You are not logged in.

This means you

CAN ONLY VIEW reports that were published prior to Saturday, September 21, 2024.

You

MUST UPGRADE YOUR MEMBERSHIP if you want to see any current reports.

AFTER MARKET UPDATE - FRIDAY, NOVEMBER 7TH, 2014

Previous After Market Report Next After Market Report >>>

|

|

|

|

DOW |

+19.46 |

17,573.93 |

+0.11% |

|

Volume |

756,529,490 |

+3% |

|

Volume |

1,743,475,950 |

-4% |

|

NASDAQ |

-5.94 |

4,632.53 |

-0.13% |

|

Advancers |

1,892 |

59% |

|

Advancers |

1,388 |

47% |

|

S&P 500 |

+0.71 |

2,031.92 |

+0.03% |

|

Decliners |

1,191 |

37% |

|

Decliners |

1,489 |

50% |

|

Russell 2000 |

+1.46 |

1,173.32 |

+0.12% |

|

52 Wk Highs |

184 |

|

|

52 Wk Highs |

106 |

|

|

S&P 600 |

+0.16 |

679.06 |

+0.02% |

|

52 Wk Lows |

39 |

|

|

52 Wk Lows |

59 |

|

|

|

Major Averages Rose for a Third Consecutive Week

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

The Dow posted a weekly gain of +1.1%, the S&P 500 increased +0.7%, and the NASDAQ rose less than +0.1%. The major averages finished little changed on Friday. The volume totals were reported mixed, higher than the prior session total on the NYSE and lighter on the Nasdaq exchange. Breadth was positive as advancers led decliners by about a 3-2 margin on the NYSE, however decliners narrowly outnumbered advancers on the Nasdaq exchange. There were 74 high-ranked companies from the CANSLIM.net Leaders List that made new 52-week highs and appeared on the CANSLIM.net BreakOuts Page, down from the prior session total of 84 stocks. New 52-week highs outnumbered new 52-week lows on the NYSE and on the Nasdaq exchange. There were gains for 4 of the 12 high-ranked companies currently on the Featured Stocks Page, a list which recently gained several new companies as broader market conditions improved. Disciplined investors know that new buying efforts may be made under the fact-based investment system only in stocks meeting all key criteria.

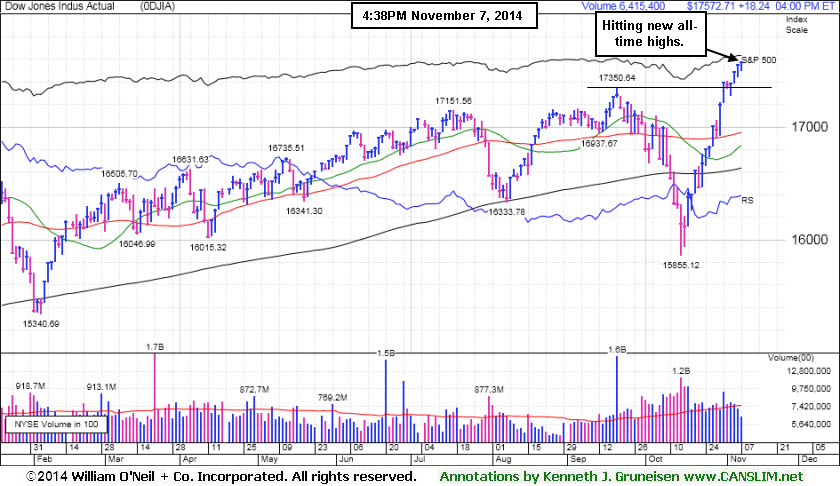

PICTURED: The Dow increased 19 points to 17,573 and closed at a fresh record high.

The S&P 500 rose less than a point to 2,031, a new record high. The NASDAQ Composite fell 6 points to 4,632.

Stocks spent the day toggling between gains and losses as the monthly jobs report fell short of expectations. Non-farm payrolls rose by a less than anticipated 214,000 in October, but it was the ninth straight month that more than 200,000 jobs were added. Meanwhile, the unemployment rate edged down to a six-year low of 5.8% even as more Americans entered the labor force.

