9/22/2021 12:32:49 PM - Retreating from its all-time high, it violated its 50 DMA line ($363) with a spurt of damaging volume-driven losses. The 9/15/21 mid-day report last cautioned members - "Reported earnings +101% on +56% sales revenues for the Jun '21 quarter versus the year-ago period. The past 3 quarterly comparisons have been well above the +25% minimum earnings guideline (C criteria) with impressive acceleration in its sales revenues growth rate. Downturn in FY '19 earnings versus the year ago broke its streak of strong annual earnings increases (A criteria). Not a good match with most winning models of the fact-based investment system. Large supply of shares outstanding (S criteria) and as of Jun '21 it is heavily owned by 5,429 top-rated mutual funds. Stocks with a small supply and just beginning to attract the serious interest of institutional investors (I criteria) are considered most ideal."

9/15/2021 12:52:48 PM - Retreating from its all-time high, it is extended from any sound base. Found support above its 50 DMA line ($362) during its ongoing ascent. Reported earnings +101% on +56% sales revenues for the Jun '21 quarter versus the year-ago period. The past 3 quarterly comparisons have been well above the +25% minimum earnings guideline (C criteria) with impressive acceleration in its sales revenues growth rate. Downturn in FY '19 earnings versus the year ago broke its streak of strong annual earnings increases (A criteria). Not a good match with most winning models of the fact-based investment system. Large supply of shares outstanding (S criteria) and as of Jun '21 it is heavily owned by 5,429 top-rated mutual funds. Stocks with a small supply and just beginning to attract the serious interest of institutional investors (I criteria) are considered most ideal.

7/29/2021 12:13:47 PM - Gapped down today, retreating from its all-time high. Very extended from any sound base. Found support above its 50 DMA line. Reported earnings +101% on +56% sales revenues for the Jun '21 quarter versus the year-ago period. The past 3 quarterly comparisons have been well above the +25% minimum earnings guideline (C criteria) with impressive acceleration in its sales revenues growth rate. Downturn in FY '19 earnings versus the year ago broke its streak of strong annual earnings increases (A criteria). Not a good match with most winning models of the fact-based investment system. Large supply of shares outstanding (S criteria) and as of Jun '21 it is heavily owned by 5,267 top-rated mutual funds. Stocks with a small supply and just beginning to attract the serious interest of institutional investors (I criteria) are considered most ideal.

7/28/2021 12:40:15 PM - Held its ground since noted on 7/23/21 after a gap up and hitting new all-time highs with today's volume-driven gain. Very extended from any sound base. Found support above its 50 DMA line. Reported earnings +93% on +48% sales revenues for the Mar '21 quarter versus the year-ago period. Three of the past 4 quarterly comparisons have been well above the +25% minimum earnings guideline (C criteria). Downturn in FY '19 earnings versus the year ago broke its streak of strong annual earnings increases (A criteria). Not a good match with most winning models of the fact-based investment system. Large supply of shares outstanding (S criteria) and as of Jun '21 it is heavily owned by 5,265 top-rated mutual funds. Stocks with a small supply and just beginning to attract the serious interest of institutional investors (I criteria) are considered most ideal.

7/27/2021 12:17:28 PM - Holding its ground since last noted on 7/23/21 after a gap up hitting new all-time highs with a big volume-driven gain. Very extended from any sound base. Found support above its 50 DMA line. Reported earnings +93% on +48% sales revenues for the Mar '21 quarter versus the year-ago period. Three of the past 4 quarterly comparisons have been well above the +25% minimum earnings guideline (C criteria). Downturn in FY '19 earnings versus the year ago broke its streak of strong annual earnings increases (A criteria). Not a good match with most winning models of the fact-based investment system. Large supply of shares outstanding (S criteria) and as of Jun '21 it is heavily owned by 5,261 top-rated mutual funds. Stocks with a small supply and just beginning to attract the serious interest of institutional investors (I criteria) are considered most ideal.

7/23/2021 12:20:25 PM - Gapped up today hitting new all-time highs with a big volume-driven gain, getting very extended from any sound base. Found support above its 50 DMA line. Reported earnings +93% on +48% sales revenues for the Mar '21 quarter versus the year-ago period. Three of the past 4 quarterly comparisons have been well above the +25% minimum earnings guideline (C criteria). Downturn in FY '19 earnings versus the year ago broke its streak of strong annual earnings increases (A criteria). Not a good match with most winning models of the fact-based investment system. Large supply of shares outstanding (S criteria) and as of Jun '21 it is heavily owned by 5,261 top-rated mutual funds. Stocks with a small supply and just beginning to attract the serious interest of institutional investors (I criteria) are considered most ideal.

6/29/2021 1:08:10 PM - Hit a new all-time high on the prior session with a big volume-driven gain and it is extended from any sound base. Found support well above its 50 DMA line Reported earnings +93% on +48% sales revenues for the Mar '21 quarter versus the year-ago period. Three of the past 4 quarterly comparisons have been well above the +25% minimum earnings guideline (C criteria). Downturn in FY '19 earnings versus the year ago broke its streak of strong annual earnings increases (A criteria). Not a good match with most winning models of the fact-based investment system. Large supply of shares outstanding (S criteria) and as of Mar '21 it is heavily owned by 5,159 top-rated mutual funds. Stocks with a small supply and just beginning to attract the serious interest of institutional investors (I criteria) are considered most ideal.

11/4/2020 12:20:32 PM - Gapped up today rebounding above its 50 DMA line ($270) again. The 10/30/20 mid-day report noted - "Reported earnings +13% on +22% sales revenues for the Sep '20 quarter versus the year-ago period. Quarterly comparisons have not been strong and steady above the +25% minimum earnings guideline (C criteria). Downturn in FY '19 earnings versus the year ago broke its streak of strong annual earnings increases (A criteria). Not a good match with most winning models of the fact-based investment system. Large supply of shares outstanding (S criteria) and it is heavily owned by 4,849 top-rated mutual funds as of Sep '20. Stocks with a small supply and just beginning to attract the serious interest of institutional investors (I criteria) are considered most ideal."

10/30/2020 12:49:14 PM - Slumping below its 50 DMA line ($270) again with today's big loss on higher volume. Reported earnings +13% on +22% sales revenues for the Sep '20 quarter versus the year-ago period. Quarterly comparisons have not been strong and steady above the +25% minimum earnings guideline (C criteria). Downturn in FY '19 earnings versus the year ago broke its streak of strong annual earnings increases (A criteria). Not a good match with most winning models of the fact-based investment system. Large supply of shares outstanding (S criteria) and it is heavily owned by 4,849 top-rated mutual funds as of Sep '20. Stocks with a small supply and just beginning to attract the serious interest of institutional investors (I criteria) are considered most ideal.

10/21/2020 12:14:57 PM - Gapped up today rebounding above its 50 DMA line. Reported earnings +98% on +11% sales revenues for the Jun '20 quarter versus the year-ago period, its 2nd consecutive quarter with a marked improvement after 6 consecutive quarterly comparisons below the +25% minimum earnings guideline (C criteria). Downturn in FY '19 earnings versus the year ago broke its streak of strong annual earnings increases (A criteria). Not a good match with most winning models of the fact-based investment system. Large supply of shares outstanding (S criteria) and it is heavily owned by 4,849 top-rated mutual funds as of Sep '20. Stocks with a small supply and just beginning to attract the serious interest of institutional investors (I criteria) are considered most ideal.

8/27/2020 12:00:05 PM - Pulling back today after powering to new 52-week and all-time highs with 3 consecutive gains backed by ever-increasing volume. Found prompt support near its 50 DMA line during recent consolidations. Reported earnings +98% on +11% sales revenues for the Jun '20 quarter versus the year-ago period, its 2nd consecutive quarter with a marked improvement after 6 consecutive quarterly comparisons below the +25% minimum earnings guideline (C criteria). Downturn in FY '19 earnings versus the year ago broke its streak of strong annual earnings increases (A criteria). Not a good match with most winning models of the fact-based investment system. Large supply of shares outstanding (S criteria) and it is heavily owned by 4,720 top-rated mutual funds as of Mar '20. Stocks with a small supply and just beginning to attract the serious interest of institutional investors (I criteria) are considered most ideal.

8/26/2020 12:08:43 PM - Powering to new 52-week and all-time highs with today's 3rd consecutive gain backed by ever-increasing volume. Found prompt support near its 50 DMA line during recent consolidations. Reported earnings +98% on +11% sales revenues for the Jun '20 quarter versus the year-ago period, its 2nd consecutive quarter with a marked improvement after 6 consecutive quarterly comparisons below the +25% minimum earnings guideline (C criteria). Downturn in FY '19 earnings versus the year ago broke its streak of strong annual earnings increases (A criteria). Not a good match with most winning models of the fact-based investment system. Large supply of shares outstanding (S criteria) and it is heavily owned by 4,720 top-rated mutual funds as of Mar '20. Stocks with a small supply and just beginning to attract the serious interest of institutional investors (I criteria) are considered most ideal.

