Negative Reversal, Yet Still Above Max Buy Level

Wednesday, September 16, 2009 CANSLIM.net

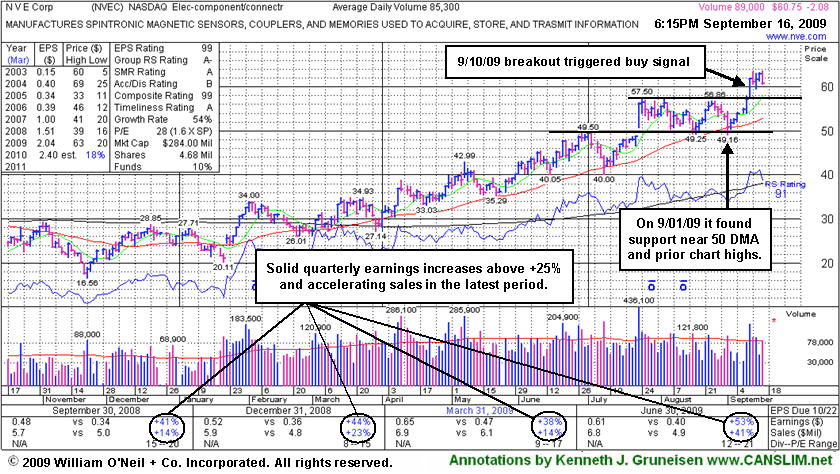

NVE Corp's (NVEC -$2.08 or -3.31% to $60.75) touched a new 52-week high today and then negatively reversed for a loss on average volume. It quickly got extended from its latest sound base, and it remains above its "max buy" level after having cleared its latest pivot point. It has a very small supply of only 4.68 million shares outstanding (the S criteria) which can contribute to greater than usual volatility. Be mindful of its still rather minuscule sales revenues. These concerns heighten the need for great discipline in trading (buying AND selling). It has shown bullish action since its last appearance in this FSU section on 9/01/09 which included an annotated graphs and analysis under the headline "Critical Chart Support Levels Tested Again While Market Weakens." The broader market's (the M criteria) improved strength was most certainly was a factor, as 3 out of 4 stocks typically move in sync with the major averages.

Prior chart highs are important support to watch now, and any deterioration leading to a close back into its prior base would negate the stock's latest bullish technical breakout raising concerns. Throughout its ongoing advance, NVEC has found support near its 50-day moving average (DMA) line (the red line). NVEC was first featured in yellow at $33.85 in the Friday, March 13, 2009 Mid-Day Breakouts Report (read here). This high-ranked Electronics - Components industry group leader has a good quarterly and annual earnings growth history (C & A criteria) and even showed acceleration in the latest report for the quarter ended June 30, 2009. In that period sales revenues were up +41% and earnings were up +53%, even bigger percentage increases than prior solid (+25% or better) earnings comparisons. That is what we call earnings growth acceleration, and it is a very encouraging characteristic commonly seen in the market's biggest winners.