Seven of the 10 sectors in the S&P 500 rose. Energy and materials advanced as WTI crude rebounded while gold posted its biggest gain since June. Schlumberger (SLB +1.6%) and Freeport-McMoRan (FCX +2.4%) rose. Utilities also gained ground led by PG&E Corp's (PCG +1.9%) Health care and consumer discretionary weighed on the market. Humana (HUM -6.4%) fell after posting a disappointing full-year forecast. Walt Disney (DIS -2.3%) fell as the company's media revenue fell short of expectations.

Treasuries rose for the first time in three sessions. The 10-year note gained 23/32 to yield 2.30%.

Large gains on 10/21/14 backed by higher volume totals while leadership (stocks hitting new 52-week highs) expanded met the definition of a "follow-through day" confirming a new uptrend for the market (M criteria). The S&P 500 Index, Nasdaq Composite Index, and the Dow Jones Industrial Average have collectively rebounded above their respective 50-day and 200-day moving average (DMA) lines, technically putting the market in a healthier stance.

The CANSLIM.net Featured Stocks Page shows the most action-worthy candidates and their latest notes and a Headline Link directs members to the latest detailed analysis with data-packed graphs annotated by a Certified expert along with links to additional resources. The Premium Member Homepage includes "dynamic archives" to all prior pay reports published.

|

Kenneth J. Gruneisen started out as a licensed stockbroker in August 1987, a couple of months prior to the historic stock market crash that took the Dow Jones Industrial Average down -22.6% in a single day. He has published daily fact-based fundamental and technical analysis on high-ranked stocks online for two decades. Through FACTBASEDINVESTING.COM, Kenneth provides educational articles, news, market commentary, and other information regarding proven investment systems that work in good times and bad.

Kenneth J. Gruneisen started out as a licensed stockbroker in August 1987, a couple of months prior to the historic stock market crash that took the Dow Jones Industrial Average down -22.6% in a single day. He has published daily fact-based fundamental and technical analysis on high-ranked stocks online for two decades. Through FACTBASEDINVESTING.COM, Kenneth provides educational articles, news, market commentary, and other information regarding proven investment systems that work in good times and bad.

Comments contained in the body of this report are technical opinions only and are not necessarily those of Gruneisen Growth Corp. The material herein has been obtained from sources believed to be reliable and accurate, however, its accuracy and completeness cannot be guaranteed. Our firm, employees, and customers may effect transactions, including transactions contrary to any recommendation herein, or have positions in the securities mentioned herein or options with respect thereto. Any recommendation contained in this report may not be suitable for all investors and it is not to be deemed an offer or solicitation on our part with respect to the purchase or sale of any securities. |

|

|

Commodity-Linked Groups, Retail, and Networking Rose

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

The Biotechnology Index ($BTK -1.28%) and the Semiconductor Index ($SOX -0.90%) dragged the tech sector lower while the Networking Index ($NWX +1.24%) rose. The Broker/Dealer Index ($XBD -0.71%) outpaced the Bank Index ($BKX -0.14%) to the downside while the Retail Index ($RLX +0.40%) was a positive influence on the major averages. Commodity-linked groups had a positive bias as the Integrated Oil Index ($XOI +0.89%) and the Oil Services Index ($OSX +1.88%) rose. The Gold & Silver Index ($XAU +7.42%) was a standout gainer for a 2nd consecutive session as it bounced back from multi-year lows.

Charts courtesy www.stockcharts.com

PICTURED: The Retail Index ($RLX +0.40%) recently rebounded near its 2014 highs.