8/7/2020 12:41:05 PM - Powering to new 52-week and all-time highs with today's 2nd consecutive big volume-driven gain. Found prompt support near its 50 DMA line during recent consolidations. Reported earnings +98% on +11% sales revenues for the Jun '20 quarter versus the year-ago period, its 2nd consecutive quarter with a marked improvement after 6 consecutive quarterly comparisons below the +25% minimum earnings guideline (C criteria). Downturn in FY '19 earnings versus the year ago broke its streak of strong annual earnings increases (A criteria). Not a good match with most winning models of the fact-based investment system. Large supply of shares outstanding (S criteria) and it is heavily owned by 4,697 top-rated mutual funds as of Mar '20. Stocks with a small supply and just beginning to attract the serious interest of institutional investors (I criteria) are considered most ideal.

7/31/2020 12:54:45 PM - Gapped up today hitting new 52-week and all-time highs. Briefly undercut its 50 DMA line during recent consolidations. Reported earnings +98% on +11% sales revenues for the Jun '20 quarter versus the year-ago period, its 2nd consecutive quarter with a marked improvement after 6 consecutive quarterly comparisons below the +25% minimum earnings guideline (C criteria). Downturn in FY '19 earnings versus the year ago broke its streak of strong annual earnings increases (A criteria). Not a good match with most winning models of the fact-based investment system. Large supply of shares outstanding (S criteria) and it is heavily owned by 4,638 top-rated mutual funds as of Mar '20. Stocks with a small supply and just beginning to attract the serious interest of institutional investors (I criteria) are considered most ideal.

7/1/2020 12:26:45 PM - Rebounding toward its 52-week high after recently undercutting its 50 DMA line ($220). Noted with caution in prior mid-day reports - "Reported earnings +101% on +18% sales revenues for the Mar '20 quarter, a marked improvement after 6 consecutive quarterly comparisons below the +25% minimum earnings guideline (C criteria). Downturn in FY '19 earnings versus the year ago broke its streak of strong annual earnings increases (A criteria). Not a good match with most winning models of the fact-based investment system. Large supply of shares outstanding (S criteria) and it is heavily owned by 4,546 top-rated mutual funds as of Mar '20. Stocks with a small supply and just beginning to attract the serious interest of institutional investors (I criteria) are considered most ideal."

6/29/2020 1:01:56 PM - Rebounding today after undercutting its 50 DMA line ($217.65). Noted with caution in prior mid-day reports - "Reported earnings +101% on +18% sales revenues for the Mar '20 quarter, a marked improvement after 6 consecutive quarterly comparisons below the +25% minimum earnings guideline (C criteria). Downturn in FY '19 earnings versus the year ago broke its streak of strong annual earnings increases (A criteria). Not a good match with most winning models of the fact-based investment system. Large supply of shares outstanding (S criteria) and it is heavily owned by 4,546 top-rated mutual funds as of Mar '20. Stocks with a small supply and just beginning to attract the serious interest of institutional investors (I criteria) are considered most ideal."

6/26/2020 12:59:34 PM - Abruptly retreating from its all-time high with today's big volume-driven loss testing its 50 DMA line ($217). Last noted with caution in the 6/09/20 mid-day report - "Reported earnings +101% on +18% sales revenues for the Mar '20 quarter, a marked improvement after 6 consecutive quarterly comparisons below the +25% minimum earnings guideline (C criteria). Downturn in FY '19 earnings versus the year ago broke its streak of strong annual earnings increases (A criteria). Not a good match with most winning models of the fact-based investment system. Large supply of shares outstanding (S criteria) and it is heavily owned by 4,546 top-rated mutual funds as of Mar '20. Stocks with a small supply and just beginning to attract the serious interest of institutional investors (I criteria) are considered most ideal."

6/9/2020 12:50:37 PM - Challenging its all-time high with today's gain. Reported earnings +101% on +18% sales revenues for the Mar '20 quarter, a marked improvement after 6 consecutive quarterly comparisons below the +25% minimum earnings guideline (C criteria). Downturn in FY '19 earnings versus the year ago broke its streak of strong annual earnings increases (A criteria). Not a good match with most winning models of the fact-based investment system. Large supply of shares outstanding (S criteria) and it is heavily owned by 4,515 top-rated mutual funds as of mar '20. Stocks with a small supply and just beginning to attract the serious interest of institutional investors (I criteria) are considered most ideal.

5/21/2020 12:34:06 PM - Gapped up again today for another new all-time high with its 6th consecutive gain. Reported earnings +101% on +18% sales revenues for the Mar '20 quarter, a marked improvement after 6 consecutive quarterly comparisons below the +25% minimum earnings guideline (C criteria). Downturn in FY '19 earnings versus the year ago broke its streak of strong annual earnings increases (A criteria). Not a good match with most winning models of the fact-based investment system. Large supply of shares outstanding (S criteria) and it is heavily owned by 4,462 top-rated mutual funds as of Dec '19. Stocks with a small supply and just beginning to attract the serious interest of institutional investors (I criteria) are considered most ideal.

5/20/2020 12:24:51 PM - Gapped up today for a new all-time high. Reported earnings +101% on +18% sales revenues for the Mar '20 quarter, a marked improvement after 6 consecutive quarterly comparisons below the +25% minimum earnings guideline (C criteria). Downturn in FY '19 earnings versus the year ago broke its streak of strong annual earnings increases (A criteria). Not a good match with most winning models of the fact-based investment system. Large supply of shares outstanding (S criteria) and it is heavily owned by 4,466 top-rated mutual funds as of Dec '19. Stocks with a small supply and just beginning to attract the serious interest of institutional investors (I criteria) are considered most ideal.

2/11/2020 12:53:47 PM - Gapped down today slumping back below its 50 DMA line ($209). Gapped down when last noted with caution in the 1/30/20 mid-day report - "Reported earnings +8% on +25% sales revenues for the Dec '19 quarter, its 6th consecutive quarterly comparison below the +25% minimum earnings guideline (C criteria). Downturn in FY '19 earnings versus the year ago broke its streak of strong annual earnings increases (A criteria). Not a good match with most winning models of the fact-based investment system. Large supply of shares outstanding (S criteria) and it is heavily owned by 4,413 top-rated mutual funds as of Dec '19. That can be problematic in cases where sentiment shifts due to news events. Stocks with a small supply and just beginning to attract the serious interest of institutional investors (I criteria) are considered most ideal."

1/30/2020 11:52:20 AM - Gapped down today retreating from its all-time high and testing its 50 DMA line ($207). Reported earnings +8% on +25% sales revenues for the Dec '19 quarter, its 6th consecutive quarterly comparison below the +25% minimum earnings guideline (C criteria). Downturn in FY '19 earnings versus the year ago broke its streak of strong annual earnings increases (A criteria). Not a good match with most winning models of the fact-based investment system. Large supply of shares outstanding (S criteria) and it is heavily owned by 4,413 top-rated mutual funds as of Dec '19. That can be problematic in cases where sentiment shifts due to news events. Stocks with a small supply and just beginning to attract the serious interest of institutional investors (I criteria) are considered most ideal.

1/29/2020 11:56:27 AM - Perched within striking distance of its all-time high, extended from any sound base. Reported earnings +20% on +29% sales revenues for the Sep '19 quarter, its 5th consecutive quarterly comparison below the +25% minimum earnings guideline (C criteria). Impressive annual earnings history (A criteria). Not a good match with most winning models of the fact-based investment system because of its large supply of shares outstanding (S criteria) and it is heavily owned by 4,413 top-rated mutual funds as of Dec '19. That can be problematic in cases where sentiment shifts due to news events. Stocks with a small supply and just beginning to attract the serious interest of institutional investors (I criteria) are considered most ideal.

1/7/2020 12:40:52 PM - Hitting a new 52-week high today and perched within striking distance of its all-time high after a deep and choppy consolidation. Reported earnings +20% on +29% sales revenues for the Sep '19 quarter, its 5th consecutive quarterly comparison below the +25% minimum earnings guideline (C criteria). Impressive annual earnings history (A criteria). Not a good match with most winning models of the fact-based investment system because of its large supply of shares outstanding (S criteria) and it is heavily owned by 4,387 top-rated mutual funds as of Sep '19. That can be problematic in cases where sentiment shifts due to news events. Stocks with a small supply and just beginning to attract the serious interest of institutional investors (I criteria) are considered most ideal.

7/25/2019 12:27:30 PM - Rebounded near its 52-week high after a deep and choppy consolidation. Reported earnings +14% on +28% sales revenues for the Jun '19 quarter, its 4th consecutive quarterly comparison below the +25% minimum earnings guideline (C criteria). Impressive annual earnings history (A criteria). Not a good match with most winning models of the fact-based investment system because of its large supply of shares outstanding (S criteria) and it is heavily owned by 4,184 top-rated mutual funds as of Mar '19. That can be problematic in cases where sentiment shifts due to news events. Stocks with a small supply and just beginning to attract the serious interest of institutional investors (I criteria) are considered most ideal.

