2/2/2024 1:28:30 PM - Reversed into the red after hitting a new 52-week high today. Reported earnings +39% on +71% sales revenues for the Dec '23 quarter but fundamental concerns remain. Prior quarterly comparisons were not strong and steady above the +25% minimum earnings guideline (C criteria). It was dropped from the Featured Stocks list on 2/02/15.

11/29/2023 12:26:56 PM - Rebounding toward previously stubborn resistance in the $43 area. Reported earnings +31% on +67% sales revenues for the Sep '23 quarter but fundamental concerns remain. Prior quarterly comparisons were below the +25% minimum earnings guideline (C criteria). It was dropped from the Featured Stocks list on 2/02/15.

6/21/2019 12:39:17 PM - Pulling back today from a new all-time high hit on the prior session after 3 consecutive volume-driven gains. Found support near its 50 DMA line and recently wedged higher. Prior mid-day reports cautioned members - "Reported earnings +19% on +5% sales revenues for the Mar '19 quarter and fundamental concerns remain, Sub par sales revenues growth and prior quarterly comparisons were below the +25% minimum earnings guideline (C criteria). Choppy action continued since dropped from the Featured Stocks list on 2/02/15."

6/20/2019 12:45:18 PM - Hitting new 52-week and all-time highs with today's 3rd consecutive volume-driven gain. Found support near its 50 DMA line and recently wedged higher. Prior mid-day reports cautioned members - "Reported earnings +19% on +5% sales revenues for the Mar '19 quarter and fundamental concerns remain, Sub par sales revenues growth and prior quarterly comparisons were below the +25% minimum earnings guideline (C criteria). Choppy action continued since dropped from the Featured Stocks list on 2/02/15."

6/18/2019 12:28:20 PM - Found support near its 50 DMA line and wedged higher with gains lacking great volume conviction since noted with caution in the 5/16/19 mid-day report - "Reported earnings +19% on +5% sales revenues for the Mar '19 quarter and fundamental concerns remain, Sub par sales revenues growth and prior quarterly comparisons were below the +25% minimum earnings guideline (C criteria). Choppy action continued since dropped from the Featured Stocks list on 2/02/15."

6/17/2019 12:45:42 PM - Found support near its 50 DMA line and wedged higher with gains lacking great volume conviction since noted with caution in the 5/16/19 mid-day report - "Reported earnings +19% on +5% sales revenues for the Mar '19 quarter and fundamental concerns remain, Sub par sales revenues growth and prior quarterly comparisons were below the +25% minimum earnings guideline (C criteria). Choppy action continued since dropped from the Featured Stocks list on 2/02/15."

6/6/2019 12:41:13 PM - Found support near its 50 DMA line after last noted with caution in the 5/16/19 mid-day report - "Reported earnings +19% on +5% sales revenues for the Mar '19 quarter and fundamental concerns remain, Sub par sales revenues growth and prior quarterly comparisons were below the +25% minimum earnings guideline (C criteria). Choppy action continued since dropped from the Featured Stocks list on 2/02/15."

5/16/2019 11:55:09 AM - Reported earnings +19% on +5% sales revenues for the Mar '19 quarter and fundamental concerns remain, Sub par sales revenues growth and prior quarterly comparisons were below the +25% minimum earnings guideline (C criteria). Choppy action continued since dropped from the Featured Stocks list on 2/02/15.

5/15/2019 1:15:55 PM - Reported earnings +19% on +5% sales revenues for the Mar '19 quarter and fundamental concerns remain, Sub par sales revenues growth and prior quarterly comparisons were below the +25% minimum earnings guideline (C criteria). Choppy action continued since dropped from the Featured Stocks list on 2/02/15.

1/25/2019 12:38:25 PM - Reported earnings +33% on +4% sales revenues for the Sep '18 quarter and fundamental concerns remain, Sub par sales revenues growth and prior quarterly comparisons were below the +25% minimum earnings guideline (C criteria). Choppy action continued since dropped from the Featured Stocks list on 2/02/15.

10/21/2016 12:36:43 PM - Finding support above its 50 DMA line and still perched near all-time highs since last noted with caution in the 9/14/16 mid-day report - "Reported earnings +2% on +0% sales revenues for the Jun '16 quarter and fundamental concerns remain, Prior quarterly comparisons were below the +25% minimum earnings guideline (C criteria). Rebounded impressively after a deep and choppy consolidation since dropped from the Featured Stocks list on 2/02/15."

9/14/2016 12:34:52 PM - Promptly repaired the 9/09/16 damaging 50 DMA line violation and rallied to new all-time highs. Noted with caution in prior mid-day reports - "Reported earnings +2% on +0% sales revenues for the Jun '16 quarter and fundamental concerns remain, Prior quarterly comparisons were below the +25% minimum earnings guideline (C criteria). Rebounded impressively after a deep and choppy consolidation since dropped from the Featured Stocks list on 2/02/15."

9/13/2016 12:20:44 PM - Promptly repaired the 9/09/16 damaging 50 DMA line violation and rallied to new all-time highs. Noted with caution in prior mid-day reports - "Reported earnings +2% on +0% sales revenues for the Jun '16 quarter and fundamental concerns remain, Prior quarterly comparisons were below the +25% minimum earnings guideline (C criteria). Rebounded impressively after a deep and choppy consolidation since dropped from the Featured Stocks list on 2/02/15."

9/12/2016 1:03:02 PM - Gapped up today, promptly repairing a 50 DMA line violation from the prior session and hitting new all-time highs. Noted with caution in prior mid-day reports - "Reported earnings +2% on +0% sales revenues for the Jun '16 quarter and fundamental concerns remain, Prior quarterly comparisons were below the +25% minimum earnings guideline (C criteria). Rebounded impressively after a deep and choppy consolidation since dropped from the Featured Stocks list on 2/02/15."

9/9/2016 12:25:42 PM - Violated its 50 DMA line after gapping down today, retreating from all-time highs. Last noted with caution in the 9/01/16 mid-day report - "Reported earnings +2% on +0% sales revenues for the Jun '16 quarter and fundamental concerns remain, Prior quarterly comparisons were below the +25% minimum earnings guideline (C criteria). Rebounded impressively after a deep and choppy consolidation since dropped from the Featured Stocks list on 2/02/15."

9/1/2016 12:31:43 PM - Found support at its 50 DMA line during recent consolidations and it is quietly perched at all-time highs with volume totals cooling. Reported earnings +2% on +0% sales revenues for the Jun '16 quarter and fundamental concerns remain, Prior quarterly comparisons were below the +25% minimum earnings guideline (C criteria). Rebounded impressively after a deep and choppy consolidation since dropped from the Featured Stocks list on 2/02/15.

7/28/2016 1:14:05 PM - Reported earnings +2% on +0% sales revenues for the Jun '16 quarter. Gapped down today testing its 50 DMA line ($59.44). That important short-term average acted as support during its consolidation since noted with caution in the 6/21/16 mid-day report - "Reported earnings +21% on -2% sales revenues for the Mar '16 quarter and fundamental concerns remain, Prior quarterly comparisons were below the +25% minimum earnings guideline (C criteria). It was dropped from the Featured Stocks list on 2/02/15."

7/20/2016 12:57:07 PM - Found support at its 50 DMA line during its consolidation since noted with caution in the 6/21/16 mid-day report - "Reported earnings +21% on -2% sales revenues for the Mar '16 quarter and fundamental concerns remain, Prior quarterly comparisons were below the +25% minimum earnings guideline (C criteria). It was dropped from the Featured Stocks list on 2/02/15."

6/21/2016 12:24:50 PM - Noted with caution in prior mid-day reports - "Reported earnings +21% on -2% sales revenues for the Mar '16 quarter and fundamental concerns remain, Prior quarterly comparisons were below the +25% minimum earnings guideline (C criteria). It was dropped from the Featured Stocks list on 2/02/15."

6/20/2016 12:56:02 PM - Noted with caution in prior mid-day reports - "Reported earnings +21% on -2% sales revenues for the Mar '16 quarter and fundamental concerns remain, Prior quarterly comparisons were below the +25% minimum earnings guideline (C criteria). It was dropped from the Featured Stocks list on 2/02/15."

6/3/2016 12:55:48 PM - Making gradual progress toward prior highs since last noted with caution in the 5/18/16 mid-day report - "Reported earnings +21% on -2% sales revenues for the Mar '16 quarter and fundamental concerns remain, Prior quarterly comparisons were below the +25% minimum earnings guideline (C criteria). It was dropped from the Featured Stocks list on 2/02/15."

5/18/2016 12:35:35 PM - Prior mid-day reports cautioned - "Reported earnings +21% on -2% sales revenues for the Mar '16 quarter and fundamental concerns remain, Prior quarterly comparisons were below the +25% minimum earnings guideline (C criteria). It was dropped from the Featured Stocks list on 2/02/15."

5/12/2016 12:29:50 PM - The 5/03/16 mid-day report cautioned - "Reported earnings +21% on -2% sales revenues for the Mar '16 quarter and fundamental concerns remain, Prior quarterly comparisons were below the +25% minimum earnings guideline (C criteria). It was dropped from the Featured Stocks list on 2/02/15."

5/3/2016 12:50:45 PM - Reported earnings +21% on -2% sales revenues for the Mar '16 quarter and fundamental concerns remain, Prior quarterly comparisons were below the +25% minimum earnings guideline (C criteria). It was dropped from the Featured Stocks list on 2/02/15.

