You are not logged in.

This means you

CAN ONLY VIEW reports that were published prior to Thursday, February 20, 2025.

You

MUST UPGRADE YOUR MEMBERSHIP if you want to see any current reports.

AFTER MARKET UPDATE - WEDNESDAY, FEBRUARY 4TH, 2015

Previous After Market Report Next After Market Report >>>

|

|

|

|

DOW |

+6.62 |

17,673.02 |

+0.04% |

|

Volume |

1,009,700,640 |

+5% |

|

Volume |

2,032,588,660 |

+2% |

|

NASDAQ |

-11.04 |

4,716.70 |

-0.23% |

|

Advancers |

1,083 |

34% |

|

Advancers |

1,088 |

37% |

|

S&P 500 |

-8.52 |

2,041.51 |

-0.42% |

|

Decliners |

2,001 |

63% |

|

Decliners |

1,756 |

60% |

|

Russell 2000 |

-5.55 |

1,191.44 |

-0.46% |

|

52 Wk Highs |

131 |

|

|

52 Wk Highs |

75 |

|

|

S&P 600 |

-2.02 |

688.51 |

-0.29% |

|

52 Wk Lows |

22 |

|

|

52 Wk Lows |

35 |

|

|

|

Breadth Negative as Major Averages Ended Mixed

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

The major averages ended mixed and little changed on Wednesday after choppy trading. The Dow gained 6 points to 17,673. The S&P 500 fell 8 points to 2,041. The NASDAQ declined 11 points to 4,716. The volume totals were reported higher than the prior session totals on the NYSE and on the Nasdaq exchange, a sign of institutional selling pressure. Breadth was negative as decliners led advancers by a 2-1 margin on the NYSE and 3-2 on the Nasdaq exchange. Leadership improved as there were 57 high-ranked companies from the CANSLIM.net Leaders List that made new 52-week highs and appeared on the CANSLIM.net BreakOuts Page, up from the prior session total of 50 stocks. New 52-week highs outnumbered new 52-week lows on the NYSE and on the Nasdaq exchange. There were gains for 6 of the 10 high-ranked companies currently on the Featured Stocks Page.

Concerning the M criteria, Tuesday's gains with higher volume were an encouraging follow-up to Monday's "positive reversal", avoiding more worrisome damage for the major averages that would signal the beginning of a more serious market "correction".

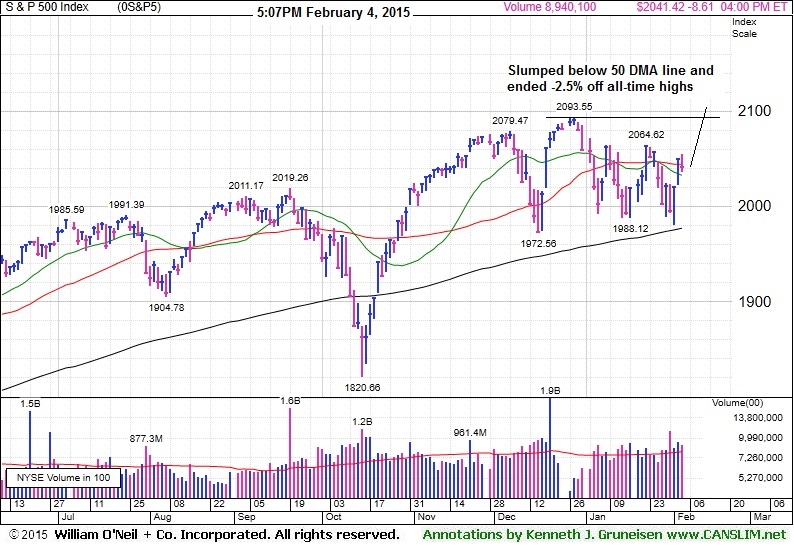

PICTURED: The S&P 500 Index fell back below its 50-day moving average (DMA) line, ending -2.5% off its all-time high.

The major averages toggled between gains and losses as investors focused on economic data, earnings and oil prices. ADP provided insight to Friday's labor market report as they announced 213,000 jobs were added in January. Meanwhile, two gauges of sentiment, spanning the services, manufacturing, non-manufacturing and construction groups, both showed surprisingly positive improvement.

At the close, six of the 10 sectors in the S&P 500 were in negative territory. Energy and health care were down the most. Exxon Mobil (XOM -0.86%) fell on steep losses in the price of oil. In health care, Gilead Sciences (GILD -8.16%) fell after failing to meet analyst earnings estimates. In M&A, Office Depot and Staples agreed to a marriage, helping Office Depot (ODP +2.21%) end higher but sending Staples (SPLS -11.99%) tumbling

Treasuries erased losses to finish higher. The benchmark 10-year note climbed 8/32 to yield 1.76%.