7/10/2019 12:38:29 PM - Wedging higher while rebounding toward its 52-week high after a deep and choppy consolidation. Reported earnings +12% on +26% sales revenues for the Mar '19 quarter, its 3rd consecutive quarterly comparison below the +25% minimum earnings guideline (C criteria). Impressive annual earnings history (A criteria). Not a good match with most winning models of the fact-based investment system because of its large supply of shares outstanding (S criteria) and it is heavily owned by 4,159 top-rated mutual funds as of Mar '19. That can be problematic in cases where sentiment shifts due to news events. Stocks with a small supply and just beginning to attract the serious interest of institutional investors (I criteria) are considered most ideal.

6/18/2019 12:09:42 PM - Reported earnings +12% on +26% sales revenues for the Mar '19 quarter, its 3rd consecutive quarterly comparison below the +25% minimum earnings guideline (C criteria). Impressive annual earnings history (A criteria). Went through a deep consolidation since noted with caution in the 7/24/18 mid-day report - "Not a good match with most winning models of the fact-based investment system because of its large supply of shares outstanding (S criteria) and it is heavily owned by 3,958 top-rated mutual funds. That can be problematic in cases where sentiment shifts due to news events. Stocks with a small supply and just beginning to attract the serious interest of institutional investors (I criteria) are considered most ideal."

6/17/2019 12:34:07 PM - Reported earnings +12% on +26% sales revenues for the Mar '19 quarter, its 3rd consecutive quarterly comparison below the +25% minimum earnings guideline (C criteria). Impressive annual earnings history (A criteria). Went through a deep consolidation since noted with caution in the 7/24/18 mid-day report - "Not a good match with most winning models of the fact-based investment system because of its large supply of shares outstanding (S criteria) and it is heavily owned by 3,958 top-rated mutual funds. That can be problematic in cases where sentiment shifts due to news events. Stocks with a small supply and just beginning to attract the serious interest of institutional investors (I criteria) are considered most ideal."

4/26/2019 12:19:52 PM - Gapped up on the prior session after reporting earnings +12% on +26% sales revenues for the Mar '19 quarter, its 3rd consecutive quarterly comparison below the +25% minimum earnings guideline (C criteria). Impressive annual earnings history (A criteria). Went through a deep consolidation since last noted with caution in the 7/24/18 mid-day report - "Not a good match with most winning models of the fact-based investment system because of its large supply of shares outstanding (S criteria) and it is heavily owned by 3,958 top-rated mutual funds. That can be problematic in cases where sentiment shifts due to news events. Stocks with a small supply and just beginning to attract the serious interest of institutional investors (I criteria) are considered most ideal."

7/24/2018 11:41:17 AM - Gapped up today hitting another new high after recently wedging to new all-time highs with gains lacking great volume conviction. Due to report earnings news on 7/25/18. Reported earnings +63% on +49% sales revenues for the Mar '18 quarter, and prior quarterly comparisons were above the +25% minimum earnings guideline (C criteria). Impressive annual earnings history (A criteria). Not a good match with most winning models of the fact-based investment system because of its large supply of shares outstanding (S criteria) and it is heavily owned by 3,958 top-rated mutual funds. That can be problematic in cases where sentiment shifts due to news events. Stocks with a small supply and just beginning to attract the serious interest of institutional investors (I criteria) are considered most ideal.

1/12/2018 12:22:50 PM - Gapped down today for a big volume-driven loss testing its 50 DMA line ($179), abruptly retreating after recently wedging to new all-time highs with gains lacking great volume conviction. Reported earnings +77% on +47% sales revenues for the Sep '17 quarter, and prior quarterly comparisons were above the +25% minimum earnings guideline (C criteria). Impressive annual earnings history (A criteria). Prior mid-day reports cautioned members - "Not a good match with most winning models of the fact-based investment system because of its large supply of shares outstanding (S criteria) and it is heavily owned by 3,834 top-rated mutual funds. That can be problematic in cases where sentiment shifts due to news events. Stocks with a small supply and just beginning to attract the serious interest of institutional investors (I criteria) are considered most ideal."

11/29/2017 12:45:10 PM - Retreating from its all-time high with today's big volume-driven loss testing its 50 DMA line ($175). Last noted in the 11/02/17 mid-day report - "Reported earnings +77% on +47% sales revenues for the Sep '17 quarter, and prior quarterly comparisons were above the +25% minimum earnings guideline (C criteria). Impressive annual earnings history (A criteria). Not a good match with most winning models of the fact-based investment system because of its large supply of shares outstanding (S criteria) and it is heavily owned by 3,834 top-rated mutual funds. That can be problematic in cases where sentiment shifts due to news events. Stocks with a small supply and just beginning to attract the serious interest of institutional investors (I criteria) are considered most ideal."

11/2/2017 12:26:30 PM - Retreating from a new all-time high today following 4 consecutive volume-driven gains. Reported earnings +77% on +47% sales revenues for the Sep '17 quarter, and prior quarterly comparisons were above the +25% minimum earnings guideline (C criteria). Impressive annual earnings history (A criteria). Not a good match with most winning models of the fact-based investment system because of its large supply of shares outstanding (S criteria) and it is heavily owned by 3,834 top-rated mutual funds. That can be problematic in cases where sentiment shifts due to news events. Stocks with a small supply and just beginning to attract the serious interest of institutional investors (I criteria) are considered most ideal.

10/30/2017 1:25:53 PM - Hitting a new all-time high today with a 2nd consecutive volume-driven gain. Due to report Sep '17 earnings after the close on Wednesday, November 1st. Reported earnings +69% on +45% sales revenues for the Jun '17 quarter, and prior quarterly comparisons were above the +25% minimum earnings guideline (C criteria). Impressive annual earnings history (A criteria). Not a good match with most winning models of the fact-based investment system because of its large supply of shares outstanding (S criteria). It is also heavily owned by 3,823 top-rated mutual funds. That can be problematic in cases where sentiment shifts due to news events. Stocks with a small supply just beginning to attract the serious interest of institutional investors (I criteria) are considered most ideal.

9/25/2017 12:24:41 PM - Abruptly retreating from its all-time high, violating its 50 DMA line and undercutting the prior low ($165 on 8/29/17) with today's damaging volume-driven loss. On 7/27/17 when the mid-day report noted - "Reported earnings +69% on +45% sales revenues for the Jun '17 quarter, and prior quarterly comparisons were above the +25% minimum earnings guideline (C criteria). Impressive annual earnings history (A criteria). Not a good match with most winning models of the fact-based investment system because of its large supply of shares outstanding (S criteria). It is also heavily owned by 3,689 top-rated mutual funds. That can be problematic in cases where sentiment shifts due to news events. Stocks with a small supply just beginning to attract the serious interest of institutional investors (I criteria) are considered most ideal."

7/31/2017 11:33:39 AM - Perched near its all-time high hit on 7/27/17 when the mid-day report noted - "Reported earnings +69% on +45% sales revenues for the Jun '17 quarter, and prior quarterly comparisons were above the +25% minimum earnings guideline (C criteria). Impressive annual earnings history (A criteria). Not a good match with most winning models of the fact-based investment system because of its large supply of shares outstanding (S criteria). It is also heavily owned by 3,689 top-rated mutual funds. That can be problematic in cases where sentiment shifts due to news events. Stocks with a small supply just beginning to attract the serious interest of institutional investors (I criteria) are considered most ideal."

7/27/2017 1:24:18 PM - Gapped up today hitting new all-time highs. Reported earnings +69% on +45% sales revenues for the Jun '17 quarter, and prior quarterly comparisons were above the +25% minimum earnings guideline (C criteria). Impressive annual earnings history (A criteria). Not a good match with most winning models of the fact-based investment system because of its large supply of shares outstanding (S criteria). It is also heavily owned by 3,689 top-rated mutual funds. That can be problematic in cases where sentiment shifts due to news events. Stocks with a small supply just beginning to attract the serious interest of institutional investors (I criteria) are considered most ideal.

5/4/2017 12:23:12 PM - Reported earnings +73% on +49% sales revenues for the Mar '17 quarter, and prior quarterly comparisons were above the +25% minimum earnings guideline (C criteria). Impressive annual earnings history (A criteria). Not a good match with winning models of the fact-based investment system because of its large supply of shares outstanding (S criteria). It is also heavily owned by 3,632 top-rated mutual funds. That can be problematic in cases where sentiment shifts due to news events. Stocks with a small supply just beginning to attract the serious interest of institutional investors (I criteria) are most ideal.

10/13/2016 10:38:20 AM - Gapped down today testing its 50 DMA line. Reported earnings +94% on +59% sales revenues for the Jun '16 quarter, marking its 4th consecutive quarterly comparison above the +25% minimum earnings guideline (C criteria). Impressive annual earnings history (A criteria). Not a good match with winning models of the fact-based investment system because of its large supply of shares outstanding (S criteria). It is also heavily owned by 3,405 top-rated mutual funds. That can be problematic in cases where sentiment shifts due to news events. Stocks with a small supply just beginning to attract the serious interest of institutional investors (I criteria) are most ideal.