| Oil Services |

$OSX |

248.84 |

+4.59 |

+1.88% |

-11.45% |

| Integrated Oil |

$XOI |

1,473.69 |

+13.01 |

+0.89% |

-1.96% |

| Semiconductor |

$SOX |

637.48 |

-5.82 |

-0.90% |

+19.15% |

| Networking |

$NWX |

342.21 |

+4.19 |

+1.24% |

+5.64% |

| Broker/Dealer |

$XBD |

175.72 |

-1.25 |

-0.71% |

+9.44% |

| Retail |

$RLX |

952.27 |

+3.83 |

+0.40% |

+1.33% |

| Gold & Silver |

$XAU |

69.04 |

+4.77 |

+7.42% |

-17.96% |

| Bank |

$BKX |

73.12 |

-0.10 |

-0.14% |

+5.57% |

| Biotech |

$BTK |

3,279.25 |

-42.64 |

-1.28% |

+40.71% |

|

|

|

|

Consolidating Above Prior Highs Which Define Initial Support

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

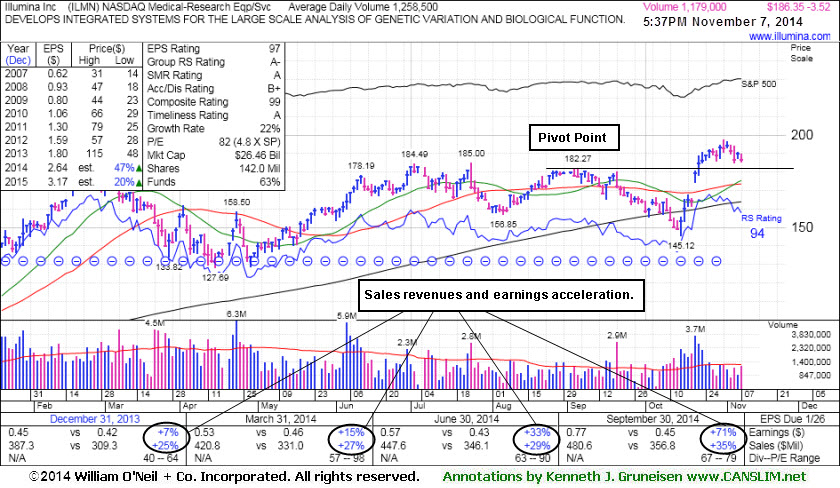

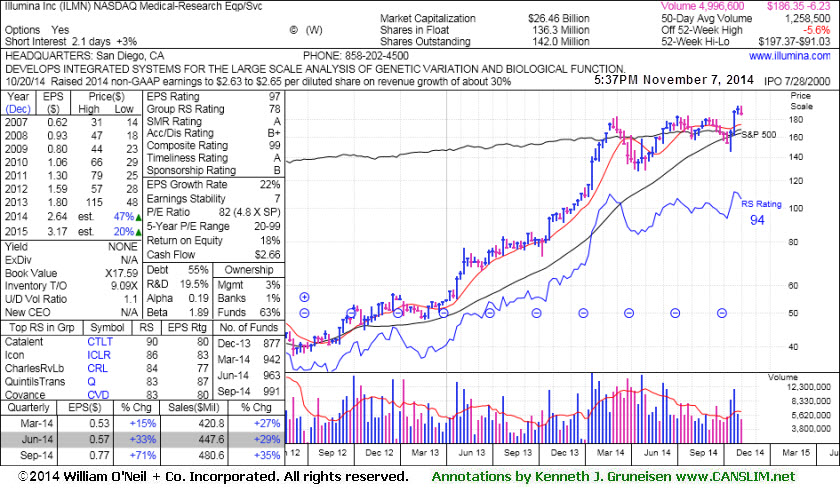

Illumina Inc (ILMN +$5.27 or +2.94% to $184.82) has recently endured mild distributional pressure, but recent losses were on below average volume. Its color code was changed to yellow after dipping below its "max buy" level. Prior highs near $182 define initial support to watch on pullbacks. Disciplined investors always limit losses by selling any stock that falls more than -7% from their purchase price.

It was last shown in this FSU section on 10/22/14 with annotated graphs under the headline, "Breakout Cleared 'Double Bottom' Base Pattern", after highlighted in the earlier mid-day report (read here). The pivot point cited was based on its 9/04/14 high in a "double bottom" base pattern. Considerable volume-driven gains added to its winning streak and triggered a technical buy signal. This Medical - Research Equipment/Services firm reported earnings +71% on +35% sales revenues for the Sep '14 quarter, its 2nd consecutive quarterly comparison with earnings above the +25% minimum guideline (C criteria). Sequential quarterly comparisons show encouraging sales revenues and earnings acceleration.

Its current Relative Strength (RS) rank of 94 is well above the 80+ minimum guideline for buy candidates. Historic examples of the market's biggest winners typically showed their relative strength lines (the jagged blue line) usually spiked to new highs ahead of, or while the stock was making new highs. In this case, however, its RS line peaked a bit higher in February of 2014. Its annual earnings (A criteria) growth history has improved steadily since a downturn in FY '09. The number of top-rated funds owning its shares rose from 877 in Dec '13 to 991 in Sep '14, a reassuring sign concerning the I criteria.

|

|

|

Color Codes Explained :

Y - Better candidates highlighted by our

staff of experts.