In commodities, the energy patch witnessed a -7.9% plunge in WTI prices to $48.88/barrel, while natural gas lost -3.5% to $2.66/MMBtu. Despite a 0.5% climb in the U.S. dollar, COMEX gold advanced +0.5% to $1,2636.10. Meanwhile, the euro fell -0.8% to $1.1386/EUR, but the Yen strengthened +0.3% to ¥117.22/USD.

The Featured Stocks Page shows recent notes and Headline Links directing members to detailed analysis with data-packed graphs annotated by a Certified expert. See the Premium Member Homepage for archives to all prior pay reports published.

|

Kenneth J. Gruneisen started out as a licensed stockbroker in August 1987, a couple of months prior to the historic stock market crash that took the Dow Jones Industrial Average down -22.6% in a single day. He has published daily fact-based fundamental and technical analysis on high-ranked stocks online for two decades. Through FACTBASEDINVESTING.COM, Kenneth provides educational articles, news, market commentary, and other information regarding proven investment systems that work in good times and bad.

Kenneth J. Gruneisen started out as a licensed stockbroker in August 1987, a couple of months prior to the historic stock market crash that took the Dow Jones Industrial Average down -22.6% in a single day. He has published daily fact-based fundamental and technical analysis on high-ranked stocks online for two decades. Through FACTBASEDINVESTING.COM, Kenneth provides educational articles, news, market commentary, and other information regarding proven investment systems that work in good times and bad.

Comments contained in the body of this report are technical opinions only and are not necessarily those of Gruneisen Growth Corp. The material herein has been obtained from sources believed to be reliable and accurate, however, its accuracy and completeness cannot be guaranteed. Our firm, employees, and customers may effect transactions, including transactions contrary to any recommendation herein, or have positions in the securities mentioned herein or options with respect thereto. Any recommendation contained in this report may not be suitable for all investors and it is not to be deemed an offer or solicitation on our part with respect to the purchase or sale of any securities. |

|

|

Energy Indexes Fell and Gold & Silver Index Rose

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

The Oil Services Index ($OSX -2.97%) and the Integrated Oil Index ($XOI -1.66%) were some of the session's worst decliners. The Bank Index ($BKX -0.55%) edged lower while the Retail Index ($RLX +0.10%) and the Broker/Dealer Index ($XBD +0.24%) posted small gains. The Semiconductor Index ($SOX +0.33%) edged higher but the Biotechnology Index ($BTK -1.69%) and the Networking Index ($NWX -1.01%) fell. The Gold & Silver Index ($XAU +1.42%) was a standout gainer.

Charts courtesy www.stockcharts.com

PICTURED: The Semiconductor Index ($SOX +0.33%) is consolidating below its 50-day moving average (DMA) line and above its 200 DMA line.

