4/17/2024 4:03:16 PM - Slumped for a 4th consecutive loss today, falling further below its 50 DMA line ($568) and below the prior low ($546.91 on 3/15/23) where damaging losses raised concerns and triggered technical sell signals. It will be dropped from the Featured Stocks list tonight.

4/12/2024 5:45:54 PM - G - Volume totals have been below average as it slumped below its 50 DMA line ($569) raising concerns. The prior low ($546.91 on 3/15/23) defines the next important support where a damaging loss would raise serious concerns and trigger a more worrisome technical sell signal.

4/10/2024 5:40:56 PM - G - Volume totals have been cooling and its color code is changed to green after a quiet slump below its 50 DMA line ($568) today raised concerns. The prior low ($546.91 on 3/15/23) defines the next important support where a damaging loss would raise serious concerns and trigger a more worrisome technical sell signal. See the latest FSU analysis for more details and a new annotated graph.

4/5/2024 7:35:58 PM - Y - Volume totals have been cooling while still consolidating just above near-term support at its 50 DMA line ($566). More damaging losses would raise concerns and trigger a technical sell signal. Previously noted - " A strong volume-driven gain and close above the pivot point is needed to clinch a proper technical buy signal."

4/2/2024 11:51:34 AM - Y - Consolidating just above near-term support to watch at its 50 DMA line ($564.48). More damaging losses would raise concerns and trigger a technical sell signal. Previously noted - " A strong volume-driven gain and close above the pivot point is needed to clinch a proper technical buy signal."

3/26/2024 5:25:46 PM - Y - Perched within striking distance of its all-time high. Near-term support to watch is its 50 DMA line ($559). Previously noted - " A strong volume-driven gain and close above the pivot point is needed to clinch a proper technical buy signal."

3/21/2024 5:36:29 PM - Y - Posted a 4th consecutive gain today with +38% above-average volume and managed a best-ever close. Found support above its 50 DMA line ($554). Previously noted - " A strong volume-driven gain and close above the pivot point is needed to clinch a proper technical buy signal."

3/19/2024 6:57:33 PM - Y - Posted a big gain today with +14% above-average volume, finding support above its 50 DMA line ($550). Volume totals had cooled in recent weeks while consolidating. Previously noted - " A strong volume-driven gain and close above the pivot point is needed to clinch a proper technical buy signal. See the latest FSU analysis for more details and a new annotated graph.

3/18/2024 5:10:34 PM - Y - Posted a gain today with lighter volume, finding support above its 50 DMA line ($548). Volume totals have been cooling in recent weeks while consolidating. Previously noted - "A strong volume-driven gain and close above the pivot point is needed to clinch a proper technical buy signal. Reported Jan '24 quarterly earnings +36% on +21% sales revenues versus the year-ago period, its 3rd strong quarter above the +25% minimum earnings guideline (C criteria). Annual earnings growth (A criteria) has been strong and steady."

3/13/2024 10:20:11 PM - Y - Pulled back today with higher (still below-average) volume. Volume totals have been cooling in recent weeks while consolidating. The prior low ($555 on 3/11/24) defines near-term support above its 50 DMA line ($544.38). Previously noted - "A strong volume-driven gain and close above the pivot point is needed to clinch a proper technical buy signal. Reported Jan '24 quarterly earnings +36% on +21% sales revenues versus the year-ago period, its 3rd strong quarter above the +25% minimum earnings guideline (C criteria). Annual earnings growth (A criteria) has been strong and steady."

3/12/2024 9:06:25 PM - Y - Posted a small gain today with below-average volume, and volume totals have been cooling in recent weeks while consolidating. The prior low ($555 on 3/11/24) defines near-term support above its 50 DMA line ($543.46). Previously noted - "A strong volume-driven gain and close above the pivot point is needed to clinch a proper technical buy signal. Reported Jan '24 quarterly earnings +36% on +21% sales revenues versus the year-ago period, its 3rd strong quarter above the +25% minimum earnings guideline (C criteria). Annual earnings growth (A criteria) has been strong and steady."

