealer Index ($XBD -0.23%) rebounded impressively from its December low yet remains below its 200-day moving average (DMA) line.

| Oil Services |

$OSX |

98.79 |

-0.12 |

-0.12% |

+22.57% |

| Integrated Oil |

$XOI |

1,291.90 |

-11.61 |

-0.89% |

+11.46% |

| Semiconductor |

$SOX |

1,333.76 |

+33.63 |

+2.59% |

+15.46% |

| Networking |

$NWX |

545.38 |

+0.98 |

+0.18% |

+11.61% |

| Broker/Dealer |

$XBD |

262.86 |

-0.59 |

-0.23% |

+10.75% |

| Retail |

$RLX |

2,119.35 |

-17.18 |

-0.80% |

+8.61% |

| Gold & Silver |

$XAU |

75.36 |

-0.95 |

-1.24% |

+6.65% |

| Bank |

$BKX |

96.85 |

-0.09 |

-0.09% |

+12.89% |

| Biotech |

$BTK |

4,905.11 |

-20.44 |

-0.41% |

+16.21% |

|

|

|

|

Breakaway Gap Backed by Volume +388% Above Average

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

Paycom Software Inc (PAYC +$12.18 or +7.76% to $169.14) was highlighted in yellow with new pivot point cited based on its 9/14/18 high plus 10 cents in the earlier mid-day report (read here). Today's "breakaway gap" cleared all overhead supply and triggered a technical buy signal. Bullish action came after it reported earnings +24% on +32% sales revenues for the Dec '18 quarter, one notch below the +25% minimum earnings guideline (C criteria). Prior comparisons established its strong earnings track record and it has earned a 93 Earnings Per Share Rating.

The high-ranked Computer Software - Enterprise firm was last shown in this FSU section on 9/18/18 with an annotated graph under the headline, "Very Extended From Base After Impressive Rally". It found support after a deep slump below its 200 DMA line since dropped from the Featured Stocks list on 10/10/18.

The current Up/Down Volume Ratio of 1.7 is an unbiased indication its shares have been under heavy accumulation over the past 50 days. Its small supply of only 58.6 million shares outstanding (S criteria) can contribute to greater price volatility in the event of institutional buying or selling. The number of top-rated funds owning its shares rose from 384 in Jun '17 to 478 in Dec '18, a reassuring sign concerning the I criteria. It has a Timeliness rating of A and Sponsorship rating of B. It completed Secondary Offerings on on 11/13/15, 9/16/15, 5/15/15 and 1/14/15 since its $15 IPO on 4/15/14. |

|

|

Color Codes Explained :

Y - Better candidates highlighted by our

staff of experts.

G - Previously featured

in past reports as yellow but may no longer be buyable under the

guidelines.

***Last / Change / Volume data in this table is the closing quote data***

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

MLR

-

NYSE

Miller Industries Inc

AUTOMOTIVE - Auto Parts

|

$30.20

|

-0.27

-0.89% |

$30.66

|

14,448

42.49% of 50 DAV

50 DAV is 34,000

|

$30.84

-2.08%

|

11/30/2018

|

$28.35

|

PP = $29.50

|

|

MB = $30.98

|

Most Recent Note - 2/4/2019 5:30:07 PM

Y - Reversed early gains today after hitting new highs, ending near the session low with a loss on higher (near average) volume. Subsequent gains above the pivot point backed by at least +40% above average volume may help clinch a proper technical buy signal. Its 50 DMA line and recent low define near-term support to watch on pullbacks.

>>> FEATURED STOCK ARTICLE : Traded Above Pivot Point Recently Without Great Volume - 1/29/2019 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

LHCG

-

NASDAQ

L H C Group Inc

HEALTH SERVICES - Home Health Care

|

$109.87

|

-1.84

-1.65% |

$111.65

|

261,530

99.44% of 50 DAV

50 DAV is 263,000

|

$112.22

-2.09%

|

1/23/2019

|

$107.29

|

PP = $107.61

|

|

MB = $112.99

|

Most Recent Note - 2/6/2019 5:38:35 PM

Most Recent Note - 2/6/2019 5:38:35 PM

Y - Pulled back today with higher (near average) volume. Subsequent gains above the pivot point backed by at least +40% above average volume may help clinch a convincing technical buy signal.

