7/29/2009 - Today was its 5th consecutive damaging loss with above average volume, and it violated its June low ($49.73), triggering additional technical sell signals. Based on substantial weakness it will be dropped from the Featured Stocks list tonight. Detailed analysis was included when recently featured in the June 2009 issue of CANSLIM.net News (read here).

7/29/2009 7:02:16 PM - G - Today was its 5th consecutive damaging loss with above average volume, and it violated its June low ($49.73), triggering additional technical sell signals. Based on substantial weakness it will be dropped from the Featured Stocks list tonight. Detailed analysis was included when recently featured in the June 2009 issue of CANSLIM.net News (read here).

7/28/2009 4:03:06 PM - G - Gapped down again today after the prior session's violation of its 50 DMA line, clearly a distribution day that hurt its outlook. Technically, it also dipped under its June low ($49.73) intra-day, where deterioration raises more serious concerns and triggers additional sell signals. Detailed analysis was included when recently featured in the June 2009 issue of CANSLIM.net News. Be sure to review the "What to Look Out For" section and entire detailed summary - read here).

7/27/2009 2:17:42 PM - G - Gapped down today and violated its 50 DMA line, clearly a distribution day that hurts its outlook. Technically, deterioration under its June low ($49.73) raise more serious concerns and trigger additional sell signals. Detailed analysis was included when recently featured in the June 2009 issue of CANSLIM.net News. Be sure to review the "What to Look Out For" section and entire detailed summary - read here).

7/24/2009 - G - Down again today after a negative reversal on the prior session, falling near its 50 DMA line - important support to watch now. Color code is changed to green based on distributional action, and it would need to rally above its latest pivot point with conviction to trigger a new technical buy signal. Detailed analysis was included when recently featured in the June 2009 issue of CANSLIM.net News. Be sure to review the "What to Look Out For" section and entire detailed summary - read here).

7/23/2009 4:55:17 PM - Y - Reversed earlier gains and closed with a loss today with heavy volume. Its 50 DMA line and recent chart lows are important support to watch now Yesterday its color code was changed to yellow with new pivot point and max buy levels noted. Detailed analysis was included when recently featured in the June 2009 issue of CANSLIM.net News. Be sure to review the "What to Look Out For" section and entire detailed summary - read here).

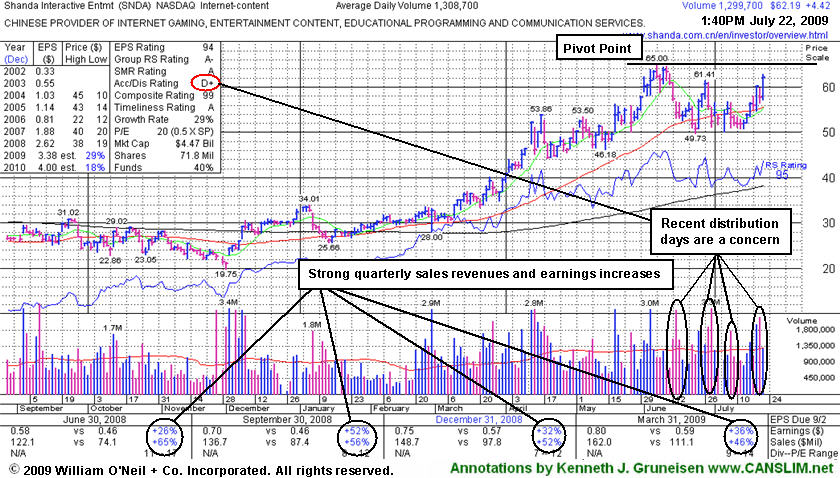

7/22/2009 7:11:37 PM - Y - Considerable gain today with above average volume, rallying well above its 50 DMA line toward prior chart highs. Color code was changed to yellow with new pivot point and max buy levels noted. Detailed analysis was included when recently featured in the June 2009 issue of CANSLIM.net News. Be sure to review the "What to Look Out For" section and entire detailed summary - read here).

7/22/2009 2:06:07 PM - Y - Considerable gain today, rallying well above its 50 DMA line toward prior chart highs. Color code is changed to yellow with new pivot point and max buy levels noted. Detailed analysis was included when recently featured in the June 2009 issue of CANSLIM.net News. Be sure to review the "What to Look Out For" section and entire detailed summary - read here).

7/21/2009 6:23:01 PM - G - Gapped down today for a loss on higher volume than the prior session, erasing a large part of the prior session's gain that had helped it rally well above its 50 DMA line. Detailed analysis was included when recently featured in the June 2009 issue of CANSLIM.net News. Be sure to review the "What to Look Out For" section and entire detailed summary - read here).

7/20/2009 8:38:20 PM - G - Big gain today with above average volume helped it rally well above its 50 DMA line, helping its out look improve. Detailed analysis was included when recently featured in the June 2009 issue of CANSLIM.net News. Be sure to review the "What to Look Out For" section and entire detailed summary - read here).

7/17/2009 5:54:52 PM - G - Negatively reversed today yet stayed above its 50 DMA line. Subsequent deterioration below its recent chart low near $50 could raise more serious concerns and trigger a worrisome technical sell signal. Detailed analysis was included when recently featured in the June 2009 issue of CANSLIM.net News. Be sure to review the "What to Look Out For" section and entire detailed summary - read here).

7/16/2009 3:58:09 PM - G - Gain on near average volume today helped it rally above its 50 DMA line. Subsequent deterioration below its recent chart low near $50 could raise more serious concerns and trigger a worrisome technical sell signal. Detailed analysis was included when recently featured in the June 2009 issue of CANSLIM.net News. Be sure to review the "What to Look Out For" section and entire detailed summary - read here).