3/5/2024 9:06:52 PM - Y - Suffered a big loss today with below-average volume, retreating from a best-ever close. Previously noted - "A strong volume-driven gain and close above the pivot point is needed to clinch a proper technical buy signal. Found support recently at its 50 DMA line ($538). Reported Jan '24 quarterly earnings +36% on +21% sales revenues versus the year-ago period, its 3rd strong quarter above the +25% minimum earnings guideline (C criteria). Annual earnings growth (A criteria) has been strong and steady."

3/1/2024 4:58:45 PM - Y - Posted a gain today with below-average volume for a best-ever close. A strong volume-driven gain and close above the pivot point is needed to clinch a proper technical buy signal. Found support recently at its 50 DMA line ($538). Reported Jan '24 quarterly earnings +36% on +21% sales revenues versus the year-ago period, its 3rd strong quarter above the +25% minimum earnings guideline (C criteria). Annual earnings growth (A criteria) has been strong and steady.

2/29/2024 12:47:29 PM - Y - Volume totals have been cooling while hovering near its all-time high. Encountered distributional pressure after a gap up on 2/22/24 and ended near the session low, closing below the pivot point cited based on its 2/09/24 high after a cup-with-handle base. A strong close above the pivot point is needed to clinch a proper technical buy signal. Found support recently at its 50 DMA line ($536). Reported Jan '24 quarterly earnings +36% on +21% sales revenues versus the year-ago period, its 3rd strong quarter above the +25% minimum earnings guideline (C criteria). Annual earnings growth (A criteria) has been strong and steady.

2/22/2024 5:55:08 PM - Y - Gapped up and hit a new all-time high today but encountered distributional pressure and ended near the session low, closing below the pivot point cited based on its 2/09/24 high after a cup-with-handle base. A strong close above the pivot point is needed to clinch a proper technical buy signal. Found support recently at its 50 DMA line ($536). Reported Jan '24 quarterly earnings +36% on +21% sales revenues versus the year-ago period, its 3rd strong quarter above the +25% minimum earnings guideline (C criteria). Annual earnings growth (A criteria) has been strong and steady. See the latest FSU analysis for more details and a new annotated graph.

2/22/2024 1:32:29 PM - Y - Color code is changed to yellow with pivot point cited based on its 2/09/24 high after a cup-with-handle base. A strong close above the pivot point is needed to clinch a proper technical buy signal. Gapped up today hitting a new all-time high, however it has slumped from the early high. Found support at its 50 DMA line ($536). Reported Jan '24 quarterly earnings +36% on +21% sales revenues versus the year ago period, its 3rd strong quarter above the +25% minimum earnings guideline (C criteria). Annual earnings growth (A criteria) has been string and steady.

1/22/2024 12:44:29 PM - Gapped up today rebounding above its 50 DMA line ($528). Reported Oct '23 quarterly earnings +66% on +25% sales revenues versus the year ago period, its 2nd strong quarter. Prior quarterly comparisons were not strong and steady above the +25% minimum earnings guideline (C criteria). It went through a deep consolidation then rebounded impressively since dropped from the Featured Stocks list on 9/01/22.

1/19/2024 12:35:39 PM - Sputtering below its 50 DMA line ($527) in recent weeks after retreating from its all-time high with volume-driven losses. Reported Oct '23 quarterly earnings +66% on +25% sales revenues versus the year ago period, its 2nd strong quarter. Prior quarterly comparisons were not strong and steady above the +25% minimum earnings guideline (C criteria). It went through a deep consolidation then rebounded impressively since dropped from the Featured Stocks list on 9/01/22.

1/18/2024 12:58:34 PM - Sputtering below its 50 DMA line ($526) in recent weeks after retreating from its all-time high with volume-driven losses. Reported Oct '23 quarterly earnings +66% on +25% sales revenues versus the year ago period, its 2nd strong quarter. Prior quarterly comparisons were not strong and steady above the +25% minimum earnings guideline (C criteria). It went through a deep consolidation then rebounded impressively since dropped from the Featured Stocks list on 9/01/22.

