9/22/2015 12:37:34 PM - Managed a choppy advance since dropped from the Featured Stocks list on 10/10/14. Has not formed a sound base and faces resistance due to overhead supply up through the $173 level. Reported earnings +124% on +65% sales revenues for the Jun '15 quarter, and earnings have been strong and steady above the +25% minimum earnings guideline (C criteria).

3/18/2015 12:49:28 PM - Finding support at its 200 DMA line and today it is tallying a 5th consecutive gain. Reported earnings +29% on +11% sales revenues for the Dec '14 quarter, but fundamental concerns remain. The fact-based investment system calls for earnings strong and steady above the +25% minimum earnings guideline (C criteria) but the Jun '14 quarter showed earnings -18% on -15% sales revenues. It was dropped from the Featured Stocks list on 10/10/14.

11/18/2014 12:28:21 PM - Slumped below its 50 DMA line with above average volume behind losses following a "negative reversal" on 11/10/14. Reported earnings +56% on +22% sales revenues for the Sep '14 quarter, but fundamental concerns remain. Earnings were -18% on -15% for the Jun '14 quarter, and the fact-based investment system calls for earnings strong and steady above the +25% minimum earnings guideline (C criteria). Found support above its 200 DMA line and rebounded since dropped from the Featured Stocks list on 10/10/14.

11/11/2014 12:55:39 PM - Slumping below its 50 DMA line with above average volume behind today's 3rd consecutive loss following a "negative reversal" on the prior session. Reported earnings +56% on +22% sales revenues for the Sep '14 quarter, but fundamental concerns remain. Earnings were -18% on -15% for the Jun '14 quarter, and the fact-based investment system calls for earnings strong and steady above the +25% minimum earnings guideline (C criteria). Found support above its 200 DMA line and rebounded since dropped from the Featured Stocks list on 10/10/14.

10/24/2014 12:46:21 PM - Still trading below its 50 DMA line after damaging losses raised concerns and triggered a technical sell signal. Earnings for the Jun '14 quarter were below the +25% minimum earnings guideline (C criteria) raising fundamental concerns. It was dropped from the Featured Stocks list on 10/10/14.

10/10/2014 5:36:41 PM - Down today with above average volume for a 5th consecutive loss. Damaging losses raised concerns and triggered a technical sell signal after earnings for the Jun '14 quarter below the +25% minimum earnings guideline (C criteria) raised fundamental concerns. It will be dropped from the Featured Stocks list tonight. See the latest FSU analysis for more details and annotated graphs.

10/7/2014 12:34:41 PM - G - Gapped down today, yet it is up from earlier lows. Its 50 DMA line recently acted as resistance after damaging losses raised concerns and triggered a technical sell signal. Repeatedly noted with caution - "Recently reported earnings for the Jun '14 quarter below the +25% minimum earnings guideline (C criteria) raising fundamental concerns."

10/6/2014 1:51:27 PM - G - Consolidating near its 50 DMA line. Recent losses raised concerns and triggered a technical sell signal. Repeatedly noted with caution - "Recently reported earnings for the Jun '14 quarter below the +25% minimum earnings guideline (C criteria) raising fundamental concerns."

10/3/2014 12:17:49 PM - G - Rebounding near its 50 DMA line today. Recent losses raised concerns and triggered a technical sell signal. Repeatedly noted with caution - "Recently reported earnings for the Jun '14 quarter below the +25% minimum earnings guideline (C criteria) raising fundamental concerns."

10/1/2014 1:58:15 PM - G - Violating its 50 DMA line and undercutting prior lows with today's 3rd consecutive loss raising concerns and triggering a technical sell signal. Repeatedly noted with caution - "Recently reported earnings for the Jun '14 quarter below the +25% minimum earnings guideline (C criteria) raising fundamental concerns."

9/29/2014 12:34:28 PM - G - Found support last week while consolidating above its 50 DMA line. Repeatedly noted with caution - "Recently reported earnings for the Jun '14 quarter below the +25% minimum earnings guideline (C criteria) raising fundamental concerns."

9/26/2014 12:32:51 PM - G - Still consolidating above its 50 DMA line after enduring recent distributional pressure. Repeatedly noted with caution - "Recently reported earnings for the Jun '14 quarter below the +25% minimum earnings guideline (C criteria) raising fundamental concerns."

9/23/2014 5:11:40 PM - G - Consolidating above its 50 DMA line and -6% off its 52-week high. Enduring recent distributional pressure. See the latest FSU analysis for more details and new annotated graphs. Repeatedly noted with caution - "Recently reported earnings for the Jun '14 quarter below the +25% minimum earnings guideline (C criteria) raising fundamental concerns."

9/22/2014 12:39:37 PM - G - Consolidating above its 50 DMA line and -5.3% off its 52-week high, enduring more distributional pressure today. Repeatedly noted with caution - "Recently reported earnings for the Jun '14 quarter below the +25% minimum earnings guideline (C criteria) raising fundamental concerns."

9/18/2014 1:03:24 PM - G - Consolidating above its 50 DMA line and -3.2% off its 52-week high. Recently enduring distributional pressure and noted with caution - "Extended from any sound base. Recently reported earnings for the Jun '14 quarter below the +25% minimum earnings guideline (C criteria) raising fundamental concerns."

9/15/2014 7:35:16 PM - G - Consolidating near its 50 DMA line and -8.4% off its 52-week high. Recently enduring distributional pressure and noted with caution - "Extended from any sound base. Recently reported earnings for the Jun '14 quarter below the +25% minimum earnings guideline (C criteria) raising fundamental concerns."

9/10/2014 12:56:21 PM - G - Consolidating above its 50 DMA line and only -5.1% off its 52-week high. Recently enduring distributional pressure and noted with caution - "Extended from any sound base. Recently reported earnings for the Jun '14 quarter below the +25% minimum earnings guideline (C criteria) raising fundamental concerns."

9/4/2014 12:47:30 PM - G - Churning above average volume perched at its 52-week high, enduring distributional pressure. Previously noted with caution - "Extended from any sound base. Recently reported earnings for the Jun '14 quarter below the +25% minimum earnings guideline (C criteria) raising fundamental concerns."