7/15/2009 7:55:10 PM - G - Gain on near average volume today leaves it still trading under its 50 DMA line, and concerns increase the longer it trades below that short-term average. Meanwhile, subsequent deterioration below its recent chart low near $50 could raise more serious concerns and trigger a worrisome technical sell signal. Detailed analysis was included when recently featured in the June 2009 issue of CANSLIM.net News. Be sure to review the "What to Look Out For" section and entire detailed summary - read here).

7/14/2009 7:41:15 PM - G - Slumped under its 50 DMA line recently, and concerns increase the longer it trades below that short-term average. Meanwhile, subsequent deterioration below its recent chart low near $50 could raise more serious concerns and trigger a worrisome technical sell signal. Detailed analysis was included when recently featured in the June 2009 issue of CANSLIM.net News. Be sure to review the "What to Look Out For" section and entire detailed summary - read here).

7/13/2009 8:28:03 PM - G - Slumped under its 50 DMA line recently. Concerns increase the longer it trades below that short-term average, while subsequent deterioration below its recent chart low near $50 would raise more serious concerns and trigger a worrisome technical sell signal. Detailed analysis was included when recently featured in the June 2009 issue of CANSLIM.net News. Be sure to review the "What to Look Out For" section and entire detailed summary - read here).

7/10/2009 4:54:10 PM - G - Slumped under its 50 DMA line this week, and subsequent deterioration below its recent chart low near $50 would raise more serious concerns and trigger a worrisome technical sell signal. Detailed analysis was included when recently featured in the June 2009 issue of CANSLIM.net News. Be sure to review the "What to Look Out For" section and entire detailed summary - read here).

7/9/2009 5:37:21 PM - G - Loss today on ligher volume, closing further under its 50 DMA line. Subsequent deterioration below its recent chart low near $50 would raise more serious concerns and trigger a worrisome technical sell signal. Detailed analysis was included when recently featured in the June 2009 issue of CANSLIM.net News. Be sure to review the "What to Look Out For" section and entire detailed summary - read here).

7/8/2009 7:06:51 PM - G - Loss today on above average volume, closing under its 50 DMA line. Subsequent deterioration below its recent chart low near $50 would raise more serious concerns and trigger a worrisome technical sell signal. Detailed analysis was included when recently featured in the June 2009 issue of CANSLIM.net News. Be sure to review the "What to Look Out For" section and entire detailed summary - read here).

7/7/2009 7:05:25 PM - G - Consolidating near its 50 DMA line, and subsequent deterioration below its recent chart low near $50 would raise more serious concerns and trigger a worrisome technical sell signal. Detailed analysis was included when recently featured in the June 2009 issue of CANSLIM.net News. Be sure to review the "What to Look Out For" section and entire detailed summary - read here).

7/2/2009 4:13:44 PM - G - Gapped down today for a loss on light volume, sinking below its 50 DMA line again. Deterioration below its recent chart low near $50 would raise more serious concerns and trigger a worrisome technical sell signal. Detailed analysis was included when recently featured in the June 2009 issue of CANSLIM.net News. Be sure to review the "What to Look Out For" section and entire detailed summary - read here).

7/1/2009 12:51:40 PM - G - Gapped up today after an analyst upgrade, repairing the prior session's 50 DMA line violation. Deterioration below its recent chart low near $50 would raise more serious concerns and trigger a worrisome technical sell signal. Detailed analysis was included when recently featured in the June 2009 issue of CANSLIM.net News. Be sure to review the "What to Look Out For" section and entire detailed summary - read here).

6/30/2009 5:28:22 PM - G - Considerable loss today with very heavy volume indicated distributional pressure as it again violated its 50 DMA line and prior chart highs. Deterioration below its recent chart low near $50 would raise more serious concerns and trigger a worrisome technical sell signal. Detailed analysis was included when recently featured in the June 2009 issue of CANSLIM.net News. Be sure to review the "What to Look Out For" section and entire detailed summary - read here).

6/29/2009 6:09:50 PM - G - Considerable loss today with above average volume pressured it back toward its 50 DMA line and prior chart highs. Any deterioration below its recent chart low near $50 would raise more serious concerns and trigger a worrisome technical sell signal. Its color code was changed to green after its latest bounce back above its "max buy" level. Detailed analysis was included when recently featured in the June 2009 issue of CANSLIM.net News. Be sure to review the "What to Look Out For" section and entire detailed summary - read here).

6/26/2009 5:53:44 PM - G - Considerable gains helped promptly repair this week's violation of its 50 DMA line and prior chart highs -weakness which had raised concerns and triggered a technical sell signal. Its color code is changed to green after its latest bounce back above its "max buy" level. Detailed analysis was included when recently featured in the June 2009 issue of CANSLIM.net News. Be sure to review the "What to Look Out For" section and entire detailed summary - read here).

6/25/2009 2:43:30 PM - Y - Holding its ground today after a considerable gain higher volume helped promptly repair this week's violation of its 50 DMA line and prior chart highs -weakness which had raised concerns and triggered a technical sell signal. Its color code was changed to yellow based on its resilience after the recently noted distributional pressure. Detailed analysis was included when recently featured in the June 2009 issue of CANSLIM.net News. Be sure to review the "What to Look Out For" section and entire detailed summary - read here).

6/24/2009 4:18:51 PM - Y - Considerable gain today on slightly higher volume helped promptly repair this week's violation of its 50 DMA line and prior chart highs -weakness which had raised concerns and triggered a technical sell signal. Its color code is changed to yellow based on its resilience after the recently noted distributional pressure. Detailed analysis was included when recently featured in the June 2009 issue of CANSLIM.net News. Be sure to review the "What to Look Out For" section and entire detailed summary - read here).