1/17/2024 12:32:38 PM - Sputtering below its 50 DMA line ($526) in recent weeks after retreating from its all-time high with volume-driven losses. Reported Oct '23 quarterly earnings +66% on +25% sales revenues versus the year ago period, its 2nd strong quarter. Prior quarterly comparisons were not strong and steady above the +25% minimum earnings guideline (C criteria). It went through a deep consolidation then rebounded impressively since dropped from the Featured Stocks list on 9/01/22.

1/16/2024 12:53:34 PM - Sputtering below its 50 DMA line ($526) in recent weeks after retreating from its all-time high with volume-driven losses. Reported Oct '23 quarterly earnings +66% on +25% sales revenues versus the year ago period, its 2nd strong quarter. Prior quarterly comparisons were not strong and steady above the +25% minimum earnings guideline (C criteria). It went through a deep consolidation then rebounded impressively since dropped from the Featured Stocks list on 9/01/22.

1/8/2024 12:51:47 PM - Slumped well below its 50 DMA line ($522) while abruptly retreating from its all-time high with volume-driven losses. Reported Oct '23 quarterly earnings +66% on +25% sales revenues versus the year ago period, its 2nd strong quarter. Prior quarterly comparisons were not strong and steady above the +25% minimum earnings guideline (C criteria). It went through a deep consolidation then rebounded impressively since dropped from the Featured Stocks list on 9/01/22.

12/26/2023 12:23:46 PM - Consolidating above its 50 DMA line ($518) after abruptly retreating from its all-time high with a volume-driven loss on the prior session. Reported Oct '23 quarterly earnings +66% on +25% sales revenues versus the year ago period, its 2nd strong quarter. Prior quarterly comparisons were not strong and steady above the +25% minimum earnings guideline (C criteria). It went through a deep consolidation then rebounded impressively since dropped from the Featured Stocks list on 9/01/22.

12/15/2023 12:51:26 PM - Consolidating after touching a new all-time high this week. Reported Oct '23 quarterly earnings +66% on +25% sales revenues versus the year ago period, its 2nd strong quarter. Prior quarterly comparisons were not strong and steady above the +25% minimum earnings guideline (C criteria). It went through a deep consolidation then rebounded impressively since dropped from the Featured Stocks list on 9/01/22.

11/30/2023 2:44:15 PM - Reversed into the red today after touching a new all-time high. Reported Oct '23 quarterly earnings +66% on +25% sales revenues versus the year ago period, its 2nd strong quarter. Prior quarterly comparisons were not strong and steady above the +25% minimum earnings guideline (C criteria). It went through a deep consolidation then rebounded impressively since dropped from the Featured Stocks list on 9/01/22.

9/7/2023 12:43:03 PM - Rebounded above its 50 DMA line ($444) and recently wedged up touch a new all-time high with gains lacking great volume conviction. Reported Jul '23 quarterly earnings +37% on +19% sales revenues versus the year ago period, but the 4 prior quarterly comparisons were below the +25% minimum earnings guideline (C criteria). It went through a deep consolidation then rebounded impressively since dropped from the Featured Stocks list on 9/01/22.

8/17/2023 1:53:36 PM - Meeting resistance when trying to rebound above its 50 DMA line ($440). Consolidating for 12-weeks following considerable volume-driven gains. Reported Jul '23 quarterly earnings +37% on +19% sales revenues versus the year ago period, but the 4 prior quarterly comparisons were below the +25% minimum earnings guideline (C criteria). It went through a deep consolidation then rebounded impressively since dropped from the Featured Stocks list on 9/01/22.

6/16/2023 1:17:05 PM - Hovering near its all-time high following considerable volume-driven gains in recent weeks. Reported Apr '23 quarterly earnings +2% on +9% sales revenues versus the year ago period, its 4th consecutive quarterly comparison below the +25% minimum earnings guideline (C criteria). It went through a deep consolidation then rebounded impressively since dropped from the Featured Stocks list on 9/01/22.

