12/22/2021 12:40:50 PM - Perched within striking distance of its all-time high. Reported earnings +43% on +29% sales revenues for the Sep '21 quarter versus the year ago period, its 3rd strong quarter. Fundamental concerns remain. Has a small supply (S criteria) of only 55.6 million shares outstanding. Annual earnings (A criteria) included a downturn in FY '20, a fundamental flaw Prior quarterly comparisons have not shown strong and steady earnings increases above the +25% minimum earnings guideline (C criteria).

12/14/2021 1:19:49 PM - Perched within striking distance of its all-time high. Reported earnings +43% on +29% sales revenues for the Sep '21 quarter versus the year ago period, its 3rd strong quarter. Fundamental concerns remain. Has a small supply (S criteria) of only 55.6 million shares outstanding. Annual earnings (A criteria) included a downturn in FY '20, a fundamental flaw Prior quarterly comparisons have not shown strong and steady earnings increases above the +25% minimum earnings guideline (C criteria).

7/17/2019 12:36:54 PM - Hit a new 52-week high on the prior session and it is perched within striking distance of its all-time high. Prior mid-day reports cautioned members - "Reported earnings +15% on +17% sales revenues for the Mar '19 quarter, and fundamental concerns remain. Has a small supply (S criteria) of only 55.7 million shares outstanding. Prior quarterly comparisons have not shown strong and steady earnings increases above the +25% minimum earnings guideline (C criteria)."

5/20/2019 12:44:10 PM - The 5/10/19 mid-day report cautioned members - "Consolidating above its 50 DMA line. Reported earnings +15% on +17% sales revenues for the Mar '19 quarter, and fundamental concerns remain. Has a small supply (S criteria) of only 55.7 million shares outstanding. Prior quarterly comparisons have not shown strong and steady earnings increases above the +25% minimum earnings guideline (C criteria)."

5/10/2019 12:57:51 PM - Consolidating above its 50 DMA line. Reported earnings +15% on +17% sales revenues for the Mar '19 quarter, and fundamental concerns remain. Has a small supply (S criteria) of only 55.7 million shares outstanding. Prior quarterly comparisons have not shown strong and steady earnings increases above the +25% minimum earnings guideline (C criteria).

4/2/2019 12:45:11 PM - Rebounding toward prior highs with today's 7th consecutive gain. Reported earnings +10% on +20% sales revenues for the Dec '18 quarter, and fundamental concerns remain. Has a small supply (S criteria) of only 55.8 million shares outstanding. Prior quarterly comparisons have not shown strong and steady earnings increases above the +25% minimum earnings guideline (C criteria).

2/28/2019 12:49:01 PM - Reported earnings +10% on +20% sales revenues for the Dec '18 quarter, and fundamental concerns remain. Has a small supply (S criteria) of only 55.8 million shares outstanding. Prior quarterly comparisons have not shown strong and steady earnings increases above the +25% minimum earnings guideline (C criteria).

2/19/2019 12:22:25 PM - Reported earnings +15% on +20% sales revenues for the Sep '18 quarter, and fundamental concerns remain. Has a small supply (S criteria) of only 55.8 million shares outstanding. Prior quarterly comparisons have not shown strong and steady earnings increases above the +25% minimum earnings guideline (C criteria).

2/12/2019 1:52:48 PM - Reported earnings +15% on +20% sales revenues for the Sep '18 quarter, and fundamental concerns remain. Has a small supply (S criteria) of only 55.8 million shares outstanding. Prior quarterly comparisons have not shown strong and steady earnings increases above the +25% minimum earnings guideline (C criteria).

6/16/2016 12:18:14 PM - Gapped down today retreating from its 52-week high with heavy volume. Prior mid-day reports cautioned - "Reported earnings +33% on +27% sales revenues for the Mar '16 quarter, but fundamental concerns remain. Has a small supply (S criteria) of only 57.3 million shares outstanding. Prior quarterly comparisons have not shown strong and steady earnings increases above the +25% minimum earnings guideline (C criteria)."

5/13/2016 12:43:19 PM - Rallying with heavy volume toward its 52-week high and making a 2nd consecutive mid-day report appearance. The 5/12/16 mid-day report cautioned - "Reported earnings +33% on +27% sales revenues for the Mar '16 quarter, but fundamental concerns remain. Has a small supply (S criteria) of only 57.3 million shares outstanding. Prior quarterly comparisons have not shown strong and steady earnings increases above the +25% minimum earnings guideline (C criteria)."

5/12/2016 12:27:24 PM - Reported earnings +33% on +27% sales revenues for the Mar '16 quarter, but fundamental concerns remain. Has a small supply (S criteria) of only 57.3 million shares outstanding. Prior quarterly comparisons have not shown strong and steady earnings increases above the +25% minimum earnings guideline (C criteria).

8/14/2015 1:16:32 PM - Found prompt support after abruptly retreating from 52-week highs and undercutting its 50 DMA line with a volume-driven loss on the prior session. Reported earnings +20% on +3% sales revenues for the Jun '15 quarter, and fundamental concerns remain. Noted with caution in the 2/11/15 mid-day report following M&A news - "No resistance remains due to overhead supply, and it has a small supply (S criteria) of only 57.3 million shares outstanding. Prior quarterly comparisons have not shown strong and steady earnings increases above the +25% minimum earnings guideline (C criteria) and its sales revenues growth rate has shown deceleration."

8/13/2015 1:04:31 PM - Abruptly retreating from 52-week highs and undercutting its 50 DMA line with today's gap down and loss on heavy volume. Reported earnings +20% on +3% sales revenues for the Jun '15 quarter, and fundamental concerns remain. Noted with caution in the 2/11/15 mid-day report following M&A news - "No resistance remains due to overhead supply, and it has a small supply (S criteria) of only 57.3 million shares outstanding. Prior quarterly comparisons have not shown strong and steady earnings increases above the +25% minimum earnings guideline (C criteria) and its sales revenues growth rate has shown deceleration."

7/15/2015 12:44:52 PM - Hitting new 52-week highs with today's 5th consecutive gain on ever-increasing volume. Reported earnings +36% on +9% sales revenues for the Mar '15 quarter, but fundamental concerns remain. Made gradual progress since noted with caution in the 2/11/15 mid-day report following M&A news - "No resistance remains due to overhead supply, and it has a small supply (S criteria) of only 57.3 million shares outstanding. Prior quarterly comparisons have not shown strong and steady earnings increases above the +25% minimum earnings guideline (C criteria) and its sales revenues growth rate has shown deceleration."

4/21/2015 12:38:34 PM - Sputtering just below its 50 DMA line. Reported earnings +9% on +15% sales revenues for the Dec '14 quarter. Noted with caution in the 2/11/15 mid-day report following M&A news - "No resistance remains due to overhead supply, and it has a small supply (S criteria) of only 57.3 million shares outstanding. Prior quarterly comparisons have not shown strong and steady earnings increases above the +25% minimum earnings guideline (C criteria) and its sales revenues growth rate has shown deceleration."