2/2/2015 6:28:04 PM - Encountered more distributional pressure and reversed into the red after meeting resistance at its 50 DMA line today. Found support at its 200 DMA line, however its Relative Strength rating has slumped to 67, below the 80+ minimum guideline for buy candidates. Reported earnings +23% on +29% sales revenues for the Dec '14 quarter, below the +25% minimum earnings guideline (C criteria) raising fundamental concerns. It did not clear the previously noted "double bottom" base and trigger a convincing technical buy signal. See the latest FSU analysis for more details and an annotated weekly graph. It will be dropped from the Featured Stocks list tonight.

1/29/2015 12:58:17 PM - G - Gapped down for a damaging volume-driven loss violating its 50 DMA line triggering a technical sell signal on the prior session. Finding support at its 200 DMA line, however its Relative Strength rating has slumped to 71, below the 80+ minimum guideline for buy candidates. Reported earnings +23% on +29% sales revenues for the Dec '14 quarter, below the +25% minimum earnings guideline (C criteria) raising fundamental concerns. It did not clear the previously noted "double bottom" base and trigger a convincing technical buy signal. See the latest FSU analysis for more details and an annotated weekly graph.

1/28/2015 1:22:04 PM - G - Color code is changed to green. Gapped down today for a damaging volume-driven loss violating its 50 DMA line and testing support at its 200 DMA line. Reported earnings +23% on +29% sales revenues for the Dec '14 quarter, below the +25% minimum earnings guideline (C criteria) raising fundamental concerns. It did not clear the previously noted "double bottom" base and trigger a convincing technical buy signal. See the latest FSU analysis for more details and an annotated weekly graph.

1/27/2015 6:29:45 PM - Y - Today's gain backed by +142% above average volume still left it finishing 8 cents short of the pivot point cited based on its 12/24/14 high. To clear the "double bottom" base it needs additional volume-driven gains above the pivot point that may trigger a convincing technical buy signal. Little resistance remains due to overhead supply up through the $60 level. See the latest FSU analysis for more details and an annotated weekly graph.

1/27/2015 6:24:16 PM - Y - Today's gain backed by +142% above average volume still left it finishing 8 cents short of the pivot point cited based on its 12/24/14 high. To clear the "double bottom" base it needs additional volume-driven gains above the pivot point that may trigger a convincing technical buy signal. Little resistance remains due to overhead supply up through the $60 level. See the latest FSU analysis for more details and an annotated weekly graph.

1/26/2015 1:02:29 PM - Y - Color code is changed to yellow with pivot point cited based on its 12/24/14 high in a "double bottom" base. Volume-driven gains above the pivot point are needed to trigger a technical buy signal, then very little resistance remains due to overhead supply. Reported earnings +41% on +40% sales revenues for the Sep '14 quarter, its 3rd consecutive quarterly comparison above the +25% minimum guideline (C criteria), helping it better match the fact-based investment system's fundamental guidelines.

1/20/2015 12:41:54 PM - Prior mid-day reports cautioned - "Recently enduring mild distributional pressure and consolidating near its 50 DMA line, with resistance remaining due to overhead supply up to the $60 level. Reported earnings +41% on +40% sales revenues for the Sep '14 quarter, its 3rd consecutive quarterly comparison above the +25% minimum guideline (C criteria), helping it better match the fact-based investment system's fundamental guidelines.

1/16/2015 12:42:59 PM - Making its 2nd consecutive mid-day report appearance. Recently enduring mild distributional pressure and consolidating near its 50 DMA line, with resistance remaining due to overhead supply up to the $60 level. Reported earnings +41% on +40% sales revenues for the Sep '14 quarter, its 3rd consecutive quarterly comparison above the +25% minimum guideline (C criteria), helping it better match the fact-based investment system's fundamental guidelines.

1/15/2015 1:00:39 PM - Meeting resistance at its 50 DMA line, and subsequent gains above that short-term average are needed for its outlook to improve. Rebounded impressively since last noted with caution in the 10/23/14 mid-day report - "Reported earnings +41% on +40% sales revenues for the Sep '14 quarter, its 3rd consecutive quarterly comparison above the +25% minimum guideline (C criteria), helping it better match the fact-based investment system's fundamental guidelines."

10/23/2014 1:19:58 PM - Reported earnings +41% on +40% sales revenues for the Sep '14 quarter, its 3rd consecutive quarterly comparison above the +25% minimum guideline (C criteria), helping it better match the fact-based investment system's fundamental guidelines. Gapped down today, encountering more distributional pressure after meeting resistance at its 50 DMA line. Found support recently at prior highs in the $52 area.

10/22/2014 1:04:48 PM - Encountering resistance near its 50 DMA line today following 3 consecutive volume-driven gains. Found support recently at prior highs in the $52 area. Repeatedly noted with caution in prior mid-day reports - "Reported earnings +46% on +42% sales revenues for the Jun '14 quarter, but fundamental concerns remain. Fundamentals are not a match with the C criteria. Earnings increased above the +25% minimum earnings guideline in only 2 of the past 4 quarterly comparisons. It survived but failed to impress since dropped from the Featured Stocks list on 8/05/11."

10/21/2014 12:58:11 PM - Rebounding near its 50 DMA line with today's 3rd consecutive volume-driven gain. Found support at prior highs in the $52 area. Repeatedly noted with caution in prior mid-day reports - "Reported earnings +46% on +42% sales revenues for the Jun '14 quarter, but fundamental concerns remain. Fundamentals are not a match with the C criteria. Earnings increased above the +25% minimum earnings guideline in only 2 of the past 4 quarterly comparisons. It survived but failed to impress since dropped from the Featured Stocks list on 8/05/11."

10/20/2014 12:43:10 PM - After recently slumping below its 50 DMA line it found support at prior highs in the $52 area. Noted with caution in the 8/01/14 mid-day report - "Reported earnings +46% on +42% sales revenues for the Jun '14 quarter, but fundamental concerns remain. Fundamentals are not a match with the C criteria. Earnings increased above the +25% minimum earnings guideline in only 2 of the past 4 quarterly comparisons. It survived but failed to impress since dropped from the Featured Stocks list on 8/05/11."

10/17/2014 12:49:32 PM - Slumped below its 50 DMA line testing support at prior highs in the $52 area. Last noted with caution in the 8/01/14 mid-day report - "Reported earnings +46% on +42% sales revenues for the Jun '14 quarter, but fundamental concerns remain. Fundamentals are not a match with the C criteria. Earnings increased above the +25% minimum earnings guideline in only 2 of the past 4 quarterly comparisons. It survived but failed to impress since dropped from the Featured Stocks list on 8/05/11."

8/1/2014 12:29:24 PM - Holding its ground near its 52-week high following a considerable gap up gain on the prior session. Found support near its 50 DMA line since last noted with caution in the 7/11/14 mid-day report. Reported earnings +46% on +42% sales revenues for the Jun '14 quarter, but fundamental concerns remain. Fundamentals are not a match with the C criteria. Earnings increased above the +25% minimum earnings guideline in only 2 of the past 4 quarterly comparisons. It survived but failed to impress since dropped from the Featured Stocks list on 8/05/11.

7/11/2014 12:24:12 PM - Consolidating above and below its 50 DMA line, staying well above its 200 DMA line since last noted with caution in the 5/06/14 mid-day report - "Reported earnings +33% on +31% sales revenues for the Mar '14 quarter, but fundamental concerns remain. Fundamentals are not a match with the C criteria. Earnings increased above the +25% minimum earnings guideline in only one of the past 4 quarterly comparisons through Sep '13. It survived but failed to impress since dropped from the Featured Stocks list on 8/05/11."

5/6/2014 12:35:48 PM - Rebounded above its 50 DMA line on 4/25/14 with a volume-driven gain. Reported earnings +33% on +31% sales revenues for the Mar '14 quarter, but fundamental concerns remain. Prior mid-day reports repeatedly cautioned members - "Fundamentals are not a match with the C criteria. Earnings increased above the +25% minimum earnings guideline in only one of the past 4 quarterly comparisons through Sep '13. It survived but failed to impress since dropped from the Featured Stocks list on 8/05/11."

1/30/2014 1:04:06 PM - Consolidating above prior highs following a considerable gap up and volume-driven gain on 1/24/14 for a new 52-week high. Found support at its 50 DMA line during its recent consolidation. Prior mid-day reports repeatedly cautioned members - "Fundamentals are not a match with the C criteria. Earnings increased above the +25% minimum earnings guideline in only one of the past 4 quarterly comparisons through Sep '13. It survived but failed to impress since dropped from the Featured Stocks list on 8/05/11."

1/27/2014 12:47:33 PM - Pulling back today after a considerable gap up and volume-driven gain on the prior session for a new 52-week high. Found support at its 50 DMA line during its consolidation since noted with caution in the 12/11/13 mid-day report - "Fundamentals are not a match with the C criteria. Earnings increased above the +25% minimum earnings guideline in only one of the past 4 quarterly comparisons through Sep '13. It survived but failed to impress since dropped from the Featured Stocks list on 8/05/11."

1/24/2014 12:40:49 PM - Gapped up today for a new 52-week high with a considerble volume-driven gain. Found support at its 50 DMA line during its consolidation since last noted with caution in the 12/11/13 mid-day report - "Fundamentals are not a match with the C criteria. Earnings increased above the +25% minimum earnings guideline in only one of the past 4 quarterly comparisons through Sep '13. It survived but failed to impress since dropped from the Featured Stocks list on 8/05/11."

12/11/2013 12:43:43 PM - Perched at its 52-week high today after recent volume-driven gains. Prior mid-day reports repeatedly cautioned members - "Fundamentals are not a match with the C criteria. Earnings increased above the +25% minimum earnings guideline in only one of the past 4 quarterly comparisons through Sep '13. It survived but failed to impress since dropped from the Featured Stocks list on 8/05/11."