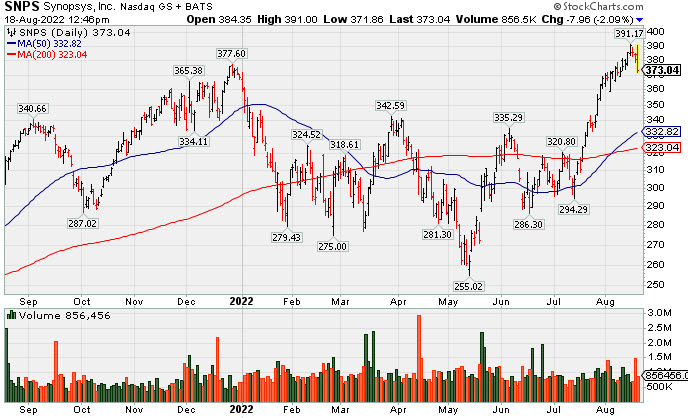

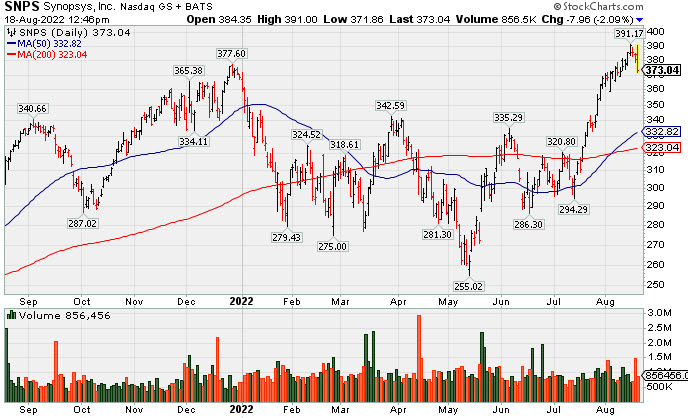

9/1/2022 6:51:09 PM - Violated its 50 DMA line ($342.94) with today's damaging volume-driven loss raising concerns and triggering a technical sell signal. Encountering distributional pressure while retreating from its all-time high in recent weeks. Reported Jul '22 quarterly earnings +16% on +18% sales revenues versus the year ago period, below the +25% minimum earnings guideline (C criteria), raising fundamental concerns. It will be dropped from the Featured Stocks list tonight. Only a prompt rebound above the 50 DMA line would help its outlook improve.

8/31/2022 12:50:29 PM - G - Holding its ground today after testing its 50 DMA line ($342) with a spurt of losses. More damaging losses would raise greater concerns. Encountered distributional pressure while retreating from its all-time high in recent weeks. Reported Jul '22 quarterly earnings +16% on +18% sales revenues versus the year ago period, below the +25% minimum earnings guideline (C criteria), raising fundamental concerns. Renewed strength and subsequent gains above the pivot point backed by at least +40% above average volume are needed to clinch a technical buy signal.

8/30/2022 5:24:20 PM - G - Tested its 50 DMA line ($341.44) with today's 3rd consecutive loss. More damaging losses would raise greater concerns. Encountered distributional pressure while retreating from its all-time high in recent weeks. Reported Jul '22 quarterly earnings +16% on +18% sales revenues versus the year ago period, below the +25% minimum earnings guideline (C criteria), raising fundamental concerns. Renewed strength and subsequent gains above the pivot point backed by at least +40% above average volume are needed to clinch a technical buy signal.

8/24/2022 5:13:55 PM - G - Halted its slide this week after encountering distributional pressure since reaching a new all-time high. Reported Jul '22 quarterly earnings +16% on +18% sales revenues versus the year ago period, below the +25% minimum earnings guideline (C criteria), raising fundamental concerns. Renewed strength and subsequent gains above the pivot point backed by at least +40% above average volume are needed to clinch a technical buy signal.