9/23/2016 12:19:46 PM - Gapped down today, retreating from all-time highs with another loss marked by above average volume. Reported earnings +94% on +59% sales revenues for the Jun '16 quarter, marking its 4th consecutive quarterly comparison above the +25% minimum earnings guideline (C criteria). Impressive annual earnings history (A criteria). Not a good match with winning models of the fact-based investment system because of its large supply of shares outstanding (S criteria). It is also heavily owned by 3,353 top-rated mutual funds. That can be problematic in cases where sentiment shifts due to news events. Stocks with a small supply just beginning to attract the serious interest of institutional investors (I criteria) are most ideal.

9/7/2016 12:37:33 PM - Hitting new all-time highs (N criteria) with gains backed by above average volume. Reported earnings +94% on +59% sales revenues for the Jun '16 quarter, marking its 4th consecutive quarterly comparison above the +25% minimum earnings guideline (C criteria). Impressive annual earnings history (A criteria). Not a good match with winning models of the fact-based investment system because of its large supply of shares outstanding (S criteria). It is also heavily owned by 3,343 top-rated mutual funds. That can be problematic in cases where sentiment turns due to news events. Most ideal are stocks with a small supply just beginning to attract the serious interest of institutional investors (I criteria).

7/29/2016 12:31:27 PM - Perched at new all-time highs (N criteria) today' following 2 consecutive volume-driven gains. Reported earnings +94% on +59% sales revenues for the Jun '16 quarter, marking its 4th consecutive quarterly comparison above the +25% minimum earnings guideline (C criteria). Impressive annual earnings history (A criteria). Large supply of shares outstanding (S criteria) and already heavily owned by 3,312 top-rated mutual funds, rather than a small supply and only beginning to attract the interest of institutional investors (I criteria).

7/28/2016 12:41:31 PM - Hitting new all-time highs (N criteria) with today's 2nd consecutive volume-driven gain. Reported earnings +94% on +59% sales revenues for the Jun '16 quarter, marking its 4th consecutive quarterly comparison above the +25% minimum earnings guideline (C criteria). Impressive annual earnings history (A criteria). Large supply of shares outstanding (S criteria) and already heavily owned by 3,309 top-rated mutual funds, rather than a small supply and onl0y beginning to attract the interest of institutional investors (I criteria).

4/28/2016 12:30:45 PM - Gapped up today hitting new all-time highs, rebounding from a slump below its 50 DMA line. Reported earnings +83% on +52% sales revenues for the Mar '16 quarter, marking its 3rd consecutive quarterly comparison above the +25% minimum earnings guideline (C criteria). Heavily owned by 3,137 top-rated mutual funds, rather than just starting to attract institutional investors (I criteria).

4/22/2016 12:20:10 PM - Gapped down today. Recent losses with higher volume totals were noted as "indicative of distributional pressure" while slumping to its 50 DMA line which acted as support. Heavily owned by 3,129 top-rated mutual funds, rather than just starting to attract institutional investors (I criteria). Noted with caution in prior mid-day reports - "There are still fundamental concerns. Reported earnings +46% on +52% sales revenues for the Dec '15 quarter, its 2nd quarterly comparison above the +25% minimum earnings guideline (C criteria)."

4/13/2016 12:21:29 PM - Recent losses with higher volume totals were noted as "indicative of distributional pressure" while slumping toward its 50 DMA line. Heavily owned by 3,114 top-rated mutual funds, rather than just starting to attract institutional investors (I criteria). Noted with caution in prior mid-day reports - "There are still fundamental concerns. Reported earnings +46% on +52% sales revenues for the Dec '15 quarter, its 2nd quarterly comparison above the +25% minimum earnings guideline (C criteria)."

4/11/2016 12:33:45 PM - Recent losses with higher volume totals were noted as "indicative of distributional pressure" while slumping toward its 50 DMA line. Heavily owned by 3,104 top-rated mutual funds, rather than just starting to attract institutional investors (I criteria). Noted with caution in prior mid-day reports - "There are still fundamental concerns. Reported earnings +46% on +52% sales revenues for the Dec '15 quarter, its 2nd quarterly comparison above the +25% minimum earnings guideline (C criteria)."

4/8/2016 12:22:23 PM - Pulled back on Monday and today with higher volume totals indicative of distributional pressure, slumping toward its 50 DMA line. Heavily owned by 3,101 top-rated mutual funds, rather than just starting to attract institutional investors (I criteria). Noted with caution in prior mid-day reports - "There are still fundamental concerns. Reported earnings +46% on +52% sales revenues for the Dec '15 quarter, its 2nd quarterly comparison above the +25% minimum earnings guideline (C criteria)."

4/4/2016 12:30:57 PM - Pulling back today with higher volume indicative of distributional pressure. Heavily owned by 3,092 top-rated mutual funds, rather than just starting to attract institutional investors (I criteria). Last noted with caution in the 2/16/16 mid-day report - "There are still fundamental concerns. Reported earnings +46% on +52% sales revenues for the Dec '15 quarter, its 2nd quarterly comparison above the +25% minimum earnings guideline (C criteria)."

2/16/2016 1:09:46 PM - Abruptly violated its 50 DMA line and undercut prior highs with damaging volume-driven losses following a "negative reversal" with higher volume on 2/02/16. Heavily owned by 3,017 top-rated mutual funds, rather than just starting to attract institutional investors (I criteria). Noted with caution repeatedly in prior mid-day reports - "There are still fundamental concerns. Reported earnings +46% on +52% sales revenues for the Dec '15 quarter, its 2nd quarterly comparison above the +25% minimum earnings guideline (C criteria)."

2/10/2016 12:30:16 PM - Abruptly violated its 50 DMA line and undercut prior highs with damaging volume-driven losses following a "negative reversal" with higher volume on 2/02/16. Heavily owned by 3,001 top-rated mutual funds, rather than just starting to attract institutional investors (I criteria). Noted with caution repeatedly in prior mid-day reports - "There are still fundamental concerns. Reported earnings +46% on +52% sales revenues for the Dec '15 quarter, its 2nd quarterly comparison above the +25% minimum earnings guideline (C criteria)."

2/5/2016 12:11:54 PM - Abruptly retreating near its 50 DMA line, undercutting prior highs with today's 4th consecutive loss following a "negative reversal" with higher volume on 2/02/16. Rallied into new high territory with 3 consecutive gains with above average but ever-decreasing. FB is heavily owned by 2,992 top-rated mutual funds, rather than just starting to attract institutional investors (I criteria). Noted with caution repeatedly in prior mid-day reports - "There are still fundamental concerns. Reported earnings +46% on +52% sales revenues for the Dec '15 quarter, its 2nd quarterly comparison above the +25% minimum earnings guideline (C criteria)."

2/3/2016 12:44:23 PM - Down today following a "negative reversal" on the prior session, pulling back after rallying into new high territory with 3 consecutive volume-driven gains. Heavily owned by 2,986 top-rated mutual funds, rather than just starting to attract institutional investors (I criteria). Noted with caution in prior mid-day reports - "There are still fundamental concerns. Reported earnings +46% on +52% sales revenues for the Dec '15 quarter, its 2nd quarterly comparison above the +25% minimum earnings guideline (C criteria)."

2/2/2016 12:48:20 PM - Hitting yet another new high today, rallying with no resistance due to overhead supply. Gapped up for a considerable volume-driven gain challenging its prior high on 1/28/16 following strong earnings news. Noted with caution in prior mid-day reports - "There are still fundamental concerns. Reported earnings +46% on +52% sales revenues for the Dec '15 quarter, its 2nd quarterly comparison above the +25% minimum earnings guideline (C criteria)."

2/1/2016 12:53:37 PM - Hitting another new high today, rallying with no resistance due to overhead supply. Gapped up for a considerable volume-driven gain challenging its prior high on 1/28/16 following strong earnings news. Noted with caution in prior mid-day reports - "There are still fundamental concerns. Reported earnings +46% on +52% sales revenues for the Dec '15 quarter, its 2nd quarterly comparison above the +25% minimum earnings guideline (C criteria)."

1/29/2016 12:53:07 PM - Hitting a new high today, rallying with no resistance due to overhead supply. Gapped up for a considerable volume-driven gain challenging its prior high on the prior session following strong earnings news when noted with caution in the mid-day report - "There are still fundamental concerns. Reported earnings +46% on +52% sales revenues for the Dec '15 quarter, its 2nd quarterly comparison above the +25% minimum earnings guideline (C criteria)."

1/28/2016 12:38:00 PM - Gapped up today for a considerable volume-driven gain challenging its prior high following strong earnings news. Little resistance remains, however there are still fundamental concerns. Reported earnings +46% on +52% sales revenues for the Dec '15 quarter, its 2nd quarterly comparison above the +25% minimum earnings guideline (C criteria).

1/15/2016 12:09:49 PM - Gapped down amid widespread weakness today. Testing support at its 200 DMA line. Damaging volume-driven losses undercut prior highs in the $99 area following a gap down violating its 50 DMA line on 1/04/16. Fundamental concerns were repeatedly noted in several Nov '15 mid-day reports while hovering near its all-time high - "Reported earnings +33% on +41% sales revenues for the Sep '15 quarter, an improvement after 2 prior quarterly comparisons below the +25% minimum earnings guideline (C criteria)."