12/10/2013 1:01:59 PM - Perched at its 52-week high today after recent volume-driven gains. Prior mid-day reports repeatedly cautioned members - "Fundamentals are not a match with the C criteria. Earnings increased above the +25% minimum earnings guideline in only one of the past 4 quarterly comparisons through Sep '13. It survived but failed to impress since dropped from the Featured Stocks list on 8/05/11."

12/2/2013 12:43:27 PM - Touched a new 52-week high today. Held its ground in a tight range as volume totals cooled following a streak of volume-driven gains. Prior mid-day reports repeatedly cautioned members - "Fundamentals are not a match with the C criteria. Earnings increased above the +25% minimum earnings guideline in only one of the past 4 quarterly comparisons through Sep '13. It survived but failed to impress since dropped from the Featured Stocks list on 8/05/11."

11/8/2013 1:25:41 PM - Perched at its 52-week high today following a streak of volume-driven gains. Prior mid-day reports repeatedly cautioned members - "Fundamentals are not a match with the C criteria. Earnings increased above the +25% minimum earnings guideline in only one of the past 4 quarterly comparisons through Sep '13. It survived but failed to impress since dropped from the Featured Stocks list on 8/05/11."

11/7/2013 12:13:34 PM - Perched at its 52-week high today while tallying its 5th consecutive gain. The 11/06/13 mid-day report cautioned members - "Fundamentals are not a match with the C criteria. Earnings increased above the +25% minimum earnings guideline in only one of the past 4 quarterly comparisons through Sep '13. It survived but failed to impress since dropped from the Featured Stocks list on 8/05/11."

11/6/2013 12:53:07 PM - Fundamentals are not a match with the C criteria. Earnings increased above the +25% minimum earnings guideline in only one of the past 4 quarterly comparisons through Sep '13. It survived but failed to impress since dropped from the Featured Stocks list on 8/05/11.

6/3/2013 12:56:35 PM - Fundamentals are not a match with the C criteria as only 2 of the past 4 quarterly comparisons through Mar '13 showed increases at or slightly above the +25% minimum earnings guideline. It survived but failed to impress since dropped from the Featured Stocks list on 8/05/11.

8/5/2011 6:08:32 PM - Down today with higher volume indicative of more distributional pressure, closing -17% off its 52-week high. Dipped below prior lows near $58 intra-day while slumping near its 200 DMA line. Based on deterioration it will be dropped from the Featured Stocks list tonight.

8/4/2011 5:37:15 PM - G - Violated the prior session low with another damaging loss today. Prior lows near $58 define the next support level above its 200 DMA line.

8/3/2011 7:38:47 PM - G - Today it managed a positive reversal. Violated support at old highs near $66 and slumped under its 50 DMA line on the prior session with a damaging loss on above average volume, triggering a technical sell signal. A prompt rally above its 50 DMA would helped its outlook, technically.

8/2/2011 4:11:36 PM - G - Violated support at old highs near $66 and slumped under its 50 DMA line today with a damaging loss on above average volume, triggering a technical sell signal. Color code is changed to green based on worrisome action. It stalled after its 7/13/11 technical buy signal with a negative reversal marking its all-time high.

8/1/2011 4:29:20 PM - Y - Holding its ground near its pivot point now, it stalled after its 7/13/11 technical buy signal. Volume totals have been near average or lighter since its negative reversal at its all-time high. Prior resistance near $66 defines important chart support to watch above its 50 DMA line.

7/27/2011 5:43:06 PM - Y - Still stubbornly holding its ground above its pivot point yet below its "max buy" level. It stalled after its 7/13/11 technical buy signal, with volume totals cooling since its negative reversal at its all-time high. Prior resistance near $66 defines important chart support to watch above its 50 DMA line.

7/25/2011 5:44:14 PM - Y - Quietly holding its ground above its pivot point yet below its "max buy" level. It stalled after its 7/13/11 technical buy signal, with volume totals cooling since its negative reversal at its all-time high. Prior resistance near $66 defines important chart support to watch above its 50 DMA line.

7/20/2011 6:37:30 PM - Y - Holding its ground above its pivot point. Volume totals have been cooling since its negative reversal after hitting a new all-time high on 7/14/11. The 7/13/11 gain with volume +187% above average had confirmed a technical buy signal.

7/14/2011 1:27:09 PM - Y - It has reversed into the red today from earlier highs above its "max buy" level after a gap up. The 7/13/11 gain with volume +187% above average confirmed a technical buy signal.

7/14/2011 11:27:53 AM - Y - It has slumped from earlier highs above its "max buy" level after a gap up today. It finished strong on the prior session with a considerable volume-driven gain that confirmed a technical buy signal.

7/13/2011 10:56:41 AM - Y - Rising near its 52-week high today after announcing it has acquired Global 360 Holding Corporation, a leading provider of process and case management solutions. Volume-driven gains above the previously cited pivot point may trigger a technical buy signal.

7/11/2011 11:24:38 AM - Y - Pulling back from its 52-week high and slumping back under its pivot point today after a recent streak of consecutive gains without great volume conviction. Volume-driven gains above the previously cited pivot point may trigger a technical buy signal.

7/7/2011 11:28:14 AM - Y - Hit a new 52-week high and rallied above its pivot point after a small gap up today, on track for its 8th consecutive gain without great volume conviction. Volume-driven gains above the previously cited pivot point may trigger a technical buy signal.

7/6/2011 2:27:16 PM - Y - Today's 7th consecutive gain without great volume conviction helped it inch up very near its 52-week high. Volume-driven gains above the previously cited pivot point may trigger a technical buy signal.

7/1/2011 4:13:30 PM - Y - Lighter volume was behind today's 5th consecutive gain to a close -3.5% off its 52-week high. Color code was changed to yellow based on recent resilience, yet volume-driven gains above the previously cited pivot point are necessary to trigger a technical buy signal.

6/30/2011 3:58:17 PM - Y - Today's 4th consecutive gain has it rising above its 50 DMA line to within -4.8% of its 52-week high. Color code is changed to yellow after its recent resilience, yet volume-driven gains above the previously cited pivot point are necessary to trigger a technical buy signal.

6/28/2011 3:26:59 PM - G - Gain today without great volume conviction has it challenging its 50 DMA line which has acted as resistance recently. It faces overhead supply up through $66 after trading at higher levels in recent months.

6/24/2011 3:42:29 PM - G - Gains above its 50 DMA line are needed for its outlook to improve, technically. Its 50 DMA line has acted as resistance recently, and it faces overhead supply up through $66 after trading at higher levels in recent months.

6/21/2011 2:39:36 PM - G - Technically, today's gain has it rallying back near its 50 DMA line which may now act as resistance. It faces overhead supply up through $66 after trading at higher levels in recent months.

6/20/2011 4:54:16 PM - G - Closed near the session high today after a positive reversal. It faces resistance up through $66 due to the overhead supply created while trading at higher levels in recent months. Technically, gains above its 50 DMA line are needed for its outlook to improve.

6/15/2011 5:05:03 PM - G - This week it halted its losing streak near highs prior to its 3/29/11 breakout. It now faces resistance due to the overhead supply created while trading at higher levels in recent months. Technically, gains above its 50 DMA line are needed for its outlook to improve.

6/14/2011 1:06:22 PM - G - Quiet gain today halted its losing streak near highs prior to its 3/29/11 breakout. It faces resistance now due to the overhead supply created while trading at higher levels in recent months. Color code was changed to green based on damaging technical deterioration.

6/10/2011 5:22:24 PM - G - Down considerably today with above average volume, closing near old highs prior to its 3/29/11 breakout. It faces resistance now due to the overhead supply created while trading at higher levels in recent months. Color code was changed to green based on damaging technical deterioration.

6/10/2011 11:26:04 AM - G - Down considerably today, trading near old highs prior to the 3/29/11 breakout. It faces resistance now due to the overhead supply created while trading at higher levels in recent months. Color code was changed to green based on damaging technical deterioration.

6/8/2011 - G - Disciplined investors avoided the temptation to get in "early" before a technical buy signal. A breakout did not occur, and it was down today for a 5th consecutive loss while volume increased to above average and it violated its 50 DMA line. Color code is changed to green based on damaging technical deterioration.

6/6/2011 7:01:05 PM - Y - Down for a 3rd consecutive session with a small loss today on below average volume, slumping near its 50 DMA line. No resistance remains from overhead supply, however a breakout on volume is still needed to confirm a proper new technical buy signal.

6/3/2011 4:18:09 PM - Y - Small gap down today for a loss on below average volume. No resistance remains from overhead supply, however a breakout on volume is still needed to confirm a proper new technical buy signal. See the latest FSU analysis for details and a new annotated daily graph.

6/2/2011 6:59:18 PM - Y - No resistance remains from overhead supply, however a breakout on volume is still needed to confirm a proper new technical buy signal. See the latest FSU analysis for details and a new annotated daily graph.