6/23/2009 4:10:32 PM - G - Down again today on lighter volume. Weakness on 6/22/09 under its previously cited pivot point and a violation of its 50 DMA line raised concerns and triggered a technical sell signal. Last week a worrisome 5-session losing streak and distributional pressure raised concerns. Its color code was changed to green. Detailed analysis was included when recently featured in the June 2009 issue of CANSLIM.net News. Be sure to review the "What to Look Out For" section and entire detailed summary - read here).

6/22/2009 9:43:13 PM - G - Weakness under its previously cited pivot point and a violation of its 50 DMA line today raised concerns and triggered a technical sell signal. Last week a worrisome 5-session losing streak and distributional pressure raised concerns. Its color code was changed to green. Detailed analysis was included when recently featured in the June 2009 issue of CANSLIM.net News. Be sure to review the "What to Look Out For" section and entire detailed summary - read here).

6/22/2009 12:05:57 PM - G - Early weakness has it trading under its previously cited pivot point and testing its 50 DMA line. Last week a worrisome 5-session losing streak and distributional pressure raised concerns. Violations of its 50 DMA and last week's low ($52.61) could trigger more worrisome technical sell signals. Its color code is changed to green. Detailed analysis was included when recently featured in the June 2009 issue of CANSLIM.net News. Be sure to review the "What to Look Out For" section and entire detailed summary - read here).

6/19/2009 6:28:38 PM - Y - This week it halted a worrisome 5-session losing streak after distributional pressure drove it down near its previously cited pivot point and its 50 DMA line. Subsequent violations could trigger technical sell signals. Its color code was changed to yellow. Detailed analysis was included when recently featured in the June 2009 issue of CANSLIM.net News. Be sure to review the "What to Look Out For" section and entire detailed summary - read here).

6/18/2009 6:38:27 PM - Y - Two tiny gains on light volume have helped halt a worrisome 5-session losing streak near its previously cited pivot point and its 50 DMA line, where violations could trigger technical sell signals. Its color code was changed to yellow. Detailed analysis was included when recently featured in the June 2009 issue of CANSLIM.net News. Be sure to review the "What to Look Out For" section and entire detailed summary - read here).

6/17/2009 5:57:45 PM - Y - Tiny gain today on light volume followed 3 straight losses with above average volume, yet ended a 5-day losing streak near its previously cited pivot point. Its color code is changed to yellow. Prior chart highs and its 50 DMA line are still important support levels to watch, where violations could trigger technical sell signals. Detailed analysis was included when recently featured in the June 2009 issue of CANSLIM.net News. Be sure to review the "What to Look Out For" section and entire detailed summary - read here).

6/16/2009 7:10:30 PM - G - Loss today was its 3rd straight loss with above average volume of a 5-day losing streak, raising concerns. It is near prior chart highs and its 50 DMA line, important support levels to watch. Detailed analysis was included when recently featured in the June 2009 issue of CANSLIM.net News. Be sure to review the "What to Look Out For" section and entire detailed summary - read here).

6/15/2009 5:19:03 PM - G - Considerable loss today with above average volume. It is too extended from a sound base to be considered buyable under the investment system's guidelines. Patient investors may watch for a pullback near prior chart highs, or its 50 DMA line, an important support level which has not been tested since breaking out in March. Detailed analysis was included when recently featured in the June 2009 issue of CANSLIM.net News. Be sure to review the "What to Look Out For" section and entire detailed summary - read here).

6/12/2009 4:14:29 PM - G - Considerable loss today with above average volume. It is too extended from a sound base to be considered buyable under the investment system's guidelines. Patient investors may watch for a pullback near prior chart highs, or its 50 DMA line, an important support level which has not been tested since breaking out in March. Detailed analysis was included when recently featured in the June 2009 issue of CANSLIM.net News. Be sure to review the "What to Look Out For" section and entire detailed summary - read here).

6/11/2009 2:26:17 PM - G - Pulling back on lighter volume, but it is still too extended from a sound base to be considered buyable under the investment system's guidelines. Patient investors may watch for a pullback near its 50 DMA line, an important support level which has not been tested since breaking out in March. Detailed analysis was included when recently featured in the June 2009 issue of CANSLIM.net News. Be sure to review the "What to Look Out For" section and entire detailed summary - read here).

6/10/2009 5:11:10 PM - G - Too extended from a sound base to be considered buyable under the proper guidelines now. Patient investors may watch for a pullback near its 50 DMA line, an important support level which has not been tested since breaking out in March. Just featured in the June 2009 issue of CANSLIM.net News. Be sure to review the "What to Look Out For" section and entire detailed summary - read here).

6/9/2009 6:38:17 PM - G - Gain today on average volume for a new high close, too extended from a sound base to be considered buyable under the proper guidelines. Patient investors may watch for a pullback near its 50 DMA line, an important support level which has not been tested since breaking out in March. Just featured in the June 2009 issue of CANSLIM.net News. Be sure to review the "What to Look Out For" section and entire detailed summary - read here).

6/8/2009 4:16:34 PM - G - Closed lower for a second consecutive day. It is currently extended from a sound base to be considered buyable under the proper guidelines. Patient investors may watch for a pullback near its 50 DMA line, an important support level which has not been tested since breaking out in March. Just featured in the June 2009 issue of CANSLIM.net News. Be sure to review the "What to Look Out For" section and entire detailed summary - read here).