4/17/2015 1:09:11 PM - Slumping below its 50 DMA line. Reported earnings +9% on +15% sales revenues for the Dec '14 quarter. Noted with caution in the 2/11/15 mid-day report following M&A news - "No resistance remains due to overhead supply, and it has a small supply (S criteria) of only 57.3 million shares outstanding. Prior quarterly comparisons have not shown strong and steady earnings increases above the +25% minimum earnings guideline (C criteria) and its sales revenues growth rate has shown deceleration."

3/12/2015 12:23:18 PM - Gapped down on 3/04/15 and found prompt support at its 50 DMA line. Reported earnings +9% on +15% sales revenues for the Dec '14 quarter. Noted with caution in the 2/11/15 mid-day report following M&A news - "No resistance remains due to overhead supply, and it has a small supply (S criteria) of only 57.3 million shares outstanding. Prior quarterly comparisons have not shown strong and steady earnings increases above the +25% minimum earnings guideline (C criteria) and its sales revenues growth rate has shown deceleration."

3/6/2015 12:30:45 PM - Gapped down on 3/04/15 and found prompt support at its 50 DMA line. Reported earnings +9% on +15% sales revenues for the Dec '14 quarter. Noted with caution in the 2/11/15 mid-day report following M&A news - "No resistance remains due to overhead supply, and it has a small supply (S criteria) of only 57.3 million shares outstanding. Prior quarterly comparisons have not shown strong and steady earnings increases above the +25% minimum earnings guideline (C criteria) and its sales revenues growth rate has shown deceleration."

3/5/2015 1:12:27 PM - Gapped down on the prior session, abruptly retreating from near its 52-week high, and it found support at its 50 DMA line. Reported earnings +9% on +15% sales revenues for the Dec '14 quarter. Noted with caution in the 2/11/15 mid-day report following M&A news - "No resistance remains due to overhead supply, and it has a small supply (S criteria) of only 57.3 million shares outstanding. Prior quarterly comparisons have not shown strong and steady earnings increases above the +25% minimum earnings guideline (C criteria) and its sales revenues growth rate has shown deceleration."

3/4/2015 12:35:20 PM - Gapped down today, abruptly retreating from near its 52-week high and testing support at its 50 DMA line. Reported earnings +9% on +15% sales revenues for the Dec '14 quarter. Noted with caution in the 2/11/15 mid-day report following M&A news - "No resistance remains due to overhead supply, and it has a small supply (S criteria) of only 57.3 million shares outstanding. Prior quarterly comparisons have not shown strong and steady earnings increases above the +25% minimum earnings guideline (C criteria) and its sales revenues growth rate has shown deceleration."

2/11/2015 1:12:36 PM - Hitting new 52-week highs with today's big gain on above average volume following news it will acquire Marsal & Sons, Inc. No resistance remains due to overhead supply, and it has a small supply (S criteria) of only 57.3 million shares outstanding. Found support near its 50 DMA line since last noted in the 12/29/14 mid-day report - "Reported better earnings increases in the Jun and Sep '14 quarters. Prior quarterly comparisons have not shown strong and steady earnings increases above the +25% minimum earnings guideline (C criteria) and its sales revenues growth rate has shown deceleration."

12/29/2014 12:32:28 PM - Quiet gains have it perched within close striking distance of its 52-week high. Found support above its 50 DMA line during its consolidation since last noted with caution in the 12/02/14 mid-day report - "Reported better earnings increases in the Jun and Sep '14 quarters. Prior quarterly comparisons have not shown strong and steady earnings increases above the +25% minimum earnings guideline (C criteria) and its sales revenues growth rate has shown deceleration."

12/2/2014 12:41:30 PM - Making its 2nd consecutive mid-day report appearance today while rebounding toward its 52-week high following another dip below its 200 DMA line since noted with caution on 9/18/14 mid-day report. Reported better earnings increases in the Jun and Sep '14 quarters. Prior quarterly comparisons have not shown strong and steady earnings increases above the +25% minimum earnings guideline (C criteria) and its sales revenues growth rate has shown deceleration.

12/1/2014 12:20:48 PM - Rebounding toward its 52-week high following another dip below its 200 DMA line since noted with caution on 9/18/14 mid-day report. Reported better earnings increases in the Jun and Sep '14 quarters. Prior quarterly comparisons have not shown strong and steady earnings increases above the +25% minimum earnings guideline (C criteria) and its sales revenues growth rate has shown deceleration.

9/18/2014 12:20:24 PM - Quarterly comparisons have not shown strong and steady earnings increases above the +25% minimum earnings guideline (C criteria). Rebounding toward its 52-week high following a deep consolidation below its 200 DMA line since last noted with caution on 3/04/14 after a considerable "breakaway gap" for new all-time highs.

3/4/2014 12:28:03 PM - Pulling back from its 52-week high following a considerable "breakaway gap" for new all-time highs last week, quickly getting extended from prior highs near $260. Prior mid-day report noted - "Reported earnings +29% on +29% sales revenues for the Dec '13 quarter, beating expectations. Now 3 of the past 4 quarterly comparisons have shown earnings increases above the +25% minimum earnings guideline (C criteria). Found support near its 50 DMA line and proved resilient since dropped from the Featured Stocks list on 4/18/13."

3/3/2014 12:45:52 PM - Pulling back from its 52-week high following a considerable "breakaway gap" for new all-time highs last week, quickly getting extended from prior highs near $260. The 2/26/14 mid-day report noted - "Reported earnings +29% on +29% sales revenues for the Dec '13 quarter, beating expectations. Now 3 of the past 4 quarterly comparisons have shown earnings increases above the +25% minimum earnings guideline (C criteria). Found support near its 50 DMA line and proved resilient since dropped from the Featured Stocks list on 4/18/13."

2/27/2014 12:47:41 PM - Making a 2nd consecutive mid-day report appearance after a considerable "breakaway gap" for new 52-week and all-time highs, quickly distancing itself from prior highs near $260. The 2/26/14 mid-day report noted - "Reported earnings +29% on +29% sales revenues for the Dec '13 quarter, beating expectations. Now 3 of the past 4 quarterly comparisons have shown earnings increases above the +25% minimum earnings guideline (C criteria). Found support near its 50 DMA line and proved resilient since dropped from the Featured Stocks list on 4/18/13."

2/26/2014 1:11:22 PM - Considerable "breakaway gap" today for new 52-week and all-time highs, quickly distancing itself from prior highs near $260. Reported earnings +29% on +29% sales revenues for the Dec '13 quarter, beating expectations. Now 3 of the past 4 quarterly comparisons have shown earnings increases above the +25% minimum earnings guideline (C criteria). Found support near its 50 DMA line and proved resilient since dropped from the Featured Stocks list on 4/18/13.

11/15/2013 12:47:32 PM - Testing support at its 50 DMA line again today with a loss on higher volume. The 50 DMA line acted as support following a "negative reversal" at its 52-week high on 11/06/13 when the mid-day report cautioned members - "Reported earnings +36% on +40% sales revenues for the Sep '13 quarter. Found support near its 50 DMA line and proved resilient since dropped from the Featured Stocks list on 4/18/13. Fundamental concerns remain since it reported sub par earnings in Sep and Dec '12, and Jun '13 below the +25% minimum earnings guideline (C criteria)."