| Oil Services |

$OSX |

196.94 |

-6.02 |

-2.97% |

-6.61% |

| Integrated Oil |

$XOI |

1,363.60 |

-23.00 |

-1.66% |

+1.15% |

| Semiconductor |

$SOX |

669.15 |

+2.22 |

+0.33% |

-2.58% |

| Networking |

$NWX |

344.75 |

-3.53 |

-1.01% |

-3.68% |

| Broker/Dealer |

$XBD |

173.72 |

+0.41 |

+0.24% |

-5.92% |

| Retail |

$RLX |

1,062.38 |

+1.10 |

+0.10% |

+2.87% |

| Gold & Silver |

$XAU |

80.02 |

+1.12 |

+1.42% |

+16.34% |

| Bank |

$BKX |

69.13 |

-0.38 |

-0.55% |

-6.91% |

| Biotech |

$BTK |

3,576.77 |

-61.30 |

-1.69% |

+4.00% |

|

|

|

|

Pullback Following Big Volume-Driven Gain For New Highs

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

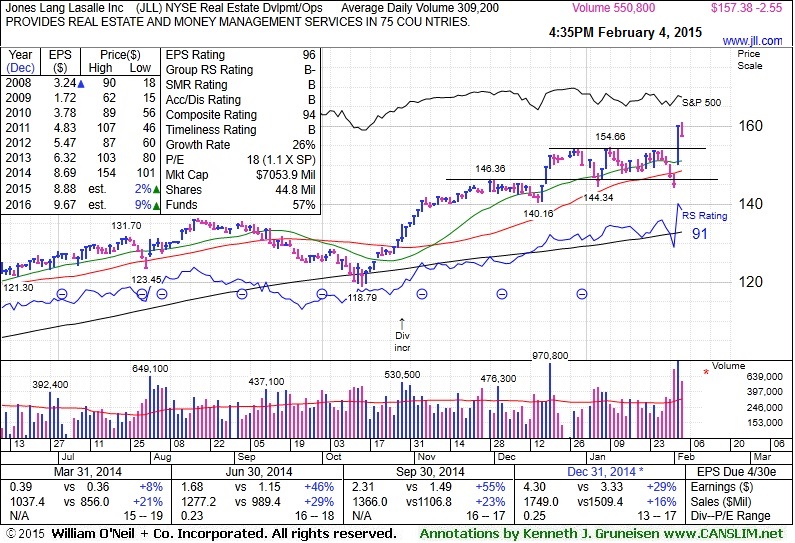

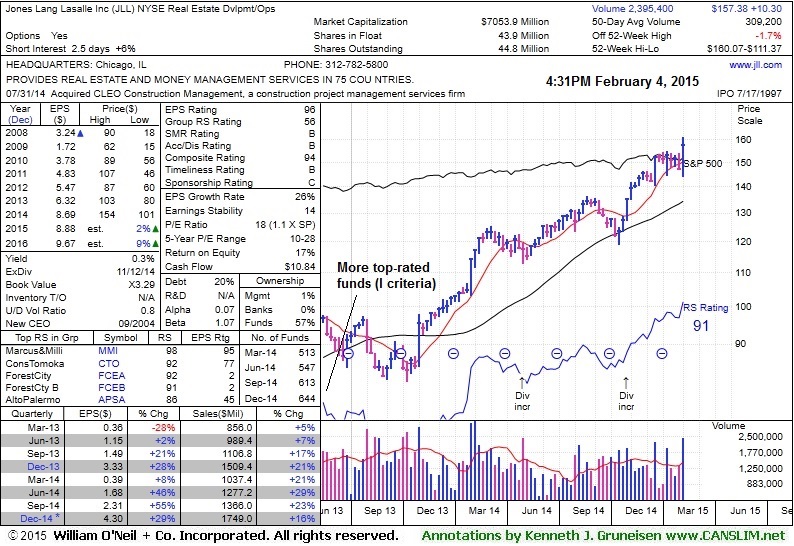

Jones Lang Lasalle Inc (JLL -$2.55 or -1.59% to $157.38) pulled back on Wednesday with above average but lighter volume. On the prior session it finished strong with +251% above average volume behind its gain for a new 52-week high (N criteria) after gapping up. It was highlighted in yellow in the 2/03/15 mid-day report (read here) and noted - "Has the look of a valid Secondary Buy point up to +5% above prior highs."

JLL reported Dec '14 earnings +29% on +16% sales revenues, above the +25% minimum earnings guideline (C criteria) for the 3rd consecutive quarterly comparison versus the year ago periods. That helped provide a reassurance, fundamentally, and it appeared to form a base-on-base type pattern after a breakout in mid-December which came after noted with caution in the 12/02/14 mid-day report, "Patient investors may watch for a new base or secondary buy point to possibly develop and be noted in the weeks ahead."

The number of top-rated funds owning its shares rose from 513 in Mar '14 to 644 in Dec '14, which is a reassuring sign concerning the I criteria. Its small supply (S criteria) of only 43.9 million shares in the public float contribute to greater price volatility in the event of institutional buying or selling.

|

|

|

Color Codes Explained :

Y - Better candidates highlighted by our

staff of experts.

G - Previously featured

in past reports as yellow but may no longer be buyable under the

guidelines.

***Last / Change / Volume data in this table is the closing quote data***

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

ACT

-

NYSE

Actavis plc

Medical-Generic Drugs

|

$266.23

|

-2.12

-0.79% |

$268.40

|

1,883,647

72.12% of 50 DAV

50 DAV is 2,612,000

|

$285.09

-6.62%

|

12/29/2014

|

$260.22

|

PP = $272.85

|

|

MB = $286.49

|

Most Recent Note - 2/2/2015 6:18:31 PM

Y - Halted is slide at its 50 DMA line with a gain on light volume following 4 consecutive losses. See the latest FSU analysis for more details and new annotated graphs.

>>> FEATURED STOCK ARTICLE : Found Support at 50-Day Moving Average Line - 2/2/2015

View all notes |

Set NEW NOTE alert |

CANSLIM.net Company Profile |

SEC

News |

Chart |

Request a new note

C

A N

S L

I M

|

AMBA

-

NASDAQ

Ambarella Inc

ELECTRONICS - Semiconductor - Specialized

|

$56.52

|

-0.20

-0.35% |

$57.14

|

768,727

38.02% of 50 DAV

50 DAV is 2,022,000

|

$63.20

-10.57%

|

1/7/2015

|

$54.96

|

PP = $58.10

|

|

MB = $61.01

|

Most Recent Note - 2/2/2015 6:21:44 PM

Y - Volume totals have been cooling while consolidating in a tight trading range above its 50 DMA line ($53.70). That important short-term average recently acted as support.

