4/23/2020 12:35:37 PM - Due to report earnings news. Perched at its high. Previously noted M&A news with Nvidia (NVDA). Held its ground stubbornly since rebounding above its 50 and 200 DMA lines with big volume-driven gains. This Israel-based Electronics - Semiconductor firm reported earnings +63% with sales revenues +31% for the Dec '19 quarter versus the year ago period. Three of the past 4 comparisons were above the +25% minimum guideline (C criteria). Annual earnings (A criteria) history included a downturn in FY '17, not a good match with the fact-based investment system's guidelines. It was dropped from the Featured Stocks list on 7/17/12.

4/21/2020 12:23:31 PM - Perched at its high. Previously noted M&A news with Nvidia (NVDA). Held its ground stubbornly since rebounding above its 50 and 200 DMA lines with big volume-driven gains. Due to report earnings news on 4/23/20. This Israel-based Electronics - Semiconductor firm reported earnings +63% with sales revenues +31% for the Dec '19 quarter versus the year ago period. Three of the past 4 comparisons were above the +25% minimum guideline (C criteria). Annual earnings (A criteria) history included a downturn in FY '17, not a good match with the fact-based investment system's guidelines. It was dropped from the Featured Stocks list on 7/17/12.

4/17/2020 12:58:19 PM - Perched at its high. Previously noted M&A news with Nvidia (NVDA). Held its ground stubbornly since rebounding above its 50 and 200 DMA lines with big volume-driven gains. Due to report earnings news on 4/23/20. This Israel-based Electronics - Semiconductor firm reported earnings +63% with sales revenues +31% for the Dec '19 quarter versus the year ago period. Three of the past 4 comparisons were above the +25% minimum guideline (C criteria). Annual earnings (A criteria) history included a downturn in FY '17, not a good match with the fact-based investment system's guidelines. It was dropped from the Featured Stocks list on 7/17/12.

4/16/2020 12:49:29 PM - Gapped up and hit a new high today. Previously noted M&A news with Nvidia (NVDA). Held its ground stubbornly since rebounding above its 50 and 200 DMA lines with big volume-driven gains. This Israel-based Electronics - Semiconductor firm reported earnings +63% with sales revenues +31% for the Dec '19 quarter versus the year ago period. Three of the past 4 comparisons were above the +25% minimum guideline (C criteria). Annual earnings (A criteria) history included a downturn in FY '17, not a good match with the fact-based investment system's guidelines. It was dropped from the Featured Stocks list on 7/17/12.

4/14/2020 1:02:26 PM - Previously noted M&A news with Nvidia (NVDA). Holding its ground stubbornly since rebounding above its 50 and 200 DMA lines with big volume-driven gains. This Israel-based Electronics - Semiconductor firm reported earnings +63% with sales revenues +31% for the Dec '19 quarter versus the year ago period. Three of the past 4 comparisons were above the +25% minimum guideline (C criteria). Annual earnings (A criteria) history included a downturn in FY '17, not a good match with the fact-based investment system's guidelines. It was dropped from the Featured Stocks list on 7/17/12.

4/13/2020 12:31:47 PM - Previously noted M&A news with Nvidia (NVDA). Holding its ground stubbornly since rebounding above its 50 and 200 DMA lines with big volume-driven gains. This Israel-based Electronics - Semiconductor firm reported earnings +63% with sales revenues +31% for the Dec '19 quarter versus the year ago period. Three of the past 4 comparisons were above the +25% minimum guideline (C criteria). Annual earnings (A criteria) history included a downturn in FY '17, not a good match with the fact-based investment system's guidelines. It was dropped from the Featured Stocks list on 7/17/12.

4/7/2020 12:18:51 PM - Previously noted M&A news with Nvidia (NVDA). Holding its ground stubbornly since rebounding above its 50 and 200 DMA lines with big volume-driven gains. This Israel-based Electronics - Semiconductor firm reported earnings +63% with sales revenues +31% for the Dec '19 quarter versus the year ago period. Three of the past 4 comparisons were above the +25% minimum guideline (C criteria). Annual earnings (A criteria) history included a downturn in FY '17, not a good match with the fact-based investment system's guidelines. It was dropped from the Featured Stocks list on 7/17/12.

4/3/2020 12:17:22 PM - Previously noted M&A news with Nvidia (NVDA). Holding its ground stubbornly since rebounding above its 50 and 200 DMA lines with big volume-driven gains week. This Israel-based Electronics - Semiconductor firm reported earnings +63% with sales revenues +31% for the Dec '19 quarter versus the year ago period. Three of the past 4 comparisons were above the +25% minimum guideline (C criteria). Annual earnings (A criteria) history included a downturn in FY '17, not a good match with the fact-based investment system's guidelines. It was dropped from the Featured Stocks list on 7/17/12.

4/2/2020 12:34:02 PM - Previously noted M&A news with Nvidia (NVDA). Holding its ground stubbornly since rebounding above its 50 and 200 DMA lines with big volume-driven gains last week. This Israel-based Electronics - Semiconductor firm reported earnings +63% with sales revenues +31% for the Dec '19 quarter versus the year ago period. Three of the past 4 comparisons were above the +25% minimum guideline (C criteria). Annual earnings (A criteria) history included a downturn in FY '17, not a good match with the fact-based investment system's guidelines. It was dropped from the Featured Stocks list on 7/17/12.

4/1/2020 12:55:12 PM - Previously noted M&A news with Nvidia (NVDA). Rebounded above its 50 and 200 DMA lines with big volume-driven gains last week. This Israel-based Electronics - Semiconductor firm reported earnings +63% with sales revenues +31% for the Dec '19 quarter versus the year ago period. Three of the past 4 comparisons were above the +25% minimum guideline (C criteria). Annual earnings (A criteria) history included a downturn in FY '17, not a good match with the fact-based investment system's guidelines. It was dropped from the Featured Stocks list on 7/17/12.

3/27/2020 12:28:24 PM - Previously noted M&A news with Nvidia (NVDA). Rebounded above its 50 and 200 DMA lines with big volume-driven gains this week. This Israel-based Electronics - Semiconductor firm reported earnings +63% with sales revenues +31% for the Dec '19 quarter versus the year ago period. Three of the past 4 comparisons were above the +25% minimum guideline (C criteria). Annual earnings (A criteria) history included a downturn in FY '17, not a good match with the fact-based investment system's guidelines. It was dropped from the Featured Stocks list on 7/17/12.

3/26/2020 12:33:34 PM - Previously noted M&A news with Nvidia (NVDA). Rebounded above its 50 and 200 DMA lines with big volume-driven gains this week. This Israel-based Electronics - Semiconductor firm reported earnings +63% with sales revenues +31% for the Dec '19 quarter versus the year ago period. Three of the past 4 comparisons were above the +25% minimum guideline (C criteria). Annual earnings (A criteria) history included a downturn in FY '17, not a good match with the fact-based investment system's guidelines. It was dropped from the Featured Stocks list on 7/17/12.

3/24/2020 12:20:48 PM - Previously noted M&A news with Nvidia (NVDA). Rebounding above its 50 and 200 DMA lines with today's big volume-driven gain. This Israel-based Electronics - Semiconductor firm reported earnings +63% with sales revenues +31% for the Dec '19 quarter versus the year ago period. Three of the past 4 comparisons were above the +25% minimum guideline (C criteria). Annual earnings (A criteria) history included a downturn in FY '17, not a good match with the fact-based investment system's guidelines. It was dropped from the Featured Stocks list on 7/17/12.

3/20/2020 1:03:00 PM - Previously noted M&A news with Nvidia (NVDA). Sputtering below its 200 DMA line ($113) in recent weeks. This Israel-based Electronics - Semiconductor firm reported earnings +63% with sales revenues +31% for the Dec '19 quarter versus the year ago period. Three of the past 4 comparisons were above the +25% minimum guideline (C criteria). Annual earnings (A criteria) history included a downturn in FY '17, not a good match with the fact-based investment system's guidelines. It was dropped from the Featured Stocks list on 7/17/12.

3/18/2020 12:51:11 PM - Previously noted M&A news with Nvidia (NVDA). Slumped well below its 200 DMA line ($113). This Israel-based Electronics - Semiconductor firm reported earnings +63% with sales revenues +31% for the Dec '19 quarter versus the year ago period. Three of the past 4 comparisons were above the +25% minimum guideline (C criteria). Annual earnings (A criteria) history included a downturn in FY '17, not a good match with the fact-based investment system's guidelines. It was dropped from the Featured Stocks list on 7/17/12.