11/11/2013 1:05:24 PM - Finding support at its 50 DMA line following a "negative reversal" at its 52-week high on 11/06/13 when the mid-day report cautioned members - "Reported earnings +36% on +40% sales revenues for the Sep '13 quarter. Found support near its 50 DMA line and proved resilient since dropped from the Featured Stocks list on 4/18/13. Fundamental concerns remain since it reported sub par earnings in Sep and Dec '12, and Jun '13 below the +25% minimum earnings guideline (C criteria)."

11/6/2013 12:49:46 PM - Hit a new 52-week high today then reversed into the red. Reported earnings +36% on +40% sales revenues for the Sep '13 quarter. Found support near its 50 DMA line and proved resilient since dropped from the Featured Stocks list on 4/18/13. Fundamental concerns remain since it reported sub par earnings in Sep and Dec '12, and Jun '13 below the +25% minimum earnings guideline (C criteria).

9/23/2013 12:51:39 PM - Perched near its 52-week high, extended from any sound base. Prior mid-day reports repeatedly cautioned members - "Reported earnings +20% on +40% sales revenues for the Jun '13 quarter, below the +25% minimum earnings guideline (C criteria). Pulling back from its 52-week high following a spurt of 3 consecutive volume-driven gains after finding support near its 50 DMA line. Proved resilient since dropped from the Featured Stocks list on 4/18/13. Fundamental concerns remain since it reported sub par earnings in Sep and Dec '12, below the +25% minimum earnings guideline (C criteria)."

9/11/2013 1:18:11 PM - Hitting a new 52-week high with today's 7th consecutive gain. Found support at its 50 DMA line during its consolidation since noted in prior mid-day reports repeatedly with caution - "Reported earnings +20% on +40% sales revenues for the Jun '13 quarter, below the +25% minimum earnings guideline (C criteria). Pulling back from its 52-week high following a spurt of 3 consecutive volume-driven gains after finding support near its 50 DMA line. Proved resilient since dropped from the Featured Stocks list on 4/18/13. Fundamental concerns remain since it reported sub par earnings in Sep and Dec '12, below the +25% minimum earnings guideline (C criteria)."

9/5/2013 12:31:30 PM - Found support at its 50 DMA line during its consolidation since noted in prior mid-day reports repeatedly with caution - "Reported earnings +20% on +40% sales revenues for the Jun '13 quarter, below the +25% minimum earnings guideline (C criteria). Pulling back from its 52-week high following a spurt of 3 consecutive volume-driven gains after finding support near its 50 DMA line. Proved resilient since dropped from the Featured Stocks list on 4/18/13. Fundamental concerns remain since it reported sub par earnings in Sep and Dec '12, below the +25% minimum earnings guideline (C criteria)."

8/15/2013 12:42:19 PM - The 8/14/13 mid-day report noted - "Reported earnings +20% on +40% sales revenues for the Jun '13 quarter, below the +25% minimum earnings guideline (C criteria). Pulling back from its 52-week high following a spurt of 3 consecutive volume-driven gains after finding support near its 50 DMA line. Proved resilient since dropped from the Featured Stocks list on 4/18/13. Fundamental concerns remain since it reported sub par earnings in Sep and Dec '12, below the +25% minimum earnings guideline (C criteria)."

8/14/2013 12:41:33 PM - Reported earnings +20% on +40% sales revenues for the Jun '13 quarter, below the +25% minimum earnings guideline (C criteria). Pulling back from its 52-week high following a spurt of 3 consecutive volume-driven gains after finding support near its 50 DMA line. Proved resilient since dropped from the Featured Stocks list on 4/18/13. Fundamental concerns remain since it reported sub par earnings in Sep and Dec '12, below the +25% minimum earnings guideline (C criteria).

8/13/2013 12:53:46 PM - Reported earnings +20% on +40% sales revenues for the Jun '13 quarter, below the +25% minimum earnings guideline (C criteria). Holding its ground perched at its 52-week high following 3 consecutive volume-driven gains after finding support near its 50 DMA line. Proved resilient since dropped from the Featured Stocks list on 4/18/13. Fundamental concerns remain since it reported sub par earnings in Sep and Dec '12, below the +25% minimum earnings guideline (C criteria).

8/12/2013 12:50:48 PM - Reported earnings +20% on +40% sales revenues for the Jun '13 quarter, below the +25% minimum earnings guideline (C criteria). Holding its ground today, it hit a new 52-week high on the prior session after gapping up. Found support near its 50 DMA line last week. Proved resilient since dropped from the Featured Stocks list on 4/18/13. Fundamental concerns remain since it reported sub par earnings in Sep and Dec '12, below the +25% minimum earnings guideline (C criteria).

8/9/2013 12:51:06 PM - Reported earnings +20% on +40% sales revenues for the Jun '13 quarter, below the +25% minimum earnings guideline (C criteria). Powering to a new 52-week high after gapping up today. Found support near its 50 DMA line this week. Proved resilient since dropped from the Featured Stocks list on 4/18/13. Fundamental concerns remain since it reported sub par earnings in Sep and Dec '12, below the +25% minimum earnings guideline (C criteria).

8/7/2013 1:25:34 PM - Due to release 2013 second quarter earnings on Thursday, August 8 after the market closes. Reported earnings +38% on +43% sales revenues for the Mar '13 quarter. Pulling back abruptly to its 50 DMA line today. It proved resilient since dropped from the Featured Stocks list on 4/18/13. Fundamental concerns remain since it reported sub par earnings in Sep and Dec '12, below the +25% minimum earnings guideline (C criteria).

5/13/2013 12:26:20 PM - Reported earnings +38% on +43% sales revenues for the Mar '13 quarter. Pulling back today after spiking to new 52-week highs with volume-driven gains last week. It proved resilient since dropped from the Featured Stocks list on 4/18/13, however fundamental concerns remain since it reported sub par earnings in Sep and Dec '12, below the +25% minimum earnings guideline (C criteria).

5/10/2013 12:25:25 PM - Reported earnings +38% on +43% sales revenues for the Mar '13 quarter and spiked to new 52-week highs with volume-driven gains this week. It proved resilient since dropped from the Featured Stocks list on 4/18/13, however fundamental concerns remain since it reported sub par earnings in Sep and Dec '12, below the +25% minimum earnings guideline (C criteria).

4/18/2013 6:16:22 PM - Based on lackluster price/volume action and fundamental concerns previously noted it will be dropped from the Featured Stocks list tonight. See the latest FSU analysis for more details and a new annotated graph.

4/18/2013 12:18:31 PM - G - Its Relative Strength rating is 86 today. Lingering below its 50 DMA line, it slumped under prior lows in the $144 area raising greater concerns. Technically, a rebound above its 50 DMA line is needed for its outlook to improve. Fundamental concerns were recently noted.

4/17/2013 12:14:36 PM - G - Its Relative Strength rating is 85 today, but the longer a stock lingers below its 50 DMA line the worse its outlook gets. Its also slumped under recent lows in the $144 area raising greater concerns. Fundamental concerns were recently noted.