6/8/2009 4:16:10 PM - G - Closed lower for the second consecutive day. It is currently extended from a sound base to be considered buyable under the proper guidelines. Patient investors may watch for a pullback near its 50 DMA line, an important support level which has not been tested since breaking out in March. Just featured in the June 2009 issue of CANSLIM.net News. Be sure to review the "What to Look Out For" section and entire detailed summary - read here).

6/5/2009 6:10:20 PM - G - Negatively reversed today after hitting a new all-time high, ending its streak of 7 consecutive gains. It is extended from a sound base. Patient investors may watch for a pullback near its 50 DMA line, an important support level which has not been tested since breaking out in March. Just featured in the June 2009 issue of CANSLIM.net News. Be sure to review the "What to Look Out For" section and entire detailed summary - read here).

6/4/2009 7:04:14 PM - G - New high close today, posting a 7th consecutive gain. It is extended from a sound base. Patient investors may watch for a pullback near its 50 DMA line, an important support level which has not been tested since breaking out in March. Just featured in the June 2009 issue of CANSLIM.net News. Be sure to review the "What to Look Out For" section and entire detailed summary - read here).

6/3/2009 4:45:53 PM - G - Ended in the middle of its intra-day range today after hitting a new all-time high following solid results for the latest quarter. It is extended from a sound base. Patient investors may watch for a pullback near its 50 DMA line, an important support level which has not been tested since breaking out in March. Just featured in the June 2009 issue of CANSLIM.net News. Be sure to review the "What to Look Out For" section and entire detailed summary - read here).

6/3/2009 12:52:36 PM - G - Hit a new all-time highs today after reporting solid earnings and sales results for the latest quarter. It is extended from a sound base. Patient investors may watch for a pullback near its 50 DMA line, an important support level which has not been tested since breaking out in March. Just featured in the June 2009 issue of CANSLIM.net News. Be sure to review the "What to Look Out For" section and entire detailed summary - read here).

6/2/2009 7:07:54 PM - G - Held its ground at all-time highs today after a gap up on the prior session. Recent gains with only slightly above average volume have it now extended from a sound base. Patient investors may watch for a pullback near its 50 DMA line, an important support level which has not been tested since breaking out in March. Just featured in the June 2009 issue of CANSLIM.net News. Be sure to review the "What to Look Out For" section and entire detailed summary - read here).

6/1/2009 7:02:49 PM - G - Gapped up today and posted a solid gain with slightly above average volume, getting more dangerously extended from a sound base. Just featured in the June 2009 issue of CANSLIM.net News. Be sure to review the "What to Look Out For" section and entire detailed summary - read here).

6/1/2009 1:27:32 PM - G - Gapped up today, getting more dangerously extended from a sound base. Just featured in the June 2009 issue of CANSLIM.net News. Be sure to review the "What to Look Out For" and entire detailed summary - read here).

5/31/2009 - G - Just featured in the June CANSLIM.net News here.