9/3/2014 5:47:19 PM - G - Churned above average volume perched at its 52-week high again today, enduring distributional pressure. Previously noted with caution - "Extended from any sound base. Recently reported earnings for the Jun '14 quarter below the +25% minimum earnings guideline (C criteria) raising fundamental concerns."

9/2/2014 6:22:56 PM - G - Churned above average volume at its 52-week high today, finishing with a loss and near the session low. Enduring distributional pressure, and it was previously noted with caution - "Extended from any sound base. Recently reported earnings for the Jun '14 quarter below the +25% minimum earnings guideline (C criteria) raising fundamental concerns." See the latest FSU analysis for more details and new annotated graphs.

9/2/2014 12:53:45 PM - G - Churning above average volume at its 52-week high today, extended from any sound base. Recently reported earnings for the Jun '14 quarter below the +25% minimum earnings guideline (C criteria) raising fundamental concerns.

8/29/2014 12:55:32 PM - G - Hitting another new 52-week high with today's volume-driven gain, getting more extended from any sound base. Recently reported earnings for the Jun '14 quarter below the +25% minimum earnings guideline (C criteria) raising fundamental concerns.

8/28/2014 6:19:41 PM - G - Stubbornly holding its ground near its 52-week high. Recently reported earnings for the Jun '14 quarter below the +25% minimum earnings guideline (C criteria) raising fundamental concerns.

8/22/2014 5:55:47 PM - G - Rallied for a new 52-week high with today's volume-driven gain. Recently reported earnings for the Jun '14 quarter below the +25% minimum earnings guideline (C criteria) raising fundamental concerns.

8/19/2014 12:43:28 PM - G - Recently churning above average volume while remaining perched at its 52-week high, enduring distributional pressure. Found support at its 50 DMA line while building on its latest base pattern. Reported earnings -18% on -15% sales revenues for the Jun '14 quarter, below the +25% minimum earnings guideline (C criteria) raising fundamental concerns and its color code was changed to green.

8/18/2014 1:39:01 PM - G - Touched yet another new 52-week high with today's 8th consecutive gain. Found support at its 50 DMA line while building on its latest base pattern. Reported earnings -18% on -15% sales revenues for the Jun '14 quarter, below the +25% minimum earnings guideline (C criteria) raising fundamental concerns and its color code was changed to green.

8/15/2014 2:19:43 PM - G - Hitting yet another new 52-week high with today's 7th consecutive gain. Found support at its 50 DMA line while building on its latest base pattern. Reported earnings -18% on -15% sales revenues for the Jun '14 quarter, below the +25% minimum earnings guideline (C criteria) raising fundamental concerns and its color code was changed to green.

8/14/2014 12:58:21 PM - G - Hitting yet another new 52-week high with today's 6th consecutive gain. Found support at its 50 DMA line while building on its latest base pattern. Reported earnings -18% on -15% sales revenues for the Jun '14 quarter, below the +25% minimum earnings guideline (C criteria) raising fundamental concerns and its color code was changed to green.

8/13/2014 12:37:05 PM - G - Hitting another new 52-week high with today's 5th consecutive gain. Found support at its 50 DMA line while building on its latest base pattern. Reported earnings -18% on -15% sales revenues for the Jun '14 quarter, below the +25% minimum earnings guideline (C criteria) raising fundamental concerns and its color code was changed to green.

8/12/2014 11:13:47 AM - G - Touched a new 52-week high with today's 4th consecutive gain. Found support at its 50 DMA line while building on its latest base pattern. Reported earnings -18% on -15% sales revenues for the Jun '14 quarter, below the +25% minimum earnings guideline (C criteria) raising fundamental concerns and its color code was changed to green.

8/8/2014 12:53:00 PM - G - Erased early losses and found support at its 50 DMA line today while still building on an advanced base pattern. Reported earnings -18% on -15% sales revenues for the Jun '14 quarter, below the +25% minimum earnings guideline (C criteria) raising fundamental concerns and its color code is changed to green.

8/6/2014 6:41:14 PM - Y - Still building on an advanced base pattern. Subsequent volume-driven gains to new highs may trigger a new (or add-on) buy signal. See the latest FSU analysis for more details and new annotated graphs.

8/5/2014 5:44:03 PM - Y - Stubbornly holding its ground in a tight range since forming an advanced "3-weeks tight" base. Subsequent volume-driven gains to new highs may trigger a new (or add-on) buy signal.

7/30/2014 1:08:02 PM - Y - Color code is changed to yellow with new pivot point cited based on its 7/14/14 high while building on an advanced "3-weeks tight" base. Subsequent volume-driven gains to new highs may trigger a new (or add-on) buy signal. Tallying a volume-driven gain today.

7/23/2014 4:27:29 PM - G - Stubbornly holding its ground after tallying big gains following its recent breakout, an encouraging sign. Disciplined investors avoid chasing stocks more than +5% above prior highs.

7/18/2014 6:45:47 PM - G - Tallied big gains after recent breakout, an encouraging sign. Disciplined investors avoid chasing stocks more than +5% above prior highs. See latest FSU analysis for more details and annotated graphs.

7/17/2014 4:30:47 PM - G - Pulled back for a 3rd consecutive loss today on lighter volume. Extended from its prior base. Disciplined investors avoid chasing stocks more than +5% above prior highs.

7/15/2014 4:17:33 PM - G - Pulled back today on lighter volume. Extended from its prior base. Disciplined investors avoid chasing stocks more than +5% above prior highs.

7/14/2014 6:25:21 PM - G - Hit a new all-time high with today's 3rd consecutive gain, getting more extended from its prior base. Disciplined investors avoid chasing stocks more than +5% above prior highs.

7/8/2014 1:09:04 PM - G - Perched near its all-time high and stubbornly holding its ground following considerable volume-driven gains, extended from its prior base. Disciplined investors avoid chasing stocks more than +5% above prior highs.

7/3/2014 11:21:34 AM - G - Perched at its all-time high following 6 consecutive volume-driven gains, extended from its prior base. Disciplined investors avoid chasing stocks more than +5% above prior highs.

7/2/2014 12:46:46 PM - G - Hitting yet another new high with today's 6th consecutive gain. Triggered a technical buy signal and quickly got extended with considerable volume-driven gains. Disciplined investors avoid chasing stocks more than +5% above prior highs.