4/12/2013 3:24:15 PM - G - Its Relative Strength rating is 86 today, but the longer a stock lingers below its 50 DMA line the worse its outlook gets. Recent lows in the $144 area define important support to watch where violation may raise greater concerns. Fundamental concerns were recently noted.

4/8/2013 5:52:53 PM - G - Recently slumping below its 50 DMA line raising concerns with losses on light volume. Fundamental concerns were recently noted.

4/1/2013 6:13:43 PM - G - Recently staying in tight trading range near all-time highs, stubbornly holding its ground above its 50 DMA line. Fundamental concerns were recently noted.

3/25/2013 9:01:47 PM - G - Recently staying in tight trading range near all-time highs, stubbornly holding its ground. Fundamental concerns were recently noted. See latest FSU analysis for more details and a new annotated graph.

3/20/2013 5:21:19 PM - G - Tallied a gain today with above average volume for a best-ever close. Recently staying in tight trading range near all-time highs, stubbornly holding its ground. Fundamental concerns were recently noted. Its 50 DMA line defines important near-term chart support.

3/19/2013 5:37:15 PM - G - Still hovering in a tight trading range near all-time highs, stubbornly holding its ground. Fundamental concerns were recently noted. Its 50 DMA line defines important near-term chart support.

3/12/2013 1:52:24 PM - G - Still hovering near all-time highs today with volume totals cooling. Fundamental concerns were recently noted. Its 50 DMA line defines important near-term chart support.

3/5/2013 1:44:24 PM - G - Hovering near all-time highs today. Fundamental concerns were recently noted and prior reports cautioned members that it is extended from any sound base. Its 50 DMA line defines important near-term chart support above prior highs in the $134-135 area.

2/27/2013 12:51:03 PM - G - Rallied to a new all-time high today with a 2nd consecutive gain backed by above average volume. Fundamental concerns were recently noted and prior reports cautioned members that it is extended from any sound base. Its 50 DMA line defines important near-term chart support above prior highs in the $134-135 area.

2/25/2013 4:45:43 PM - G - Reversed early gains today and finished near the session low with a damaging loss on above average volume. Fundamental concerns were recently noted and prior reports cautioned members that it is extended from any sound base. Its 50 DMA line defines important near-term chart support above prior highs in the $134-135 area.

2/22/2013 7:40:45 PM - G - Still hovering near its all-time high with volume totals cooling over the past week. Fundamental concerns were recently noted and prior reports cautioned members that it is extended from any sound base. Prior highs and its 50 DMA line define important near-term chart support in the $134-135 area.

2/15/2013 12:33:30 PM - G - Hovering near its all-time high still, but enduring distributional pressure this week with above average volume behind 2 recent losses. Fundamental concerns were recently noted and prior reports cautioned members that it is extended from any sound base. Prior highs and its 50 DMA line define important near-term chart support in the $134-135 area.

2/14/2013 6:55:15 PM - G - Retreated from its all-time high with above average volume behind its loss today. It has been repeatedly noted - "Extended from any sound base. Prior highs and its 50 DMA line define important near-term chart support in the $132-134 area."

2/12/2013 1:47:16 PM - G - Touched another new all-time high today then reversed into the red after getting even more extended from any sound base. Prior highs and its 50 DMA line define important near-term chart support in the $132-134 area.

2/5/2013 3:36:13 PM - G - Volume is above average while rallying and hitting another new all-time high today, getting even more extended from any sound base. Prior highs and its 50 DMA line define important near-term chart support in the $132-134 area.

2/1/2013 12:32:03 PM - G - Hitting another new all-time high today, getting even more extended from any sound base. See the latest FSU analysis for more details and a new annotated graph.

1/30/2013 5:57:49 PM - G - Pulled back from all-time highs today after getting extended from any sound base. See the latest FSU analysis for more details and a new annotated graph.

1/25/2013 4:16:32 PM - G - Rallied for a 6th consecutive gain today and further into new all-time high territory. Prior mid-day reports noted - "Disciplined investors may watch closely for sell signals if holding it and giving it a chance to produce more climactic gains. Its 50-day moving average (DMA) line defines near-term chart support to watch where any violation would trigger a technical sell signal." Earnings +23% on +18% sales for the Sep '12 quarter, below the +25% minimum earnings guideline (C criteria), raised concerns.

1/23/2013 12:19:37 PM - G - Rallying today for a considerable volume-driven gain and new 52-week and all-time highs after an analyst upgrade. Prior reports noted - "Disciplined investors may watch closely for sell signals if holding it and giving it a chance to produce more climactic gains. Its 50-day moving average (DMA) line defines near-term chart support to watch where any violation would trigger a technical sell signal." Earnings +23% on +18% sales for the Sep '12 quarter, below the +25% minimum earnings guideline (C criteria), raised concerns.

1/22/2013 3:23:24 PM - G - Hitting new 52-week and all-time highs with today's 3rd consecutive gain. Earnings +23% on +18% sales for the Sep '12 quarter, below the +25% minimum earnings guideline (C criteria), raised concerns.

1/14/2013 5:50:33 PM - G - Holding its ground stubbornly near its 52-week and all-time highs with recent volume totals below average. Earnings +23% on +18% sales for the Sep '12 quarter, below the +25% minimum earnings guideline (C criteria), raised concerns. See latest FSU analysis for more details and a new annotated graph.

1/8/2013 2:43:21 PM - G - Holding its ground stubbornly near its 52-week and all-time highs with recent volume totals below average. Earnings +23% on +18% sales for the Sep '12 quarter, below the +25% minimum earnings guideline (C criteria), raised concerns.

1/2/2013 4:11:05 PM - G - Gapped up today and challenged its 52-week and all-time high with a volume-driven gain. Earnings +23% on +18% sales for the Sep '12 quarter, below the +25% minimum earnings guideline (C criteria), raised concerns.

12/31/2012 2:07:36 PM - G - Holding its ground near its 50 DMA line today with a gain on light volume following distributional pressure after a negative reversal on 12/19/12 at its new 52-week and all-time high. Earnings +23% on +18% sales for the Sep '12 quarter, below the +25% minimum earnings guideline (C criteria), raised concerns.

12/26/2012 5:19:55 PM - G - Halted its slide with a gain today on light volume following distributional pressure after a negative reversal on 12/19/12 at its new 52-week and all-time high. Earnings +23% on +18% sales for the Sep '12 quarter, below the +25% minimum earnings guideline (C criteria), raised concerns. See the latest FSU analysis for more details and an annotated graph.

12/21/2012 5:35:21 PM - G - Down today for a 3rd consecutive loss with above average volume, enduring distributional pressure after a negative reversal on 12/19/12 at its new 52-week and all-time high. Earnings +23% on +18% sales for the Sep '12 quarter, below the +25% minimum earnings guideline (C criteria), raised concerns.

12/19/2012 12:16:58 PM - G - Hitting new 52-week and all-time highs again with today's 4th consecutive gain, getting more extended beyond its "max buy" level. Earnings +23% on +18% sales for the Sep '12 quarter, below the +25% minimum earnings guideline (C criteria), raised concerns.