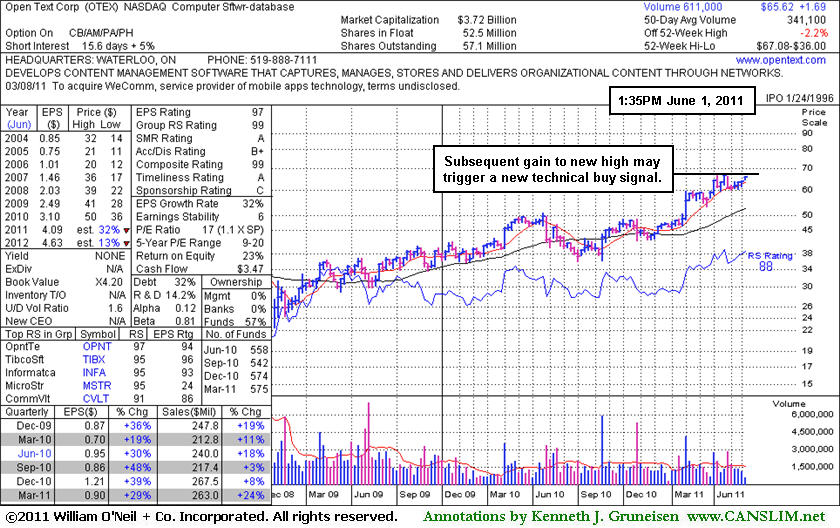

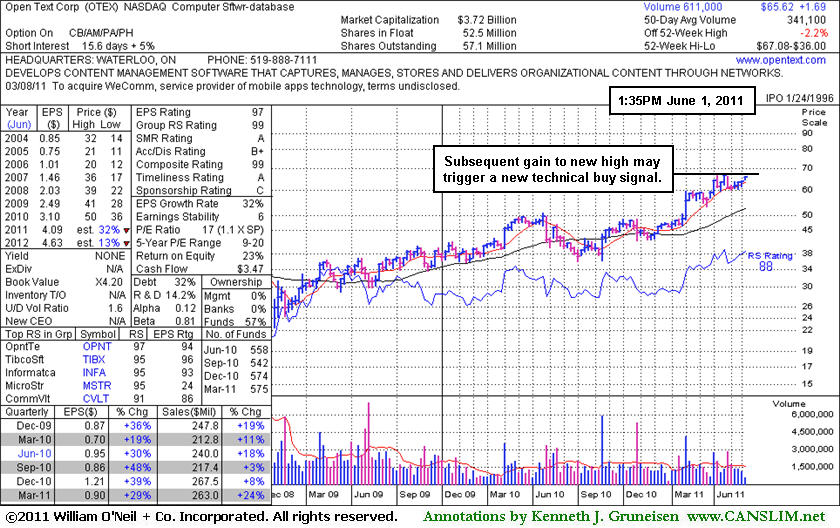

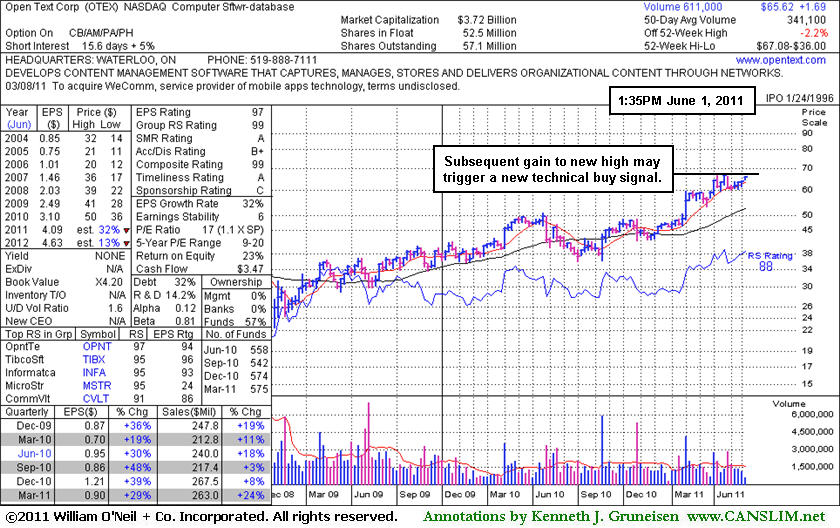

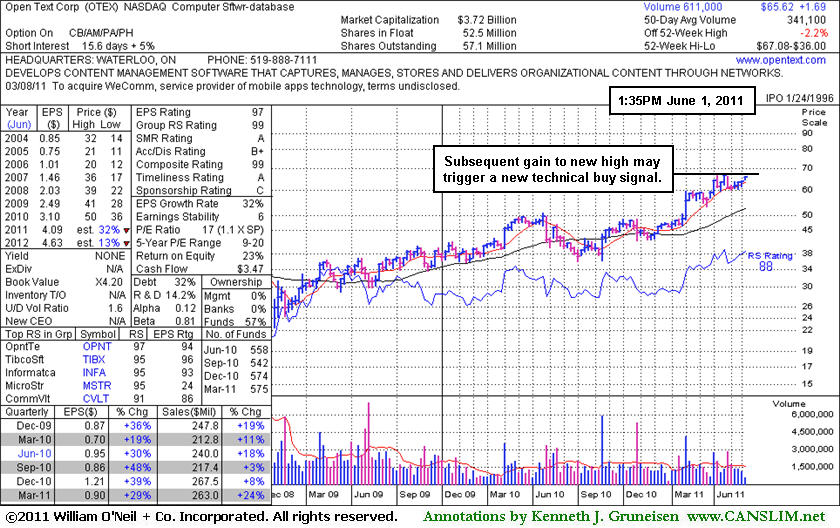

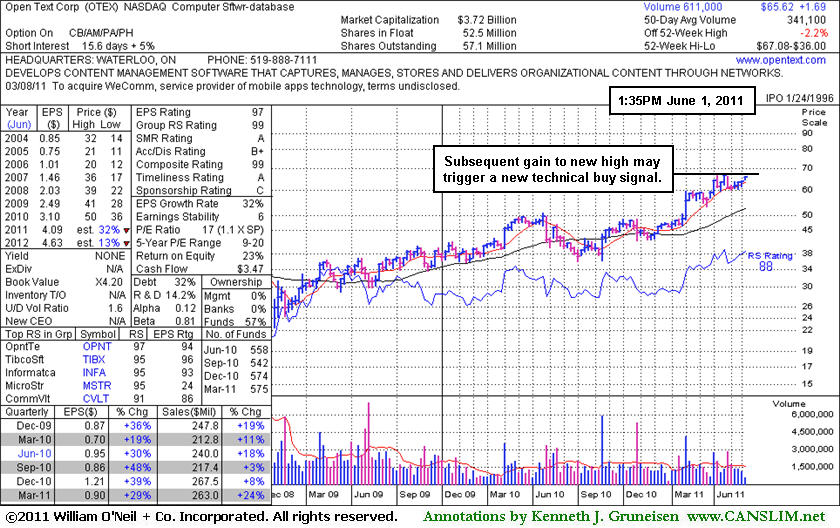

6/1/2011 5:48:08 PM - Y - Found support near prior highs and above its 50 DMA line during its consolidation. Higher than average volume without great price progress may be a sign of distributional pressure. In today's mid-day report its color code was changed to yellow as it was noted - "With pivot point cited based on its high plus 10 cents. No resistance remains from overhead supply, however a breakout on volume is still needed to confirm a proper new technical buy signal. It has a very good annual earnings (the A criteria) history. The 4 latest quarterly earnings increases have been reported above the +25% guideline of the investment system. This Ontario, Canada-based Computer Software - Database firm's sales revenues increased by +24% in the quarter ended March 31, 2011 versus the year ago period. Sales revenues were previously noted at only in the +3-8% range in the Sep '10 and Dec '10 quarters."

6/1/2011 - Y - Found support near prior highs and above its 50 DMA line during its consolidation. Color code is changed to yellow with pivot point cited based on its high plus 10 cents. No resistance remains from overhead supply, however a breakout on volume is still needed to confirm a proper new technical buy signal. It has a very good annual earnings (the A criteria) history. The 4 latest quarterly earnings increases have been reported above the +25% guideline of the investment system. This Ontario, Canada-based Computer Software - Database firm's sales revenues increased by +24% in the quarter ended March 31, 2011 versus the year ago period. Sales revenues were previously noted at only in the +3-8% range in the Sep '10 and Dec '10 quarters.

4/26/2011 12:54:45 PM - Found support near prior highs and above its 50 DMA line during its consolidation since last noted in the 4/04/11 mid-day report - "No resistance remains from overhead supply. It has a very good annual earnings (the A criteria) history. The 3 latest quarterly earnings increases have been reported above the +25% guideline of the investment system, however, this Ontario, Canada-based Computer Software - Database firm's sales revenues increases were only in the +3-8% range in the Sep '10 and Dec '10 quarters."

4/4/2011 1:04:51 PM - Gapped up again today and hit a new high, getting extended after technically breaking out of a flat base last week with a streak of gain backed by above average volume. The 3/30/11 mid-day report noted - "No resistance remains from overhead supply. It has a very good annual earnings (the A criteria) history. The 3 latest quarterly earnings increases have been reported above the +25% guideline of the investment system, however, this Ontario, Canada-based Computer Software - Database firm's sales revenues increases were only in the +3-8% range in the Sep '10 and Dec '10 quarters."

3/30/2011 12:19:35 PM - Gapped up today after technically breaking out of a flat base with above averatge volume on the prior session. No resistance remains from overhead supply. It has a very good annual earnings (the A criteria) history. The 3 latest quarterly earnings increases have been reported above the +25% guideline of the investment system, however, this Ontario, Canada-based Computer Software - Database firm's sales revenues increases were only in the +3-8% range in the Sep '10 and Dec '10 quarters.

4/21/2009 11:57:06 AM - Pulling back abruptly from recent chart highs on light volume, testing its 50 DMA line today. Little resistance remains from overhead supply. It has a good annual earnings (the A criteria) history, but sales revenues increases are below the +25% guideline while quarterly earnings increases have been reported near the minimum guidelines of the investment system.

4/15/2009 11:32:37 AM - Very little resistance due to overhead supply remains. Good annual earnings (the A criteria) history, but sales revenues increases are below the +25% guideline while quarterly earnings increases have been reported near the minimum guidelines of the investment system.

4/14/2009 11:46:29 AM - Rallying toward prior chart highs in the $39 area that were a stubborn resistance level last year. Good annual earnings (the A criteria) history, but sales revenues increases are below the +25% guideline while quarterly earnings increases have been reported near the minimum guidelines of the investment system.