7/1/2014 12:29:51 PM - G - Hitting yet another new high with today's 5th consecutive gain. Triggered a technical buy signal and quickly got extended with considerable volume-driven gains. Disciplined investors avoid chasing stocks more than +5% above prior highs.

6/30/2014 12:17:33 PM - G - Hitting another new high with today's 4th consecutive gain. Triggered a technical buy signal and quickly got extended with a considerable volume-driven gain on the prior session just one day after highlighted in yellow in the 6/26/14 mid-day report (read here). Disciplined investors avoid chasing stocks more than +5% above prior highs.

6/27/2014 1:17:50 PM - G - Considerable volume-driven gain today rallying above its pivot point and hitting a new 52-week high, triggering a technical buy signal yet quickly getting extended beyond its "max buy" level. Color code is changed to green. Highlighted in yellow in the 6/26/14 mid-day report (read here) while approaching the pivot point based upon its 5/02/14 high plus 10 cents. See the latest FSU analysis for more details and new annotated graphs.

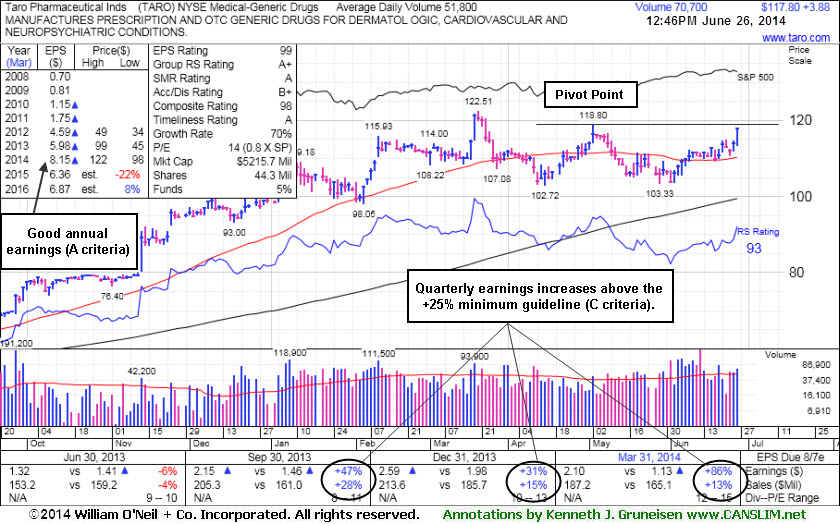

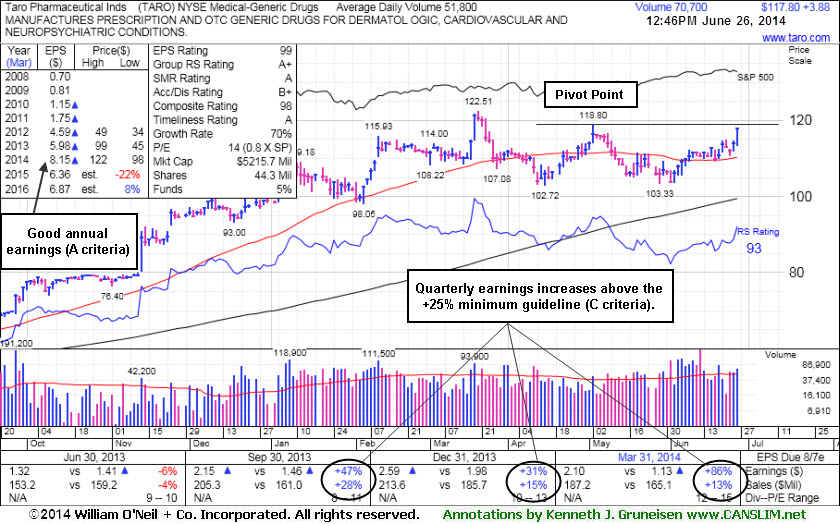

6/26/2014 6:19:05 PM - Y - Posted a solid gain backed by 2 times average volume after highlighted in yellow in the earlier mid-day report (read here) while approaching a pivot point based upon its 5/02/14 high plus 10 cents. Subsequent volume-driven gains above the pivot point may trigger a convincing technical buy signal. See the latest FSU analysis for more details and new annotated graphs.

6/26/2014 12:56:31 PM - Y - Color code is changed to yellow while approaching a new pivot point based upon its 5/02/14 high plus 10 cents. Still facing some resistance due to overhead supply up through $122. Last noted in the 6/19/14 mid-day report - "Patient and disciplined investors may watch for a proper base to possibly develop and be noted in the weeks ahead. Reported earnings +86% on +13% sales revenues for the Mar '14 quarter, a 3rd consecutive quarterly comparison above the +25% minimum guideline (C criteria). The Israel-based Medical - Generic Drugs has seen the number of top-rated funds owning its shares rise from 2 in Mar '12 to 46 as of Mar '14, a reassuring sign concerning the I criteria."

6/19/2014 1:16:05 PM - Consolidating above its 50 DMA line and perched -9.4% off its 52-week high, enduring distributional pressure in recent weeks and still facing some resistance due to overhead supply. Patient and disciplined investors may watch for a proper base to possibly develop and be noted in the weeks ahead. Reported earnings +86% on +13% sales revenues for the Mar '14 quarter, a 3rd consecutive quarterly comparison above the +25% minimum guideline (C criteria). The Israel-based Medical - Generic Drugs has seen the number of top-rated funds owning its shares rise from 2 in Mar '12 to 46 as of Mar '14, a reassuring sign concerning the I criteria.

6/11/2014 12:55:23 PM - Trading back above its 50 DMA line following 5 consecutive small gains with above average volume. It is -9.4% off its 52-week high and faces some resistance due to overhead supply. Patient and disciplined investors may watch for a proper base to possibly develop and be noted in the weeks ahead. Reported earnings +86% on +13% sales revenues for the Mar '14 quarter, a 3rd consecutive quarterly comparison above the +25% minimum guideline (C criteria). The Israel-based Medical - Generic Drugs has seen the number of top-rated funds owning its shares rise from 2 in Mar '12 to 45 as of Mar '14, a reassuring sign concerning the I criteria.