1/14/2016 12:18:50 PM - Testing support at its 200 DMA line today. Damaging volume-driven losses undercut prior highs in the $99 area following a gap down violating its 50 DMA line on 1/04/16. Fundamental concerns were repeatedly noted in several Nov '15 mid-day reports while hovering near its all-time high - "Reported earnings +33% on +41% sales revenues for the Sep '15 quarter, an improvement after 2 prior quarterly comparisons below the +25% minimum earnings guideline (C criteria)."

1/8/2016 12:26:08 PM - A damaging volume-driven loss on the prior session undercut prior highs in the $99 area previously noted as important near-term support to watch. Gapped down violating its 50 DMA line on 1/04/16. Fundamental concerns were repeatedly noted in several Nov '15 mid-day reports while hovering near its all-time high - "Reported earnings +33% on +41% sales revenues for the Sep '15 quarter, an improvement after 2 prior quarterly comparisons below the +25% minimum earnings guideline (C criteria)."

1/7/2016 12:30:47 PM - With today's loss it is testing prior highs in the $99 area previously noted as important near-term support to watch. Gapped down violating its 50 DMA line on 1/04/16. Fundamental concerns were repeatedly noted in several Nov '15 mid-day reports while hovering near its all-time high - "Reported earnings +33% on +41% sales revenues for the Sep '15 quarter, an improvement after 2 prior quarterly comparisons below the +25% minimum earnings guideline (C criteria)."

1/4/2016 12:32:51 PM - Gapped down today violating its 50 DMA line and undercutting prior lows. Prior highs in the $99 area define near-term support to watch. Fundamental concerns were repeatedly noted in prior mid-day reports - "Reported earnings +33% on +41% sales revenues for the Sep '15 quarter, an improvement after 2 prior quarterly comparisons below the +25% minimum earnings guideline (C criteria)."

11/16/2015 12:33:53 PM - Abruptly retreating toward prior highs in the $99 area which define initial chart support to watch. Fundamental concerns were last noted in the 11/05/15 mid-day report - "Reported earnings +33% on +41% sales revenues for the Sep '15 quarter, an improvement after 2 prior quarterly comparisons below the +25% minimum earnings guideline (C criteria)."

11/5/2015 12:33:10 PM - Gapped up today for a new all-time high, getting extended from prior highs in the $99 area. Reported earnings +33% on +41% sales revenues for the Sep '15 quarter, an improvement after 2 prior quarterly comparisons below the +25% minimum earnings guideline (C criteria).

8/25/2015 12:42:31 PM - Founding prompt support near its 200 DMA line. Suffered damaging volume-driven losses violating its 50 DMA line. Sputtered after a "negative reversal" when noted with caution in the 8/06/15 mid-day report - "Reported earnings +16% on +39% sales revenues for the Jun '15 quarter, its 2nd consecutive quarterly comparison below the +25% minimum earnings guideline (C criteria). Enduring distributional pressure..."

8/20/2015 12:54:51 PM - Slumping after last noted with caution in the 8/06/15 mid-day report - "Reported earnings +16% on +39% sales revenues for the Jun '15 quarter, its 2nd consecutive quarterly comparison below the +25% minimum earnings guideline (C criteria). Enduring distributional pressure after breaking out from a previously noted advanced "3-weeks tight" base. Found support at its 200 DMA line and rebounded since dropped from the Featured Stocks list on 4/30/15."

8/6/2015 12:32:52 PM - Reported earnings +16% on +39% sales revenues for the Jun '15 quarter, its 2nd consecutive quarterly comparison below the +25% minimum earnings guideline (C criteria). Enduring distributional pressure after breaking out from a previously noted advanced "3-weeks tight" base. Found support at its 200 DMA line and rebounded since dropped from the Featured Stocks list on 4/30/15.

7/30/2015 12:22:41 PM - Reported earnings +16% on +39% sales revenues for the Jun '15 quarter, its 2nd consecutive quarterly comparison below the +25% minimum earnings guideline (C criteria). Gapped down today, while bullish action had followed the previously noted advanced "3-weeks tight" base. Found support at its 200 DMA line and rebounded since dropped from the Featured Stocks list on 4/30/15.

7/27/2015 12:24:57 PM - Holding its ground perched near all-time highs, and bullish action has continued following the previously noted advanced "3-weeks tight" base. Reports Jun '15 earnings on 7/29/15, and volume and volatility often increase near earnings news. Earnings +20% on +42% sales revenues for the Mar '15 quarter were below the +25% minimum earnings guideline (C criteria) of the fact-based investment system, raising fundamental concerns. Found support at its 200 DMA line during its consolidation since dropped from the Featured Stocks list on 4/30/15.

7/21/2015 12:17:43 PM - Hitting new all-time highs again today, getting more extended from the previously noted advanced "3-weeks tight" base above prior highs. Reports Jun '15 earnings on 7/29/15, and volume and volatility often increase near earnings news. Earnings +20% on +42% sales revenues for the Mar '15 quarter were below the +25% minimum earnings guideline (C criteria) of the fact-based investment system, raising fundamental concerns. Found support at its 200 DMA line during its consolidation since dropped from the Featured Stocks list on 4/30/15.

7/20/2015 12:11:53 PM - Hitting new all-time highs again today, getting more extended from the previously noted advanced "3-weeks tight" base above prior highs. Reports Jun '15 earnings on 7/29/15, and volume and volatility often increase near earnings news. Earnings +20% on +42% sales revenues for the Mar '15 quarter were below the +25% minimum earnings guideline (C criteria) of the fact-based investment system, raising fundamental concerns. Found support at its 200 DMA line during its consolidation since dropped from the Featured Stocks list on 4/30/15.

7/17/2015 12:24:28 PM - Gapped up today hitting new all-time highs. Getting extended from the previously noted advanced "3-weeks tight" base above prior highs. Due to report Jun '15 earnings 7/29/15. Earnings +20% on +42% sales revenues for the Mar '15 quarter were below the +25% minimum earnings guideline (C criteria) of the fact-based investment system, raising fundamental concerns. Found support at its 200 DMA line during its consolidation since dropped from the Featured Stocks list on 4/30/15.

7/15/2015 12:34:00 PM - Wedged to new all-time highs with recent gains lacking great volume conviction following an advanced "3-weeks tight" base above prior highs. Recently reported earnings +20% on +42% sales revenues for the Mar '15 quarter, below the +25% minimum earnings guideline (C criteria) of the fact-based investment system, raising fundamental concerns. Found support at its 200 DMA line during its consolidation since dropped from the Featured Stocks list on 4/30/15.

7/14/2015 12:12:50 PM - Wedging to new all-time highs with gains lacking great volume conviction following an advanced "3-weeks tight" base above prior highs. Recently reported earnings +20% on +42% sales revenues for the Mar '15 quarter, below the +25% minimum earnings guideline (C criteria) of the fact-based investment system, raising fundamental concerns. Found support at its 200 DMA line during its consolidation since dropped from the Featured Stocks list on 4/30/15.

7/13/2015 12:52:31 PM - Gapped up today hitting new all-time highs following an advanced "3-weeks tight" base above prior highs. Recently reported earnings +20% on +42% sales revenues for the Mar '15 quarter, below the +25% minimum earnings guideline (C criteria) of the fact-based investment system, raising fundamental concerns. Found support at its 200 DMA line during its consolidation since dropped from the Featured Stocks list on 4/30/15.

4/30/2015 6:08:49 PM - Slumped further below its 50 DMA line today and its Relative Strength rating has slumped to 73, below the 80+ minimum guideline for buy candidates. Recently reported earnings +20% on +42% sales revenues for the Mar '15 quarter, below the +25% minimum earnings guideline (C criteria) of the fact-based investment system, raising fundamental concerns. It will be dropped from the Featured Stocks list tonight.

4/27/2015 6:12:54 PM - G - Recently reported earnings +20% on +42% sales revenues for the Mar '15 quarter, below the +25% minimum earnings guideline (C criteria) of the fact-based investment system, raising concerns. Consolidating above its 50 DMA line ($81.00) where a subsequent violation would trigger a technical sell signal.

4/23/2015 12:21:13 PM - G - Churning above average volume near its all-time high today. Reported earnings +20% on +42% sales revenues for the Mar '15 quarter, below the +25% minimum earnings guideline (C criteria) of the fact-based investment system. Found support at its 50 DMA line. See the latest FSU analysis for more details and annotated graphs.

4/22/2015 5:53:18 PM - G - Reported earnings +20% on +42% sales revenues for the Mar '15 quarter, below the +25% minimum earnings guideline (C criteria) of the fact-based investment system. Found support at its 50 DMA line. See the latest FSU analysis for more details and annotated graphs.

4/21/2015 9:05:03 PM - G - Rebounded well above its "max buy" level today after consolidating above support at its 50 DMA line. See the latest FSU analysis for more details and new annotated graphs.

4/20/2015 1:38:15 PM - G - Color code is changed to green after rebounding back above its "max buy" level today while consolidating above support at its 50 DMA line ($80.25). A subsequent violation would raise concerns an trigger a technical sell signal. Its Relative Strength rating has slumped to 79, below the 80+ minimum guideline for buy candidates.