>>> FEATURED STOCK ARTICLE : Volume Totals Cooling While Staying Above 50-Day Moving Average - 1/27/2015

View all notes |

Set NEW NOTE alert |

CANSLIM.net Company Profile |

SEC

News |

Chart |

Request a new note

C

A N

S L

I M

|

EPAM

-

NYSE

Epam Systems Inc

COMPUTER SOFTWARE and SERVICES - Information Technology Service

|

$50.51

|

+3.05

6.43% |

$50.81

|

376,293

110.35% of 50 DAV

50 DAV is 341,000

|

$52.89

-4.50%

|

10/23/2014

|

$45.21

|

PP = $46.09

|

|

MB = $48.39

|

Most Recent Note - 2/4/2015 5:25:33 PM

Most Recent Note - 2/4/2015 5:25:33 PM

Y - Rebounded above its 50 DMA line with today's gain helping its technical stance improve and its color code is changed to yellow. Still faces some overhead supply up through the $52 level.

>>> FEATURED STOCK ARTICLE : Recovery Above 50-Day Average Needed for Outlook to Improve - 1/21/2015

View all notes |

Set NEW NOTE alert |

CANSLIM.net Company Profile |

SEC

News |

Chart |

Request a new note

C

A N

S L

I M

|

ILMN

-

NASDAQ

Illumina Inc

DRUGS - Biotechnology

|

$192.03

|

-0.97

-0.50% |

$193.75

|

900,011

70.59% of 50 DAV

50 DAV is 1,275,000

|

$213.33

-9.98%

|

12/30/2014

|

$186.26

|

PP = $196.00

|

|

MB = $205.80

|

Most Recent Note - 2/3/2015 5:53:32 PM

Y - Undercut its 50 DMA line intra-day yet found support and finished in the upper third of its intra-day range. More damaging losses would raise greater concerns. Reported earnings +93% on +32% sales revenues for the Dec '14 quarter.

>>> FEATURED STOCK ARTICLE : Rebound Above 50-Day Moving Average Helped Technical Stance - 1/20/2015

View all notes |

Set NEW NOTE alert |

CANSLIM.net Company Profile |

SEC

News |

Chart |

Request a new note

C

A N

S L

I M

|

JLL

-

NYSE

Jones Lang Lasalle Inc

REAL ESTATE - Property Management/Developmen

|

$157.38

|

-2.55

-1.59% |

$160.91

|

565,555

183.03% of 50 DAV

50 DAV is 309,000

|

$160.07

-1.68%

|

2/3/2015

|

$156.95

|

PP = $154.66

|

|

MB = $162.39

|

Most Recent Note - 2/4/2015 5:27:15 PM

Most Recent Note - 2/4/2015 5:27:15 PM

Y - Pulled back today on lighter but above average volume. Has the look of a valid Secondary Buy point up to +5% above prior highs. See the latest FSU analysis for more details and new annotated graphs.

>>> FEATURED STOCK ARTICLE : Pullback Following Big Volume-Driven Gain For New Highs - 2/4/2015

View all notes |

Set NEW NOTE alert |

CANSLIM.net Company Profile |

SEC

News |

Chart |

Request a new note

C

A N

S L

I M

|

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

NXPI

-

NASDAQ

Nxp Semiconductors N V

ELECTRONICS - Semiconductor - Broad Line

|

$79.75

|

+0.01

0.01% |

$80.39

|

4,708,806

156.49% of 50 DAV

50 DAV is 3,009,000

|

$82.76

-3.64%

|

1/5/2015

|

$76.43

|

PP = $78.44

|

|

MB = $82.36

|

Most Recent Note - 2/4/2015 5:32:31 PM

Most Recent Note - 2/4/2015 5:32:31 PM

Y - Churned above average volume but made no meaningful price progress today, a sign of distributional pressure. No resistance remains to hinder its progress. Its 50 DMA line ($77.05) acted as support recently, where a violation would raise concerns and trigger a technical sell signal.