12/18/2012 12:21:10 PM - G - Hitting new 52-week and all-time highs with today's volume-driven gain, getting more extended beyond its "max buy" level. Earnings +23% on +18% sales for the Sep '12 quarter, below the +25% minimum earnings guideline (C criteria), raised concerns.

12/17/2012 5:43:22 PM - G - Still hovering just above its "max buy" level at today's close. Earnings +23% on +18% sales for the Sep '12 quarter, below the +25% minimum earnings guideline (C criteria), raised concerns.

12/11/2012 7:00:05 PM - G - Color code is changed to green after a volume-driven gain today above its "max buy" level. Earnings +23% on +18% sales for the Sep '12 quarter, below the +25% minimum earnings guideline (C criteria), raised concerns.

12/6/2012 4:46:13 PM - Y - Wedged to new highs with recent gains lacking great volume conviction. Earnings +23% on +18% sales for the Sep '12 quarter, below the +25% minimum earnings guideline (C criteria), raised concerns. See the latest FSU analysis for more details and a new annotated graph.

12/3/2012 6:18:44 PM - Y - Still consolidating in a tight trading range near its all-time high. Recently reported earnings +23% on +18% sales for the Sep '12 quarter, below the +25% minimum earnings guideline (C criteria), raising fundamental concerns.

11/26/2012 5:55:09 PM - Y - Consolidating in a tight trading range near its all-time high. Recently reported earnings +23% on +18% sales for the Sep '12 quarter, below the +25% minimum earnings guideline (C criteria), raising fundamental concerns.

11/19/2012 7:07:21 PM - Y - Traded up today with below average volume, finishing at its best-ever close. Reported earnings +23% on +18% sales for the Sep '12 quarter, below the +25% minimum earnings guideline (C criteria). The M criteria remains an overriding concern until a FTD confirms a new rally.

11/15/2012 5:14:04 PM - Y - Traded up today with above average volume, touching a new 52-week high and finishing at its best-ever close. Reported earnings +23% on +18% sales for the Sep '12 quarter, below the +25% minimum earnings guideline (C criteria). The M criteria remains an overriding concern until a FTD confirms a new rally.

11/13/2012 3:35:30 PM - Y - Trading up today with light volume within striking distance of a best-ever close. Reported earnings +23% on +18% sales for the Sep '12 quarter, below the +25% minimum earnings guideline (C criteria). The M criteria remains an overriding concern until a FTD confirms a new rally.

11/9/2012 4:00:54 PM - Y - Found prompt support at its 50 DMA line this week. Reported earnings +23% on +18% sales for the Sep '12 quarter, below the +25% minimum earnings guideline (C criteria). The M criteria remains an overriding concern until a FTD confirms a new rally.

11/7/2012 4:01:04 PM - Y - Rallied near its 52-week high with above average volume behind today's 2nd consecutive gain, rising back above its pivot point after finding prompt support at its 50 DMA line. Reported earnings +23% on +18% sales for the Sep '12 quarter, below the +25% minimum earnings guideline (C criteria). The M criteria remains an overriding concern until a FTD confirms a new rally.

11/5/2012 5:36:45 PM - Y - Retreating abruptly from its 52-week high with above average volume behind today's damaging loss as it sank below its pivot point toward its 50 DMA line raising concerns. The M criteria remains an overriding concern until a FTD confirms a new rally. Company will release 2012 third quarter earnings on Tuesday, November 6 after the market closes.

11/1/2012 6:08:28 PM - Y - Hit a new 52-week high with +41% above average volume behind today's 4th consecutive gain. Volume-driven gains above the pivot point confirmed a new (or add-on) technical buy signal, however the M criteria remains an overriding concern until a FTD confirms a new rally. Its 50 DMA line and recent lows define near-term chart support to watch.

10/26/2012 4:25:47 PM - Y - Finished just -0.5% off its 52-week high today. Volume totals have been below average in recent weeks while stubbornly holding its ground. Subsequent volume-driven gains above the pivot point may confirm a new (or add-on) technical buy signal. Its 50 DMA line and recent lows define near-term chart support to watch.

10/22/2012 6:52:50 PM - Y - Finished just -0.9% off its 52-week high today. Volume totals have been below average in recent weeks while stubbornly holding its ground. Subsequent volume-driven gains above the pivot point may trigger a new (or add-on) technical buy signal. Its 50 DMA line and recent lows define near-term chart support to watch. See the latest FSU analysis for more details and a new annotated graph.

10/16/2012 3:46:22 PM - Y - Poised for a best-ever close with a quiet gain today and trading just -1.3% off its 52-week high. Volume totals have been below average in recent weeks while stubbornly holding its ground. Subsequent volume-driven gains above the pivot point may trigger a new (or add-on) technical buy signal. Its 50 DMA line and recent lows define near-term chart support to watch.

10/12/2012 4:30:52 PM - Y - Perched -3.2% off its 52-week high today with volume totals cooling in recent weeks while stubbornly holding its ground. Subsequent volume-driven gains above the pivot point may trigger a new (or add-on) technical buy signal. Its 50 DMA line and recent lows define near-term chart support to watch.

10/8/2012 3:54:32 PM - Y - Perched -3.4% off its 52-week high today with volume totals cooling in recent weeks while holding its ground. Color code is changed to yellow with new pivot point cited based on its 9/06/12 high plus 10 cents. Subsequent volume-driven gains above the pivot point may trigger a new (or add-on) technical buy signal. Its 50 DMA line and recent lows define near-term chart support to watch.

10/1/2012 5:59:10 PM - G - Perched -4.4% off its 52-week high after a gain today with higher (near average) volume. Extended from its prior base, and its 50 DMA line and recent lows define near-term chart support to watch.

9/26/2012 1:09:42 PM - G - Perched -5.5% off its 52-week high today. Extended from its prior base, and its 50 DMA line and recent lows define near-term chart support to watch.

9/18/2012 5:25:56 PM - G - Perched -3.3% off its 52-week high today. Extended from its prior base, and its 50 DMA line and recent lows define near-term chart support to watch. See the latest FSU analysis for more details and a new annotated graph.

9/12/2012 4:49:00 PM - G - Volume was light today while holding its ground near its 52-week high. Extended from its prior base, its 50 DMA line and prior highs define important chart support to watch.

9/10/2012 4:39:57 PM - G - Pulled back from last week's new 52-week high. Extended from its prior base, its 50 DMA line and prior highs define important chart support to watch.

9/5/2012 6:15:05 PM - G - Finished in the middle of its intra-day range after touching a new 52-week high with today's 3rd consecutive gain backed by above average volume. Extended from its prior base, its 50 DMA line and prior highs in the $104 area define important chart support to watch.

9/5/2012 12:39:14 PM - G - Touched a new 52-week high with today's 3rd consecutive gain backed by above average volume. Extended from its prior base, its 50 DMA line and prior highs in the $104 area define important chart support to watch.

9/4/2012 4:17:28 PM - G - Rallied to a best-ever close today with above average volume behind its gain. Extended from its prior base, its 50 DMA line and prior highs in the $104 area define important chart support to watch.