2/9/2009 12:45:58 PM - Gains with above average volume in recent weeks helped it rally toward prior chart highs in the $39 area that were a stubborn resistance level last year. Good annual earnings (the A criteria) history, but sales revenues increases are below the +25% guideline while quarterly earnings increases have been reported near the minimum guidelines of the investment system.

2/5/2009 12:39:07 PM - Gains with above average volume in recent weeks helped it rally toward prior chart highs in the $39 area that were a stubborn resistance level last year. Good annual earnings (the A criteria) history, but sales revenues increases are below the +25% guideline while quarterly earnings increases have been reported near the minimum guidelines of the investment system.

1/30/2009 12:34:11 PM - Gains with above average volume this week helped it rally further above its 200 DMA line, on course toward prior chart highs in the $39 area that were a stubborn resistance level last year. Good annual earnings (the A criteria) history, but sales revenues increases are below the +25% guideline while quarterly earnings increases have been reported near the minimum guidelines of the investment system.

10/1/2008 12:46:31 PM - Consolidating after recent gains with heavy volume helped it rise straight up from the bottom of its base to reach new highs. Good annual earnings history, but quarterly earnings and sales increases are below the +25% guideline.

9/26/2008 12:43:43 PM - Consolidating after recent gains with heavy volume helped it rise straight up from the bottom of its base to reach new highs. Good annual earnings history, but quarterly earnings and sales increases are below the +25% guideline.

9/24/2008 12:51:00 PM - Pulling back today after 4 consecutive gains with heavy volume helped it rise straight up from the bottom of its base to reach new highs. Good annual earnings history, but quarterly earnings and sales increases are below the +25% guideline.

9/23/2008 1:10:50 PM - Perched below recent chart highs. Good annual history yet quarterly earnings and sales increases are below the +25% guideline.

7/1/2008 - Loss 7/1/2008 on heavy volume, triggering technical sell signals while sinking well under its 200 DMA line. Based on weak technical action it was removed from the Featured Stocks list that night. Struggling since its 6/09/08 violation of its 50 DMA line raised concerns. It made very little headway, then began consolidating after it triggered a technical buy signal on 4/30/08 as it surged from a 5-month base. See the Featured Stock Update section of the 4/24/2008 CANSLIM.net After Market Update for analysis and an annotated graph (read here). Featured in the 4/16/08 CANSLIM.net Mid-Day BreakOuts Report (read here). The high-ranked leader has been talked about as an acquisition candidate, a point noted in a 4/10/08 "New America" column in the paper (read here). Good annual and quarterly earnings increases and high ranks.

7/1/2008 7:55:46 PM - G - Loss today on heavy volume, triggering technical sell signals while sinking well under its 200 DMA line. Based on weak technical action it will be dropped from the Featured Stocks list tonight. Struggling since its 6/09/08 violation of its 50 DMA line raised concerns. It made very little headway, then began consolidating after it triggered a technical buy signal on 4/30/08 as it surged from a 5-month base. See the Featured Stock Update section of the 4/24/2008 CANSLIM.net After Market Update for analysis and an annotated graph (read here). Featured in the 4/16/08 CANSLIM.net Mid-Day BreakOuts Report (read here). The high-ranked leader has been talked about as an acquisition candidate, a point noted in a 4/10/08 "New America" column in the paper (read here). Good annual and quarterly earnings increases and high ranks.

6/30/2008 11:10:18 PM - G - Hovering near support at its 200 DMA line. Struggling since its 6/09/08 violation of its 50 DMA line raised concerns. It made very little headway, then began consolidating after it triggered a technical buy signal on 4/30/08 as it surged from a 5-month base. See the Featured Stock Update section of the 4/24/2008 CANSLIM.net After Market Update for analysis and an annotated graph (read here). Featured in the 4/16/08 CANSLIM.net Mid-Day BreakOuts Report (read here). The high-ranked leader has been talked about as an acquisition candidate, a point noted in a 4/10/08 "New America" column in the paper (read here). Good annual and quarterly earnings increases and high ranks.

6/27/2008 7:12:49 PM - G - Hovering near support at its 200 DMA line. Struggling since its 6/09/08 violation of its 50 DMA line raised concerns. It made very little headway, then began consolidating after it triggered a technical buy signal on 4/30/08 as it surged from a 5-month base. See the Featured Stock Update section of the 4/24/2008 CANSLIM.net After Market Update for analysis and an annotated graph (read here). Featured in the 4/16/08 CANSLIM.net Mid-Day BreakOuts Report (read here). The high-ranked leader has been talked about as an acquisition candidate, a point noted in a 4/10/08 "New America" column in the paper (read here). Good annual and quarterly earnings increases and high ranks.

6/26/2008 4:08:36 PM - G - Small gain on above average volume today, finding support at its 200 DMA line. Struggling since its 6/09/08 violation of its 50 DMA line raised concerns. It made very little headway, then began consolidating after it triggered a technical buy signal on 4/30/08 as it surged from a 5-month base. See the Featured Stock Update section of the 4/24/2008 CANSLIM.net After Market Update for analysis and an annotated graph (read here). Featured in the 4/16/08 CANSLIM.net Mid-Day BreakOuts Report (read here). The high-ranked leader has been talked about as an acquisition candidate, a point noted in a 4/10/08 "New America" column in the paper (read here). Good annual and quarterly earnings increases and high ranks.

6/24/2008 5:09:32 PM - G - Consolidating at its 200 DMA line now, failing to produce any gains with volume conviction since its 6/09/08 violation of its 50 DMA line raised concerns. It made very little headway, then began consolidating after it triggered a technical buy signal on 4/30/08 as it surged from a 5-month base. See the Featured Stock Update section of the 4/24/2008 CANSLIM.net After Market Update for analysis and an annotated graph (read here). Featured in the 4/16/08 CANSLIM.net Mid-Day BreakOuts Report (read here). The high-ranked leader has been talked about as an acquisition candidate, a point noted in a 4/10/08 "New America" column in the paper (read here). Good annual and quarterly earnings increases and high ranks.

6/20/2008 5:09:39 PM - G - Consolidating just above recent chart lows in the $32 area that are now an important support level above its 200 DMA line. Recent violation of its 50 DMA line raised concerns. It made very little headway, then began consolidating after it triggered a technical buy signal on 4/30/08 as it surged from a 5-month base. See the Featured Stock Update section of the 4/24/2008 CANSLIM.net After Market Update for analysis and an annotated graph (read here). Featured in the 4/16/08 CANSLIM.net Mid-Day BreakOuts Report (read here). The high-ranked leader has been talked about as an acquisition candidate, a point noted in a 4/10/08 "New America" column in the paper (read here). Good annual and quarterly earnings increases and high ranks.

6/19/2008 5:53:06 PM - G - Hovering just above recent chart lows in the $32 area that are now an important support level above its 200 DMA line. Recent violation of its 50 DMA line raised concerns. It made very little headway, then began consolidating after it triggered a technical buy signal on 4/30/08 as it surged from a 5-month base. See the Featured Stock Update section of the 4/24/2008 CANSLIM.net After Market Update for analysis and an annotated graph (read here). Featured in the 4/16/08 CANSLIM.net Mid-Day BreakOuts Report (read here). The high-ranked leader has been talked about as an acquisition candidate, a point noted in a 4/10/08 "New America" column in the paper (read here). Good annual and quarterly earnings increases and high ranks.

6/17/2008 6:33:18 PM - G - Loss today on average volume, falling toward recent chart lows in the $32 area that are now an important support level above its 200 DMA line. Recent violation of its 50 DMA line raised concerns. It made very little headway, then began consolidating after it triggered a technical buy signal on 4/30/08 as it surged from a 5-month base. See the Featured Stock Update section of the 4/24/2008 CANSLIM.net After Market Update for analysis and an annotated graph (read here). Featured in the 4/16/08 CANSLIM.net Mid-Day BreakOuts Report (read here). The high-ranked leader has been talked about as an acquisition candidate, a point noted in a 4/10/08 "New America" column in the paper (read here). Good annual and quarterly earnings increases and high ranks.

6/16/2008 6:52:05 PM - G - Gain today on light volume from recent chart lows in the $32 area that are now an important support level above its 200 DMA line. Recent violation of its 50 DMA line raised concerns. It made very little headway, then began consolidating after it triggered a technical buy signal on 4/30/08 as it surged from a 5-month base. See the Featured Stock Update section of the 4/24/2008 CANSLIM.net After Market Update for analysis and an annotated graph (read here). Featured in the 4/16/08 CANSLIM.net Mid-Day BreakOuts Report (read here). The high-ranked leader has been talked about as an acquisition candidate, a point noted in a 4/10/08 "New America" column in the paper (read here). Good annual and quarterly earnings increases and high ranks.

6/12/2008 6:21:20 PM - G - Recent violations of prior chart lows and its 50 DMA line raised concerns. It made very little headway, then began consolidating after it triggered a technical buy signal on 4/30/08 as it surged from a 5-month base. See the Featured Stock Update section of the 4/24/2008 CANSLIM.net After Market Update for analysis and an annotated graph (read here). Featured in the 4/16/08 CANSLIM.net Mid-Day BreakOuts Report (read here). The high-ranked leader has been talked about as an acquisition candidate, a point noted in a 4/10/08 "New America" column in the paper (read here). Good annual and quarterly earnings increases and high ranks.

6/11/2008 4:18:32 PM - G - Fourth consecutive loss today on lighter volume, and its violations of recent chart lows and its 50 DMA line raised concerns. It made very little headway, then began consolidating after it triggered a technical buy signal on 4/30/08 as it surged from a 5-month base. See the Featured Stock Update section of the 4/24/2008 CANSLIM.net After Market Update for analysis and an annotated graph (read here). Featured in the 4/16/08 CANSLIM.net Mid-Day BreakOuts Report (read here). The high-ranked leader has been talked about as an acquisition candidate, a point noted in a 4/10/08 "New America" column in the paper (read here). Good annual and quarterly earnings increases and high ranks.

