You are not logged in.

This means you

CAN ONLY VIEW reports that were published prior to Thursday, April 10, 2025.

You

MUST UPGRADE YOUR MEMBERSHIP if you want to see any current reports.

AFTER MARKET UPDATE - FRIDAY, FEBRUARY 19TH, 2016

Previous After Market Report Next After Market Report >>>

|

|

|

|

DOW |

-21.44 |

16,391.99 |

-0.13% |

|

Volume |

1,133,497,380 |

+8% |

|

Volume |

1,723,186,000 |

-2% |

|

NASDAQ |

+16.89 |

4,504.43 |

+0.38% |

|

Advancers |

1,494 |

49% |

|

Advancers |

1,600 |

55% |

|

S&P 500 |

-0.05 |

1,917.78 |

-0.00% |

|

Decliners |

1,554 |

51% |

|

Decliners |

1,285 |

45% |

|

Russell 2000 |

+5.30 |

1,010.01 |

+0.53% |

|

52 Wk Highs |

33 |

|

|

52 Wk Highs |

18 |

|

|

S&P 600 |

+2.57 |

620.28 |

+0.42% |

|

52 Wk Lows |

43 |

|

|

52 Wk Lows |

53 |

|

|

|

Major Averages Tallied Best Weekly Gains of 2016

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

For the week, the Dow added 2.6%, the S&P 500 gained 2.8%, and the Nasdaq Composite advanced 3.9%. Stocks were mixed on Friday. The Dow was down 21 points to 16391. The S&P 500 finished flat at 1917. The Nasdaq Composite added 16 points to 4504.Volume was reported higher on the NYSE and lower on the Nasdaq exchange. Advancers led decliners by 4-3 on the Nasdaq exchange but decliners narrowly outnumbered advancers on the NYSE. There were 13 high-ranked companies from the Leaders List that made new 52-week highs and were listed on the BreakOuts Page, down from a total of 14 on the prior session. New 52-week lows outnumbered new 52-week highs on the NYSE and on the Nasdaq exchange. The Featured Stocks Page includes new noteworthy leaders only as the tone of the market dictates.

PICTURED: The Nasdaq Composite Index rebounded this week after a recent slump to new lows.

Improved action from the major averages (M criteria) on Wednesday signaled a new follow through day and confirmed rally, an encouraging sign that a deeper correction and more serious "Bear Market" may be avoided. Members have been repeatedly reminded -"Any sustained rally requires a healthy crop of leaders (defined as stocks hitting new highs), however, few leaders have bullish chart patterns and the few isolated technical breakouts of late have been quickly negated." The major averages fluctuated to cap their best weekly performance of 2016. On the data front, a gauge of inflation showed consumer prices were unchanged in January. Subtracting the effects of food and energy, prices rose 0.3% versus the consensus forecast to increase 0.2%. In earnings, Applied Materials (AMAT +7.05%) rose as the company’s profits and revenue slightly exceeded analyst expectations. Deere & Co (DE -4.15%) was lower after the agricultural equipment maker lowered its guidance. Nordstrom (JWN -6.73%) fell after the retailer posted disappointing holiday sales numbers. United Continental Airlines (UAL +3.62%) rose as the company doubled its first-quarter share repurchase guidance to $1.5 billion. Six of 10 sectors in the S&P 500 finished lower on Friday. Materials and Telecommunications stocks led the losses while Technology shares outperformed. Treasuries were slightly lower along the curve with the 10-year note losing 2/32 to yield 1.75%. In commodities, NYMEX WTI crude fell 3.0% to $29.85/barrel. COMEX gold was up 0.4% to $1230.30/ounce. In FOREX, the Dollar Index retreated 0.3%. The Featured Stocks Page includes most current notes with headline links for access to more detailed letter-by-letter analysis including price/volume graphs annotated by our experts. See the Premium Member Homepage for archives to all prior pay reports. |

Kenneth J. Gruneisen started out as a licensed stockbroker in August 1987, a couple of months prior to the historic stock market crash that took the Dow Jones Industrial Average down -22.6% in a single day. He has published daily fact-based fundamental and technical analysis on high-ranked stocks online for two decades. Through FACTBASEDINVESTING.COM, Kenneth provides educational articles, news, market commentary, and other information regarding proven investment systems that work in good times and bad.

Kenneth J. Gruneisen started out as a licensed stockbroker in August 1987, a couple of months prior to the historic stock market crash that took the Dow Jones Industrial Average down -22.6% in a single day. He has published daily fact-based fundamental and technical analysis on high-ranked stocks online for two decades. Through FACTBASEDINVESTING.COM, Kenneth provides educational articles, news, market commentary, and other information regarding proven investment systems that work in good times and bad.

