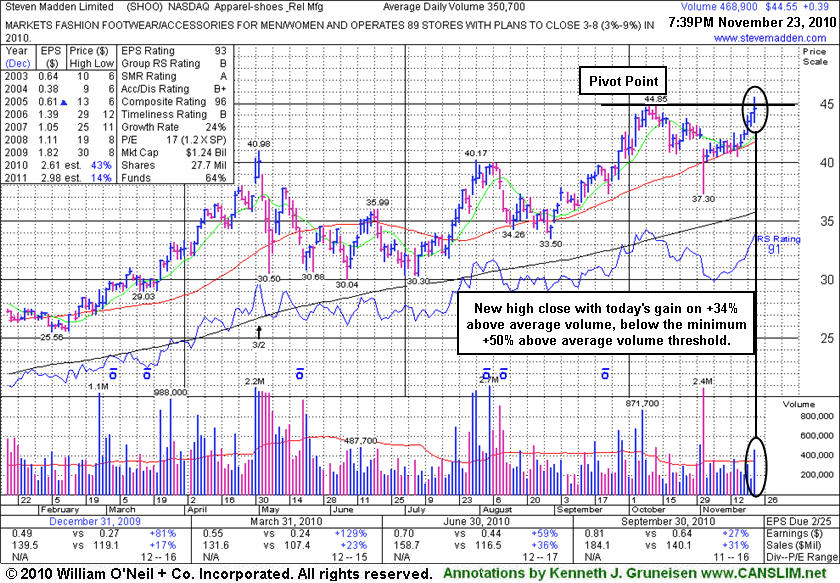

New High Close Not A Powerful Breakout

Tuesday, November 23, 2010 CANSLIM.net

Steve Madden Ltd (SHOO +$0.45 or +1.02% to $44.61) faces no resistance due to overhead supply. There was +34% above average volume was behind today's 5th consecutive gain as it hit and closed at new 2010 highs. It may be considered a valid base-on-base type pattern, yet it was not a convincing breakout. Its color code is changed to yellow with new pivot point cited based on its 10/13/10 high plus ten cents. Disciplined investors will watch for a new confirmed rally with a follow-through day (FTD) gain of at least +1.8% from one or more of the major averages with higher volume and an expansion in leadership (new highs). A strong FTD would suggest that another sustainable advance may be at hand. Patience is called for before new buying efforts are justified.

SHOO recently found support above its 50-day moving average (DMA) line and prior chart highs in the $40 area. In its last FSU section appearance on 9/29/10 an annotated graph was included under the headline "Breakout Narrowly Met Volume Guideline When Clearing Adjusted Pivot" it had posted a 2nd consecutive gain with above average volume while hitting new 52-week highs. Its solid gain on 9/28/10 with +50% above average volume triggered a technical buy signal, not with very heavy volume, but volume just meeting the minimum volume threshold under the fact-based investment system guidelines. It had found prompt support after it gapped down on 11/02/10, rebounding to close above its 50-day moving average line. Earlier, that short term average was noted as a key support level during its deep consolidation after its appearance in the FSU section on 8/05/10 under the headline "

Footwear Firm's Sales Growth Has Been Kicking."

The high-ranked Apparel firm's quarterly earnings increases have been well above the +25% guideline, satisfying the C criteria. Its annual earnings history (A criteria) since FY '07 has been good. Top-rated funds owning an interest increased from 359 in Dec '09 to 396 in Sep '10, which is good news concerning the I criteria. (NOTE: Prior notes on this and other stocks cited top-rated US funds, and now our source is including foreign funds and hedge funds in their totals reported).