6/9/2014 12:56:40 PM - Trading back above its 50 DMA line with above average volume today while on track for a 5th consecutive small gain. It is -9.8% off its 52-week high and faces some resistance due to overhead supply. Patient and disciplined investors may watch for a proper base to possibly develop and be noted in the weeks ahead. Reported earnings +86% on +13% sales revenues for the Mar '14 quarter, a 3rd consecutive quarterly comparison above the +25% minimum guideline (C criteria). The Israel-based Medical - Generic Drugs has seen the number of top-rated funds owning its shares rise from 2 in Mar '12 to 45 as of Mar '14, a reassuring sign concerning the I criteria.

5/22/2014 12:28:26 PM - Consolidating near its 50 DMA line and -10.2% off its 52-week high. The 5/08/14 mid-day report cautioned members - "Reported earnings +31% on +15% sales revenues for the Dec '13 quarter, but fundamental concerns remain. The Israel-based Medical - Generic Drugs firm faces no resistance due to overhead supply. The number of top-rated funds owning its shares from 2 in Mar '12 to 44 as of Mar '14, a reassuring sign concerning the I criteria."

5/21/2014 12:27:01 PM - Consolidating near its 50 DMA line and -11.3% off its 52-week high. The 5/08/14 mid-day report cautioned members - "Reported earnings +31% on +15% sales revenues for the Dec '13 quarter, but fundamental concerns remain. The Israel-based Medical - Generic Drugs firm faces no resistance due to overhead supply. The number of top-rated funds owning its shares from 2 in Mar '12 to 44 as of Mar '14, a reassuring sign concerning the I criteria."

5/8/2014 12:36:49 PM - Consolidating above its 50 DMA line and -7.2% off its 52-week high. Reported earnings +31% on +15% sales revenues for the Dec '13 quarter, but fundamental concerns remain. The Israel-based Medical - Generic Drugs firm faces no resistance due to overhead supply. The number of top-rated funds owning its shares from 2 in Mar '12 to 44 as of Mar '14, a reassuring sign concerning the I criteria.

4/1/2014 1:19:01 PM - Consolidating near its 50 DMA line. Reported earnings +31% on +15% sales revenues for the Dec '13 quarter, but fundamental concerns remain. The Israel-based Medical - Generic Drugs firm faces no resistance due to overhead supply. The number of top-rated funds owning its shares from 2 in Mar '12 to 33 as of Dec '13, a reassuring sign concerning the I criteria.

2/11/2014 1:25:39 PM - Today's 6th consecutive volume-driven gain has it rallying for new 52-week and all-time highs. Found support when recently consolidating near its 50 DMA line. Reported earnings +31% on +15% sales revenues for the Dec '13 quarter, but fundamental concerns remain. The Israel-based Medical - Generic Drugs firm faces no resistance due to overhead supply. The number of top-rated funds owning its shares from 2 in Mar '12 to 33 as of Dec '13, a reassuring sign concerning the I criteria.

2/10/2014 1:20:05 PM - Today's 5th consecutive gain has it challenging its 52-week and all-time highs. Found support when recently consolidating near its 50 DMA line. Prior mid-day reports repeatedly cautioned members - Reported earnings +47% on +28% sales revenues for the Sep '13 quarter, but fundamental concerns remain. Reported earnings -6% on -4% sales revenues for the Jun '13 quarter, below the +25% minimum guideline (C criteria). The Israel-based Medical - Generic Drugs firm faced no resistance due to overhead supply when noted in prior mid-day reports with caution. The number of top-rated funds owning its shares from 2 in Mar '12 to 23 as of Jun '13, a reassuring sign concerning the I criteria."

2/6/2014 2:51:32 PM - Making repeated mid-day report appearances consolidating near its 50 DMA line, and it is enduring more distributional pressure today. Prior mid-day reports repeatedly cautioned members - Reported earnings +47% on +28% sales revenues for the Sep '13 quarter, but fundamental concerns remain. Reported earnings -6% on -4% sales revenues for the Jun '13 quarter, below the +25% minimum guideline (C criteria). The Israel-based Medical - Generic Drugs firm faced no resistance due to overhead supply when noted in prior mid-day reports with caution. The number of top-rated funds owning its shares from 2 in Mar '12 to 23 as of Jun '13, a reassuring sign concerning the I criteria."

2/5/2014 12:33:43 PM - Making repeated mid-day report appearances consolidating near its 50 DMA line, and it is enduring more distributional pressure today. Prior mid-day reports repeatedly cautioned members - Reported earnings +47% on +28% sales revenues for the Sep '13 quarter, but fundamental concerns remain. Reported earnings -6% on -4% sales revenues for the Jun '13 quarter, below the +25% minimum guideline (C criteria). The Israel-based Medical - Generic Drugs firm faced no resistance due to overhead supply when noted in prior mid-day reports with caution. The number of top-rated funds owning its shares from 2 in Mar '12 to 23 as of Jun '13, a reassuring sign concerning the I criteria."

2/3/2014 12:44:50 PM - Making repeated mid-day report appearances consolidating above its 50 DMA line, and it is enduring more distributional pressure today. Prior mid-day reports repeatedly cautioned members - Reported earnings +47% on +28% sales revenues for the Sep '13 quarter, but fundamental concerns remain. Reported earnings -6% on -4% sales revenues for the Jun '13 quarter, below the +25% minimum guideline (C criteria). The Israel-based Medical - Generic Drugs firm faced no resistance due to overhead supply when noted in prior mid-day reports with caution. The number of top-rated funds owning its shares from 2 in Mar '12 to 23 as of Jun '13, a reassuring sign concerning the I criteria."

1/29/2014 2:42:53 PM - Making its 3rd consecutive mid-day report appearance consolidating above its 50 DMA line after enduring recent distributional pressure. Prior mid-day reports repeatedly cautioned members - Reported earnings +47% on +28% sales revenues for the Sep '13 quarter, but fundamental concerns remain. Reported earnings -6% on -4% sales revenues for the Jun '13 quarter, below the +25% minimum guideline (C criteria). The Israel-based Medical - Generic Drugs firm faced no resistance due to overhead supply when noted in prior mid-day reports with caution. The number of top-rated funds owning its shares from 2 in Mar '12 to 23 as of Jun '13, a reassuring sign concerning the I criteria."