4/17/2015 6:53:49 PM - Y - Color code is changed to yellow as it pulled back below its "max buy" level and below prior resistance in the $82 area, retreating near its 50 DMA line ($80.10). A subsequent violation would raise concerns an trigger a technical sell signal

4/13/2015 6:20:10 PM - G - Posted a gain today with higher (near average) volume, still consolidating above prior resistance in the $82 area defining important near-term support above the 50 DMA line.

4/10/2015 6:35:14 PM - G - Volume totals have cooled while consolidating above prior resistance in the $82 area defining important near-term support above the 50 DMA line.

4/6/2015 6:36:02 PM - G - Posted a gain today on light volume following 4 consecutive losses with light volume while consolidating. Prior resistance in the $82 area defines important near-term support above the 50 DMA line.

3/31/2015 6:13:14 PM - G - Consolidating above prior resistance in the $82 area defining important near-term support above the 50 DMA line. See the latest FSU analysis for more details and new annotated graphs.

3/30/2015 7:33:23 PM - G - Consolidating above prior resistance in the $82 area defining important near-term support above the 50 DMA line. Its Relative Strength rating has improved to 82, above the 80+ minimum guideline for new buy candidates.

3/23/2015 5:54:39 PM - G - Hit another new 52 week high with today's 6th consecutive gain, recently rallying clear of all resistance due to overhead supply. Its Relative Strength rating has improved to 82, above the 80+ minimum guideline for new buy candidates.

3/19/2015 12:13:27 PM - G - Hitting a new 52 week high with today's 4th consecutive gain, rallying clear of all resistance due to overhead supply. Its Relative Strength rating is at 77, still below the 80+ minimum guideline for new buy candidates. Its Relative Strength line was also plotted higher in October.

3/19/2015 10:27:40 AM - G - Hitting a new 52 week high with today's 4th consecutive gain, rallying clear of all resistance due to overhead supply. Its Relative Strength rating is at 77, below the 80+ minimum guideline for new buy candidates, and its Relative Strength line was higher in October.

3/18/2015 12:24:02 PM - G - Consolidating above support at its 50 DMA line, perched near its 52 week high, making limited progress in recent months. Its Relative Strength rating is at 75, below the 80+ minimum guideline for new buy candidates.

3/16/2015 6:07:26 PM - G - Still testing support at its 50 DMA line. While consolidating near it 52 week high it has made limited progress, and its Relative Strength rating, at 71 now, is below the 80+ minimum guideline for new buy candidates.

3/11/2015 6:21:02 PM - G - Testing support at its 50 DMA line. While consolidating near it 52 week high it has made limited progress, and its Relative Strength rating, at 71 now, is below the 80+ minimum guideline for new buy candidates. See the latest FSU analysis for more details and new annotated graphs.

3/10/2015 5:40:39 PM - G - Finished at the session low with today's 3rd consecutive loss testing support at its 50 DMA line. While consolidating near it 52 week high it has made limited progress, and its Relative Strength rating, at 73 now, is below the 80+ minimum guideline for new buy candidates.

3/3/2015 7:00:47 PM - G - Small loss today with lighter than average volume, holding its ground above the previously cited pivot point of a "double bottom" base. While consolidating near it 52 week high it has made limited progress, and its Relative Strength rating, at 78 now, is below the 80+ minimum guideline for new buy candidates.

2/27/2015 6:22:45 PM - G - Down today with above average volume, slumping toward the previously cited pivot point of a "double bottom" base. While consolidating near it 52 week high it has made limited progress, and its Relative Strength rating, at 76 now, is below the 80+ minimum guideline for new buy candidates.

2/24/2015 5:46:32 PM - G - Holding its ground perched within close striking distance of its 52-week high with volume totals cooling since featured in the 2/20/15 mid-day report (read here). Faces very little resistance due to overhead supply up through the $82 level. Rallied above its 50 DMA line with volume-driven gain on 2/19/15 technically clearing a "double bottom" base. Relative Strength rating has slumped to 73, below the 80+ minimum guideline for buy candidates and its color code is changed to green. See the latest FSU analysis for more details and annotated graphs.

2/20/2015 6:09:49 PM - Y - Highlighted in yellow while perched within close striking distance of its 52-week high in the earlier mid-day report (read here). Faces very little resistance due to overhead supply up through the $82 level. Rallied well above its 50 DMA line with volume-driven gain on the prior session technically clearing a "double bottom" base. Relative Strength rating has improved to 81, just above the 80+ minimum guideline for buy candidates. See the latest FSU analysis for more details and new annotated graphs.

2/20/2015 12:37:04 PM - Y - Color code is changed to yellow while perched within close striking distance of its 52-week high. Faces very little resistance due to overhead supply up through the $82 level. Returned to the Featured Stocks list. Rallied well above its 50 DMA line with volume-driven gain on the prior session technically clearing a "double bottom" base. Relative Strength rating has improved to 81, just above the 80+ minimum guideline for buy candidates.

2/2/2015 6:31:37 PM - Slumped further below its 50 DMA line with a 2nd consecutive volume-driven loss. Relative Strength rating has slumped to 76, below the 80+ minimum guideline for buy candidates. Faces resistance due to overhead supply up through the $82 level. Waning leadership (L criteria) in the Internet - Content industry group was noted as a concern. It will be dropped from the Featured Stocks list tonight.

1/30/2015 6:31:07 PM - G - Slumped below its 50 DMA line, enduring distributional pressure. Faces resistance due to overhead supply up through the $82 level. Waning leadership (L criteria) in the Internet - Content industry group was noted as a concern. See the latest FSU analysis for more details and new annotated graphs.

1/30/2015 12:40:47 PM - G - Churned above average volume this week near its 50 DMA line, not making meaningful price progress - a sign of distributional pressure. Faces resistance due to overhead supply up through the $82 level. Waning leadership (L criteria) in the Internet - Content industry group was noted as a concern.

1/29/2015 12:43:44 PM - G - Churning above average volume for a 2nd consecutive session near its 50 DMA line, not making meaningful price progress - a sign of distributional pressure. Faces resistance due to overhead supply up through the $82 level. Waning leadership (L criteria) in the Internet - Content industry group was noted as a concern.

1/28/2015 6:31:54 PM - G - Ended below its 50 DMA line and near the session low today after churning above average volume and its color code is changed to green. Faces resistance due to overhead supply up through the $82 level. Waning leadership (L criteria) in the Internet - Content industry group is a concern.

1/26/2015 6:15:26 PM - Y - Still faces resistance due to overhead supply up through the $82 level. Waning leadership (L criteria) in the Internet - Content industry group is a concern. Subsequent volume-driven gains for new highs are needed to clinch a new technical buy signal.

1/23/2015 5:52:11 PM - Y - Faces resistance due to overhead supply up through the $82 level. Color code is changed to yellow, but subsequent volume-driven gains above the pivot point are still needed to clinch a proper new (or add-on) technical buy signal. Rebounded further above its 50 DMA line ($76.66) with today's 5th consecutive gain on near or below average volume. Relative Strength rating has improved to 81, just above the 80+ minimum guideline for buy candidates.

1/20/2015 7:05:31 PM - G - Rebounded near its 50 DMA line ($76.53) with today's 2nd consecutive gain on near average volume. Relative Strength rating has slumped to 78, below the 80+ minimum guideline for buy candidates. Needs a rebound above the 50 DMA line for its outlook to improve, and it also faces resistance due to overhead supply up through the $82 level. Subsequent volume-driven gains above the pivot point are needed to clinch a proper new (or add-on) technical buy signal.

1/15/2015 12:44:13 PM - G - Sputtering below its 50 DMA line with today's 5th consecutive loss and its color code is changed to green. Relative Strength rating has slumped to 82, but remains above the 80+ minimum guideline for buy candidates. Needs a rebound above the 50 DMA line for its outlook to improve, and it also faces resistance due to overhead supply up through the $82 level. Subsequent volume-driven gains above the pivot point are needed to clinch a proper new (or add-on) technical buy signal.

1/12/2015 6:26:48 PM - Y - Consolidating near its 50 DMA line with volume totals cooling. Resistance remains due to overhead supply up through the $82 level.Volume-driven gains above the pivot point are still needed to clinch a proper new (or add-on) technical buy signal. See the latest FSU analysis for more details and new annotated graphs.

1/8/2015 1:54:15 PM - Y - Halted its slide after quietly retreating near its 50 DMA line. Little resistance remains due to overhead supply up through the $82 level, however, convincing volume-driven gains above the pivot point are still needed to clinch a proper new (or add-on) technical buy signal.

1/5/2015 7:15:07 PM - Y - Pulled back today on higher but below average volume, retreating near its 50 DMA line ($76.69). Little resistance remains due to overhead supply up through the $82 level, however, convincing volume-driven gains above the pivot point are needed to clinch a proper new (or add-on) technical buy signal.

12/31/2014 6:09:21 PM - Y - Pulled back for a 3rd consecutive loss, retreating from its all-time high. No resistance remains due to overhead supply. Volume-driven gains above the pivot point are needed to clinch a proper new (or add-on) technical buy signal.