>>> FEATURED STOCK ARTICLE : Healthcare Services Firm Reached a New High - 1/23/2019 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

BSTC

-

NASDAQ

Biospecifics Technologie

Medical-Biomed/Biotech

|

$68.27

|

+0.59

0.87% |

$69.30

|

36,834

89.84% of 50 DAV

50 DAV is 41,000

|

$70.25

-2.82%

|

1/18/2019

|

$67.40

|

PP = $66.31

|

|

MB = $69.63

|

Most Recent Note - 2/6/2019 5:42:52 PM

Most Recent Note - 2/6/2019 5:42:52 PM

Y - Perched near its 52-week high. The thinly traded Biomed/Biotech firm rose above its pivot point on 2/04/19 with a big gain backed by +148% above average volume, a reassuring sign of institutional accumulation clinching a technical buy signal. See the latest FSU analysis for more details and an annotated graph.

>>> FEATURED STOCK ARTICLE : Reversed Into Red After Hitting a New High - 2/5/2019 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

UBNT

-

NASDAQ

Ubiquiti Networks

TELECOMMUNICATIONS - Diversified Communication Serv

|

$109.59

|

+0.88

0.81% |

$109.92

|

201,105

61.69% of 50 DAV

50 DAV is 326,000

|

$115.44

-5.07%

|

11/9/2018

|

$108.20

|

PP = $101.43

|

|

MB = $106.50

|

Most Recent Note - 2/5/2019 3:59:16 PM

G - Encountering mild distributional pressure today while reversing an early gain. Still quietly consolidating above its 50 DMA line ($105.18). Faces some resistance due to overhead supply up to the $115 level. Prior low ($92.08 on 12/24/18) defines the next important support.

>>> FEATURED STOCK ARTICLE : Consolidating Above 50-Day Moving Average - 1/31/2019 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

NOW

-

NYSE

Servicenow Inc

Computer Sftwr-Enterprse

|

$225.56

|

-2.79

-1.22% |

$229.50

|

1,662,821

72.20% of 50 DAV

50 DAV is 2,303,000

|

$229.40

-1.67%

|

1/31/2019

|

$218.14

|

PP = $206.40

|

|

MB = $216.72

|

Most Recent Note - 2/1/2019 5:06:59 PM

G - Color code is changed to green after rising above its "max buy" level. Highlighted in yellow with pivot point cited based on its 9/13/18 high plus 10 cents when highlighted in the 1/31/19 mid-day report as it triggered a technical buy signal with a big "breakaway gap". Bullish action came after it reported earnings +79% on +30% sales revenues for the Dec '18 quarter, continuing its strong earnings track record. Prior mid-day report noted - "Volume and volatility often increase near earnings news." See the latest FSU analysis for more details and a new annotated graph.

>>> FEATURED STOCK ARTICLE : Breakaway Gap Followed Strong Earnings Report - 2/1/2019 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

PAYC

-

NYSE

Paycom Software Inc

COMPUTER SOFTWARE and SERVICES - Application Software

|

$169.14

|

+12.18

7.76% |

$179.22

|

2,738,673

488.18% of 50 DAV

50 DAV is 561,000

|

$164.08

3.08%

|

2/6/2019

|

$171.66

|

PP = $164.18

|

|

MB = $172.39

|

Most Recent Note - 2/6/2019 5:34:19 PM

Most Recent Note - 2/6/2019 5:34:19 PM

Y - Highlighted in yellow with new pivot point cited based on its 9/14/18 high plus 10 cents in the earlier mid-day report. Today's "breakaway gap" with +388% above average volume cleared all overhead supply and triggered a technical buy signal. Reported earnings +24% on +32% sales revenues for the Dec '18 quarter, one notch below the +25% minimum earnings guideline (C criteria). Found support after a deep slump below its 200 DMA line since dropped from the Featured Stocks list on 10/10/18. See the latest FSU analysis for more details and a new annotated graph.

