Recent Offering And Split Increased Supply of Shares

Thursday, March 18, 2010 CANSLIM.net

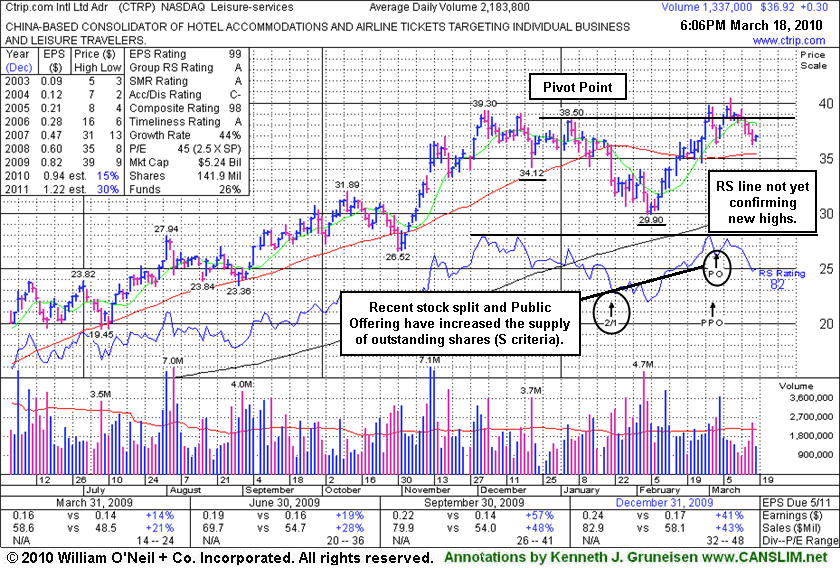

Ctrip.com Int'l Ltd. (CTRP +0.30 or +0.82% to $36.92) halted its slide today with a small gain on light volume following 5 consecutive losses. It has been slumping below its pivot point toward its 50-day moving average (DMA) line. A gain above its pivot point or its most recent chart highs is still needed to confirm a fresh technical buy signal with +50% above average volume or more. Any subsequent slump below its 50-day moving average (DMA) line would raise concerns and trigger technical sell signals.

It completed an offering of additional shares on 3/03/10, shortly after it was featured under the headline "Leisure Services Firm Building Double Bottom Base" in the March 2010 issue of CANSLIM.net News. That offering, and a recent 2:1 stock split, had the effect of increasing the supply of shares outstanding (S criteria) for this high-ranked China-based firm in the strong-performing Leisure - Services industry. It has maintained a strong and steady annual earnings (A criteria) history. Fundamentally, its sales revenues and earnings increases have been strong in the 3 most recent quarterly comparisons and solidly above the +25% guideline (C criteria). Another very encouraging sign with respect to the investment system guidelines is that the number of top-rated funds owning its shares increased from 51 in Mar '09 to 126 in Dec '09, which helps satisfy the I criteria. Return On Equity is reported at 32%, well above the 17% minimum.

While the stock is currently trading within close striking range of its pivot point and all-time highs it is important to remain disciplined. It could be accumulated under the investment system guidelines only if a proper technical buy signal occurs. The stock did not trigger a technical buy signal and only encountered resistance since the "double bottom" type base was identified and it returned to the Featured Stocks list. Now it faces some resistance up through the $39-40 area, yet it does not have a lot of overhead supply to hinder its progress. Patient and disciplined investors will avoid the temptation to get in "early" and be on the watch for a fresh indication that more serious institutional accumulation is taking place which could lead to a sustainable advance into new high ground.