3/17/2020 1:17:19 PM - Previously noted M&A news with Nvidia (NVDA). Slumped well below its 200 DMA line ($113). This Israel-based Electronics - Semiconductor firm reported earnings +63% with sales revenues +31% for the Dec '19 quarter versus the year ago period. Three of the past 4 comparisons were above the +25% minimum guideline (C criteria). Annual earnings (A criteria) history included a downturn in FY '17, not a good match with the fact-based investment system's guidelines. It was dropped from the Featured Stocks list on 7/17/12.

3/12/2020 12:34:16 PM - Previously noted M&A news with Nvidia (NVDA). Slumping below its 200 DMA line ($113). This Israel-based Electronics - Semiconductor firm reported earnings +63% with sales revenues +31% for the Dec '19 quarter versus the year ago period. Three of the past 4 comparisons were above the +25% minimum guideline (C criteria). Annual earnings (A criteria) history included a downturn in FY '17, not a good match with the fact-based investment system's guidelines. It was dropped from the Featured Stocks list on 7/17/12.

3/6/2020 12:29:09 PM - Previously noted M&A news with Nvidia (NVDA). Slumping near its 200 DMA line ($113.59). This Israel-based Electronics - Semiconductor firm reported earnings +63% with sales revenues +31% for the Dec '19 quarter versus the year ago period. Three of the past 4 comparisons were above the +25% minimum guideline (C criteria). Annual earnings (A criteria) history included a downturn in FY '17, not a good match with the fact-based investment system's guidelines. It was dropped from the Featured Stocks list on 7/17/12.

10/18/2019 12:44:57 PM - Consolidating above support at its 200 DMA line ($109). Previously noted M&A news with Nvidia (NVDA). This Israel-based Electronics - Semiconductor firm reported earnings +22% with sales revenues +16% for the Jun '19 quarter versus the year ago period, below the +25% minimum guideline (C criteria). Up and down annual earnings (A criteria) history is not a match with the fact-based investment system's guidelines. It was dropped from the Featured Stocks list on 7/17/12.

10/11/2019 12:59:46 PM - Consolidating above support at its 200 DMA line ($108). Previously noted M&A news with Nvidia (NVDA). This Israel-based Electronics - Semiconductor firm reported earnings +22% with sales revenues +16% for the Jun '19 quarter versus the year ago period, below the +25% minimum guideline (C criteria). Up and down annual earnings (A criteria) history is not a match with the fact-based investment system's guidelines. It was dropped from the Featured Stocks list on 7/17/12.

10/8/2019 12:50:30 PM - Consolidating above support at its 200 DMA line ($108). Previously noted M&A news with Nvidia (NVDA). This Israel-based Electronics - Semiconductor firm reported earnings +22% with sales revenues +16% for the Jun '19 quarter versus the year ago period, below the +25% minimum guideline (C criteria). Up and down annual earnings (A criteria) history is not a match with the fact-based investment system's guidelines. It was dropped from the Featured Stocks list on 7/17/12.

9/20/2019 12:10:32 PM - Found support at its 200 DMA line. Previously noted M&A news with Nvidia (NVDA). This Israel-based Electronics - Semiconductor firm reported earnings +22% with sales revenues +16% for the Jun '19 quarter versus the year ago period, below the +25% minimum guideline (C criteria). Up and down annual earnings (A criteria) history is not a match with the fact-based investment system's guidelines. It was dropped from the Featured Stocks list on 7/17/12.

9/12/2019 12:45:25 PM - Found support at its 200 DMA line. Previously noted M&A news with Nvidia (NVDA). This Israel-based Electronics - Semiconductor firm reported earnings +22% with sales revenues +16% for the Jun '19 quarter versus the year ago period, below the +25% minimum guideline (C criteria). Up and down annual earnings (A criteria) history is not a match with the fact-based investment system's guidelines. It was dropped from the Featured Stocks list on 7/17/12.

9/5/2019 12:40:30 PM - Consolidating near its 200 DMA line. Previously noted M&A news with Nvidia (NVDA). This Israel-based Electronics - Semiconductor firm reported earnings +22% with sales revenues +16% for the Jun '19 quarter versus the year ago period, below the +25% minimum guideline (C criteria). Up and down annual earnings (A criteria) history is not a match with the fact-based investment system's guidelines. It was dropped from the Featured Stocks list on 7/17/12.

8/13/2019 12:26:28 PM - Consolidating in a tight range since previously noted M&A news with Nvidia (NVDA). This Israel-based Electronics - Semiconductor firm reported earnings +22% with sales revenues +16% for the Jun '19 quarter versus the year ago period, below the +25% minimum guideline (C criteria). Up and down annual earnings (A criteria) history is not a match with the fact-based investment system's guidelines. It was dropped from the Featured Stocks list on 7/17/12.

8/5/2019 12:46:21 PM - Consolidating in a tight range since previously noted M&A news with Nvidia (NVDA). This Israel-based Electronics - Semiconductor firm reported earnings +22% with sales revenues +16% for the Jun '19 quarter versus the year ago period, below the +25% minimum guideline (C criteria). Up and down annual earnings (A criteria) history is not a match with the fact-based investment system's guidelines. It was dropped from the Featured Stocks list on 7/17/12.

7/1/2019 12:31:07 PM - Still consolidating below its 50 DMA line ($114) since last noted in the 6/18/19 mid-day report - "Gapped up 3/11/19 on M&A news with Nvidia (NVDA). This Israel-based Electronics - Semiconductor firm reported earnings +62% with sales revenues +22% for the Mar '19 quarter versus the year ago period, its 5th strong quarter. Up and down annual earnings (A criteria) history is not a match with the fact-based investment system's guidelines. It was dropped from the Featured Stocks list on 7/17/12."

6/18/2019 12:18:14 PM - Consolidating below its 50 DMA line. Gapped up 3/11/19 on M&A news with Nvidia (NVDA). This Israel-based Electronics - Semiconductor firm reported earnings +62% with sales revenues +22% for the Mar '19 quarter versus the year ago period, its 5th strong quarter. Up and down annual earnings (A criteria) history is not a match with the fact-based investment system's guidelines. It was dropped from the Featured Stocks list on 7/17/12.

5/17/2019 12:55:37 PM - Consolidating since a gap up 3/11/19 on M&A news with Nvidia (NVDA). This Israel-based Electronics - Semiconductor firm reported earnings +62% with sales revenues +22% for the Mar '19 quarter versus the year ago period, its 5h strong quarter. Up and down annual earnings (A criteria) history is not a match with the fact-based investment system's guidelines. It was dropped from the Featured Stocks list on 7/17/12.

3/20/2019 1:11:04 PM - Gapped up hitting a new 52-week high on 3/11/19 M&A news with Nvidia (NVDA). This Israel-based Electronics - Semiconductor firm reported earnings +73% with sales revenues +22% for the Dec '18 quarter versus the year ago period, its 4th strong quarter. Up and down annual earnings (A criteria) history is not a match with the fact-based investment system's guidelines. It was dropped from the Featured Stocks list on 7/17/12.

3/14/2019 1:17:43 PM - Gapped up hitting a new 52-week high on 3/11/19 M&A news with Nvidia (NVDA). This Israel-based Electronics - Semiconductor firm reported earnings +73% with sales revenues +22% for the Dec '18 quarter versus the year ago period, its 4th strong quarter. Up and down annual earnings (A criteria) history is not a match with the fact-based investment system's guidelines. It was dropped from the Featured Stocks list on 7/17/12.

3/13/2019 12:28:55 PM - Gapped up hitting a new 52-week high on 3/11/19 M&A news with Nvidia (NVDA). This Israel-based Electronics - Semiconductor firm reported earnings +73% with sales revenues +22% for the Dec '18 quarter versus the year ago period, its 4th strong quarter. Up and down annual earnings (A criteria) history is not a match with the fact-based investment system's guidelines. It was dropped from the Featured Stocks list on 7/17/12.

3/12/2019 12:35:37 PM - Gapped up hitting a new 52-week high on 3/11/19 M&A news with Nvidia (NVDA). This Israel-based Electronics - Semiconductor firm reported earnings +73% with sales revenues +22% for the Dec '18 quarter versus the year ago period, its 4th strong quarter. Up and down annual earnings (A criteria) history is not a match with the fact-based investment system's guidelines. It was dropped from the Featured Stocks list on 7/17/12.

3/11/2019 12:21:11 PM - Gapped up today hitting a new 52-week high. Found support near its 200 DMA line during its consolidation since 11/08/18 M&A news. This Israel-based Electronics - Semiconductor firm reported earnings +73% with sales revenues +22% for the Dec '18 quarter versus the year ago period, its 4th strong quarter. Up and down annual earnings (A criteria) history is not a match with the fact-based investment system's guidelines. Survived but failed to impress since it was dropped from the Featured Stocks list on 7/17/12.

