Consolidation Continues For Computer Software Firm

Friday, February 26, 2010 CANSLIM.net

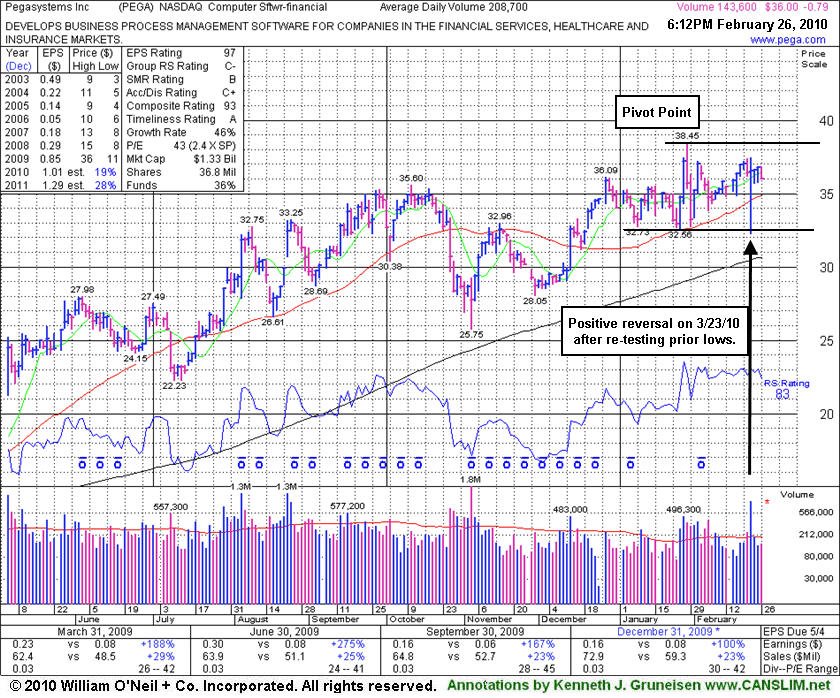

Pegasystems Inc. (PEGA -0.79 or -2.15% to $36.00) has shown mostly healthy action since its last appearance in this FSU section on 2/08/10 under the headline "Latest Breakout Promptly Failed, Yet 50 DMA Acted As Support". Now consolidating above its 50-day moving average (DMA) line for about 5-weeks since reaching its all-time high on 1/28/10, its color code was changed to yellow today with a new pivot point cited. Disciplined investors would note that it still needs a convincing gain above its pivot point to trigger a new technical buy signal. It positively reversed on 2/23/10 after a brief 50 DMA line violation, finding prompt support near prior chart lows in the $32 area. Market conditions (M criteria) are currently an overriding concern prompting great caution, since a follow-through day is currently needed from at least one of the major averages to confirm the latest rally.

PEGA was featured in the January 2010 issue of CANSLIM.net News (read here). This high-ranked Computer Software - Financial firm develops, markets, licenses, and supports software to automate various business processes primarily the United States, the United Kingdom, and Europe. It has attracted an increasing number of institutional investors, as the number of top-rated funds owning its shares rose from 43 in Sep '08 to 89 in Dec '09, which is a solid reassurance concerning the investment system's I criteria. PEGA has shown good sales revenues increases and its earnings increases were well above the +25% guideline in the 5 last quarterly comparisons versus the year ago period. The previously noted downturn in annual earnings (the A criteria) from 2003 to 2006 has been followed by a solid turn around and big earnings increases in '07, '08 and '09. The stock has built a new base but caution and patience are suggested until and the broader market (M criteria) proves itself.