8/19/2022 12:23:26 PM - G - Color code is changed to green due to fundamental concerns while pulling back today for a 4th consecutive loss marked by above average volume, encountering distributional pressure since reaching a new all-time high. Reported Jul '22 quarterly earnings +16% on +18% sales revenues versus the year ago period, below the +25% minimum earnings guideline (C criteria), raising fundamental concerns. Renewed strength and subsequent gains above the pivot point backed by at least +40% above average volume are needed to clinch a technical buy signal.

8/18/2022 5:23:55 PM - Y - Encountering distributional pressure while pulling back from its all-time high. Highlighted in yellow in the prior mid-day report with pivot point cited based on its 12/28/21 high plus 10 cents. However, it reported Jul '22 quarterly earnings +16% on +18% sales revenues versus the year ago period, below the +25% minimum earnings guideline (C criteria), raising fundamental concerns. Volume and volatility often increase near earnings news. Subsequent gains above the pivot point backed by at least +40% above average volume may help clinch a convincing technical buy signal. See the latest FSU for more detailed analysis and a new annotated graph.

8/18/2022 12:49:32 PM - Y - Perched at its all-time high, enduring distributional pressure. Color code was changed to yellow in the prior mid-day report with pivot point cited based on its 12/28/21 high plus 10 cents. However, it reported Jul '22 quarterly earnings +16% on +18% sales revenues versus the year ago period, below the +25% minimum earnings guideline (C criteria), raising fundamental concerns. Volume and volatility often increase near earnings news. Subsequent gains above the pivot point backed by at least +40% above average volume may help clinch a convincing technical buy signal. Earnings for the Jan and Apr '22 quarters versus the year ago periods were well above the +25% minimum guideline (C criteria). Annual earnings (A criteria) history has been strong and steady.

8/17/2022 12:28:20 PM - Y - Color code is changed to yellow with pivot point cited based on its 12/28/21 high plus 10 cents. Perched at its all-time high with earnings news due for the Jul '22 quarter. Volume and volatility often increase near earnings news. Subsequent gains above the pivot point backed by at least +40% above average volume may help clinch a convincing technical buy signal. Earnings for the Jan and Apr '22 quarters versus the year ago periods were above the +25% minimum guideline (C criteria). Annual earnings (A criteria) history has been strong and steady.

12/2/2021 1:05:55 PM - Hit a new all-time high with today's early gain. Earnings for the Jul and Oct '21 quarters versus the year ago periods were below the +25% minimum guideline. It showed resilience after last noted when dropped from the Featured Stocks list on 10/04/21.

10/4/2021 5:49:57 PM - Sank well below the prior high in the $300 area and its Relative Strength Rating has slumped to 73, well below the 80+ minimum guideline for buy candidates. A rebound above the 50 DMA line ($311) is needed for its outlook to improve. It will be dropped from the Featured Stocks list tonight.

9/28/2021 5:07:46 PM - G - Gapped down today violating its 50 DMA line ($309) with a volume-driven loss triggering a technical sell signal. Testing the prior high in the $300 area defining the next important near-term support. Only a rebound above the 50 DMA line is needed for its outlook to improve.

9/24/2021 5:11:44 PM - G - Volume totals are cooling since halting its slide. Extended from the previously noted base. Its 50 DMA line ($308.44) defines important support above the prior high in the $300 area define important near-term support.

9/17/2021 1:09:34 PM - G - Gapped down today retreating from near its all-time high. Extended from the previously noted base, its 50 DMA line ($304) and prior high in the $300 area define important near-term support.

9/15/2021 3:54:56 PM - G - Still holding its ground stubbornly near its all-time high. Its 50 DMA line ($302) and prior high in the $300 area define important near-term support.

9/8/2021 5:24:11 PM - G - Perched at its all-time high, extended from any sound base. Prior high in the $300 area defines initial support above its 50 DMA line ($296.61).

9/1/2021 5:39:59 PM - G - Perched at its all-time high stubbornly holding its ground after a streak of gains. Prior high in the $300 area defines initial support to watch on pullbacks.

8/25/2021 5:24:27 PM - G - Hit a new all-time high above its "max buy" level and its color code is changed to green after today's 5th gain following a noted "breakaway gap" backed by heavy volume. Prior high in the $300 area defines initial support to watch on pullbacks.