3/4/2019 12:23:29 PM - Touched another new 52-week high today after recently wedging higher. Found support near its 200 DMA line during its consolidation since 11/08/18 M&A news. This Israel-based Electronics - Semiconductor firm reported earnings +73% with sales revenues +22% for the Dec '18 quarter versus the year ago period, its 4th strong quarter. Up and down annual earnings (A criteria) history is not a match with the fact-based investment system's guidelines. Survived but failed to impress since it was dropped from the Featured Stocks list on 7/17/12.

2/25/2019 12:53:29 PM - Quietly hitting another new 52-week high today. Found support near its 200 DMA line during its consolidation since 11/08/18 M&A news. This Israel-based Electronics - Semiconductor firm reported earnings +73% with sales revenues +22% for the Dec '18 quarter versus the year ago period, its 4th strong quarter. Up and down annual earnings (A criteria) history is not a match with the fact-based investment system's guidelines. Survived but failed to impress since it was dropped from the Featured Stocks list on 7/17/12.

2/20/2019 12:38:37 PM - Hitting a new 52-week high today. Found support near its 200 DMA line during its consolidation since 11/08/18 M&A news. This Israel-based Electronics - Semiconductor firm reported earnings +73% with sales revenues +22% for the Dec '18 quarter versus the year ago period, its 4th strong quarter. Up and down annual earnings (A criteria) history is not a match with the fact-based investment system's guidelines. Survived but failed to impress since it was dropped from the Featured Stocks list on 7/17/12.

2/13/2019 12:57:27 PM - Inching into new 52-week high territory. Found support near its 200 DMA line during its consolidation since 11/08/18 M&A news. This Israel-based Electronics - Semiconductor firm reported earnings +73% with sales revenues +22% for the Dec '18 quarter versus the year ago period, its 4th strong quarter. Up and down annual earnings (A criteria) history is not a match with the fact-based investment system's guidelines. Survived but failed to impress since it was dropped from the Featured Stocks list on 7/17/12.

2/4/2019 1:02:13 PM - Challenging its 52-week high with today's 4th consecutive volume-driven gain. This Israel-based Electronics - Semiconductor firm reported earnings +73% with sales revenues +22% for the Dec '18 quarter versus the year ago period, its 4th strong quarter. Consolidating since 11/08/18 M&A news. Up and down annual earnings (A criteria) history is not a match with the fact-based investment system's guidelines. Survived but failed to impress since it was dropped from the Featured Stocks list on 7/17/12.

2/1/2019 1:15:40 PM - Challenging its 52-week high with today's 3rd consecutive volume-driven gain. This Israel-based Electronics - Semiconductor firm reported earnings +73% with sales revenues +22% for the Dec '18 quarter versus the year ago period, its 4th strong quarter. Consolidating since 11/08/18 M&A news. Up and down annual earnings (A criteria) history is not a match with the fact-based investment system's guidelines. Survived but failed to impress since it was dropped from the Featured Stocks list on 7/17/12.

1/31/2019 12:58:40 PM - Gapped up today after this Israel-based Electronics - Semiconductor firm reported earnings +73% with sales revenues +22% for the Dec '18 quarter versus the year ago period, its 4th strong quarter. Consolidating since 11/08/18 M&A news. Up and down annual earnings (A criteria) history is not a match with the fact-based investment system's guidelines. Survived but failed to impress since it was dropped from the Featured Stocks list on 7/17/12.

1/30/2019 2:10:07 PM - Consolidating since 11/08/18 M&A news. Gapped up on 10/26/18 for a considerable volume-driven gain and rallied straight up from the bottom of a 19-week base. This Israel-based Electronics - Semiconductor firm reported earnings +87% with sales revenues +24% for the Sep '18 quarter versus the year ago period, its 3rd strong quarter. Up and down annual earnings (A criteria) history is not a match with the fact-based investment system's guidelines. Survived but failed to impress since it was dropped from the Featured Stocks list on 7/17/12.

12/19/2018 12:24:58 PM - Hovering near its 52-week high after 11/08/18 M&A news. Gapped up on 10/26/18 for a considerable volume-driven gain and rallied straight up from the bottom of a 19-week base. This Israel-based Electronics - Semiconductor firm reported earnings +87% with sales revenues +24% for the Sep '18 quarter versus the year ago period, its 3rd strong quarter. Up and down annual earnings (A criteria) history is not a match with the fact-based investment system's guidelines. Survived but failed to impress since it was dropped from the Featured Stocks list on 7/17/12.

11/20/2018 12:32:54 PM - Perched at its 52-week high after 11/08/18 M&A news. Gapped up on 10/26/18 for a considerable volume-driven gain and rallied straight up from the bottom of a 19-week base. This Israel-based Electronics - Semiconductor firm reported earnings +87% with sales revenues +24% for the Sep '18 quarter versus the year ago period, its 3rd strong quarter. Up and down annual earnings (A criteria) history is not a match with the fact-based investment system's guidelines. Survived but failed to impress since it was dropped from the Featured Stocks list on 7/17/12.

11/19/2018 12:35:22 PM - Perched at its 52-week high after 11/08/18 M&A news. Gapped up on 10/26/18 for a considerable volume-driven gain and rallied straight up from the bottom of a 19-week base. This Israel-based Electronics - Semiconductor firm reported earnings +87% with sales revenues +24% for the Sep '18 quarter versus the year ago period, its 3rd strong quarter. Up and down annual earnings (A criteria) history is not a match with the fact-based investment system's guidelines. Survived but failed to impress since it was dropped from the Featured Stocks list on 7/17/12.

11/14/2018 12:59:34 PM - Perched at its 52-week high after 11/08/18 M&A news. Gapped up on 10/26/18 for a considerable volume-driven gain and rallied straight up from the bottom of a 19-week base. This Israel-based Electronics - Semiconductor firm reported earnings +87% with sales revenues +24% for the Sep '18 quarter versus the year ago period, its 3rd strong quarter. Up and down annual earnings (A criteria) history is not a match with the fact-based investment system's guidelines. Survived but failed to impress since it was dropped from the Featured Stocks list on 7/17/12.

11/12/2018 12:42:02 PM - Perched at its 52-week high after 11/08/18 M&A news. Gapped up on 10/26/18 for a considerable volume-driven gain and rallied straight up from the bottom of a 19-week base. This Israel-based Electronics - Semiconductor firm reported earnings +87% with sales revenues +24% for the Sep '18 quarter versus the year ago period, its 3rd strong quarter. Up and down annual earnings (A criteria) history is not a match with the fact-based investment system's guidelines. Survived but failed to impress since it was dropped from the Featured Stocks list on 7/17/12.

11/9/2018 1:23:19 PM - Perched at its 52-week high after 11/08/18 M&A news. Gapped up on 10/26/18 for a considerable volume-driven gain and rallied straight up from the bottom of a 19-week base. This Israel-based Electronics - Semiconductor firm reported earnings +87% with sales revenues +24% for the Sep '18 quarter versus the year ago period, its 3rd strong quarter. Up and down annual earnings (A criteria) history is not a match with the fact-based investment system's guidelines. Survived but failed to impress since it was dropped from the Featured Stocks list on 7/17/12.

11/8/2018 12:06:09 PM - Perched at its 52-week high after M&A news. Gapped up on 10/26/18 for a considerable volume-driven gain and rallied straight up from the bottom of a 19-week base. This Israel-based Electronics - Semiconductor firm reported earnings +87% with sales revenues +24% for the Sep '18 quarter versus the year ago period, its 3rd strong quarter. Up and down annual earnings (A criteria) history is not a match with the fact-based investment system's guidelines. Survived but failed to impress since it was dropped from the Featured Stocks list on 7/17/12.

11/1/2018 12:29:50 PM - Gapped up on 10/26/18 for a considerable volume-driven gain, rallying straight up from the bottom of a 19-week base and nearly challenging its 52-week high. This Israel-based Electronics - Semiconductor firm reported earnings +87% with sales revenues +24% for the Sep '18 quarter versus the year ago period, its 3rd strong quarter. Noted with caution in prior mid-day reports - "Prior quarterly comparisons were not strong and steady. Up and down annual earnings (A criteria) history is not a match with the fact-based investment system's guidelines. Survived but failed to impress since it was dropped from the Featured Stocks list on 7/17/12."