8/28/2012 12:30:08 PM - G - Still quietly consolidating -5.6% off its 52-week high today, extended from its prior base. Its 50 DMA line and prior highs in the $104 area define important chart support to watch.

8/27/2012 3:15:52 PM - G - Still quietly consolidating -5.9% off its 52-week high today. Prior highs in the $104 area define initial support to watch on pullbacks.

8/20/2012 2:39:34 PM - G - Quietly consolidating, holding its ground today near its 52-week high. Prior highs in the $104 area define initial support to watch on pullbacks.

8/14/2012 12:57:07 PM - G - Holding its ground today, extended after 3 consecutive volume-driven gains into new high territory. Prior highs define initial support to watch on pullbacks. See the latest FSU analysis for more details and a new annotated graph.

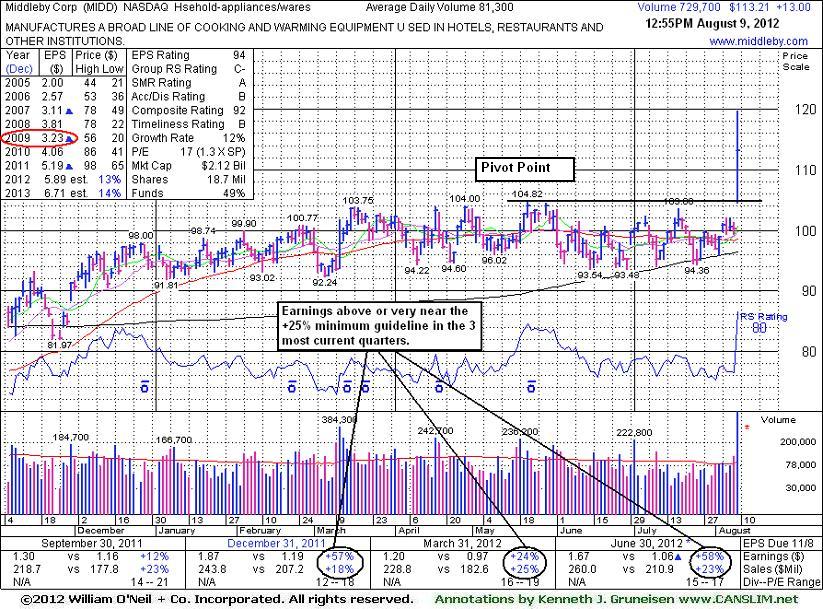

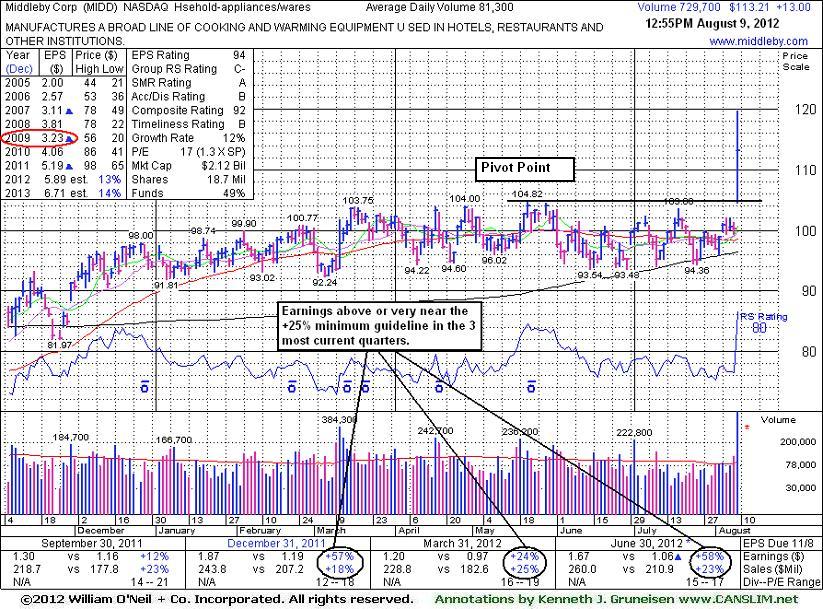

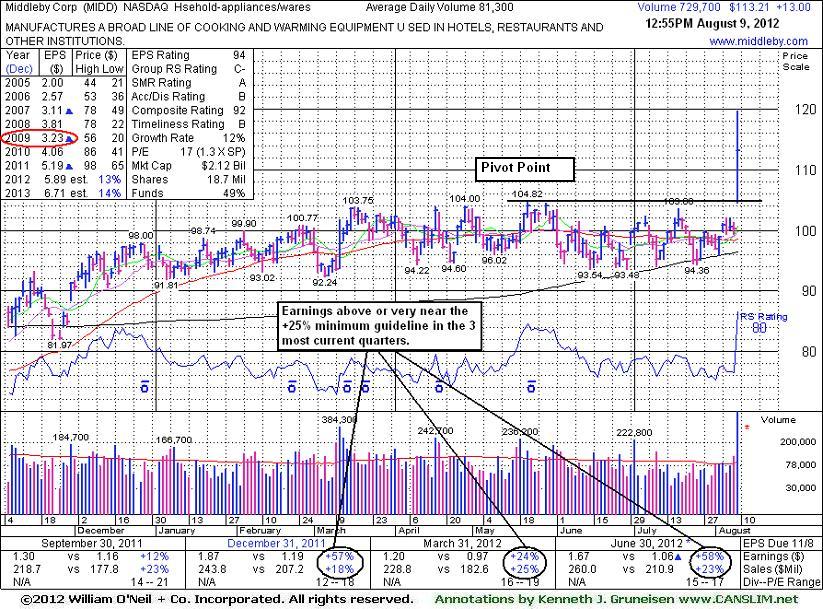

8/13/2012 4:03:48 PM - G - Getting more extended with today's 3rd consecutive volume-driven gain into new high territory, and its color code is changed to green. Last week it broke out from a long flat base with 9 times average volume. Reported earnings +58% on +23% sales revenues for the Jun '12 quarter. Recent quarterly comparisons show strong sales and earnings reasonably meeting the C criteria. Its annual earnings (A criteria) had a downturn in FY '09, yet they have otherwise been good and steady.

8/10/2012 12:31:17 PM - Y - Holding its ground today. On the prior session it was highlighted in yellow with pivot point cited based on its 5/22/12 high plus 10 cents as it gapped up for a new 52-week and all-time high, breaking out from a long flat base with 9 times average volume. Reported earnings +58% on +23% sales revenues for the Jun '12 quarter. A "breakaway gap" is one noted exception when buying more than +5% above prior highs is permitted under the fact-based system, however risk increases the further one chases a stock above its pivot point. Recent quarterly comparisons show strong sales and earnings reasonably meeting the C criteria. Its annual earnings (A criteria) had a downturn in FY '09, yet they have otherwise been good and steady.