Comments contained in the body of this report are technical opinions only and are not necessarily those of Gruneisen Growth Corp. The material herein has been obtained from sources believed to be reliable and accurate, however, its accuracy and completeness cannot be guaranteed. Our firm, employees, and customers may effect transactions, including transactions contrary to any recommendation herein, or have positions in the securities mentioned herein or options with respect thereto. Any recommendation contained in this report may not be suitable for all investors and it is not to be deemed an offer or solicitation on our part with respect to the purchase or sale of any securities. |

|

|

Tech and Retail Indexes Outpaced Financials

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

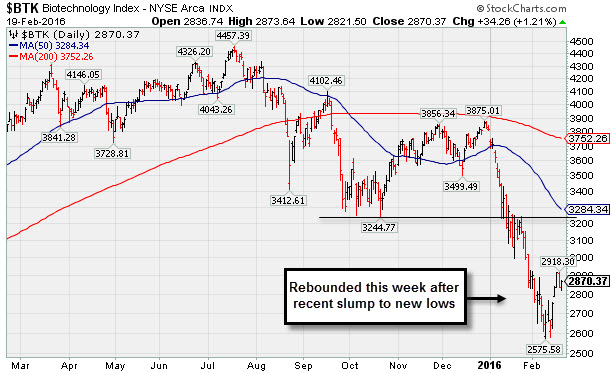

The Broker/Dealer Index ($XBD +0.30%) and the Bank Index ($BKX+0.37%) both eked out small gains and the Retail Index ($RLX+0.77%) also was a positive influence on the major averages on Friday. The tech sector was led higher by the Networking Index ($NWX +1.43%) and the Biotechnology Index ($BTK +1.21%), with a smaller gain from the Semiconductor Index ($SOX +0.49%). The Integrated Oil Index ($XOI +0.04%) finished flat and the Oil Services Index ($OSX -0.28%) edged lower, and the Gold & Silver Index ($XAU -1.67%) was a standout decliner.Charts courtesy www.stockcharts.com

PICTURED: The Biotechnology Index ($BTK +1.21%) rebounded this week after slumping to new lows.

| Oil Services |

$OSX |

141.96 |

-0.40 |

-0.28% |

-10.00% |

| Integrated Oil |

$XOI |

979.51 |

+0.38 |

+0.04% |

-8.69% |

| Semiconductor |

$SOX |

605.46 |

+2.94 |

+0.49% |

-8.74% |

| Networking |

$NWX |

338.57 |

+4.77 |

+1.43% |

-9.94% |

| Broker/Dealer |

$XBD |

145.97 |

+0.43 |

+0.30% |

-18.04% |

| Retail |

$RLX |

1,162.21 |

+8.89 |

+0.77% |

-9.45% |

| Gold & Silver |

$XAU |

60.53 |

-1.02 |

-1.66% |

+33.62% |

| Bank |

$BKX |

60.85 |

+0.23 |

+0.38% |

-16.74% |

| Biotech |

$BTK |

2,870.37 |

+34.26 |

+1.21% |

-24.74% |

|

|

|

|

When You Get Back In Do It On The Right Foot

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

To receive more details use the inquiry form to submit your request. Thank you! Asset Management Services Using the Winning Fact-Based Investment System - Inquire Now!

You can have professional help in limiting your losses and maximizing your gains in all market environments. Consider talking with an expert for personalized help in how your portfolio is managed in 2016 and beyond. Click here and indicate "Find a Broker" to get connected. *Accounts over $250,000 please. **Serious inquires only, please. |

|

|

Color Codes Explained :

Y - Better candidates highlighted by our

staff of experts.

G - Previously featured

in past reports as yellow but may no longer be buyable under the

guidelines.

***Last / Change / Volume data in this table is the closing quote data***

|

|

|

THESE ARE NOT BUY RECOMMENDATIONS!

Comments contained in the body of this report are technical

opinions only. The material herein has been obtained

from sources believed to be reliable and accurate, however,

its accuracy and completeness cannot be guaranteed.

This site is not an investment advisor, hence it does

not endorse or recommend any securities or other investments.

Any recommendation contained in this report may not

be suitable for all investors and it is not to be deemed

an offer or solicitation on our part with respect to

the purchase or sale of any securities. All trademarks,

service marks and trade names appearing in this report

are the property of their respective owners, and are

likewise used for identification purposes only.

This report is a service available

only to active Paid Premium Members.

You may opt-out of receiving report notifications

at any time. Questions or comments may be submitted

by writing to Premium Membership Services 665 S.E. 10 Street, Suite 201 Deerfield Beach, FL 33441-5634 or by calling 1-800-965-8307

or 954-785-1121.

|

|

|