10/30/2018 11:47:48 AM - Gapped up on 10/26/18 for a considerable volume-driven gain, rallying straight up from the bottom of a 19-week base and nearly challenging its 52-week high. This Israel-based Electronics - Semiconductor firm reported earnings +87% with sales revenues +24% for the Sep '18 quarter versus the year ago period, its 3rd strong quarter. Noted with caution in prior mid-day reports - "Prior quarterly comparisons were not strong and steady. Up and down annual earnings (A criteria) history is not a match with the fact-based investment system's guidelines. Survived but failed to impress since it was dropped from the Featured Stocks list on 7/17/12."

10/29/2018 12:07:53 PM - Gapped up on the prior session for a considerable volume-driven gain, rallying straight up from the bottom of a 19-week base and nearly challenging its 52-week high. This Israel-based Electronics - Semiconductor firm reported earnings +87% with sales revenues +24% for the Sep '18 quarter versus the year ago period, its 3rd strong quarter. Noted with caution in prior mid-day reports - "Prior quarterly comparisons were not strong and steady. Up and down annual earnings (A criteria) history is not a match with the fact-based investment system's guidelines. Survived but failed to impress since it was dropped from the Featured Stocks list on 7/17/12."

10/26/2018 12:50:50 PM - Gapped up today for a considerable volume-driven gain, rallying straight up from the bottom of a 19-week base and nearly challenging its 52-week high. This Israel-based Electronics - Semiconductor firm reported earnings +87% with sales revenues +24% for the Sep '18 quarter versus the year ago period, its 3rd strong quarter. Noted with caution in prior mid-day reports - "Prior quarterly comparisons were not strong and steady. Up and down annual earnings (A criteria) history is not a match with the fact-based investment system's guidelines. Survived but failed to impress since it was dropped from the Featured Stocks list on 7/17/12."

9/4/2018 12:59:25 PM - Sputtering and slumping back below its 50 DMA line with today's big loss on higher volume. Last noted with caution in the 7/20/18 mid-day report - "This Israel-based Electronics - Semiconductor firm reported earnings +184% with sales revenues +27% for the Jun '18 quarter versus the year ago period, its 2nd strong quarter. Prior quarterly comparisons were not strong and steady. Up and down annual earnings (A criteria) history is not a match with the fact-based investment system's guidelines. Survived but failed to impress since it was dropped from the Featured Stocks list on 7/17/12."

7/20/2018 11:33:39 AM - Sputtering near its 50 DMA line. This Israel-based Electronics - Semiconductor firm reported earnings +184% with sales revenues +27% for the Jun '18 quarter versus the year ago period, its 2nd strong quarter. Prior quarterly comparisons were not strong and steady. Up and down annual earnings (A criteria) history is not a match with the fact-based investment system's guidelines. Survived but failed to impress since it was dropped from the Featured Stocks list on 7/17/12.

7/18/2018 12:00:01 PM - Sputtering near its 50 DMA line. This Israel-based Electronics - Semiconductor firm reported earnings +184% with sales revenues +27% for the Jun '18 quarter versus the year ago period, its 2nd strong quarter. Prior quarterly comparisons were not strong and steady. Up and down annual earnings (A criteria) history is not a match with the fact-based investment system's guidelines. Survived but failed to impress since it was dropped from the Featured Stocks list on 7/17/12.

7/12/2018 12:17:58 PM - Violating its 50 DMA line with today's volume-driven loss. Noted with caution in the 6/20/18 mid-day report when hitting a new 52-week high - "This Israel-based Electronics - Semiconductor firm reported earnings +238% with sales revenues +33% for the Mar '18 quarter versus the year ago period. Prior quarterly comparisons were not strong and steady. Up and down annual earnings (A criteria) history is not a match with the fact-based investment system's guidelines. Survived but failed to impress since it was dropped from the Featured Stocks list on 7/17/12."

7/10/2018 12:44:25 PM - Recently testing support at its 50 DMA line. Noted with caution in the 6/20/18 mid-day report when hitting a new 52-week high - "This Israel-based Electronics - Semiconductor firm reported earnings +238% with sales revenues +33% for the Mar '18 quarter versus the year ago period. Prior quarterly comparisons were not strong and steady. Up and down annual earnings (A criteria) history is not a match with the fact-based investment system's guidelines. Survived but failed to impress since it was dropped from the Featured Stocks list on 7/17/12."

6/26/2018 12:25:08 PM - Retesting support at its 50 DMA line. Last noted with caution when hitting a new 52-week high in the 6/20/18 mid-day report - "This Israel-based Electronics - Semiconductor firm reported earnings +238% with sales revenues +33% for the Mar '18 quarter versus the year ago period. Prior quarterly comparisons were not strong and steady. Up and down annual earnings (A criteria) history is not a match with the fact-based investment system's guidelines. Survived but failed to impress since it was dropped from the Featured Stocks list on 7/17/12."

6/20/2018 12:40:45 PM - Gapped up today for a considerable gain hitting a new 52-week high after testing support at its 50 DMA line. Made gradual progress since noted in the 4/18/18 mid-day report - "This Israel-based Electronics - Semiconductor firm reported earnings +238% with sales revenues +33% for the Mar '18 quarter versus the year ago period. Prior quarterly comparisons were not strong and steady. Up and down annual earnings (A criteria) history is not a match with the fact-based investment system's guidelines. Survived but failed to impress since it was dropped from the Featured Stocks list on 7/17/12."

5/17/2018 12:44:21 PM - Hitting a new 52-week high today. Made gradual progress since last noted in the 4/18/18 mid-day report - "This Israel-based Electronics - Semiconductor firm reported earnings +238% with sales revenues +33% for the Mar '18 quarter versus the year ago period. Prior quarterly comparisons were not strong and steady. Up and down annual earnings (A criteria) history is not a match with the fact-based investment system's guidelines. Survived but failed to impress since it was dropped from the Featured Stocks list on 7/17/12."

4/18/2018 1:28:39 PM - Churning above average volume while recently hovering near its 52-week high in a tight range. This Israel-based Electronics - Semiconductor firm reported earnings +238% with sales revenues +33% for the Mar '18 quarter versus the year ago period. Prior quarterly comparisons were not strong and steady. Up and down annual earnings (A criteria) history is not a match with the fact-based investment system's guidelines. Survived but failed to impress since it was dropped from the Featured Stocks list on 7/17/12.

4/15/2016 12:41:58 PM - Hovering near its 52-week high in a tight range with volume totals cooling since this Israel-based Electronics - Semiconductor firm was last noted with caution in the 3/22/16 mid-day report - "Reported +25% sales revenues and +31% earnings increases for the Dec '15 quarter versus the year ago period, and prior quarterly comparisons were even stronger. Up and down annual earnings (A criteria) history is not a match with the fact-based investment system's guidelines. Survived but failed to impress since it was dropped from the Featured Stocks list on 7/17/12."

3/22/2016 11:51:31 AM - Hitting another new 52-week high with today's 5th consecutive gain. This Israel-based Electronics - Semiconductor firm was noted with caution in prior reports - "Reported +25% sales revenues and +31% earnings increases for the Dec '15 quarter versus the year ago period, and prior quarterly comparisons were even stronger. Up and down annual earnings (A criteria) history is not a match with the fact-based investment system's guidelines. Survived but failed to impress since it was dropped from the Featured Stocks list on 7/17/12."

3/21/2016 12:46:29 PM - Hitting a new 52-week high with today's 4th consecutive gain. This Israel-based Electronics - Semiconductor firm was noted with caution in prior reports - "Reported +25% sales revenues and +31% earnings increases for the Dec '15 quarter versus the year ago period, and prior quarterly comparisons were even stronger. Up and down annual earnings (A criteria) history is not a match with the fact-based investment system's guidelines. Survived but failed to impress since it was dropped from the Featured Stocks list on 7/17/12."

3/8/2016 12:26:41 PM - Pulling back for a 4th consecutive loss after a recent streak of volume-driven gains to nearly challenge its 52-week high. Prior reports cautioned - "Reported +25% sales revenues and +31% earnings increases for the Dec '15 quarter versus the year ago period, and prior quarterly comparisons were even stronger. Up and down annual earnings (A criteria) history is not a match with the fact-based investment system's guidelines. Survived but failed to impress since it was dropped from the Featured Stocks list on 7/17/12."

2/26/2016 12:29:14 PM - Making its 4th consecutive mid-day report appearance and adding to a streak of volume-driven gains to nearly challenge its 52-week high. Prior reports cautioned - "Reported +25% sales revenues and +31% earnings increases for the Dec '15 quarter versus the year ago period, and prior quarterly comparisons were even stronger. Up and down annual earnings (A criteria) history is not a match with the fact-based investment system's guidelines. Survived but failed to impress since it was dropped from the Featured Stocks list on 7/17/12."