8/9/2012 1:05:36 PM - Y - Color code is changed to yellow with pivot point cited based on its 5/22/12 high plus 10 cents. Reported earnings +58% on +23% sales revenues for the Jun '12 quarter. Gapped up today for a new 52-week and all-time high, breaking out from a long flat base. A "breakaway gap" is one noted exception when buying more than +5% above prior highs is permitted under the fact-based system, however risk increases the further one chases a stock above its pivot point. Recent quarterly comparisons show strong sales and earnings reasonably meeting the C criteria. Its annual earnings (A criteria) had a downturn in FY '09, yet they have otherwise been good and steady.

6/1/2012 12:02:28 PM - Slumping under its 50 DMA line today. Still consolidating only -5.8% off its all-time high. The 5/18/12 mid-day report noted - "Recent quarterly comparisons show improving sales and earnings, but its growth history is below the guidelines of the fact-based system."

5/29/2012 12:12:01 PM - Still consolidating near its all-time high. The 5/18/12 mid-day report noted - "Recent quarterly comparisons show improving sales and earnings, but its growth history is below the guidelines of the fact-based system."

5/18/2012 12:37:03 PM - Consolidating near its all-time high. Recent quarterly comparisons show improving sales and earnings, but its growth history is below the guidelines of the fact-based system.

4/1/2011 1:13:38 PM - Hit a new 52 week high today with an 8th consecutive gain. It is clear of all overhead supply. Recent quarterly comparisons show improving sales and earnings but its prior earnings and sales growth history is below the guidelines of the fact-based system.

3/8/2011 12:26:58 PM - Consolidating near its 50 DMA line and prior highs after enduring distributional pressure, remaining perched at multi-year highs. Noted in recent mid-day reports - "With volume-driven gains helping it rise clear of all overhead supply. Earnings and sales growth history below guidelines."

3/4/2011 12:41:35 PM - Consolidating above its 50 DMA line and prior highs after enduring distributional pressure, remaining perched at multi-year highs. Noted in recent mid-day reports - "With volume-driven gains helping it rise clear of all overhead supply. Earnings and sales growth history below guidelines."

3/3/2011 12:00:18 PM - Consolidating just above its 50 DMA line and prior highs after a bout of distributional pressure last week. Perched at multi-year highs after noted in recent mid-day reports - "With volume-driven gains helping it rise clear of all overhead supply. Earnings and sales growth history below guidelines."

3/2/2011 12:41:25 PM - Consolidating just above its 50 DMA line and prior highs after a bout of distributional pressure last week. Last noted in the 2/22/11 mid-day report - "Hit a new 52-week high and multi-year highs last week with volume-driven gains helping it rise clear of all overhead supply. Earnings and sales growth history below guidelines."

2/22/2011 12:57:37 PM - Down on above average volume today, slumping near its 50 DMA line and prior highs. Hit a new 52-week high and multi-year highs last week with volume-driven gains helping it rise clear of all overhead supply. Prior mid-day reports noted - "Earnings and sales growth history below guidelines."

12/7/2010 12:38:16 PM - Hit a new 52-week high today with a 9th consecutive gain. Earnings and sales growth history below guidelines.

11/9/2010 1:41:13 PM - Hit a new 52-week high today. Earnings and sales growth history below guidelines.

10/20/2010 1:34:05 PM - Earnings and sales growth history below guidelines.

1/3/2008 12:43:28 PM - Strong action since its 11/09/07 gap up above its 50 and 200 DMA line. Poised to possibly close at a new all-time high. Earnings and sales growth history below guidelines.

11/23/2007 11:24:09 AM - Strong action since its 11/09/07 gap up abvoe its 50 and 200 DMA line has it poised to possibly close at a new all-time best. Earnings and sales history below guidelines.

11/20/2007 12:49:43 PM - Strong action since its 11/09/07 gap up abvoe its 50 and 200 DMA line has it poised to possibly close at a new all-time best. Earnings and sales history below guidelines.

8/9/2007 1:06:09 PM - Base remains questionable.

8/8/2007 1:25:06 PM - Base remains questionable.

5/4/2007 12:52:25 PM - Base remains questionable.

5/3/2007 12:39:10 PM - Base remains questionable.

4/20/2007 12:58:57 PM - Huge gap open after announcing earnings on 3/9 yet group rank was below guidelines and base is now somewhat questionable.

4/3/2007 2:03:23 PM - Huge gap open after announcing earnings on 3/9 yet group rank was below guidelines and base is now somewhat questionable.

4/2/2007 1:46:21 PM - Huge gap open after announcing earnings on 3/9 yet group rank was below guidelines and base is now somewhat questionable.

3/20/2007 12:42:55 PM - Huge gap open after announcing earnings on 3/9 yet group rank was below guidelines and base is now somewhat questionable.

3/19/2007 12:24:12 PM - Huge gap open after announcing earnings on 3/9 yet group rank was below guidelines and base is now somewhat questionable.

3/16/2007 12:55:55 PM - Huge gap open after announcing earnings on 3/9 yet group rank was below guidelines and base is now somewhat questionable.

3/13/2007 1:06:01 PM - Huge gap open after announcing earnings on 3/9 yet group rank was below guidelines and base is somewhat questionable.

3/12/2007 12:46:23 PM - Huge gap open after announcing earnings yet group rank is below guidelines and base is somewhat questionable.

3/9/2007 12:33:34 PM - Huge gap open after announcing earnings yet group rank is below guidelines and base is somewhat questionable.

2/23/2007 12:55:14 PM - "C" and sales history just below the guidelines and base somewhat questionable.

1/29/2007 1:00:31 PM - "C" and sales history just below the guidelines and base somewhat questionable.

1/23/2007 12:37:14 PM - "C" and sales history just below the guidelines and base somewhat questionable.

1/22/2007 12:58:49 PM - "C" and sales history just below the guidelines and base somewhat questionable.

1/16/2007 1:10:28 PM - "C" and sales history just below the guidelines.

1/12/2007 12:42:25 PM - "C" and sales history just below the guidelines.

1/11/2007 12:49:39 PM - "C" and sales history just below the guidelines.

1/4/2007 1:05:58 PM - "C" and sales history just below the guidelines.

12/21/2006 12:56:13 PM - Base somewhat questionable at this point to be considered buyable under the guidelines.

12/13/2006 12:59:25 PM - Base somewhat questionable at this point to be considered buyable under the guidelines.

11/21/2006 12:44:05 PM - "C" just below guidelines and too extended from a sound base of support at this point to be considered buyable under the guidelines.

11/13/2006 1:01:57 PM - "C" just below guidelines and too extended from a sound base of support at this point to be considered buyable under the guidelines.

11/10/2006 12:55:48 PM - "C" just below guidelines and too extended from a sound base of support at this point to be considered buyable under the guidelines.

11/9/2006 12:52:46 PM - "C" just below guidelines and too extended from a sound base of support at this point to be considered buyable under the guidelines.

11/8/2006 12:53:53 PM - "C" just below guidelines and base questionable.

3/10/2006 4:18:41 PM - G - Further declines today after above average volume declines yesterday that broke support of an upward trendline and its 50 DMA triggering sell signals after announcing earnings that are up only 10%. That is below the CAN SLIM(TM) guidelines of 25%. As of tonight this issue will be dropped from CANSLIM.net's Featured Stocks List.

