You are not logged in.

This means you

CAN ONLY VIEW reports that were published prior to Friday, April 11, 2025.

You

MUST UPGRADE YOUR MEMBERSHIP if you want to see any current reports.

AFTER MARKET UPDATE - TUESDAY, FEBRUARY 9TH, 2016

Previous After Market Report Next After Market Report >>>

|

|

|

|

DOW |

-12.67 |

16,014.38 |

-0.08% |

|

Volume |

1,128,669,500 |

-14% |

|

Volume |

2,255,932,360 |

-10% |

|

NASDAQ |

-14.99 |

4,268.76 |

-0.35% |

|

Advancers |

937 |

30% |

|

Advancers |

1,081 |

35% |

|

S&P 500 |

-1.23 |

1,852.21 |

-0.07% |

|

Decliners |

2,153 |

70% |

|

Decliners |

1,984 |

65% |

|

Russell 2000 |

-5.44 |

963.90 |

-0.56% |

|

52 Wk Highs |

66 |

|

|

52 Wk Highs |

8 |

|

|

S&P 600 |

-2.71 |

597.03 |

-0.45% |

|

52 Wk Lows |

476 |

|

|

52 Wk Lows |

431 |

|

|

|

Breadth Negative and Leadership Remains Thin

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

Stocks finished mildly lower on Tuesday. The Dow was off 12 points to 16014. The S&P 500 was down 1 point to 1852. The NASDAQ lost 14 points at 4268. Volume was reported lighter on the NYSE and on the Nasdaq exchange. Breadth was still negative as decliners led advancers by more than a 2-1 margin on the NYSE and nearly 2-1 margin on the Nasdaq exchange. Leadership remained thin as there were 8 high-ranked companies from the Leaders List that made new 52-week highs and were listed on the BreakOuts Page, up from a total of 6 on the prior session. The total number of new 52-week lows easily outnumbered new highs on the NYSE and on the Nasdaq exchange. The Featured Stocks Page includes new noteworthy leaders only as the tone of the market dictates.Charts used courtesy of www.stockcharts.com

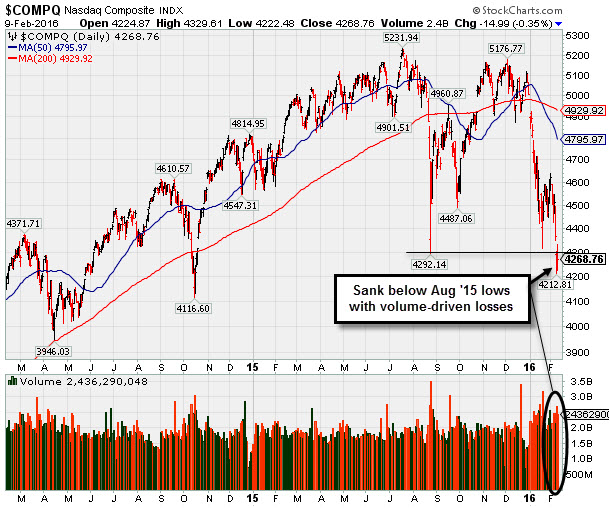

PICTURED: The Nasdaq Composite Index recently sank below its Aug '15 lows with losses on higher volume. Damaging losses technically ended a brief rally. Patience and strict discipline remain paramount. Any sustained rally requires a healthy crop of leaders (defined as stocks hitting new highs), however, few leaders have bullish chart patterns and the few isolated technical breakouts of late have been quickly negated. Recent action from the major averages (M criteria) has signaled a deeper correction with the characteristics of a more serious "Bear Market" environment. The major averages fluctuated throughout the session while the dollar and oil

prices retreated. Overseas, Japan’s Nikkei experienced its sharpest decline

since 2013. The index fell 5.4% as the yen climbed to the highest level in more

than a year against the dollar. On the data front, wholesale inventories

declined by less than expected. JOLTS Job openings in the U.S. registered just

over 5.6 million, the second highest reading ever.

In earnings, Coca-Cola (KO +1.52%) rose after beating analyst estimates

on both the top and bottom line. CVS Health (CVS +0.96%) rose after topping

Wall Street revenue forecasts. Viacom (VIA -17.76%) tumbled on

weaker-than-expected domestic revenue.

Five out of ten sectors in the S&P 500 declined on Tuesday. Energy and

Telecom stocks led the losses while materials shares outperformed. Anadarko (APC -7.02%) headlined the energy slide after cutting its quarterly

dividend by more than 80%.

Treasuries were mixed with the curve flattening. The benchmark ten-year note

added 4/32 to yield 1.73%. In commodities, NYMEX WTI tumbled 4.5% to

$28.355/barrel. COMEX gold was off 0.6% to $1191.20/ounce. In FOREX, the Dollar

Index fell another 0.5% against its peers. The Featured Stocks Page includes most current notes with headline links for access to more detailed letter-by-letter analysis including price/volume graphs annotated by our experts. See the Premium Member Homepage for archives to all prior pay reports.

|

Kenneth J. Gruneisen started out as a licensed stockbroker in August 1987, a couple of months prior to the historic stock market crash that took the Dow Jones Industrial Average down -22.6% in a single day. He has published daily fact-based fundamental and technical analysis on high-ranked stocks online for two decades. Through FACTBASEDINVESTING.COM, Kenneth provides educational articles, news, market commentary, and other information regarding proven investment systems that work in good times and bad.

