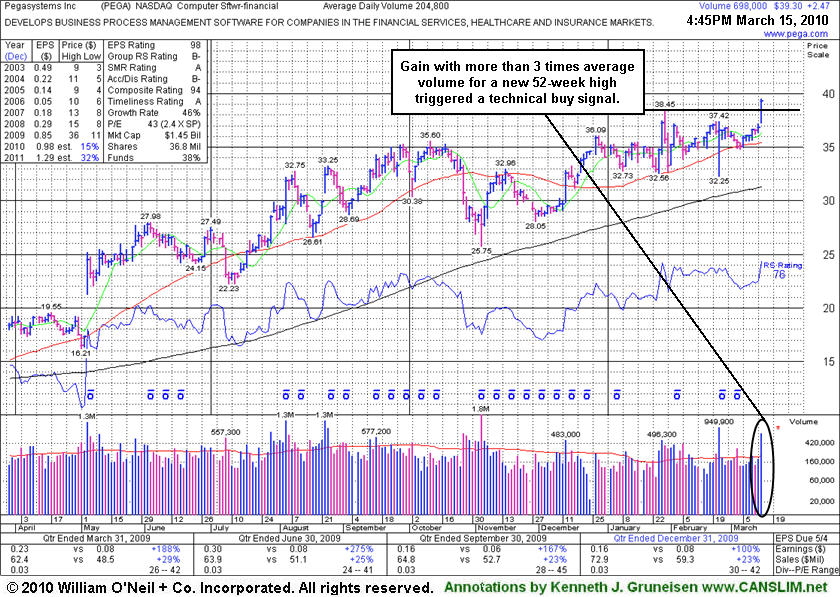

Software Firm Breaks Out After Announcing Acquisition Plans

Monday, March 15, 2010 CANSLIM.net

Pegasystems Inc. (PEGA +2.47 or +7.15% to $39.30) gapped up today and rallied to a new 52-week high. The considerable gain above its pivot point with more than 3 times average volume met the requirement for a technical buy signal. The bullish action came after the high-ranked Computer Software - Financial firm announced plans to buy Chordiant Software Inc (CHRD), a firm with sub par fundamentals under the investment system guidelines. It is far more common for any company making an acquisition to pull back while the firm being acquired rises, however the market reacted positively to the news and lifted PEGA shares. Prior chart highs are now an initial support level to watch on subsequent pullbacks.

It recently found support near its 50-day moving average (DMA) line. Mostly healthy action has followed since its color code was changed to yellow 2/26/10 with a new pivot point cited and an annotated graph included under the headline "Consolidation Continues For Computer Software Firm." It was featured in the January 2010 issue of CANSLIM.net News (read here). The company has attracted an increasing number of institutional investors, as the number of top-rated funds owning its shares rose from 43 in Sep '08 to 90 in Dec '09, which is a solid reassurance concerning the investment system's I criteria. It has shown good sales revenues increases and its earnings increases were well above the +25% guideline in the 5 last quarterly comparisons versus the year ago period.