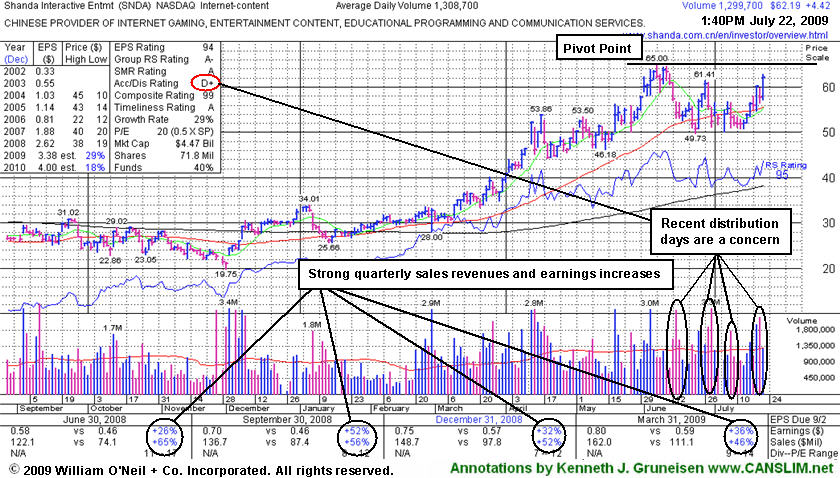

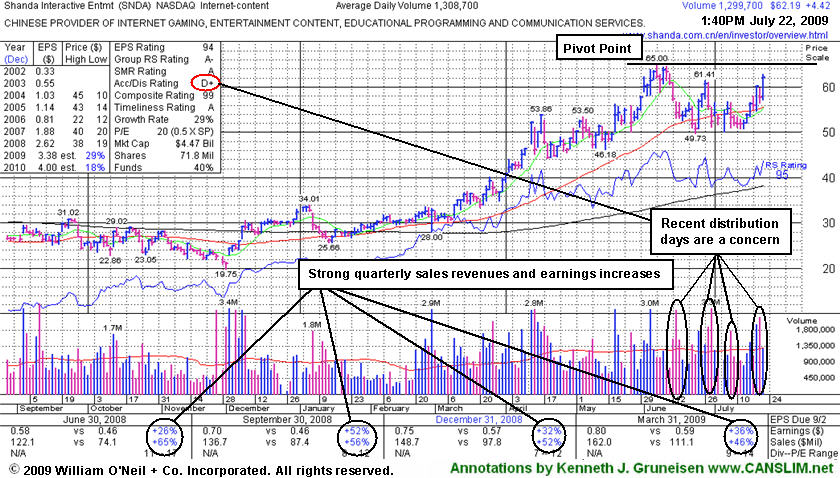

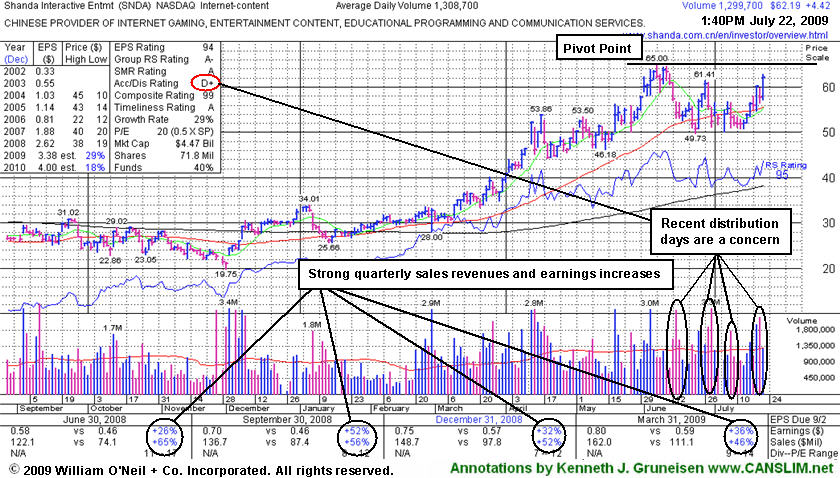

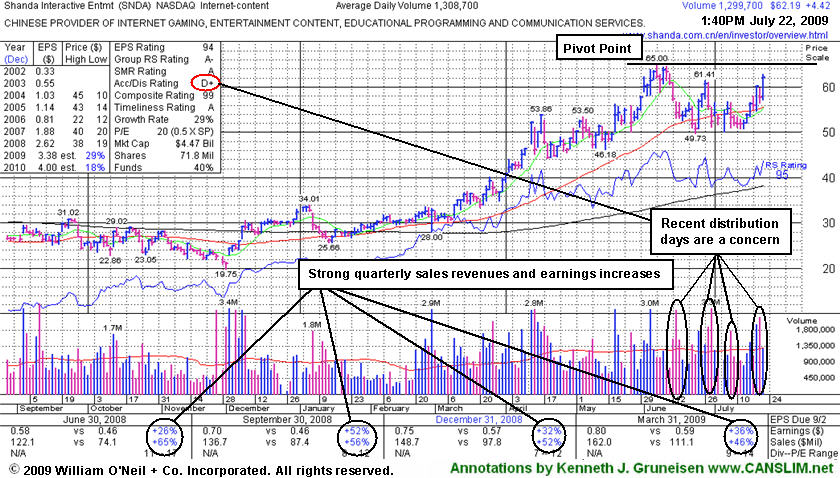

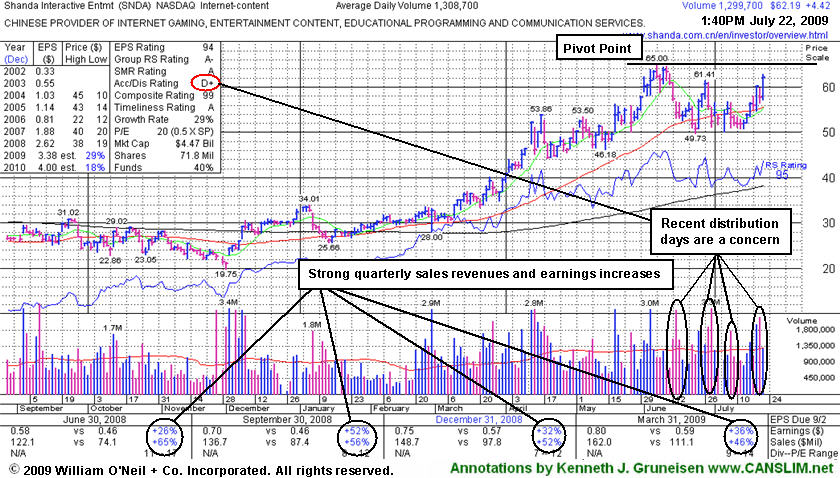

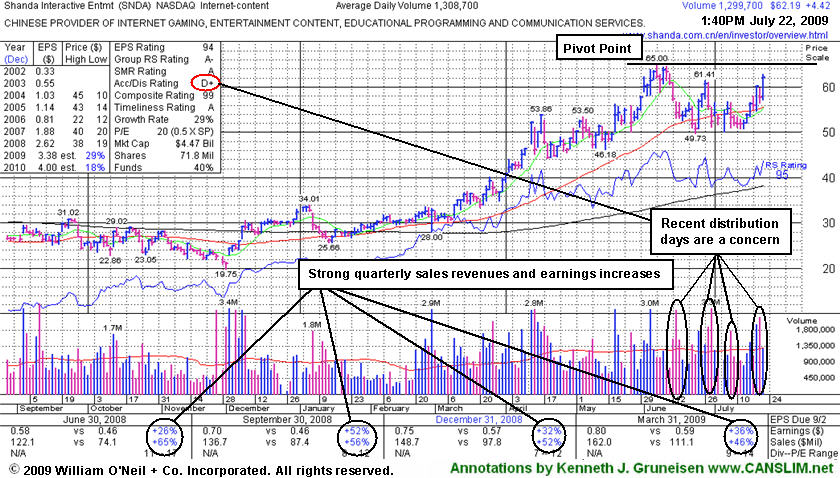

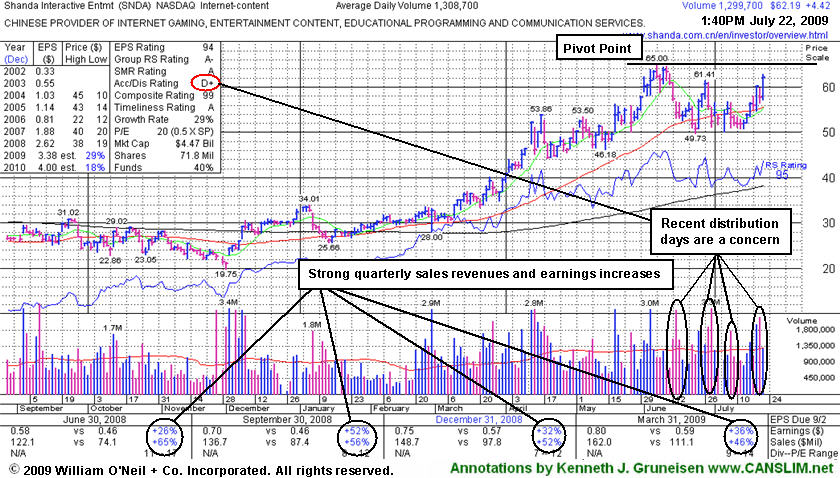

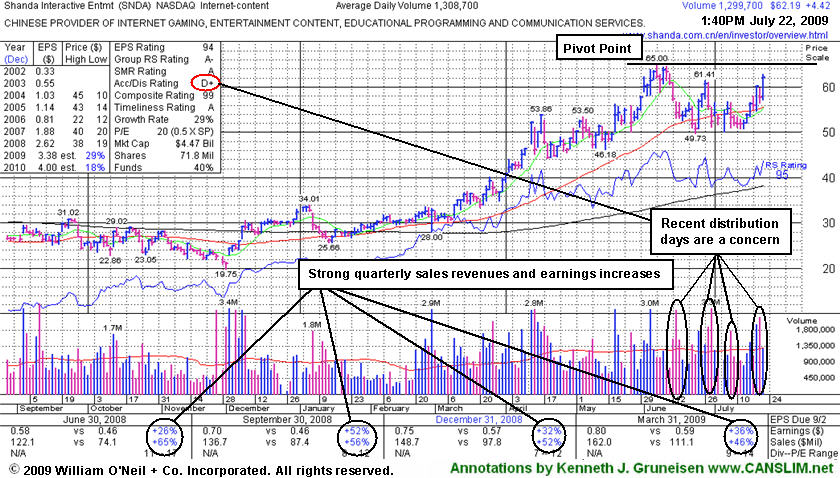

5/27/2009 12:55:55 PM - Perched near all-time highs with no resistance remaining due to overhead supply. This week Shanda said that, subject to SEC clearance, it would offer shares in its online gaming unit "as capital-markets conditions permit" -the number of shares the subsidiary will sell, and price, not yet determined. Previously noted in March as it challenged and broke out above its January chart highs near $34. This Chinese provider of internet gaming, entertainment, and educational content has shown strong quarterly sales and earnings increases (good C criteria). Up and down annual earnings history (the A criteria) was previously noted as a concern. Additional concerns are the same as those noted in the 4/02/09 Featured Stock Update section summarizing yet another China-based firm (read here).

4/21/2009 12:03:29 PM - Consolidating after a recent sprint to new all-time highs, and extended from a sound base. Previously noted in March as it challenged and broke out above its January chart highs near $34. This Chinese provider of internet gaming, entertainment, and educational content has shown strong quarterly sales and earnings increases (good C criteria). Up and down annual earnings history (the A criteria) was previously noted as a concern. Additional concerns are the same as those noted in the 4/02/09 Featured Stock Update section summarizing yet another China-based firm (read here).

4/16/2009 11:18:47 AM - Continues moving higher after Tuesday's steep decline. It is consolidating after reaching new all-time highs, but extended from a sound base after rallying in recent weeks. Previously noted in March as it challenged and broke out above its January chart highs near $34. This Chinese provider of internet gaming, entertainment, and educational content has shown strong quarterly sales and earnings increases (good C criteria). Up and down annual earnings history (the A criteria) was previously noted as a concern. Additional concerns are the same as those noted in the 4/02/09 Featured Stock Update section summarizing yet another China-based firm (read here).