8/20/2021 12:46:11 PM - Y - Hit a new all-time high on the prior session with a "breakaway gap" backed by heavy volume. Color code was changed to yellow with pivot point cited based on its 2/16/21 high plus 10 cents in the 8/18/21 mid-day report. After the 8/18/21 close it reported sub par Jul '21 quarterly earnings +4% on +10% sales revenues versus the year ago period. As previously noted - "Volume and volatility often increase near earnings news."

8/19/2021 12:33:51 PM - Y - Hitting new all-time highs with today's breakaway gap with heavy volume. Color code was changed to yellow with pivot point cited based on its 2/16/21 high plus 10 cents in the 8/18/21 mid-day report. After the close it reported sub par Jul '21 quarterly earnings +4% on +10% sales revenues versus the year ago period. As previously noted - "Volume and volatility often increase near earnings news. Subsequent gains above the pivot point backed by at least +40% above average volume may trigger a technical buy signal. Earnings rose +39% on +19% sales revenues for the Apr '21 quarter versus the year ago period, its 4th strong quarterly comparison above the +25% minimum guideline (C criteria). Annual earnings (A criteria) growth has been strong and steady."

8/18/2021 5:20:15 PM - Y - Color code was changed to yellow with pivot point cited based on its 2/16/21 high plus 10 cents in the earlier mid-day report. Challenged its all-time high with recent gains. Reported sub par Jul '21 quarterly results after the close. Volume and volatility often increase near earnings news. Subsequent gains above the pivot point backed by at least +40% above average volume may trigger a technical buy signal. Earnings rose +39% on +19% sales revenues for the Apr '21 quarter versus the year ago period, its 4th strong quarterly comparison above the +25% minimum guideline (C criteria). Annual earnings (A criteria) growth has been strong and steady. See the latest FSU for more detailed analysis and a new annotated graph.

8/18/2021 12:44:18 PM - Y - Color code is changed to yellow with pivot point cited based on its 2/16/21 high plus 10 cents. Challenging its all-time high with recent gains. Due to report Jul '21 quarterly results. Volume and volatility often increase near earnings news. Subsequent gains above the pivot point backed by at least +40% above average volume may trigger a technical buy signal. Reported earnings +39% on +19% sales revenues for the Apr '21 quarter versus the year ago period, its 4th strong quarterly comparison above the +25% minimum guideline (C criteria). Annual earnings (A criteria) growth has been strong and steady.

12/3/2020 1:15:16 PM - Challenging its all-time high with today's big volume-driven gain. Found prompt support near its 50 DMA line during its ongoing ascent. Reported earnings +37% on +20% sales revenues for the Oct '20 quarter versus the year ago period, its 2nd strong quarterly comparison. Fundamental concerns remain. Prior quarterly earnings increases were not strong and steady above the +25% minimum guideline (C criteria). Annual earnings (A criteria) growth has been steady.

9/8/2020 12:50:46 PM - Abruptly retreating from its all-time high with today's 3rd consecutive volume-driven loss testing its 50 DMA line ($202.65). Bullish action came in recent weeks after it reported earnings +47% on +13% sales revenues for the Jul '20 quarter but fundamental concerns remain. Prior quarterly earnings increases were not strong and steady above the +25% minimum guideline (C criteria).

8/21/2020 1:20:42 PM - Gapped up on the prior session hitting new 52-week and all-time highs with a big volume-driven gain. Bullish action came after it reported earnings +47% on +13% sales revenues for the Jul '20 quarter but fundamental concerns remain. Prior quarterly earnings increases were not strong and steady above the +25% minimum guideline (C criteria).

8/20/2020 12:38:56 PM - Gapped up today and it is hitting new 52-week and all-time highs with a big volume-driven gain. Reported earnings +47% on +13% sales revenues for the Jul '20 quarter but fundamental concerns remain. Prior quarterly earnings increases were not strong and steady above the +25% minimum guideline (C criteria).

