12/8/2010 6:12:23 PM - Damaging distribution on 12/07/10 amid widespread weakness in many China-based companies led to a violation of a recent chart low ($37.71 on 11/15/10) raising more serious concerns and triggering a more worrisome technical sell signal. It was dropped from the Featured Stocks list.

12/7/2010 11:42:38 AM - G - Down considerably today amid widespread weakness in many China-based companies. Its damaging loss led to a violation of a recent chart low ($37.71 on 11/15/10) raising more serious concerns and triggering a more worrisome technical sell signal.

12/6/2010 2:52:50 PM - G - Slumping -9.4% off its all-time high, it violated its 50 DMA line today, raising concerns. More damaging losses leading to a violation of its recent low ($37.71 on 11/15/10) would raise more serious concerns and trigger a more worrisome technical sell signal.

12/3/2010 5:51:03 PM - Y - Perched -7.3% off its all-time high, above support near its 50 DMA line, it traded very light volume today. More damaging losses leading to a violation of the short-term average would raise concerns and trigger a technical sell signal.

12/1/2010 5:45:25 PM - Y - Perched -7.6% off its all-time high, it closed near today's session low while higher volume without meaningful price progress was indicative of more worrisome distributional pressure. Its latest slump below its pivot point raised concerns while it is still consolidating above support near its 50 DMA line.

11/29/2010 5:21:18 PM - Y - Perched -7.5% off its all-time high today. Its latest slump below its pivot point raised concerns again, yet volume totals have been cooling while consolidating above support near its 50 DMA line.

11/24/2010 4:12:44 PM - Y - Perched only -4.5% off its all-time high after a small gap up gain today. Volume totals have been cooling while consolidating above support near its 50 DMA line.

11/22/2010 3:48:26 PM - Y - Recently consolidating above support near its 50 DMA line. Color code was changed to yellow after a rebound above the $40 level helped its outlook.

11/18/2010 5:11:53 PM - Y - Recently found support near its 50 DMA line. Color code is changed to yellow after a rebound above the $40 level helped its outlook.

11/15/2010 10:06:26 AM - G - Violated prior highs in the $40-41 area and slumped quickly below its 50 DMA line today, raising concerns. Color code is changed to green, and only a prompt rebound above the $40 would help its outlook.

11/11/2010 11:53:26 AM - Y - Gapped down today for a small loss, pulling back from an all-time high hit on the prior session. Prior highs in the $40-41 area define support above its 50 DMA line

11/9/2010 6:19:50 PM - Y - Inching higher on light volume this week. Big gains last week including a strong close on 11/05/10 with heavy volume confirmed a technical buy signal. Color code was changed to yellow with its new pivot point cited based on its 10/14/10 high plus 10 cents.

11/5/2010 11:22:29 PM - Y - Color code was changed to yellow with new pivot point cited in today's mid-day report based on its 10/14/10 high plus 10 cents. Its Relative Strength rank has improved to 83 based on its recent gains. A strong close with heavy volume confirmed a new technical buy signal.

11/5/2010 1:12:06 PM - Y - Color code is changed to yellow with new pivot point cited based on its 10/14/10 high plus 10 cents. Its Relative Strength rank has improved to 82 based on its recent gains. A strong close with heavy volume could confirm a new technical buy signal. As last noted on 10/29/10 - "Outlook would only turn bullish upon powerful gains above the $40 level which has been a stubborn resistance level."

10/29/2010 4:20:55 PM - G - Loss today with above average volume raised greater concerns while it slumped further below its 50 DMA line and finished -13% below its 52-week high. Its Relative Strength rank has slumped to 70 while it has struggled in recent weeks. Based on weak action it will be dropped from the Featured Stocks list tonight. Outlook would only turn bullish upon powerful gains above the $40 level which has been a stubborn resistance level.

10/27/2010 4:54:20 PM - G - Slumped near its 50 DMA line - an important level to watch. Gains with above average volume for a new high close are needed for its outlook to improve, technically.

10/25/2010 5:07:37 PM - G - Small gap up gain today with light volume, consolidating above support at its 50 DMA line - an important level to watch. Gains with above average volume for a new high close are needed for its outlook to improve, technically.

10/21/2010 2:59:18 PM - G - Losses without great volume this week have it slumping toward recent support near its 50 DMA line. Color code is changed to green after failing to make progress following noted signs of distributional pressure. When it returned to the Featured Stocks list on 10/14/10 it had formed a 10-month long flat base and maintained a very strong sales revenues and earnings track record. Previously noted - "Patient and disciplined investors will resist the urge to get in 'early' and wait for a proper buy signal."

10/19/2010 3:55:52 PM - Y - Gapped down, slumping today without great volume as it trades toward recent support near its 50 DMA line. It has formed a 10-month long flat base and maintained a very strong sales revenues and earnings track record. Its high volume and lack of meaningful price progress is a sign of distributional pressure since it returned to the Featured Stocks list on 10/14/10 and was noted - "Patient and disciplined investors will resist the urge to get in 'early' and wait for a proper buy signal."

10/18/2010 4:17:30 PM - Y - Up with average volume today after finding prompt support near its 50 DMA line on 10/15/10 following a gap down. It has formed a 10-month long flat base and maintained a very strong sales revenues and earnings track record. It returned to the Featured Stocks list on 10/14/10 and was noted - "Patient and disciplined investors will resist the urge to get in 'early' and wait for a proper buy signal."

10/15/2010 3:05:06 PM - Y - Up from early lows near its 50 DMA line after gapping down today. It has formed a 10-month long flat base and maintained a very strong sales revenues and earnings track record. It returned to the Featured Stocks list on 10/14/10 and was noted - "Patient and disciplined investors will resist the urge to get in 'early' and wait for a proper buy signal."

10/14/2010 1:00:31 PM - Y - It has formed a 10-month long flat base and maintained a very strong sales revenues and earnings track record since dropped from the Featured Stocks list on 2/02/10. Color code is changed to yellow with pivot point based on its all-time high plus ten cents. Widespread strength in China-based issues combined with leadership in the Computer Software groups (L criteria) are reassuring signs. Patient and disciplined investors will resist the urge to get in "early" and wait for a proper buy signal, while it is now within -5% of its 52-week high after a streak of small gains with above average volume.

2/2/2010 - Loss today on above average volume, sinking further below its 50 DMA line. Based on weak action it will be dropped from the Featured Stocks list tonight. Recently probing its prior chart highs in the $31-33 area which define the next technical support level. Due to report earnings on Wednesday, February 10 after the market close. Widespread weakness in China-based issues has clearly been a factor in recent days.

2/2/2010 4:26:31 PM - G - Loss today on above average volume, sinking further below its 50 DMA line. Based on weak action it will be dropped from the Featured Stocks list tonight. Recently probing its prior chart highs in the $31-33 area which define the next technical support level. Due to report earnings on Wednesday, February 10 after the market close. Widespread weakness in China-based issues has clearly been a factor in recent days.

2/1/2010 5:27:39 PM - G - Small gain today following a gap down on 1/29/10 for a loss with very heavy volume. Still trading below its 50 DMA line. Recently probing its prior chart highs in the $31-33 area which define the next technical support level. Due to report earnings on Wednesday, February 10 after the market close. Widespread weakness in China-based issues has clearly been a factor in recent days.

1/29/2010 6:38:57 PM - G - Gapped down today for a loss with very heavy volume. Still trading below its 50 DMA line while probing its prior chart highs in the $31-33 area which define the next technical support level. Due to report earnings on Wednesday, February 10 after the market close. Widespread weakness in China-based issues has clearly been a factor in recent days.

1/28/2010 6:03:18 PM - G - Posted a small gain with average volume. Still trading below its 50 DMA line, while its prior chart highs in the $31-33 area define the next technical support level. Due to report earnings on Wednesday, February 10 after the market close. Widespread weakness in China-based issues has clearly been a factor in recent days.

1/27/2010 4:51:41 PM - G - Positively reversed today for a small gain with above average volume. Trading below its 50 DMA line now, its prior chart highs in the $31-33 area define the next technical support level. Due to report earnings on Wednesday, February 10 after the market close. Widespread weakness in China-based issues has clearly been a factor in recent days.

1/26/2010 5:33:01 PM - G - Loss today with above average volume for its lowest close since November, promptly slumping back below its 50 DMA line. Due to report earnings on Wednesday, February 10 after the market close. Widespread weakness in China-based issues has clearly been a factor in recent days.

1/25/2010 4:55:21 PM - G - Positive reversal today for a considerable gain with above average volume, rallying back above its 50 DMA line, helping its outlook improve. Widespread weakness in China-based issues has clearly been a factor in recent days.

1/22/2010 5:35:24 PM - G - Today's loss with above average volume indicated more worrisome distributional pressure as it traded further under its 50 DMA line. Widespread weakness in China-based issues has clearly been a factor in recent days.