2/25/2016 12:27:38 PM - Reported +25% sales revenues and +31% earnings increases for the Dec '15 quarter versus the year ago period, and prior quarterly comparisons were even stronger. Up and down annual earnings (A criteria) history is not a match with the fact-based investment system's guidelines. Survived but failed to impress since it was dropped from the Featured Stocks list on 7/17/12.

2/24/2016 12:19:16 PM - Reported improved sales and earnings increases in quarterly comparisons through Dec '15 but fundamental concerns remain. Noted with caution in prior mid-day reports - "Prior quarterly and annual earnings history is not a match with the fact-based investment system's guidelines (C and A criteria). Survived but failed to impress since it was dropped from the Featured Stocks list on 7/17/12."

2/23/2016 12:37:39 PM - Reported improved sales and earnings increases in quarterly comparisons through Dec '15 but fundamental concerns remain. There was a "negative reversal" after hitting a new 52-week high and it has been sputtering since last noted with caution in the 6/18/15 mid-day report - "Prior quarterly and annual earnings history is not a match with the fact-based investment system's guidelines (C and A criteria). Survived but failed to impress since it was dropped from the Featured Stocks list on 7/17/12."

6/18/2015 12:52:20 PM - Hitting new 52-week highs with volume-driven gains this week. Made gradual progress and held its ground near prior highs in the $50 area while consolidating since last noted with caution in the 5/14/15 mid-day report - "Reported greatly improved sales revenues and earnings increases in the Dec '14 and Mar '15 quarters. Prior quarterly and annual earnings history is not a match with the fact-based investment system's guidelines (C and A criteria). Survived but failed to impress since it was dropped from the Featured Stocks list on 7/17/12."

5/14/2015 1:35:01 PM - Reported greatly improved sales revenues and earnings increases in the Dec '14 and Mar '15 quarters. Prior quarterly and annual earnings history is not a match with the fact-based investment system's guidelines (C and A criteria). Survived but failed to impress since it was dropped from the Featured Stocks list on 7/17/12.

9/7/2012 12:25:42 PM - Gapped down today, pulling back from its all-time high with above average volume. It did not form a sound base or secondary buy point since noted in the 7/26/12 mid-day report - "It may go on to produce more climactic gains, meanwhile it has stubbornly held its ground following a huge 7/19/12 gap up gain for a new high after reporting earnings +267% on +111% sales revenues for the quarter ended June 30, 2012 versus the year ago period. Did not form a sound new base pattern, yet found prompt support after a streak of losses capped by a violation of its 50 DMA line triggered a technical sell signal. Weak action had prompted it to be dropped from the Featured Stocks list on 7/17/12."

9/4/2012 12:22:32 PM - Stubbornly holding its ground and wedging higher without forming a sound base or secondary buy point since last noted in the 7/26/12 mid-day report - "It may go on to produce more climactic gains, meanwhile it has stubbornly held its ground following a huge 7/19/12 gap up gain for a new high after reporting earnings +267% on +111% sales revenues for the quarter ended June 30, 2012 versus the year ago period. Did not form a sound new base pattern, yet found prompt support after a streak of losses capped by a violation of its 50 DMA line triggered a technical sell signal. Weak action had prompted it to be dropped from the Featured Stocks list on 7/17/12."

7/26/2012 12:34:33 PM - Gapped up today for another new high. Prior mid-day reports noted - "It may go on to produce more climactic gains, meanwhile it has stubbornly held its ground following a huge 7/19/12 gap up gain for a new high after reporting earnings +267% on +111% sales revenues for the quarter ended June 30, 2012 versus the year ago period. Did not form a sound new base pattern, yet found prompt support after a streak of losses capped by a violation of its 50 DMA line triggered a technical sell signal. Weak action had prompted it to be dropped from the Featured Stocks list on 7/17/12."

7/25/2012 12:46:33 PM - It may go on to produce more climactic gains, meanwhile it has stubbornly held its ground following a huge 7/19/12 gap up gain for a new high after reporting earnings +267% on +111% sales revenues for the quarter ended June 30, 2012 versus the year ago period. Did not form a sound new base pattern, yet found prompt support after a streak of losses capped by a violation of its 50 DMA line triggered a technical sell signal. Weak action had prompted it to be dropped from the Featured Stocks list on 7/17/12.

7/24/2012 12:14:57 PM - It may go on to produce more climactic gains, while now consolidating following a huge 7/19/12 gap up gain for a new high after reporting earnings +267% on +111% sales revenues for the quarter ended June 30, 2012 versus the year ago period. Did not form a sound new base pattern, yet found prompt support after a streak of losses capped by a violation of its 50 DMA line triggered a technical sell signal. Weak action had prompted it to be dropped from the Featured Stocks list on 7/17/12.

7/23/2012 12:43:55 PM - It may go on to produce more climactic gains, yet it is pulling back again today, consolidating following a huge 7/19/12 gap up gain for a new high after reporting earnings +267% on +111% sales revenues for the quarter ended June 30, 2012 versus the year ago period. Did not form a sound new base pattern, yet found prompt support after a streak of losses capped by a violation of its 50 DMA line triggered a technical sell signal. Weak action had prompted it to be dropped from the Featured Stocks list on 7/17/12.

7/19/2012 11:52:26 AM - Huge gap up gain for a new high today came after reporting earnings +267% on +111% sales revenues for the quarter ended June 30, 2012 versus the year ago period. It found prompt support on the prior session after a violation of its 50 DMA line had triggered a technical sell signal. It did not form a sound new base pattern, and weak action had prompted it to be dropped from the Featured Stocks list on 7/17/12.

7/17/2012 5:50:07 PM - Down today with above average volume for an 8th consecutive loss, violating its 50 DMA line and triggering a technical sell signal. Based on weak action it ended -19.9% off its 52-week high and it will be dropped from the Featured Stocks list tonight.

7/17/2012 11:12:08 AM - G - Down today for an 8th consecutive loss, trading under its 50 DMA line, raising concerns. As previously noted - "A damaging violation of that important short-term average would trigger a more worrisome technical sell signal."

7/16/2012 12:24:01 PM - G - Distributional action raised some concerns as it recently undercut its pivot point, and today it is still testing support at its 50 DMA line. A damaging violation of that important short-term average would trigger a more worrisome technical sell signal.

7/11/2012 2:45:29 PM - G - Pulling back for a damaging 4th consecutive loss today with ever-increasing volume, undercutting its pivot point and raising concerns. Recent chart lows define important support to watch nearly coinciding with its 50 DMA line.

7/10/2012 12:30:05 PM - G - Pulling back for a 3rd consecutive loss today, retreating from its all-time high after getting extended from its prior base with a spurt of volume-driven gains. Recent chart lows define important support to watch nearly coinciding with its 50 DMA line.

7/6/2012 6:27:40 PM - G - Pulled back today on average volume from its all-time high after getting extended from its prior base with a spurt of volume-driven gains. Recent chart lows define near-term support to watch above its 50 DMA line.

7/5/2012 12:12:05 PM - G - Today's 4th consecutive gain helped it hit another new all-time high, getting more extended from its prior base. Recent chart lows define near-term support to watch above its 50 DMA line.

7/3/2012 1:53:01 PM - G - Today's 3rd consecutive gain on lighter volume lifted it to another new all-time high, getting more extended from its prior base. Recent chart lows define near-term support to watch above its 50 DMA line.

7/2/2012 12:32:27 PM - G - Perched near its all-time high, extended from its prior base. Recent chart lows define near-term support to watch above its 50 DMA line.

6/29/2012 6:03:46 PM - G - Tallied a solid gain with higher volume after gapping up today. Closed near the session high and finished above its "max buy" level, and its color code is changed to green. Its recent chart lows define support to watch above its 50 DMA line.

6/28/2012 5:53:50 PM - Y - Loss on below average volume today led to a close just below its pivot point. Prior highs define chart support to watch. Disciplined investors limit losses if ever a stock falls more than -7% from their purchase price.

6/25/2012 5:38:01 PM - Y - Finished the session in the upper third of its intra-day range and above its pivot point, but it was its 3rd loss with above average volume in the span of 4 sessions. Prior highs define chart support to watch. Disciplined investors limit losses if ever a stock falls more than -7% from their purchase price.

6/25/2012 12:46:01 PM - Y - Pulling back again today near its pivot point and prior chart highs that define chart support to watch. Disciplined investors limit losses if ever a stock falls more than -7% from their purchase price.