6/10/2008 10:28:17 AM - G - Gapped down today, sinking under its recent chart lows after the prior session's 50 DMA line violation raised concerns. It triggered a technical buy signal on 4/30/08 as it surged from a 5-month base, rallying above its pivot point on very heavy turnover after reporting latest quarterly results. See the Featured Stock Update section of the 4/24/2008 CANSLIM.net After Market Update for analysis and an annotated graph (read here). Featured in the 4/16/08 CANSLIM.net Mid-Day BreakOuts Report (read here). The high-ranked leader has been talked about as an acquisition candidate, a point noted in a 4/10/08 "New America" column in the paper (read here). Good annual and quarterly earnings increases and high ranks.

6/9/2008 4:11:34 PM - G - Loss today on average volume, closing under its 50 DMA line, raising concerns. It triggered a technical buy signal on 4/30/08 as it surged from a 5-month base, rallying above its pivot point on very heavy turnover after reporting latest quarterly results. See the Featured Stock Update section of the 4/24/2008 CANSLIM.net After Market Update for analysis and an annotated graph (read here). Featured in the 4/16/08 CANSLIM.net Mid-Day BreakOuts Report (read here). The high-ranked leader has been talked about as an acquisition candidate, a point noted in a 4/10/08 "New America" column in the paper (read here). Good annual and quarterly earnings increases and high ranks.

6/6/2008 6:53:57 PM - G - Quietly consolidating in recent weeks near prior chart highs and its 50 DMA line, both of which are important support levels. It triggered a technical buy signal on 4/30/08 as it surged from a 5-month base, rallying above its pivot point on very heavy turnover after reporting latest quarterly results. See the Featured Stock Update section of the 4/24/2008 CANSLIM.net After Market Update for analysis and an annotated graph (read here). Featured in the 4/16/08 CANSLIM.net Mid-Day BreakOuts Report (read here). The high-ranked leader has been talked about as an acquisition candidate, a point noted in a 4/10/08 "New America" column in the paper (read here). Good annual and quarterly earnings increases and high ranks.

6/2/2008 4:48:53 PM - G - Gapped down for a loss today on above average volume, falling back near prior chart highs that are an important support level along with its 50 DMA line ($34.74 now). It triggered a technical buy signal on 4/30/08 as it surged from a 5-month base, rallying above its pivot point on very heavy turnover after reporting latest quarterly results. See the Featured Stock Update section of the 4/24/2008 CANSLIM.net After Market Update for analysis and an annotated graph (read here). Featured in the 4/16/08 CANSLIM.net Mid-Day BreakOuts Report (read here). The high-ranked leader has been talked about as an acquisition candidate, a point noted in a 4/10/08 "New America" column in the paper (read here). Good annual and quarterly earnings increases and high ranks.

5/28/2008 6:38:47 PM - G - Gain today on above average volume, bouncing after a pullback near prior chart highs that are an important support level along with its 50 DMA line ($34.36 now). It triggered a technical buy signal on 4/30/08 as it surged from a 5-month base, rallying above its pivot point on very heavy turnover after reporting latest quarterly results. See the Featured Stock Update section of the 4/24/2008 CANSLIM.net After Market Update for analysis and an annotated graph (read here). Featured in the 4/16/08 CANSLIM.net Mid-Day BreakOuts Report (read here). The high-ranked leader has been talked about as an acquisition candidate, a point noted in a 4/10/08 "New America" column in the paper (read here). Good annual and quarterly earnings increases and high ranks.

5/27/2008 - G - Steady after fifth consecutive loss, pulling back near prior chart highs that are an important support level along with its 50 DMA line ($34.14 now). It triggered a technical buy signal on 4/30/08 as it surged from a 5-month base, rallying above its pivot point on very heavy turnover after reporting latest quarterly results. See the Featured Stock Update section of the 4/24/2008 CANSLIM.net After Market Update for analysis and an annotated graph (read here). Featured in the 4/16/08 CANSLIM.net Mid-Day BreakOuts Report (read here). The high-ranked leader has been talked about as an acquisition candidate, a point noted in a 4/10/08 "New America" column in the paper (read here). Good annual and quarterly earnings increases and high ranks.

5/23/2008 7:01:14 PM - G - Fifth consecutive loss, pulling back near prior chart highs that are an important support level along with its 50 DMA line ($34.14 now). It triggered a technical buy signal on 4/30/08 as it surged from a 5-month base, rallying above its pivot point on very heavy turnover after reporting latest quarterly results. See the Featured Stock Update section of the 4/24/2008 CANSLIM.net After Market Update for analysis and an annotated graph (read here). Featured in the 4/16/08 CANSLIM.net Mid-Day BreakOuts Report (read here). The high-ranked leader has been talked about as an acquisition candidate, a point noted in a 4/10/08 "New America" column in the paper (read here). Good annual and quarterly earnings increases and high ranks.

5/21/2008 4:35:52 PM - G - Loss on slightly above average volume today, pulling back near prior chart highs in the $35-36 area that are an important support level above its 50 DMA line ($33.96 now). It triggered a technical buy signal on 4/30/08 as it surged from a 5-month base, rallying above its pivot point on very heavy turnover after reporting latest quarterly results. See the Featured Stock Update section of the 4/24/2008 CANSLIM.net After Market Update for analysis and an annotated graph (read here). Featured in the 4/16/08 CANSLIM.net Mid-Day BreakOuts Report (read here). The high-ranked leader has been talked about as an acquisition candidate, a point noted in a 4/10/08 "New America" column in the paper (read here). Good annual and quarterly earnings increases and high ranks.

5/21/2008 4:10:41 PM - G - Loss on near average volume today, pulling back near prior chart highs in the $35-36 area that are an important support level above its 50 DMA line ($33.96 now). It triggered a technical buy signal on 4/30/08 as it surged from a 5-month base, rallying above its pivot point on very heavy turnover after reporting latest quarterly results. See the Featured Stock Update section of the 4/24/2008 CANSLIM.net After Market Update for analysis and an annotated graph (read here). Featured in the 4/16/08 CANSLIM.net Mid-Day BreakOuts Report (read here). The high-ranked leader has been talked about as an acquisition candidate, a point noted in a 4/10/08 "New America" column in the paper (read here). Good annual and quarterly earnings increases and high ranks.

5/19/2008 5:56:06 PM - G - Loss on light volume today, pulling back near prior chart highs in the $35-36 area. It triggered a technical buy signal on 4/30/08 as it surged from a 5-month base, rallying above its pivot point on very heavy turnover after reporting latest quarterly results. See the Featured Stock Update section of the 4/24/2008 CANSLIM.net After Market Update for analysis and an annotated graph (read here). Featured in the 4/16/08 CANSLIM.net Mid-Day BreakOuts Report (read here). The high-ranked leader has been talked about as an acquisition candidate, a point noted in a 4/10/08 "New America" column in the paper (read here). Good annual and quarterly earnings increases and high ranks.

5/16/2008 6:29:47 PM - G - Healthy action continues after its pullback near prior chart highs in the $35-36 area. It triggered a technical buy signal on 4/30/08 as it surged from a 5-month base, rallying above its pivot point on very heavy turnover after reporting latest quarterly results. See the Featured Stock Update section of the 4/24/2008 CANSLIM.net After Market Update for analysis and an annotated graph (read here). Featured in the 4/16/08 CANSLIM.net Mid-Day BreakOuts Report (read here). The high-ranked leader has been talked about as an acquisition candidate, a point noted in a 4/10/08 "New America" column in the paper (read here). Good annual and quarterly earnings increases and high ranks.

5/14/2008 4:50:58 PM - G - Holding up well after a pullback near prior chart highs in the $35-36 area. Negatively reversed after hitting a new high on 5/07/08. It triggered a technical buy signal on 4/30/08 as it surged from a 5-month base, rallying above its pivot point on very heavy turnover after reporting latest quarterly results. See the Featured Stock Update section of the 4/24/2008 CANSLIM.net After Market Update for analysis and an annotated graph (read here). Featured in the 4/16/08 CANSLIM.net Mid-Day BreakOuts Report (read here). The high-ranked leader has been talked about as an acquisition candidate, a point noted in a 4/10/08 "New America" column in the paper (read here). Good annual and quarterly earnings increases and high ranks.

5/13/2008 6:40:34 PM - G - Holding up well after a pullback near prior chart highs in the $35-36 area. Negatively reversed after hitting a new high on 5/07/08. It triggered a technical buy signal on 4/30/08 as it surged from a 5-month base, rallying above its pivot point on very heavy turnover after reporting latest quarterly results. See the Featured Stock Update section of the 4/24/2008 CANSLIM.net After Market Update for analysis and an annotated graph (read here). Featured in the 4/16/08 CANSLIM.net Mid-Day BreakOuts Report (read here). The high-ranked leader has been talked about as an acquisition candidate, a point noted in a 4/10/08 "New America" column in the paper (read here). Good annual and quarterly earnings increases and high ranks.

5/12/2008 5:42:47 PM - G - Rallied after a pullback near prior chart highs in the $35-36 area. Negatively reversed after hitting a new high on 5/07/08. It triggered a technical buy signal on 4/30/08 as it surged from a 5-month base, rallying above its pivot point on very heavy turnover after reporting latest quarterly results. See the Featured Stock Update section of the 4/24/2008 CANSLIM.net After Market Update for analysis and an annotated graph (read here). Featured in the 4/16/08 CANSLIM.net Mid-Day BreakOuts Report (read here). The high-ranked leader has been talked about as an acquisition candidate, a point noted in a 4/10/08 "New America" column in the paper (read here). Good annual and quarterly earnings increases and high ranks.