4/15/2009 11:41:00 AM - Gapped up today after a heavy distribution day. It is consolidating after reaching new all-time highs, but extended from a sound base after rallying in recent weeks. Previously noted in March as it challenged and broke out above its January chart highs near $34. This Chinese provider of internet gaming, entertainment, and educational content has shown strong quarterly sales and earnings increases (good C criteria). Up and down annual earnings history (the A criteria) was previously noted as a concern. Additional concerns are the same as those noted in the 4/02/09 Featured Stock Update section summarizing yet another China-based firm (read here).

4/13/2009 11:15:26 AM - Gapped up today and again hit a new all-time high, getting more extended from a sound base after rallying in recent weeks. Previously noted in March as it challenged and broke out above its January chart highs near $34. This Chinese provider of internet gaming, entertainment, and educational content has shown strong quarterly sales and earnings increases (good C criteria). Up and down annual earnings history (the A criteria) was previously noted as a concern. Additional concerns are the same as those noted in the 4/02/09 Featured Stock Update section summarizing yet another China-based firm (read here).

4/9/2009 11:10:42 AM - Extended from a sound base after rallying in recent weeks, now hitting new all-time highs. Previously noted in March as it challenged and broke out above its January chart highs near $34. This Chinese provider of internet gaming, entertainment, and educational content has shown strong quarterly sales and earnings increases (good C criteria). Up and down annual earnings history (the A criteria) was previously noted as a concern. Additional concerns are the same as those noted in the 4/02/09 Featured Stock Update section summarizing yet another China-based firm (read here).