12/29/2014 6:08:05 PM - Y - Holding its ground with volume totals cooling while perched at its all-time high and no resistance remains due to overhead supply. Volume-driven gains above the pivot point are needed to clinch a proper new (or add-on) technical buy signal.

12/22/2014 6:04:56 PM - Y - A new pivot point was cited based on its 10/28/14 high plus 10 cents. It hit a new high with today's 4th consecutive gain and no resistance remains due to overhead supply. Volume-driven gains are needed to clinch a proper technical buy signal. See the latest FSU analysis for more details and new annotated graphs.

12/22/2014 12:59:11 PM - Y - New pivot point is cited based on its 10/28/14 high plus 10 cents. Hitting a new high with today's 4th consecutive gain and no resistance remains due to overhead supply. A strong finish may clinch a technical buy signal, however, the broader market averages (M criteria) also needs to produce confirming gains.

12/16/2014 2:56:03 PM - Y - Quietly consolidating near its 50 DMA line ($75.80). Recent lows in the $72 area define the next chart support level above its 200 DMA line.

12/10/2014 6:20:51 PM - Y - Reversed an early gain today and pulled back on higher (but below average) volume, ending near the session lows and 50 DMA line ($75.80). Prior lows in the $72 area define the next chart support level above its 200 DMA line.

12/8/2014 6:38:07 PM - Y - Posted quiet gains to get back above the 50 DMA line helping its outlook to improve and its color code is changed to yellow yet no new pivot point has been cited.

12/4/2014 6:13:51 PM - G - Recent gains lacked volume conviction. Needs gains above the 50 DMA line for its outlook to improve. See the latest FSU analysis for more details new annotated graphs.

12/1/2014 6:46:27 PM - G - Its color code is changed to green after slumping back below its 50 DMA line today hurting its technical stance and near-term outlook.

11/26/2014 1:25:21 PM - Y - It has not formed a sound base, yet its color code is changed to yellow after quietly rebounding above the 50 DMA line helping its outlook to improve.

11/25/2014 5:33:35 PM - G - Volume was higher but still below average today while rebounding near its 50 DMA line which may act as resistance. Gains above the 50 DMA line ($76.14) are needed for its outlook to improve.

11/20/2014 5:21:28 PM - G - Volume totals have been cooling and recent gains have lacked volume conviction. Its outlook gets worse the longer it lingers below its 50 DMA line.

11/14/2014 6:09:43 PM - G - Recent gains have lacked volume conviction and it encountered resistance at its 50 DMA line following a violation on 3 times average volume on 10/29/14 that raised concerns and triggered a technical sell signal. See the latest FSU analysis for more details and new annotated graphs.

11/10/2014 5:47:51 PM - G - Encountered resistance at its 50 DMA line following a violation on 3 times average volume on 10/29/14 that raised concerns and triggered a technical sell signal.

11/5/2014 1:52:48 PM - G - Encountering resistance at its 50 DMA line following a violation on 3 times average volume on 10/29/14 that raised concerns and triggered a technical sell signal. Volume and volatility often increase near earnings news. The company reported earnings +59% on +59% sales for the Sep '14 quarter but warned of rising costs. Historic studies show that investors have a far better chance of success when buying as a stock is breaking out, not buying on pullbacks.

10/30/2014 1:01:31 PM - G - Falling again today with above average volume after a 50 DMA line violation on 3 times average volume raised concerns and triggered a technical sell signal on the prior session. Volume and volatility often increase near earnings news. The company reported earnings +59% on +59% sales for the Sep '14 quarter but warned of rising costs. Historic studies show that investors have a far better chance of success when buying as a stock is breaking out, not buying on pullbacks. See the latest FSU analysis for more details and annotated graphs.

10/29/2014 5:48:52 PM - G - Gapped down today and violated its 50 DMA line with a damaging loss on 3 times average volume raising concerns and triggering a technical sell signal. Volume and volatility often increase near earnings news. The company reported earnings +59% on +59% sales for the Sep '14 quarter but warned of rising costs. Historic studies show that investors have a far better chance of success when buying as a stock is breaking out, not buying on pullbacks. See the latest FSU analysis for more details and new annotated graphs.

10/29/2014 12:24:02 PM - G - Gapped down today and undercut its 50 DMA line raising concerns. Volume and volatility often increase near earnings news. The company reported earnings +59% on +59% sales for the Sep '14 quarter and warned of rising costs. Historic studies show that investors have a far better chance of success when buying as a stock is breaking out, not buying on pullbacks. Disciplined investors avoid chasing stocks more than +5% above their pivot point and always limit losses by selling any stock that falls more than -7% from their purchase price.

10/29/2014 11:58:14 AM - G - Gapped down today and violated its 50 DMA line raising concerns. Volume and volatility often increase near earnings news. The company reported earnings +59% on +59% sales for the Sep '14 quarter following Tuesday's close and it warned of rising costs. Disciplined investors avoid chasing stocks more than +5% above their pivot point and always limit losses by selling any stock that falls more than -7% from their purchase price.

10/28/2014 6:43:22 PM - G - Color code is changed to green after rising above its "max buy" level with 2 times average volume behind today's gain. Reported earnings +59% on +59% sales for the Sep '14 quarter following the close and it warned of rising costs. Disciplined investors avoid chasing stocks more than +5% above their pivot point and always limit losses by selling any stock that falls more than -7% from their purchase price.

10/23/2014 5:51:21 PM - Y - Wedged higher and hit another new 52-week high while approaching its "max buy" level with average volume behind today's gain. Rebound above the 50 DMA line helped its outlook improve and its color code was changed to yellow.

10/21/2014 6:05:13 PM - Y - Wedged near its 52-week high with below average volume behind today's gain. Rebound above the 50 DMA line ($75.83) helped its outlook improve and its color code was changed to yellow.

10/17/2014 5:28:41 PM - G - Volume-driven gain today helped it rebound and close just above the 50 DMA line ($75.83) helping its outlook to improve and its color code is changed to yellow. See the latest FSU analysis for more details and annotated graphs.

10/16/2014 6:20:22 PM - G - Volume-driven losses recently raised concerns and triggered technical sell signals. A rebound above the 50 DMA line is needed for its outlook to improve. See the latest FSU analysis for more details and new annotated graphs.

10/16/2014 12:32:00 PM - G - Slumped below its 50 DMA line and prior lows ($73.07 on 9/16/14) with volume-driven losses raising concerns and triggering a technical sell signal. A rebound above the 50 DMA line is needed for its outlook to improve.

10/15/2014 12:15:16 PM - G - Slumping further below its 50 DMA line after undercutting prior lows ($73.07 on 9/16/14) raising concerns and triggering a technical sell signal. Only a prompt rebound above the 50 DMA line would help its outlook improve.

10/13/2014 5:45:49 PM - G - Failed to rebound today after the prior session's volume-driven loss violated its 50 DMA line and undercut prior lows ($73.07 on 9/16/14) triggering a technical sell signal.

10/10/2014 12:30:24 PM - G - Color code was changed to green as today's volume-driven loss violated its 50 DMA line and undercut prior lows ($73.07 on 9/16/14). Previously noted with caution - "Subsequent violations of the 50 DMA line and recent lows would raise greater concerns and trigger technical sell signals."

10/10/2014 11:11:11 AM - G - Color code is changed to green as today's volume-driven loss has violated its 50 DMA line and undercut prior lows ($73.07 on 9/16/14). Previously noted - "Subsequent violations of the 50 DMA line and recent lows would raise greater concerns and trigger technical sell signals."

10/8/2014 6:16:51 PM - Y - Managed a "positive reversal" today after briefly undercutting its 50 DMA line ($75.72). Subsequent violations of the 50 DMA line and recent lows would raise greater concerns and trigger technical sell signals.

10/7/2014 6:38:24 PM - Y - Slumped near its 50 DMA line ($75.64) with a loss today on below average volume. A subsequent violation would trigger a technical sell signal.

10/1/2014 1:53:21 PM - Y - Pulling back with higher volume today after wedging higher with gains lacking great volume conviction. Its 50 DMA line ($75.41) defines important near term support where a violation would trigger a technical sell signal

9/25/2014 6:09:18 PM - Y - Reversed into the red for a loss on near average volume after touching a new high. Its 50 DMA line ($74.60) defines important near term support. See the latest FSU analysis for more details and new annotated graphs.

9/23/2014 5:18:08 PM - Y - Rallied with average volume for its best-ever close today. The volume-driven gain on 9/19/14 helped confirm a new (or add-on) technical buy signal. Found support at its 50 DMA line ($74.19) last week after a light bout of distributional pressure.

9/19/2014 5:50:11 PM - Y - Rallied with 2 times average volume for its second best close today. The volume-driven gain helped confirm a new (or add-on) technical buy signal. Found support at its 50 DMA line ($73.77) this week after a light bout of distributional pressure.

9/18/2014 1:13:52 PM - Y - Found support at its 50 DMA line ($73.51) this week after a bout of distributional pressure. Prior notes repeatedly cautioned members - "Recent gains lacked great volume conviction while gains above a stock's pivot point must have at least +40% above averages volume to trigger a proper new (or add-on) technical buy signal. See the latest FSU analysis for more details and annotated graphs. Prior highs in the $72 area define initial support along with its 50 DMA line."