1/21/2010 5:21:36 PM - G - Another loss today with above average volume indicated more worrisome distributional pressure, and it traded under its 50 DMA line before recovering to close near the middle of its intra-day range. Widespread weakness in China-based issues has clearly been a factor in recent days.

1/20/2010 5:10:26 PM - G - Holding its ground this week after losses last week with above average volume indicated worrisome distributional pressure. Its 50 DMA line near $35 has been previously noted as an initial support level to watch on pullbacks. Its fundamentals remain strong.

1/19/2010 4:33:52 PM - G - Held its ground with a gain on above average volume today. Losses last week with above average volume indicated worrisome distributional pressure. Its 50 DMA line near $35 has been previously noted as an initial support level to watch on pullbacks. Its fundamentals remain strong.

1/15/2010 6:50:42 PM - G - Held its ground after a big loss on 1/13/10 with above average volume indicated more worrisome distributional pressure. Its 50 DMA line near $35 has been previously noted as an initial support level to watch on pullbacks. Its fundamentals remain strong.

1/14/2010 6:32:05 PM - G - Held its ground today after a big loss on 1/13/10 with above average volume indicated more worrisome distributional pressure. Its 50 DMA line near $35 has been previously noted as an initial support level to watch on pullbacks. Its fundamentals remain strong.

1/13/2010 - G - Big early loss today with above average volume indicates more worrisome distributional pressure. Its 50 DMA line near $35 has been previously noted as an initial support level to watch on pullbacks. Its fundamentals remain strong.

1/12/2010 7:04:24 PM - G - Gapped down today for a small loss with lighter volume, pulling back from the all-time high set on the prior session. Recent action was described by some as a "3 weeks tight" pattern, however it is considerably extended from the choppy 14-week base previously noted here. Its 50 DMA line is an initial support level to watch on pullbacks. A proposed offering of additional shares on 11/16/09 seems well received by the market. Its fundamentals remain strong.

1/11/2010 6:15:31 PM - G - Gain today with lighter volume for a new all-time high. Extended from a sound buy point after recently rising from a choppy 14-week base. Its 50 DMA line is an initial support level to watch. A proposed offering of additional shares on 11/16/09 seems well received by the market. Its fundamentals remain strong.

1/8/2010 5:54:50 PM - G - Gain today with slightly above average volume for a new all-time high. Extended from a sound buy point after recently rising from a choppy 14-week base. Its 50 DMA line is an initial support level to watch. A proposed offering of additional shares on 11/16/09 seems well received by the market. Its fundamentals remain strong.

1/7/2010 5:29:25 PM - G - Holding its ground near all-time highs, extended from a sound buy point after recently rising from a choppy 14-week base. Its 50 DMA line is an initial support level to watch. A proposed offering of additional shares on 11/16/09 seems well received by the market. Its fundamentals remain strong.

1/6/2010 6:37:11 PM - G - Gapped up slightly today but reversed and ended with a loss. It is extended from a sound buy point after recently rising from a choppy 14-week base. Its 50 DMA line and prior chart highs are initial support levels to watch. A proposed offering of additional shares on 11/16/09 seems well received by the market. Its fundamentals remain strong.

1/5/2010 5:50:29 PM - G - Gapped down today with a loss on higher volume negating much of its prior session's considerable gain for a new all-time high. It is extended from a sound buy point after recently rising from a choppy 14-week base. Its 50 DMA line and prior chart highs are initial support levels to watch. A proposed offering of additional shares on 11/16/09 seems well received by the market. Its fundamentals remain strong.

1/5/2010 1:02:28 PM - G - Gappped down today with a loss on higher volume negating much of its prior session's considerable gain for a new all-time high. It is extended from a sound buy point after recently rising from a choppy 14-week base. Its 50 DMA line and prior chart highs are initial support levels to watch. A proposed offering of additional shares on 11/16/09 seems well received by the market. Its fundamentals remain strong.

1/4/2010 6:07:34 PM - G - Considerable gain today with slightly above average volume for a new all-time high. Extended from a sound buy point now after recently rising from a choppy 14-week base. Its 50 DMA line and prior chart highs are initial support levels to watch. A proposed offering of additional shares on 11/16/09 seems well received by the market. Its fundamentals remain strong.

12/31/2009 5:38:45 PM - G - Hovering near all-time highs with a 3rd consecutive loss on light volume. Extended from a sound buy point now after recently rising from a choppy 14-week base. Its 50 DMA line and prior chart highs are an initial support levels to watch. A proposed offering of additional shares on 11/16/09 seems well received by the market. Its fundamentals remain strong.

12/30/2009 6:55:53 PM - G - Second consecutive small loss on very light volume while hovering near all-time highs. Extended from a sound buy point now after recently rising from a choppy 14-week base. Its 50 DMA line and prior chart highs are an initial support levels to watch. A proposed offering of additional shares on 11/16/09 seems well received by the market. Its fundamentals remain strong.

12/29/2009 5:54:03 PM - G - Small loss on very light volume today while hovering near all-time highs. Extended from a sound buy point now after recently rising from a choppy 14-week base. Its 50 DMA line coincides with prior chart highs in the $32 area are an initial support level to watch. A proposed offering of additional shares on 11/16/09 seems well received by the market. Its fundamentals remain strong.

12/28/2009 5:18:18 PM - G - Quiet gain today for its second highest close ever while hovering near all-time highs. Extended from a sound buy point now after recently rising from a choppy 14-week base. Its 50 DMA line coincides with prior chart highs in the $32 area are an initial support level to watch. A proposed offering of additional shares on 11/16/09 seems well received by the market. Its fundamentals remain strong.

12/24/2009 2:20:57 PM - G - Quietly hovering near all-time highs, extended from a sound buy point now after recently rising from a choppy 14-week base. Its 50 DMA line coincides with prior chart highs in the $32 area are an initial support level to watch. A proposed offering of additional shares on 11/16/09 seems well received by the market. Its fundamentals remain strong.

12/23/2009 4:52:14 PM - G - Quietly consolidating near all-time highs. Extended from a sound buy point now after recently rising from a choppy 14-week base. Its 50 DMA line coincides with prior chart highs in the $32 area are an initial support level to watch. A proposed offering of additional shares on 11/16/09 seems well received by the market. Its fundamentals remain strong.

12/22/2009 4:43:09 PM - G - Loss today, closing near the session low with higher volume (near average) after briefly touching a new all-time high on the prior session. Extended from a sound buy point now after recently rising from a choppy 14-week base. Its 50 DMA line coincides with prior chart highs in the $32 area are an initial support level to watch. A proposed offering of additional shares on 11/16/09 seems well received by the market. Its fundamentals remain strong.

12/21/2009 6:24:59 PM - G - Closed in the lower third of its intra-day range today after briefly touching a new all-time high. Extended after recently rising from a choppy 14-week base. Prior chart highs in the $31 area are an initial support level to watch. A proposed offering of additional shares on 11/16/09 seems well received by the market. Its fundamentals remain strong.

12/18/2009 5:26:58 PM - G - Perched near all-time highs, extended after recently rising from a choppy 14-week base. Prior chart highs in the $31 area are an initial support level to watch. A proposed offering of additional shares on 11/16/09 seems well received by the market. Its fundamentals remain strong.

12/17/2009 6:03:23 PM - G - Loss on lighter volume today erased a large part of its prior gain with above average volume for a new all-time high. It got extended after recently rising from a choppy 14-week base. Prior chart highs in the $31 area are an initial support level to watch. A proposed offering of additional shares on 11/16/09 seems well received by the market. Its fundamentals remain strong.

12/16/2009 5:15:40 PM - G - Considerable gain today with above average volume for a new all-time high, getting extended after recently rising from a choppy 14-week base. Prior chart highs in the $31 area are an initial support level to watch. A proposed offering of additional shares on 11/16/09 seems well received by the market. Its fundamentals remain strong.

12/15/2009 4:56:34 PM - G - Gain today on below average volume leaves it perched near all-time highs, extended after recently rising from a choppy 14-week base. Prior chart highs in the $31 area are an initial support level to watch. A proposed offering of additional shares on 11/16/09 seems well received by the market. Its fundamentals remain strong.

12/14/2009 5:07:01 PM - G - Small gain today on very light volume leaves it perched near all-time highs, extended after recently rising from a choppy 14-week base. Prior chart highs in the $31 area are an initial support level to watch. A proposed offering of additional shares on 11/16/09 seems well received by the market. Its fundamentals remain strong.

12/11/2009 5:06:14 PM - G - Small gain today on light volume halted a 4 session slide. It is still quietly perched near all-time highs. It remains a bit extended after recently rising from a choppy 14-week base. Prior chart highs in the $31 area are an initial support level to watch. A proposed offering of additional shares on 11/16/09 seems well received by the market. Its fundamentals remain strong.

