5/14/2012 10:28:58 AM - Gapped down today, slumping further below its 50 DMA line and further below its prior low ($16.14 on 4/10/12), raising more serious concerns. Based on damaging losses it will be dropped from the Featured Stocks list tonight. Only a rebound above its 50 DMA line would help its technical stance improve.

5/9/2012 4:20:38 PM - G - Gapped down today and slumped further below its 50 DMA line with its 5th consecutive loss, also sinking below its prior low ($16.14 on 4/10/12), raising more serious concerns.

5/8/2012 11:27:10 AM - G - Slumping below its 50 DMA line today, raising concerns while on track for a 4th consecutive loss. Its prior low ($16.14 on 4/10/12) defines near-term support where further deterioration would raise more serious concerns.

5/2/2012 4:02:01 PM - G - Rebounded from lows near its 50 DMA and managed a positive reversal today. Its consolidation is not a sufficient length to be considered a sound new base pattern. It already has tested support at its 10-week moving average line multiple times this year, so it may not be considered an ideal "secondary buy point" now.

4/30/2012 12:57:36 PM - G - Its consolidation is not a sufficient length to be considered a sound new base pattern. It already has tested support at its 10-week moving average line multiple times this year, so it may not be considered an ideal "secondary buy point" now.

4/27/2012 3:49:47 PM - G - Considerable gain today backed by above average volume, challenging its 52-week high. Found support at its 50 DMA line recently, important near-term chart support to watch. Recent consolidation is not a sufficient length base pattern.

4/24/2012 4:44:45 PM - G - Consolidating just above its 50 DMA line. Its prior low ($16.14 on 4/10/12) and its short-term average define important near-term chart support to watch. It is -11.7% off its 52-week high today, extended from any sound base pattern.

4/18/2012 1:57:37 PM - G - Volume totals have been cooling while recently consolidating above its 50 DMA line. Last week's low and its short-term average define important near-term chart support to watch. It is -9.5% off its 52-week high today, extended from any sound base pattern.

4/11/2012 11:35:52 AM - G - Rebounding today following a slump near its 50 DMA line with 4 consecutive losses since hitting its 52-week high. It is extended from any sound base pattern.

4/10/2012 5:38:47 PM - G - Down today with above average volume for its 4th consecutive loss since hitting its 52-week high. It is extended from any sound base pattern. Its 50 DMA line defines support to watch on pullbacks.

4/4/2012 4:46:14 PM - G - Pulled back today on average volume from a new 52-week high hit on the prior session with a volume-driven gain. It may produce more climactic gains, but it is extended from any sound base pattern. Its 50 DMA line defines support to watch on pullbacks.

4/3/2012 12:19:56 PM - G - Today's 3rd consecutive gain helped it hit a new 52-week high. It may produce more climactic gains, but it is extended from any sound base pattern. Its 50 DMA line defines support to watch on pullbacks.

4/2/2012 5:43:15 PM - G - Volume increased behind today's gain for its best close of the year. It may produce more climactic gains, but it is extended from any sound base pattern. Its 50 DMA line defines support to watch on pullbacks.

3/30/2012 3:39:48 PM - G - Volume totals have been cooling in recent weeks while holding its ground following a streak of gains. It may produce more climactic gains, but it is extended from any sound base pattern. Its 50 DMA line defines support to watch on pullbacks.

3/28/2012 11:38:09 AM - G - Holding its ground stubbornly following a recent streak of gains. It may produce more climactic gains, but it is extended from any sound base pattern. Its 50 DMA line defines support to watch on pullbacks.

3/19/2012 7:03:54 PM - G - Hit another new 52-week high today with its 10th gain in the span of 11 sessions. It may produce more climactic gains, but it is extended from any sound base pattern. Its 50 DMA line defines support to watch on pullbacks.

3/16/2012 6:06:57 PM - G - Up today with 2 times average volume for a new 52-week high. It is extended from any sound base pattern. Its 50 DMA line defines support to watch on pullbacks.

