8/21/2018 1:04:31 PM - Hovering in a tight range since gapping up on 1/29/18 M&A news. Fundamental concerns remain. It was dropped from the Featured Stocks list on 7/08/14.

5/25/2018 12:34:43 PM - Hovering in a tight range since gapping up on 1/29/18 M&A news. Fundamental concerns remain. It was dropped from the Featured Stocks list on 7/08/14.

1/13/2015 12:13:24 PM - Reported earnings +15% on +11% sales revenues for the Sep '14 quarter, below the +25% minimum earnings guideline (C criteria). Sputtering while fundamental concerns were raised since it was dropped from the Featured Stocks list on 7/08/14.

7/25/2014 12:32:12 PM - Rebounded above its 50 DMA line with a volume-driven gain on the prior session and it is approaching its 52-week high with today's 3rd consecutive gain. The rally above its 50 DMA line helped its technical stance and outlook improve, however its choppy consolidation is not recognized as a sound base pattern. Found support at its 200 DMA line then rebounded since dropped from the Featured Stocks list on 7/08/14 due to technical deterioration.

7/8/2014 1:25:44 PM - Down considerably today with heavy volume behind its 3rd big loss in the span of 4 sessions, violating its 50 DMA line and triggering a technical sell signal. Only a prompt rebound above its 50 DMA line would help its outlook improve. Disciplined investors limit losses by selling any stock that falls more than -7% from their purchase price. It will be dropped from the Featured Stocks list today due to technical deterioration.

7/7/2014 4:20:14 PM - Y - Down considerably today with heavy volume, undercutting prior highs near $32 raising concerns. Disciplined investors limit losses by selling any stock that falls more than -7% from their purchase price.

7/2/2014 3:56:52 PM - Y - Pulling back today toward prior highs near $32 defining initial support to watch on pullbacks. Held its ground stubbornly since highlighted in yellow while rallying from a "cup-with-handle" base in the 6/20/14 mid-day report (read here).

6/27/2014 4:58:24 PM - Y - Tallied a small gain today with light volume and finished at a best-ever close very near its "max buy" level. Prior highs near $32 define initial support to watch on pullbacks. Held its ground stubbornly since highlighted in yellow while rallying from a "cup-with-handle" base in the 6/20/14 mid-day report (read here).

6/23/2014 12:28:54 PM - Y - Reversed into the red after briefly rallying beyond its "max buy" level in today's early session. Prior highs near $32 define initial support to watch on pullbacks. It was highlighted in yellow while rallying from a cup-with-handle base in the 6/20/14 mid-day report (read here).

6/20/2014 5:46:51 PM - Y - Finished strong with a gain on 4 times average volume triggering a technical buy signal today. Highlighted in yellow while rallying from a cup-with-handle base in the earlier mid-day report (read here). See the latest FSU analysis for more details and new annotated graphs.