1/28/2014 1:10:13 PM - Consolidating above its 50 DMA line after enduring recent distributional pressure. Prior mid-day reports repeatedly cautioned members - Reported earnings +47% on +28% sales revenues for the Sep '13 quarter, but fundamental concerns remain. Reported earnings -6% on -4% sales revenues for the Jun '13 quarter, below the +25% minimum guideline (C criteria). The Israel-based Medical - Generic Drugs firm faced no resistance due to overhead supply when noted in prior mid-day reports with caution. The number of top-rated funds owning its shares from 2 in Mar '12 to 23 as of Jun '13, a reassuring sign concerning the I criteria."

1/27/2014 12:59:24 PM - Slumping toward its 50 DMA line, enduring recent distributional pressure. Prior mid-day reports repeatedly cautioned members - Reported earnings +47% on +28% sales revenues for the Sep '13 quarter, but fundamental concerns remain. Reported earnings -6% on -4% sales revenues for the Jun '13 quarter, below the +25% minimum guideline (C criteria). The Israel-based Medical - Generic Drugs firm faced no resistance due to overhead supply when noted in prior mid-day reports with caution. The number of top-rated funds owning its shares from 2 in Mar '12 to 23 as of Jun '13, a reassuring sign concerning the I criteria."

1/21/2014 12:24:43 PM - Hovering near its 52-week high, enduring recent distributional pressure. Prior mid-day reports repeatedly cautioned members - Reported earnings +47% on +28% sales revenues for the Sep '13 quarter, but fundamental concerns remain. Reported earnings -6% on -4% sales revenues for the Jun '13 quarter, below the +25% minimum guideline (C criteria). The Israel-based Medical - Generic Drugs firm faced no resistance due to overhead supply when noted in prior mid-day reports with caution. The number of top-rated funds owning its shares from 2 in Mar '12 to 23 as of Jun '13, a reassuring sign concerning the I criteria."

1/16/2014 12:49:27 PM - Pulling back from its 52-week high toward prior highs with above average volume behind today's 5th consecutive loss following recent volume-driven gains. Prior mid-day reports repeatedly cautioned members - . Reported earnings +47% on +28% sales revenues for the Sep '13 quarter, but fundamental concerns remain. Reported earnings -6% on -4% sales revenues for the Jun '13 quarter, below the +25% minimum guideline (C criteria). The Israel-based Medical - Generic Drugs firm faced no resistance due to overhead supply when noted in prior mid-day reports with caution. The number of top-rated funds owning its shares from 2 in Mar '12 to 23 as of Jun '13, a reassuring sign concerning the I criteria."

1/14/2014 12:37:52 PM - Pulling back from its 52-week high with today's 3rd consecutive loss following recent volume-driven gains. Prior mid-day reports repeatedly cautioned members - . Reported earnings +47% on +28% sales revenues for the Sep '13 quarter, but fundamental concerns remain. Reported earnings -6% on -4% sales revenues for the Jun '13 quarter, below the +25% minimum guideline (C criteria). The Israel-based Medical - Generic Drugs firm faced no resistance due to overhead supply when noted in prior mid-day reports with caution. The number of top-rated funds owning its shares from 2 in Mar '12 to 23 as of Jun '13, a reassuring sign concerning the I criteria."

1/13/2014 1:25:20 PM - Perched at its 52-week high holding its ground stubbornly following recent volume-driven gains. Prior mid-day reports repeatedly cautioned members - . Reported earnings +47% on +28% sales revenues for the Sep '13 quarter, but fundamental concerns remain. Reported earnings -6% on -4% sales revenues for the Jun '13 quarter, below the +25% minimum guideline (C criteria). The Israel-based Medical - Generic Drugs firm faced no resistance due to overhead supply when noted in prior mid-day reports with caution. The number of top-rated funds owning its shares from 2 in Mar '12 to 23 as of Jun '13, a reassuring sign concerning the I criteria."

1/9/2014 12:48:02 PM - Perched at its 52-week high today following 4 consecutive volume-driven gains. Prior mid-day reports repeatedly cautioned members - . Reported earnings +47% on +28% sales revenues for the Sep '13 quarter, but fundamental concerns remain. Reported earnings -6% on -4% sales revenues for the Jun '13 quarter, below the +25% minimum guideline (C criteria). The Israel-based Medical - Generic Drugs firm faced no resistance due to overhead supply when noted in prior mid-day reports with caution. The number of top-rated funds owning its shares from 2 in Mar '12 to 23 as of Jun '13, a reassuring sign concerning the I criteria."

1/8/2014 1:10:12 PM - Hitting new 52-week highs with today's 4th consecutive volume-driven gain. Prior mid-day reports repeatedly cautioned members - . Reported earnings +47% on +28% sales revenues for the Sep '13 quarter, but fundamental concerns remain. Reported earnings -6% on -4% sales revenues for the Jun '13 quarter, below the +25% minimum guideline (C criteria). The Israel-based Medical - Generic Drugs firm faced no resistance due to overhead supply when noted in prior mid-day reports with caution. The number of top-rated funds owning its shares from 2 in Mar '12 to 23 as of Jun '13, a reassuring sign concerning the I criteria."

1/7/2014 12:41:54 PM - Inching to new 52-week highs and stubbornly holding its ground while tallying small volume-driven gains. Prior mid-day reports cautioned members - . Reported earnings +47% on +28% sales revenues for the Sep '13 quarter, but fundamental concerns remain. Reported earnings -6% on -4% sales revenues for the Jun '13 quarter, below the +25% minimum guideline (C criteria). The Israel-based Medical - Generic Drugs firm faced no resistance due to overhead supply when noted in prior mid-day reports with caution. The number of top-rated funds owning its shares from 2 in Mar '12 to 23 as of Jun '13, a reassuring sign concerning the I criteria."

12/4/2013 12:40:11 PM - Perched at its 52-week high, holding its ground stubbornly after its gap up and considerable volume-driven gain when last noted in the 11/25/13 mid-day report with caution - . Reported earnings +47% on +28% sales revenues for the Sep '13 quarter, but fundamental concerns remain. Reported earnings -6% on -4% sales revenues for the Jun '13 quarter, below the +25% minimum guideline (C criteria). The Israel-based Medical - Generic Drugs firm faced no resistance due to overhead supply when noted in prior mid-day reports with caution. The number of top-rated funds owning its shares from 2 in Mar '12 to 23 as of Jun '13, a reassuring sign concerning the I criteria."

