High-Ranked Leisure Services Firm Hitting New Highs

Thursday, March 25, 2010 CANSLIM.net

|

Ctrip.com Intl Ltd ADR |

|

|

Ticker Symbol: CTRP (NASDAQ) |

Industry Group: Leisure-Services |

Shares Outstanding: 141,900,000 |

|

Price: $40.74 2:39PM ET 3/25/10 |

Day's Volume: 3,110,900 3/25/2010 2:39PM 3/25/10 |

Shares in Float: 136,200,000 |

|

52 Week High: $40.49 3/09/2010 |

50-Day Average Volume: 2,184,600 |

Up/Down Volume Ratio: 1.4 |

|

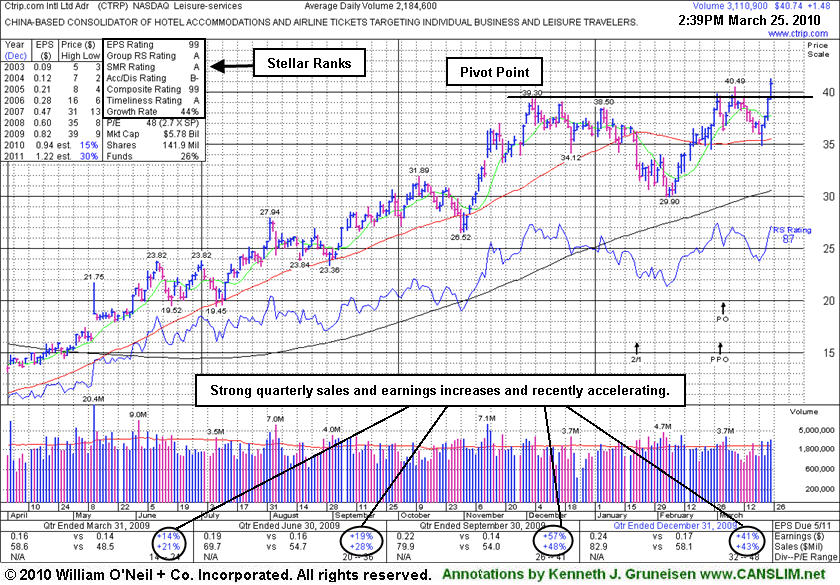

Pivot Point: $39.40 12/03/09 high plus .10 |

Pivot Point +5% = Max Buy Price: $41.37 |

Web Address: http://www.ctrip.com

|

C A N S L I M | StockTalk | News | Chart | SEC | Zacks Reports |

View all notes | Alert me of new notes | CANSLIM.net Company Profile

CANSLIM.net Profile: Ctrip.com International, Ltd. (CTRP), together with its subsidiaries, provides travel services for hotel accommodations, airline tickets, and packaged tours in China. It also sells independent leisure travelers bundled package-tour products, which include transportation and accommodations, as well as guided tours covering various domestic and international destinations. The company was founded in 1999 and is headquartered in Shanghai, the People's Republic of China. The stock resides in the Leisure-Services group which is presently ranked 19 on the 197 Industry Groups list which is in the much-preferred top quartile of groups, easily satisfying the L criteria. The number of top-rated funds with an ownership interest has grown from 52 funds in Mar '09 to 127 funds as of Dec '09, a sign of increasing institutional interest (the I criteria). It has maintained a strong and steady annual earnings (A criteria) history. Fundamentally, its sales revenues and earnings increases have been strong in the 3 most recent quarterly comparisons and solidly above the +25% guideline (C criteria). Return On Equity is reported at 32%, well above the 17% minimum.

What to Look For and What to Look Out For: Look for the stock to offer investors a chance to accumulate shares within 5% of its prior chart highs. Keep in mind that much of a stock's success depends on the broader market's ability to sustain a meaningful rally without encountering more damaging distributional pressure. It is very important for the stock's pullback to be contained, whereas a violation of its $38.50 pivot point would have the effect of technically negating its latest breakout, raising concerns. Conversely, if the stock finds support near/above its pivot point then begins advancing again, preferably on higher volume, then odds would favor that higher prices will follow.

Technical Analysis: It had rallied on average volume to a new 52-week high when featured in the March 2010 issue of CANSLIM.net News (read here), however it failed to immediately follow through with confirming gains above its pivot point with sufficient volume to trigger a technical buy signal. Meanwhile, the broader market action (M criteria) turned definitively more bullish with a follow-through-day (FTD) and an increase in the number of stocks making it to Breakouts Page. CTRP went on to consolidate above its 50-day moving average (DMA) line. Its latest appearance in the Featured Stock Update section on 3/18/10 under the headline " Recent Offering And Split Increased Supply of Shares" an annotated graph included the reminder "it is important to remain disciplined. It could be accumulated under the investment system guidelines only if a proper technical buy signal occurs. The stock did not trigger a technical buy signal and only encountered resistance since the "double bottom" type base was identified." There is no overhead supply now to act as resistance. Ideally, one would like to see significant volume show up and a strong close to confirm a proper technical buy signal based upon a solid gain above its new pivot point illustrated above.

|

|

About :

Adam Sarhan, Contributing Writer,

You can contact Adam Sarhan, Contributing Writer, at kengruneisen@gmail.com

|

|

The information

and writings made

avaialable by individuals that successfully passed the CAN SLIM®

Masters Program are their own. Copyright © 1996-2025

Gruneisen Growth Corp. All rights reserved. Protected by the

copyright laws of the United States and Canada and by international

treaties.

|

|

|

|

|