12/10/2009 5:55:43 PM - G - Today was its 4th consecutive small loss on light volume while still quietly perched near all-time highs. It remains a bit extended after recently rising from a choppy 14-week base. Prior chart highs in the $31 area are an initial support level to watch. A proposed offering of additional shares on 11/16/09 seems well received by the market. Its fundamentals remain strong.

12/9/2009 6:09:41 PM - G - Today was its 3rd consecutive loss on light volume while still quietly perched near all-time highs. It remains a bit extended after recently rising from a choppy 14-week base. Prior chart highs in the $31 area are an initial support level to watch. A proposed offering of additional shares on 11/16/09 seems well received by the market. Its fundamentals remain strong.

12/8/2009 6:01:58 PM - G - Small loss again today on light volume. Quietly perched near all-time highs, extended after recently rising from a choppy 14-week base. Prior chart highs in the $31 area are an initial support level to watch. A proposed offering of additional shares on 11/16/09 seems well received by the market. Its fundamentals remain strong.

12/7/2009 5:35:04 PM - G - Small loss today on light volume. Quietly perched near all-time highs, extended after recently rising from a choppy 14-week base. Prior chart highs in the $31 area are an initial support level to watch. A proposed offering of additional shares on 11/16/09 seems well received by the market. Its fundamentals remain strong.

12/4/2009 - G - Small gain today on light volume. Perched near all-time highs, extended after recently rising from a choppy 14-week base. Prior chart highs in the $31 area are an initial support level to watch. A proposed offering of additional shares on 11/16/09 seems well received by the market. Its fundamentals remain strong.

12/3/2009 5:31:40 PM - G - Small loss today on light volume. Perched near all-time highs, extended after recently rising from a choppy 14-week base. Prior chart highs in the $31 area are an initial support level to watch. A proposed offering of additional shares on 11/16/09 seems well received by the market. Its fundamentals remain strong.

12/2/2009 5:36:07 PM - G - Gain today on lighter volume for another new all-time high, getting extended after recently rising from a choppy 14-week base. Prior chart highs in the $31 area are an initial support level to watch. A proposed offering of additional shares on 11/16/09 seems well received by the market. Its fundamentals remain strong.

12/1/2009 5:58:54 PM - G - Gain today on near average volume for a new all-time high, getting extended after recently rising from a choppy 14-week base. Prior chart highs in the $31 area are an initial support level to watch. A proposed offering of additional shares on 11/16/09 seems well received by the market. Its fundamentals remain strong.

11/30/2009 5:25:56 PM - G - Holding its ground near all-time highs after recently rising from a choppy 14-week base. Prior chart highs in the $31 area are an initial support level to watch. A proposed offering of additional shares on 11/16/09 seems well received by the market. Its fundamentals remain strong.

11/27/2009 1:25:41 PM - G -Gapped down then rebounded today for a gain on light volume and a new all-time high close. Last week it rose from a choppy 14-week base. Recent highs in the $31 area are an initial support level to watch. A proposed offering of additional shares on 11/16/09 seems well received by the market. Its fundamentals remain strong.

11/25/2009 5:44:44 PM - G -Gain on light volume today for a new all-time high close. Last week it rose from a choppy 14-week base. Recent highs in the $31 area are an initial support level to watch. A proposed offering of additional shares on 11/16/09 seems well received by the market. Its fundamentals remain strong.

11/24/2009 5:26:07 PM - G -Gain on light volume today for a new high close following a negative reversal after hitting a new all-time high on the prior session. Last week it rose from a choppy 14-week base. Recent highs in the $31 area are an initial support level to watch. A proposed offering of additional shares on 11/16/09 seems well received by the market. Its fundamentals remain strong.

11/23/2009 5:46:04 PM - G - Negatively reversed today after hitting a new all-time high. Last week it rose from a choppy 14-week base. Recent highs in the $31 area are an initial support level to watch. A proposed offering of additional shares on 11/16/09 seems well received by the market. Its fundamentals remain strong.

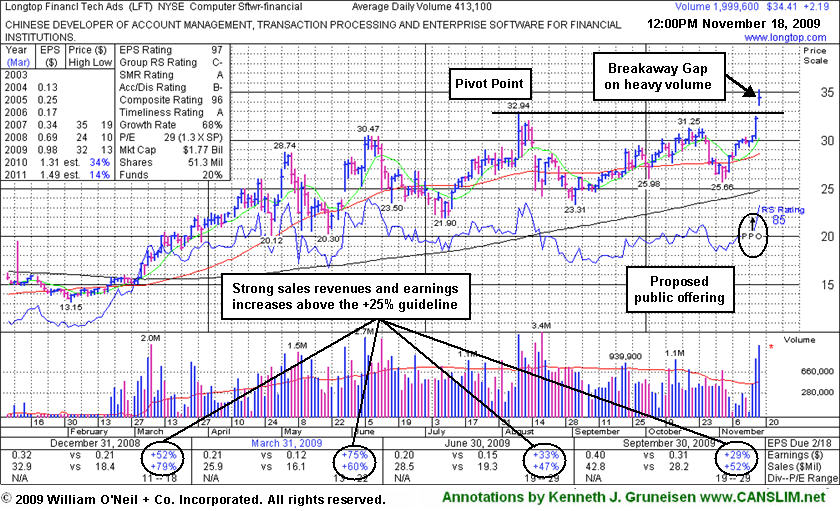

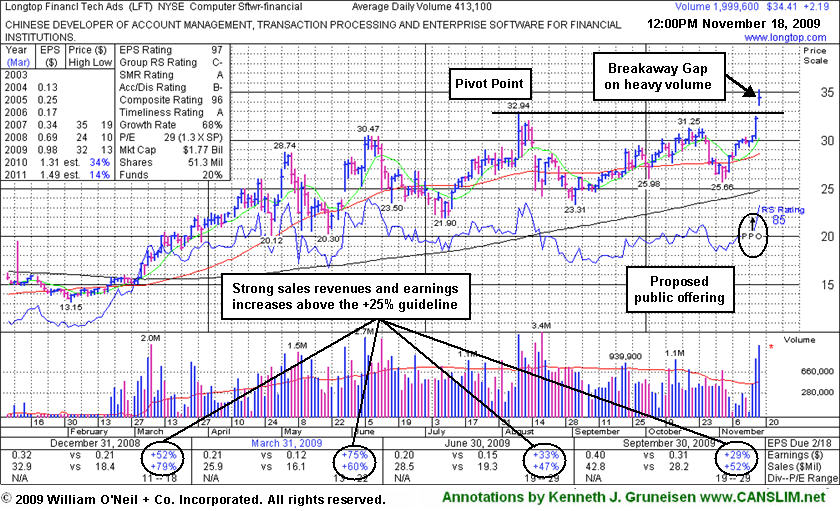

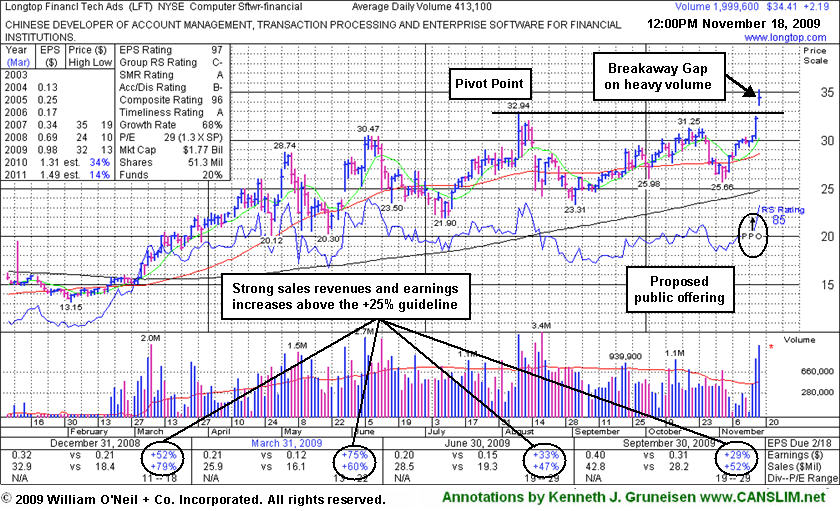

11/20/2009 6:57:09 PM - G - Considerable gain today with +78% above average volume lifted it to a close beyond its "max buy" level. Color code is changed to green. It rose this week from a choppy 14-week base. Recent highs in the $31 area are an initial support level to watch. A proposed offering of additional shares on 11/16/09 seems well received by the market. Its fundamentals remain strong.

11/20/2009 12:55:30 PM - Y - Rising near its "max buy" level today after the prior gain with +47% above average volume in the face of a negative overall market helped it close above its pivot point. Volume was borderline with the +50% above average guideline for a proper breakout, yet provided a confirmation to the prior session's "breakaway gap" from a choppy 14-week base. Recent highs in the $31 area are an initial support level to watch. A proposed offering of additional shares on 11/16/09 seems well received by the market. Its fundamentals remain strong.