11/25/2013 1:09:39 PM - Gapped up today for another new 52-week high. Held its ground stubbornly after it powered higher with a considerable volume-driven gain on 11/13/13 as the mid-day report cautioned members - . Reported earnings +47% on +28% sales revenues for the Sep '13 quarter, but fundamental concerns remain. Reported earnings -6% on -4% sales revenues for the Jun '13 quarter, below the +25% minimum guideline (C criteria). The Israel-based Medical - Generic Drugs firm faced no resistance due to overhead supply when noted in prior mid-day reports with caution. The number of top-rated funds owning its shares from 2 in Mar '12 to 23 as of Jun '13, a reassuring sign concerning the I criteria."

11/14/2013 12:55:36 PM - Powering to new 52-week highs with considerable volume-driven gains this week. Reported earnings +47% on +28% sales revenues for the Sep '13 quarter, but fundamental concerns remain. Prior mid-day reports repeatedly cautioned members - "Reported earnings -6% on -4% sales revenues for the Jun '13 quarter, below the +25% minimum guideline (C criteria). The Israel-based Medical - Generic Drugs firm faced no resistance due to overhead supply when noted in prior mid-day reports with caution. The number of top-rated funds owning its shares from 2 in Mar '12 to 23 as of Jun '13, a reassuring sign concerning the I criteria."

11/13/2013 12:54:08 PM - Powering to new 52-week highs with today's considerable volume-driven gain. Reported earnings +47% on +28% sales revenues for the Sep '13 quarter, but fundamental concerns remain. Prior mid-day reports repeatedly cautioned members - "Reported earnings -6% on -4% sales revenues for the Jun '13 quarter, below the +25% minimum guideline (C criteria). The Israel-based Medical - Generic Drugs firm faced no resistance due to overhead supply when noted in prior mid-day reports with caution. The number of top-rated funds owning its shares from 2 in Mar '12 to 23 as of Jun '13, a reassuring sign concerning the I criteria."

9/30/2013 12:53:14 PM - Perched at its 52-week high and adding to a recent spurt of volume-driven gains. Prior mid-day reports repeatedly cautioned members - "Reported earnings -6% on -4% sales revenues for the Jun '13 quarter, below the +25% minimum guideline (C criteria). The Israel-based Medical - Generic Drugs firm faced no resistance due to overhead supply when noted in prior mid-day reports with caution. The number of top-rated funds owning its shares from 2 in Mar '12 to 23 as of Jun '13, a reassuring sign concerning the I criteria."

9/26/2013 12:44:14 PM - Churning heavy volume while still hovering near its 52-week high. Prior mid-day reports repeatedly cautioned members - "Reported earnings -6% on -4% sales revenues for the Jun '13 quarter, below the +25% minimum guideline (C criteria). The Israel-based Medical - Generic Drugs firm faced no resistance due to overhead supply when noted in prior mid-day reports with caution. The number of top-rated funds owning its shares from 2 in Mar '12 to 23 as of Jun '13, a reassuring sign concerning the I criteria."

9/24/2013 12:56:32 PM - Still hovering near its 52-week high, enduring recent distributional pressure. Prior mid-day reports repeatedly cautioned members - "Reported earnings -6% on -4% sales revenues for the Jun '13 quarter, below the +25% minimum guideline (C criteria). The Israel-based Medical - Generic Drugs firm faced no resistance due to overhead supply when noted in prior mid-day reports with caution. The number of top-rated funds owning its shares from 2 in Mar '12 to 23 as of Jun '13, a reassuring sign concerning the I criteria."

9/23/2013 1:09:27 PM - Hovering near its 52-week high, enduring recent distributional pressure. Prior mid-day reports repeatedly cautioned members - "Reported earnings -6% on -4% sales revenues for the Jun '13 quarter, below the +25% minimum guideline (C criteria). The Israel-based Medical - Generic Drugs firm faced no resistance due to overhead supply when noted in prior mid-day reports with caution. The number of top-rated funds owning its shares from 2 in Mar '12 to 23 as of Jun '13, a reassuring sign concerning the I criteria."

9/18/2013 12:47:23 PM - Pulled back from its 52-week high with a loss on 9/16/13 with above average volume as the mid-day report cautioned members - "Reported earnings -6% on -4% sales revenues for the Jun '13 quarter, below the +25% minimum guideline (C criteria). The Israel-based Medical - Generic Drugs firm faced no resistance due to overhead supply when noted in prior mid-day reports with caution. The number of top-rated funds owning its shares from 2 in Mar '12 to 23 as of Jun '13, a reassuring sign concerning the I criteria."

9/16/2013 1:10:22 PM - Pulling back from its 52-week high with a loss on above average volume today. Reported earnings -6% on -4% sales revenues for the Jun '13 quarter, below the +25% minimum guideline (C criteria). The Israel-based Medical - Generic Drugs firm faced no resistance due to overhead supply when noted in prior mid-day reports with caution. The number of top-rated funds owning its shares from 2 in Mar '12 to 23 as of Jun '13, a reassuring sign concerning the I criteria.

6/5/2013 12:38:11 PM - Sputtering below its 50 DMA line for the past week with volume totals cooling after violating that important short-term average when last noted in the 5/28/13 mid-day report with caution - "Reported earnings +7% on +14% sales revenues for the Mar '13 quarter, below the fact-based investment system's guidelines. The Israel-based Medical - Generic Drugs firm faced no resistance due to overhead supply when noted in the 5/14/13 mid-day report with caution - 'Rallying from an orderly flat base pattern above its 50 DMA line. Reported earnings +40% on +25% sales revenues for the Dec '12 quarter, a solid improvement following its previously noted sub par results for the Sep '12 quarter (below the +25% minimum guideline for the C criteria). The number of top-rated funds owning its shares from 2 in Mar '12 to 20 as of Mar '13, a reassuring sign concerning the I criteria.'"