2/20/2020 12:53:51 PM - Slumping toward its 50 DMA line ($147) and enduring distributional pressure with today's big volume-driven loss. Reported earnings -6% on +2% sales revenues for the Jan '20 quarter and fundamental concerns remain. Prior quarterly earnings increases were not strong and steady above the +25% minimum guideline (C criteria).

12/5/2019 12:37:12 PM - Slumping below its 50 DMA line ($137) and enduring distributional pressure. Reported earnings +47% on +7% sales revenues for the Oct '19 quarter but fundamental concerns remain. Prior quarterly earnings increases were below the +25% minimum guideline (C criteria).

8/22/2019 1:27:33 PM - Gapped up today hitting a new all-time high. It has not formed any sound base. Reported earnings +24% on +9% sales revenues for the Jul '19 quarter. Fundamental concerns remain and prior mid-day reports cautioned - "Quarterly and annual earnings (C and A criteria) history is not a good match with the fact-based investment system's guidelines."

11/30/2017 1:15:07 PM - Gapped up today hitting a new all-time high, getting more extended from any sound base. Reported earnings -10% on +10% sales revenues for the Oct '17 quarter, and fundamental concerns remain. Prior mid-day reports cautioned - "Quarterly and annual earnings (C and A criteria) history is not a good match with the fact-based investment system's guidelines."

10/11/2017 12:38:27 PM - Perched at its all-time high, extended from any sound base. Reported earnings +21% on +13% sales revenues for the Jun '17 quarter, and fundamental concerns remain. Prior mid-day reports cautioned - "Quarterly and annual earnings (C and A criteria) history is not a good match with the fact-based investment system's guidelines."

9/14/2017 1:22:51 PM - Posting a volume-driven gain today challenging its all-time high. Reported earnings +21% on +13% sales revenues for the Jun '17 quarter, and fundamental concerns remain. Prior mid-day reports cautioned - "Quarterly and annual earnings (C and A criteria) history is not a good match with the fact-based investment system's guidelines."

8/17/2017 12:17:33 PM - Perched at its all-time high. Reported earnings +21% on +13% sales revenues for the Jun '17 quarter, and fundamental concerns remain. Prior mid-day reports cautioned - "Quarterly and annual earnings (C and A criteria) history is not a good match with the fact-based investment system's guidelines."

3/15/2017 1:51:23 PM - Consolidating since its big gap up for new 52-week and all-time highs on 2/16/17. Reported earnings +38% on +15% sales revenues for the Dec '16 quarter, but fundamental concerns remain. Prior mid-day reports cautioned - "Quarterly and annual earnings (C and A criteria) history is not a good match with the fact-based investment system's guidelines."

3/14/2017 12:55:49 PM - Consolidating since its big gap up for new 52-week and all-time highs on 2/16/17. Reported earnings +38% on +15% sales revenues for the Dec '16 quarter, but fundamental concerns remain. Prior mid-day reports cautioned - "Quarterly and annual earnings (C and A criteria) history is not a good match with the fact-based investment system's guidelines."

2/17/2017 12:06:24 PM - Gapped up for a new 52-week high on the prior session. Reported earnings +38% on +15% sales revenues for the Dec '16 quarter, but fundamental concerns remain. Went through a choppy consolidation and rose to new highs since noted with caution in the 8/20/15 mid-day report - "Quarterly and annual earnings (C and A criteria) history is not a good match with the fact-based investment system's guidelines."

10/10/2016 12:32:20 PM - Found support above its 50 DMA line and hit a new 52-week high today. Reported earnings +21% on +11% sales revenues for the Jun '16 quarter, and fundamental concerns remain. Went through a choppy consolidation and rose to new highs since last noted with caution in the 8/20/15 mid-day report - "Quarterly and annual earnings (C and A criteria) history is not a good match with the fact-based investment system's guidelines."