>>> FEATURED STOCK ARTICLE : 50-Day Moving Average Acted as Support After "Negative Reversal" - 1/22/2015

View all notes |

Set NEW NOTE alert |

CANSLIM.net Company Profile |

SEC

News |

Chart |

Request a new note

C

A N

S L

I M

|

PANW

-

NYSE

Palo Alto Networks

Computer Sftwr-Security

|

$125.68

|

+2.15

1.74% |

$126.23

|

906,320

66.35% of 50 DAV

50 DAV is 1,366,000

|

$130.00

-3.32%

|

7/30/2014

|

$84.21

|

PP = $85.88

|

|

MB = $90.17

|

Most Recent Note - 2/3/2015 5:49:57 PM

G - Testing support at its 50 DMA line with losses this week. Recent low ($117.60 on 1/02/15) defines the next important near-term support to watch where violations may trigger technical sell signals.

>>> FEATURED STOCK ARTICLE : Finished With a Loss and Near Session Low After Chance at Best-Ever Close - 1/28/2015

View all notes |

Set NEW NOTE alert |

CANSLIM.net Company Profile |

SEC

News |

Chart |

Request a new note

C

A N

S L

I M

|

RH

-

NYSE

Restoration Hardware Hld

RETAIL - Home Furnishing Stores

|

$92.72

|

+0.77

0.84% |

$94.38

|

569,344

59.74% of 50 DAV

50 DAV is 953,000

|

$100.66

-7.89%

|

12/11/2014

|

$98.66

|

PP = $94.60

|

|

MB = $99.33

|

Most Recent Note - 2/3/2015 5:44:38 PM

Y - Quietly rebounded above its 50 DMA line with a 2nd gain on light volume following a technical sell signal. Color code is changed to yellow, however it faces some resistance due to overhead supply. See the attest FSU analysis for more details and new annotated graphs.

>>> FEATURED STOCK ARTICLE : Quiet Rebound Above 50-Day Moving Average Helped Technical Stance - 2/3/2015

View all notes |

Set NEW NOTE alert |

CANSLIM.net Company Profile |

SEC

News |

Chart |

Request a new note

C

A N

S L

I M

|

UIHC

-

NASDAQ

United Insurance Holding

Insurance-Prop/Cas/Titl

|

$27.95

|

+1.06

3.94% |

$28.28

|

598,827

215.41% of 50 DAV

50 DAV is 278,000

|

$26.93

3.79%

|

12/5/2014

|

$20.64

|

PP = $20.31

|

|

MB = $21.33

|

Most Recent Note - 2/4/2015 5:28:45 PM

Most Recent Note - 2/4/2015 5:28:45 PM

G - Rallied for a 3rd consecutive volume-driven gain today and hit another new 52-week high, getting more extended from any sound base. Prior highs in the $22 area and its 50 DMA line define near-term support to watch.

>>> FEATURED STOCK ARTICLE : Extended After Tallying More Volume-Driven Gains - 1/29/2015

View all notes |

Set NEW NOTE alert |

CANSLIM.net Company Profile |

SEC

News |

Chart |

Request a new note

C

A N

S L

I M

|

VRX

-

NYSE

Valeant Pharmaceuticals

DRUGS - Drug Manufacturers - Other

|

$160.87

|

+1.16

0.73% |

$161.75

|

1,616,396

83.71% of 50 DAV

50 DAV is 1,931,000

|

$165.69

-2.91%

|

1/5/2015

|

$144.84

|

PP = $149.90

|

|

MB = $157.40

|

Most Recent Note - 2/2/2015 6:24:32 PM

G - Rallied for a best-ever close with below average volume behind today's gain, getting more extended from any sound base. Its 50 DMA line defines near-term support to watch.

>>> FEATURED STOCK ARTICLE : Perched at All-Time High Following 3 Quiet Gains - 1/23/2015

View all notes |

Set NEW NOTE alert |

CANSLIM.net Company Profile |

SEC

News |

Chart |

Request a new note

C

A N

S L

I M

|

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

|

|

|

THESE ARE NOT BUY RECOMMENDATIONS!

Comments contained in the body of this report are technical

opinions only. The material herein has been obtained

from sources believed to be reliable and accurate, however,

its accuracy and completeness cannot be guaranteed.

This site is not an investment advisor, hence it does

not endorse or recommend any securities or other investments.

Any recommendation contained in this report may not

be suitable for all investors and it is not to be deemed

an offer or solicitation on our part with respect to

the purchase or sale of any securities. All trademarks,

service marks and trade names appearing in this report

are the property of their respective owners, and are

likewise used for identification purposes only.

This report is a service available

only to active Paid Premium Members.

You may opt-out of receiving report notifications

at any time. Questions or comments may be submitted

by writing to Premium Membership Services 665 S.E. 10 Street, Suite 201 Deerfield Beach, FL 33441-5634 or by calling 1-800-965-8307

or 954-785-1121.

|

|

|