G - Previously featured

in past reports as yellow but may no longer be buyable under the

guidelines.

***Last / Change / Volume data in this table is the closing quote data***

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

ACT

-

NYSE

Actavis plc

Medical-Generic Drugs

|

$245.91

|

-4.47

-1.79% |

$250.05

|

2,038,182

89.12% of 50 DAV

50 DAV is 2,287,000

|

$254.41

-3.34%

|

6/20/2014

|

$216.53

|

PP = $230.87

|

|

MB = $242.41

|

Most Recent Note - 11/6/2014 5:38:55 PM

G - Perched at its 52-week high today following 2 volume-driven gains, extended from any sound base. Recent lows near $208 define initial support to watch below its 50 DMA line ($236) on pullbacks. See the latest FSU analysis for more details and new annotated graphs.

>>> FEATURED STOCK ARTICLE : New Highs Following Deep "V" Shaped Pullback - Not a Sound Base - 11/6/2014

View all notes |

Set NEW NOTE alert |

CANSLIM.net Company Profile |

SEC

News |

Chart |

Request a new note

C

A N

S L

I M

|

AFSI

-

NASDAQ

Amtrust Financial Svcs

INSURANCE - Property and; Casualty Insurance

|

$49.89

|

-0.58

-1.15% |

$50.71

|

1,222,835

129.67% of 50 DAV

50 DAV is 943,000

|

$53.50

-6.75%

|

10/17/2014

|

$45.24

|

PP = $46.02

|

|

MB = $48.32

|

Most Recent Note - 11/5/2014 6:23:12 PM

G - Tallied 4 consecutive gains with above average volume, rallying back toward its 52-week high. Found support at its 50 DMA line when abruptly retreating last week following an analyst downgrade. See the latest FSU analysis for more details and new annotated graphs.

>>> FEATURED STOCK ARTICLE : 50-Day Average Acted as Support Following Analyst Downgrade - 11/5/2014

View all notes |

Set NEW NOTE alert |

CANSLIM.net Company Profile |

SEC

News |

Chart |

Request a new note

C

A N

S L

I M

|

ALXN

-

NASDAQ

Alexion Pharmaceuticals

DRUGS - Drug Manufacturers - Other

|

$193.81

|

+0.67

0.35% |

$195.26

|

695,553

56.78% of 50 DAV

50 DAV is 1,225,000

|

$197.64

-1.94%

|

10/23/2014

|

$184.01

|

PP = $185.53

|

|

MB = $194.81

|

Most Recent Note - 11/6/2014 5:41:54 PM

Y - Managed a best-ever close with today's gain on slightly higher than average volume. Prior highs in the $180 area define initial support to watch on pullbacks.

>>> FEATURED STOCK ARTICLE : Finished Strong After Gapping Up Above Prior High - 10/23/2014

View all notes |

Set NEW NOTE alert |

CANSLIM.net Company Profile |

SEC

News |

Chart |

Request a new note

C

A N

S L

I M

|

BIDU

-

NASDAQ

Baidu Inc Ads

INTERNET - Internet Information Providers

|

$236.54

|

-0.36

-0.15% |

$238.63

|

1,911,777

49.92% of 50 DAV

50 DAV is 3,830,000

|

$246.00

-3.85%

|

10/30/2014

|

$234.08

|

PP = $231.51

|

|

MB = $243.09

|

Most Recent Note - 11/4/2014 5:43:47 PM

Y - Gain today on lighter volume for a best-ever close but still finished below its "max buy" level. Prior highs near $230 define near-term support to watch on pullbacks.

>>> FEATURED STOCK ARTICLE : Technical Breakout on Triple Average Volume Following Strong Earnings - 10/30/2014

View all notes |

Set NEW NOTE alert |

CANSLIM.net Company Profile |

SEC

News |

Chart |

Request a new note

C

A N

S L

I M

|

EPAM

-

NYSE

Epam Systems Inc

COMPUTER SOFTWARE and SERVICES - Information Technology Service

|

$46.95

|

-0.97

-2.02% |

$48.05

|

415,541

98.24% of 50 DAV

50 DAV is 423,000

|

$50.00

-6.10%

|

10/23/2014

|

$45.21

|

PP = $46.09

|

|

MB = $48.39

|

Most Recent Note - 11/5/2014 1:45:06 PM

Y - Poised for a best-ever close with today's big gain. Found prompt support on the prior session after briefly undercutting prior highs in the $44 area. The latest FSU analysis (10/24/14) reminded members - "Keep in mind that the high-ranked Computer - Tech Services firm is due to report earnings for the Sep '14 quarter on 11/04/14. Volume and volatility often increase near earnings news."