4/8/2009 12:00:10 PM - Considerable gain today with volume running at an above average pace while rallying to a new all-time high. Previously noted in March as it challenged and broke out above its January chart highs near $34. This Chinese provider of internet gaming, entertainment, and educational content has shown strong quarterly sales and earnings increases (good C criteria). Up and down annual earnings history (the A criteria) was previously noted as a concern. Additional concerns are the same as those noted in the 4/02/09 Featured Stock Update section summarizing yet another China-based firm (read here).

4/2/2009 12:25:56 PM - Gapped up today, charging above its November 2007 high with volume running at an above average pace. Previously noted in March as it challenged and broke out above its January chart highs near $34. This Chinese provider of internet gaming, entertainment, and educational content has shown strong quarterly sales and earnings increases (good C criteria). Up and down annual earnings history (the A criteria) was previously noted as a concern.

4/1/2009 1:05:38 PM - Recently challenging its November 2007 high, it was previously noted in March as it challenged and broke out above its January chart highs near $34. This Chinese provider of internet gaming, entertainment, and educational content has shown strong quarterly sales and earnings increases (good C criteria). Up and down annual earnings history (the A criteria) was previously noted as a concern.

3/26/2009 12:37:43 PM - Gapped down today after an analyst downgrade, falling back toward its prior base. Noted previously, "It faces some resistance due to overhead supply", yet since then it rallied to challenge its November 2007 high. Recently broke out above its January high near $34 - now an important chart support level. This Chinese provider of internet gaming, entertainment, and educational content has shown strong quarterly sales and earnings increases (good C criteria). Up and down annual earnings history (the A criteria) was previously noted as a concern.

3/25/2009 12:32:21 PM - Gains this week have it getting extended from its prior base after breaking out above its January high near $34 that may now act as a support level. It faces some resistance due to overhead supply. This Chinese provider of internet gaming, entertainment, and educational content has shown strong quarterly sales and earnings increases (good C criteria). Its up and down annual earnings history (the A criteria) was previously noted as a concern.

3/23/2009 12:00:50 PM - Consolidating above its January high near $34 that may now act as a support level, yet it faces some resistance due to overhead supply. This Chinese provider of internet gaming, entertainment, and educational content has shown strong quarterly sales and earnings increases (good C criteria). Its up and down annual earnings history (the A criteria) was previously noted as a concern.

3/12/2009 11:54:50 AM - Pulling back after trading above its January high yesterday. This Chinese provider of internet gaming, entertainment, and educational content has shown strong quarterly sales and earnings increases (good C criteria). Its up and down annual earnings history (the A criteria) and current market conditions (the M criteria) are reasons for concern.

3/11/2009 11:27:28 AM - Trading above its January high today after a considerable gain on 3/10/09 backed by above average volume. This Chinese provider of internet gaming, entertainment, and educational content has shown strong quarterly sales and earnings increases (good C criteria). Its up and down annual earnings history (the A criteria) and current market conditions (the M criteria) are reasons for concern.

3/10/2009 11:44:21 AM - Considerable gain today has it challenging its January high in the $34 area. This Chinese provider of internet gaming, entertainment, and educational content has shown strong quarterly sales and earnings increases (good C criteria). Its up and down annual earnings history (the A criteria) and current market conditions (the M criteria) are reasons for concern.

10/17/2007 1:51:05 PM - Reversed from earlier gains to new highs. It encountered heavy distribution on 9/19/07 and 9/20/07 after 6 consecutive gains on above average volume, but it found support promptly after testing its July highs - prior resistance. Earnings and sales increases have been strong in the past 3 comparisons (satisfying the C criteria) however its annual earnings (the A criteria) fail to meet guidelines. This Chinese provider of internet gaming has work to do to recover to its 2004-2005 chart highs in the $45 area.

10/15/2007 12:51:42 PM - Gapped up for gains on above average volume to nearly reach new highs. It encountered heavy distribution on 9/19/07 and 9/20/07 after 6 consecutive gains on above average volume, but it found support promptly after testing its July highs - prior resistance. Earnings and sales increases have been strong in the past 3 comparisons (satisfying the C criteria) however its annual earnings (the A criteria) fail to meet guidelines. This Chinese provider of internet gaming has work to do to recover to its 2004-2005 chart highs in the $45 area.

10/9/2007 2:00:44 PM - Hovering near 2007 highs. It encountered heavy distribution on 9/19/07 and 9/20/07 after 6 consecutive gains on above average volume, but it found support promptly after testing its July highs - prior resistance. Earnings and sales increases have been strong in the past 3 comparisons (satisfying the C criteria) however its annual earnings (the A criteria) fail to meet guidelines. This Chinese provider of internet gaming has work to do to recover to its 2004-2005 chart highs in the $45 area.

9/26/2007 1:28:03 PM - Reversed after hitting new highs again. It encountered heavy distribution on 9/19/07 and 9/20/07 after 6 consecutive gains on above average volume, but it found support promptly after testing its July highs - prior resistance. Earnings and sales increases have been strong in the past 3 comparisons (satisfying the C criteria) however its annual earnings (the A criteria) fail to meet guidelines. This Chinese provider of internet gaming has work to do to recover to its 2004-2005 chart highs in the $45 area.

9/25/2007 12:57:28 PM - Hitting new highs again with gains on heavy volume. It encountered heavy distribution on 9/19/07 and 9/20/07 after 6 consecutive gains on above average volume, but it found support promptly after testing its July highs - prior resistance. Earnings and sales increases have been strong in the past 3 comparisons (satisfying the C criteria) however its annual earnings (the A criteria) fail to meet guidelines. This Chinese provider of internet gaming has work to do to recover to its 2004-2005 chart highs in the $45 area.