5/9/2008 6:54:59 PM - G - Pulled back on average or light volume this week to near prior chart highs in the $35-36 area. Negatively reversed after hitting a new high on 5/07/08. It triggered a technical buy signal on 4/30/08 as it surged from a 5-month base, rallying above its pivot point on very heavy turnover after reporting latest quarterly results. See the Featured Stock Update section of the 4/24/2008 CANSLIM.net After Market Update for analysis and an annotated graph (read here). Featured in the 4/16/08 CANSLIM.net Mid-Day BreakOuts Report (read here). The high-ranked leader has been talked about as an acquisition candidate, a point noted in a 4/10/08 "New America" column in the paper (read here). Good annual and quarterly earnings increases and high ranks.

5/8/2008 4:48:33 PM - G - Pulled back on average volume to near prior chart highs in the $35-36 area today, then recovered to close in the upper half of its intra-day range. Negatively reversed after hitting a new high on 5/07/08. It triggered a technical buy signal on 4/30/08 as it surged from a 5-month base, rallying above its pivot point on very heavy turnover after reporting latest quarterly results. See the Featured Stock Update section of the 4/24/2008 CANSLIM.net After Market Update for analysis and an annotated graph (read here). Featured in the 4/16/08 CANSLIM.net Mid-Day BreakOuts Report (read here). The high-ranked leader has been talked about as an acquisition candidate, a point noted in a 4/10/08 "New America" column in the paper (read here). Good annual and quarterly earnings increases and high ranks.

5/7/2008 3:06:49 PM - G - Negatively reversing after hitting another new high today. Trading near its max buy price. Color code changed from yellow to green. It triggered a technical buy signal on 4/30/08 as it surged from a 5-month base, rallying above its pivot point on very heavy turnover after reporting latest quarterly results. Recently, found support near its 50 DMA line. See the Featured Stock Update section of the 4/24/2008 CANSLIM.net After Market Update for analysis and an annotated graph (read here). Featured in the 4/16/08 CANSLIM.net Mid-Day BreakOuts Report (read here). The high-ranked leader has been talked about as an acquisition candidate, a point noted in a 4/10/08 "New America" column in the paper (read here). Good annual and quarterly earnings increases and high ranks. Based on weak technical action it was previously dropped from the Featured Stocks list on 1/07/08. It was featured in the December 2007 CANSLIM.net News (see here), however a proper technical buy signal was not triggered after that appearance (as a set up).

5/6/2008 3:46:51 PM - G - Hit another new high today sending it above its max buy price. Color code changing from yellow to green. It triggered a technical buy signal on 4/30/08 as it surged from a 5-month base, rallying above its pivot point on very heavy turnover after reporting latest quarterly results. Recently, found support near its 50 DMA line. See the Featured Stock Update section of the 4/24/2008 CANSLIM.net After Market Update for analysis and an annotated graph (read here). Featured in the 4/16/08 CANSLIM.net Mid-Day BreakOuts Report (read here). The high-ranked leader has been talked about as an acquisition candidate, a point noted in a 4/10/08 "New America" column in the paper (read here). Good annual and quarterly earnings increases and high ranks. Based on weak technical action it was previously dropped from the Featured Stocks list on 1/07/08. It was featured in the December 2007 CANSLIM.net News (see here), however a proper technical buy signal was not triggered after that appearance (as a set up).

5/5/2008 3:49:52 PM - Y - Light pullback on below average volume. It triggered a technical buy signal on 4/30/08 as it surged from a 5-month base, rallying above its pivot point on very heavy turnover after reporting latest quarterly results. Recently, found support near its 50 DMA line. See the Featured Stock Update section of the 4/24/2008 CANSLIM.net After Market Update for analysis and an annotated graph (read here). Featured in the 4/16/08 CANSLIM.net Mid-Day BreakOuts Report (read here). The high-ranked leader has been talked about as an acquisition candidate, a point noted in a 4/10/08 "New America" column in the paper (read here). Good annual and quarterly earnings increases and high ranks. Based on weak technical action it was previously dropped from the Featured Stocks list on 1/07/08. It was featured in the December 2007 CANSLIM.net News (see here), however a proper technical buy signal was not triggered after that appearance (as a set up).

5/2/2008 - Y - Hit a new high on about average volume. It triggered a technical buy signal on 4/30/08 as it surged from a 5-month base, rallying above its pivot point on very heavy turnover after reporting latest quarterly results. Recently, found support near its 50 DMA line. See the Featured Stock Update section of the 4/24/2008 CANSLIM.net After Market Update for analysis and an annotated graph (read here). Featured in the 4/16/08 CANSLIM.net Mid-Day BreakOuts Report (read here). The high-ranked leader has been talked about as an acquisition candidate, a point noted in a 4/10/08 "New America" column in the paper (read here). Good annual and quarterly earnings increases and high ranks. Based on weak technical action it was previously dropped from the Featured Stocks list on 1/07/08. It was featured in the December 2007 CANSLIM.net News (see here), however a proper technical buy signal was not triggered after that appearance (as a set up).

5/1/2008 6:26:02 PM - Y - Small gain today on high volume. It triggered a technical buy signal on 4/30/08 as it surged from a 5-month base, rallying above its pivot point on very heavy turnover after reporting latest quarterly results. Recently, found support near its 50 DMA line. See the Featured Stock Update section of the 4/24/2008 CANSLIM.net After Market Update for analysis and an annotated graph (read here). Featured in the 4/16/08 CANSLIM.net Mid-Day BreakOuts Report (read here). The high-ranked leader has been talked about as an acquisition candidate, a point noted in a 4/10/08 "New America" column in the paper (read here). Good annual and quarterly earnings increases and high ranks. Based on weak technical action it was previously dropped from the Featured Stocks list on 1/07/08. It was featured in the December 2007 CANSLIM.net News (see here), however a proper technical buy signal was not triggered after that appearance (as a set up).

5/1/2008 1:17:49 PM - Y - Triggered a technical buy signal on 4/30/08 as it surged from a 5-month base, rallying above its pivot point on very heavy turnover after reporting latest quarterly results. Recently, found support near its 50 DMA line. See the Featured Stock Update section of the 4/24/2008 CANSLIM.net After Market Update for analysis and an annotated graph (read here). Featured in the 4/16/08 CANSLIM.net Mid-Day BreakOuts Report (read here). The high-ranked leader has been talked about as an acquisition candidate, a point noted in a 4/10/08 "New America" column in the paper (read here). Good annual and quarterly earnings increases and high ranks. Based on weak technical action it was previously dropped from the Featured Stocks list on 1/07/08. It was featured in the December 2007 CANSLIM.net News (see here), however a proper technical buy signal was not triggered after that appearance (as a set up).

4/30/2008 3:37:47 PM - Y - Triggering a technical buy signal as it surges above its pivot point on very heavy turnover after reporting latest quarterly results. Recently, found support near its 50 DMA line. See the Featured Stock Update section of the 4/24/2008 CANSLIM.net After Market Update for analysis and an annotated graph (read here). Tested support at its 50 DMA line today, ending near the middle of its intra-day range with a 4th consecutive loss on light volume. Featured in the 4/16/08 CANSLIM.net Mid-Day BreakOuts Report (read here). It is clear of almost all overhead supply, trading near highs after a 5-month base. The high-ranked leader has been talked about as an acquisition candidate, a point noted in a 4/10/08 "New America" column in the paper (read here). Good annual and quarterly earnings increases and high ranks. Based on weak technical action it was previously dropped from the Featured Stocks list on 1/07/08. It was featured in the December 2007 CANSLIM.net News (see here), however a proper technical buy signal was not triggered after that appearance (as a set up).

4/30/2008 1:07:47 PM - Y - Jumping above its pivot point after reporting latest quarterly results. Recently, found support near its 50 DMA line. Updated $35.84 pivot point and $37.63 maximum buy price. See the Featured Stock Update section of the 4/24/2008 CANSLIM.net After Market Update for analysis and an annotated graph (read here). Tested support at its 50 DMA line today, ending near the middle of its intra-day range with a 4th consecutive loss on light volume. Featured in the 4/16/08 CANSLIM.net Mid-Day BreakOuts Report (read here). It is clear of almost all overhead supply, trading near highs after a 5-month base. The high-ranked leader has been talked about as an acquisition candidate, a point noted in a 4/10/08 "New America" column in the paper (read here). Good annual and quarterly earnings increases and high ranks. Based on weak technical action it was previously dropped from the Featured Stocks list on 1/07/08. It was featured in the December 2007 CANSLIM.net News (see here), however a proper technical buy signal was not triggered after that appearance (as a set up).

4/29/2008 - Y - Finding support near its 50 DMA line. See the Featured Stock Update section of the 4/24/2008 CANSLIM.net After Market Update for analysis and an annotated graph (read here). Tested support at its 50 DMA line today, ending near the middle of its intra-day range with a 4th consecutive loss on light volume. Featured in the 4/16/08 CANSLIM.net Mid-Day BreakOuts Report (read here). It is clear of almost all overhead supply, trading near highs after a 5-month base. The high-ranked leader has been talked about as an acquisition candidate, a point noted in a 4/10/08 "New America" column in the paper (read here). Good annual and quarterly earnings increases and high ranks. Based on weak technical action it was previously dropped from the Featured Stocks list on 1/07/08. It was featured in the December 2007 CANSLIM.net News (see here), however a proper technical buy signal was not triggered after that appearance (as a set up).