11/19/2009 5:42:12 PM - Y - Gain with +47% above average volume today in the face of a negative overall market helped it close above its pivot point. Volume today was borderline with the +50% above average guideline for a proper breakout, yet provided a confirmation to the prior session's "breakaway gap" from a choppy 14-week base. Recent highs in the $31 area are an initial support level to watch. A proposed offering of additional shares on 11/16/09 seems well received by the market. Its fundamentals remain strong.

11/18/2009 5:40:32 PM - Y - Breakaway gap up today helped it blast from a choppy 14-week base, confirming a powerful technical breakout with heavy volume. However, its close near the session low raised some concerns because it technically put it back below its pivot point after it had briefly traded above its "max buy" price and above Oct 2007 all-time high. Recent highs in the $31 area are an initial support level to watch. A proposed offering of additional shares on 11/16/09 seems well received by the market. Its fundamentals remain strong.

11/18/2009 12:46:39 PM - Y - Breakaway gap up today helped it blast from a choppy 14-week base, confirming a powerful technical breakout with heavy volume. Traded above its Oct 2007 all-time high. A proposed offering of additional shares on 11/16/09 seems well received by the market. Its fundamentals remain strong.

11/18/2009 11:45:52 AM - Y - Gapped up today for a considerable gain and it briefly cleared its Oct 2007 all-time high. The breakaway gap helped it blast from a choppy 14-week base and confirmed a powerful technical breakout. A proposed offering of additional shares on 11/16/09 seems well received by the market. Its fundamentals remain strong.

11/17/2009 6:26:43 PM - Y - Gain today with above average volume cleared its October high and approached its August highs, ending at a new 2009 high close. It has formed a choppy 14-week base, and gains with volume above its pivot point (based on its 8/10/09 high) are still needed to confirm a proper technical breakout. Based on weak action LFT was previously dropped from the Featured Stocks list on 9/02/09, yet it has rebounded impressively and its fundamentals remain strong.

11/17/2009 1:26:57 PM - Y - Gain today with above average volume has it clearing its October high and approaching its August highs. It has formed a choppy 14-week base, and gains with volume above its pivot point (based on its 8/10/09 high) are still needed to confirm a proper technical breakout. Based on weak action LFT was previously dropped from the Featured Stocks list on 9/02/09, yet it has rebounded impressively and its fundamentals remain strong.

9/2/2009 - Closed near its session high today with a gain on lighter than average volume. On 8/31/09 it was noted when "violating a multi-month upward trendline connecting February, July, and August chart lows, raising more serious concerns and triggering additional technical sell signals." Volume behind recent gains has been very light since previously noted "substantial losses on heavy volume indicative of distributional pressure." It would need to rally back above its 50 DMA and recent chart highs for its outlook to improve. Based on weak action it will be dropped from the Featured Stocks list tonight.

9/2/2009 4:36:39 PM - G - Closed near its session high today with a gain on lighter than average volume. On 8/31/09 it was noted when "violating a multi-month upward trendline connecting February, July, and August chart lows, raising more serious concerns and triggering additional technical sell signals." Volume behind recent gains has been very light since previously noted "substantial losses on heavy volume indicative of distributional pressure." It would need to rally back above its 50 DMA and recent chart highs for its outlook to improve. Based on weak action it will be dropped from the Featured Stocks list tonight.

9/1/2009 6:09:26 PM - G - Third consecutive loss today on average volume. On 8/31/09 it was noted when "violating a multi-month upward trendline connecting February, July, and August chart lows, raising more serious concerns and triggering additional technical sell signals." Volume behind recent gains has been very light since previously noted "substantial losses on heavy volume indicative of distributional pressure." It would need to rally back above its 50 DMA and recent chart highs for its outlook to improve.

8/31/2009 4:23:22 PM - G - Gapped down today for a loss on average volume, violating a multi-month upward trendline connecting February, July, and August chart lows, raising more serious concerns and triggering additional technical sell signals. Volume behind recent gains has been very light since previously noted "substantial losses on heavy volume indicative of distributional pressure." It would need to rally back above its 50 DMA and recent chart highs for its outlook to improve.

8/28/2009 6:25:18 PM - G - Weak action in the past week led to a violation of its 50 DMA line again, and volume behind recent gains has been very light since previously noted "substantial losses on heavy volume indicative of distributional pressure." It is trading near recent chart lows an its multi-month upward trendline connecting the February, July, and August chart lows where further deterioration would raise more serious concerns and trigger additional technical sell signals. It would need to rally back above its 50 DMA and recent chart highs for its outlook to improve.

8/27/2009 6:00:39 PM - G - Small gain today after a considerable loss on average volume led to a violation of its 50 DMA line again on the prior session. Recently noted "substantial losses on heavy volume indicative of distributional pressure."

8/26/2009 6:22:25 PM - G - Considerable loss on average volume today led to a violation of its 50 DMA line again after a small gap down. Recently noted "substantial losses on heavy volume indicative of distributional pressure."

8/25/2009 4:25:33 PM - G - Holding its ground after rebounding above its 50 DMA line following substantial losses on heavy volume indicative of distributional pressure.

8/24/2009 4:27:06 PM - G - Held its ground today after rebounding above its 50 DMA line last week following substantial losses on heavy volume indicative of distributional pressure.

8/21/2009 8:37:44 PM - G - Gain today with light volume after rebounding above its 50 DMA line on the prior session. In the past week it fell substantially on heavy volume indicative of distributional pressure.

8/20/2009 5:38:45 PM - G - Gain today with volume near average helped it promptly rebound above its 50 DMA line. After reporting results for the quarter ended June 30, 2009 it fell substantially on heavy volume 4 times average indicative of distributional pressure. Color code was changed to green after it technically negated its recent breakout.

8/19/2009 4:52:05 PM - G - Gapped down again today after reporting results for the quarter ended June 30, 2009, falling substantially on heavy volume 4 times average indicative of distributional pressure. Color code was changed to green after it technically negated its recent breakout.

8/19/2009 2:24:02 PM - G - Gapped down again today after reporting results for the quarter ended June 30, 2009, falling substantially on heavy volume indicative of distributional pressure. Color code was changed to green after it technically negated its recent breakout.

8/18/2009 5:23:44 PM - G - Positively reversed today and found support, still managing to close above its 50 DMA line. Earnings news for the quarter ended June 30, 2009 was released after the close. Color code was changed to green as it has technically negated its recent breakout.

8/17/2009 5:12:49 PM - G - Down considerably today on heavy volume after gapping lower and violating its 50 DMA line, then rebounding to close above it. Earnings news for the quarter ended June 30, 2009 its due on Tuesday 8/18/09. Color code was changed to green as it has technically negated its recent breakout.

8/17/2009 11:59:09 AM - G - Down considerably today on heavy volume after gapping lower and violating its 50 DMA line, then rebounding above it. Earnings news for the quarter ended June 30, 2009 its due on Tuesday 8/18/09. Color code is changed to green as it has technically negated its recent breakout.

8/14/2009 4:05:22 PM - Y - Loss today on below average volume, slumping under its pivot point after gains earlier this week with above average volume helped it rally above its new pivot point - see the latest FSU analysis from 8/12/09.

8/14/2009 3:49:22 PM - Y - Loss today has it slumping under its pivot point on near average volume after gains earlier this week with above average volume helped it rally above its new pivot point - see the latest FSU analysis from 8/12/09.

8/13/2009 5:47:25 PM - Y - Small loss today on near average volume, closing at its second best level this year. No overhead supply remains to act as resistance after gains this week with above average volume helped it rally above its new pivot point - see the latest FSU analysis from 8/12/09.

8/12/2009 7:10:15 PM - Y - Gain today with +55% above average volume while rallying back above its new pivot point for a new high close. New pivot point and max buy prices noted - be sure to read the latest FSU analysis! It has repaired its 50 DMA violation and rebounded impressively since weak action prompted it to be dropped from the Featured Stocks list on 7/08/09.

8/12/2009 6:53:21 PM - Y - Gain today with +55% above average volume while rallying back above its new pivot point for a new high close. Color code was changed to yellow with new pivot point and max buy prices noted. It has repaired its 50 DMA violation and rebounded impressively since weak action it will be dropped from the Featured Stocks list on 7/08/09.

8/10/2009 1:18:43 PM - Y - Gapped up today and rallied for a considerable gain with heavy volume, reaching a new 52-week high, yet pulling back from intra-day highs. Color code is changed to yellow with new pivot point and max buy prices noted. It has repaired its 50 DMA violation and rebounded impressively since weak action it will be dropped from the Featured Stocks list on 7/08/09.