3/15/2012 9:21:15 PM - G - Up today with slightly above average volume for its highest close of the year. It is extended from any sound base pattern. See the latest FSU analysis for more details and a new annotated daily graph.

3/14/2012 10:25:43 PM - G - Small loss on light volume today after 7 consecutive gains. Extended from any sound base pattern. It may produce more climactic gains, but it is outside of the buyable range under the rules-based system. Patient investors may watch for secondary buy points to possibly develop and be noted.

3/12/2012 6:14:19 PM - G - Up today for a 6th consecutive gain, getting more extended from any sound base pattern. It may produce more climactic gains, but it is outside of the buyable range under the rules-based system, and patient investors may watch for secondary buy points to possibly develop and be noted.

3/9/2012 8:45:29 PM - G - Up today for a 5th consecutive gain, getting more extended from any sound base pattern. It may produce more climactic gains, but it is outside of the buyable range under the rules-based system, and patient investors may watch for secondary buy points to possibly develop and be noted.

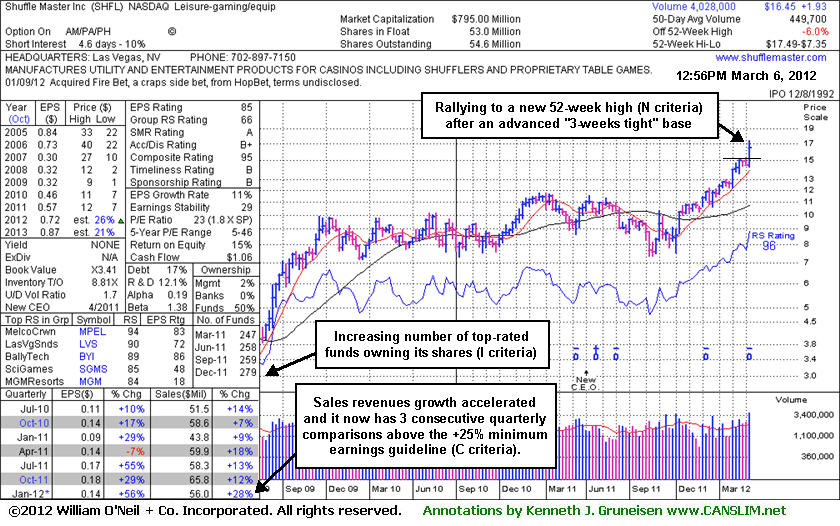

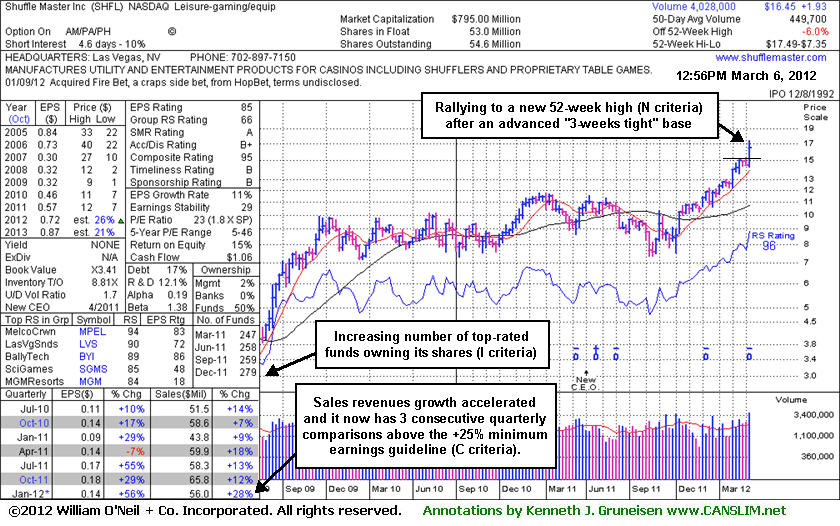

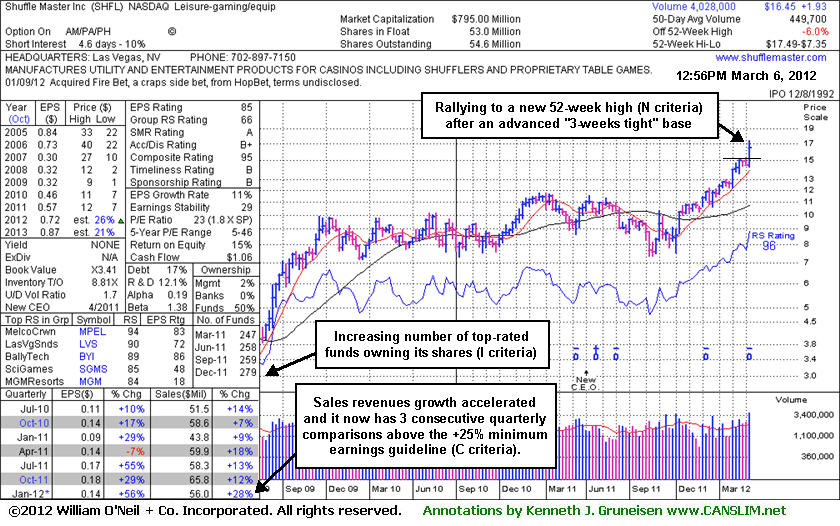

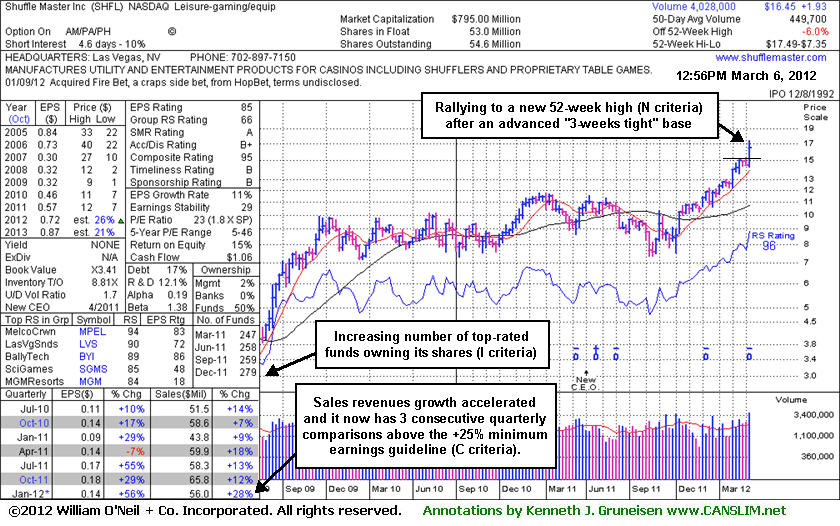

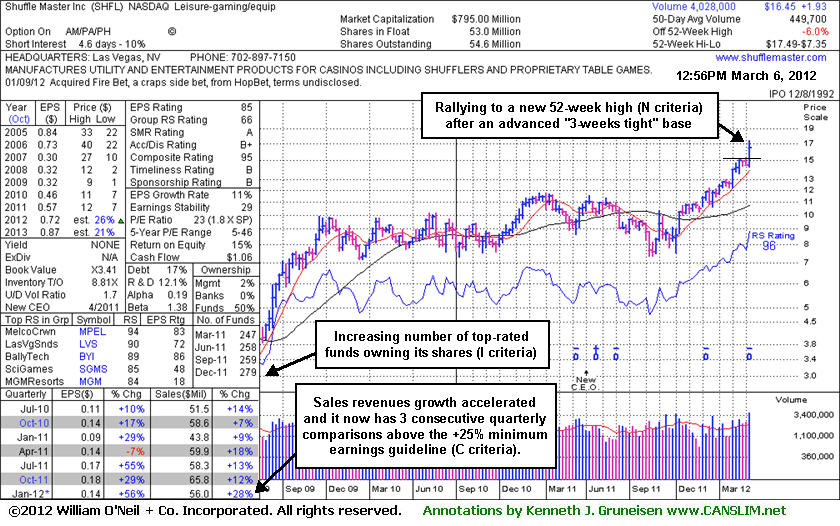

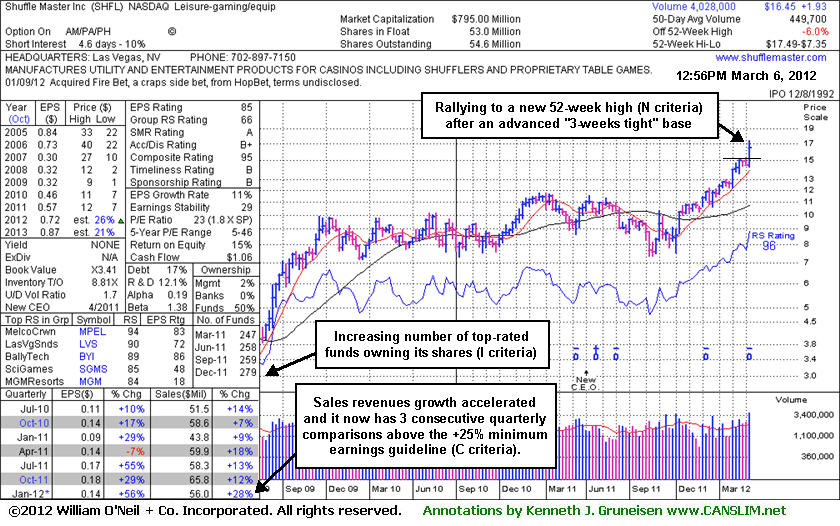

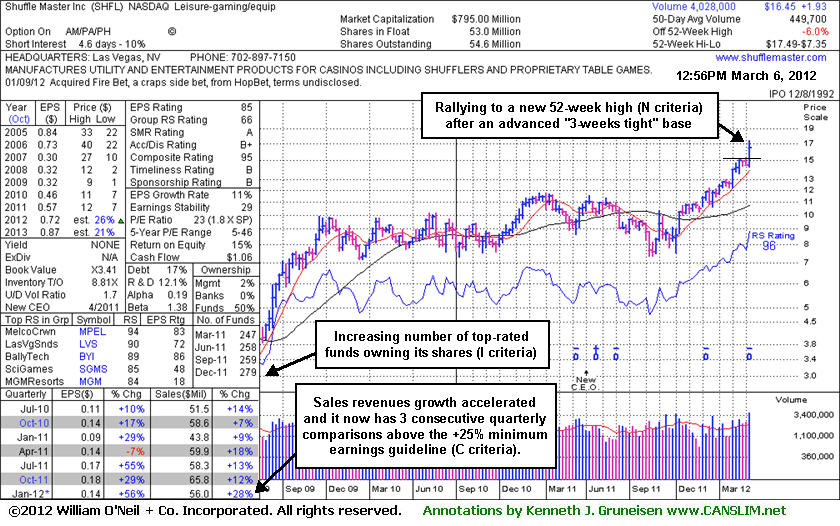

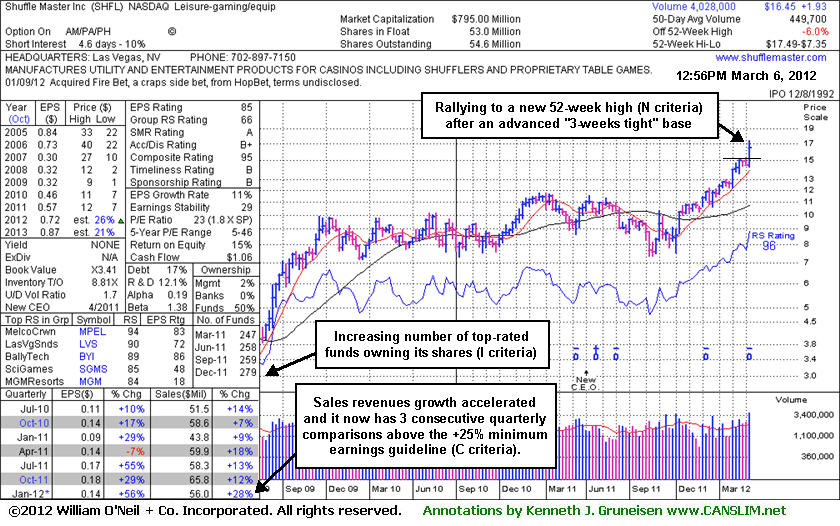

3/7/2012 12:50:08 PM - G - Up today after a finish in the lower half of its intra-day range on the prior session, and its color code is changed to green while quickly getting too extended. The 3 latest quarterly comparisons showed strong earnings increases (C criteria) and its annual earnings growth (A criteria) has been strong after FY '09. It was featured in the 3/06/12 mid-day report with heavy volume behind its gain as it technically broke out from the previously noted advanced "3-weeks tight" base pattern with pivot point based on its 2/17/12 high plus 10 cents. No resistance remains due to overhead supply.