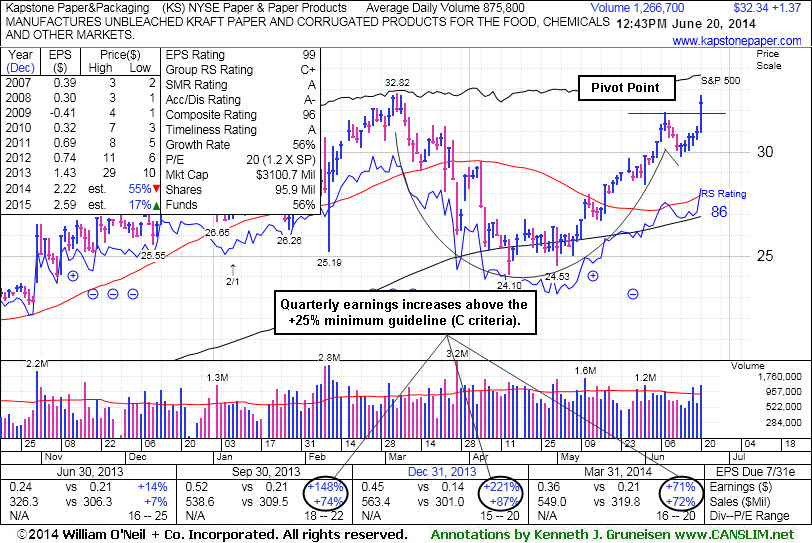

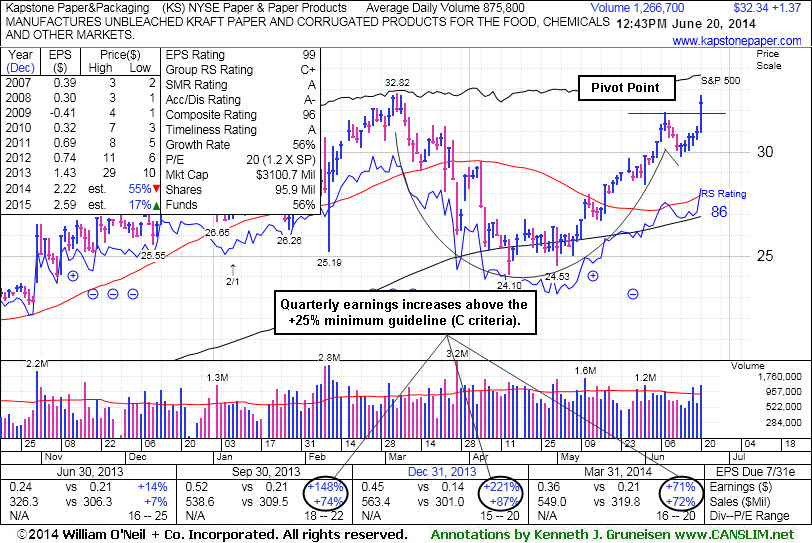

6/20/2014 1:19:22 PM - Y - Color code is changed to yellow while rallying from a cup-with-handle base and challenging its 52-week high with above average volume behind today's 6th consecutive gain. Found support near its 200 DMA line during its consolidation then rebounded, and very little resistance remains due to overhead supply. Reported earnings +71% on +72% sales revenues for the Mar '14 quarter, its 3rd consecutive quarterly comparison above the +25% minimum earnings guideline (C criteria). Annual earnings (A criteria) have been improving steadily since a downturn and loss in FY '09.

6/18/2014 12:17:42 PM - Found support near its 200 DMA line during its consolidation then rebounded since last noted with caution in the 2/12/14 mid-day report. Little resistance remains due to overhead supply. Reported earnings +71% on +72% sales revenues for the Mar '14 quarter, its 3rd consecutive quarterly comparison above the +25% minimum earnings guideline (C criteria). Annual earnings (A criteria) have been improving steadily since a downturn and loss in FY '09

2/12/2014 12:33:15 PM - Up today following a "positive reversal" on the prior session after undercutting its 50 DMA line and it is perched near its 52-week high. The prior mid-day report cautioned members - "Reported earnings +221% on +87% sales revenues for the Dec '13 quarter, but fundamental concerns remain. Earnings history is below guidelines of the fact-based investment system."

2/11/2014 1:04:36 PM - Churning heavy volume today, up after undercutting its 50 DMA line following a "negative reversal" after touching a new 52-week high on the prior session. Reported earnings +221% on +87% sales revenues for the Dec '13 quarter, but fundamental concerns remain. Earnings history is below guidelines of the fact-based investment system.

2/10/2014 1:03:10 PM - Hitting new 52-week and all-time highs with today's 3rd consecutive volume-driven gain, rallying from a short flat base. Its 50 DMA line acted as support while it made gradual progress after a considerable gap up and volume-driven gain on 10/31/13 as the mid-day report cautioned members - "Reported earnings +156% on +74% sales revenues for the Sep '13 quarter but fundamental concerns remain. Reported earnings +14% on +7% sales revenues for the Jun '13 quarter. Earnings history is below guidelines of the fact-based investment system."

2/7/2014 12:23:28 PM - Touched new 52-week and all-time highs today, attempting to rally from a short flat base. Its 50 DMA line acted as support while it made gradual progress after a considerable gap up and volume-driven gain on 10/31/13 as the mid-day report cautioned members - "Reported earnings +156% on +74% sales revenues for the Sep '13 quarter but fundamental concerns remain. Reported earnings +14% on +7% sales revenues for the Jun '13 quarter. Earnings history is below guidelines of the fact-based investment system."

1/23/2014 12:21:05 PM - Consolidating near its 52-week and all-time highs. Made gradual progress after a considerable gap up and volume-driven gain on 10/31/13 as the mid-day report cautioned members - "Reported earnings +156% on +74% sales revenues for the Sep '13 quarter but fundamental concerns remain. Reported earnings +14% on +7% sales revenues for the Jun '13 quarter. Earnings history is below guidelines of the fact-based investment system."