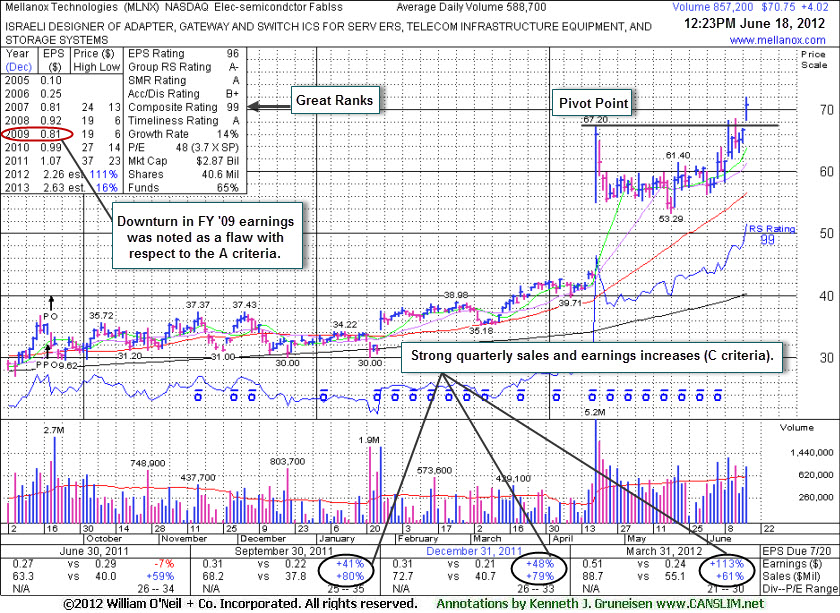

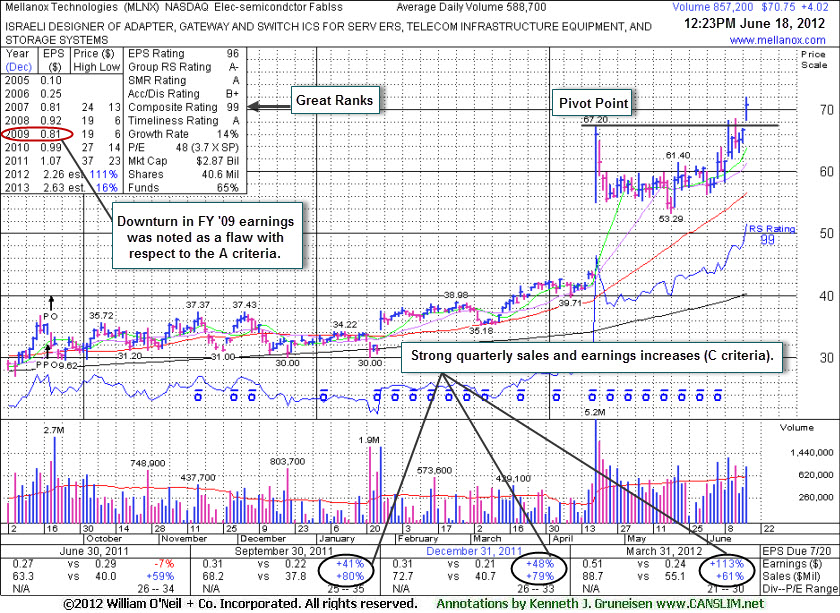

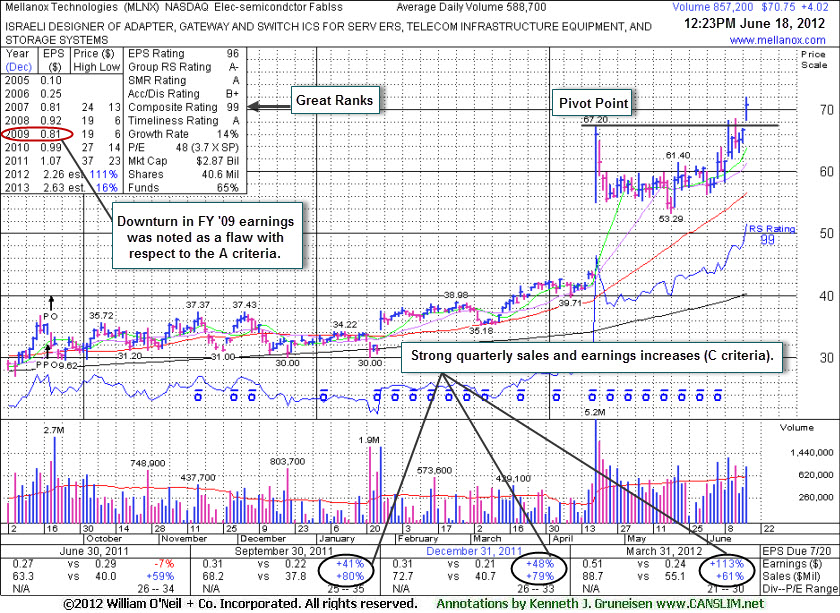

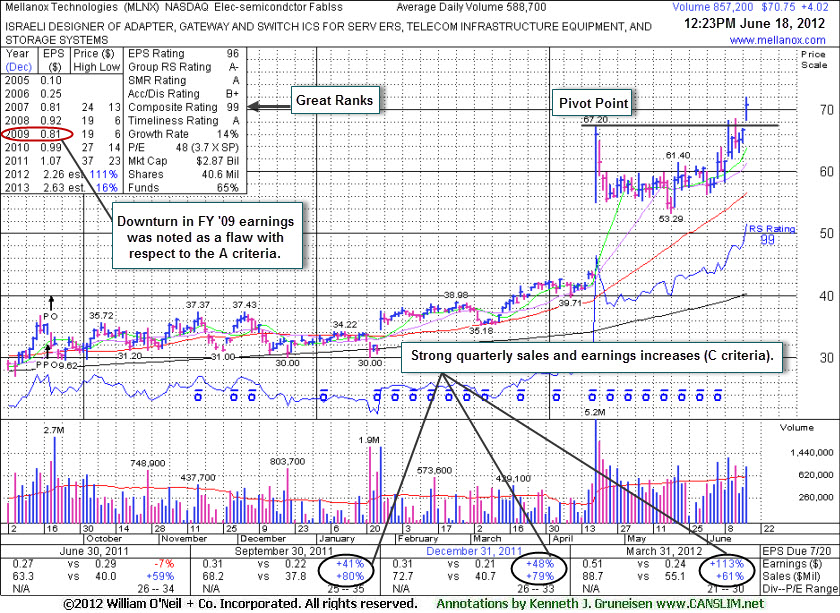

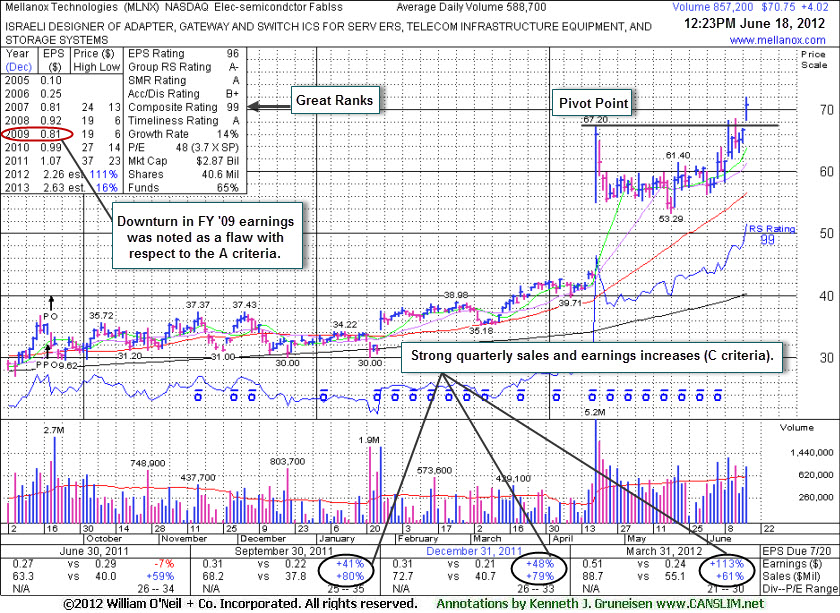

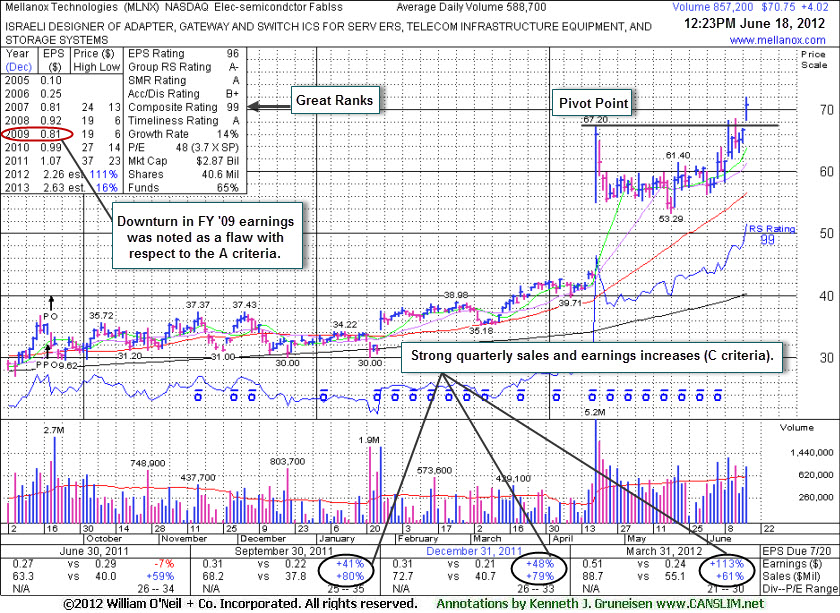

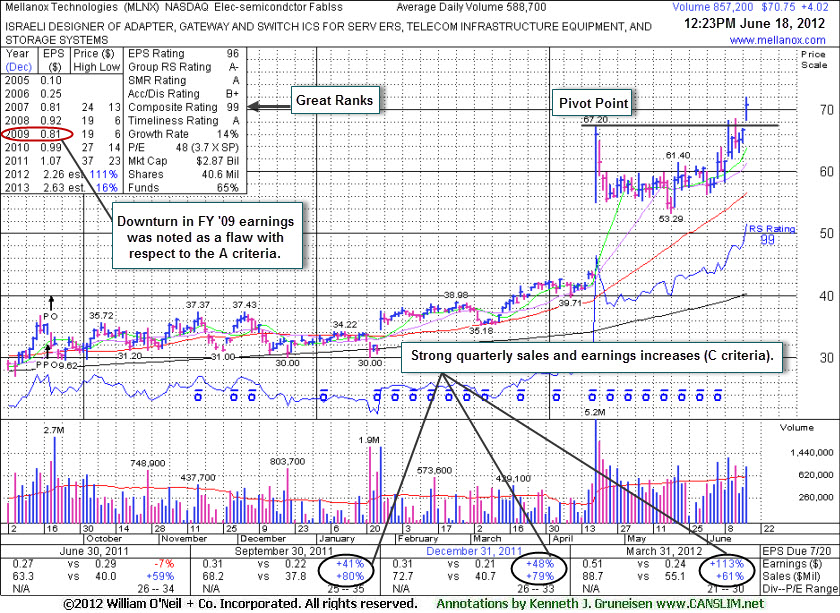

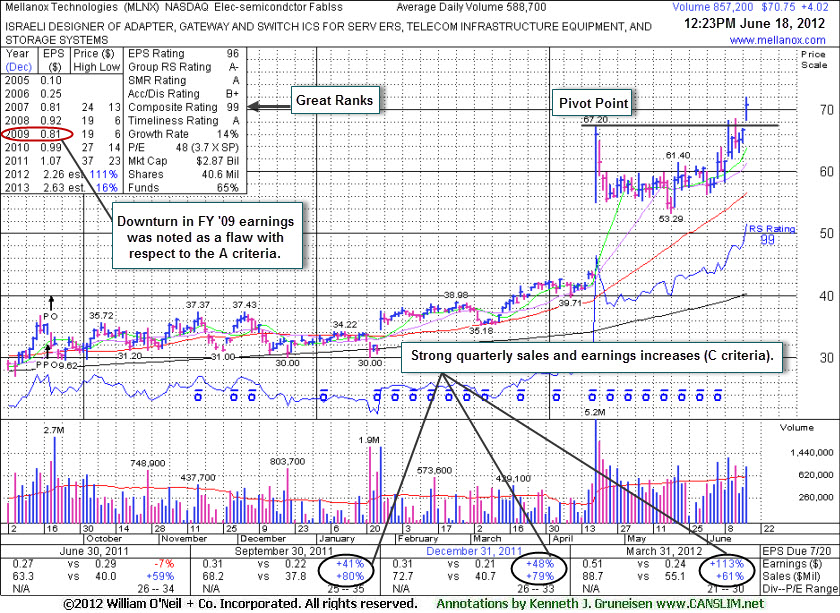

6/22/2012 5:19:45 PM - Y - Managed a "positive reversal" today for a solid volume-driven gain and close back above its pivot point. Prior highs define chart support to watch. Disciplined investors limit losses if ever a stock falls more than -7% from their purchase price. On 6/18/12 it was highlighted in yellow in the mid-day report after it gapped up, rising from an 9-week cup-shaped base without a handle triggering a technical buy signal. Reported earnings +113% on +61% sales revenues for the quarter ended March 31, 2012 versus the year ago period. Its streak of 3 strong quarterly earnings comparisons now satisfies the C criteria. A downturn in FY '09 earnings is a small flaw in its annual earnings (A criteria) history. Gapped up on 4/17/12 for a new all-time high following an analyst upgrade. Top-rated funds owning its shares rose from 108 in Jun '11 to 177 in Mar '12 a reassuring sign concerning the I criteria.

6/21/2012 2:47:11 PM - Y - Pulling back today toward its pivot point and prior highs that define initial chart support to watch. Disciplined investors limit losses if ever a stock falls more than -7% from their purchase price. On 6/18/12 it was highlighted in yellow in the mid-day report after it gapped up, rising from an 9-week cup-shaped base without a handle triggering a technical buy signal. Reported earnings +113% on +61% sales revenues for the quarter ended March 31, 2012 versus the year ago period. Its streak of 3 strong quarterly earnings comparisons now satisfies the C criteria. A downturn in FY '09 earnings is a small flaw in its annual earnings (A criteria) history. Gapped up on 4/17/12 for a new all-time high following an analyst upgrade. Top-rated funds owning its shares rose from 108 in Jun '11 to 177 in Mar '12 a reassuring sign concerning the I criteria.