5/28/2013 12:54:35 PM - On Friday it gapped down for a damaging loss with above average volume, and it is slumping below its 50 DMA line today after showing some resilience near that important short-term average. Reported earnings +7% on +14% sales revenues for the Mar '13 quarter, below the fact-based investment system's guidelines. The Israel-based Medical - Generic Drugs firm faced no resistance due to overhead supply when noted in the 5/14/13 mid-day report with caution - "Rallying from an orderly flat base pattern above its 50 DMA line. Reported earnings +40% on +25% sales revenues for the Dec '12 quarter, a solid improvement following its previously noted sub par results for the Sep '12 quarter (below the +25% minimum guideline for the C criteria). The number of top-rated funds owning its shares from 2 in Mar '12 to 20 as of Mar '13, a reassuring sign concerning the I criteria."

5/24/2013 1:00:58 PM - Reported earnings +7% on +14% sales revenues for the Mar '13 quarter, below the fact-based investment system's guidelines. Gapped down for a damaging loss with above average volume, now trading near its 50 DMA line, up from earlier lows. This Israel-based Medical - Generic Drugs firm faced no resistance due to overhead supply when last noted in the 5/14/13 mid-day report with caution - "Rallying from an orderly flat base pattern above its 50 DMA line. Reported earnings +40% on +25% sales revenues for the Dec '12 quarter, a solid improvement following its previously noted sub par results for the Sep '12 quarter (below the +25% minimum guideline for the C criteria). The number of top-rated funds owning its shares from 2 in Mar '12 to 20 as of Mar '13, a reassuring sign concerning the I criteria."

5/14/2013 1:09:22 PM - Israel-based Medical - Generic Drugs firm faces no resistance due to overhead supply while hovering near its 52-week high. Held its ground stubbornly since noted in the 4/30/13 mid-day report - "Rallying from an orderly flat base pattern above its 50 DMA line. Reported earnings +40% on +25% sales revenues for the Dec '12 quarter, a solid improvement following its previously noted sub par results for the Sep '12 quarter (below the +25% minimum guideline for the C criteria). The number of top-rated funds owning its shares from 2 in Mar '12 to 20 as of Mar '13, a reassuring sign concerning the I criteria."

5/8/2013 1:17:37 PM - Israel-based Medical - Generic Drugs firm faces no resistance due to overhead supply while hovering near its 52-week high. Held its ground stubbornly since last noted in the 4/30/13 mid-day report - "Rallying from an orderly flat base pattern above its 50 DMA line. Reported earnings +40% on +25% sales revenues for the Dec '12 quarter, a solid improvement following its previously noted sub par results for the Sep '12 quarter (below the +25% minimum guideline for the C criteria). The number of top-rated funds owning its shares from 2 in Mar '12 to 20 as of Mar '13, a reassuring sign concerning the I criteria."

4/30/2013 1:19:00 PM - Israel-based Medical - Generic Drugs firm faces no resistance due to overhead supply while hitting a new 52-week high today, rallying from an orderly flat base pattern above its 50 DMA line. Reported earnings +40% on +25% sales revenues for the Dec '12 quarter, a solid improvement following its previously noted sub par results for the Sep '12 quarter (below the +25% minimum guideline for the C criteria). The number of top-rated funds owning its shares from 2 in Mar '12 to 20 as of Mar '13, a reassuring sign concerning the I criteria.

3/22/2013 3:43:42 PM - On track for its 8th consecutive weekly gain and perched at its 52-week high today. Churning above average volume in recent weeks while holding its ground stubbornly and gradually rising. Noted in the 2/22/13 mid-day report with caution - "Reported earnings +40% on +25% sales revenues for the Dec '12 quarter, a solid improvement following its previously noted sub par results for the Sep '12 quarter (below the +25% minimum guideline for the C criteria). It faces no resistance due to overhead supply. The number of top-rated funds owning its shares from 2 in Mar '12 to 19 as of Dec '12, a reassuring sign concerning the I criteria. Found support above its 200 DMA line during its 9-month consolidation since noted in the 4/12/12 mid-day report when hitting its 52-week high - 'The thinly traded stock has rallied 3-fold in the past year, finding support at its 50 DMA line throughout its ongoing advance. The Israel-based Medical - Generic Drugs firm reportedly is owned by only 1 top-rated fund. Recent quarterly comparisons through Dec '11 showed impressive acceleration in sales revenues and earnings increases satisfying the C criteria.'"

3/20/2013 12:38:28 PM - On track for its 8th consecutive weekly gain and perched at its 52-week high today. Churning above average volume in recent weeks while holding its ground stubbornly and gradually rising. Last noted in the 2/22/13 mid-day report with caution - "Reported earnings +40% on +25% sales revenues for the Dec '12 quarter, a solid improvement following its previously noted sub par results for the Sep '12 quarter (below the +25% minimum guideline for the C criteria). It faces no resistance due to overhead supply. The number of top-rated funds owning its shares from 2 in Mar '12 to 19 as of Dec '12, a reassuring sign concerning the I criteria. Found support above its 200 DMA line during its 9-month consolidation since noted in the 4/12/12 mid-day report when hitting its 52-week high - 'The thinly traded stock has rallied 3-fold in the past year, finding support at its 50 DMA line throughout its ongoing advance. The Israel-based Medical - Generic Drugs firm reportedly is owned by only 1 top-rated fund. Recent quarterly comparisons through Dec '11 showed impressive acceleration in sales revenues and earnings increases satisfying the C criteria.'"

2/22/2013 12:52:17 PM - Inching to another new 52-week high today with a volume-driven gain. Held its ground stubbornly after a recent streak of volume-driven gains. Recent mid-day mid-day reports noted - "Reported earnings +40% on +25% sales revenues for the Dec '12 quarter, a solid improvement following its previously noted sub par results for the Sep '12 quarter (below the +25% minimum guideline for the C criteria). It faces no resistance due to overhead supply. The number of top-rated funds owning its shares from 2 in Mar '12 to 19 as of Dec '12, a reassuring sign concerning the I criteria. Found support above its 200 DMA line during its 9-month consolidation since noted in the 4/12/12 mid-day report when hitting its 52-week high - 'The thinly traded stock has rallied 3-fold in the past year, finding support at its 50 DMA line throughout its ongoing advance. The Israel-based Medical - Generic Drugs firm reportedly is owned by only 1 top-rated fund. Recent quarterly comparisons through Dec '11 showed impressive acceleration in sales revenues and earnings increases satisfying the C criteria.'"