7/8/2009 - Gapped down today and suffered a considerable loss on higher (near average) volume, closing more than -25% of its 52-week high while sinking further under its 50 DMA line. Based on weak action it will be dropped from the Featured Stocks list tonight. Its progress could be hindered by future share offerings. This Chinese Computer Software firm recently filed a registration of approximately 16 million shares for resale, and it also revealed a planned acquisition of another Chinese service provider.

7/8/2009 6:36:02 PM - G - Gapped down today and suffered a considerable loss on higher (near average) volume, closing more than -25% of its 52-week high while sinking further under its 50 DMA line. Based on weak action it will be dropped from the Featured Stocks list tonight. Its progress could be hindered by future share offerings. This Chinese Computer Software firm recently filed a registration of approximately 16 million shares for resale, and it also revealed a planned acquisition of another Chinese service provider.

7/7/2009 7:17:20 PM - G - Its outlook gets increasingly questionable the longer it remains trading under its 50 DMA line. Its progress could be hindered by future share offerings. This Chinese Computer Software firm recently filed a registration of approximately 16 million shares for resale, and it also revealed a planned acquisition of another Chinese service provider.

7/2/2009 4:02:40 PM - G - Gapped down today and sank to its lowest level since May 27th. Its outlook gets increasingly questionable the longer it remains treading under its 50 DMA line. Its progress could be hindered by future share offerings. This Chinese Computer Software firm recently filed a registration of approximately 16 million shares for resale, and it also revealed a planned acquisition of another Chinese service provider.

7/1/2009 5:47:26 PM - G - Its outlook gets increasingly questionable the longer it remains treading under its 50 DMA line. Its progress could be hindered by future share offerings. This Chinese Computer Software firm recently filed a registration of approximately 16 million shares for resale, and it also revealed a planned acquisition of another Chinese service provider.

6/30/2009 5:20:20 PM - G - Loss today on very light volume, staying under its 50 DMA line, raising concerns. Its progress could be hindered by future share offerings. This Chinese Computer Software firm recently filed a registration of approximately 16 million shares for resale, and it also revealed a planned acquisition of another Chinese service provider.

6/29/2009 6:03:14 PM - G - Loss today on lighter volume led to another close back under its 50 DMA line, raising concerns. Its progress could be hindered by future share offerings. This Chinese Computer Software firm recently filed a registration of approximately 16 million shares for resale, and it also revealed a planned acquisition of another Chinese service provider.

6/26/2009 5:46:43 PM - G - Gain today with heavy volume helped repair this week's violation of its 50 DMA line. Its progress could be hindered by future share offerings. This Chinese Computer Software firm recently filed a registration of approximately 16 million shares for resale, and it also revealed a planned acquisition of another Chinese service provider.

6/25/2009 2:34:30 PM - G - Recently violated its 50 DMA line, raising concerns, and its outlook becomes more questionable the longer it lingers below that important short-term average. Previously noted on 6/05/09 as it rose from a choppy (improper) base pattern. Its progress could be hindered by future share offerings. This Chinese Computer Software firm recently filed a registration of approximately 16 million shares for resale, and it also revealed a planned acquisition of another Chinese service provider.

6/24/2009 4:05:25 PM - G - Violated its 50 DMA line on the prior session, raising concerns. Its outlook remains questionable the longer it lingers below that important short-term average. Previously noted on 6/05/09 as it rose from a choppy (improper) base pattern. Its progress could be hindered by future share offerings. This Chinese Computer Software firm recently filed a registration of approximately 16 million shares for resale, and it also revealed a planned acquisition of another Chinese service provider.

6/23/2009 11:56:23 AM - G - Gapped down today and violated its 50 DMA line, raising concerns. Previously noted on 6/05/09 as it rose from a choppy (improper) base pattern. Its progress could be hindered by future share offerings. Prompt repair of its recent 50 DMA line violation, and its gap up, were noted as signs of solid institutional (the I criteria) support and buying demand. This Chinese Computer Software firm recently filed a registration of approximately 16 million shares for resale, and it also revealed a planned acquisition of another Chinese service provider.

6/22/2009 9:37:06 PM - G - Loss today on light volume while closing still above support at its 50 DMA line. Previously noted on 6/05/09 as it rose from a choppy (improper) base pattern. Its progress could be hindered by future share offerings. Prompt repair of its recent 50 DMA line violation, and its gap up, were noted as signs of solid institutional (the I criteria) support and buying demand. This Chinese Computer Software firm recently filed a registration of approximately 16 million shares for resale, and it also revealed a planned acquisition of another Chinese service provider.

6/19/2009 6:02:23 PM - G - Held its ground this week after a 6/17/09 positive reversal was an encouraging sign of institiutional support near its 50 DMA line. Previously noted on 6/05/09 as it rose from a choppy (improper) base pattern. Its progress could be hindered by future share offerings. Prompt repair of its recent 50 DMA line violation, and its gap up, were noted as signs of solid institutional (the I criteria) support and buying demand. This Chinese Computer Software firm recently filed a registration of approximately 16 million shares for resale, and it also revealed a planned acquisition of another Chinese service provider.

6/18/2009 6:29:47 PM - G - Small gain on lighter volume today followed a positive reversal which was a very encouraging sign of institiutional support after an intra-day violation of its 50 DMA line. Previously noted on 6/05/09 as it rose from a choppy (improper) base pattern. Its progress could be hindered by future share offerings. Prompt repair of its recent 50 DMA line violation, and its gap up, were noted as signs of solid institutional (the I criteria) support and buying demand. This Chinese Computer Software firm recently filed a registration of approximately 16 million shares for resale, and it also revealed a planned acquisition of another Chinese service provider.

6/17/2009 5:41:12 PM - G - Positive reversal today and close near the session high with a gain on higher volume was a very encouraging sign of institiutional support after an earlier intra-day violation of its 50 DMA line. At its low of the session it had completely negated its 5/28/09 gap up gain and all gains that had followed. Previously noted on 6/05/09 as it rose from a choppy (improper) base pattern. Its progress could be hindered by future share offerings. Prompt repair of its recent 50 DMA line violation, and its gap up, were noted as signs of solid institutional (the I criteria) support and buying demand. This Chinese Computer Software firm recently filed a registration of approximately 16 million shares for resale, and it also revealed a planned acquisition of another Chinese service provider.

6/16/2009 7:05:27 PM - G - Loss on above average volume today was yet another dose of distributional pressure. The stock is currently trading just above its 50 DMA line, an important area of support. Hit a new 52-week high on 6/05/09 as it rose from a choppy (improper) base pattern. Its progress could be hindered by future share offerings. Its 5/28/09 gap up and considerable gain followed another strong quarterly financial report. Prompt repair of its recent 50 DMA line violation, and its gap up, were noted as signs of solid institutional (the I criteria) support and buying demand. This Chinese Computer Software firm recently filed a registration of approximately 16 million shares for resale, and it also revealed a planned acquisition of another Chinese service provider.

6/15/2009 5:15:51 PM - G - Gapped down on above average volume after last week's worrisome distributional pressure. The stock is currently trading above its 50 DMA line which is the next logical area of support. Hit a new 52-week high on 6/05/09 as it rose from a choppy (improper) base pattern. Its progress could be hindered by future share offerings. Its 5/28/09 gap up and considerable gain followed another strong quarterly financial report. Prompt repair of its recent 50 DMA line violation, and its gap up, were noted as signs of solid institutional (the I criteria) support and buying demand. This Chinese Computer Software firm recently filed a registration of approximately 16 million shares for resale, and it also revealed a planned acquisition of another Chinese service provider.

6/12/2009 4:02:19 PM - G - Loss today on heavy volume is a sign of more worrisome distributional pressure, and it tested it 50 DMA line again at its intra-day low. Hit a new 52-week high on 6/05/09 as it rose from a choppy (improper) base pattern. Its progress could be hindered by future share offerings. Its 5/28/09 gap up and considerable gain followed another strong quarterly financial report. Prompt repair of its recent 50 DMA line violation, and its gap up, were noted as signs of solid institutional (the I criteria) support and buying demand. This Chinese Computer Software firm recently filed a registration of approximately 16 million shares for resale, and it also revealed a planned acquisition of another Chinese service provider.

6/11/2009 4:57:25 PM - G - Small loss today on higher volume was a sign of distributional pressure. Hit a new 52-week high on 6/05/09 as it rose from a choppy (improper) base pattern. Its progress could be hindered by future share offerings. Its 5/28/09 gap up and considerable gain followed another strong quarterly financial report. Prompt repair of its recent 50 DMA line violation, and its gap up, were noted as signs of solid institutional (the I criteria) support and buying demand. This Chinese Computer Software firm recently filed a registration of approximately 16 million shares for resale, and it also revealed a planned acquisition of another Chinese service provider.