6/20/2012 1:19:48 PM - Y - Pulling back today from a new 52-week high hit on the prior session. On 6/18/12 it was highlighted in yellow in the mid-day report after it gapped up, rising from an 9-week cup-shaped base without a handle triggering a technical buy signal. Reported earnings +113% on +61% sales revenues for the quarter ended March 31, 2012 versus the year ago period. Its streak of 3 strong quarterly earnings comparisons now satisfies the C criteria. A downturn in FY '09 earnings is a small flaw in its annual earnings (A criteria) history. Gapped up on 4/17/12 for a new all-time high following an analyst upgrade. Top-rated funds owning its shares rose from 108 in Jun '11 to 177 in Mar '12 a reassuring sign concerning the I criteria.

6/18/2012 - Y - Gapped up today, hitting a 52-week high, rising from an 9-week cup-shaped base without a handle. Color code is changed to yellow with pivot point cited based on its 4/19/12 high plus 10 cents. It stayed well above its 50 DMA line during the latest consolidation. Reported earnings +113% on +61% sales revenues for the quarter ended March 31, 2012 versus the year ago period. Its streak of 3 strong quarterly earnings comparisons now satisfies the C criteria. A downturn in FY '09 earnings is a small flaw in its annual earnings (A criteria) history. Gapped up on 4/17/12 for a new all-time high following an analyst upgrade. Top-rated funds owning its shares rose from 108 in Jun '11 to 177 in Mar '12 a reassuring sign concerning the I criteria.

6/13/2012 12:09:59 PM - Touched another new 52-week high today, churning above average volume on the right side of an 8-week cup-shaped base without a handle. It stayed well above its 50 DMA line during the latest consolidation. Reported earnings +113% on +61% sales revenues for the quarter ended March 31, 2012 versus the year ago period. Prior mid-day reports noted - "Its streak of 3 strong quarterly earnings comparisons now satisfies the C criteria. A downturn in FY '09 earnings is a small flaw in its annual earnings (A criteria) history. Gapped up on 4/17/12 for a new all-time high following an analyst upgrade."