2/15/2013 1:05:01 PM - Perched at its 52-week high today, holding its ground stubbornly after a recent streak of 6 consecutive volume-driven gains. The 2/12/13 mid-day mid-day report noted - "Reported earnings +40% on +25% sales revenues for the Dec '12 quarter, a solid improvement following its previously noted sub par results for the Sep '12 quarter (below the +25% minimum guideline for the C criteria). It faces no resistance due to overhead supply. The number of top-rated funds owning its shares from 2 in Mar '12 to 19 as of Dec '12, a reassuring sign concerning the I criteria. Found support above its 200 DMA line during its 9-month consolidation since noted in the 4/12/12 mid-day report when hitting its 52-week high - 'The thinly traded stock has rallied 3-fold in the past year, finding support at its 50 DMA line throughout its ongoing advance. The Israel-based Medical - Generic Drugs firm reportedly is owned by only 1 top-rated fund. Recent quarterly comparisons through Dec '11 showed impressive acceleration in sales revenues and earnings increases satisfying the C criteria.'"

2/12/2013 1:12:26 PM - Perched at its 52-week high today while on track for a 6th consecutive volume-driven gain. Reported earnings +40% on +25% sales revenues for the Dec '12 quarter, a solid improvement following its previously noted sub par results for the Sep '12 quarter (below the +25% minimum guideline for the C criteria). It faces no resistance due to overhead supply. The number of top-rated funds owning its shares from 2 in Mar '12 to 19 as of Dec '12, a reassuring sign concerning the I criteria. Found support above its 200 DMA line during its 9-month consolidation since noted in the 4/12/12 mid-day report when hitting its 52-week high - "The thinly traded stock has rallied 3-fold in the past year, finding support at its 50 DMA line throughout its ongoing advance. The Israel-based Medical - Generic Drugs firm reportedly is owned by only 1 top-rated fund. Recent quarterly comparisons through Dec '11 showed impressive acceleration in sales revenues and earnings increases satisfying the C criteria."

11/12/2012 1:07:38 PM - Reported earnings +11% on +16% sales revenues for the Sep '12 quarter, its first quarterly comparison with earnings below the +25% minimum earnings guideline since Dec '10. It faces very little resistance due to overhead supply up through the $49 level. The number of top-rated funds owning its shares from 2 in Mar '12 to 12 as of Sep '12, a reassuring sign concerning the I criteria. Found support above its 200 DMA line during its consolidation since noted in the 4/12/12 mid-day report when hitting its 52-week high - "The thinly traded stock has rallied 3-fold in the past year, finding support at its 50 DMA line throughout its ongoing advance. The Israel-based Medical - Generic Drugs firm reportedly is owned by only 1 top-rated fund. Recent quarterly comparisons through Dec '11 showed impressive acceleration in sales revenues and earnings increases satisfying the C criteria."

9/20/2012 12:38:27 PM - Reported earnings +74% on +43% sales revenues for the Jun '12 quarter. It faces some resistance due to overhead supply up through the $49 level. The number of top-rated funds owning its shares rose to 6 as of Jun '12. Found support above its 200 DMA line during its consolidation since noted in the 4/12/12 mid-day report when hitting its 52-week high - "The thinly traded stock has rallied 3-fold in the past year, finding support at its 50 DMA line throughout its ongoing advance. The Israel-based Medical - Generic Drugs firm reportedly is owned by only 1 top-rated fund. Recent quarterly comparisons through Dec '11 showed impressive acceleration in sales revenues and earnings increases satisfying the C criteria."

9/19/2012 12:57:54 PM - Reported earnings +74% on +43% sales revenues for the Jun '12 quarter. It faces some resistance due to overhead supply up through the $49 level. The number of top-rated funds owning its shares rose to 6 as of Jun '12. Found support above its 200 DMA line during its consolidation since last noted in the 4/12/12 mid-day report when hitting its 52-week high - " The thinly traded stock has rallied 3-fold in the past year, finding support at its 50 DMA line throughout its ongoing advance. The Israel-based Medical - Generic Drugs firm reportedly is owned by only 1 top-rated fund. Recent quarterly comparisons through Dec '11 showed impressive acceleration in sales revenues and earnings increases satisfying the C criteria."

4/12/2012 12:39:14 PM - Touched yet another new 52-week high today. The 4/10/12 mid-day report noted - "Adding to its streak of consecutive gains with above average volume. The thinly traded stock has rallied 3-fold in the past year, finding support at its 50 DMA line throughout its ongoing advance. The Israel-based Medical - Generic Drugs firm reportedly is owned by only 1 top-rated fund. Recent quarterly comparisons through Dec '11 showed impressive acceleration in sales revenues and earnings increases satisfying the C criteria."

4/10/2012 1:07:25 PM - Perched near its new 52-week high today while adding to its streak of consecutive gains with above average volume. The thinly traded stock has rallied 3-fold in the past year, finding support at its 50 DMA line throughout its ongoing advance. The Israel-based Medical - Generic Drugs firm reportedly is owned by only 1 top-rated fund. Recent quarterly comparisons through Dec '11 showed impressive acceleration in sales revenues and earnings increases satisfying the C criteria.

4/9/2012 12:33:29 PM - Perched near its new 52-week high today after 4 consecutive gains on ever-increasing volume. The thinly traded stock has rallied 3-fold in the past year, finding support at its 50 DMA line throughout its ongoing advance. The Israel-based Medical - Generic Drugs firm reportedly is owned by only 1 top-rated fund. Recent quarterly comparisons through Dec '11 showed impressive acceleration in sales revenues and earnings increases satisfying the C criteria.

4/5/2012 1:12:25 PM - Hitting a new 52-week high with today's 4th consecutive gain on ever-increasing volume. The thinly traded stock has rallied 3-fold in the past year, finding support at its 50 DMA line throughout its ongoing advance. The Israel-based Medical - Generic Drugs firm reportedly is owned by only 1 top-rated fund. Recent quarterly comparisons through Dec '11 showed impressive acceleration in sales revenues and earnings increases satisfying the C criteria.