6/11/2009 12:44:58 PM - G - Holding its ground stubbornly for the past week since hitting a new 52-week high on 6/05/09 as it rose from a choppy (improper) base pattern. Its progress could be hindered by future share offerings. Its 5/28/09 gap up and considerable gain followed another strong quarterly financial report. Prompt repair of its recent 50 DMA line violation, and its gap up, were noted as signs of solid institutional (the I criteria) support and buying demand. This Chinese Computer Software firm recently filed a registration of approximately 16 million shares for resale, and it also revealed a planned acquisition of another Chinese service provider.

6/10/2009 5:07:07 PM - G - Holding its ground stubbornly since hitting a new 52-week high on 6/05/09 as it rose from a choppy (improper) base pattern. Its progress could be hindered by future share offerings. Its 5/28/09 gap up and considerable gain followed another strong quarterly financial report. Prompt repair of its recent 50 DMA line violation, and its gap up, were noted as signs of solid institutional (the I criteria) support and buying demand. This Chinese Computer Software firm recently filed a registration of approximately 16 million shares for resale, and it also revealed a planned acquisition of another Chinese service provider.

6/9/2009 6:34:50 PM - G - Holding its ground since hitting a new 52-week high on 6/05/09 as it rose from a choppy (improper) base pattern. Its progress could be hindered by future share offerings. Its 5/28/09 gap up and considerable gain followed another strong quarterly financial report. Prompt repair of its recent 50 DMA line violation, and its gap up, were noted as signs of solid institutional (the I criteria) support and buying demand. This Chinese Computer Software firm recently filed a registration of approximately 16 million shares for resale, and it also revealed a planned acquisition of another Chinese service provider.

6/9/2009 12:42:15 PM - G - Hit a new 52-week high on 6/05/09 as it rose from a choppy (improper) base pattern. Its progress could be hindered by future share offerings. Its 5/28/09 gap up and considerable gain followed another strong quarterly financial report. Prompt repair of its recent 50 DMA line violation, and its gap up, were noted as signs of solid institutional (the I criteria) support and buying demand. This Chinese Computer Software firm recently filed a registration of approximately 16 million shares for resale, and it also revealed a planned acquisition of another Chinese service provider.

6/8/2009 4:13:02 PM - G - Hit a new 52-week high today on above average volume, rising from a choppy (improper) base pattern. Its progress could be hindered by future share offerings. Its 5/28/09 gap up and considerable gain followed another strong quarterly financial report. Prompt repair of its recent 50 DMA line violation, and its gap up, were noted as signs of solid institutional (the I criteria) support and buying demand. This Chinese Computer Software firm recently filed a registration of approximately 16 million shares for resale, and it also revealed a planned acquisition of another Chinese service provider.

6/8/2009 12:27:58 PM - G - Holding its ground today after rallying to new 52-week high on 6/05/09 with a considerable gain backed by nearly 5 times average volume, rising from a choppy (improper) base pattern. Its progress could be hindered by future share offerings. Its 5/28/09 gap up and considerable gain followed another strong quarterly financial report. Prompt repair of its recent 50 DMA line violation, and its gap up, were noted as signs of solid institutional (the I criteria) support and buying demand. This Chinese Computer Software firm recently filed a registration of approximately 16 million shares for resale, and it also revealed a planned acquisition of another Chinese service provider.

6/5/2009 6:03:07 PM - G - Hit a new 52-week high today with a considerable gain backed by nearly 5 times average volume, rising from a choppy (improper) base pattern. Its progress could be hindered by future share offerings. Its 5/28/09 gap up and considerable gain followed another strong quarterly financial report. Prompt repair of its recent 50 DMA line violation, and its gap up, were noted as signs of solid institutional (the I criteria) support and buying demand. This Chinese Computer Software firm recently filed a registration of approximately 16 million shares for resale, and it also revealed a planned acquisition of another Chinese service provider.

6/5/2009 12:52:50 PM - G - Hit a new 52-week high today with a considerable gain backed by above average volume. It needs more time to form another sound base, and its progress could be hindered by future share offerings. Its 5/28/09 gap up and considerable gain followed another strong quarterly financial report. Prompt repair of its recent 50 DMA line violation, and its gap up, were noted as signs of solid institutional (the I criteria) support and buying demand. This Chinese Computer Software firm recently filed a registration of approximately 16 million shares for resale, and it also revealed a planned acquisition of another Chinese service provider.

6/4/2009 6:15:25 PM - G - Ended near its session high after a positive reversal, stubbornly holding its ground within close striking distance of its 52-week high. Its 5/28/09 gap up and considerable gain followed another strong quarterly financial report. Prompt repair of its recent 50 DMA line violation, and its gap up, were noted as signs of solid institutional (the I criteria) support and buying demand. This Chinese Computer Software firm recently filed a registration of approximately 16 million shares for resale, and it also revealed a planned acquisition of another Chinese service provider.

6/3/2009 4:15:33 PM - G - Stubbornly holding its ground -6% off its 52-week high. Its 5/28/09 gap up and considerable gain followed another strong quarterly financial report. Prompt repair of its recent 50 DMA line violation, and its gap up, were noted as signs of solid institutional (the I criteria) support and buying demand. This Chinese Computer Software firm recently filed a registration of approximately 16 million shares for resale, and it also revealed a planned acquisition of another Chinese service provider.

6/2/2009 6:52:32 PM - G - Stubbornly holding its ground near its 52-week high since its 5/28/09 gap up and considerable gain that followed another strong quarterly financial report. Prompt repair of its recent 50 DMA line violation, and its gap up, were noted as signs of solid institutional (the I criteria) support and buying demand. This Chinese Computer Software firm recently filed a registration of approximately 16 million shares for resale, and it also revealed a planned acquisition of another Chinese service provider.

6/1/2009 6:54:14 PM - G - Higher volume and lack of progress today was indicative of dustributional pressure. Last week's 5/28/09 gap up and considerable gain followed another strong quarterly financail report. Prompt repair of its recent 50 DMA line violation, and its gap up, were noted as signs of solid institutional (the I criteria) support and buying demand. This Chinese Computer Software firm recently filed a registration of approximately 16 million shares for resale, and it also revealed a planned acquisition of another Chinese service provider.

5/29/2009 5:57:44 PM - G - Held its ground following a gap up and considerable gain on the prior session after reporting another strong quarter. Prompt repair of its recent 50 DMA line violation, and its gap up, are indicative of solid institutional (the I criteria) support and buying demand. This Chinese Computer Software firm recently filed a registration of approximately 16 million shares for resale, and it also revealed a planned acquisition of another Chinese service provider.

5/28/2009 4:33:15 PM - G - Gapped up today after reporting another strong quarter, closing near its session high with a considerable gain backed by more than triple its average volume. Prompt repair of its recent 50 DMA line violation, and its gap up, are indicative of solid institutional (the I criteria) support and buying demand. This Chinese Computer Software firm recently filed a registration of approximately 16 million shares for resale, and it also revealed a planned acquisition of another Chinese service provider.

5/28/2009 12:42:36 PM - G - Gapped up today after reporting another strong quarter. The promptly repair of a recent 50 DMA line violation, and its gap up are indicative of solid institutional (the I criteria) support and buying demand. This Chinese Computer Software firm recently filed a registration of approximately 16 million shares for resale, and it also revealed a planned acquisition of another Chinese service provider.

5/27/2009 4:26:20 PM - G - Rallyied above its 50 DMA line yesterday. Distributional pressure last week led to a violation of its 50 DMA line that triggered a technical sell signal. This Chinese Computer Software firm recently filed a registration of approximately 16 million shares for resale, and it also revealed a planned acquisition of another Chinese service provider.

5/26/2009 3:42:24 PM - G - Rallying above its 50 DMA line today. Distributional pressure last week led to a violation of its 50 DMA line that triggered a technical sell signal. This Chinese Computer Software firm recently filed a registration of approximately 16 million shares for resale, and it also revealed a planned acquisition of another Chinese service provider.

5/22/2009 3:12:16 PM - G - Rising today with lighter volume after distributional pressure on the prior session led to a violation of its 50 DMA line that triggered a technical sell signal. This Chinese Computer Software firm recently filed a registration of approximately 16 million shares for resale, and it also revealed a planned acquisition of another Chinese service provider.

5/21/2009 4:49:35 PM - G - Considerable loss today with higher volume was a sign of distributional pressure as it violated its 50 DMA line, triggering a technical sell signal. This Chinese Computer Software firm recently filed a registration of approximately 16 million shares for resale, and it also revealed a planned acquisition of another Chinese service provider.

5/19/2009 - G - Testing important support near its 50 DMA line again. As previously noted, this Chinese Computer Software firm filed a registration of approximately 16 million shares for resale, and revealed a planned acquisition of another Chinese service provider. This high-ranked leader has reported strong annual and quarterly earnings increases (good concerning the C & A criteria) backed by strong sales revenues increases. Of few strong leaders showing up in recent screens, Chinese firms have enjoyed a heavy weighting.