>>> FEATURED STOCK ARTICLE : Pulled Back After Challenging Prior Highs - 10/24/2014

View all notes |

Set NEW NOTE alert |

CANSLIM.net Company Profile |

SEC

News |

Chart |

Request a new note

C

A N

S L

I M

|

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

FB

-

NASDAQ

Facebook Inc Cl A

INTERNET

|

$75.60

|

+0.34

0.45% |

$75.86

|

20,755,427

52.14% of 50 DAV

50 DAV is 39,805,000

|

$81.16

-6.85%

|

9/9/2014

|

$76.67

|

PP = $76.84

|

|

MB = $80.68

|

Most Recent Note - 11/5/2014 1:52:48 PM

G - Encountering resistance at its 50 DMA line following a violation on 3 times average volume on 10/29/14 that raised concerns and triggered a technical sell signal. Volume and volatility often increase near earnings news. The company reported earnings +59% on +59% sales for the Sep '14 quarter but warned of rising costs. Historic studies show that investors have a far better chance of success when buying as a stock is breaking out, not buying on pullbacks.

>>> FEATURED STOCK ARTICLE : Gapped Down Following Latest Strong Earnings Report - 10/29/2014

View all notes |

Set NEW NOTE alert |

CANSLIM.net Company Profile |

SEC

News |

Chart |

Request a new note

C

A N

S L

I M

|

FLT

-

NYSE

Fleetcor Technologies

DIVERSIFIED SERVICES - Business/Management Services

|

$149.18

|

-1.29

-0.86% |

$150.98

|

615,856

86.38% of 50 DAV

50 DAV is 713,000

|

$153.52

-2.83%

|

10/31/2014

|

$148.50

|

PP = $146.29

|

|

MB = $153.60

|

Most Recent Note - 11/5/2014 1:57:22 PM

Y - Holding its ground after volume-driven gains for new 52-week highs. Finished strong after highlighted in yellow in the 10/31/14 mid-day report (read here) clinching a convincing technical buy signal. Disciplined investors avoid chasing stocks more than +5% above prior highs and always limit losses by selling any stock that falls more than -7% from their purchase price.

>>> FEATURED STOCK ARTICLE : Strong Finish Following Gap Up After Earnings News - 10/31/2014

View all notes |

Set NEW NOTE alert |

CANSLIM.net Company Profile |

SEC

News |

Chart |

Request a new note

C

A N

S L

I M

|

ILMN

-

NASDAQ

Illumina Inc

DRUGS - Biotechnology

|

$186.35

|

-3.52

-1.85% |

$189.69

|

1,179,086

93.73% of 50 DAV

50 DAV is 1,258,000

|

$197.37

-5.58%

|

10/22/2014

|

$188.77

|

PP = $182.27

|

|

MB = $191.38

|

Most Recent Note - 11/7/2014 6:00:16 PM

Most Recent Note - 11/7/2014 6:00:16 PM

Y - Color code was changed to yellow after dipping below its "max buy" level. Prior highs near $182 define initial support to watch on pullbacks. See the latest FSU analysis for more details and new annotated graphs.

>>> FEATURED STOCK ARTICLE : Consolidating Above Prior Highs Which Define Initial Support - 11/7/2014

View all notes |

Set NEW NOTE alert |

CANSLIM.net Company Profile |

SEC

News |

Chart |

Request a new note

C

A N

S L

I M

|

NBCB

-

NASDAQ

First N B C Bank Hldg

Banks-Southeast

|

$37.08

|

-0.17

-0.46% |

$37.27

|

74,457

84.61% of 50 DAV

50 DAV is 88,000

|

$37.83

-1.98%

|

10/31/2014

|

$36.31

|

PP = $35.93

|

|

MB = $37.73

|

Most Recent Note - 11/5/2014 6:30:11 PM

Y - Pulled back today on higher (near average) volume following 8 consecutive gains. No resistance remains due to overhead supply. Highlighted in yellow in the 10/31/14 mid-day report (read here). Prior highs near $34 define near-term support to watch on pullbacks.