8/20/2015 1:16:13 PM - Violating its 50 DMA line with a considerable volume-driven loss today. Perched at its 52-week high after a volume-driven gains the 8/10/15 mid-day report cautioned members - "Reported earnings +5% on +8% sales revenues for the Jun '15 quarter, and fundamental concerns remain. "Quarterly and annual earnings (C and A criteria) history is not a good match with the fact-based investment system's guidelines."

8/10/2015 9:52:07 PM - Perched at its 52-week high today after a volume-driven gain. Reported earnings +5% on +8% sales revenues for the Jun '15 quarter, and fundamental concerns remain. Made gradual progress since noted with caution in the 12/08/14 mid-day report - "Quarterly and annual earnings (C and A criteria) history is not a good match with the fact-based investment system's guidelines."

6/30/2015 1:46:49 PM - Perched at its 52-week high today. Reported earnings +36% on +13% sales revenues for the Mar '15 quarter, but fundamental concerns remain. Made gradual progress since noted with caution in the 12/08/14 mid-day report - "Quarterly and annual earnings (C and A criteria) history is not a good match with the fact-based investment system's guidelines."

5/22/2015 12:53:59 PM - Perched at its 52-week high today following 4 consecutive gains, extended from any sound base. Reported earnings +36% on +13% sales revenues for the Mar '15 quarter, but fundamental concerns remain. Made gradual progress since noted with caution in the 12/08/14 mid-day report - "Quarterly and annual earnings (C and A criteria) history is not a good match with the fact-based investment system's guidelines."

5/21/2015 1:12:43 PM - Hitting another new 52-week high with today's 4th consecutive gain, getting more extended from any sound base. Reported earnings +36% on +13% sales revenues for the Mar '15 quarter, but fundamental concerns remain. Made gradual progress since noted with caution in the 12/08/14 mid-day report - "Quarterly and annual earnings (C and A criteria) history is not a good match with the fact-based investment system's guidelines."

5/20/2015 1:32:37 PM - Perched at a new 52-week high today, wedging higher while getting extended from any sound base. Reported earnings +36% on +13% sales revenues for the Mar '15 quarter, but fundamental concerns remain. Made gradual progress since last noted with caution in the 12/08/14 mid-day report - "Quarterly and annual earnings (C and A criteria) history is not a good match with the fact-based investment system's guidelines."

12/8/2014 12:18:36 PM - Perched at a new 52-week high following volume-driven gains last week. Fundamentals remain a concern as when noted with caution in the 9/07/12 mid-day report - "Quarterly and annual earnings (C and A criteria) history is not a good match with the fact-based investment system's guidelines."

12/5/2014 12:40:05 PM - Perched at a new 52-week high following volume-driven gains this week. Fundamentals remain a concern as when last noted with caution in the 9/07/12 mid-day report - "Quarterly and annual earnings (C and A criteria) history is not a good match with the fact-based investment system's guidelines."

9/7/2012 12:37:10 PM - Holding its ground stubbornly and rising with more gains backed by above average volume since its considerable "breakaway gap" on 8/23/12 for a new 52-week high. Fundamentals remain a concern following sub par earnings results in the Apr and Jul '12 quarters. Found impressive support near its 200 DMA line during its consolidation since noted in the 1/19/12 mid-day report - "Quarterly and annual earnings (C and A criteria) history is not a good match with the fact-based investment system's guidelines."

8/24/2012 12:33:46 PM - Holding its ground today following a considerable "breakaway gap" on the prior session for a new 52-week high. Fundamentals remain a concern following sub par earnings results in the Apr and Jul '12 quarters. Found impressive support near its 200 DMA line during its consolidation since last noted in the 1/19/12 mid-day report - "Quarterly and annual earnings (C and A criteria) history is not a good match with the fact-based investment system's guidelines."

1/19/2012 12:24:07 PM - On track today for a 10th consecutive small gain with below average volume, inching to within striking distance of its 52-week high. Quarterly and annual earnings (C and A criteria) history is not a good match with the fact-based investment system's guidelines.

12/2/2011 1:13:21 PM - Quarterly and annual earnings (C and A criteria) history is not a good match with the fact-based investment system's guidelines.