5/15/2009 4:16:25 PM - G - Held its ground after a positive reversal on the prior session, testing important support near its 50 DMA line again. As previously noted, this Chinese Computer Software firm filed a registration of approximately 16 million shares for resale, and revealed a planned acquisition of another Chinese service provider. This high-ranked leader has reported strong annual and quarterly earnings increases (good concerning the C & A criteria) backed by strong sales revenues increases. Of few strong leaders showing up in recent screens, Chinese firms have enjoyed a heavy weighting.

5/14/2009 4:22:30 PM - G - Positive reversal today after intra-day weakness had it trading below its 50 DMA line again. As previously noted, this Chinese Computer Software firm filed a registration of approximately 16 million shares for resale, and revealed a planned acquisition of another Chinese service provider. This high-ranked leader has reported strong annual and quarterly earnings increases (good concerning the C & A criteria) backed by strong sales revenues increases. Of few strong leaders showing up in recent screens, Chinese firms have enjoyed a heavy weighting.

5/13/2009 5:08:38 PM - G - Considerable loss today has it again testing support near recent chart lows and its 50 DMA line. As previously noted, this Chinese Computer Software firm filed a registration of approximately 16 million shares for resale, and revealed a planned acquisition of another Chinese service provider. This high-ranked leader has reported strong annual and quarterly earnings increases (good concerning the C & A criteria) backed by strong sales revenues increases. Of few strong leaders showing up in recent screens, Chinese firms have enjoyed a heavy weighting.

5/12/2009 6:56:35 PM - G - Positive reversal on 5/11/09 was a sign of prompt support near recent chart lows and its 50 DMA line. As previously noted, this Chinese Computer Software firm filed a registration of approximately 16 million shares for resale, and revealed a planned acquisition of another Chinese service provider. This high-ranked leader has reported strong annual and quarterly earnings increases (good concerning the C & A criteria) backed by strong sales revenues increases. Of few strong leaders showing up in recent screens, Chinese firms have enjoyed a heavy weighting.

5/11/2009 7:48:35 PM - G - Positive reversal today for a considerable gain on heavy volume, finding prompt support near recent chart lows and its 50 DMA line. As previously noted, this Chinese Computer Software firm filed a registration of approximately 16 million shares for resale, and revealed a planned acquisition of another Chinese service provider. This high-ranked leader has reported strong annual and quarterly earnings increases (good concerning the C & A criteria) backed by strong sales revenues increases. Of few strong leaders showing up in recent screens, Chinese firms have enjoyed a heavy weighting.

5/8/2009 4:46:37 PM - G - Considerable loss on heavy volume today was its third consecutive loss with above average volume, indicating obvious distributional pressure. As previously noted, this Chinese Computer Software firm might be hindered by future share offerings. On 4/27/09 it filed a registration of approximately 16 million shares for resale, and revealed a planned acquisition of another Chinese service provider. This high-ranked leader has reported strong annual and quarterly earnings increases (good concerning the C & A criteria) backed by strong sales revenues increases. Of few strong leaders showing up in recent screens, Chinese firms have enjoyed a heavy weighting.

5/8/2009 1:42:33 PM - G - Considerable loss on higher volume today is its third consecutive loss with above average volume, indicating obvious distributional pressure. As previously noted, this Chinese Computer Software firm might be hindered by future share offerings. On 4/27/09 it filed a registration of approximately 16 million shares for resale, and revealed a planned acquisition of another Chinese service provider. This high-ranked leader has reported strong annual and quarterly earnings increases (good concerning the C & A criteria) backed by strong sales revenues increases. Of few strong leaders showing up in recent screens, Chinese firms have enjoyed a heavy weighting.

5/7/2009 4:18:08 PM - G - Extended from a sound base now, today was the second consecutive loss with above average volume, a sign of distributional pressure. The 4/02/09 Featured Stock Update (read here) anticipated the Chinese Computer Software firm might be hindered by future share offerings, and last week it filed a registration of approximately 16 million shares for resale (read here). It also revealed plans for a mostly cash acquisition of another Chinese service provider (read here). This high-ranked leader has reported strong annual and quarterly earnings increases (good concerning the C & A criteria) backed by strong sales revenues increases. Of few strong leaders showing up in recent screens, Chinese firms have enjoyed a heavy weighting.

5/6/2009 4:59:48 PM - G - Down with higher volume today, a sign of distributional pressure. The 4/02/09 Featured Stock Update (read here) anticipated the Chinese Computer Software firm might be hindered by future share offerings, and last week it filed a registration of approximately 16 million shares for resale (read here). It also revealed plans for a mostly cash acquisition of another Chinese service provider (read here). This high-ranked leader has reported strong annual and quarterly earnings increases (good concerning the C & A criteria) backed by strong sales revenues increases. Of few strong leaders showing up in recent screens, Chinese firms have enjoyed a heavy weighting.

5/6/2009 12:39:13 PM - G - Pulling back with higher volume today, a sign of distribution pressure. The 4/02/09 Featured Stock Update (read here) anticipated the Chinese Computer Software firm might be hindered by future share offerings, and lasts week it filed a registration of approximately 16 million shares for resale (read here). It also revealed plans for a mostly cash acquisition of another Chinese service provider (read here). This high-ranked leader has reported strong annual and quarterly earnings increases (good concerning the C & A criteria) backed by strong sales revenues increases. Of few strong leaders showing up in recent screens, Chinese firms have enjoyed a heavy weighting.

5/5/2009 5:47:21 PM - G - Trading higher and remains perched below its 52-week high. The 4/02/09 Featured Stock Update (read here) anticipated the Chinese Computer Software firm might be hindered by future share offerings, and this week it filed a registration of approximately 16 million shares for resale (read here). It also revealed plans for a mostly cash acquisition of another Chinese service provider (read here). This high-ranked leader has reported strong annual and quarterly earnings increases (good concerning the C & A criteria) backed by strong sales revenues increases. Of few strong leaders showing up in recent screens, Chinese firms have enjoyed a heavy weighting.

5/5/2009 12:33:49 PM - G - Trading higher and remains perched below its 52-week high. The 4/02/09 Featured Stock Update (read here) anticipated the Chinese Computer Software firm might be hindered by future share offerings, and this week it filed a registration of approximately 16 million shares for resale (read here). It also revealed plans for a mostly cash acquisition of another Chinese service provider (read here). This high-ranked leader has reported strong annual and quarterly earnings increases (good concerning the C & A criteria) backed by strong sales revenues increases. Of few strong leaders showing up in recent screens, Chinese firms have enjoyed a heavy weighting.

5/4/2009 9:05:12 PM - G - Gapped up and hit a new 52-week high today. The 4/02/09 Featured Stock Update (read here) anticipated the Chinese Computer Software firm might be hindered by future share offerings, and this week it filed a registration of approximately 16 million shares for resale (read here). It also revealed plans for a mostly cash acquisition of another Chinese service provider (read here). This high-ranked leader has reported strong annual and quarterly earnings increases (good concerning the C & A criteria) backed by strong sales revenues increases. Of few strong leaders showing up in recent screens, Chinese firms have enjoyed a heavy weighting.

5/4/2009 12:24:16 PM - G - Hit a new 52-week high today. The 4/02/09 Featured Stock Update (read here) anticipated the Chinese Computer Software firm might be hindered by future share offerings, and this week it filed a registration of approximately 16 million shares for resale (read here). It also revealed plans for a mostly cash acquisition of another Chinese service provider (read here). This high-ranked leader has reported strong annual and quarterly earnings increases (good concerning the C & A criteria) backed by strong sales revenues increases. Of few strong leaders showing up in recent screens, Chinese firms have enjoyed a heavy weighting.

5/1/2009 5:45:27 PM - G - It found prompt support near its 10-week average this week, and a considerable gain on Friday with more than 2 times average volume helped it hit a new 52-week high. The 4/02/09 Featured Stock Update (read here) anticipated the Chinese Computer Software firm might be hindered by future share offerings, and this week it filed a registration of approximately 16 million shares for resale (read here). It also revealed plans for a mostly cash acquisition of another Chinese service provider (read here). This high-ranked leader has reported strong annual and quarterly earnings increases (good concerning the C & A criteria) backed by strong sales revenues increases. Of few strong leaders showing up in recent screens, Chinese firms have enjoyed a heavy weighting.

5/1/2009 12:39:41 PM - G - It found prompt support near its 10-week average this week, and a considerable gain today with volume running at an above average pace helped it hit a new 52-week high. The 4/02/09 Featured Stock Update (read here) anticipated this Chinese Computer Software firm might be hindered by share offerings, and this week it filed a registration of approximately 16 million shares for resale (read here). It also revealed plans for a mostly cash acquisition of another Chinese service provider (read here). This high-ranked leader has reported strong annual and quarterly earnings increases (good concerning the C & A criteria) backed by strong sales revenues increases. Of few strong leaders showing up in recent screens, Chinese firms have enjoyed a heavy weighting.