>>> FEATURED STOCK ARTICLE : Financial Firm at 52-Week High Tallied 8th Consecutive Gain - 11/3/2014

View all notes |

Set NEW NOTE alert |

CANSLIM.net Company Profile |

SEC

News |

Chart |

Request a new note

C

A N

S L

I M

|

PANW

-

NYSE

Palo Alto Networks

Computer Sftwr-Security

|

$107.02

|

+0.91

0.86% |

$107.35

|

1,019,254

439.33% of 50 DAV

50 DAV is 232,000

|

$108.50

-1.36%

|

7/30/2014

|

$84.21

|

PP = $85.88

|

|

MB = $90.17

|

Most Recent Note - 11/7/2014 12:33:28 PM

Most Recent Note - 11/7/2014 12:33:28 PM

G - Perched near its all-time high with volume totals cooling in recent weeks, a sign that few investors have headed for the exit, however it has not formed a sound base. Its 50 DMA line ($99) defines near-term support to watch.

>>> FEATURED STOCK ARTICLE : Rebound and Rally Leaves Tech Firm Extended From Base - 10/28/2014

View all notes |

Set NEW NOTE alert |

CANSLIM.net Company Profile |

SEC

News |

Chart |

Request a new note

C

A N

S L

I M

|

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

SNCR

-

NASDAQ

Synchronoss Technologies

COMPUTER SOFTWARE andamp; SERVICES - Application Software

|

$52.12

|

-0.21

-0.40% |

$52.58

|

463,790

86.53% of 50 DAV

50 DAV is 536,000

|

$53.47

-2.52%

|

10/27/2014

|

$46.40

|

PP = $47.81

|

|

MB = $50.20

|

Most Recent Note - 11/6/2014 5:40:47 PM

G - Matched its best-ever close with today's volume-driven gain. Prior highs in the $47 area define initial support to watch above its 50 DMA line ($45.53) on pullbacks.

>>> FEATURED STOCK ARTICLE : No Resistance Remains; Perched at Secondary Buy Point - 10/27/2014

View all notes |

Set NEW NOTE alert |

CANSLIM.net Company Profile |

SEC

News |

Chart |

Request a new note

C

A N

S L

I M

|

STRT

-

NASDAQ

Strattec Security Corp

AUTOMOTIVE - Auto Parts

|

$104.96

|

+1.96

1.90% |

$106.40

|

19,311

68.97% of 50 DAV

50 DAV is 28,000

|

$109.44

-4.09%

|

9/19/2014

|

$86.06

|

PP = $89.97

|

|

MB = $94.47

|

Most Recent Note - 11/4/2014 5:45:39 PM

G - Hovering near its 52-week high, extended from its prior base after volume-driven gains. Prior highs in the $88 area define important near-term support to watch above its 50 DMA line. See the latest FSU analysis for more details and new annotated graphs.

>>> FEATURED STOCK ARTICLE : Stock With Small Supply Quickly Got Extended From Prior Base - 11/4/2014

View all notes |

Set NEW NOTE alert |

CANSLIM.net Company Profile |

SEC

News |

Chart |

Request a new note

C

A N

S L

I M

|

|

|

|

THESE ARE NOT BUY RECOMMENDATIONS!

Comments contained in the body of this report are technical

opinions only. The material herein has been obtained

from sources believed to be reliable and accurate, however,

its accuracy and completeness cannot be guaranteed.

This site is not an investment advisor, hence it does

not endorse or recommend any securities or other investments.

Any recommendation contained in this report may not

be suitable for all investors and it is not to be deemed

an offer or solicitation on our part with respect to

the purchase or sale of any securities. All trademarks,

service marks and trade names appearing in this report

are the property of their respective owners, and are

likewise used for identification purposes only.

This report is a service available

only to active Paid Premium Members.

You may opt-out of receiving report notifications

at any time. Questions or comments may be submitted

by writing to Premium Membership Services 665 S.E. 10 Street, Suite 201 Deerfield Beach, FL 33441-5634 or by calling 1-800-965-8307

or 954-785-1121.

|

|

|