9/15/2014 3:31:32 PM - Y - Down considerably with heavy volume behind today's loss, action indicative of distributional pressure. Prior notes cautioned members "Recent gains lacked great volume conviction while gains above a stock's pivot point must have at least +40% above averages volume to trigger a proper new (or add-on) technical buy signal. See the latest FSU analysis for more details and annotated graphs. Prior highs in the $72 area define initial support along with its 50 DMA line."

9/10/2014 4:49:18 PM - Y - Posted a small gain today on light volume. Color code was changed to yellow with new pivot point cited based on its 7/24/14 high plus 10 cents. Recent gains lacked great volume conviction while gains above a stock's pivot point must have at least +40% above averages volume to trigger a proper new (or add-on) technical buy signal. See the latest FSU analysis for more details and annotated graphs. Prior highs in the $72 area define initial support along with its 50 DMA line.

9/9/2014 6:59:43 PM - Y - Color code is changed to yellow with new pivot point cited based on its 7/24/14 high plus 10 cents. Recent gains lacked great volume conviction while gains above a stock's pivot point must have at least +40% above averages volume to trigger a proper new (or add-on) technical buy signal. See the latest FSU analysis for more details and new annotated graphs. Prior highs in the $72 area define initial support along with its 50 DMA line.

9/2/2014 6:36:55 PM - G - Color code is changed to green after it rallied for a best-ever close and finished near the session high with today's gain on higher volume but below average volume. Prior highs in the $72 area define initial support above its 50 DMA line ($70.98).

8/25/2014 3:30:40 PM - Y - Volume totals have cooled while consolidating in a tight range, stubbornly holding its ground since gapping up on 7/24/14. Prior highs in the $72 area define initial support above its 50 DMA line ($69.93).

8/18/2014 7:06:52 PM - Y - Volume totals have generally been cooling while consolidating near its pivot point, stubbornly holding its ground after gapping up on 7/24/14. Prior highs in the $72 area define initial support above its 50 DMA line ($68.91).

8/8/2014 4:06:39 PM - Y - Volume totals have been cooling while consolidating near its pivot point, stubbornly holding its ground after gapping up on 7/24/14. Prior highs in the $72 area define initial support above its 50 DMA line.

8/5/2014 5:42:30 PM - Y - Consolidating today near its pivot point, stubbornly holding its ground after gapping up on 7/24/14 to a new 52-week high following strong earnings news for the Jun '14 quarter.

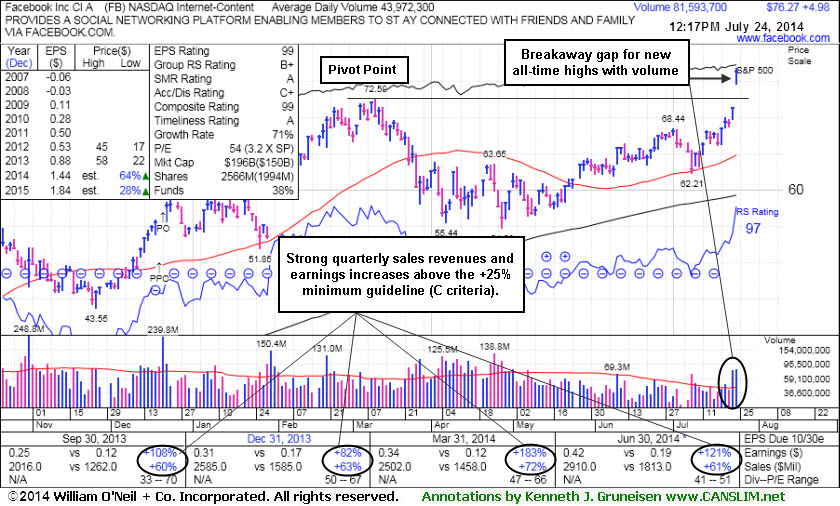

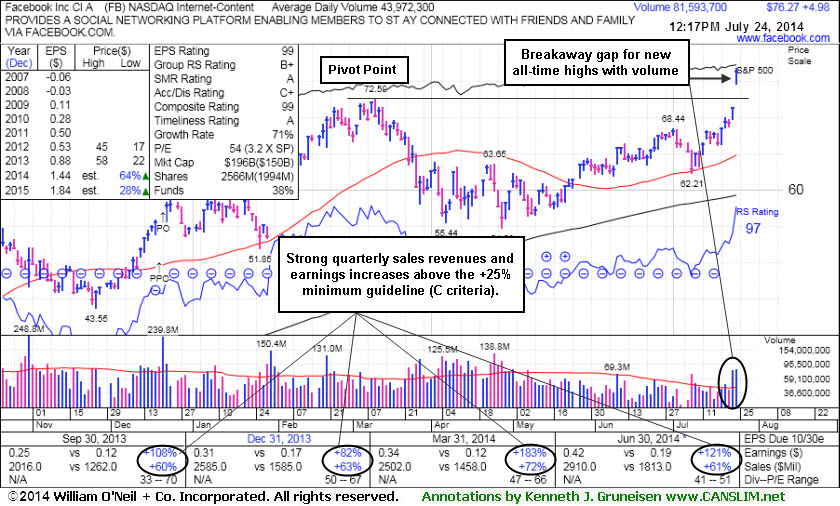

7/30/2014 5:47:33 PM - Y - Holding its ground stubbornly near its 52-week high, above its pivot point and below its "max buy" level. Highlighted in yellow in the 7/24/14 mid-day report (read here) as a "breakaway gap" followed strong earnings news for the Jun '14 quarter and it triggered a technical buy signal.

7/24/2014 6:19:31 PM - Y - Finished strong after highlighted in yellow with pivot point cited based on its 3/11/14 high plus 10 cents in the earlier mid-day report (read here). The "breakaway gap" with nearly 3 times average volume followed strong earnings news for the Jun '14 quarter and triggered a technical buy signal. See the latest FSU analysis for more details and new annotated graphs.

7/24/2014 12:29:55 PM - Y - Color code is changed to yellow with pivot point cited based on its 3/11/14 high plus 10 cents. Today's "breakaway gap" following strong earnings news for the Jun '14 quarter is triggering a technical buy signal. Found support at its 50 DMA line during its latest consolidation and stayed well above its 200 DMA line during its consolidation after dropped from the Featured Stocks list on 4/04/14 due to weakness.

4/4/2014 12:40:49 PM - Triggering a more worrisome technical sell signal today while violating the recent low ($57.98 on 3/27/14) and slumping below prior highs in the $58 area defining important near-term support. It has slumped -21.9% off its high and will be dropped from the Featured Stocks list tonight due to weakness.

4/3/2014 2:41:48 PM - G - Slumping today toward the recent low ($57.98 on 3/27/14) coinciding with prior highs in the $58 area defining important near-term support. A rebound above its 50 DMA line is needed, meanwhile, the longer it lingers below that important short-term average the worse its outlook gets.

4/3/2014 2:40:04 PM - G - The recent low ($57.98 on 3/27/14) coincides with prior highs in the $58 area defining important near-term support. A rebound above its 50 DMA line is needed, meanwhile, the longer it lingers below that important short-term average the worse its outlook gets.

4/1/2014 5:55:22 PM - G - Still sputtering below its 50 DMA line after damaging losses. A rebound above that important short-term average is needed to help its outlook improve.

3/28/2014 6:53:57 PM - G - Violated its 50 DMA line this week triggering a technical sell signal. Only a prompt rebound above that important short term average would help its outlook improve. See the latest FSU analysis for more details and new annotated graphs.

3/26/2014 1:51:34 PM - G - Violating its 50 DMA line and undercutting Monday's low today with a damaging loss raising concerns and triggering a technical sell signal. Only a prompt rebound above that important short term average would help its outlook improve.

3/24/2014 11:59:26 AM - G - Down considerably today amid widespread weakness. Testing its 50 DMA line ($64.36 now) which defines near-term support to watch.

3/21/2014 7:59:35 PM - G - Extended from any sound base. Consolidating above its 50 DMA line ($64.25 now) which defines near-term support to watch.

3/14/2014 5:36:57 PM - G - Pulling back after getting extended from any sound base. Its 50 DMA line ($63 now) defines near-term support to watch. See the latest FSU analysis for more details and new annotated graphs.

3/13/2014 9:33:50 PM - G - Pulling back after getting more extended from any sound base. Its 50 DMA line ($62.83 now) defines near-term support to watch.

3/10/2014 3:48:57 PM - G - Hitting another new all-time high with today's gain. Getting more extended from any sound base and its 50 DMA line ($61.97 now) defining near-term support to watch.

3/5/2014 5:19:09 PM - G - Gapped up and hit another new all-time high with today's volume-driven gain. Extended from any sound base and its 50 DMA line ($61.13 now) defines near-term support to watch.

3/3/2014 2:45:51 PM - G - Pulling back on light volume today for a 5th consecutive small loss while retreating from its all-time high. Its 50 DMA line ($60.54 now) defines near-term support to watch.