3/9/2006 - G - Above average volume declines breaking support of an upward trendline and its 50 DMA triggering sell signals after announcing earnings that are up only 10%. That is below the CAN SLIM(TM) guidelines of 25%.

3/2/2006 5:26:18 PM - G - Holding up near all-time highs while trading lighter volume.

3/1/2006 4:51:56 PM - G - Holding up near all-time highs.

2/27/2006 4:20:53 PM - G - Holding up near all-time highs.

2/23/2006 4:00:08 PM - G - Holding up near all-time highs.

2/22/2006 4:34:38 PM - G - Holding up near all-time highs.

2/21/2006 3:42:34 PM - G - Holding up near all-time highs.

2/14/2006 5:37:09 PM - G - Gains from near support yet volume should have been better. A break below there would be a concern.

2/10/2006 4:30:52 PM - G - Recently found support at its 50 DMA. A break below there would be a concern.

2/8/2006 5:32:54 PM - G - Found support at its 50 DMA. A break below there would be a concern.

2/2/2006 4:42:15 PM - G - Continues holding near all-time highs after a move up from support of its 50 DMA after a gap down following a downgrade by Lehman Bros.

1/30/2006 4:06:44 PM - G - Continues moving up with volume conviction from support of its 200 DMA after a gap down following a downgrade by Lehman Bros.

1/20/2006 12:27:39 PM - G - Continues moving up with volume conviction from support of its 200 DMA after a gap down following a downgrade by Lehman Bros.

1/19/2006 4:06:34 PM - G - Continues moving up with volume conviction from support of its 200 DMA after a gap down following a downgrade by Lehman Bros.

1/18/2006 - G - Holding above support of its 200 DMA after a gap down following a downgrade by Lehman Bros.

1/17/2006 9:55:15 AM - G - Gap down after a downgrade by Lehman Bros. Did find support at its 200 DMA and is trading above there now.

1/13/2006 - G - A few days of declines yet remains in overall solid uptrend.

1/11/2006 - G - Remains in overall solid uptrend.

1/9/2006 - G - Another new high close yet volume could have been better.

1/6/2006 - G - New high close yet volume could have been better.

1/5/2006 - G - Holding up after above average volume gains yesterday.

1/4/2006 - G - Above average volume gains today adding to gains since featured.

12/27/2005 - G - Remains near all-time highs.

12/16/2005 - G - Remains near all-time highs.

12/16/2005 - G - Remains near all-time highs.

12/15/2005 - G - Remains near all-time highs.

12/14/2005 - G - New highs today on above average volume!

12/14/2005 - G - New highs today on above average volume!

12/13/2005 - G - Holding up near all-time highs with steady gains since featured.

12/12/2005 - G - High volume without any price progress is a concern.

12/12/2005 - G - More above average volume gains today.

12/9/2005 - G - Solid gains today closing at a new high adding to gains since featured.

12/9/2005 - G - New all-time highs today adding to gains since featured.

12/8/2005 - G - Holding near all-time highs.

12/2/2005 - G - Holding near all-time highs.

12/1/2005 - G - High volume advance today!

12/1/2005 - G - Continues holding up near all-time highs.

11/30/2005 - G - Holding up near all-time highs.

11/29/2005 5:23:03 PM - G - Holding up near all-time highs.

11/29/2005 - G - Holding up near all-time highs.

11/28/2005 5:49:52 PM - G - Holding up near all-time highs.

11/23/2005 4:36:17 PM - G - Holding up near all-time highs. Now trading above the max buy price so CANSLIM.net Status has been changed to green.

11/21/2005 4:14:40 PM - Y - Holding up near all-time highs. A hgh volume advance up to the max buy price of $78.38 would trigger another technical buy signal.

11/18/2005 1:01:07 PM - Y - High volume without any price progress is a concern.

11/17/2005 - Y - Above average volume advance today . Was first featured on 10/24/03 at $21.75. Now being re-featured as it has built a new base to buy from.

11/17/2005 1:36:43 PM - Y - Above average volume advance today triggering a technical buy signal. Was first featured on 10/24/03 at $21.75. Now being re-featured as it has built a new base to buy from.

11/16/2005 - Y - Volume remains light. Recently broke above its pivot point of $74.65 and triggered a technical buy signal. Was first featured on 10/24/03 at $21.75. Now being re-featured as it has built a new base to buy from.

11/16/2005 - Y - Volume remains light. Recently broke above its pivot point of $74.65 and triggered a technical buy signal. Was first featured on 10/24/03 at $21.75. Now being re-featured as it has built a new base to buy from.

11/15/2005 4:32:08 PM - Y - Again declines today yet volume light. Recently broke above its pivot point of $74.65 and triggered a technical buy signal. Was first featured on 10/24/03 at $21.75. Now being re-featured as it has built a new base to buy from.

11/15/2005 4:32:07 PM - Y - Again declines today yet volume light. Recently broke above its pivot point of $74.65 and triggered a technical buy signal. Was first featured on 10/24/03 at $21.75. Now being re-featured as it has built a new base to buy from.

11/14/2005 - Y - Declines today yet volume light. Recently broke above its pivot point of $74.65 and triggered a technical buy signal. Was first featured on 10/24/03 at $21.75. Now being re-featured as it has built a new base to buy from.

11/11/2005 5:00:41 PM - Y - New high close on above average volume breaking above its pivot point of $74.65 and triggering a technical buy signal. Was first featured on 10/24/03 at $21.75. Now being re-featured as it has built a new base to buy from.

11/11/2005 12:30:48 PM - Y - Breaking above its pivot point of $74.65 and triggering a technical buy signal. Was first featured on 10/24/03 at $21.75. Now being re-featured as it has built a new base to buy from.

11/10/2005 12:58:51 PM - Y - Breaking above its pivot point of $74.65 and triggering a technical buy signal. Was first featured on 10/24/03 at $21.75. Now being re-featured as it has built a new base to buy from.

11/9/2005 4:25:00 PM - Y - Another above average volume break above its pivot point of $74.65 would trigger a technical buy signal. Was first featured on 10/24/03 at $21.75. Now being re-featured as it has built a new base to buy from.

11/4/2005 5:19:51 PM - Y - Another above average volume break above its pivot point of $74.65 would trigger a technical buy signal. Was first featured on 10/24/03 at $21.75. Now being re-featured as it has built a new base to buy from.

11/2/2005 - Y - Big volume breakout today from a decent base of consolidation. Was first featured on 10/24/03 at $21.75. Now being re-featured as it has built a new base to buy from.

10/26/2005 1:55:06 PM - G - Recent gap open and a solid advance. Consolidating recent gains. Featured on 10/24/03 at $21.75.

10/14/2005 12:38:11 PM - G - Gap open and a solid advance today! Featured on 10/24/03 at $21.75.

10/13/2005 1:04:32 PM - G - Remians above its 50 DMA. Featured on 10/24/03 at $21.75.

6/1/2004 1:00:00 PM - G - Previously indicated as noteworthy on 10/24/03 at $21.75. Getting a little ET at this point