6/11/2012 12:27:53 PM - Gapped up today and hit a new 52-week high after a 7-week consolidation above its 50 DMA line. Reported earnings +113% on +61% sales revenues for the quarter ended March 31, 2012 versus the year ago period. Prior mid-day reports noted - "Its streak of 3 strong quarterly earnings comparisons now satisfies the C criteria. A downturn in FY '09 earnings is a small flaw in its annual earnings (A criteria) history. Gapped up on 4/17/12 for a new all-time high following an analyst upgrade."

6/6/2012 12:38:32 PM - Consolidating since last noted when pulling back following a considerable gap up and volume-driven gain to a new high. Reported earnings +113% on +61% sales revenues for the quarter ended March 31, 2012 versus the year ago period. Prior mid-day reports noted - "Its streak of 3 strong quarterly earnings comparisons now satisfies the C criteria. A downturn in FY '09 earnings is a small flaw in its annual earnings (A criteria) history. Gapped up on 4/17/12 for a new all-time high following an analyst upgrade. It is now very extended from any sound base pattern."

4/20/2012 12:15:44 PM - Pulling back today following a considerable gap up and volume-driven gain on the prior session, blasting to new highs. Reported earnings +113% on +61% sales revenues for the quarter ended March 31, 2012 versus the year ago period. The 4/19/12 mid-day report noted - "Its streak of 3 strong quarterly earnings comparisons now satisfies the C criteria. A downturn in FY '09 earnings is a small flaw in its annual earnings (A criteria) history. Gapped up on 4/17/12 for a new all-time high following an analyst upgrade. It is now very extended from any sound base pattern."

4/19/2012 12:17:13 PM - Considerable gap up gain today, blasting to new highs after reporting earnings +113% on +61% sales revenues for the quarter ended March 31, 2012 versus the year ago period. Its streak of 3 strong quarterly earnings comparisons now satisfies the C criteria. A downturn in FY '09 earnings is a small flaw in its annual earnings (A criteria) history. Gapped up on 4/17/12 for a new all-time high following an analyst upgrade. It is now very extended from any sound base pattern.

4/17/2012 12:31:02 PM - Gapped up today for a new all-time high following an analyst upgrade. Previously noted when consolidating above prior highs and its 50 DMA line that define near-term support in the $38 area - "Showed better sales revenues and earnings increases in the Sep and Dec '11 quarters, however prior quarterly comparisons and its up and down annual history are below the C and A guidelines of the fact-based system."

4/11/2012 12:02:21 PM - Consolidating above prior highs and its 50 DMA line that define near-term support in the $38 area. Last noted in the 3/29/12 mid-day report - "Showed better sales revenues and earnings increases in the Sep and Dec '11 quarters, however prior quarterly comparisons and its up and down annual history are below the C and A guidelines of the fact-based system."

3/29/2012 1:11:48 PM - Found support above its 50 DMA line when enduring recent distributional pressure, then rallied to new 52-week and all-time highs since last noted in the 2/16/12 mid-day report - "Showed better sales revenues and earnings increases in the Sep and Dec '11 quarters, however prior quarterly comparisons and its up and down annual history are below the C and A guidelines of the fact-based system."

2/16/2012 12:25:18 PM - Stubbornly holding its ground near its 52-week and all-time high. Showed better sales revenues and earnings increases in the Sep and Dec '11 quarters, however prior quarterly comparisons and its up and down annual history are below the C and A guidelines of the fact-based system.

1/27/2011 1:23:48 PM - Rallying from support at its 50 DMA near its 52-week and all-time high today. Prior quarterly comparisons and its up and down annual history are below the C and A guidelines of the fact-based system.

4/26/2010 12:44:40 PM - Pulling back since reaching its 4/22/10 all-time high after the quarter ended March 31, 2010 showed much improved sales and earnings increases. Gains backed by above average volume prompted recent mid-day report notes as it was - "rising from an orderly base. Latest quarter ended Dec 31, 2009 showed strong sales and earnings increases, however its prior quarterly comparisons and annual history are below the C and A guidelines."

4/23/2010 1:26:01 PM - Pulling back today after a considerable gain on 4/22/10 for a new all-time high after the quarter ended March 31, 2010 showed much improved sales and earnings increases. Gains backed by above average volume prompted recent mid-day report notes as it was - "rising from an orderly base. Latest quarter ended Dec 31, 2009 showed strong sales and earnings increases, however its prior quarterly comparisons and annual history are below the C and A guidelines."

4/22/2010 1:43:55 PM - Considerable gain today for a new all-time high after the quarter ended March 31, 2010 showed much improved sales and earnings increases. Gains backed by above average volume prompted recent mid-day report notes as it was - "rising from an orderly base. Latest quarter ended Dec 31, 2009 showed strong sales and earnings increases, however its prior quarterly comparisons and annual history are below the C and A guidelines."

4/15/2010 12:44:24 PM - Perched at its all-time high after 2 considerable gap up gains backed by above average volume this week. Noted in recent mid-day reports as "rising from an orderly base. Latest quarter ended Dec 31, 2009 showed strong sales and earnings increases, however its prior quarterly comparisons and annual history are below the C and A guidelines."

4/14/2010 12:54:34 PM - Gapped up and hit yet another new 52 week high with today's considerable gain backed by above average volume. Noted in recent mid-day reports as "rising from an orderly base. Latest quarter ended Dec 31, 2009 showed strong sales and earnings increases, however its prior quarterly comparisons and annual history are below the C and A guidelines."

4/12/2010 12:54:32 PM - Gapped up and hit another new 52 week high with today's considerable gain backed by above average volume. Noted in recent mid-day reports as "rising from an orderly base. Latest quarter ended Dec 31, 2009 showed strong sales and earnings increases, however its prior quarterly comparisons and annual history are below the C and A guidelines."

4/1/2010 1:15:08 PM - Hit another new 52 week high today. Noted in recent mid-day reports as "rising from an orderly base. Latest quarter ended Dec 31, 2009 showed strong sales and earnings increases, however its prior quarterly comparisons and annual history are below the C and A guidelines."

3/31/2010 12:50:54 PM - Pulling back today from its 52 week high after 6 consecutive gains. Noted in recent mid-day reports as "rising from an orderly base. Latest quarter ended Dec 31, 2009 showed strong sales and earnings increases, however its prior quarterly comparisons and annual history are below the C and A guidelines."

3/30/2010 11:53:57 AM - Hit another new 52 week high today with its 6th consecutive gain. Noted in recent mid-day reports as "rising from an orderly base. Latest quarter ended Dec 31, 2009 showed strong sales and earnings increases, however its prior quarterly comparisons and annual history are below the C and A guidelines."

3/29/2010 1:01:09 PM - Gapped up and hit another new 52 week high today with its 5th consecutive gain. Noted in recent mid-day reports as "rising from an orderly base. Latest quarter ended Dec 31, 2009 showed strong sales and earnings increases, however its prior quarterly comparisons and annual history are below the C and A guidelines."

3/26/2010 12:31:02 PM - Hit another new 52 week high today and its 4th consecutive gain. Noted in recent mid-day reports as "rising from an orderly base. Latest quarter ended Dec 31, 2009 showed strong sales and earnings increases, however its prior quarterly comparisons and annual history are below the C and A guidelines."

3/16/2010 1:13:57 PM - Hit another new 52 week high today and its second consecutive gain with above average volume has prompted its 5th March appearance in the mid-day report. It is rising from an orderly base. Latest quarter ended Dec 31, 2009 showed strong sales and earnings increases, however its prior quarterly comparisons and annual history are below the C and A guidelines.

3/15/2010 12:50:53 PM - Hit a new 52 week high today. Recently wedging up from an orderly base in the past week. Latest quarter showed strong sales and earnings increases, however its prior quarterly comparisons and annual history are below the C and A guidelines.

3/10/2010 12:49:11 PM - Perched near its 52 week high after wedging up from an orderly base in the past week's time. Latest quarter showed strong sales and earnings increases, however its prior quarterly comparisons and annual history are below the C and A guidelines.

3/8/2010 12:37:10 PM - Quietly wedged up for a new 52 week high today on the right side of an orderly base. Latest quarter showed strong sales and earnings increases, however its prior quarterly comparisons and annual history are below the C and A guidelines.

3/4/2010 1:36:25 PM - Quietly wedged up for a new 52 week high today on the right side of an orderly base. Latest quarter showed strong sales and earnings increases, however its prior quarterly comparisons and annual history are below the C and A guidelines.

2/16/2010 1:22:32 PM - Latest quarter showed strong sales and earnings increases, however its prior quarterly comparisons and annual history are below guidelines.

10/29/2007 1:05:23 PM - Gapped down today, but it has recently challenged all-time highs and has a strong earnings and sales history.