4/30/2009 4:34:56 PM - G - Small gain on light volume today. Take time to review the 4/02/09 Featured Stock Update's final foreshadowing sentences (read here) and note this Chinese Computer Software firm's announcement this week of a registration of approximately 16 million shares for resale (read here). It also revealed plans for a mostly cash acquisition of another Chinese service provider (read here). Technically, it found support near its 50 DMA line, yet any lower closes or deterioration below its previously cited pivot point would raise more serious concerns. This high-ranked leader has reported strong annual and quarterly earnings increases (good concerning the C & A criteria) backed by strong sales revenues increases. Of few strong leaders showing up in recent screens, Chinese firms have enjoyed a heavy weighting.

4/29/2009 - G - Hearken the 4/02/09 Featured Stock Update's final foreshadowing sentences (read here) as we note this Chinese Computer Software firm's announcement this week of a registration of approximately 16 million shares for resale (read here). It also revealed plans for a mostly cash acquisition of another Chinese service provider (read here). Technically, it found support near its 50 DMA line, yet any lower closes or deterioration below its previously cited pivot point would raise more serious concerns. This high-ranked leader has reported strong annual and quarterly earnings increases (good concerning the C & A criteria) backed by strong sales revenues increases. Of few strong leaders showing up in recent screens, Chinese firms have enjoyed a heavy weighting.

4/29/2009 - G - Hearken the 4/02/09 Featured Stock Update's final foreshadowing sentences (read here) as we note this Chinese Computer Software firm's announcement this week of a registration of approximately 16 million shares for resale (read here). It also revealed plans for a mostly cash acquisition of another Chinese service provider (read here). Technically, on the prior session it found support near its 50 DMA line, yet any lower closes or deterioration below its previously cited pivot point would raise more serious concerns. This high-ranked leader has reported strong annual and quarterly earnings increases (good concerning the C & A criteria) backed by strong sales revenues increases. Of few strong leaders showing up in recent screens, Chinese firms have enjoyed a heavy weighting.

4/28/2009 3:30:09 PM - G - Distributional action pressured it near its 50 DMA line, and while today's close in the upper half of its intra-day trading range was a somewhat encouraging sign of support, deterioration below its previously cited pivot point raises concerns. High-ranked leader has reported strong annual and quarterly earnings increases (good concerning the C & A criteria) backed by strong sales revenues increases. Of few strong leaders showing up in recent screens, Chinese firms have enjoyed a heavy weighting.

4/27/2009 3:22:48 PM - G - Down today on heavy volume, closing near its session low and below its "max buy" level amid action that is indicative of distributional pressure. Pulling back after hitting a new 52-week high last week, and noted as "extended from a sound base." High-ranked leader has reported strong annual and quarterly earnings increases (good concerning the C & A criteria) backed by strong sales revenues increases. Of few strong leaders showing up in recent screens, Chinese firms have enjoyed a heavy weighting.

4/24/2009 3:27:41 PM - G - Pulled back after hitting a new 52-week high this week, and noted as "extended from a sound base." High-ranked leader has reported strong annual and quarterly earnings increases (good concerning the C & A criteria) backed by strong sales revenues increases. Of few strong leaders showing up in recent screens, Chinese firms have enjoyed a heavy weighting.

4/23/2009 11:39:55 AM - G - Considerable drop today with volume running at an above average pace, pulling back after hitting a new 52-week high on the prior session. It has been noted as "extended from a sound base." High-ranked leader has reported strong annual and quarterly earnings increases (good concerning the C & A criteria) backed by strong sales revenues increases. Of few strong leaders showing up in recent screens, Chinese firms have enjoyed a heavy weighting.

4/22/2009 3:34:06 PM - G - Hit a new 52-week high today with a solid gain on above average volume. It is extended from a sound base. High-ranked leader has reported strong annual and quarterly earnings increases (good concerning the C & A criteria) backed by strong sales revenues increases. Of few strong leaders showing up in recent screens, Chinese firms have enjoyed a heavy weighting.

4/22/2009 11:36:00 AM - G - Hit a new 52-week high today after consolidating for the past week. It is extended from a sound base. High-ranked leader has reported strong annual and quarterly earnings increases (good concerning the C & A criteria) backed by strong sales revenues increases. Of few strong leaders showing up in recent screens, Chinese firms have enjoyed a heavy weighting.

4/21/2009 2:49:37 PM - G - Quietly consolidating for the past week, extended from a sound base. High-ranked leader with strong annual and quarterly sales revenues and earnings increases (good concerning the C & A criteria). Of few strong leaders showing up in recent screens, Chinese firms have enjoyed a heavy weighting. Concerns are the same for this Chinese Computer software firm as those noted in the 4/02/09 Featured Stock Update section summarizing yet another China-based firm (read here).

4/20/2009 7:08:53 PM - G - Down today on lighter volume. It is extended from a sound base, which makes it a riskier buy candidate for disciplined investors. High-ranked leader with strong annual and quarterly sales revenues and earnings increases (good concerning the C & A criteria). Of few strong leaders showing up in recent screens, Chinese firms have enjoyed a heavy weighting. Concerns are the same for this Chinese Computer software firm as those noted in the 4/02/09 Featured Stock Update section summarizing yet another China-based firm (read here).

4/18/2009 7:01:33 AM - G - It is extended from a sound base, which makes it a riskier buy candidate for disciplined investors. High-ranked leader with strong annual and quarterly sales revenues and earnings increases (good concerning the C & A criteria). Of few strong leaders showing up in recent screens, Chinese firms have enjoyed a heavy weighting. Concerns are the same for this Chinese Computer software firm as those noted in the 4/02/09 Featured Stock Update section summarizing yet another China-based firm (read here).

4/16/2009 5:12:10 PM - G - Today's loss on average volume broke a 5 session winning streak. It is extended from a sound base, which makes it a riskier buy candidate for disciplined investors. High-ranked leader with strong annual and quarterly sales revenues and earnings increases (good concerning the C & A criteria). Of few strong leaders showing up in recent screens, Chinese firms have enjoyed a heavy weighting. Concerns are the same for this Chinese Computer software firm as those noted in the 4/02/09 Featured Stock Update section summarizing yet another China-based firm (read here).

4/15/2009 6:36:30 PM - G - Today's gain with lighter volume was its 10th gain in 11 sessions, and it is now extended from a sound base. High-ranked leader with strong annual and quarterly sales revenues and earnings increases (good concerning the C & A criteria). Of few strong leaders showing up in recent screens, Chinese firms have enjoyed a heavy weighting. Concerns are the same for this Chinese Computer software firm as those noted in the 4/02/09 Featured Stock Update section summarizing yet another China-based firm (read here).

4/14/2009 6:45:23 PM - G - Gain today with +67% above average volume, rising above its "max buy" level. Color code was changed to green. Of few strong leaders showing up in recent screens, Chinese firms have enjoyed a heavy weighting, and concerns are the same as those noted in the 4/02/09 Featured Stock Update section summarizing yet another China-based firm (read here). This developer of computer software for financial institutions has earned high ranks based upon strong annual and quarterly sales revenues and earnings increases (looking good concerning the C & A criteria).

4/14/2009 11:32:08 AM - G - Gains today with volume running at an above average pace have it trading above its "max buy" level. Color code is changed to green. Of few strong leaders showing up in recent screens, Chinese firms have enjoyed a heavy weighting, and concerns are the same as those noted in the 4/02/09 Featured Stock Update section summarizing yet another China-based firm (read here). This developer of computer software for financial institutions has earned high ranks based upon strong annual and quarterly sales revenues and earnings increases (looking good concerning the C & A criteria).

4/13/2009 6:41:43 PM - Y - Gain today with only +16% above average volume was below the volume guideline for a proper technical buy signal, and it closed near its "max buy" level. Of few strong leaders showing up in recent screens, Chinese firms have enjoyed a heavy weighting, and concerns are the same as those noted in the 4/02/09 Featured Stock Update section summarizing yet another China-based firm (read here). This developer of computer software for financial institutions has earned high ranks based upon strong annual and quarterly sales revenues and earnings increases (looking good concerning the C & A criteria). A breakout above its long-term chart high ($21.71 on 5/19/08) with heavy volume could signal the start of a more significant advance.

4/9/2009 3:20:51 PM - Y - Modest gap higher but volume was below average which means a proper technical buy signal has yet to be triggered. Of few strong leaders showing up in recent screens, Chinese firms have enjoyed a heavy weighting, and caution is advised due to the inherent risk of international exposure. This developer of computer software for financial institutions has earned high ranks based upon strong annual and quarterly sales revenues and earnings increases (looking good concerning the C & A criteria). A breakout above its long-term chart high ($21.71 on 5/19/08) with heavy volume could signal the start of a more significant advance.