>>> FEATURED STOCK ARTICLE : Breakaway Gap Backed by Volume +388% Above Average - 2/6/2019 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

PYPL

-

NASDAQ

Paypal Holdings Inc

Finance-CrdtCard/PmtPr

|

$92.25

|

-0.02

-0.02% |

$92.29

|

5,908,153

64.08% of 50 DAV

50 DAV is 9,220,000

|

$94.58

-2.46%

|

1/24/2019

|

$92.56

|

PP = $93.80

|

|

MB = $98.49

|

Most Recent Note - 2/5/2019 3:55:30 PM

Y - Rebounding after a gap down on 1/31/19 following earnings news. Reported +25% earnings on +13% sales revenues for the Dec '18 quarter. Disciplined investors note that the recent gains above the pivot point lacked the +40% above average volume needed to trigger a proper technical buy signal.

>>> FEATURED STOCK ARTICLE : Perched Within Striking Distance of High Ahead of Earnings News - 1/24/2019 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

ALRM

-

NASDAQ

Alarm.com Holdings Inc

Security/Sfty

|

$64.40

|

+2.40

3.87% |

$65.45

|

1,207,013

240.92% of 50 DAV

50 DAV is 501,000

|

$63.72

1.07%

|

1/22/2019

|

$60.52

|

PP = $60.30

|

|

MB = $63.32

|

Most Recent Note - 2/6/2019 5:41:26 PM

Most Recent Note - 2/6/2019 5:41:26 PM

G - Color code is changed to green after rallying for a new all-time high above its "max buy" level with above average volume. Stubbornly held its ground after recent gains for new highs lacked great volume conviction. Prior highs in the $60 area define initial support to watch on pullbacks.

>>> FEATURED STOCK ARTICLE : Pullback Broke Steak of Gains and Reversed From New High - 1/22/2019 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

PLNT

-

NYSE

Planet Fitness Inc Cl A

Leisure-Services

|

$57.92

|

-0.48

-0.82% |

$58.39

|

1,241,252

98.83% of 50 DAV

50 DAV is 1,256,000

|

$59.91

-3.32%

|

11/7/2018

|

$57.10

|

PP = $55.45

|

|

MB = $58.22

|

Most Recent Note - 2/5/2019 12:30:22 PM

G - Color code is changed to green after rising above its "max buy" level with above average volume today, hitting a new all-time high. Its 50 DMA line ($55.53) defines important near-term support to watch above the recent low ($48).

>>> FEATURED STOCK ARTICLE : Hovering in a Tight Range Near All-Time High - 1/25/2019 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

TEAM

-

NASDAQ

Atlassian Corp Plc Cl A

Comp Sftwr-Spec Enterprs

|

$103.54

|

+0.77

0.75% |

$104.31

|

1,500,260

86.62% of 50 DAV

50 DAV is 1,732,000

|

$103.78

-0.23%

|

1/7/2019

|

$94.68

|

PP = $98.31

|

|

MB = $103.23

|

Most Recent Note - 2/5/2019 3:58:03 PM

G - Color code is changed to green while posting a 5th consecutive gain today, rising above its "max buy" level and hitting new all-time highs, however gains have lacked great volume conviction. Gains and a strong close above the pivot point backed by at least +40% above average volume are needed to clinch a proper technical buy signal. Its 50 DMA line ($87.97) and prior low define near-term support to watch on pullbacks. Fundamentals remain strong.

