You are not logged in.

This means you

CAN ONLY VIEW reports that were published prior to Monday, April 7, 2025.

You

MUST UPGRADE YOUR MEMBERSHIP if you want to see any current reports.

AFTER MARKET UPDATE - FRIDAY, APRIL 8TH, 2016

Previous After Market Report Next After Market Report >>>

|

|

|

|

DOW |

+35.00 |

17,576.96 |

+0.20% |

|

Volume |

820,003,350 |

-10% |

|

Volume |

1,461,246,380 |

-15% |

|

NASDAQ |

+2.32 |

4,850.69 |

+0.05% |

|

Advancers |

2,305 |

76% |

|

Advancers |

1,609 |

57% |

|

S&P 500 |

+5.69 |

2,047.60 |

+0.28% |

|

Decliners |

723 |

24% |

|

Decliners |

1,214 |

43% |

|

Russell 2000 |

+4.53 |

1,097.31 |

+0.41% |

|

52 Wk Highs |

103 |

|

|

52 Wk Highs |

34 |

|

|

S&P 600 |

+3.70 |

672.42 |

+0.55% |

|

52 Wk Lows |

12 |

|

|

52 Wk Lows |

23 |

|

|

|

Major Averages Posted Small Gains

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

For the week, the Dow lost 1.2%, the S&P 500 fell 1.2%, and the Nasdaq declined 1.3%. Stocks finished mildly higher on Friday. The Dow was up 34 points to 17576. The S&P 500 added 5 points at 2047. The NASDAQ advanced 2 points to 4850. The volume totals were reported higher on the NYSE and on the Nasdaq exchange. Advancers led decliners by more than a 3-1 margin on the NYSE and 4-3 on the Nasdaq exchange. Leadership contracted as there were 14 high-ranked companies from the Leaders List made new 52-week highs and were listed on the BreakOuts Page, down from the total of 16 on the prior session. New 52-week highs outnumbered new 52-week lows on the NYSE and on the Nasdaq exchange. PICTURED: The Dow Jones Industrial Average is -4.2% off its all-time high hit in May 2015. It has rebounded well above its 50-day and 200-day moving average (DMA) lines and has been approaching prior highs.

The DOW and S&P 500 Index both remain above their respective 50-day and 200-day moving average (DMA) lines. The major averages (M criteria) have recently encountered pressure. For any rally to be sustained it requires a healthy crop of leaders (stocks hitting new highs). The Featured Stocks Page includes most current notes with headline links for access to more detailed letter-by-letter analysis including price/volume graphs annotated by our experts. The major averages gave back a strong morning advance as weakness in the Health Care sector tempered gains in Energy shares. On the data front, wholesale inventories fell 0.5% in February, more than an expected 0.2% decline. Investors will now turn their attention to first-quarter earnings season which unofficially begins on Monday. S&P 500 profits are expected to decline by 9.5% year-over-year, the most since the financial crisis. Eight of 10 sectors in the S&P 500 traded positive on the session. Anadarko (APC +5.6% ) paced the Energy sector. Regeneron (REGN -3.2%) and Allergan (AGN -2.1%) to weigh down the Health Care shares. Retailer Gap (GPS -13.9%) was a notable decliner after posting disappointing March sales results. Treasuries pared some of their weekly gain with the 10-year note falling 8/32 to yield 1.72%. In commodities, NYMEX WTI crude rallied 6.1% to $39.54/barrel, the best daily performance in two months amid declining U.S. production. COMEX gold added 0.5% to $1242.50/ounce. In FOREX, the dollar traded lower against the British pound and Canadian dollar. |

Kenneth J. Gruneisen started out as a licensed stockbroker in August 1987, a couple of months prior to the historic stock market crash that took the Dow Jones Industrial Average down -22.6% in a single day. He has published daily fact-based fundamental and technical analysis on high-ranked stocks online for two decades. Through FACTBASEDINVESTING.COM, Kenneth provides educational articles, news, market commentary, and other information regarding proven investment systems that work in good times and bad.

Kenneth J. Gruneisen started out as a licensed stockbroker in August 1987, a couple of months prior to the historic stock market crash that took the Dow Jones Industrial Average down -22.6% in a single day. He has published daily fact-based fundamental and technical analysis on high-ranked stocks online for two decades. Through FACTBASEDINVESTING.COM, Kenneth provides educational articles, news, market commentary, and other information regarding proven investment systems that work in good times and bad.