1/2/2014 12:48:58 PM - Retreating from its 52-week and all-time highs with today's 4th consecutive loss on ever-increasing volume. Made gradual progress after a considerable gap up and volume-driven gain on 10/31/13 as the mid-day report cautioned members - "Reported earnings +156% on +74% sales revenues for the Sep '13 quarter but fundamental concerns remain. Reported earnings +14% on +7% sales revenues for the Jun '13 quarter. Earnings history is below guidelines of the fact-based investment system."

12/13/2013 12:13:25 PM - Hovering near 52-week and all-time highs. Made gradual progress after a considerable gap up and volume-driven gain on 10/31/13 as the mid-day report cautioned members - "Reported earnings +156% on +74% sales revenues for the Sep '13 quarter but fundamental concerns remain. Reported earnings +14% on +7% sales revenues for the Jun '13 quarter. Earnings history is below guidelines of the fact-based investment system."

12/9/2013 12:44:39 PM - Small gap up gain today with above average volume while rallying for new 52-week and all-time highs. The 10/31/13 mid-day report cautioned members - "Reported earnings +156% on +74% sales revenues for the Sep '13 quarter but fundamental concerns remain. Reported earnings +14% on +7% sales revenues for the Jun '13 quarter. Earnings history is below guidelines of the fact-based investment system."

10/31/2013 12:44:25 PM - Considerable gap up gain today with above average volume while rallying for new 52-week and all-time highs. Reported earnings +156% on +74% sales revenues for the Sep '13 quarter but fundamental concerns remain. The 9/16/13 mid-day report cautioned members - "Reported earnings +14% on +7% sales revenues for the Jun '13 quarter. Earnings history is below guidelines of the fact-based investment system."

9/17/2013 12:45:24 PM - Pulling back today, erasing most of the prior session's considerable gap up gain for new 52-week and all-time highs. The 9/16/13 mid-day report cautioned members - "Reported earnings +14% on +7% sales revenues for the Jun '13 quarter. Earnings history is below guidelines of the fact-based investment system."

9/16/2013 12:37:23 PM - Gapped up today for a considerable gain with heavy volume while hitting new 52-week and all-time highs. Reported earnings +14% on +7% sales revenues for the Jun '13 quarter. Earnings history is below guidelines of the fact-based investment system.

2/15/2011 12:21:31 PM - Churning heavy volume at its 52-week and all-time high. Reported earnings versus a year-ago loss for the quarter ended December 31, 2010. It found support above its 50 DMA line and made steady progress since noted in the 12/17/10 mid-day report - "Perched near its 52-week and all-time high today after an orderly 5-week flat base above a longer base during which its 200 DMA line acted as support. Earnings history is below guidelines of the fact-based investment system."

2/14/2011 12:49:56 PM - Touched another new 52-week high and all-time high today. It found support above its 50 DMA line and made steady progress since noted in the 12/17/10 mid-day report - "Perched near its 52-week and all-time high today after an orderly 5-week flat base above a longer base during which its 200 DMA line acted as support. Earnings history is below guidelines of the fact-based investment system."

1/27/2011 1:10:44 PM - Touched another new 52-week high and all-time high today with a 5th consecutive gain. It found support above its 50 DMA line and made steady progress since last noted in the 12/17/10 mid-day report - "Perched near its 52-week and all-time high today after an orderly 5-week flat base above a longer base during which its 200 DMA line acted as support. Earnings history is below guidelines of the fact-based investment system."

12/17/2010 12:32:51 PM - Touched a new 52-week high today. Prior mid-day reports noted - "Perched near its 52-week and all-time high today after an orderly 5-week flat base above a longer base during which its 200 DMA line acted as support. Earnings history is below guidelines of the fact-based investment system."

12/14/2010 12:29:46 PM - The 12/13/10 mid-day report noted - "Perched near its 52-week and all-time high today after an orderly 5-week flat base above a longer base during which its 200 DMA line acted as support. Earnings history is below guidelines of the fact-based investment system."

12/13/2010 12:44:10 PM - Perched near its 52-week and all-time high today after an orderly 5-week flat base above a longer base during which its 200 DMA line acted as support. Earnings history is below guidelines of the fact-based investment system.