9/24/2007 1:59:27 PM - Hitting new highs with gains on heavy volume. It encountered heavy distribution on 9/19/07 and 9/20/07 after 6 consecutive gains on above average volume, but it found support promptly after testing its July highs - prior resistance. Earnings and sales increases have been strong in the past 3 comparisons (satisfying the C criteria) however its annual earnings (the A criteria) fail to meet guidelines. This Chinese provider of internet gaming has work to do to recover to its 2004-2005 chart highs in the $45 area.

9/21/2007 1:47:00 PM - Fighting for gains to stay above its July highs. Encountered heavy distribution on the previous 2 sessions after 6 consecutive gains on above average volume. Earnings and sales increases have been strong in the past 3 comparisons (satisfying the C criteria) however its annual earnings fail to meet guidelines. This Chinese provider of internet gaming has work to do to recover to its 2004-2005 chart highs in the $45 area.

9/19/2007 1:42:58 PM - Pulling back on heavy volume after 5 consecutive gains on above average volume. Earnings and sales increases have been strong in the past 3 comparisons (satisfying the C criteria) however its annual earnings fail to meet guidelines. This Chinese provider of internet gaming has work to do to recover to its 2004-2005 chart highs in the $45 area.

9/18/2007 1:24:39 PM - Hit another new 52-week high and now trading flat after 5 consecutive days of gains on above average volume. Earnings and sales increases have been strong in the past 3 comparisons (satisfying the C criteria) however its annual earnings fail to meet guidelines. This Chinese provider of internet gaming has work to do to recover to its 2004-2005 chart highs in the $45 area.

9/17/2007 1:25:46 PM - Hit a new 52-week high while on pace for a fifth consecutive day of gains on above average volume. Earnings and sales increases have been strong in the past 3 comparisons (satisfying the C criteria) however its annual earnings fail to meet guidelines. This Chinese provider of internet gaming has work to do to recover to its 2004-2005 chart highs in the $45 area.

9/14/2007 1:19:49 PM - Earnings and sales increases have been strong in the past 3 comparisons (satisfying the C criteria) however its annual earnings fail to meet guidelines. Nearing prior highs after a choppy 8-week base, during which it found support at its 200 DMA line. This Chinese provider of internet gaming has work to do to recover to its 2004-2005 chart highs in the $45 area.

7/2/2007 12:41:23 PM - "C" and sales history below guidelines. Current earnings per share should be up 25% or more and in many cases accelerating in recent quarters. Quarterly sales should also be up 25% or more or accelerating over prior quarters.

6/29/2007 12:45:52 PM - "C" and sales history below guidelines. Current earnings per share should be up 25% or more and in many cases accelerating in recent quarters. Quarterly sales should also be up 25% or more or accelerating over prior quarters.

6/28/2007 1:00:07 PM - "C" and sales history below guidelines. Current earnings per share should be up 25% or more and in many cases accelerating in recent quarters. Quarterly sales should also be up 25% or more or accelerating over prior quarters.

5/23/2007 - "C" and sales history below guidelines. Current earnings per share should be up 25% or more and in many cases accelerating in recent quarters. Quarterly sales should also be up 25% or more or accelerating over prior quarters.

5/22/2007 12:50:08 PM - "C" and sales hsitory below guidelines. Current earnings per share should be up 25% or more and in many cases accelerating in recent quarters. Quarterly sales should also be up 25% or more or accelerating over prior quarters.

5/21/2007 1:10:24 PM - "C" and sales hsitory below guidelines. Current earnings per share should be up 25% or more and in many cases accelerating in recent quarters. Quarterly sales should also be up 25% or more or accelerating over prior quarters.

5/18/2007 1:27:05 PM - "C" and sales hsitory below guidelines. Current earnings per share should be up 25% or more and in many cases accelerating in recent quarters. Quarterly sales should also be up 25% or more or accelerating over prior quarters.

5/15/2007 - "C" and sales hsitory below guidelines. Current earnings per share should be up 25% or more and in many cases accelerating in recent quarters. Quarterly sales should also be up 25% or more or accelerating over prior quarters.

3/29/2007 12:52:09 PM - Solid gains again today yet "C" and sales hsitory below guidelines. Current earnings per share should be up 25% or more and in many cases accelerating in recent quarters. Quarterly sales should also be up 25% or more or accelerating over prior quarters.

3/22/2007 1:08:13 PM - Solid gains again today yet "C" and sales hsitory below guidelines. Current earnings per share should be up 25% or more and in many cases accelerating in recent quarters. Quarterly sales should also be up 25% or more or accelerating over prior quarters.

3/20/2007 12:49:08 PM - Solid gains today yet "C" and sales hsitory below guidelines. Current earnings per share should be up 25% or more and in many cases accelerating in recent quarters. Quarterly sales should also be up 25% or more or accelerating over prior quarters.

2/20/2007 1:21:36 PM - "C" and sales hsitory below guidelines. Current earnings per share should be up 25% or more and in many cases accelerating in recent quarters. Quarterly sales should also be up 25% or more or accelerating over prior quarters.

2/16/2007 1:03:32 PM - "C" and sales hsitory below guidelines. Current earnings per share should be up 25% or more and in many cases accelerating in recent quarters. Quarterly sales should also be up 25% or more or accelerating over prior quarters.

12/30/2004 12:28:54 PM - New IPO, short history.

12/10/2004 12:39:17 PM - New IPO, short history.

12/7/2004 12:43:56 PM - New IPO, short history.

11/24/2004 12:53:38 PM - New IPO, short history.