Kenneth J. Gruneisen started out as a licensed stockbroker in August 1987, a couple of months prior to the historic stock market crash that took the Dow Jones Industrial Average down -22.6% in a single day. He has published daily fact-based fundamental and technical analysis on high-ranked stocks online for two decades. Through FACTBASEDINVESTING.COM, Kenneth provides educational articles, news, market commentary, and other information regarding proven investment systems that work in good times and bad.

Comments contained in the body of this report are technical opinions only and are not necessarily those of Gruneisen Growth Corp. The material herein has been obtained from sources believed to be reliable and accurate, however, its accuracy and completeness cannot be guaranteed. Our firm, employees, and customers may effect transactions, including transactions contrary to any recommendation herein, or have positions in the securities mentioned herein or options with respect thereto. Any recommendation contained in this report may not be suitable for all investors and it is not to be deemed an offer or solicitation on our part with respect to the purchase or sale of any securities. |

|

|

Retail and Biotech Indexes Rose; Commodity-Linked Groups Down Big

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

The Retail Index ($RLX+0.49%) had a positive influence on the major averages on Tuesday. The Broker/Dealer Index ($XBD -0.09%) was little changed and the Bank Index ($BKX+0.24%) posted a small gain. The tech sector was mixed as the Biotechnology Index ($BTK +0.30%) posted a small gain but the Networking Index ($NWX -0.54%), and the Semiconductor Index ($SOX -0.60%) ended lower. Commodity-linked groups faced pressure as the Gold & Silver Index ($XAU -4.28%), Oil Services Index ($OSX -5.91%) and the Integrated Oil Index ($XOI -2.40%) ended solidly lower.Charts courtesy www.stockcharts.com

PICTURED: The Gold & Silver Index ($XAU -4.28%) pulled back. It recently rallied above its 200-day moving average (DMA) line for the first time since Sep '14.

| Oil Services |

$OSX |

133.30 |

-8.37 |

-5.91% |

-15.49% |

| Integrated Oil |

$XOI |

929.86 |

-22.85 |

-2.40% |

-13.32% |

| Semiconductor |

$SOX |

567.99 |

-3.46 |

-0.61% |

-14.39% |

| Networking |

$NWX |

310.70 |

-1.69 |

-0.54% |

-17.35% |

| Broker/Dealer |

$XBD |

141.44 |

-0.12 |

-0.09% |

-20.58% |

| Retail |

$RLX |

1,072.63 |

+5.26 |

+0.49% |

-16.43% |

| Gold & Silver |

$XAU |

54.34 |

-2.44 |

-4.30% |

+19.96% |

| Bank |

$BKX |

59.59 |

+0.14 |

+0.24% |

-18.46% |

| Biotech |

$BTK |

2,654.45 |

+7.83 |

+0.30% |

-30.40% |

|

|

|

|

When You Get Back In Do It On The Right Foot

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

To receive more details use the inquiry form to submit your request. Thank you! Asset Management Services Using the Winning Fact-Based Investment System - Inquire Now!

You can have professional help in limiting your losses and maximizing your gains in all market environments. Consider talking with an expert for personalized help in how your portfolio is managed in 2016 and beyond. Click here and indicate "Find a Broker" to get connected. *Accounts over $250,000 please. **Serious inquires only, please. |

|

|

Color Codes Explained :

Y - Better candidates highlighted by our

staff of experts.

G - Previously featured

in past reports as yellow but may no longer be buyable under the

guidelines.

***Last / Change / Volume data in this table is the closing quote data***

Symbol/Exchange

Company Name

Industry Group |

PRICE |

CHANGE

(%Change) |

Day High |

Volume

(% DAV)

(% 50 day avg vol) |

52 Wk Hi

% From Hi |

Featured

Date |

Price

Featured |

Pivot Featured |

|

Max Buy |

JBSS

-

NASDAQ

Sanfilippo John B & Son

FOOD and BEVERAGE - Processed and Packaged Goods

|

$61.46

|

-0.43

-0.69% |

$62.96

|

81,601

104.62% of 50 DAV

50 DAV is 78,000

|

$66.29

-7.29%

|

1/29/2016

|

$62.25

|

PP = $66.39

|

|

MB = $69.71

|

Most Recent Note - 2/8/2016 6:55:29 PM

Y - Posted a gain with higher volume on a widely negative session. Highlighted in yellow with new pivot point cited based on its 11/02/15 high plus 10 cents in the 1/29/16 mid-day report (read here). The Special Dividend effective 11/30/15 impacted price history shown on some chart sources. Faces resistance due to overhead supply up through the $66 level.

>>> FEATURED STOCK ARTICLE : Gap Up Gain Nearly Challenging Prior Highs - 1/29/2016 |

View all notes |

Set NEW NOTE alert |

Company Profile |

SEC

News |

Chart |

Request a new note

C

A

S

I |

|

|

|

THESE ARE NOT BUY RECOMMENDATIONS!

Comments contained in the body of this report are technical

opinions only. The material herein has been obtained

from sources believed to be reliable and accurate, however,

its accuracy and completeness cannot be guaranteed.

This site is not an investment advisor, hence it does

not endorse or recommend any securities or other investments.

Any recommendation contained in this report may not

be suitable for all investors and it is not to be deemed

an offer or solicitation on our part with respect to

the purchase or sale of any securities. All trademarks,

service marks and trade names appearing in this report

are the property of their respective owners, and are

likewise used for identification purposes only.

This report is a service available

only to active Paid Premium Members.

You may opt-out of receiving report notifications

at any time. Questions or comments may be submitted

by writing to Premium Membership Services 665 S.E. 10 Street, Suite 201 Deerfield Beach, FL 33441-5634 or by calling 1-800-965-8307

or 954-785-1121.

|

|

|