>>> FEATURED STOCK ARTICLE : Volume Light While Hovering Near High - 1/28/2019 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

TTD

-

NASDAQ

The Trade Desk Inc Cl A

Comml Svcs-Advertising

|

$147.50

|

-7.66

-4.94% |

$155.97

|

1,736,511

161.09% of 50 DAV

50 DAV is 1,078,000

|

$161.50

-8.67%

|

2/6/2019

|

$148.65

|

PP = $149.00

|

|

MB = $156.45

|

Most Recent Note - 2/6/2019 1:12:12 PM

Most Recent Note - 2/6/2019 1:12:12 PM

Y - Pulling back today with higher volume indicative of distributional pressure. Color code is changed to yellow with pivot point cited based on its 12/03/18 high. Gain on 2/04/19 was backed by +48% above average volume while clearing a "double bottom" base and approaching its 52-week high. Faces very little resistance due to overhead supply up to the $161 level. Reported earnings +86% on +50% sales revenues for the Sep '18 quarter. Three of the past 4 quarterly comparisons were well above the +25% minimum guideline (C criteria). Found support at its 200 DMA line during its choppy consolidation since noted with caution in the 10/03/18 mid-day report - " Limited history is a concern. Rallied considerably and completed Secondary Offerings on 2/28/17 and 5/24/17 since its Sep '16 IPO at $18."

There are no Featured Stock Updates™ available for this stock at this time. You may request one by clicking the Request a New Note link below |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

MEDP

-

NASDAQ

Medpace Holdings Inc

Medical-Research Eqp/Svc

|

$66.04

|

-0.47

-0.71% |

$67.19

|

556,711

74.03% of 50 DAV

50 DAV is 752,000

|

$69.71

-5.26%

|

1/30/2019

|

$64.10

|

PP = $65.19

|

|

MB = $68.45

|

Most Recent Note - 2/1/2019 4:55:41 PM

Y - Wedged to a new 52-week high with +22% above average volume behind today's 3rd consecutive gain. Pivot point cited is based on its 9/17/18 high plus 10 cents. Subsequent gains above the pivot point backed by at least +40% above average volume may trigger a technical buy signal. Fundamentals remain strong. The 200 DMA line acted as support above the prior low and it has rebounded since dropped from the Featured Stocks list on 12/19/18. See the latest FSU analysis for more details and an annotated graph.

>>> FEATURED STOCK ARTICLE : Rallied Near 52-Week High With a Volume-Driven Gain - 1/30/2019 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

INVA

-

NASDAQ

Innoviva Inc

Medical-Biomed/Biotech

|

$15.34

|

-0.98

-6.00% |

$16.30

|

2,512,054

206.07% of 50 DAV

50 DAV is 1,219,000

|

$20.54

-25.32%

|

11/23/2018

|

$17.74

|

PP = $18.09

|

|

MB = $18.99

|

Most Recent Note - 2/6/2019 5:37:06 PM

Most Recent Note - 2/6/2019 5:37:06 PM

G - Fell further today and violated its 200 DMA line. Reported earnings news after the close. Damaging volume-driven losses last week triggered technical sell signals. A rebound above the 50 DMA line is ($17.86) needed for its outlook to improve. See the latest FSU analysis for more details and an annotated graph.

>>> FEATURED STOCK ARTICLE : Volume Heavy Behind Damaging Losses Negating Breakout - 2/4/2019 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

|

|

|

THESE ARE NOT BUY RECOMMENDATIONS!

Comments contained in the body of this report are technical

opinions only. The material herein has been obtained

from sources believed to be reliable and accurate, however,

its accuracy and completeness cannot be guaranteed.

This site is not an investment advisor, hence it does

not endorse or recommend any securities or other investments.

Any recommendation contained in this report may not

be suitable for all investors and it is not to be deemed

an offer or solicitation on our part with respect to

the purchase or sale of any securities. All trademarks,

service marks and trade names appearing in this report

are the property of their respective owners, and are

likewise used for identification purposes only.

This report is a service available

only to active Paid Premium Members.

You may opt-out of receiving report notifications

at any time. Questions or comments may be submitted

by writing to Premium Membership Services 665 S.E. 10 Street, Suite 201 Deerfield Beach, FL 33441-5634 or by calling 1-800-965-8307

or 954-785-1121.

|

|

|