4/28/2008 3:47:25 PM - Y - Finding support near its 50 DMA line. See the Featured Stock Update section of this evening's CANSLIM.net After Market Update for analysis and an annotated graph (read here). Tested support at its 50 DMA line today, ending near the middle of its intra-day range with a 4th consecutive loss on light volume. Featured in the 4/16/08 CANSLIM.net Mid-Day BreakOuts Report (read here). It is clear of almost all overhead supply, trading near highs after a 5-month base. The high-ranked leader has been talked about as an acquisition candidate, a point noted in a 4/10/08 "New America" column in the paper (read here). Good annual and quarterly earnings increases and high ranks. Based on weak technical action it was previously dropped from the Featured Stocks list on 1/07/08. It was featured in the December 2007 CANSLIM.net News (see here), however a proper technical buy signal was not triggered after that appearance (as a set up).

4/25/2008 - Y - Finding support near its 50 DMA line. See the Featured Stock Update section of this evening's CANSLIM.net After Market Update for analysis and an annotated graph (read here). Tested support at its 50 DMA line today, ending near the middle of its intra-day range with a 4th consecutive loss on light volume. Featured in the 4/16/08 CANSLIM.net Mid-Day BreakOuts Report (read here). It is clear of almost all overhead supply, trading near highs after a 5-month base. The high-ranked leader has been talked about as an acquisition candidate, a point noted in a 4/10/08 "New America" column in the paper (read here). Good annual and quarterly earnings increases and high ranks. Based on weak technical action it was previously dropped from the Featured Stocks list on 1/07/08. It was featured in the December 2007 CANSLIM.net News (see here), however a proper technical buy signal was not triggered after that appearance (as a set up).

4/24/2008 6:29:12 PM - Y - See the Featured Stock Update section of this evening's CANSLIM.net After Market Update for analysis and an annotated graph (read here). Tested support at its 50 DMA line today, ending near the middle of its intra-day range with a 4th consecutive loss on light volume. Featured in the 4/16/08 CANSLIM.net Mid-Day BreakOuts Report (read here). It is clear of almost all overhead supply, trading near highs after a 5-month base. The high-ranked leader has been talked about as an acquisition candidate, a point noted in a 4/10/08 "New America" column in the paper (read here). Good annual and quarterly earnings increases and high ranks. Based on weak technical action it was previously dropped from the Featured Stocks list on 1/07/08. It was featured in the December 2007 CANSLIM.net News (see here), however a proper technical buy signal was not triggered after that appearance (as a set up).

4/24/2008 6:21:43 PM - Y - Tested support at its 50 DMA line today, ending near the middle of its intra-day range with a 4th consecutive loss on light volume. Featured in the 4/16/08 CANSLIM.net Mid-Day BreakOuts Report (read here). It is clear of almost all overhead supply, trading near highs after a 5-month base. The high-ranked leader has been talked about as an acquisition candidate, a point noted in a 4/10/08 "New America" column in the paper (read here). Good annual and quarterly earnings increases and high ranks. Based on weak technical action it was previously dropped from the Featured Stocks list on 1/07/08. It was featured in the December 2007 CANSLIM.net News (see here), however a proper technical buy signal was not triggered after that appearance (as a set up).

4/23/2008 6:54:06 PM - Y - Negatively reversed again today for a loss on light volume, ending near its session lows. Featured in the 4/16/08 CANSLIM.net Mid-Day BreakOuts Report (read here). It is clear of almost all overhead supply, trading near highs after a 5-month base. Good annual and quarterly earnings increases and high ranks. Based on weak technical action it was previously dropped from the Featured Stocks list on 1/07/08. It was featured in the December 2007 CANSLIM.net News (see here), however a proper technical buy signal was not triggered after that appearance (as a set up).

4/22/2008 5:46:25 PM - Y - Negative reversal today for a loss on light volume, ending near its session lows. Featured in the 4/16/08 CANSLIM.net Mid-Day BreakOuts Report (read here). It is clear of almost all overhead supply, trading near highs after a 5-month base. Good annual and quarterly earnings increases and high ranks. Based on weak technical action it was previously dropped from the Featured Stocks list on 1/07/08. It was featured in the December 2007 CANSLIM.net News (see here), however a proper technical buy signal was not triggered after that appearance (as a set up).

4/21/2008 6:38:47 PM - Y - Edging higher since featured in the 4/16/08 CANSLIM.net Mid-Day BreakOuts Report (read here). It is clear of virtually all overhead supply and trading near highs after a 5-month base. Good annual and quarterly earnings increases and high ranks. Based on weak technical action it was previously dropped from the Featured Stocks list on 1/07/08. It was featured in the December 2007 CANSLIM.net News (see here), however a proper technical buy signal was not triggered after that appearance (as a set up).

4/18/2008 4:31:38 PM - Y - Gapped up today for a gain on about average volume. Featured in the 4/16/08 CANSLIM.net Mid-Day BreakOuts Report (read here). It is clear of virtually all overhead supply and trading near highs after a 5-month base. Good annual and quarterly earnings increases and high ranks. Based on weak technical action it was previously dropped from the Featured Stocks list on 1/07/08. It was featured in the December 2007 CANSLIM.net News (see here), however a proper technical buy signal was not triggered after that appearance (as a set up).

4/16/2008 3:20:25 PM - Y - Reversed a fair part of its early gains on above average volume after being featured in today's CANSLIM.net Mid-Day BreakOuts Report (read here). It is clear of virtually all overhead supply and trading near highs after a 5-month base. Good annual and quarterly earnings increases and high ranks. Based on weak technical action it was previously dropped from the Featured Stocks list on 1/07/08. It was featured in the December 2007 CANSLIM.net News (see here), however a proper technical buy signal was not triggered after that appearance (as a set up).

4/16/2008 1:34:48 PM - Y - Gains on above average volume today have it clear of virtually all overhead supply and trading near highs after a 5-month base. Good annual and quarterly earnings increases and high ranks. Based on weak technical action it was previously dropped from the Featured Stocks list on 1/07/08. It was featured in the December 2007 CANSLIM.net News (see here), however a proper technical buy signal was not triggered after that appearance (as a set up).

1/8/2008 - Breach of its prior lows near $29 triggered additional technical sell signals yesterday. Based on the weak technical action it was dropped from the Featured Stocks list that night. Concerns were raised by its 1/03/08 loss on above average volume after encountering resistance at its 50 DMA line. High ranked company in the Computer Software-Enterprise Group which is ranked 10th on the Industry Group Rankings (1-197), satisfying the L criteria. It gapped down on 12/13/07, violating recent chart lows and triggering technical sell signals. It was just featured in the December 2007 CANSLIM.net News (see here), however a proper technical buy signal was not triggered after that appearance (as a set up). The action exemplifies why it is important to always adhere to the proper buy discipline and avoid the temptation to get in "early", before a proper buy signal is triggered. As always, stocks should be sold whenever they fall more than 7-8% from you buy price, regardless.

1/7/2008 8:10:20 PM - Y - Breach of its prior lows near $29 triggered additional technical sell signals today. Based on the weak technical action it will be dropped from the Featured Stocks list tonight. Concerns were raised by its 1/03/08 loss on above average volume after encountering resistance at its 50 DMA line. High ranked company in the Computer Software-Enterprise Group which is ranked 10th on the Industry Group Rankings (1-197), satisfying the L criteria. It gapped down on 12/13/07, violating recent chart lows and triggering technical sell signals. It was just featured in the December 2007 CANSLIM.net News (see here), however a proper technical buy signal was not triggered after that appearance (as a set up). The action exemplifies why it is important to always adhere to the proper buy discipline and avoid the temptation to get in "early", before a proper buy signal is triggered. As always, stocks should be sold whenever they fall more than 7-8% from you buy price, regardless.

1/4/2008 7:27:19 PM - Y - More concerns were raised by its 1/03/08 loss on above average volume after encountering resistance at its 50 DMA line. A breach of its prior lows near $29 would trigger additional technical sell signals. High ranked company in the Computer Software-Enterprise Group which is ranked 8th on the Industry Group Rankings (1-197), satisfying the L criteria. It gapped down on 12/13/07, violating recent chart lows and triggering technical sell signals. It was just featured in the December 2007 CANSLIM.net News (see here), however a proper technical buy signal was not triggered after that appearance (as a set up). The action exemplifies why it is important to always adhere to the proper buy discipline and avoid the temptation to get in "early", before a proper buy signal is triggered. As always, stocks should be sold whenever they fall more than 7-8% from you buy price, regardless.

1/2/2008 7:15:32 PM - Y - More concerns were raised by today's loss on above average volume after encountering resistance at its 50 DMA line. A breach of its prior lows near $29 would trigger additional technical sell signals. High ranked company in the Computer Software-Enterprise Group which is ranked 6th on the Industry Group Rankings (1-197), satisfying the L criteria. It gapped down on 12/13/07, violating recent chart lows and triggering technical sell signals. It was just featured in the December 2007 CANSLIM.net News (see here), however a proper technical buy signal was not triggered after that appearance (as a set up). The action exemplifies why it is important to always adhere to the proper buy discipline and avoid the temptation to get in "early", before a proper buy signal is triggered. As always, stocks should be sold whenever they fall more than 7-8% from you buy price, regardless.

1/1/2008 - High ranked company in the Computer Software-Enterprise Group which is ranked 6th on the Industry Group Rankings (1-197), satisfying the L criteria. Slipped back under its 50 DMA line promptly, raising concerns. It gapped down on 12/13/07, violating recent chart lows and triggering technical sell signals. It was just featured in the December 2007 CANSLIM.net News (see here), however a proper technical buy signal was not triggered after that appearance (as a set up). The action exemplifies why it is important to always adhere to the proper buy discipline and avoid the temptation to get in "early", before a proper buy signal is triggered. As always, stocks should be sold whenever they fall more than 7-8% from you buy price, regardless.