Comments contained in the body of this report are technical opinions only and are not necessarily those of Gruneisen Growth Corp. The material herein has been obtained from sources believed to be reliable and accurate, however, its accuracy and completeness cannot be guaranteed. Our firm, employees, and customers may effect transactions, including transactions contrary to any recommendation herein, or have positions in the securities mentioned herein or options with respect thereto. Any recommendation contained in this report may not be suitable for all investors and it is not to be deemed an offer or solicitation on our part with respect to the purchase or sale of any securities. |

|

|

Commodity-Linked Groups Led Gainers

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

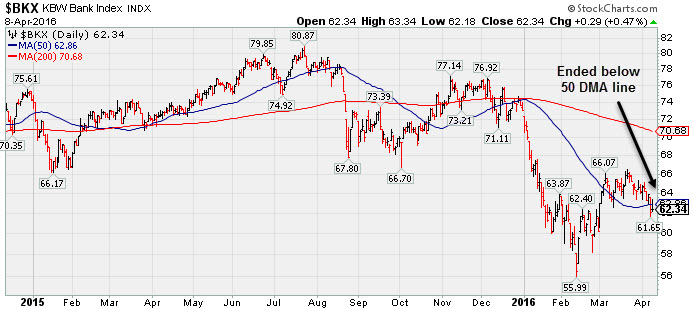

The Bank Index ($BKX +0.47%) edged higher while the Broker/Dealer Index ($XBD +0.06%) finished flat, meanwhile the Retail Index ($RLX -0.38%) was a negative influence on the major averages on Friday. The Biotechnology Index ($BTK -0.62%) dragged on the tech sector, meanwhile the Semiconductor Index ($SOX +0.58%) and the Networking Index ($NWX +0.48%) both posted small gains. The Oil Services Index ($OSX +2.96%) and the Integrated Oil Index ($XOI +2.62%) both posted solid gains, and the Gold & Silver Index ($XAU +1.72%) was a standout gainer.Charts courtesy www.stockcharts.com

PICTURED: The Bank Index ($BKX +0.47%) ended the week below its 50-day moving average (DMA) line and it remains well below its 200 DMA line.

| Oil Services |

$OSX |

154.55 |

+4.43 |

+2.95% |

-2.02% |

| Integrated Oil |

$XOI |

1,079.34 |

+27.54 |

+2.62% |

+0.62% |

| Semiconductor |

$SOX |

671.31 |

+3.85 |

+0.58% |

+1.18% |

| Networking |

$NWX |

356.15 |

+1.69 |

+0.48% |

-5.26% |

| Broker/Dealer |

$XBD |

153.64 |

+0.10 |

+0.06% |

-13.73% |

| Retail |

$RLX |

1,250.30 |

-4.81 |

-0.38% |

-2.58% |

| Gold & Silver |

$XAU |

74.02 |

+2.93 |

+4.12% |

+63.40% |

| Bank |

$BKX |

62.34 |

+0.29 |

+0.47% |

-14.70% |

| Biotech |

$BTK |

3,155.45 |

-19.85 |

-0.62% |

-17.27% |

|

|

|

|

Seriously Applying the Fact-Based System Now

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

Asset Management Services Using the Winning Fact-Based Investment System - Inquire Now! You can have professional help in limiting your losses and maximizing your gains in all market environments. For help with how your portfolio is managed in 2016 and beyond click here and indicate "Find a Broker". *Accounts over $250,000 please. **Serious inquires only, please. |

|

|

Color Codes Explained :

Y - Better candidates highlighted by our

staff of experts.

G - Previously featured

in past reports as yellow but may no longer be buyable under the

guidelines.

***Last / Change / Volume data in this table is the closing quote data***

|

|

|

THESE ARE NOT BUY RECOMMENDATIONS!

Comments contained in the body of this report are technical

opinions only. The material herein has been obtained

from sources believed to be reliable and accurate, however,

its accuracy and completeness cannot be guaranteed.

This site is not an investment advisor, hence it does

not endorse or recommend any securities or other investments.

Any recommendation contained in this report may not

be suitable for all investors and it is not to be deemed

an offer or solicitation on our part with respect to

the purchase or sale of any securities. All trademarks,

service marks and trade names appearing in this report

are the property of their respective owners, and are

likewise used for identification purposes only.

This report is a service available

only to active Paid Premium Members.

You may opt-out of receiving report notifications

at any time. Questions or comments may be submitted

by writing to Premium Membership Services 665 S.E. 10 Street, Suite 201 Deerfield Beach, FL 33441-5634 or by calling 1-800-965-8307

or 954-785-1121.

|

|

|