3/6/2012 1:12:04 PM - Y - Reported earnings +56% on +28% sales revenues for the quarter ended January 31, 2012 versus the year ago period. The 3 latest quarterly comparisons showed strong earnings increases (C criteria) and its annual earnings growth (A criteria) has been strong after FY '09. Gapped up and hit new 52-week and multi-year highs today with heavy volume behind its gain after the previously noted advanced "3-weeks tight" base pattern. Color code is changed to yellow with pivot point based on its 2/17/12 high plus 10 cents. No resistance remains due to overhead supply.

3/1/2012 1:44:11 PM - Hovering near 52-week and multi-year highs, possibly forming an advanced "3-weeks tight" base pattern. No resistance remains due to overhead supply. Annual earnings growth (A criteria) has been strong after FY '09. The 2 latest quarterly comparisons (Jul and Oct '11) showed strong earnings increases with sales revenues increases in the +12-13% range, so its fundamentals are not a truly great match with the winning models of the fact-based system.

1/6/2012 1:45:25 PM - Inching to new 52-week and multi-year highs with today's gain. Annual earnings growth (A criteria) has been strong after FY '09. The 2 latest quarterly comparisons (Jul and Sep '11) showed strong earnings increases with sales revenues increases in the +12-13% range, so its fundamentals are not a truly great match with the winning models of the fact-based system.

4/25/2006 1:29:44 PM - "C" below guidelines.

3/16/2005 1:07:27 PM - Now sits below 50 DMA and EPS rank has fallen below guidelines. (CANSLIM.net daily coverage will be suspended)

3/4/2005 12:43:55 PM - L in great group. Broke out of a 4 month base on 02.25.05 with a PP= $ 32.36 MB=$ 34.00. Now falling back into prior base.

2/28/2005 1:12:30 PM - Y- L in great group. Breaking out of a 4 month base. PP= $ 32.36 MB=$ 34.00

2/25/2005 12:50:15 PM - L in great group. Breaking out of a 4 month base. PP= $ 32.38 MB=$ 34.00

11/2/2004 12:35:55 PM - L in good group. Highly ranked by IBD. Getting a little too ET.

10/28/2004 12:59:31 PM - L in good group. Highly ranked by IBD. getting a little too ET.

10/25/2004 1:00:00 PM - L in good group. Highly ranked by IBD.

10/22/2004 1:00:00 PM - L in good group. Highly ranked by IBD.

10/21/2004 1:00:00 PM - L in good group. Highly ranked by IBD.

6/8/2004 1:00:00 PM - L in good group. Highly ranked by IBD. Gap down today after recent nice action.